GameStop Bundle

Can GameStop Rebound?

GameStop's story is a rollercoaster of retail history, from its humble beginnings to its meme-stock fame. The company's journey has been marked by dramatic shifts, forcing a critical reassessment of its business model in a rapidly evolving digital landscape. Founded in 1984, GameStop now faces the challenge of redefining its GameStop SWOT Analysis to secure a sustainable future.

This analysis dives deep into GameStop's growth strategy, exploring its future prospects amidst intense competition and changing consumer behavior. We'll dissect the GameStop company analysis, evaluating its financial performance, market share, and the effectiveness of its turnaround strategy. Understanding GameStop's challenges and opportunities, including its e-commerce strategy and expansion plans, is crucial for investors and strategists alike, seeking to navigate the complexities of the gaming retail sector and assess the GameStop stock forecast.

How Is GameStop Expanding Its Reach?

The expansion initiatives of the company are centered on adapting to the evolving gaming industry. A key element of the company's strategy involves broadening its product offerings beyond traditional physical game sales. This includes a greater emphasis on collectibles, apparel, and other merchandise, aiming to attract a wider consumer base and lessen its reliance on the physical media market, which is in decline.

The company has also explored ventures into digital assets, although its initial foray into NFTs has seen a significant pullback, indicating a recalibration of its digital strategy. The company is focused on optimizing its existing store footprint. This includes store closures in less profitable locations and enhancing the in-store experience in others, potentially through integrating more experiential elements or expanding its pre-owned market for consoles and accessories.

The company's strategic shift also involves enhancing its e-commerce capabilities to better compete in the digital marketplace. This includes improvements to its online platform, expanding its product selection, and streamlining the online shopping experience. The company aims to increase its market share by offering competitive pricing, exclusive products, and robust customer service. The company is also investing in its supply chain and logistics to ensure efficient order fulfillment and timely delivery.

The company is expanding its product range beyond physical games. This includes collectibles, apparel, and gaming accessories. The goal is to diversify revenue streams and cater to a broader customer base. This strategy helps reduce dependence on the fluctuating physical media market.

Enhancing the online platform and improving the e-commerce experience is a priority. This involves expanding the product selection and streamlining the online shopping process. The company aims to increase its market share by offering competitive pricing and robust customer service. This strategy is critical for the company's long-term success.

The company is optimizing its physical store footprint. This includes closing underperforming stores and enhancing the in-store experience. The company is focusing on experiential elements and expanding its pre-owned market for consoles and accessories. This strategy aims to improve profitability and customer engagement.

The company is recalibrating its digital assets strategy. This follows an initial foray into NFTs. The focus is on finding the right balance between innovation and market demand. The company is carefully assessing the opportunities in the digital space.

The company's expansion plans for 2024 and 2025 are focused on adapting to the changing market. The company is working to diversify its revenue streams and enhance customer engagement. The company's strategy includes a focus on e-commerce, store optimization, and digital initiatives. The company faces challenges in a competitive market, as discussed in Competitors Landscape of GameStop.

The company's growth strategy includes diversification, digital transformation, and store optimization. These initiatives aim to enhance the customer experience and increase profitability. The company is also focused on expanding its e-commerce capabilities and exploring new revenue streams.

- Diversification of product offerings to include collectibles and apparel.

- Enhancement of the e-commerce platform and online shopping experience.

- Optimization of the physical store footprint through closures and upgrades.

- Recalibration of the digital assets strategy, focusing on market demand.

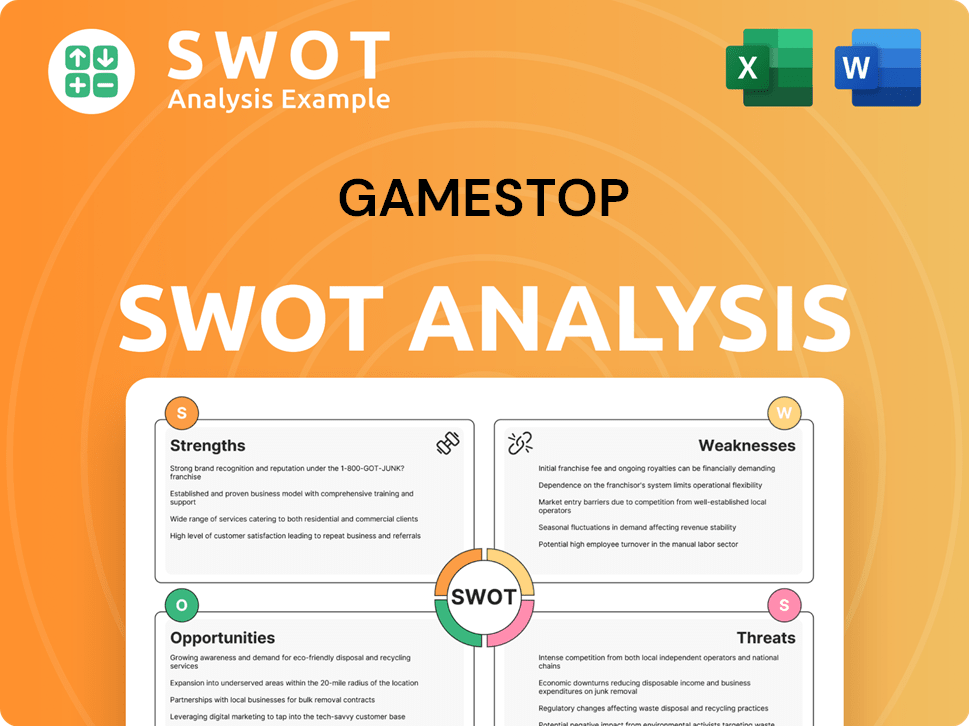

GameStop SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does GameStop Invest in Innovation?

The innovation and technology strategy of the company is crucial for its long-term success. This strategy focuses on adapting to the evolving gaming market and enhancing its digital capabilities. The goal is to move beyond its traditional retail model and create a more engaging and efficient customer experience.

The company's approach includes improvements to its e-commerce platform and digital infrastructure. This is vital to meet the growing demand for digital game downloads and online gaming services. The company is also exploring ways to improve supply chain efficiency and personalize customer interactions.

While past attempts at using blockchain and NFT marketplaces, such as its now-defunct NFT marketplace, were made to utilize new technologies, the company is now reevaluating its approach in this area. The focus is shifting towards strategies that can create a more sustainable and profitable business model.

The company is investing heavily in its e-commerce platform to provide a seamless online shopping experience. This includes website improvements, better user interfaces, and enhanced mobile capabilities. The goal is to compete effectively with online retailers.

The company is actively working on its digital transformation strategy. This involves modernizing its infrastructure and adapting to the digital nature of the gaming industry. This includes cloud computing, data analytics, and other digital tools.

The company is focused on improving supply chain efficiency through automation and data analytics. This can lead to reduced costs, faster delivery times, and better inventory management. This is crucial for the company's financial performance.

The company is exploring the use of AI to personalize customer interactions. This includes AI-driven recommendations, customized offers, and improved customer service. This can lead to increased customer loyalty and sales.

The company is looking into new digital services and subscription models within the gaming ecosystem. This could include game streaming services, exclusive content, and loyalty programs. This can create new revenue streams and increase customer engagement.

The company is using data analytics to gain insights into customer behavior, market trends, and operational efficiency. This data-driven approach helps in making informed decisions and improving overall performance. This is a key part of the company's turnaround strategy.

The company’s GameStop growth strategy involves a significant shift towards digital transformation to stay competitive in the gaming industry. The company aims to leverage technology to improve its e-commerce platform, optimize its supply chain, and personalize customer experiences. The company's efforts to modernize its infrastructure and adapt to the digital nature of the gaming industry are evident in its recent initiatives. For a deeper understanding of the company's revenue streams and business model, consider reading the article: Revenue Streams & Business Model of GameStop.

The company is focusing on several key technological initiatives to drive its GameStop future prospects. These initiatives are designed to enhance the customer experience, streamline operations, and create new revenue streams. These include:

- Enhancing the e-commerce platform to provide a seamless online shopping experience.

- Improving supply chain efficiency through automation and data analytics.

- Personalizing customer interactions through AI-driven recommendations.

- Exploring new digital services and subscription models within the gaming ecosystem.

- Modernizing infrastructure to adapt to the increasingly digital nature of the gaming industry.

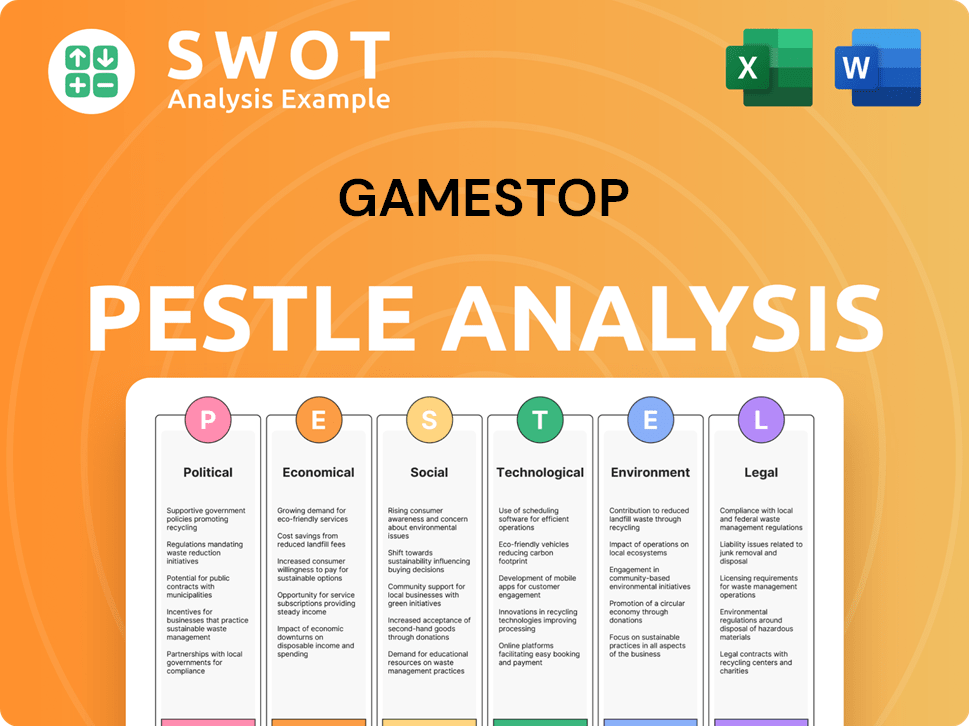

GameStop PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is GameStop’s Growth Forecast?

The financial outlook for GameStop is a key area of focus for investors, especially considering the company's efforts to stabilize and grow revenue in a challenging retail environment. The company's GameStop growth strategy includes initiatives to improve profitability, focusing on cost management and optimizing inventory. Recent reports from late 2024 and early 2025 indicate a goal of achieving sustained profitability.

GameStop's business model has been evolving, with the company aiming for organic growth through its transformation initiatives. The company's financial ambitions are often compared to its historical performance, which saw significant fluctuations, particularly during the 'meme stock' phenomenon. The company's financial strategy appears centered on achieving organic growth through its evolving business model and efficient capital allocation.

GameStop has maintained a strong cash position, which provides flexibility for strategic investments and operational improvements. While specific revenue targets and profit margin projections for the long term are subject to market volatility, the company's financial strategy appears centered on achieving organic growth through its evolving business model and efficient capital allocation. For more insights, you can explore the perspectives of Owners & Shareholders of GameStop.

GameStop's revenue streams include sales of new and pre-owned video game products, hardware, and collectibles. The company's financial performance is closely watched, with investors monitoring GameStop market share and profitability. Recent financial reports show the company is working to diversify its revenue streams and improve its financial health.

Cost management is a key aspect of GameStop's financial strategy. The company has been focusing on optimizing its inventory and reducing operational costs to improve profitability. GameStop profitability analysis is crucial for understanding its financial health and GameStop stock forecast.

GameStop's digital transformation strategy and GameStop e-commerce strategy are vital for future growth. The company is investing in its online presence to enhance customer experience and drive sales. This includes improvements to its website and online gaming strategy.

GameStop brick and mortar stores remain a part of the company's strategy, with adjustments to store layouts and offerings. GameStop's expansion plans 2024 are focused on optimizing its physical retail footprint while integrating online and in-store experiences. The company is also evaluating its GameStop recent acquisitions.

GameStop market trends, including the growth of the gaming industry and consumer preferences, influence its financial outlook. The company is focused on GameStop customer loyalty programs to retain and attract customers.

Understanding the GameStop competitive landscape is essential for assessing its financial prospects. The company faces competition from online retailers and other gaming platforms. The GameStop turnaround strategy involves adapting to these challenges.

GameStop faces GameStop challenges and opportunities, including changing consumer behavior and market dynamics. The company aims to leverage these opportunities through strategic investments and operational improvements.

GameStop investor relations are vital for maintaining investor confidence and transparency. The company regularly communicates its financial performance and strategic initiatives to shareholders. This includes updates on its GameStop online gaming strategy.

Key financial metrics, such as revenue, gross margin, and operating expenses, are closely monitored. The company's ability to manage these metrics will determine its financial success. The company's focus on efficient capital allocation is also a key factor.

The GameStop future prospects depend on its ability to execute its strategic plans and adapt to market changes. The company's success will be evaluated based on its financial performance and ability to generate sustainable growth. The company's financial health is a key factor.

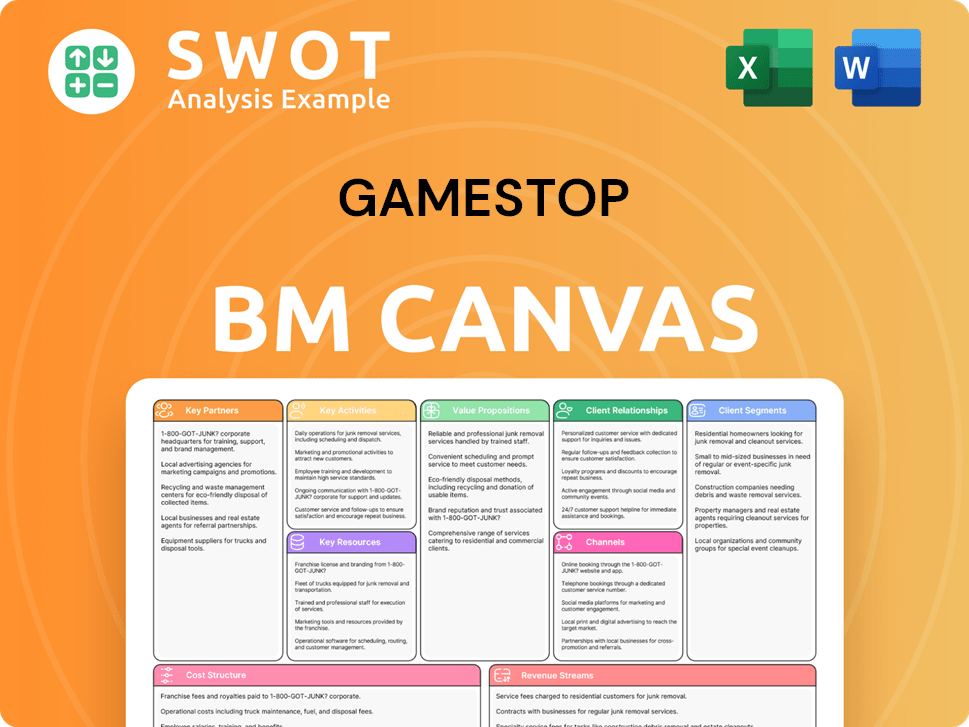

GameStop Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow GameStop’s Growth?

The path forward for GameStop, while potentially lucrative, is fraught with challenges. The company's GameStop growth strategy is constantly tested by a rapidly evolving market. Understanding the potential pitfalls is crucial for investors and stakeholders assessing the GameStop future prospects.

One of the most significant obstacles is the intense competition from digital distribution platforms. These platforms, such as the PlayStation Store and Xbox Games Store, offer direct game downloads, often at competitive prices. This shift in consumer behavior directly impacts GameStop's business model, which has traditionally relied on physical game sales.

Furthermore, the long-term viability of physical media remains uncertain. As digital downloads become more prevalent, the demand for physical games could continue to decline. This necessitates a constant evolution of GameStop's e-commerce strategy and a diversification of revenue streams to maintain relevance in the market.

The rise of digital storefronts poses a substantial threat. Platforms like Steam, PlayStation Store, and Xbox Games Store offer direct game downloads, often at competitive prices, directly impacting GameStop market share. This digital shift challenges the company's traditional reliance on physical game sales.

Technological advancements, such as cloud gaming and new console generations, could alter consumer purchasing habits. The continuous innovation in the gaming industry requires GameStop to adapt and innovate to remain competitive. This necessitates strategic foresight and responsiveness to market trends.

Supply chain disruptions can also pose challenges, particularly for physical inventory. Although the company is focusing on digital and collectibles, its brick and mortar stores still rely on physical product availability. Managing inventory and ensuring timely deliveries are critical for operational efficiency.

Attracting and retaining top talent for its digital transformation is crucial. The company needs to invest in its workforce to drive its strategic initiatives. Resource constraints, particularly in skilled labor, can hinder progress and impact the execution of its GameStop digital transformation strategy.

Changes in regulations, particularly concerning digital marketplaces or consumer data privacy, can impact operations. Compliance with new laws and regulations can be costly and may require adjustments to business practices. Staying ahead of these changes is essential for long-term sustainability.

Staying current with GameStop market trends is critical for success. The company must continually adapt to changes in consumer preferences and technological advancements. This requires robust market analysis and a flexible business model.

The GameStop competitive landscape includes both online and offline retailers, as well as digital distribution platforms. The company's ability to differentiate itself and offer unique value propositions is key to maintaining its position. The company needs to innovate and adapt to remain competitive.

Analyzing GameStop financial performance is crucial for understanding its current position and future potential. Key metrics include revenue, profitability, and cash flow. Evaluating these factors helps in assessing the company's ability to execute its strategic plans. The recent GameStop stock forecast and GameStop's expansion plans 2024 are important to consider.

Building and maintaining GameStop customer loyalty programs is essential for long-term success. The company can leverage its customer base to drive sales. The company must provide value and maintain strong relationships. The company's ability to retain and attract customers is a key factor.

The company's GameStop turnaround strategy and GameStop recent acquisitions are critical for its future. These initiatives should align with the company's overall vision and goals. Careful execution and integration of these strategies are essential for success. A thorough GameStop company analysis is required.

For a deeper understanding of the company's core values, vision, and mission, explore Mission, Vision & Core Values of GameStop.

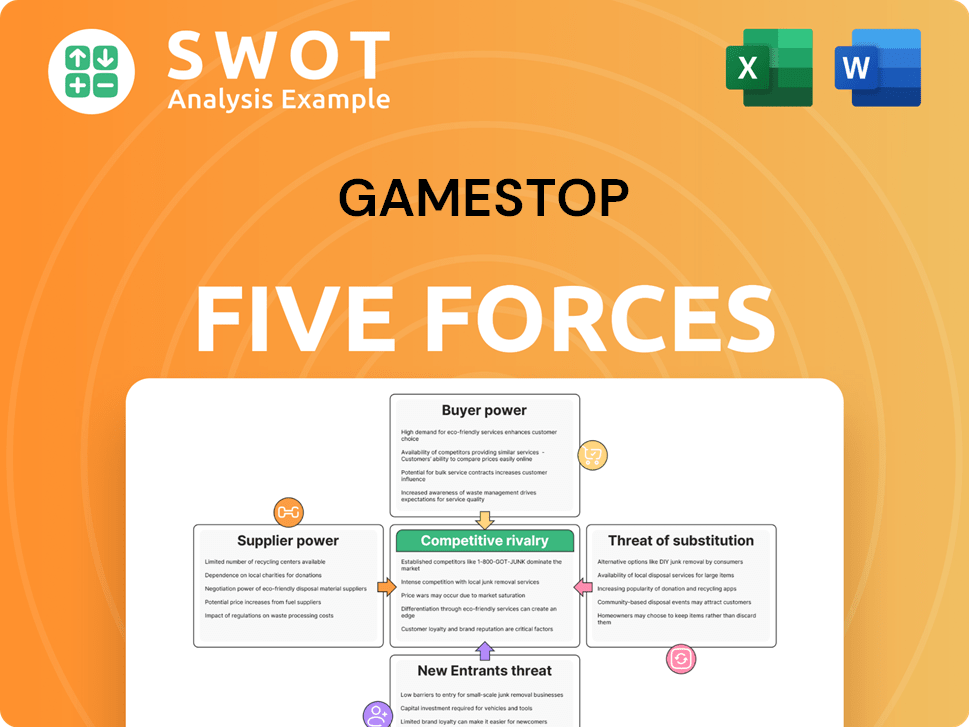

GameStop Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of GameStop Company?

- What is Competitive Landscape of GameStop Company?

- How Does GameStop Company Work?

- What is Sales and Marketing Strategy of GameStop Company?

- What is Brief History of GameStop Company?

- Who Owns GameStop Company?

- What is Customer Demographics and Target Market of GameStop Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.