GameStop Bundle

Can GameStop Conquer the Digital Realm?

GameStop, a once-dominant GameStop SWOT Analysis, has become a symbol of the evolving retail landscape. Its story, marked by the infamous short squeeze of 2021, highlights the power of retail investors and the volatility of the market. This exploration delves into the core of GameStop, examining its transformation from a brick and mortar store to a company navigating the complexities of digital distribution.

Understanding the GameStop business model is crucial for anyone interested in the video game retailer's future. We'll dissect its GameStop operations, revenue streams, and strategic pivots in a market increasingly dominated by e-commerce. This analysis will provide insights into how GameStop makes money, its customer base, and its ongoing efforts to adapt to the digital age, including whether it sells digital games.

What Are the Key Operations Driving GameStop’s Success?

The core operations of GameStop, a prominent video game retailer, center around selling video games, consoles, accessories, and collectibles. The company caters to a diverse customer base, offering both physical retail experiences and an expanding e-commerce platform. This strategy allows it to reach a wide audience, from casual gamers to dedicated enthusiasts.

GameStop's business model relies on a complex supply chain and logistics network. It sources products directly from publishers and manufacturers for new releases. The company also operates a pre-owned business, buying used games from customers, refurbishing them, and then reselling them. This dual approach allows GameStop to offer a wide variety of products and services.

The company’s value proposition includes a diverse product catalog and the convenience of physical stores. Its pre-owned business model provides affordable gaming options. GameStop's physical presence allows for in-person customer service and a tangible connection with the gaming community. Understanding the intricacies of the GameStop business model is key to appreciating its market position.

GameStop offers a wide range of products, including new and pre-owned video games, consoles, accessories, and collectibles. The company also sells pop culture merchandise. This diverse product line caters to a broad customer base, enhancing its appeal.

GameStop operates both physical brick and mortar store locations and an online store. Physical stores provide immediate access to products and a community hub. The e-commerce platform enhances online sales capabilities, offering a seamless omnichannel experience.

GameStop offers a diverse product catalog, including hard-to-find items and collectibles. The company's pre-owned business provides affordable gaming options. Physical stores offer in-person customer service and a tangible connection with the gaming community.

GameStop's operations involve a complex supply chain and logistics network. It sources products directly from publishers and manufacturers. The company also relies on customer trade-ins for its pre-owned business. These processes are essential for efficient operations.

GameStop's operations involve a multi-faceted approach to sales and customer engagement. The company's strategy includes both physical and digital channels, ensuring a broad reach. For more information, you can explore the details provided by Owners & Shareholders of GameStop.

- Product Sourcing: Direct from publishers and manufacturers for new games.

- Pre-Owned Business: Customer trade-ins, refurbishment, and resale.

- Physical Stores: Key touchpoints for immediate access and community interaction.

- E-commerce: Enhances online sales and provides an omnichannel experience.

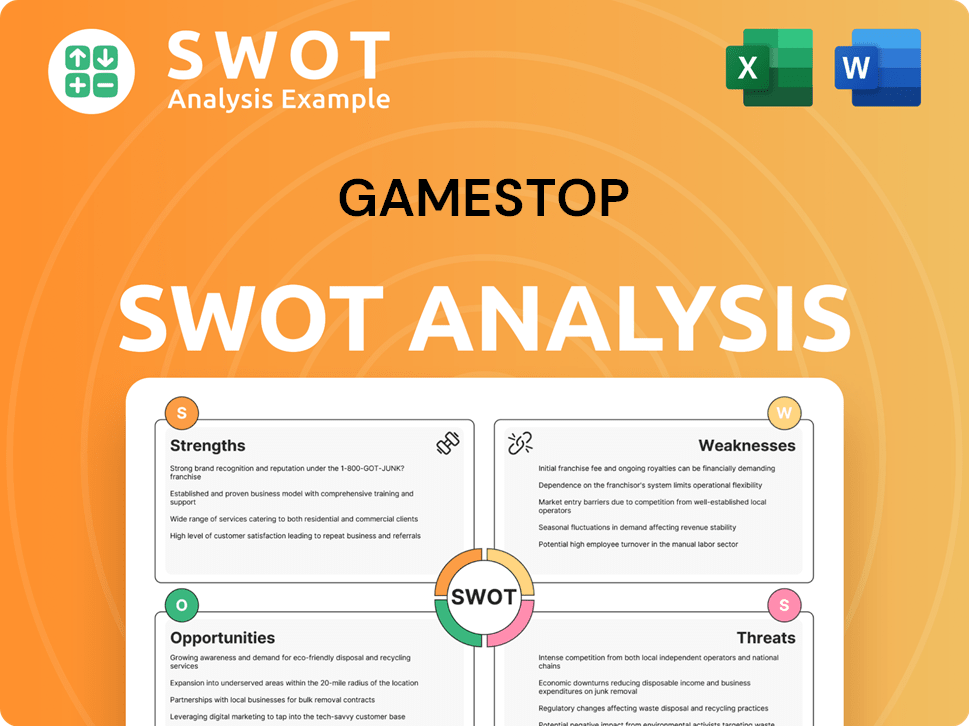

GameStop SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does GameStop Make Money?

Understanding the revenue streams and monetization strategies of the video game retailer involves examining its core business model, which has evolved over time. The company, a prominent player in the industry, generates revenue primarily through the sale of video game products and related merchandise. Analyzing these streams provides insights into how the company operates and adapts to market changes.

The company's revenue model is multifaceted, encompassing various product categories and sales channels. This includes both physical and digital offerings, as well as a growing emphasis on collectibles and other merchandise. The company's approach to generating revenue is dynamic, reflecting its efforts to stay relevant in a competitive market.

The company's primary revenue streams are centered around the sale of video game hardware, software, and accessories. In the fiscal year ending February 3, 2024, the company reported net sales of $5.27 billion. This figure underscores the significance of these product categories in the company's overall financial performance. The company's "GameStop business model" has historically relied heavily on these sales.

The company's revenue model is built upon several key strategies, with the sale of new and pre-owned video game products at its core. The company's "GameStop operations" are designed to maximize revenue through various channels and offerings.

- Product Sales: The sale of new video game hardware, software, and accessories forms a significant portion of the company's revenue. New hardware and software sales have historically represented a substantial part of the revenue.

- Pre-Owned Sales: Pre-owned games and hardware contribute to revenue, often with higher profit margins. The "GameStop business model" benefits from the trade-in of used games, allowing the company to sell them again.

- Collectibles: Expanding its collectibles category, including merchandise like apparel and toys, is a key diversification strategy. This segment aims to tap into the broader entertainment market.

- Digital Content: The company also earns revenue through digital gaming content, although this is a smaller segment compared to physical sales. Does the company sell digital games? Yes, but it is a smaller segment.

- Monetization Strategies: The company employs competitive pricing on new products, higher margins on pre-owned items, and bundling opportunities to incentivize purchases. They also use their loyalty program to drive repeat business and offer exclusive promotions.

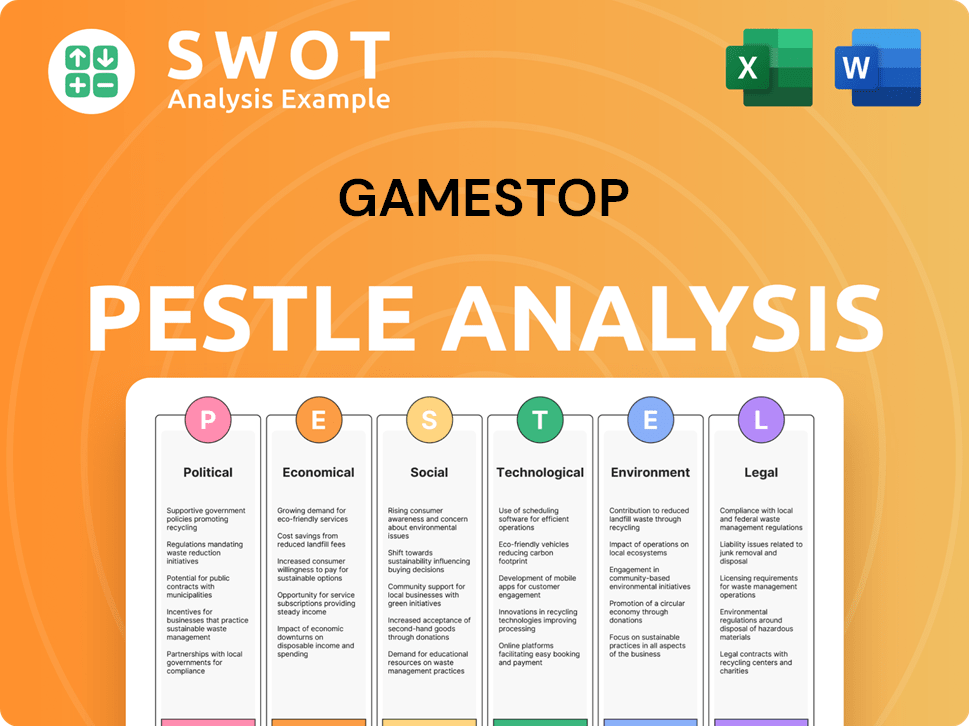

GameStop PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped GameStop’s Business Model?

The story of the video game retailer, GameStop, is one of adaptation and resilience in the face of significant industry shifts. The company's journey has been marked by key milestones and strategic pivots, especially as the gaming world moved towards digital distribution. Understanding these moves is crucial to grasping the current state and future prospects of GameStop's business model.

A major challenge for GameStop has been the decline in physical game sales, as digital downloads gained popularity. This shift forced the company to rethink its operations and find new ways to generate revenue. GameStop's response included diversifying its product offerings and focusing on e-commerce. The company's ability to navigate these changes will determine its long-term success.

Another pivotal moment was the short squeeze of early 2021, which brought unprecedented attention and capital to the company. This event provided resources to invest in transformation initiatives, including boosting its online presence and improving its supply chain. These strategic moves are aimed at positioning GameStop for sustainable growth in a competitive market.

Key milestones include the rise of digital game distribution, the expansion into collectibles, and the 2021 short squeeze. These events significantly impacted GameStop's strategic direction and financial performance. The company has had to adapt to the changing landscape of the video game industry.

Strategic moves include e-commerce expansion, supply chain optimization, and a focus on customer loyalty. GameStop has invested heavily in its online platforms to improve the digital shopping experience. The company has also sought to streamline its operations and enhance customer engagement.

GameStop's competitive advantages include brand recognition, a loyal customer base, and its physical store network. The pre-owned game market remains a differentiator, offering value to customers and higher margins. The company continues to leverage its community aspect.

In fiscal year 2023, GameStop reported net sales of approximately $5.27 billion, a decrease from $6.11 billion in 2022. The company's net loss for 2023 was $67.3 million. As of February 3, 2024, GameStop had $1.09 billion in cash and cash equivalents.

GameStop's competitive edge comes from its established brand, loyal customer base, and physical store network, which provides a unique in-person experience. The company's ability to adapt to the changing market will be critical. The future of GameStop depends on its ability to integrate into the broader gaming ecosystem, as discussed in Target Market of GameStop.

- The pre-owned game market offers value and higher margins.

- Stores often serve as gathering places for gamers, fostering community.

- Continued exploration of new technologies and partnerships is essential.

- Adapting to digital trends is vital for long-term relevance.

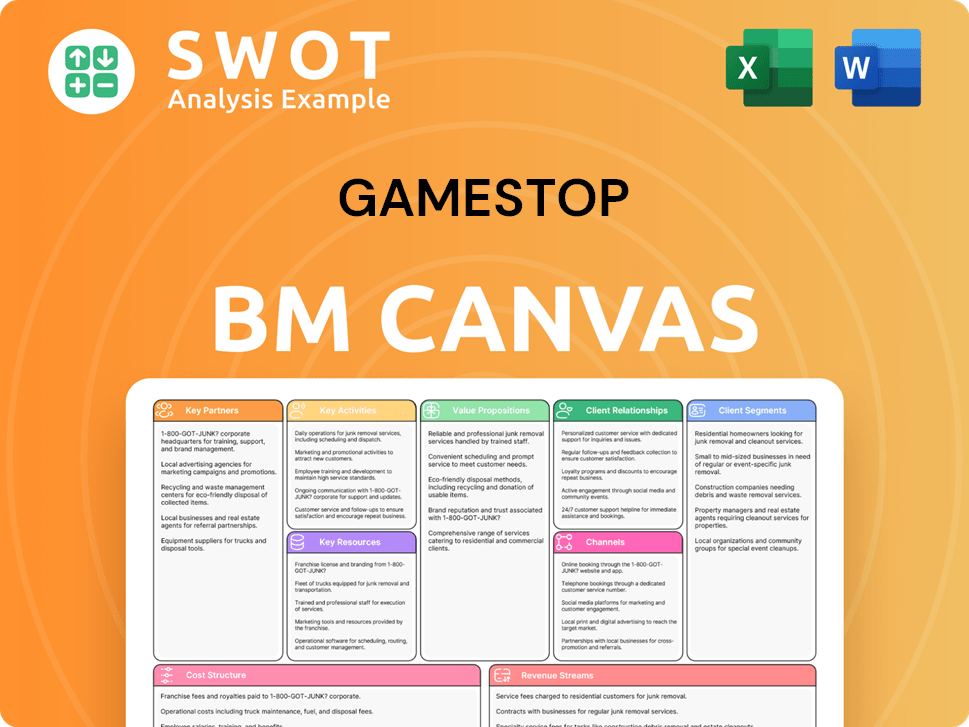

GameStop Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is GameStop Positioning Itself for Continued Success?

The video game retailer, finds itself in a unique position, navigating a rapidly evolving industry. While it maintains a strong presence as a brick and mortar store, the company faces significant challenges from the shift towards digital game sales and intense competition. Understanding the current landscape, associated risks, and future outlook is crucial for evaluating its long-term viability.

The company's business model is under pressure from digital storefronts, e-commerce platforms, and big-box retailers. Despite its customer loyalty program, the trend favors digital consumption. The company's strategic initiatives are focused on adapting to the digital future of gaming while leveraging its brand and loyal customer base.

As a video game retailer, the company's primary challenge is the dominance of digital game sales. The shift to digital distribution by console manufacturers and publishers directly impacts its revenue streams. The company must compete with digital storefronts and e-commerce giants to maintain market share.

Key risks include the decline in physical game sales, potential supply chain disruptions, and pricing pressures. Evolving consumer preferences, such as subscription-based gaming services, also pose a threat. Regulatory changes related to digital marketplaces could create further challenges for the company's operations.

The company is focused on transforming into a technology-driven company, investing in e-commerce capabilities. It aims to expand its product offerings beyond traditional games and optimize its store footprint. The long-term vision centers on customer experience and exploring new avenues within the gaming and entertainment sectors.

The company's strategy involves adapting to the digital future by enhancing its e-commerce platform and diversifying product offerings. This includes expanding into collectibles and potentially digital assets. The focus is on sustaining and expanding its ability to generate revenue by adapting to the evolving gaming landscape.

The company's ability to navigate the digital shift and maintain customer loyalty will be critical. Its success depends on effective e-commerce strategies, diversified product offerings, and adapting to changing consumer preferences. Understanding the competitive landscape, as discussed in Competitors Landscape of GameStop, is also vital.

- Digital Sales Impact: The decline in physical game sales directly impacts its revenue.

- Competition: Intense competition from digital storefronts and e-commerce platforms.

- Strategic Focus: Transformation into a technology-driven company with expanded offerings.

- Market Adaptation: Adapting to subscription-based gaming and cloud gaming trends.

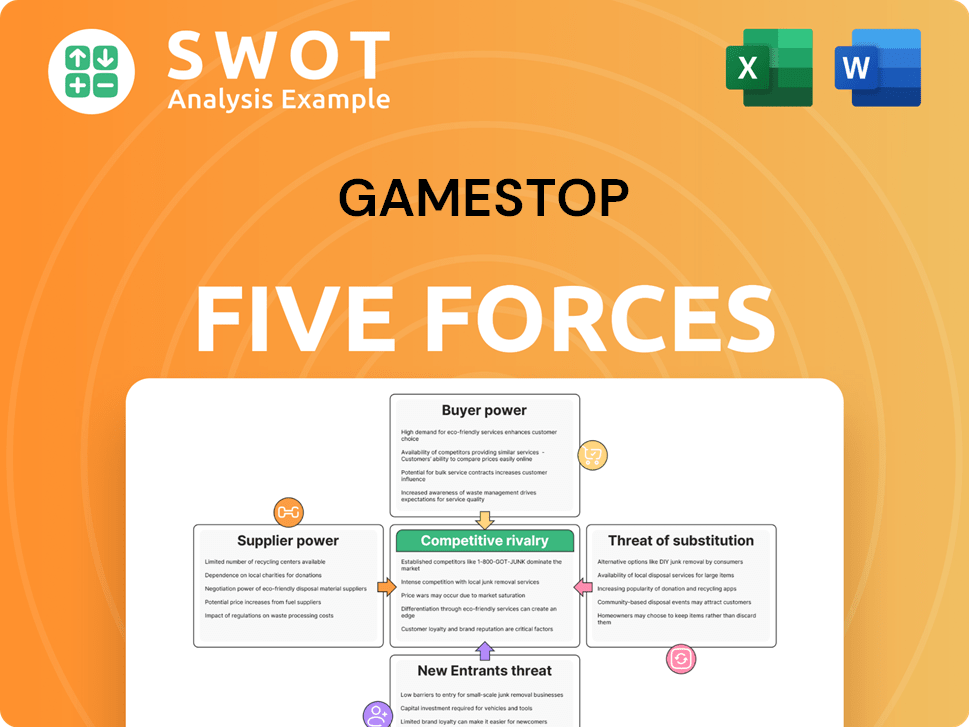

GameStop Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of GameStop Company?

- What is Competitive Landscape of GameStop Company?

- What is Growth Strategy and Future Prospects of GameStop Company?

- What is Sales and Marketing Strategy of GameStop Company?

- What is Brief History of GameStop Company?

- Who Owns GameStop Company?

- What is Customer Demographics and Target Market of GameStop Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.