Getlink Bundle

How Does Getlink Navigate Its Competitive Arena?

Getlink, the operator of the Channel Tunnel, faces a complex Getlink SWOT Analysis landscape. With a 17% revenue dip in early 2025, understanding its competitors and market dynamics is crucial. This analysis dives into Getlink's strategic positioning, challenges, and opportunities within the cross-Channel transportation sector.

This exploration of the Getlink competitive landscape provides a detailed Getlink market analysis, examining its rivals in the infrastructure sector. We'll delve into Getlink's business strategy, recent financial results, and key performance indicators to assess its market position analysis. Understanding Getlink's competitive advantages and disadvantages is vital for investors and strategists alike, offering insights into its ability to thrive amidst evolving market trends and potential challenges.

Where Does Getlink’ Stand in the Current Market?

Getlink SE holds a strong market position within the cross-Channel transport and infrastructure sector. The company's core operations center around the Channel Tunnel, connecting Folkestone, UK, and Coquelles, France. This strategic location serves both the UK and continental European markets, establishing Getlink as a key player in facilitating the movement of passengers, freight, and electricity across the English Channel.

The value proposition of Getlink lies in its integrated services, which include passenger and freight shuttle services, rail freight operations, and electricity interconnection. This comprehensive approach allows Getlink to cater to a diverse customer base, including individual travelers, commercial freight operators, and railway companies like Eurostar. Getlink's infrastructure projects, such as the Channel Tunnel, provide a critical link, reducing travel times and supporting international trade.

In Q1 2025, Eurotunnel, Getlink's core business, maintained its leading position on the Short Straits with a truck market share of 36.4%, up from 35.6% in Q1 2024. The car market share also improved to 62.1% in Q1 2025, compared to 61.5% in Q1 2024. These figures highlight Getlink's strong competitive position and its ability to attract a significant share of the cross-Channel transport market.

Getlink reported a consolidated revenue of €1.614 billion in 2024. Despite a 12% decrease from 2023, Eurotunnel's revenue increased by 3% to €1.166 billion, and Europorte's revenue grew by 12% to €168 million in 2024. The company achieved an EBITDA of €833 million in 2024. Getlink's cash position stood at €1.699 billion at the end of 2024, with net debt decreasing to €3.576 billion.

Getlink has strategically diversified its offerings, expanding its logistics portfolio and customs services. The acquisitions of ChannelPorts in April 2024, and Associated Shipping Agencies (ASA) and Boulogne International Maritime Services (BIMS) in 2025, enhance its position as a full-service cross-Channel operator. These moves reduce reliance solely on passenger and freight shuttle volumes, contributing to a more resilient business model.

S&P Global Ratings upgraded Getlink's credit rating to BB+ from BB in April 2025, reflecting a prudent financial policy and solid liquidity. Getlink's strong cash position of €1.699 billion at the end of 2024, coupled with a reduced net debt, demonstrates financial stability. These factors contribute to a positive outlook for the company's long-term sustainability and growth.

Getlink's competitive advantages include its strategic infrastructure, diversified service offerings, and strong financial performance. The Channel Tunnel provides a unique and essential service, while the company's expansion into logistics and customs services enhances its market position. Getlink's recent financial results and credit rating upgrade further solidify its competitive edge.

- Leading market share in key transport segments.

- Diversified revenue streams through Eurotunnel, Europorte, and ElecLink.

- Strong financial health with solid liquidity and a reduced net debt.

- Strategic acquisitions to expand service offerings and customer base.

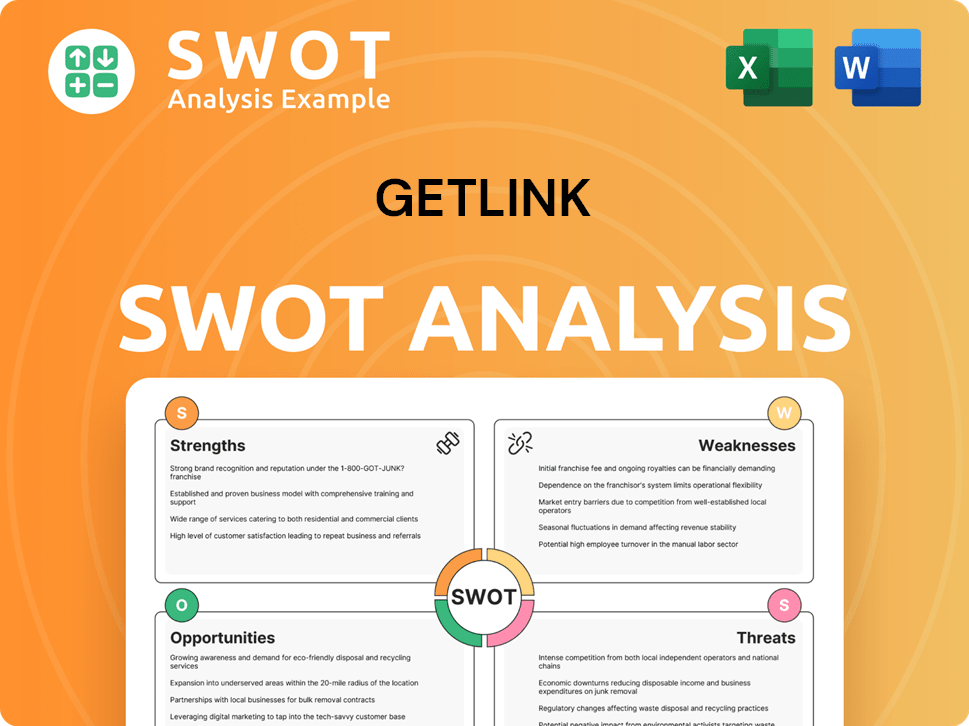

Getlink SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Getlink?

The Growth Strategy of Getlink involves navigating a complex competitive landscape. Understanding the key players and their strategies is crucial for assessing Getlink's market position and future prospects. A thorough Getlink market analysis reveals the dynamics at play within the cross-Channel transport sector.

Getlink's financial performance and business strategy are significantly impacted by its ability to compete effectively. The company's recent financial results reflect the pressures exerted by its rivals. Analyzing the Getlink competitive landscape provides insight into the challenges and opportunities the company faces.

Ferry operators are Getlink's most significant direct competitors. Companies like P&O Ferries and DFDS directly compete with Getlink's LeShuttle services. These operators offer an alternative for both passenger and truck traffic crossing the English Channel.

Ferry operators often benefit from more flexible social models, enabling them to offer competitive pricing. This pricing advantage can put pressure on Getlink's revenue streams. In 2024, Shuttle revenue faced a 1% decrease due to this competition.

While Getlink operates the Channel Tunnel infrastructure, it faces competition from railway operators. Eurostar is a key user of the tunnel for high-speed passenger services. New entrants are also expressing interest in launching high-speed passenger train services.

New operators, including companies from Spain, the Netherlands, and the UK, could increase the number of trains using the tunnel. This could potentially impact Getlink's market share in the rail transport sector. This expansion could change the Getlink competitive landscape.

Indirect competitors include broader transportation and logistics companies. Alternative infrastructure providers, such as toll road managers and other tunnel operators, also pose competition. These companies offer alternative routes and services.

The wider rail and public transport sectors include competitors like Transdev, Deutsche Bahn, and Hitachi Rail. Mergers and alliances in the transport industry can subtly shift competitive dynamics. These changes affect supply chain efficiencies and pricing strategies.

The Getlink industry faces a dynamic competitive environment. Understanding the Getlink competitors is critical for strategic planning. A Getlink SWOT analysis would reveal both strengths and weaknesses in this context.

- Ferry Operators: Offer direct competition, impacting pricing and revenue.

- Rail Operators: Eurostar and potential new entrants compete for passenger services.

- Indirect Competitors: Infrastructure providers and broader transport companies offer alternatives.

- Market Trends: Changes in the transport industry, including mergers, can shift competitive dynamics.

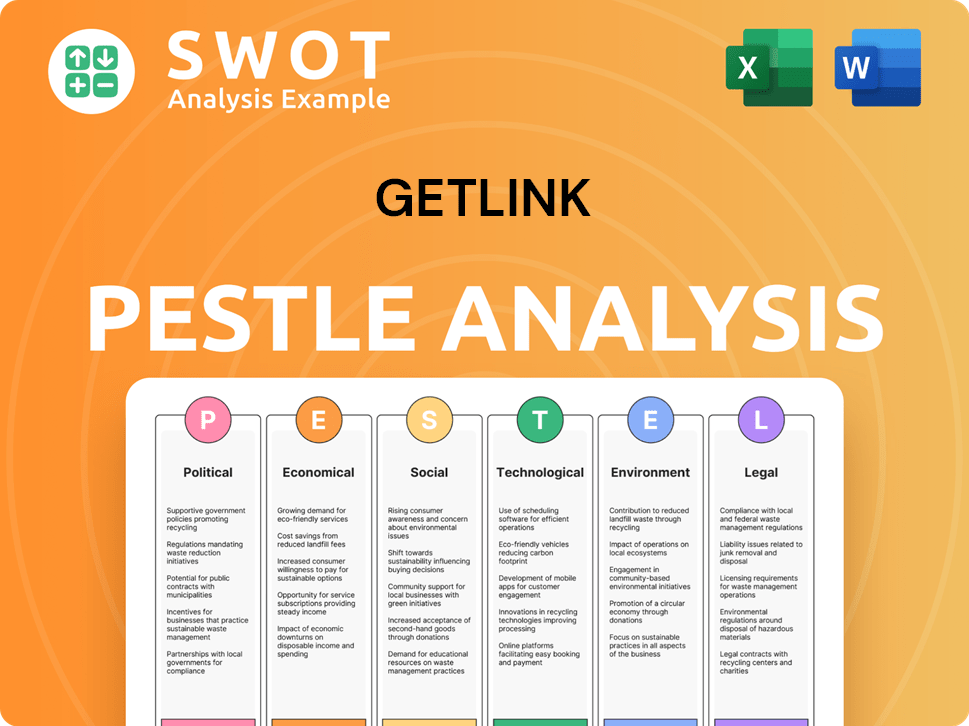

Getlink PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Getlink a Competitive Edge Over Its Rivals?

Analyzing the Marketing Strategy of Getlink reveals a company with significant competitive advantages. Getlink's core strengths are rooted in its unique infrastructure, operational efficiency, and strategic diversification. The Channel Tunnel, a proprietary asset, provides an unparalleled fixed link between the UK and continental Europe, handling a substantial portion of cross-Channel trade.

The company's operational strategies and customer-centric approach further bolster its competitive edge. Getlink has invested significantly in digital transformation to enhance customer experience and operational efficiency. The implementation of a 'smart border' system has improved speed and reliability, which is a key differentiator, particularly for time-sensitive freight and passenger traffic. This focus has allowed Getlink to maintain a strong market position.

Getlink's financial health, evidenced by a cash position of €1.699 billion at the end of 2024 and an upgraded credit rating to BB+, provides a strong foundation for continued investment and resilience. This financial stability supports its strategic initiatives and expansion plans within the Getlink competitive landscape.

The Channel Tunnel, a 50.5 km rail tunnel, is a proprietary asset providing a fixed link between the UK and continental Europe. This unique infrastructure handles a significant portion of trade between the UK and the Continent. The concession to operate the Channel Tunnel extends until 2086, ensuring long-term stability.

Getlink has invested over €300 million in digital transformation projects to enhance customer experience and operational efficiency. The 'smart border' system has reduced average wait times by 40% through automated customs checks. This commitment to speed and simplicity is a key differentiator.

Getlink leverages its rail freight subsidiary, Europorte, and the ElecLink electricity interconnector. Europorte capitalizes on the growing demand for low-carbon transport solutions. ElecLink plays an essential role in energy security for France and the UK, diversifying revenue streams.

Getlink is committed to environmental sustainability, with a 27% reduction in greenhouse gas emissions since 2019. The company aims for a 30% reduction by 2025. This focus on decarbonization, particularly the carbon efficiency of rail transport, provides a distinct environmental advantage.

Getlink's competitive advantages include its unique infrastructure, operational efficiency, strategic diversification, and commitment to environmental responsibility. These factors contribute to a strong market position and resilience in the face of challenges. The company's focus on customer experience and sustainability further enhances its competitive edge.

- Proprietary Channel Tunnel infrastructure.

- Operational efficiencies through digital transformation.

- Diversified revenue streams with Europorte and ElecLink.

- Strong financial performance and credit rating.

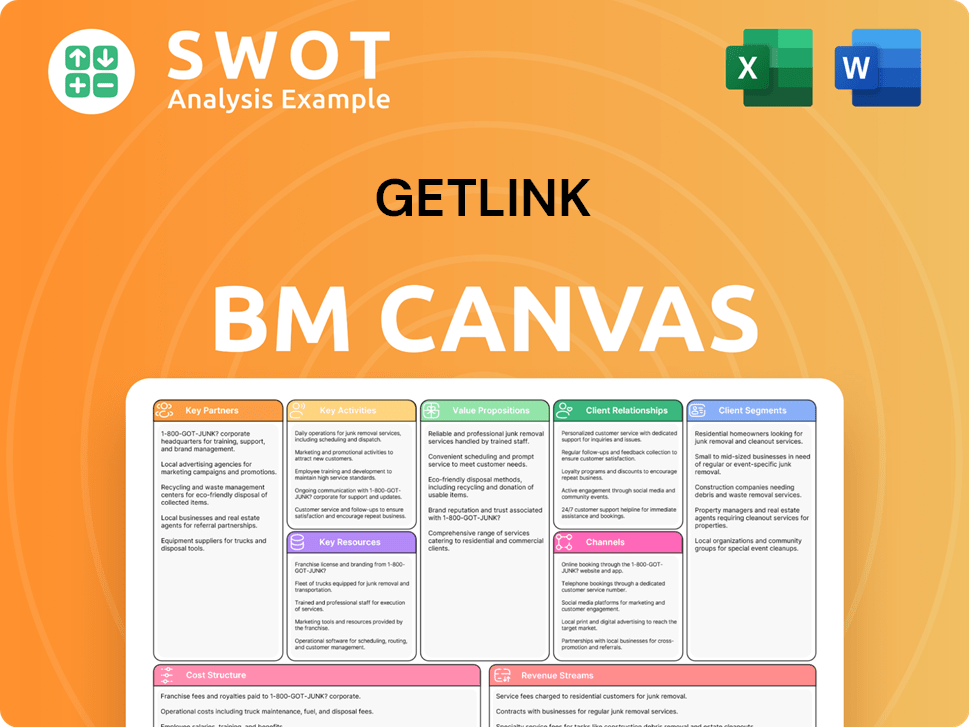

Getlink Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Getlink’s Competitive Landscape?

The cross-Channel transport industry, where Getlink operates, is undergoing significant shifts driven by technological advancements, regulatory changes, and economic factors. Understanding the Brief History of Getlink helps to contextualize its current market position and future prospects. These trends create both challenges and opportunities, influencing the company's strategic direction and financial performance. A detailed Getlink market analysis reveals the intricate dynamics shaping its competitive landscape.

Getlink faces a competitive environment, with intense rivalry from ferry operators and potential new entrants in the rail transport sector. Economic volatility and geopolitical uncertainties add further complexity to its operations. Despite these challenges, Getlink's long-term concession for the Channel Tunnel and strategic initiatives position it to capitalize on emerging opportunities, particularly in low-carbon transport solutions.

Technological advancements, especially in smart border solutions and digital transformation, are crucial. Regulatory changes, such as new border control measures, impact operations. Global economic shifts and geopolitical uncertainties also influence traffic volumes. These trends are key for Getlink's business strategy.

Competition from ferry operators and potential new rail operators poses a threat. Managing the volatility of electricity markets, which significantly impacted ElecLink's revenue in 2024 and Q1 2025, is another challenge. Adapting to regulatory changes and economic fluctuations is crucial for maintaining financial performance.

Growing demand for low-carbon transport solutions presents a strong opportunity for Europorte's rail freight services. Strategic acquisitions, like ChannelPorts, expand the logistics portfolio. The long-term concession until 2086 provides a stable foundation for growth. Getlink's commitment to sustainability enhances its appeal.

Getlink has set a consolidated EBITDA target of between €780 million and €830 million for 2025. The company plans to continue operational excellence and increase capital expenditure to €170-220 million over the next 5-7 years. These initiatives support Getlink's competitive advantages and long-term goals.

The competitive landscape includes ferry operators and potential new rail entrants. Getlink's market position analysis is influenced by its infrastructure, digital investments, and strategic acquisitions. The company's ability to manage challenges and threats, such as regulatory changes and economic volatility, is crucial for its success. A thorough Getlink SWOT analysis would highlight these factors.

- The "smart border" system streamlines customs and improves reliability.

- Passenger traffic grew by 3% year-to-date through May 2025.

- Truck freight volumes dipped 1% year-to-date.

- Getlink's long-term concession until 2086 provides a stable foundation for future growth.

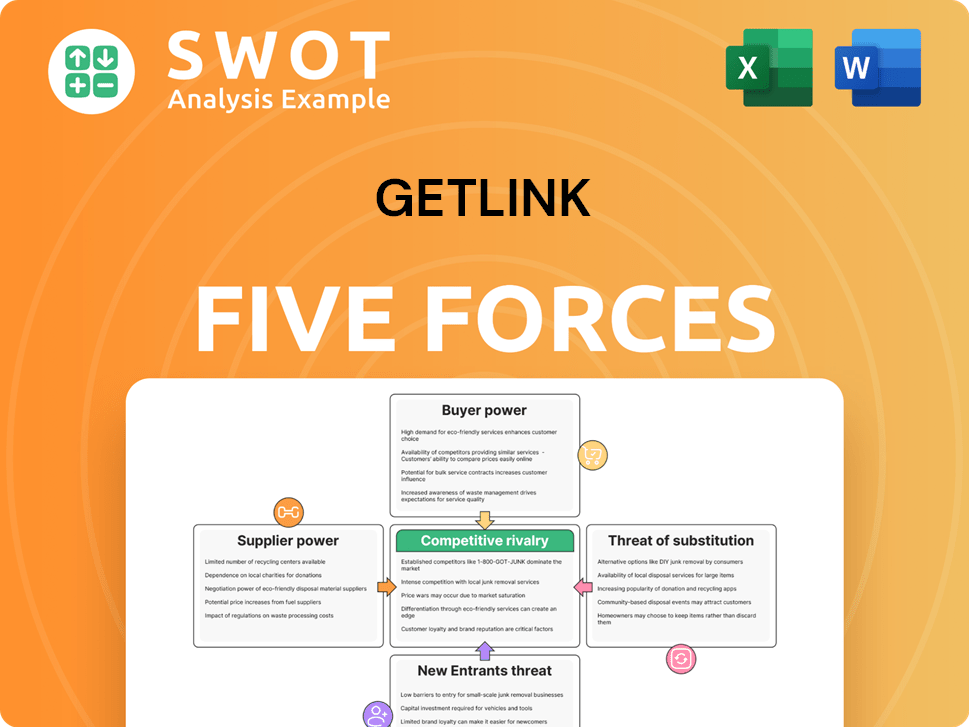

Getlink Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Getlink Company?

- What is Growth Strategy and Future Prospects of Getlink Company?

- How Does Getlink Company Work?

- What is Sales and Marketing Strategy of Getlink Company?

- What is Brief History of Getlink Company?

- Who Owns Getlink Company?

- What is Customer Demographics and Target Market of Getlink Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.