Getlink Bundle

Can Getlink's Growth Strategy Navigate Future Challenges?

Getlink SE, the operator of the iconic Channel Tunnel, stands at the forefront of European transport infrastructure. Its strategic importance is undeniable, connecting the UK and mainland Europe and facilitating trade and travel. This analysis delves into Getlink's Getlink SWOT Analysis, exploring its growth strategy and future prospects within a dynamic market.

From its roots in the Eurotunnel, Getlink has expanded into rail freight and electricity interconnection, showcasing its adaptability and vision. This Getlink company analysis will examine the company's expansion plans and strategies, assessing its long-term growth potential within the evolving landscape of transport infrastructure. Understanding Getlink's ability to capitalize on market demands and technological advancements is crucial for investors and strategists alike, making this a pivotal study of the company's future.

How Is Getlink Expanding Its Reach?

The Revenue Streams & Business Model of Getlink highlights the company's strategic approach to growth, focusing on leveraging existing assets and exploring new market opportunities. This involves expanding its service offerings and entering new markets to ensure long-term sustainability and financial success. The company's expansion initiatives are primarily centered around its core infrastructure and expertise, aiming to diversify revenue streams and capitalize on growing demands within the European market.

A key element of Getlink's growth strategy involves the continuous development of its rail freight subsidiary, Europorte. This subsidiary is crucial for expanding the company's geographical reach and increasing its market share in the European rail freight sector. The firm also focuses on enhancing its energy transmission capabilities through projects like ElecLink, which aligns with the increasing emphasis on energy security and renewable energy integration across Europe. These initiatives demonstrate Getlink's commitment to adapting to market changes and capitalizing on emerging opportunities.

Getlink's expansion strategy is designed to capitalize on the growing demand for sustainable and interconnected infrastructure in Europe. This involves exploring new routes for Europorte, acquiring additional rolling stock, and forging strategic partnerships to create seamless cross-border freight services. The firm's focus on energy transmission, particularly through projects like ElecLink, is also a key component of its strategy. These initiatives are driven by the need to diversify revenue streams and ensure long-term growth.

Europorte's expansion includes increasing its geographical reach and market share in the European rail freight sector. This strategy involves exploring new routes and acquiring additional rolling stock. Strategic partnerships with other logistics providers are also crucial for creating seamless cross-border freight services.

ElecLink, the electricity interconnector, is a key project in Getlink's expansion plans. The company aims to explore opportunities to expand its energy transmission capabilities. This may involve new interconnector projects or increasing the capacity of existing ones, subject to regulatory approvals and market demand.

Getlink's expansion strategy relies heavily on strategic partnerships and market analysis to identify growth opportunities. The company focuses on adapting to the evolving demands of the European market, particularly in the areas of rail freight and energy transmission. These initiatives are designed to diversify revenue streams and support long-term growth.

- Strategic Partnerships: Collaborations with logistics providers to enhance cross-border freight services.

- Market Analysis: Identifying new routes and opportunities for rail freight expansion.

- Energy Transmission: Exploring new interconnector projects to increase capacity.

- Revenue Diversification: Expanding into new sectors to reduce reliance on core operations.

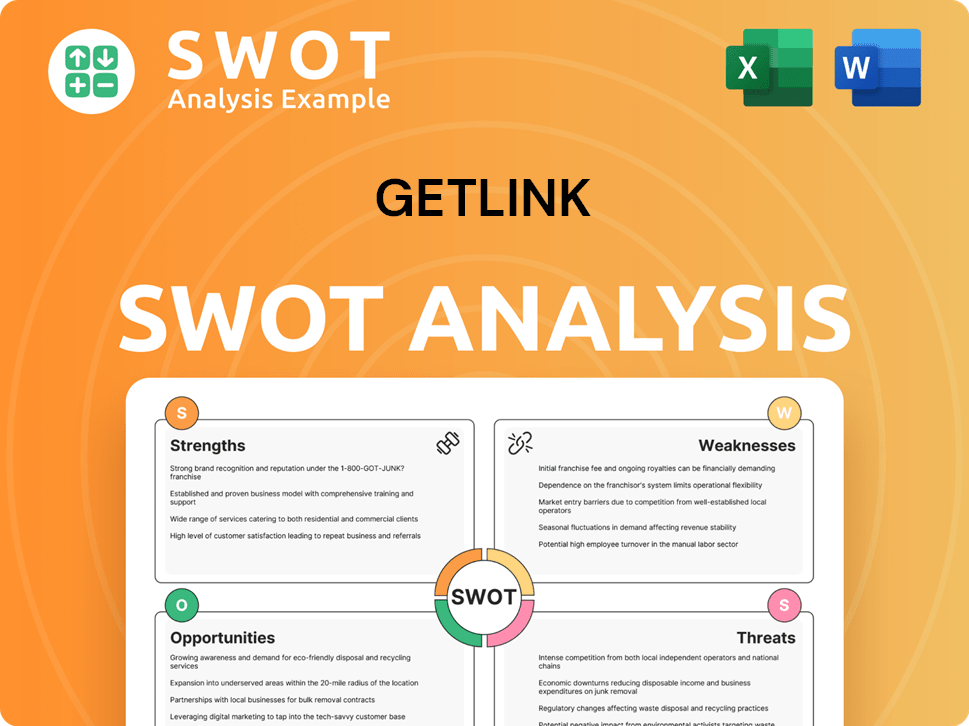

Getlink SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Getlink Invest in Innovation?

The innovation and technology strategy of Getlink is crucial for its ongoing growth. This strategy focuses on boosting operational efficiency, improving customer experience, and creating new service capabilities. The company continuously invests in research and development to maintain its leadership in railway infrastructure and operations. This approach is central to the company's Getlink growth strategy.

A key element of Getlink's technological approach is digital transformation. This aims to optimize maintenance schedules, improve real-time monitoring of tunnel operations, and enhance data analytics for better decision-making. This includes using advanced sensors and predictive maintenance algorithms. The company's focus on technology is essential for understanding the Getlink future prospects.

Furthermore, Getlink explores technologies like Artificial Intelligence (AI) and the Internet of Things (IoT). These technologies help automate processes and improve service delivery. For example, AI can optimize train scheduling, while IoT devices provide data on infrastructure health. This commitment to technology is a key part of any Getlink company analysis.

Getlink is heavily invested in digital transformation to improve its operations. This includes using advanced sensors, predictive maintenance, and integrated control systems within the Channel Tunnel. These systems enhance safety and efficiency.

The company is exploring AI and IoT to further automate processes. AI could optimize train scheduling and resource allocation. IoT devices provide data on infrastructure health and environmental conditions.

Getlink's innovation strategy is linked to sustainability. The company aims to reduce its carbon footprint through energy-efficient operations. They are also integrating renewable energy sources.

Technological advancements are key to improving operational efficiency. These improvements include better maintenance schedules and real-time monitoring. These changes lead to better decision-making.

Technological improvements also aim to enhance customer experience. This involves better services and more efficient operations. The goal is to make travel smoother and more reliable.

Getlink consistently invests in research and development. This investment helps maintain its leadership in railway infrastructure. It also supports the development of new service capabilities.

Getlink's technological advancements have a significant impact on its operations and future. The use of AI, IoT, and advanced monitoring systems improves efficiency. These technologies also contribute to sustainability and enhance customer service. For more insights, you can read a detailed Getlink company analysis.

- AI: Optimizes train scheduling and resource allocation, improving operational efficiency.

- IoT: Provides real-time data on infrastructure health and environmental conditions, enabling proactive maintenance.

- Digital Transformation: Enhances maintenance schedules and improves real-time monitoring, ensuring safety and efficiency.

- Sustainability Initiatives: Reduces carbon footprint through energy-efficient operations and renewable energy integration.

- Customer Experience: Improves service delivery through more efficient and reliable operations.

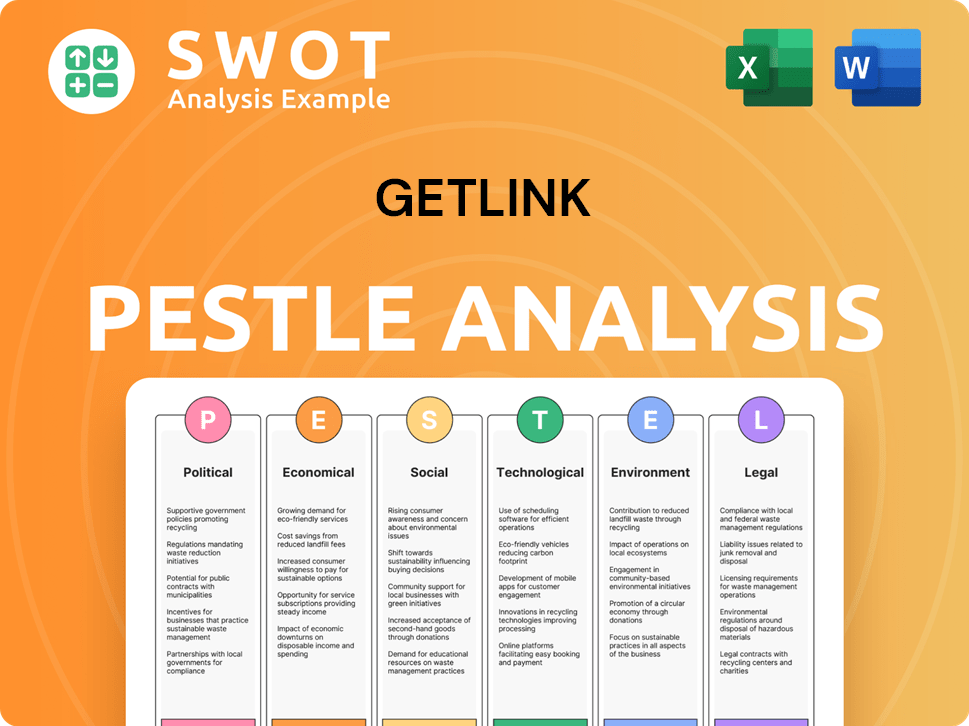

Getlink PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Getlink’s Growth Forecast?

The financial outlook for Getlink appears promising, supported by its strong performance in 2023 and strategic initiatives aimed at sustainable growth. The company's diverse operations, including Shuttle services and the Channel Tunnel, contribute to a robust revenue base. This, coupled with the expansion of projects like ElecLink and Europorte, positions Getlink favorably for future financial success.

In 2023, Getlink reported revenues of approximately €1.6 billion. This represents a significant increase, reflecting the success of its core services and strategic investments. The company's focus on operational efficiency and disciplined capital allocation further strengthens its financial position, enabling continued investment in infrastructure and expansion projects.

For 2024, Getlink anticipates continued revenue growth, projecting an EBITDA of around €980 million. This demonstrates healthy operational profitability and underscores the company's ability to generate strong cash flow. Such financial health is crucial for supporting its strategic plans and shareholder returns, as well as its role in European transport and energy infrastructure.

Getlink experienced strong revenue growth in 2023, reaching €1.6 billion. This increase was driven by the performance of its Shuttle services and increased traffic through the Channel Tunnel. The contribution from ElecLink also played a significant role in boosting the company's revenue.

For 2024, Getlink projects an EBITDA of €980 million, indicating continued operational profitability. This projection highlights the company's ability to maintain strong financial performance. The company's financial strategy focuses on maximizing returns from its existing assets.

Getlink is investing in strategic expansion projects, including the further development of ElecLink and the growth of Europorte. These investments are crucial for long-term growth and maintaining the high standards of its infrastructure. These strategic investments are key to the company's Getlink company analysis.

The company's financial strategy focuses on maximizing returns from its existing assets. This is supported by strong cash flow generation and a disciplined approach to capital allocation. This financial health supports its strategic plans and shareholder returns.

Getlink's financial performance is characterized by robust revenue growth and strong profitability. The company's strategic investments and operational efficiency improvements are key drivers of its financial success.

- €1.6 Billion in revenue reported for 2023.

- Expected EBITDA of €980 million for 2024.

- Focus on expanding ElecLink and Europorte.

- Disciplined approach to capital allocation.

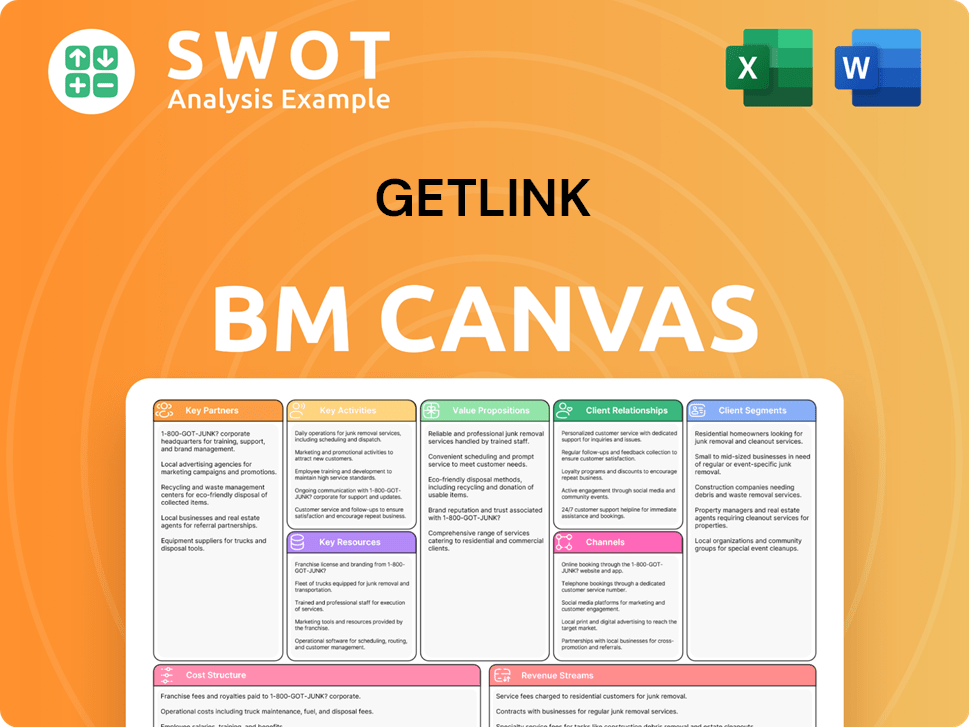

Getlink Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Getlink’s Growth?

The company's ambitious growth plans face several potential risks and obstacles. Market competition and regulatory changes present significant challenges. These factors could influence operations and financial outcomes.

Supply chain vulnerabilities and technological disruptions also pose threats. Internal resource constraints and extreme weather events further add to the list of concerns. The company must navigate these challenges to ensure its long-term success.

The company's ability to grow is tied to its capacity to adapt to a dynamic business environment. The Marketing Strategy of Getlink highlights the need for strategic flexibility.

Competition from ferries and air travel presents a constant challenge. This competition can affect the company's market share and profitability. Strategies to maintain a competitive edge are essential for sustainable growth.

Changes in regulations, especially post-Brexit, can impact operations. These changes can affect customs procedures and freight logistics. Adapting to new regulations is critical to minimize disruptions.

Disruptions to the supply chain can affect the flow of goods and services. Global events can exacerbate these vulnerabilities. Diversification and robust risk management are crucial.

Advancements in transport technology pose a risk if the company fails to innovate. New technologies could reduce the competitive advantage of the existing infrastructure. Investing in innovation is vital.

Shortages of skilled labor or capital can hinder expansion. Efficient resource allocation is essential for growth initiatives. Careful financial planning is necessary to overcome these constraints.

Increasing frequency of extreme weather can impact tunnel operations. Such events can cause delays and increase costs. Implementing robust disaster preparedness is essential.

Evolving geopolitical tensions can affect international trade and travel. This can lead to fluctuations in passenger numbers and freight volumes. Monitoring and adapting to global political dynamics are necessary.

The company employs diversification across its business segments. It also uses robust risk management frameworks. Continuous engagement with regulatory bodies helps to mitigate risks. These strategies have proven effective in the past.

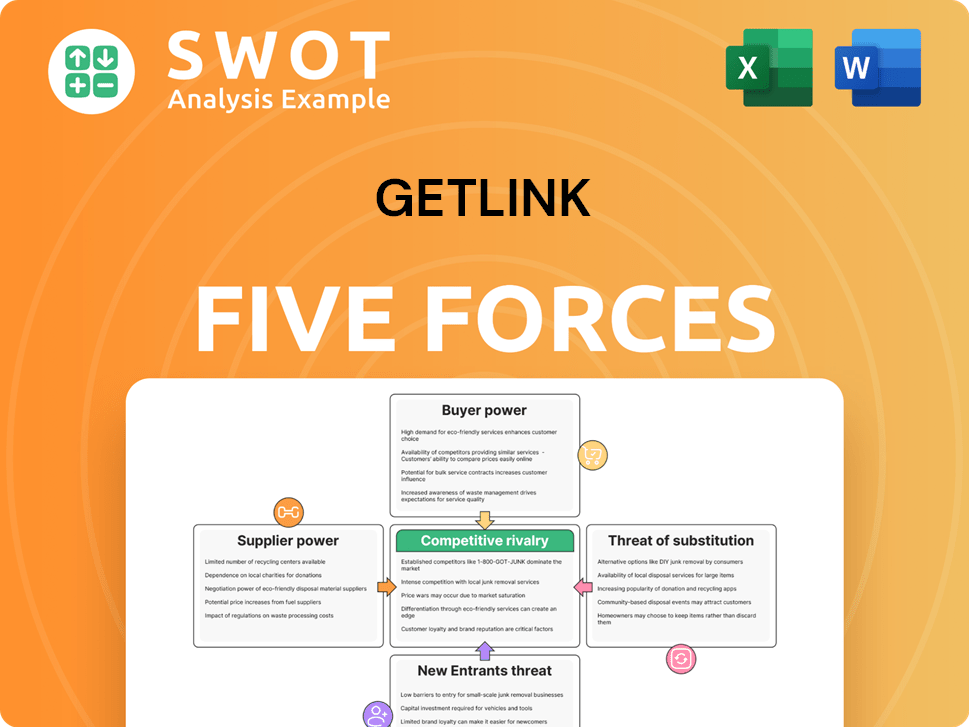

Getlink Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Getlink Company?

- What is Competitive Landscape of Getlink Company?

- How Does Getlink Company Work?

- What is Sales and Marketing Strategy of Getlink Company?

- What is Brief History of Getlink Company?

- Who Owns Getlink Company?

- What is Customer Demographics and Target Market of Getlink Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.