Getlink Bundle

How Does Getlink Company Operate and Thrive?

Getlink SE, the driving force behind the iconic Channel Tunnel, is a pivotal player in European infrastructure. This vital link facilitates the movement of passengers and freight between the UK and mainland Europe. But how does this complex operation, encompassing high-speed rail and essential infrastructure, truly function?

Beyond the tunnel itself, understanding Getlink SWOT Analysis is essential to grasping its full scope. The company's influence extends to Europorte, a major rail freight operator, and ElecLink, an electricity interconnector. This analysis will dissect How Getlink works, exploring its multifaceted business model, diverse revenue streams, and strategic positioning within the competitive landscape of European transportation and energy markets, offering a clear view of Getlink services and features.

What Are the Key Operations Driving Getlink’s Success?

The core operations of the Getlink company revolve around the management and utilization of the Channel Tunnel. This infrastructure serves as a vital link for cross-Channel transportation. Getlink provides efficient, reliable, and secure passage for both passengers and freight, offering a unique value proposition in the transportation sector.

The primary value proposition of Getlink lies in its ability to offer efficient, reliable, and secure passage across the English Channel. This is achieved through its core offerings, including the Le Shuttle service for vehicles, high-speed rail infrastructure for Eurostar passenger services, and rail freight services. These services cater to a diverse customer base, from individual travelers to logistics companies.

The operational processes are highly integrated and complex. For Le Shuttle, this includes terminal management, vehicle loading/unloading, and precise scheduling. For railway operators, Getlink provides infrastructure management, including track maintenance and safety protocols. The Channel Tunnel's unique nature offers unparalleled speed and directness, translating into reduced travel times and greater predictability.

Le Shuttle provides a frequent service for vehicles, offering a fast and convenient alternative to ferries. This service is a key component of Getlink's revenue generation, catering to a large volume of travelers and commercial vehicles. The service is known for its efficiency, with crossing times as short as 35 minutes.

Getlink manages the high-speed rail infrastructure used by Eurostar, facilitating passenger travel between the UK and continental Europe. This service is crucial for international travel, connecting major cities and providing a sustainable transport option. Eurostar services are a significant part of Getlink's operations, contributing to its overall revenue.

Getlink offers rail freight services, providing a vital link for the transportation of goods between the UK and Europe. This service supports various industries, facilitating the movement of goods efficiently and sustainably. Rail freight is essential for the supply chain, offering a reliable alternative to road transport.

Getlink is responsible for the maintenance and management of the Channel Tunnel infrastructure, ensuring the safety and reliability of all services. This includes track maintenance, signaling systems, and safety protocols. The infrastructure management is critical for the smooth operation of all services, ensuring the safety of passengers and freight.

The core operations of Getlink translate into significant customer benefits, including reduced travel times, greater predictability, and the ability to transport a wide range of goods and vehicles. These benefits contribute to the company's market differentiation and customer satisfaction.

- Reduced travel times compared to sea crossings.

- Greater predictability and reliability.

- Ability to transport a wide range of goods and vehicles.

- Efficient and secure passage across the English Channel.

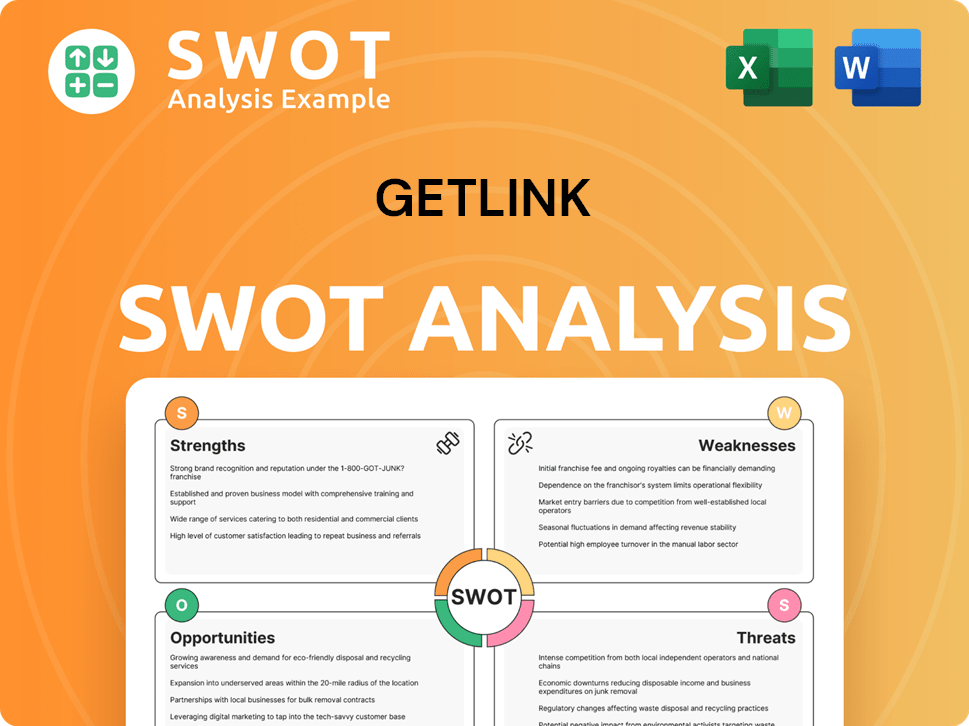

Getlink SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Getlink Make Money?

The Getlink company generates revenue through a multifaceted approach, primarily centered on its Channel Tunnel operations. This includes services like Le Shuttle, which transports vehicles, and fees from railway operators such as Eurostar for using the tunnel infrastructure. These core activities form the foundation of how Getlink works financially.

In 2023, Getlink reported consolidated revenue of €1.8 billion, reflecting a significant increase from the previous year. This growth underscores the company's strong market position and effective operational strategies. The revenue streams are diversified to ensure financial stability and growth.

Getlink platform also leverages its infrastructure to offer additional services, expanding its revenue base. This diversification allows the company to capitalize on its existing assets and explore new market opportunities.

Le Shuttle, which transports both passenger and freight vehicles, is a major revenue source. Usage fees from railway operators like Eurostar for utilizing the tunnel infrastructure also contribute significantly to the revenue.

Europorte, the rail freight operator, generates revenue through freight transport contracts across Europe. In 2023, Europorte's revenue increased by 1% to €137 million.

ElecLink, an electricity interconnector, contributes through capacity allocation and transmission fees. In 2023, ElecLink contributed €420 million to Getlink's revenue.

In 2023, Le Shuttle Freight saw a 16% increase in revenue, while Le Shuttle Passenger revenue increased by 20%. The consolidated revenue reached €1.8 billion.

The company has diversified its revenue streams, including freight transport and electricity transmission. This diversification enhances financial resilience.

ElecLink's contribution highlights innovative monetization strategies, leveraging existing infrastructure for new services. This approach adds a significant new component to overall financial performance.

The Getlink services are supported by various operational strategies, including those outlined in the growth strategy of Getlink. These strategies focus on maximizing the utilization of existing infrastructure and exploring new revenue streams to ensure long-term financial health and growth. The Getlink features, such as the efficient transport of passengers and freight, and the transmission of electricity, are all designed to generate revenue and provide value to its customers.

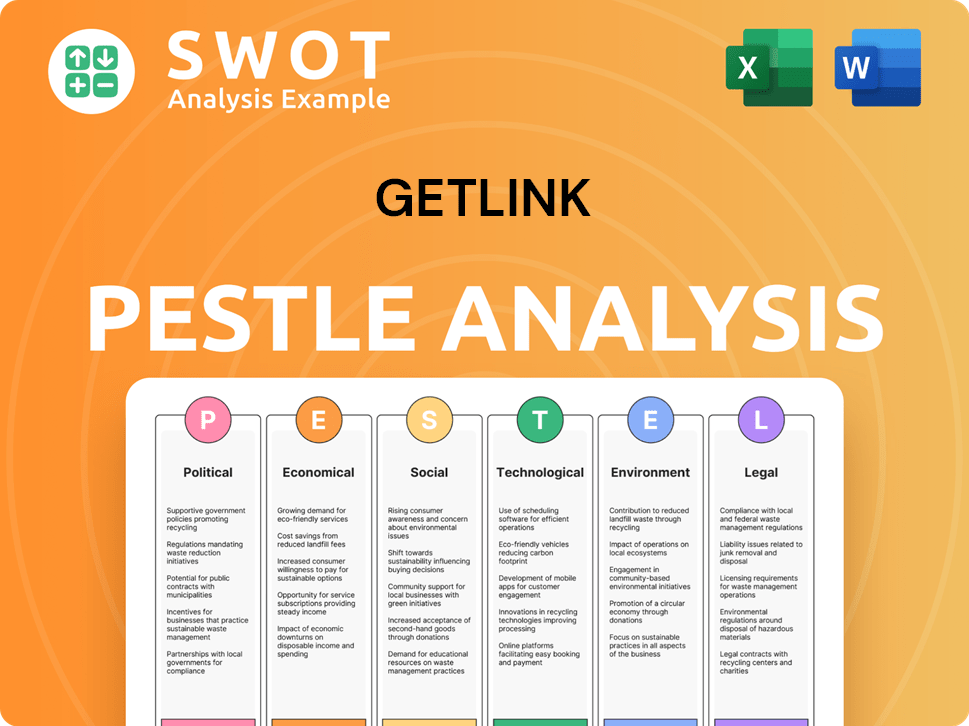

Getlink PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Getlink’s Business Model?

The journey of the Getlink company has been marked by significant milestones and strategic moves that have shaped its operational and financial landscape. The most pivotal milestone was the initial construction and opening of the Channel Tunnel in 1994, fundamentally altering cross-Channel transport. More recently, the commercial launch of ElecLink in 2022 represented a major strategic move, diversifying Getlink's revenue streams and leveraging its unique asset for electricity transmission.

The company has also navigated various operational and market challenges, including economic downturns affecting passenger and freight volumes, and the complexities of Brexit, which impacted customs procedures and cross-border trade. Getlink responded by adapting its services, investing in digital solutions for improved efficiency, and engaging with authorities to streamline processes. Its competitive advantages are formidable, primarily stemming from the unique and irreplaceable nature of the Channel Tunnel itself.

This provides an inherent barrier to entry for competitors. Furthermore, its established brand strength, particularly for Le Shuttle, and its expertise in managing complex rail infrastructure contribute to its sustained business model. Getlink continues to adapt to new trends by exploring opportunities in sustainable transport and energy, aligning with broader environmental goals and potentially expanding its service offerings in the future.

The opening of the Channel Tunnel in 1994 was a landmark achievement, revolutionizing cross-Channel transportation. The launch of ElecLink in 2022 marked a significant diversification of revenue streams. This strategic move leveraged the tunnel's infrastructure for electricity transmission.

ElecLink's commercial launch in 2022 was a key strategic decision, expanding the company's business model. Adapting to Brexit involved streamlining customs processes and digital solutions. Investing in sustainable transport aligns with environmental goals and future growth.

The Channel Tunnel's unique and irreplaceable nature provides a strong barrier to entry. Established brand recognition, particularly for Le Shuttle, is a significant advantage. Expertise in managing complex rail infrastructure supports a sustainable business model.

Economic downturns and Brexit presented operational challenges for Getlink. The company responded by adapting services and investing in digital solutions. They engaged with authorities to streamline processes and maintain efficiency.

In 2023, Getlink reported a strong performance, with revenue reaching approximately €1.6 billion, a significant increase from previous years. The Shuttle carried over 1.8 million cars and 600,000 trucks, demonstrating robust demand. The ElecLink project contributed to the company's diversified revenue streams, enhancing its financial outlook. For more details on the company's ownership and structure, you can read about the Owners & Shareholders of Getlink.

- Revenue in 2023 was approximately €1.6 billion.

- Le Shuttle transported over 1.8 million cars and 600,000 trucks.

- ElecLink has diversified revenue streams.

- The company continues to invest in sustainable transport solutions.

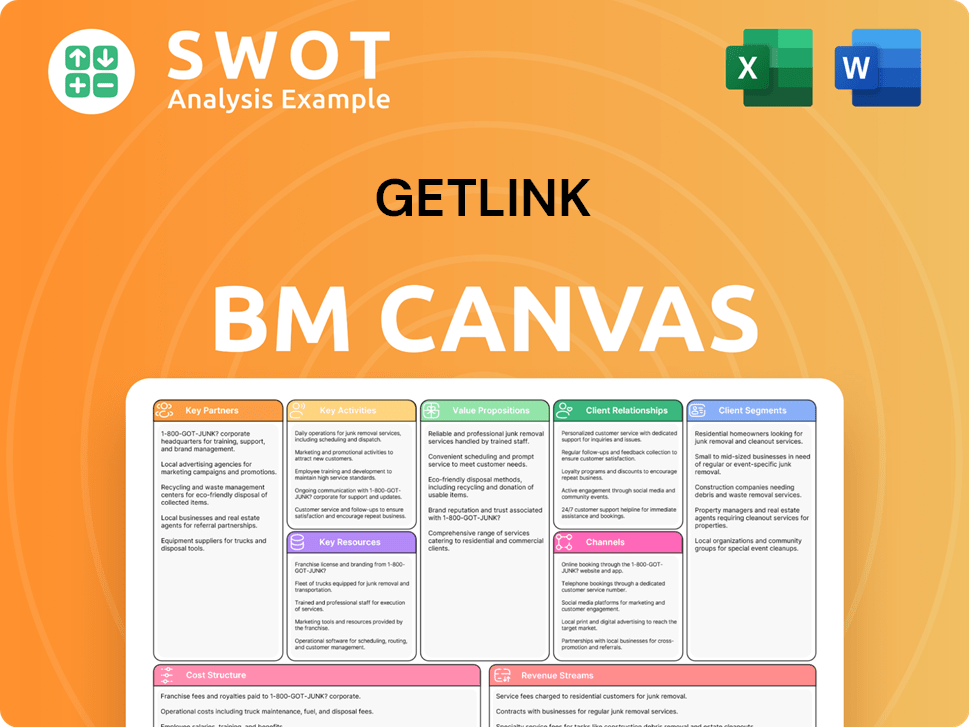

Getlink Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Getlink Positioning Itself for Continued Success?

The Getlink company holds a unique and dominant position within its industry, primarily due to its ownership and operation of the Channel Tunnel. This gives it a near-monopoly on fixed-link cross-Channel rail transport. While it faces competition from ferries and airlines, its direct rail connection provides advantages in speed, capacity, and weather resilience. The company maintains a significant market share for accompanied vehicle traffic between the UK and continental Europe.

Despite its strong market position, Getlink faces several key risks, including regulatory changes, competition from other transport sectors, and economic downturns. The future outlook for Getlink centers on optimizing existing assets, exploring new opportunities like ElecLink, and enhancing services like Le Shuttle. Strategic initiatives include infrastructure investments for long-term operational efficiency and safety. The company aims to sustain and expand its ability to generate revenue through the Channel Tunnel while adapting to market demands and regulatory changes.

As the operator of the Channel Tunnel, Getlink has a significant advantage. This infrastructure provides a crucial link for both passenger and freight transport between the UK and the European continent. The company's market share is substantial for accompanied vehicle traffic.

Regulatory changes, economic fluctuations, and competition from other transport modes pose risks to Getlink. Economic downturns and geopolitical events directly affect passenger and freight volumes. The ongoing impact of inflation and economic uncertainties can affect consumer spending and industrial activity.

Getlink aims to maximize the potential of ElecLink, increase rail freight, and improve the Le Shuttle experience. Strategic initiatives include investments in infrastructure maintenance and upgrades. The company is committed to sustainability and adapting to evolving market demands.

In the first half of 2023, Getlink reported a significant increase in revenue, driven by strong traffic volumes. Revenue reached €877 million, a 40% increase compared to the first half of 2022. The company's EBITDA also saw a substantial rise, reaching €373 million, a 50% increase year-over-year. These figures demonstrate a robust recovery from the impact of the pandemic and continued strong performance. To understand the complete picture, you can check out the Competitors Landscape of Getlink.

The company is focusing on several key areas to drive future growth and maintain its market position. These initiatives include maximizing the potential of ElecLink, expanding rail freight operations, and enhancing the customer experience with Le Shuttle.

- Investment in infrastructure maintenance and upgrades to ensure long-term operational efficiency and safety.

- Focus on sustainability and leveraging its unique infrastructure to support the transition to a low-carbon economy.

- Strategic diversification of revenue streams and adaptation to evolving market demands and regulatory landscapes.

- Continued focus on providing high-quality services through the Channel Tunnel.

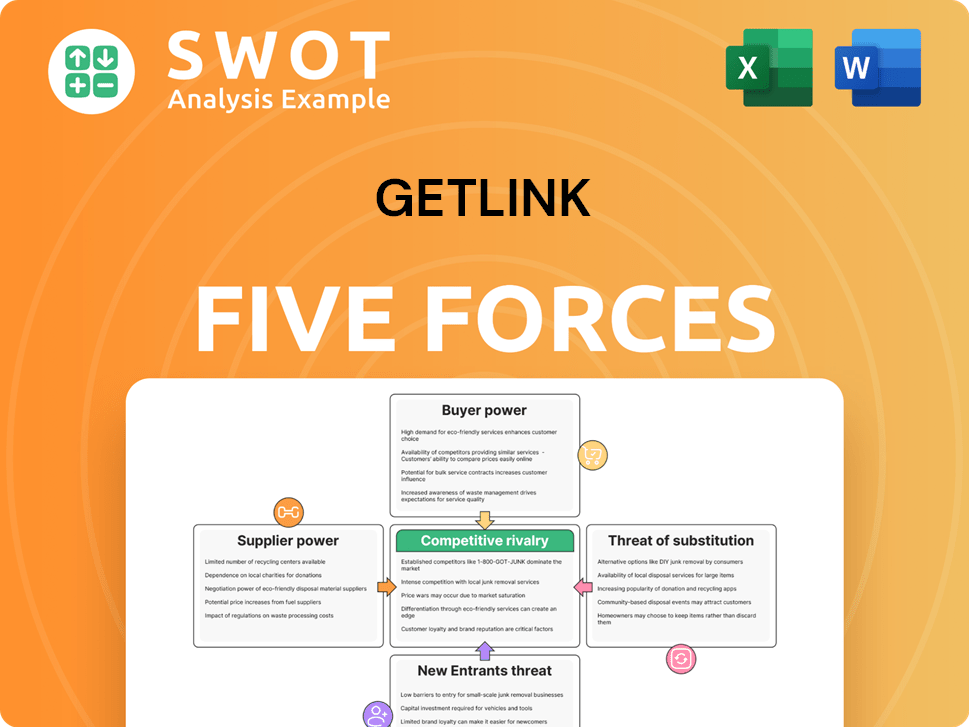

Getlink Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Getlink Company?

- What is Competitive Landscape of Getlink Company?

- What is Growth Strategy and Future Prospects of Getlink Company?

- What is Sales and Marketing Strategy of Getlink Company?

- What is Brief History of Getlink Company?

- Who Owns Getlink Company?

- What is Customer Demographics and Target Market of Getlink Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.