Hansen Bundle

How Does Hansen Company Navigate Its Competitive Arena?

In a world of relentless technological advancement, understanding the Hansen SWOT Analysis is crucial. Hansen Technologies, a leader in software and services for essential industries, has evolved from a local provider to a global force. Its journey, starting in 1971, showcases a remarkable ability to adapt and thrive in a competitive environment.

This exploration of the Hansen Company competitive landscape will dissect its market position and provide a detailed competitive analysis. We'll identify Hansen Company competitors, evaluate its strengths and weaknesses, and examine the industry trends shaping its business strategy. Furthermore, we'll uncover how Hansen Company's strategic alliances and growth strategies contribute to its success in the dynamic market.

Where Does Hansen’ Stand in the Current Market?

Hansen Technologies specializes in providing software and services for the energy, water, pay-TV, and telecommunications sectors. Its core operations revolve around customer information systems (CIS), billing solutions, and data management platforms. The company's value proposition lies in offering comprehensive, integrated solutions that streamline customer lifecycle management, moving beyond basic billing to provide end-to-end services.

This approach allows clients to modernize their operations and improve customer experiences. The company's solutions cater to a diverse clientele, from large multinational corporations to smaller regional providers, with a global presence that spans across Europe, North America, Latin America, Australia, New Zealand, and Asia. This broad reach underscores its ability to serve varied market needs effectively.

The company's strategic focus on integrated solutions reflects the industry's shift towards digital transformation and converged services. This evolution is crucial in maintaining a strong market position and adapting to changing customer demands. For a deeper understanding of the financial aspects, consider exploring Revenue Streams & Business Model of Hansen.

While specific market share figures fluctuate, Hansen Technologies is recognized as a leading provider of CIS and billing solutions. The company's strong position is particularly evident within the utilities and communications sectors. Its ability to offer scalable solutions allows it to cater to various market segments effectively.

The industry analysis reveals a trend towards digital transformation and integrated services. Hansen's focus on end-to-end customer lifecycle management aligns with these trends. This strategic positioning allows the company to capitalize on the growing demand for advanced utility and communication infrastructure.

Hansen's business strategy emphasizes comprehensive and integrated solutions to move beyond standalone billing systems. This approach supports digital transformation and converged services. The company's focus on recurring revenue and profitability is a key element of its strategy.

For the fiscal year ended June 30, 2023, Hansen Technologies reported revenue of AUD 316.5 million and an EBITDA of AUD 105.8 million. This resulted in an EBITDA margin of 33.4%, showcasing strong financial health and profitability. The company's financial performance often surpasses industry averages.

Hansen's competitive advantages include its comprehensive solutions, global presence, and strong financial performance. Its disadvantages might include the challenges of adapting to rapidly changing technology and intense competition. The company's ability to innovate and expand its offerings is crucial.

- Strong position in mature markets with legacy system replacement needs.

- Expanding presence in emerging markets to address growing infrastructure demands.

- Focus on recurring revenue and margin stability.

- Challenges include competition and the need for continuous technological advancements.

Hansen SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Hansen?

The competitive landscape for Hansen Technologies is characterized by a mix of established and emerging players. A thorough competitive analysis of Hansen Company reveals a dynamic environment where strategic positioning and innovation are crucial for sustained success. Understanding the Hansen Company competitors is vital for assessing market dynamics and formulating effective business strategies.

Hansen operates in several industries, facing different competitive pressures in each. The company's market position analysis highlights its strengths and weaknesses against key rivals. The ability to adapt to industry trends and leverage strategic alliances is key to maintaining a competitive edge.

As a company, Hansen must constantly evaluate its position and its competitive environment to make informed decisions. This includes understanding Hansen Company's competitive advantages and disadvantages. For more information, consider reading Brief History of Hansen.

In the energy and water sectors, Hansen faces strong competition from large enterprise software providers. These competitors, like Oracle and SAP, offer comprehensive ERP suites that include utility billing and customer management features. Specialized utility software vendors also pose a threat.

Within the pay-TV and telecommunications industries, Hansen competes with major global players. Amdocs, CSG Systems International, and Ericsson are key rivals providing comprehensive BSS and OSS solutions. These competitors often compete on scale and breadth of offerings.

Emerging players, particularly those focused on cloud-native solutions and AI-driven customer engagement, represent an indirect but growing challenge. These disruptors often use agile development and innovative pricing models to gain market share. Mergers and acquisitions also reshape the competitive dynamics.

Hansen's success depends on its strategic responses to its competitors. This includes product innovation, customer relationship management, and strategic partnerships. The company must constantly evaluate its position and its competitive environment to make informed decisions.

Hansen Company's market share varies across its different product lines and geographic regions. Keeping track of these changes is essential for strategic planning. The company's ability to maintain and grow its market share is a key performance indicator.

Hansen Company industry analysis reveals several trends and challenges. These include the increasing adoption of cloud-based solutions, the rise of AI, and the need for enhanced cybersecurity. Understanding these trends is crucial for long-term success.

The competitive landscape is complex and constantly evolving. How does Hansen Company compare to its competitors? To answer this, we can look at specific areas of competition.

- Oracle and SAP: These companies offer broad ERP solutions. In 2024, Oracle reported revenues of around $50 billion, while SAP's revenue was approximately $31 billion. These figures show the scale of these competitors.

- Amdocs and CSG: These companies provide BSS and OSS solutions. Amdocs had revenues of about $4.9 billion in fiscal year 2024. CSG's revenues were around $1.1 billion in the same period. These figures highlight their significant presence in the telecom sector.

- Emerging Players: These companies, often focused on cloud-native solutions, represent a growing challenge. While specific revenue figures for all emerging players are not always available, their increasing market share indicates their growing impact.

- Market Dynamics: Mergers and acquisitions are reshaping the competitive landscape. For example, in 2024, there were numerous acquisitions in the tech sector, leading to consolidation and increased competition.

Hansen PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Hansen a Competitive Edge Over Its Rivals?

Hansen Technologies distinguishes itself within the competitive landscape through several key advantages. Its deep industry expertise, particularly in sectors like energy, water, and telecommunications, allows for the development of highly specialized solutions. This focus enables the company to meet the unique compliance and functionality demands of these industries, setting it apart from broader enterprise software providers.

The company's long-standing relationships with a global client base contribute to significant customer loyalty. This loyalty is built on years of reliable service and a proven track record of successful implementations. Furthermore, continuous investment in research and development, especially in areas like cloud migration and AI-driven automation, gives it a technological edge.

Hansen's robust billing engines and customer care platforms are designed to handle high transaction volumes and complex pricing models. The flexible and scalable software architecture allows for seamless integration with existing client systems, reducing implementation risks and costs. Its global delivery model, supported by a skilled talent pool, enables localized support and adaptation to diverse market demands. However, these advantages face challenges from rapid technological advancements and potential replication by competitors.

Hansen's specialization in energy, water, pay-TV, and telecommunications provides a competitive edge. This focus allows for tailored solutions that address specific industry needs, including complex regulatory requirements. This targeted approach differentiates Hansen from general software providers.

The company benefits from long-standing relationships with a global client base. These relationships foster customer loyalty, built on years of reliable service and successful implementations. This strong foundation supports sustained market presence.

Continuous investment in R&D, particularly in cloud migration, data analytics, and AI, enhances Hansen's technological capabilities. The company's billing engines and customer care platforms are designed to manage high transaction volumes and complex pricing. This focus ensures it remains competitive.

Hansen's global delivery model, supported by a skilled talent pool, allows it to provide localized support. This approach enables the company to adapt to diverse market demands effectively. This global presence is key to its competitive strategy.

Hansen's competitive advantages include its industry-specific expertise, strong customer relationships, and technological innovation. These factors contribute to its market position and ability to serve clients effectively. The company's strategic focus on these areas supports its growth and sustainability.

- Specialized solutions tailored to energy, water, and telecommunications.

- Long-term client relationships fostering loyalty and repeat business.

- Continuous investment in R&D, particularly in cloud and AI technologies.

- A global delivery model with localized support capabilities.

Hansen Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Hansen’s Competitive Landscape?

The competitive landscape for the Hansen Company is heavily shaped by industry trends, presenting both challenges and opportunities. Digital transformation, the need for real-time data analytics, and evolving consumer preferences are key drivers. Regulatory changes and global economic shifts also play a significant role in the company's strategic positioning.

Understanding the competitive environment requires an analysis of market dynamics, including technological advancements and the actions of competitors. This analysis is critical for developing effective business strategies and maintaining market share. A thorough competitive analysis helps in identifying strategic alliances and growth strategies, ultimately impacting financial performance.

Digital transformation is a primary driver, pushing utilities and communications providers to modernize. The demand for real-time data analytics and AI-driven insights is increasing. Regulatory changes in the energy and water sectors also shape system requirements. Consumer preferences for self-service and personalized offerings are evolving.

The rapid pace of technological change requires continuous investment in R&D. Increased competition from agile startups and larger vendors poses a threat. Global economic shifts, supply chain disruptions, and geopolitical uncertainties can impact client investment cycles.

Sustained demand for core offerings due to ongoing digital transformation. Expansion into emerging markets offers substantial growth potential. Product innovations, such as advanced analytics and AI-powered automation, can drive market penetration. Strategic partnerships can unlock new revenue streams.

Hansen's ability to adapt to trends and leverage core strengths is crucial. Capitalizing on emerging opportunities while mitigating potential threats is essential. Strategic alliances and growth strategies are key to maintaining a competitive edge. Detailed competitive landscape of Hansen Company in [specific industry] requires this understanding.

The competitive environment for the Hansen Company involves several key factors. A comprehensive Marketing Strategy of Hansen is essential for navigating these dynamics. Understanding these elements is vital for effective market positioning and strategic planning.

- Technological advancements and innovation cycles.

- Competitive actions of major rivals and emerging players.

- Market share and growth rates within the industry.

- Regulatory impacts and compliance requirements.

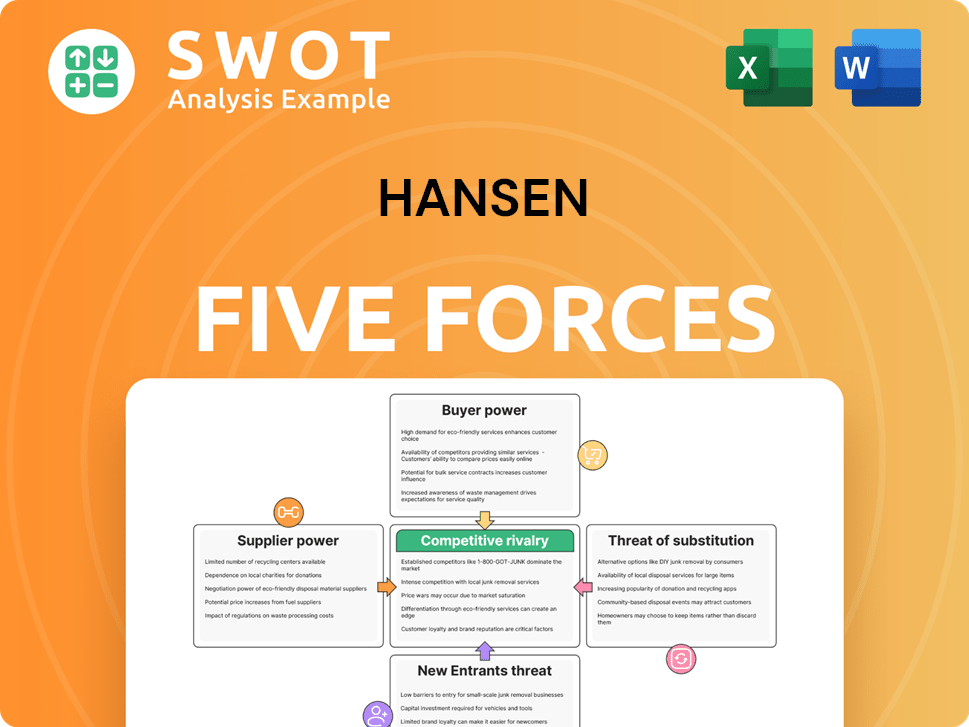

Hansen Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hansen Company?

- What is Growth Strategy and Future Prospects of Hansen Company?

- How Does Hansen Company Work?

- What is Sales and Marketing Strategy of Hansen Company?

- What is Brief History of Hansen Company?

- Who Owns Hansen Company?

- What is Customer Demographics and Target Market of Hansen Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.