Hansen Bundle

Who Really Owns Hansen Technologies?

Understanding the ownership structure of a company is paramount for investors and strategists alike. For Hansen Technologies, the journey from a private entity to a publicly traded company marks a significant evolution. This exploration unveils the intricacies of Hansen SWOT Analysis, from its founder's initial vision to the current landscape of institutional and public shareholders.

Delving into "Who owns Hansen Company?" provides critical insights into its strategic direction and future prospects. From its humble beginnings in 1971, Hansen Company history has been shaped by shifts in ownership. Knowing the Hansen Company owner and major shareholders offers a clearer picture of the company's stability and growth potential, especially considering the Hansen Company stock performance.

Who Founded Hansen?

The story of Hansen's ownership begins with its founder, Ken Hansen, who established the company in 1971. Initially, the business focused on providing services related to standby computer centers and peripherals. This early phase set the foundation for the company's future, although specific details about the initial ownership structure are not publicly available.

A significant transition occurred as the company evolved into software development. Andrew Hansen, Ken's son, joined the business, playing a key role in its shift towards software solutions. This family involvement highlights the foundational role of the Hansen family in shaping the company's direction and growth.

Andrew Hansen has served as a Director and CEO since 1993, demonstrating a long-term commitment to the company's leadership. His continued presence underscores the Hansen family's enduring influence on the company's operations and strategic decisions. The company's transformation from a service-oriented business to a software provider under the Hansen family's guidance highlights their foundational role.

Ken Hansen founded the company in 1971, initially focusing on services for standby computer centers.

Andrew Hansen, Ken's son, joined the company and has been CEO since 1993.

Andrew Hansen directly owns a significant portion of the company's shares.

The Hansen family, through Othonna Pty Ltd, remains a major shareholder.

The Hansen family's ownership reflects their vision in the company's early days.

Andrew Hansen's shares were valued at A$105.67 million as of recent data.

As of recent data, Andrew Hansen directly owns 10.54% of the company's shares, which were valued at A$105.67 million. The Hansen family, through Othonna Pty Ltd as trustee of the Hansen Property Trust, established by Kenneth and Yvonne Hansen, held approximately 10.2% of the total shares after a December 2024 sale. This ownership structure indicates the significant influence of the founding family in the company's distribution and control from its early days, solidifying their lasting impact on the company's trajectory and the question of who owns Hansen Company.

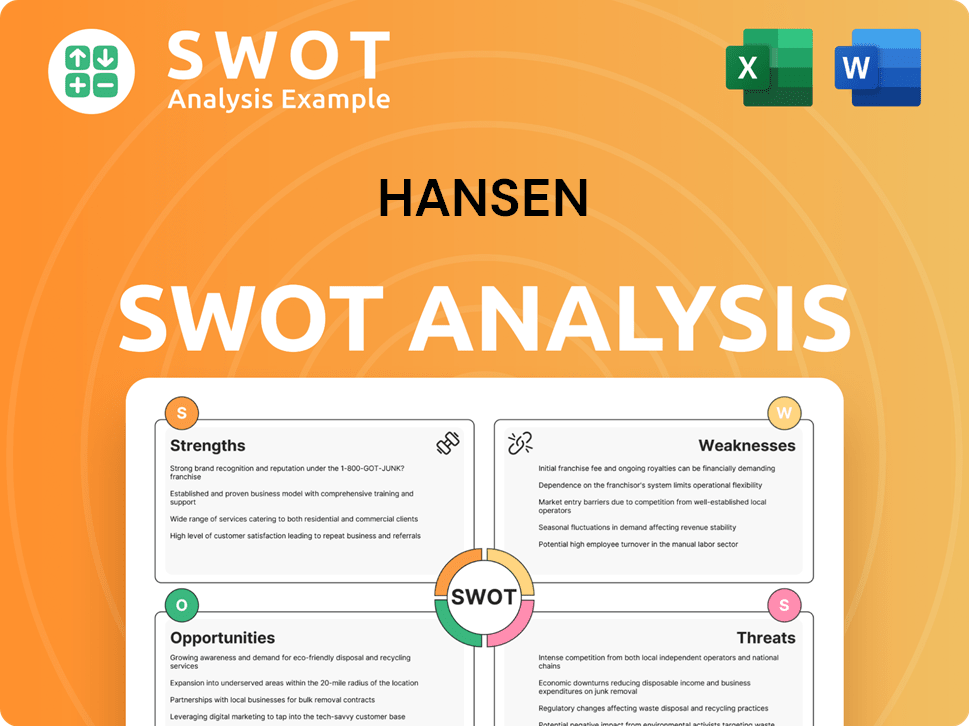

Hansen SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Hansen’s Ownership Changed Over Time?

The evolution of Hansen Technologies' ownership has been significantly shaped by its strategic decisions and market dynamics. The company transitioned to a publicly held entity with its initial public offering (IPO) in 2000, which facilitated its mergers and acquisitions strategy. This move allowed Hansen Technologies to expand its operations and market presence through various acquisitions, thereby influencing its ownership structure over time. As of June 13, 2025, the market capitalization of Hansen Technologies is approximately A$1.00 billion, reflecting its current valuation in the market.

The company’s ownership structure is influenced by major stakeholders, including institutional investors and significant shareholders. The Hansen family, through Othonna Pty Ltd, remains a key shareholder, holding approximately 10.2% of the total shares as of December 2024, despite recent sales. The acquisition of powercloud GmbH in February 2024 and selected software licenses from CONUTI GmbH in April 2025 further demonstrate Hansen's strategy to strengthen its market position and product portfolio. These acquisitions have impacted the company's financial performance and governance by integrating new entities and their operations.

| Shareholder | Stake | Date |

|---|---|---|

| Long Path Partners, LP | 5.01% voting power | May 2025 |

| Perpetual Limited | 4.99% | May 2025 |

| Othonna Pty Ltd (Hansen family) | ~10.2% | December 2024 |

Institutional investors play a crucial role in Hansen Technologies' ownership. As of March 28, 2025, there are 46 institutional owners and shareholders, holding a total of 11,160,189 shares. Key institutional holders include Vanguard and iShares. The company's revenue for the trailing 12 months, ending December 31, 2024, was $240 million USD. For more insight into the competitive environment, you can explore the Competitors Landscape of Hansen.

Hansen Technologies' ownership structure is a mix of institutional and family holdings, with the Hansen family still holding a significant stake. The company went public in 2000, with a market capitalization of A$1.00 billion as of June 13, 2025.

- Institutional investors hold a substantial number of shares.

- The Hansen family, through Othonna Pty Ltd, remains a major shareholder.

- Recent acquisitions have shaped the company’s structure.

- Long Path Partners, LP became a substantial shareholder in May 2025.

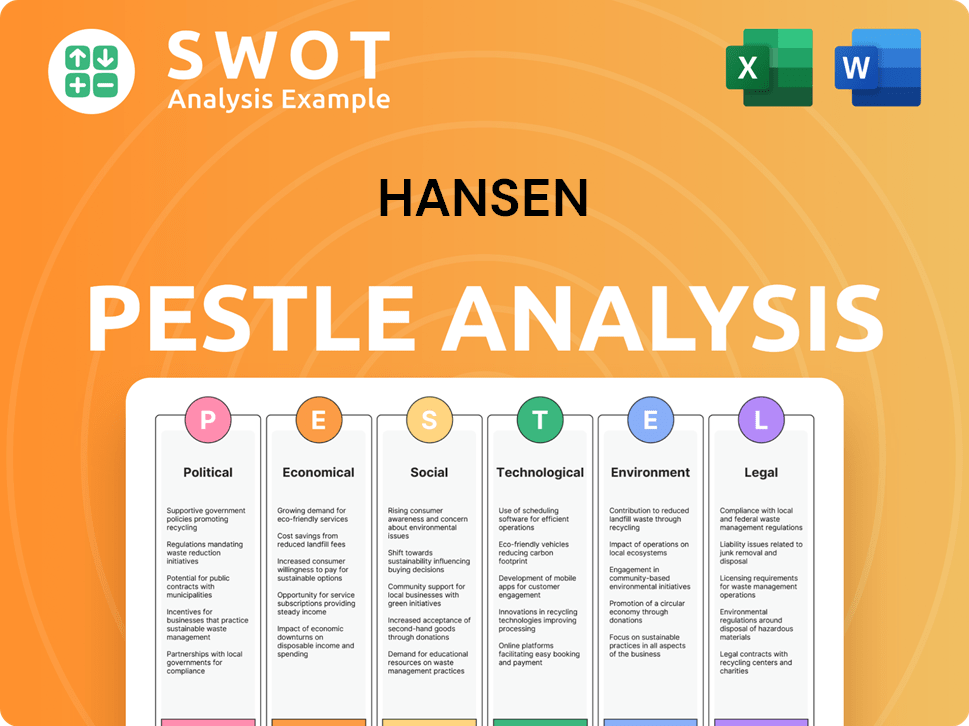

Hansen PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Hansen’s Board?

The current Board of Directors of the company plays a crucial role in overseeing the strategic direction and governance of the company. Andrew Hansen serves as the Global CEO and Managing Director, a position he has held since January 2024. He directly owns 10.54% of the company's shares, which gives him significant influence. David Trude holds the position of Non-Executive Chairman. Other key executives include Richard English as Chief Financial Officer, and Julia Chand as Global General Counsel and Company Secretary. The company's leadership structure is designed to ensure effective management and strategic oversight.

The board is responsible for making key decisions that affect the company's performance and future. Rebecca Wilson was appointed as a Director by the Board effective March 28, 2024, and was elected at the annual general meeting. The board continuously assesses and evaluates its practices and effectiveness, including combining the functions of the Remuneration Committee and Nomination Committee to improve governance structure. David Osborne is not standing for re-election as a Non-Executive Director in November 2024.

| Director | Position | Shareholding |

|---|---|---|

| Andrew Hansen | Global CEO and Managing Director | 10.54% |

| David Trude | Non-Executive Chairman | Not Specified |

| Richard English | Chief Financial Officer | Not Specified |

| Julia Chand | Global General Counsel and Company Secretary | Not Specified |

| Rebecca Wilson | Director | Not Specified |

The voting structure at the company generally follows a one-share-one-vote principle. Shareholders are entitled to vote on shares held on the record date, which for the 2025 Annual General Meeting was March 20, 2025. The Hansen family, through Othonna Pty Ltd, holds a significant 10.2% of shares. In 2024, the company faced a 'first strike' at its Annual General Meeting, with 42.5% of votes cast against the 2023 Remuneration Report, indicating shareholder dissatisfaction with executive compensation. For more information on the company's financial operations, consider reading about the Revenue Streams & Business Model of Hansen.

Understanding the ownership structure and the board of directors is crucial for evaluating the company's strategic direction. The Hansen family's holdings, combined with the CEO's direct ownership, give them considerable influence.

- Andrew Hansen, as CEO, holds significant influence through his direct shareholding.

- The voting structure is based on a one-share-one-vote principle.

- Shareholders voted against the 2023 Remuneration Report, indicating concerns about executive pay.

- The board is actively working to improve governance structures.

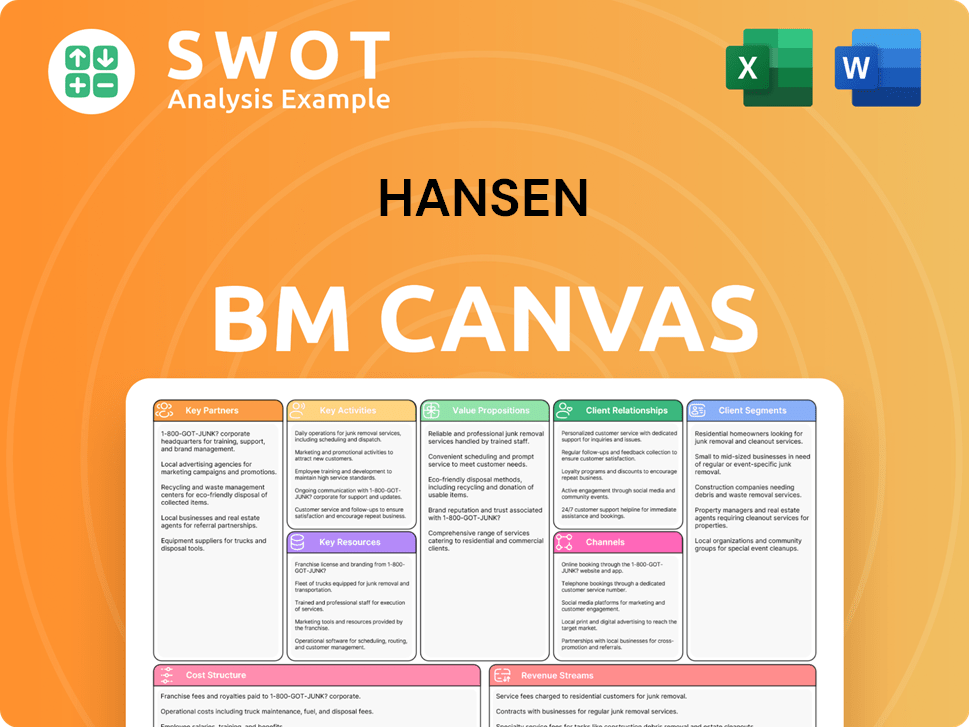

Hansen Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Hansen’s Ownership Landscape?

Over the past few years, there have been notable shifts in the ownership profile of the company. The Hansen family has been gradually reducing their stake. From 2021 to February 2025, their ownership decreased from 18% to 10%. In December 2024, Othonna Pty Ltd, associated with Andrew Hansen, sold 7 million shares, representing 3.4% of total shares. However, they remain the largest shareholder, holding 10.2%.

Institutional ownership remains a key aspect of the company's profile. As of March 2025, 46 institutional owners held over 11 million shares. In May 2025, Long Path Partners, LP became a substantial holder with a 5.01% voting power. If you're looking for more details about the company, you can find a comprehensive overview in this article about the company's company profile.

| Date | Event | Impact |

|---|---|---|

| February 2024 | Acquisition of powercloud GmbH | EBITDA accretive by FY25 |

| December 2024 | Othonna Pty Ltd share sale | Liquidity enhancement |

| April 2025 | Acquisition of software licenses from CONUTI GmbH | Strengthened service delivery |

For FY25, the company anticipates revenues between A$398 million and A$405 million, with an underlying EBITDA margin expected to be between 23-25%. The company's management expects a stronger second half of 2025, driven by license fees and major upgrade projects, including a A$50 million five-year master agreement. There have been no recent significant share buybacks, with the buyback yield reported as 0.00% as of June 2025. The company issued 5,302 new ordinary fully paid securities on September 25, 2024.

The Hansen family's ownership decreased while institutional holdings remained significant. Recent acquisitions aim to boost revenue and strengthen market presence. The company anticipates strong financial performance in FY25, driven by key projects.

FY25 revenue is projected between A$398 million and A$405 million. The underlying EBITDA margin is estimated to be between 23-25%. The company expects a stronger second half of 2025. No recent share buybacks were reported.

Acquisition of powercloud GmbH in February 2024. The integration focused on the German market, leading to profitability. Further expansion in the German market through software licenses from CONUTI GmbH.

The Hansen family remains a significant shareholder, despite reducing their stake. Othonna Pty Ltd, associated with Andrew Hansen, remains a key player. Institutional investors hold a substantial number of shares.

Hansen Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hansen Company?

- What is Competitive Landscape of Hansen Company?

- What is Growth Strategy and Future Prospects of Hansen Company?

- How Does Hansen Company Work?

- What is Sales and Marketing Strategy of Hansen Company?

- What is Brief History of Hansen Company?

- What is Customer Demographics and Target Market of Hansen Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.