Hansen Bundle

Can Hansen Company Sustain Its Growth Trajectory?

Hansen Technologies, a global force in software and services for critical infrastructure, presents a compelling case study in strategic growth. From its inception in 1971, the company has evolved from a local Australian startup to a global leader, serving over 600 customers across 80 countries. This article delves into the Hansen SWOT Analysis, exploring the company's journey and future prospects.

Understanding the Hansen Company Growth Strategy is crucial for investors and business strategists alike. This analysis will examine the Hansen Company Future Prospects, providing insights into its strategic planning, market position, and recent performance. We will also explore Business Strategy Hansen Company employs to navigate industry trends and capitalize on opportunities, offering a comprehensive view of its long-term goals and competitive advantages. Key questions addressed include: What are the growth strategies of Hansen Company and How does Hansen Company approach growth?

How Is Hansen Expanding Its Reach?

The Target Market of Hansen is actively pursuing several expansion initiatives to broaden its market reach and diversify its revenue streams. These strategies are critical for sustaining growth and maintaining a strong market position. The company's approach involves both organic growth through new product development and inorganic growth via strategic acquisitions.

A core element of the Hansen Company Growth Strategy involves entering new geographical markets, especially in regions undergoing significant deregulation or digital transformation within the utility and telecommunications sectors. This strategic focus allows the company to capitalize on emerging opportunities and expand its customer base. The company is also focused on expanding its product categories by developing and launching new modules and functionalities that address evolving client needs, such as advanced analytics, smart metering integration, and enhanced customer self-service portals.

Mergers and acquisitions (M&A) remain a crucial component of Hansen's expansion strategy. These efforts are aimed at acquiring complementary technologies, gaining access to new customer bases, and consolidating its position within specific verticals. For instance, recent reports indicate Hansen Technologies' continued interest in strategic acquisitions that align with its core offerings and provide incremental market share. The company aims to leverage its strong balance sheet to identify and integrate businesses that can accelerate its growth trajectory.

Hansen is targeting regions with high growth potential in the utility and telecommunications sectors. These markets often present opportunities for rapid expansion due to deregulation and digital transformation initiatives. The Hansen Company Future Prospects are closely tied to successful penetration of these new markets.

The company is expanding its product offerings to include advanced analytics, smart metering integration, and enhanced customer self-service portals. This diversification aims to meet evolving client needs and increase revenue streams. This strategy is a key part of the Business Strategy Hansen Company.

M&A activities are focused on acquiring complementary technologies and expanding the customer base. This approach allows Hansen to consolidate its market position and accelerate growth. The company's strong financial position supports these strategic moves.

Hansen is enhancing its partnership strategies, collaborating with system integrators and technology providers to deliver comprehensive solutions and extend its reach into new segments. The company is also exploring new business models, such as Software-as-a-Service (SaaS) offerings, to provide greater flexibility and scalability for its clients, aligning with broader industry trends towards cloud-based solutions.

Hansen's expansion plans are designed to achieve sustained double-digit revenue growth. These initiatives are supported by a robust strategic planning process, as highlighted in a recent Hansen Company Performance review.

- Entering new geographical markets with high growth potential.

- Expanding product categories to meet evolving client needs.

- Strategic mergers and acquisitions to enhance market position.

- Enhancing partnership strategies and exploring new business models.

Hansen SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Hansen Invest in Innovation?

The growth of Hansen Technologies is fundamentally linked to its innovation and technology strategy. This strategy focuses on leveraging cutting-edge advancements to improve its product offerings and drive operational efficiencies. The company's commitment to research and development (R&D), both internally and through collaborations, ensures its solutions remain at the forefront of technological innovation in the energy, water, pay-TV, and telecommunications industries. This approach is crucial for maintaining a strong market position and achieving its long-term goals.

A core element of Hansen's strategy is digital transformation, involving the adoption of automation and the integration of technologies such as Artificial Intelligence (AI), the Internet of Things (IoT), and machine learning. These technologies are embedded into core platforms to provide more intelligent and efficient solutions. For example, AI-powered analytics optimize customer interactions, while IoT integration supports smart utility management. This commitment to innovation directly impacts Hansen Company's performance and its ability to navigate industry trends.

Hansen Technologies is also dedicated to sustainability initiatives. They develop solutions that help clients manage resources more efficiently and reduce their environmental footprint, aligning with global sustainability goals and creating new market opportunities. The company regularly highlights new product releases and platform enhancements to demonstrate its leadership in innovation, showcasing how these advancements contribute directly to client growth objectives and operational excellence. For a deeper understanding of the company's origins, explore Brief History of Hansen.

Hansen invests a significant portion of its revenue in R&D. While specific figures vary, the company consistently allocates resources to stay ahead of technological advancements.

The company's digital transformation efforts include the integration of AI, IoT, and machine learning. These technologies enhance core platforms, improving efficiency and customer service.

Hansen develops solutions that promote efficient resource management and reduce environmental impact. This commitment supports global sustainability goals and opens new market opportunities.

Hansen regularly showcases new product releases and platform enhancements. These advancements contribute to client growth and operational excellence, demonstrating the company's innovative prowess.

AI-powered analytics are used to optimize customer interactions and predict consumption patterns. This data-driven approach enhances customer experience and operational efficiency.

IoT integration supports smart utility management, enabling clients to monitor and control resources more effectively. This technology is key to sustainable solutions.

Hansen's technology strategy focuses on several key areas to drive growth and maintain a competitive edge. These include:

- R&D Investment: Continuous investment in research and development to create new and improved solutions.

- Digital Transformation: Implementing AI, IoT, and machine learning to enhance core platforms.

- Sustainability Solutions: Developing products that help clients manage resources efficiently and reduce environmental impact.

- Customer-Centric Innovation: Focusing on solutions that improve customer experience and operational efficiency.

- Strategic Partnerships: Collaborating with other companies and research institutions to accelerate innovation.

Hansen PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Hansen’s Growth Forecast?

The financial outlook for Hansen Technologies is robust, reflecting its strong market position and effective growth strategies. The company's projections for the fiscal year ending June 30, 2024, included revenue growth in the range of 5% to 7%, alongside an EBITDA margin of approximately 35% to 37%. This outlook is supported by a solid order book and recurring revenue streams, which highlight the company's consistent performance and strategic financial planning.

Recent financial reports indicate continued strong performance, with a focus on maximizing shareholder returns. The company maintains a disciplined approach to capital allocation, prioritizing investments in research and development (R&D) and strategic mergers and acquisitions (M&A) to create long-term value. The balance sheet remains strong, providing ample liquidity for future expansion and potential funding rounds. The Owners & Shareholders of Hansen benefit from these strategic financial decisions.

Analyst forecasts generally align with the company's positive outlook, often highlighting its resilient business model and capacity to generate significant free cash flow. The financial narrative emphasizes sustainable growth, operational efficiency, and a commitment to delivering superior returns to investors. This positions the company favorably within its competitive landscape and supports its long-term goals.

Hansen Technologies anticipates revenue growth between 5% and 7% for the fiscal year ending June 30, 2024. This growth is supported by a strong order book and recurring revenue, indicating a solid foundation for future expansion. The company's strategic planning process is designed to capitalize on market opportunities.

The company projects an EBITDA margin of approximately 35% to 37%. This reflects efficient operations and effective cost management. The focus on operational efficiency supports the company's commitment to delivering superior returns.

Hansen Technologies prioritizes investments in R&D and strategic M&A opportunities. This disciplined approach to capital allocation aims to create long-term value and drive sustainable growth. The company's business strategy focuses on maximizing shareholder returns.

The company maintains a strong balance sheet, ensuring ample liquidity for expansion initiatives. This financial strength provides flexibility for future strategic moves and potential funding rounds. The company's financial projections are supported by its robust financial health.

Hansen Technologies' financial outlook is positive, driven by strategic planning and operational efficiency. The company's recent performance review highlights several key areas:

- Consistent revenue growth supported by a strong order book.

- Healthy EBITDA margins, reflecting effective cost management.

- Disciplined capital allocation focused on R&D and strategic M&A.

- A strong balance sheet providing ample liquidity.

Hansen Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Hansen’s Growth?

The Hansen Company Analysis reveals several potential risks and obstacles that could influence its future. These challenges range from intense market competition to the need for continuous innovation to stay ahead of technological disruptions. Understanding these risks is vital for evaluating the Hansen Company's Future Prospects.

Market competition, with both established and emerging firms, remains a significant hurdle. Regulatory changes across various regions where Hansen operates could also pose challenges, requiring adjustments to its software and services. Additionally, supply chain vulnerabilities, although less direct for a software company, could indirectly affect clients and, consequently, Hansen's business. These factors are crucial when considering the Business Strategy Hansen Company employs.

To navigate these challenges, Hansen Technologies employs a diversified client base and robust risk management frameworks. This includes scenario planning and continuous market analysis to anticipate and prepare for potential disruptions. The company's adaptability is evident in its response to economic downturns and competitive pressures. Emerging risks, such as cybersecurity threats and data privacy, are continuously addressed through investments in security measures and adherence to global data protection regulations. For more insights, read about the Marketing Strategy of Hansen.

The software industry is highly competitive, with numerous players vying for market share. Established companies and startups alike are constantly innovating, putting pressure on Hansen to maintain its Hansen Company Market Position. This competitive landscape requires continuous strategic adaptation.

Rapid technological changes necessitate constant innovation. Hansen must continuously update its offerings to meet evolving client demands and avoid obsolescence. This requires significant investment in research and development to ensure long-term viability.

Regulatory shifts across various jurisdictions can impact Hansen’s operations. Adapting to new mandates requires time and resources, potentially increasing costs. Compliance with data privacy regulations, such as GDPR or CCPA, is particularly critical.

While less direct, supply chain issues can indirectly affect Hansen's clients. Disruptions in hardware or third-party components can impact client systems. This highlights the need for resilient supply chain strategies.

The rise in cybersecurity threats poses a significant risk to data security. Hansen must invest heavily in security measures to protect client data. This includes continuous monitoring and updates to security protocols to mitigate risks.

Ensuring compliance with global data protection regulations is critical. Hansen must adhere to standards like GDPR and CCPA. This requires ongoing investment in data protection measures and strict adherence to privacy policies.

Hansen mitigates risks through a diversified client base, reducing reliance on any single market. It employs robust risk management frameworks, including scenario planning. Recent performance demonstrates its resilience and adaptability.

Ongoing investment in security measures and adherence to data protection regulations are crucial. This includes continuous monitoring and updates to security protocols. These measures help protect client data and maintain trust.

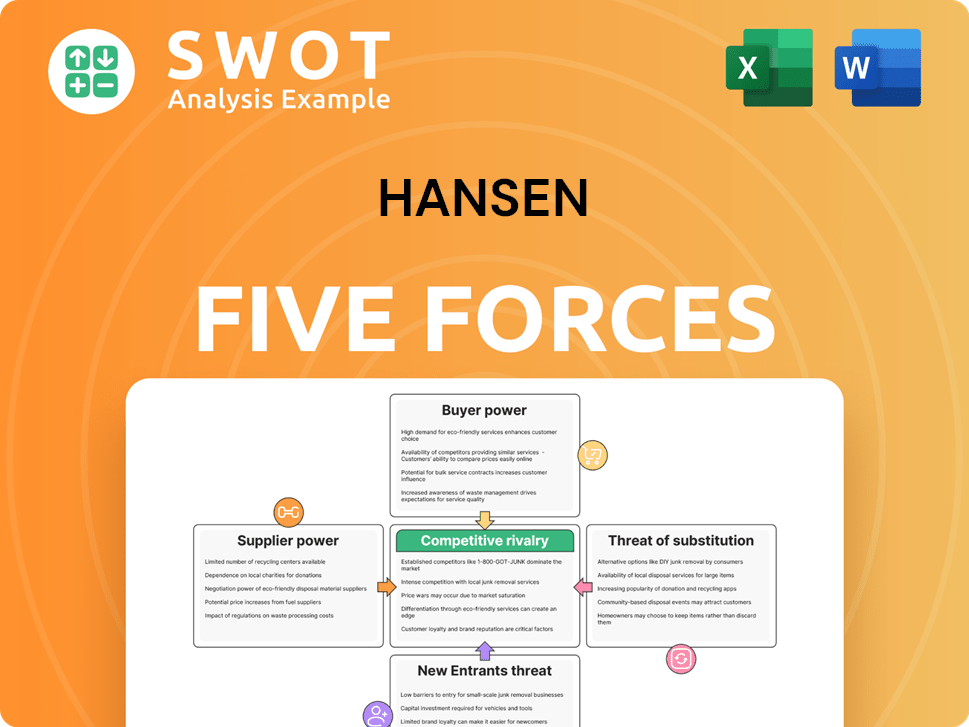

Hansen Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hansen Company?

- What is Competitive Landscape of Hansen Company?

- How Does Hansen Company Work?

- What is Sales and Marketing Strategy of Hansen Company?

- What is Brief History of Hansen Company?

- Who Owns Hansen Company?

- What is Customer Demographics and Target Market of Hansen Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.