Hansen Bundle

How Does Hansen Company Work?

Hansen Technologies stands as a global force, offering critical software and services to the energy, water, pay-TV, and telecommunications sectors. Its solutions are pivotal for operational efficiency and enhancing customer experiences, making it a key player in these essential industries. Understanding Hansen SWOT Analysis is crucial for grasping the company's strategic positioning.

Delving into the core of Hansen Company operations, we uncover how it empowers businesses to manage complex customer relationships and revenue streams. This exploration is vital for investors, customers, and industry observers alike, seeking to understand the Hansen Company business model and its impact. This detailed analysis will illuminate How Hansen Company works, from its service offerings to its strategic positioning within a dynamic global market.

What Are the Key Operations Driving Hansen’s Success?

Hansen Technologies, or Hansen Company, focuses on creating value by providing specialized software and services. These are designed to optimize critical business functions for utilities and communication service providers. Their main focus is on billing, customer care, and data management solutions.

The company's core offerings enable clients to streamline complex processes. This includes things like meter-to-cash, customer relationship management, and service provisioning. The goal is to improve operational efficiency and boost customer satisfaction. This approach supports the Hansen Company business model.

Hansen serves a diverse global customer base. This includes large multinational corporations and smaller regional providers. Their operations are built on continuous technology development, supported by a global network of experts. Their software development emphasizes scalability, reliability, and adaptability.

Hansen leverages a combination of direct sales, strategic partnerships, and a strong professional services arm. This helps them implement and support their solutions effectively. Their supply chain centers around intellectual property development and maintenance. They focus on delivering software as a service (SaaS) and on-premise solutions.

Hansen's operational uniqueness comes from its deep industry expertise. This helps them tailor solutions to the specific challenges faced by energy, water, and communication sectors. This specialized knowledge leads to tangible customer benefits. These include reduced operational costs, improved billing accuracy, and enhanced customer engagement.

The company's services include comprehensive solutions for billing, customer care, and data management. These platforms streamline complex processes. They serve a diverse global customer base. Their software development focuses on scalability, reliability, and adaptability.

Customers experience reduced operational costs. They also see improved billing accuracy and faster service delivery. Enhanced customer engagement is another key benefit. This differentiates them from general enterprise software providers.

Hansen's specialized focus on utilities and communication providers gives them a competitive edge. They offer tailored solutions that address the unique needs of these industries. This deep industry knowledge allows them to provide superior value compared to more generalized software providers.

- Focus on SaaS and on-premise solutions.

- Strong emphasis on customer satisfaction and operational efficiency.

- Continuous technology development and global support network.

- Strategic partnerships and direct sales approach.

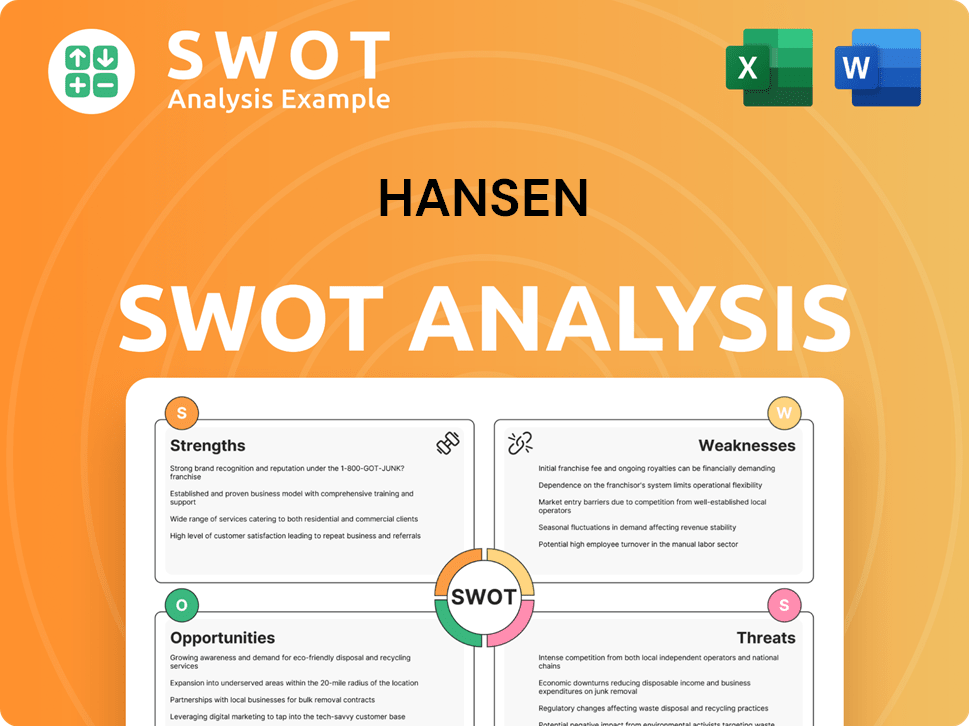

Hansen SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Hansen Make Money?

Understanding how the Hansen Company's business model generates revenue is crucial for investors and stakeholders. The company's financial health is significantly influenced by its ability to monetize its services and maintain a steady income stream. This involves a multi-faceted approach that includes software licensing, support, and professional services.

The primary revenue streams for the company are derived from software license fees, recurring support and maintenance contracts, and professional services. These services include implementation, customization, and consulting, which are essential for clients using the company's software solutions. Recurring revenue, particularly from support and maintenance, forms a substantial portion of its total revenue, providing a stable and predictable financial base.

For the first half of the 2024 financial year, the company reported a statutory net profit after tax of A$26.3 million. A significant portion of the revenue, specifically 86%, came from recurring sources, indicating a strong emphasis on long-term client relationships and subscription-based models.

The company employs several strategies to monetize its services and maintain a strong financial position. These strategies are designed to maximize revenue and ensure customer retention. The company's approach includes long-term contracts and a tiered pricing model.

- Long-Term Contracts: Given the mission-critical nature of its software, the company often engages in long-term contracts with clients. This approach ensures a stable revenue stream and fosters strong client relationships.

- Tiered Pricing Model: The company utilizes a tiered pricing model. The pricing is based on the scale and complexity of the client’s operations and the specific modules or functionalities required.

- Cross-Selling: The company capitalizes on cross-selling opportunities. This involves offering additional modules or services to existing clients as their needs evolve.

- Geographic Diversification: The company has a diversified revenue mix, with significant contributions from Europe, North America, and Asia-Pacific. This diversification helps mitigate regional economic fluctuations.

- SaaS Transition: The company is strategically shifting towards Software-as-a-Service (SaaS) offerings. This transition aims to enhance predictable revenue streams and improve customer retention.

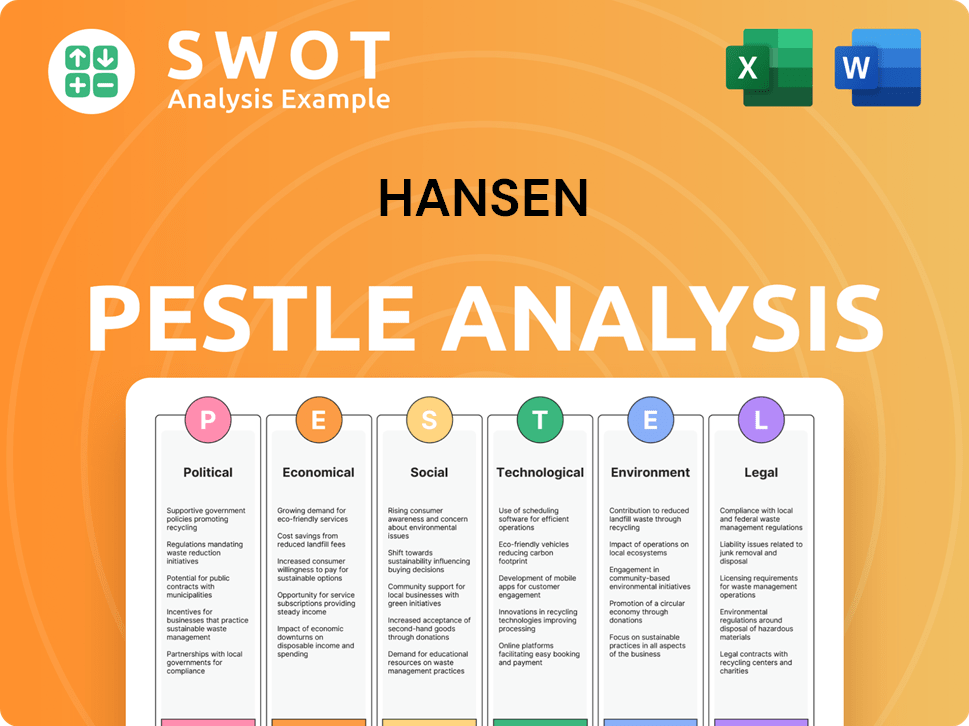

Hansen PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Hansen’s Business Model?

Understanding the inner workings of the Hansen Company involves examining its key milestones, strategic moves, and competitive advantages. The company has strategically grown through acquisitions, expanding its reach and service offerings. These moves have been crucial in solidifying its position within the utilities and infrastructure software market.

Hansen Company operations are characterized by a focus on long-term customer relationships and continuous innovation. They have adapted to industry changes by investing heavily in research and development. This approach has allowed them to maintain a strong market presence and meet evolving customer needs. Owners & Shareholders of Hansen can see how these strategies have shaped the company's trajectory.

The Hansen Company business model centers on providing essential software solutions to critical infrastructure providers. Their success is built on a foundation of deep industry specialization, robust technology, and strong customer relationships. This allows them to maintain a competitive edge in a constantly evolving market.

Significant milestones include strategic acquisitions that broadened its market presence. These acquisitions have allowed for the integration of new technologies and services, enhancing the company's overall capabilities. These moves have been critical to its expansion and ability to serve a wider customer base.

Strategic acquisitions, such as Enermatics and Northgate Public Services' global utilities business, have been key. Investments in research and development to modernize platforms and ensure compliance are also crucial. These moves have allowed the company to adapt to changing market dynamics.

Hansen Company services are enhanced by its deep industry specialization and robust technology. Strong customer relationships and high switching costs create a competitive advantage. Investing in cloud-native solutions and data analytics further strengthens their position.

The company is a key player in the utilities and infrastructure software market. Its focus on mission-critical software and long-term customer relationships supports its market position. They continue to innovate and adapt to industry changes to maintain their leading role.

Hansen Company's competitive advantages are rooted in its deep industry specialization. They have a strong track record of delivering reliable solutions, which creates a high barrier to entry for competitors. The company's ability to foster long-term relationships is a key strength.

- Deep Industry Specialization: Focus on utilities and infrastructure.

- Robust Technology: Mission-critical software with high switching costs.

- Strong Customer Relationships: Long-term partnerships and global support.

- Innovation: Investment in cloud-native solutions and data analytics.

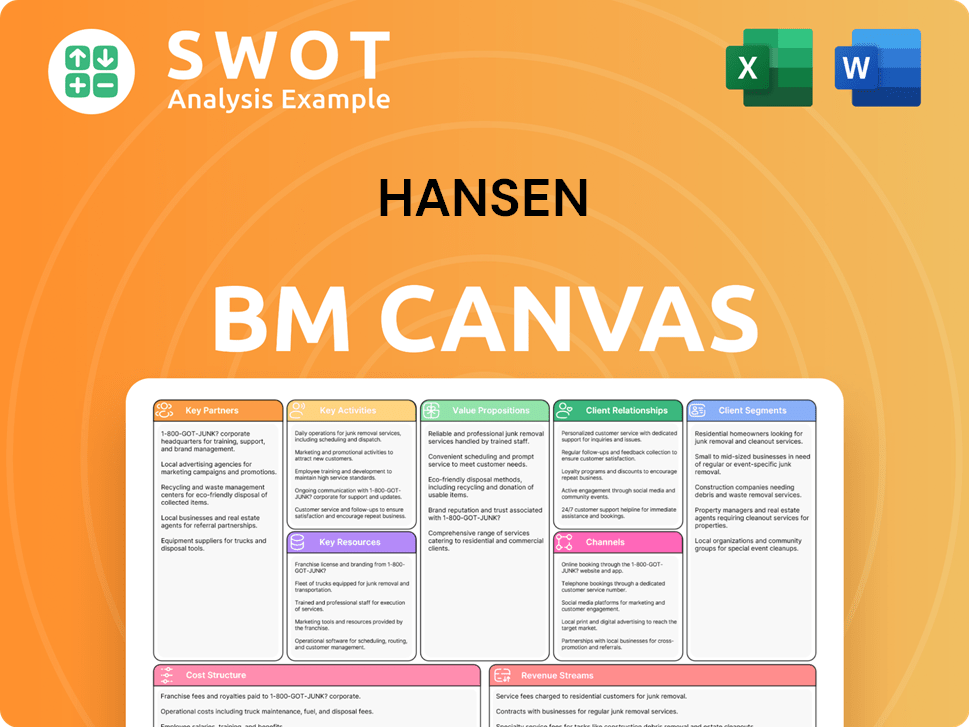

Hansen Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Hansen Positioning Itself for Continued Success?

Understanding the industry position, risks, and future outlook of the Hansen Company is crucial for assessing its long-term viability. The company's operations are centered on providing software solutions to utilities and communications providers, a niche where it has established a significant market presence. This analysis delves into its competitive standing, potential challenges, and strategic initiatives.

The Hansen Company's business model is built on recurring revenue streams from its software and services. However, it faces risks such as technological disruptions and regulatory changes. Its future plans emphasize cloud migration, market expansion, and strategic acquisitions. These factors shape its potential for growth and sustainability.

Hansen Company holds a strong market position, particularly in billing and customer care for utilities and communications. It competes with larger software vendors and specialized providers. Its global reach and substantial market share highlight its competitive strength. Customer loyalty is high due to the critical nature of its software.

The company faces risks from increased competition, technological disruption, and regulatory changes. Economic downturns could affect sales and services revenue. Changes in client spending priorities also pose a risk. Competitors Landscape of Hansen provides insights into the competitive environment.

Hansen Company is focused on cloud migration, expansion into growth markets, and strategic acquisitions. It aims to enhance recurring revenue and offer more value-added services. Leadership emphasizes innovation and customer-centricity. The company's strategic initiatives aim to sustain and expand revenue generation.

While specific, up-to-the-minute financial data for 2025 is unavailable at this moment, the company's performance is closely tied to the utilities and communications sectors. Revenue growth is influenced by new license sales, professional services, and recurring revenue from existing contracts. The company's financial health depends on its ability to adapt to market changes and maintain customer loyalty.

Hansen Company's strategic initiatives include cloud migration, expansion into growth markets, and strategic acquisitions. These initiatives aim to strengthen its market position and increase revenue. The company also focuses on enhancing its recurring revenue streams and offering more value-added services.

- Cloud Migration: Moving its product suite to the cloud to improve accessibility and scalability.

- Market Expansion: Targeting growth markets to increase its customer base.

- Strategic Acquisitions: Exploring acquisitions to bolster its capabilities and product offerings.

- Value-Added Services: Offering more services to increase customer value and revenue.

Hansen Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hansen Company?

- What is Competitive Landscape of Hansen Company?

- What is Growth Strategy and Future Prospects of Hansen Company?

- What is Sales and Marketing Strategy of Hansen Company?

- What is Brief History of Hansen Company?

- Who Owns Hansen Company?

- What is Customer Demographics and Target Market of Hansen Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.