Inpex Bundle

How Does Inpex Navigate the Shifting Sands of the Energy Sector?

Inpex Corporation, a titan in the oil and gas industry, is constantly reshaping its strategies to stay ahead in the global energy race. From its origins in Japan to its current status as a major international player, Inpex has consistently adapted to the evolving demands of the market. This article provides a deep dive into the Inpex SWOT Analysis, its competitive landscape, and the forces shaping its future.

Understanding the Inpex competitive landscape is crucial for anyone looking to make informed investment decisions or assess the dynamics of the oil and gas industry. This Inpex market analysis will explore the company's key competitors, evaluate its competitive advantages, and examine how Inpex is positioning itself amidst the challenges and opportunities within the energy sector. We'll dissect Inpex's market share analysis and explore its strategic partnerships, providing a comprehensive view of its global presence and how it stacks up against its peers in the energy sector competition.

Where Does Inpex’ Stand in the Current Market?

Inpex holds a significant position in the global upstream oil and gas industry, particularly known for its large-scale, long-life projects. While exact global market share figures for Inpex are difficult to pinpoint due to the fragmented nature of the sector, its standing is evident through its ranking among major independent players and its strategic alliances. A key asset is the Ichthys LNG Project in Australia, a major contributor to its production profile.

The company's core business involves crude oil, natural gas, and liquefied natural gas (LNG). Inpex operates globally, with projects and exploration efforts in Australia, Indonesia, Norway, and the UAE. It primarily serves industrial and utility sectors through long-term supply contracts for LNG and crude oil. Inpex has strategically emphasized LNG projects, aligning with global energy transition trends and increasing demand for natural gas.

Inpex's financial health is robust. For the fiscal year ending December 31, 2024, the company projected net sales of JPY 2,740.0 billion, operating income of JPY 1,100.0 billion, and net income of JPY 740.0 billion. The Asia-Pacific region, especially Australia with the Ichthys LNG Project, is a cornerstone of its production and revenue. Its historical strength and strategic focus remain heavily weighted towards securing energy resources for the Asian market, which is a key aspect of the Inpex competitive landscape.

Inpex's market position is reinforced by its substantial involvement in large-scale projects and strategic partnerships. The Ichthys LNG Project in Australia significantly contributes to its production capacity. The company's focus on LNG aligns with global energy transition trends, increasing its relevance in the oil and gas industry.

Inpex's primary offerings include crude oil, natural gas, and LNG. It serves industrial and utility sectors through long-term supply contracts. The company's strategic shift towards LNG projects reflects its response to the growing demand for cleaner-burning fossil fuels. This is a critical point when considering the Inpex market analysis.

Inpex has a diverse geographic presence, with active projects in Australia, Indonesia, Norway, and the UAE. Its global reach extends beyond its Japanese origins. The company's strategic focus on the Asia-Pacific region, particularly Australia, highlights its commitment to securing energy resources for this market.

For the fiscal year ending December 31, 2024, Inpex projected strong financial results. Net sales were expected to reach JPY 2,740.0 billion, with an operating income of JPY 1,100.0 billion, and net income of JPY 740.0 billion. These figures reflect the company's substantial scale and profitability.

Inpex's strategic focus on LNG projects and its strong financial performance provide it with competitive advantages. Its global presence and strategic partnerships also bolster its position in the energy sector competition. The company's ability to secure long-term supply contracts and its commitment to carbon reduction initiatives further enhance its competitive standing.

- Emphasis on LNG projects, aligning with global trends.

- Strong financial performance, as demonstrated by projected 2024 figures.

- Strategic partnerships and global presence.

- Commitment to carbon reduction and lower-carbon energy solutions.

Inpex SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Inpex?

In the dynamic Inpex competitive landscape, the company faces a complex web of rivals across the global oil and gas exploration and production sector. These competitors range from massive integrated supermajors to national oil companies (NOCs) and other independent E&P firms. Understanding these competitors is crucial for any Inpex market analysis.

The competitive environment is shaped by factors like project scale, technological capabilities, and global distribution networks. Moreover, the increasing focus on energy transition adds another layer of competition, compelling Inpex to diversify its energy portfolio. A comprehensive review of Inpex competitors reveals the strategic challenges and opportunities that the company navigates daily.

IOCs like Shell, ExxonMobil, Chevron, BP, and TotalEnergies are significant competitors. They challenge Inpex through their large scale, diverse portfolios, and technological advantages. Shell and TotalEnergies, for example, are major players in the LNG market, directly competing with Inpex for supply contracts, particularly in Asia.

NOCs such as Saudi Aramco, ADNOC, and QatarEnergy pose considerable competitive challenges. These companies often control vast reserves and benefit from state backing, enabling large-scale projects. QatarEnergy's expansion in LNG capacity directly affects the global LNG market, influencing pricing and demand for Inpex's output.

Independent E&P companies, including Woodside Energy and Santos, are key competitors, particularly in the Asia-Pacific region. Woodside Energy, as Australia's largest independent oil and gas company, directly competes with Inpex on projects and regional market influence, especially in LNG. These firms often compete through operational efficiencies and strategic partnerships.

Competition manifests in bidding wars for new exploration blocks and securing long-term supply agreements. The energy transition also introduces competition from emerging low-carbon technologies. Recent mergers and alliances, like those in the US shale sector, reshape competitive dynamics, creating larger entities. For a deeper dive, explore the Growth Strategy of Inpex.

In the LNG market, Inpex competes directly with companies like Shell and TotalEnergies. The Ichthys project, for example, faces competition from projects developed by QatarEnergy. The Asia-Pacific region is a key battleground for LNG supply contracts, influencing Inpex's market share and financial performance.

Strategic partnerships are crucial in the oil and gas industry. Inpex forms alliances to share resources and expertise. These partnerships help to mitigate risks and enhance project economics. Joint ventures and collaborations are common strategies to improve Inpex's competitive positioning in LNG and other areas.

Several factors drive competition in the energy sector competition. These include project scale, technological innovation, and access to resources. Understanding these factors is crucial for assessing Inpex's strengths and weaknesses. The ability to secure long-term supply agreements and manage operational costs also plays a significant role.

- Project Scale: The size and scope of exploration and production projects.

- Technological Prowess: Innovation in drilling, extraction, and processing.

- Geographic Presence: Access to key markets and resources.

- Financial Strength: Ability to fund large-scale projects and withstand market fluctuations.

- Operational Efficiency: Cost-effectiveness in production and distribution.

Inpex PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Inpex a Competitive Edge Over Its Rivals?

Understanding the Inpex competitive landscape involves assessing its strengths and how it differentiates itself within the oil and gas industry. Inpex Corporation has carved a niche through strategic project execution and financial resilience. This analysis of Inpex's market analysis highlights its key advantages in a fiercely contested sector.

Inpex's competitive edge is not just about extracting resources; it's about managing complex projects, maintaining financial stability, and adapting to the changing energy landscape. The company's approach to securing long-term partnerships and investing in the energy transition further solidifies its position. Examining Inpex's strategic moves reveals a commitment to sustainable growth and long-term value creation.

The company's focus on innovation, particularly in areas like carbon capture and renewable energy, positions it well for future growth. This proactive stance helps Inpex navigate the challenges of the energy sector competition and capitalize on new opportunities. For a deeper dive into their overall strategy, consider exploring the Growth Strategy of Inpex.

Inpex excels in developing and operating large-scale, complex offshore projects, such as the Ichthys LNG Project. This demonstrates advanced technological capabilities and operational proficiency. The successful execution of these mega-projects sets Inpex apart from many Inpex competitors.

Inpex benefits from robust financial backing, allowing it to undertake capital-intensive projects and manage market fluctuations. The projected net income attributable to owners of the parent for fiscal year 2024 is JPY 740.0 billion. This financial health enables strategic investments in long-term initiatives.

Inpex has established strong relationships with national oil companies, governments, and key energy consumers. These partnerships provide access to new opportunities and secure stable revenue streams. These collaborations are crucial for project development and market access.

Inpex is proactively adapting to global decarbonization efforts through its 'INPEX Net Zero by 2050' strategy. Investments in CCUS technologies and renewable energy projects are key. This forward-looking approach helps mitigate risks associated with declining fossil fuel demand.

Inpex's competitive advantages are multifaceted, including operational expertise, financial strength, and strategic partnerships. These elements contribute to its resilience and ability to thrive in a dynamic market. The company's commitment to the energy transition further strengthens its position.

- Expertise in large-scale offshore projects, like Ichthys LNG.

- Strong financial health and access to capital, with a projected net income of JPY 740.0 billion for 2024.

- Strategic partnerships with national oil companies and governments.

- Focus on energy transition through CCUS and renewable energy investments.

Inpex Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Inpex’s Competitive Landscape?

The oil and gas industry is undergoing significant shifts, with the energy transition and volatile prices shaping the Inpex competitive landscape. This environment presents both risks and opportunities for Inpex Corporation. The company's strategic focus on diversifying its portfolio and adapting to lower-carbon solutions is crucial for its future.

Understanding these trends is essential for assessing Inpex's market analysis and long-term viability. The company's ability to navigate the energy transition and capitalize on emerging markets will determine its success in the coming years. For more insights, consider reading a Brief History of Inpex.

The primary trend is the energy transition, driven by climate concerns. This involves increased investment in renewables and a shift away from fossil fuels. Another key trend is the volatility in global energy prices, influenced by geopolitical events and supply-demand imbalances.

Challenges include a potential decline in oil and gas demand. Also, there is the emergence of new competitors in renewable energy and pressure to divest from fossil fuels. Regulatory changes related to environmental standards and carbon pricing will increase operational costs.

Opportunities include the growing demand for natural gas, particularly LNG, especially in Asia. Technological advancements can improve operational efficiency and reduce costs. Strategic partnerships in hydrogen and ammonia production offer growth potential.

Inpex's strategies include the 'INPEX Net Zero by 2050' plan. This strategy focuses on emissions reduction and investments in CCUS, hydrogen, and renewable energy projects. The company is also focused on expanding its LNG assets and securing new long-term contracts.

Inpex's competitive position is evolving towards a more diversified energy company. The company is focused on both traditional hydrocarbon production and lower-carbon energy solutions. Its commitment to a 'Net Zero Carbon Society' highlights its proactive approach.

- The company's LNG assets, such as the Ichthys Project, are critical.

- Emerging markets, particularly in Asia, offer expansion opportunities.

- Strategic partnerships are important for hydrogen and ammonia development.

- Technological advancements improve operational efficiency and reduce costs.

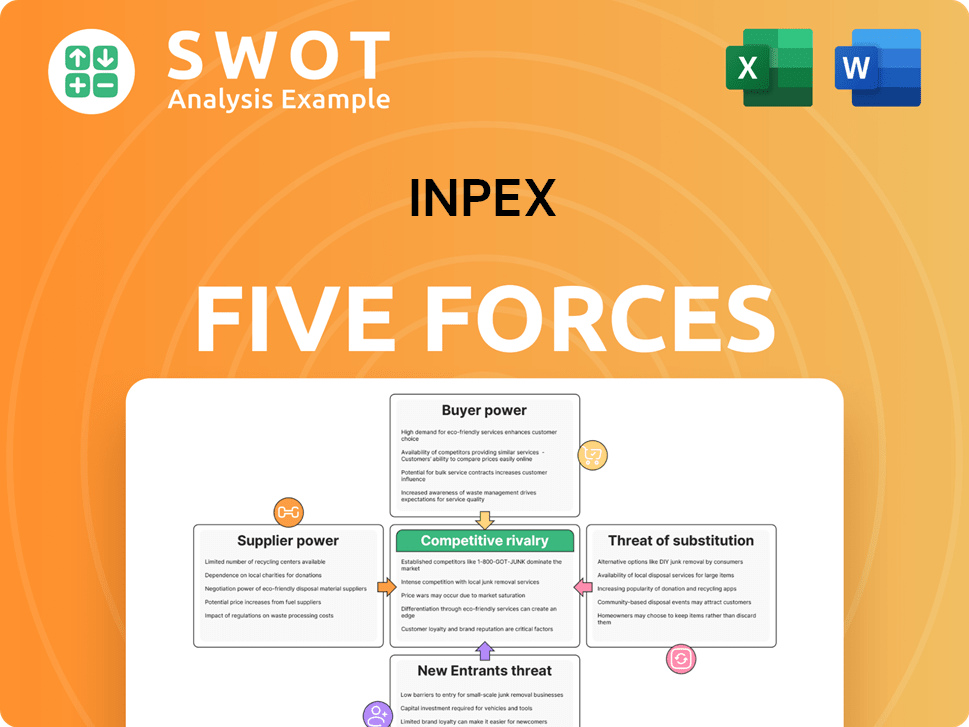

Inpex Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Inpex Company?

- What is Growth Strategy and Future Prospects of Inpex Company?

- How Does Inpex Company Work?

- What is Sales and Marketing Strategy of Inpex Company?

- What is Brief History of Inpex Company?

- Who Owns Inpex Company?

- What is Customer Demographics and Target Market of Inpex Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.