Inpex Bundle

How Does INPEX Navigate the Global Energy Landscape?

INPEX Corporation, a global leader in oil and gas, is a powerhouse in the energy sector. Founded in 2008, the company's roots trace back to 1966, evolving into a major player with significant projects worldwide. With a strong financial standing and a commitment to the future, understanding Inpex SWOT Analysis is crucial for anyone interested in the energy industry.

INPEX's operations span exploration, development, and production, making it a key player in global energy security. Its strategic positioning and diversified portfolio are vital for investors and industry observers. As INPEX continues to adapt to the energy transition, understanding its business model and future plans is more important than ever.

What Are the Key Operations Driving Inpex’s Success?

The core operations of the Inpex company center on the exploration, development, and production of oil and natural gas resources worldwide. This involves serving a diverse global customer base with a focus on providing a stable supply of energy. The company's value proposition lies in its ability to deliver a reliable and diverse range of energy sources to meet global demands.

Inpex's operational processes span the entire upstream value chain. This includes everything from initial exploration and appraisal to field development, production, and the transportation and sale of crude oil and natural gas. Key assets, such as the Ichthys LNG Project in Australia, oil fields in Abu Dhabi, and the Minami Nagaoka Gas Field in Japan, are integral to its operations. The company's global supply chain is supported by major projects in Australia, Abu Dhabi, Southeast Asia, Japan, and Europe.

A key aspect of Inpex's operations is its emphasis on safe and reliable processes. This commitment is a cornerstone of its value delivery. The Ichthys LNG Project, for example, is a significant contributor to Inpex's production capacity, with the company aiming to further increase its output. What makes Inpex unique is its track record in developing and operating complex natural gas and LNG facilities across the entire value chain, coupled with a growing focus on integrating lower-carbon solutions. Inpex is actively investing in technology and R&D to enhance extraction techniques and reduce carbon emissions, having allocated approximately ¥147 billion (around $1.3 billion) towards such initiatives in 2022.

Inpex is involved in the complete upstream value chain, from exploration to sales. Their primary focus is on oil and natural gas production. The company has a global presence, with projects in Australia, Abu Dhabi, and Japan, among other locations.

Inpex provides a stable supply of diverse energy sources to its global customers. They focus on reliability and safety in their operations. The company is also investing in lower-carbon solutions.

The Ichthys LNG Project in Australia is a major asset for Inpex. Oil fields in Abu Dhabi and the Minami Nagaoka Gas Field in Japan are also important. These assets contribute significantly to Inpex's production capacity and overall business.

Inpex is investing in technology and R&D to reduce carbon emissions. In 2022, the company allocated approximately ¥147 billion (around $1.3 billion) towards these initiatives. This demonstrates Inpex's commitment to a more sustainable energy future.

Inpex distinguishes itself through its extensive experience in developing and operating complex natural gas and LNG facilities. The company's commitment to integrating lower-carbon solutions is another key differentiator. This blend of traditional expertise and a focus on sustainability enhances its value proposition.

- Strong track record in complex projects.

- Growing focus on lower-carbon solutions.

- Global operations with key assets worldwide.

- Commitment to safe and reliable operations.

Inpex SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Inpex Make Money?

The core revenue streams for the Inpex company are rooted in the production and sale of oil, natural gas, and liquefied natural gas (LNG). The company has demonstrated a strong financial performance, driven by its established operations and strategic market positioning. The company's financial success is significantly influenced by global energy prices and currency exchange rates.

In fiscal year 2024, Inpex reported a total revenue of ¥2,265.8 billion. This reflects a 4.7% increase compared to the previous year. This growth was primarily due to the depreciation of the Japanese yen against the U.S. dollar and increased sales volume, which offset a slight decrease in oil prices. This financial performance underscores the company's resilience and strategic approach to navigating market dynamics.

Revenue from crude oil increased by 6.5% to ¥1,712.0 billion, while natural gas revenue experienced a slight decrease of 0.5% to ¥525.1 billion. These figures highlight the significance of crude oil in Inpex's revenue portfolio. The company's diversification efforts are also evident in its strategic investments in new energy sectors.

Beyond traditional hydrocarbon sales, Inpex is actively expanding its revenue streams. This includes significant investments in power-related business fields, such as carbon capture and storage (CCS) and hydrogen projects. The company's strategic vision is to establish new revenue streams through these initiatives. The company's approach involves strategic partnerships and technological innovation to drive growth and sustainability.

- The 'INPEX Vision 2035' outlines a strategy to provide greenhouse gas (GHG) reduction solutions for third parties utilizing CCS, aiming to establish a new revenue stream.

- Inpex has formed a joint venture called Metropolitan CCS Ltd. to conduct technical and business evaluations for a Metropolitan Area CCS Project in Japan, with Inpex holding an 85% stake.

- The company aims to achieve a capture capacity of 1 million tons of CO2 per year by 2025 through its carbon capture initiatives.

- Inpex is also exploring opportunities in geothermal and solar energy.

Inpex PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Inpex’s Business Model?

The Inpex company has significantly evolved, marked by key milestones and strategic shifts. A pivotal recent development is the 'INPEX Vision 2035' and the Medium-Term Business Plan for 2025-2027, announced in February 2025. This plan outlines a long-term vision for growth, focusing on natural gas and LNG expansion while investing in lower-carbon solutions.

Operationally, Inpex has navigated challenges, including project delays and cost overruns, notably with the Ichthys LNG project. The company has responded by enhancing project management and ensuring stable production. Strategic partnerships are also central to Inpex's strategy, with collaborations for renewable energy and exploration blocks.

Inpex's competitive edge stems from its established track record, diversified project portfolio, and strong financial position. The company is committed to innovation and aims to reduce its net carbon intensity by 60% by 2035 from 2019 levels.

Inpex announced 'INPEX Vision 2035' and the Medium-Term Business Plan (2025-2027) in February 2025. The Ichthys LNG project, despite initial challenges, has seen production restored. In 2024, Inpex successfully resolved a production issue at the Ichthys LNG project, restoring production.

Inpex is expanding its natural gas and LNG businesses and investing in lower-carbon solutions. The company is forming partnerships, such as with TotalEnergies for renewable energy projects. Inpex signed Technical Evaluation Agreements with BP and Eni for new exploration blocks in Malaysia under the Malaysia Bid Round 2024.

Inpex benefits from its experience in developing and operating complex oil and gas facilities. It has a diversified project portfolio across multiple continents. The company has a strong balance sheet and is committed to innovation in extraction techniques and carbon emission reduction.

Inpex aims to reduce its net carbon intensity by 60% by 2035 from 2019 levels. The company is focused on expanding natural gas and LNG businesses. Inpex will continue to invest in lower-carbon solutions like CCS and hydrogen.

Inpex's operational strategy involves enhancing project management and ensuring stable production, as seen with the Ichthys LNG project. Strategic partnerships, such as those with TotalEnergies and others, are key to expanding its business scope. The company is focused on a balanced approach, combining traditional energy sources with investments in lower-carbon solutions.

- The Ichthys LNG project is a major focus, with efforts to maintain and improve production.

- Partnerships are crucial for Inpex's expansion into renewable energy and new exploration opportunities.

- Inpex is committed to reducing its environmental impact through carbon intensity reduction targets.

- The company's financial strength supports its investments in both existing and new projects.

Inpex Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Inpex Positioning Itself for Continued Success?

The Inpex company holds a significant position in the global energy industry, functioning as Japan's largest oil and gas exploration and production company. Its extensive international operations, with approximately 90% of its business conducted overseas, underscore its global reach and market presence. This global footprint is supported by substantial financial performance, with revenues reaching ¥2,265.8 billion in 2024, demonstrating its robust market position.

Key risks and the future outlook for Inpex operations involve several factors. Fluctuations in crude oil and natural gas prices are critical, significantly influencing revenue and profits. Regulatory changes, particularly environmental regulations, and potential compliance costs also pose risks. Operationally, project delays and cost overruns, as experienced with the Ichthys LNG project, could also impact financial performance. Strategic risks include the transition towards renewable energy, requiring significant capital investments for diversification into cleaner technologies.

As Japan's largest oil and gas exploration and production company, Inpex has a strong global presence. The company's diversified portfolio and substantial revenue of ¥2,265.8 billion in 2024 demonstrate its significant market standing. Inpex's international operations are a key component of its success.

Fluctuations in oil and gas prices are a major risk, with a US$1 change in crude oil price estimated to impact profit and loss by ¥5.4 billion for the year ending December 31, 2025. Regulatory changes and potential compliance costs also present risks. Operational risks, such as project delays, also pose financial challenges.

The company aims to increase production capacity to 1 million barrels of oil equivalent per day (boe/d) by 2030. Key projects include the Abadi LNG project in Indonesia and expansion of the Ichthys LNG project. Inpex is also investing in carbon capture and storage (CCS) and hydrogen technologies.

The 'Vision 2035' and Medium-Term Business Plan 2025-2027 outline Inpex's strategic initiatives. The company plans to allocate around 20% of its investment cash flow to lower-carbon solutions and power-related fields from 2025 to 2027. Inpex remains committed to enhancing shareholder returns.

Inpex is focused on expanding its production capacity while also investing in renewable energy sources. The company plans to allocate a significant portion of its investment cash flow to lower-carbon solutions. Despite anticipated reductions in revenue and profits for 2025, Inpex is focused on sustaining production levels and enhancing shareholder returns.

- Increase production capacity to 1 million boe/d by 2030.

- Develop the Abadi LNG project in Indonesia.

- Expand the Ichthys LNG project.

- Invest in carbon capture and storage (CCS) and hydrogen technologies.

- Allocate approximately 20% of investment cash flow to lower-carbon initiatives between 2025 and 2027.

- Sustain production levels and enhance shareholder returns.

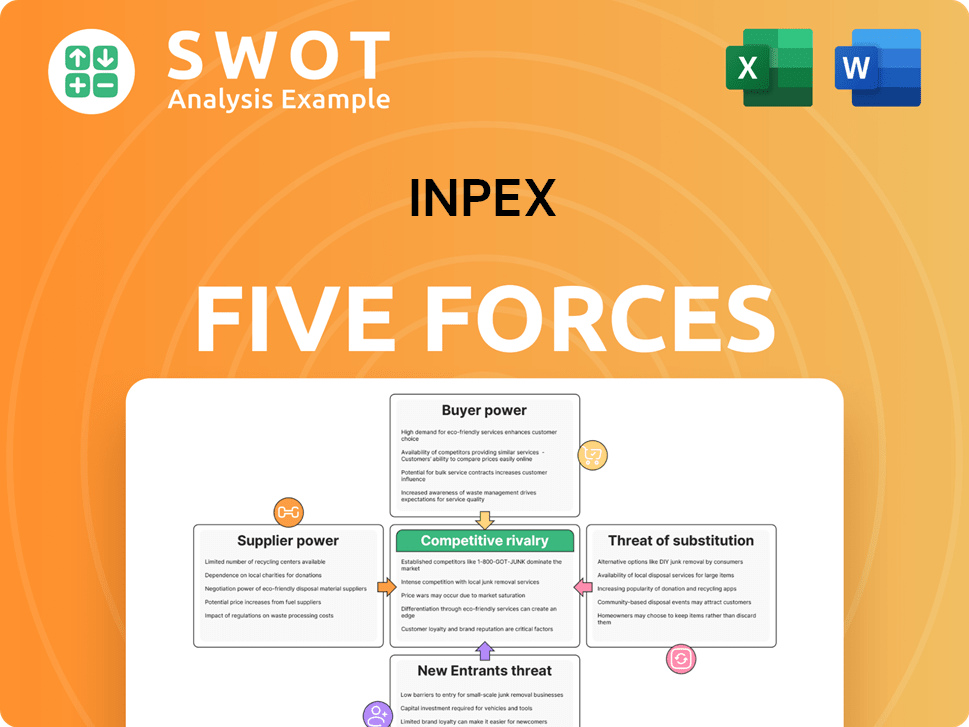

Inpex Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Inpex Company?

- What is Competitive Landscape of Inpex Company?

- What is Growth Strategy and Future Prospects of Inpex Company?

- What is Sales and Marketing Strategy of Inpex Company?

- What is Brief History of Inpex Company?

- Who Owns Inpex Company?

- What is Customer Demographics and Target Market of Inpex Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.