Intel Bundle

Can Intel Maintain Its Dominance in the Semiconductor Arena?

Intel, a titan of the tech world since 1968, has long been synonymous with cutting-edge computing. From pioneering microprocessors to shaping the "Intel Inside" era, the company has profoundly impacted our digital lives. But in today's fast-paced semiconductor industry, can Intel navigate the evolving landscape and maintain its competitive edge?

This analysis dives deep into the dynamic world of Intel competition, scrutinizing its rivals and dissecting its strategic positioning. We'll explore Intel's market share against key players and evaluate the company's strengths and weaknesses in the face of fierce competition. Discover the latest trends and challenges facing Intel, including its strategies to stay ahead, and gain insights into the impact of geopolitical factors on its rivals. For a deeper understanding, check out our comprehensive Intel SWOT Analysis.

Where Does Intel’ Stand in the Current Market?

Intel's market position within the semiconductor industry is substantial, though it's undergoing changes. The company's core operations revolve around designing and manufacturing microprocessors and related technologies. Its value proposition lies in providing high-performance computing solutions for a variety of applications, from personal computers to data centers. This includes CPUs, GPUs, and other components that power modern technology.

Intel's competitive landscape is dynamic, with the company facing pressure from several rivals. The company's focus includes client computing (CPUs for PCs), data center and AI (server CPUs, AI accelerators), network and edge, and Mobileye (automotive solutions). Intel is also investing heavily in its Intel Foundry Services (IFS) to become a major contract chip manufacturer, aiming to diversify its revenue streams and strengthen its market position.

In Q1 2024, Intel reported revenue of $12.7 billion. The Client Computing Group contributed $7.5 billion, and the Data Center and AI Group brought in $3.0 billion. The Intel Foundry segment reported $4.4 billion in revenue during the same period. This demonstrates the company's significant scale and its strategic shift towards a more diversified business model, although profitability faces challenges due to investments in manufacturing and R&D.

In Q1 2024, Intel held a desktop CPU market share of 68.4%. Its laptop CPU market share was slightly lower at 61.1%. In the server CPU market, a crucial segment, Intel's share was approximately 76.5%.

Intel operates globally, with significant operations and customer bases across North America, Europe, and Asia. The company is actively diversifying its offerings beyond high-performance computing. This includes a focus on Intel Foundry Services to expand its role in the semiconductor industry.

Intel's Q1 2024 revenue was $12.7 billion. The Client Computing Group accounted for $7.5 billion, and the Data Center and AI Group contributed $3.0 billion. The Intel Foundry segment reported $4.4 billion, highlighting a strategic shift.

Intel is focusing on diversifying its business model. The company is investing in Intel Foundry Services to become a major contract chip manufacturer. The company is working to regain market share and stay ahead of the competition.

Intel's main rivals in the CPU market include AMD, which has been gaining market share. Other competitors include companies in the graphics card market, such as Nvidia. The impact of TSMC on Intel's market position is significant, as TSMC is a major foundry for many chip manufacturers.

- Intel competition is fierce, especially in the CPU and GPU markets.

- Intel competitors like AMD are constantly innovating, challenging Intel's dominance.

- The company’s strategies for regaining market share include focusing on advanced manufacturing and new product development.

- Geopolitical factors also play a role in the Intel market share and overall competition.

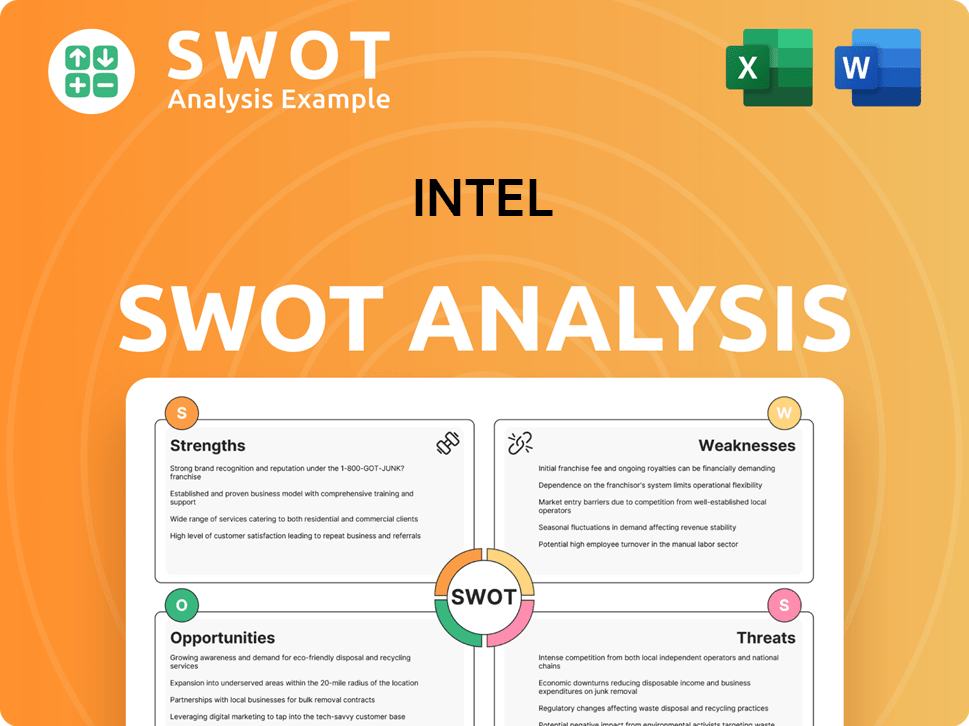

Intel SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Intel?

The competitive landscape for Intel is dynamic, with various rivals challenging its position across different market segments. Understanding the key players and their strategies is crucial for assessing Intel's market standing and future prospects. The company faces both direct and indirect competition, requiring it to innovate and adapt to maintain its market share and profitability.

Intel's ability to navigate this complex environment will determine its success in the semiconductor industry. Factors such as technological advancements, market trends, and geopolitical influences will continue to shape the competitive dynamics. For further insights into the company's ownership structure, consider reading Owners & Shareholders of Intel.

Advanced Micro Devices (AMD) is Intel's primary direct competitor in the CPU market. AMD has significantly increased its market share in recent years, offering competitive products in both client and server segments.

In Q1 2024, AMD held a desktop CPU market share of 31.6%. In the laptop CPU market, AMD held 38.9% in Q1 2024.

NVIDIA is a major competitor in the rapidly expanding artificial intelligence (AI) accelerator market. NVIDIA's GPUs, like the H100 and upcoming Blackwell platforms, pose a significant challenge to Intel's Gaudi AI accelerators.

Taiwan Semiconductor Manufacturing Company (TSMC) is a crucial indirect competitor and partner. Intel's foundry business (IFS) directly competes with TSMC for external chip manufacturing contracts.

ARM's intellectual property and architecture are increasingly used by other companies to design custom server chips, posing a long-term threat to Intel's x86 architecture dominance in data centers.

Qualcomm is expanding into the PC market with ARM-based chips. Various tech giants are designing their own custom silicon, reducing reliance on Intel's off-the-shelf components.

Intel's competitive position is influenced by several factors. These include product performance, pricing, manufacturing capabilities, and the ability to innovate in the face of intense competition. The company's strategies to stay ahead of competition involve continuous research and development, strategic partnerships, and expansion into new markets.

- Market Share Dynamics: While Intel held a 76.5% market share in server CPUs in Q1 2024, AMD captured 23.5%.

- Technological Advancements: The rapid pace of innovation in the semiconductor industry requires Intel to invest heavily in R&D to maintain its technological edge.

- Geopolitical Factors: Global trade policies and supply chain disruptions can significantly impact Intel's operations and competitive landscape.

- Custom Silicon Trend: The increasing trend of tech giants designing their own chips poses a challenge to Intel's market share.

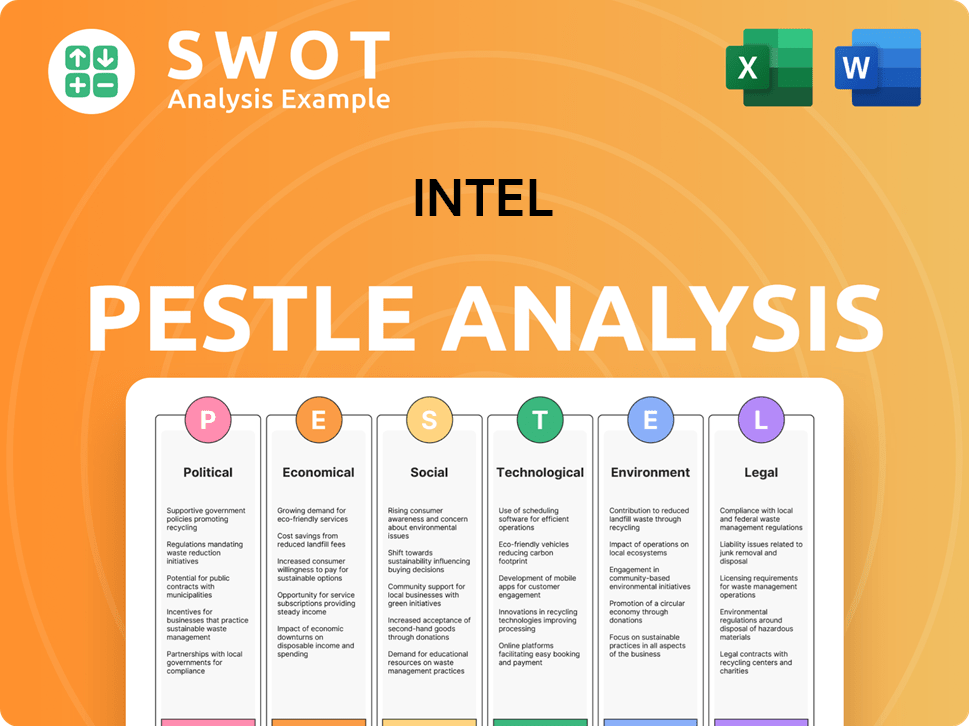

Intel PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Intel a Competitive Edge Over Its Rivals?

The competitive landscape for Intel is shaped by its historical dominance and ongoing efforts to maintain its position in the semiconductor industry. Intel's competitive advantages are rooted in its decades-long experience, proprietary x86 architecture, and extensive manufacturing capabilities. However, the company faces significant challenges from competitors and shifts in the market.

Intel's strategic moves include substantial investments in advanced manufacturing technologies and expanding its product portfolio. The company is focused on regaining process technology leadership, with its Intel 18A process technology targeted for production readiness in late 2024. This focus aims to enhance its competitive edge in the CPU market and beyond. Intel's ability to innovate and adapt to market dynamics is crucial for its future success.

Intel's competitive advantages include its strong brand equity, established relationships with major PC manufacturers, and a vast global manufacturing footprint. These advantages are essential for navigating the complex semiconductor market and competing effectively against rivals. The company's commitment to research and development, with R&D expenses of $4.1 billion in Q1 2024, underscores its dedication to staying ahead of the competition.

Intel's x86 architecture provides a significant advantage due to its vast software ecosystem and developer support. This legacy has fostered customer loyalty and established industry standards. The extensive software compatibility ensures that a wide range of applications run seamlessly on Intel processors, which is a key factor in maintaining its market share.

Intel's integrated device manufacturer (IDM) model allows it to design and manufacture its own chips, giving it greater control over the supply chain. The company is investing heavily in advanced manufacturing, targeting five nodes in four years. Advanced packaging technologies also play a crucial role in optimizing chip design and production, enhancing its competitive position.

Intel's substantial economies of scale enable significant investments in research and development. In Q1 2024, the company spent $4.1 billion on R&D, driving continuous product development. This investment fuels innovation across its diverse portfolio, including high-performance CPUs and AI accelerators. A strong R&D focus is crucial for staying ahead in the competitive semiconductor industry.

Intel's strong brand equity, built over decades, and established relationships with major PC manufacturers and data center clients provide a significant market presence. This extensive distribution network and brand recognition are essential for maintaining its market share. The company's established relationships with key players in the industry are a key advantage.

Intel’s competitive advantages include its x86 architecture, manufacturing capabilities, and R&D investments. These factors support its market position. The company is focused on regaining process technology leadership and expanding its product portfolio to stay ahead of the competition.

- x86 Architecture: Provides a broad software ecosystem and developer support.

- Manufacturing: Extensive global footprint with advanced fabs.

- R&D Investment: $4.1 billion in Q1 2024 fuels continuous innovation.

- Brand Equity: Strong brand and established market presence.

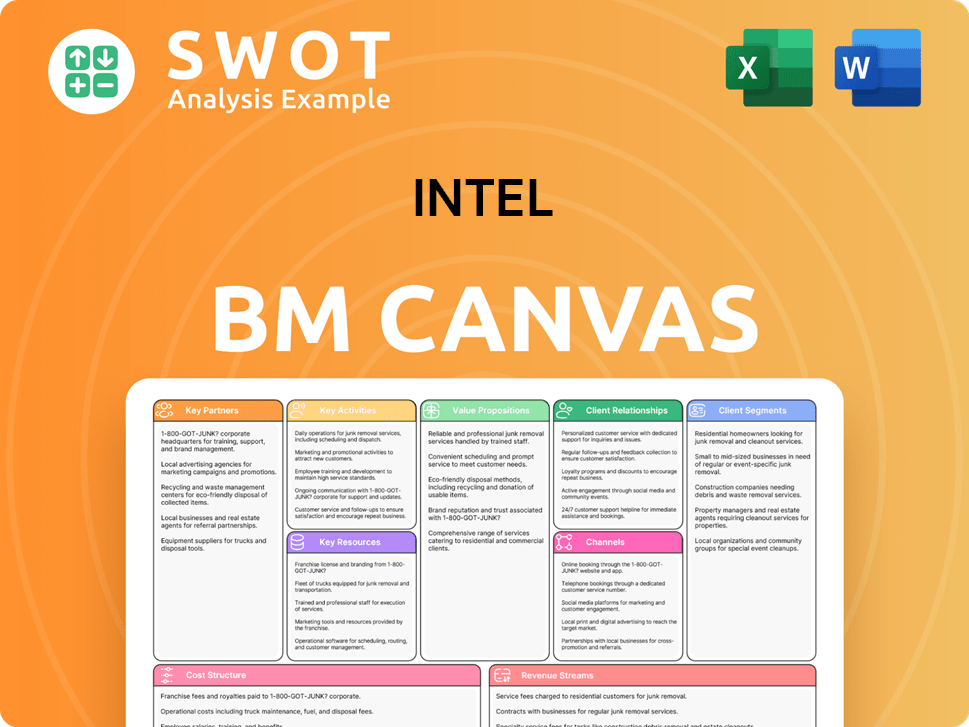

Intel Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Intel’s Competitive Landscape?

The semiconductor industry is currently undergoing significant transformation, creating both opportunities and challenges for companies like Intel. Key trends include the rapid growth of Artificial Intelligence (AI), the need for more resilient supply chains, and intense competition in the chip market. Understanding these dynamics is crucial for assessing Intel's current position and future prospects. The competitive landscape is shaped by technological advancements, strategic partnerships, and geopolitical factors, all of which influence Intel's market share and overall performance.

Intel faces a complex environment, with risks stemming from the volatile nature of the semiconductor industry, including the high costs of manufacturing and rapid technological changes. However, Intel's strategic initiatives, such as IDM 2.0 and its focus on AI, position it to capitalize on emerging trends. The future outlook for Intel hinges on its ability to execute its strategic plans, innovate, and adapt to the evolving market dynamics. The company's success will depend on its ability to maintain its competitive edge in the face of strong rivals and navigate the challenges of a globalized and increasingly complex industry.

The semiconductor industry is significantly influenced by several key trends. The rise of AI is driving demand for specialized AI accelerators and pushing computing closer to the edge. Also, there is an increasing need for diversified and resilient supply chains. These trends offer opportunities for companies that can adapt and innovate in these areas.

Intel faces several challenges in the chip market. Intense competition, particularly from NVIDIA in the AI chip market, requires rapid innovation. The high costs and complexity of advanced manufacturing processes also pose a significant hurdle. Geopolitical tensions and trade policies can also impact global supply chains and market access.

Intel has several opportunities to strengthen its position. Expanding its foundry business and capturing a larger share of the AI accelerator market are key. The company can also solidify its leadership in the AI PC segment. Intel's strategy includes a focus on automotive semiconductors through Mobileye and high-performance computing.

The competitive landscape for Intel is dynamic. Key rivals include AMD and NVIDIA, along with companies like TSMC, which impacts Intel's market position through its foundry services. Intel's ability to compete depends on its technological advancements, strategic partnerships, and how well it navigates geopolitical factors. For more details, refer to the Brief History of Intel.

Intel's IDM 2.0 strategy, which includes internal manufacturing and a growing foundry business, is central to its future. This strategy aims to address the increasing demand for diversified and reliable chip manufacturing. By 2025, Intel anticipates shipping 100 million AI PCs, significantly expanding its market presence in the AI sector.

- IDM 2.0: Emphasizes both internal manufacturing and a growing foundry business.

- AI PCs: Focus on the emerging AI PC segment.

- Gaudi AI Accelerators: Development and market expansion.

- Mobileye: Growth in automotive semiconductors.

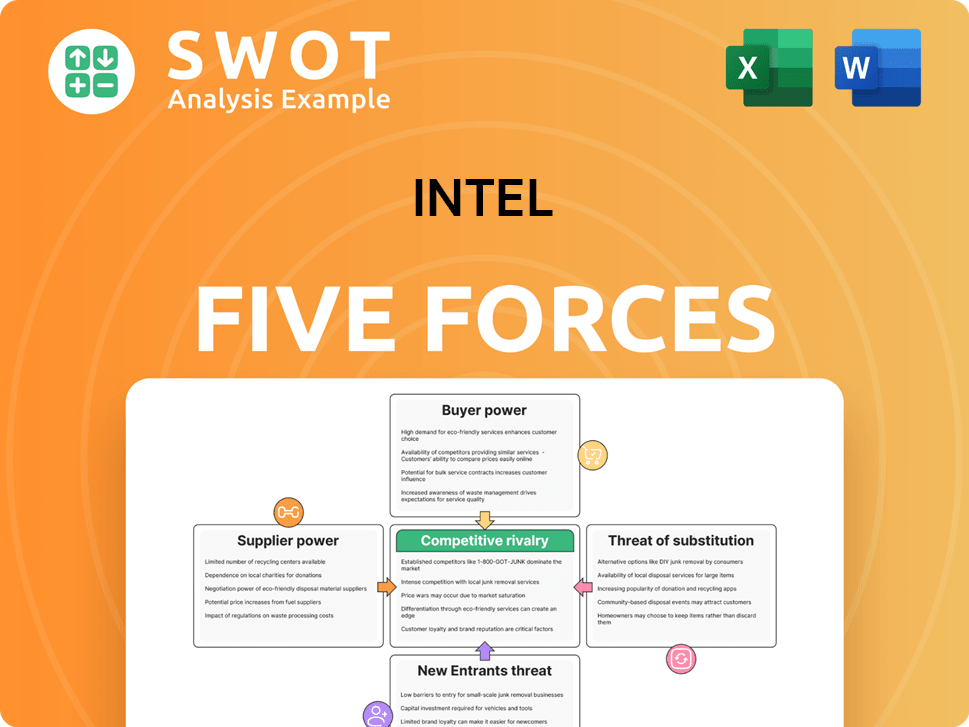

Intel Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Intel Company?

- What is Growth Strategy and Future Prospects of Intel Company?

- How Does Intel Company Work?

- What is Sales and Marketing Strategy of Intel Company?

- What is Brief History of Intel Company?

- Who Owns Intel Company?

- What is Customer Demographics and Target Market of Intel Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.