Interactive Brokers Group Bundle

How Does Interactive Brokers Stack Up in the Brokerage Battleground?

Interactive Brokers (IBKR) has revolutionized the financial landscape since its inception, pioneering technological advancements in trading. From its roots in 1978, the company has grown into a global powerhouse, offering a vast array of financial instruments and sophisticated trading platforms. But how does Interactive Brokers fare against its rivals in today's dynamic market?

This analysis dives deep into the Interactive Brokers Group SWOT Analysis, examining its competitive landscape, key competitors, and strategic positioning within the financial services industry. We'll explore the company's strengths and weaknesses, analyze its market share, and compare it against other online brokerage firms like Charles Schwab and Fidelity. Understanding Interactive Brokers' competitive advantages and future outlook is crucial for investors and industry professionals alike, making this a must-read for anyone looking to navigate the complexities of the financial market.

Where Does Interactive Brokers Group’ Stand in the Current Market?

Interactive Brokers (IBKR) stands as a leading automated global electronic broker, serving a diverse clientele. This includes individual investors, hedge funds, and financial advisors. The company operates the largest electronic trading platform in the United States by number of daily average revenue trades.

The firm offers direct access trade execution and clearing services for various electronically traded products. These include stocks, options, futures, currencies, and fixed income instruments worldwide. With operations in 36 countries and offices in major financial centers, IBKR has a significant global presence.

Interactive Brokers' strategic approach includes expanding its reach while maintaining a focus on efficiency. The introduction of IBKR Lite in 2019 aimed to attract more casual investors. This move reflects a digital transformation and diversification to attract a wider clientele. For a detailed look at who they target, see the Target Market of Interactive Brokers Group.

Interactive Brokers processes a substantial volume of trades daily. In 2024, the platform averaged 2.6 million trades per trading day. This positions IBKR as a dominant player in the online brokerage comparison, particularly in terms of trading volume.

As of December 31, 2024, IBKR had 3.337 million brokerage customers. Total customer equity reached US$568.2 billion. This highlights the company's strong financial performance and its ability to attract and retain a large customer base.

In Q1 2025, Interactive Brokers continued its strong performance. Customer accounts rose 32% year-over-year to 3.62 million. Customer equity increased 23% to $573.5 billion, and daily average revenue trades (DARTs) jumped 50% year-over-year to 3.52 million.

IBKR has a significant global footprint, operating in approximately 200 countries. More than half of its customers reside outside the United States. This global presence is a key factor in its competitive advantages within the financial services industry.

Interactive Brokers maintains a strong position among professional traders and institutions. This is due to its advanced trading platforms and low margin rates. IBKR's financial health is robust, with net revenues of $1,427 million and a pretax profit margin of 74% in Q1 2025.

- Advanced Trading Platforms: IBKR offers sophisticated platforms.

- Low Margin Rates: Competitive rates attract active traders.

- Global Reach: Operations in numerous countries expand its market.

- Strong Financials: High profitability and equity levels.

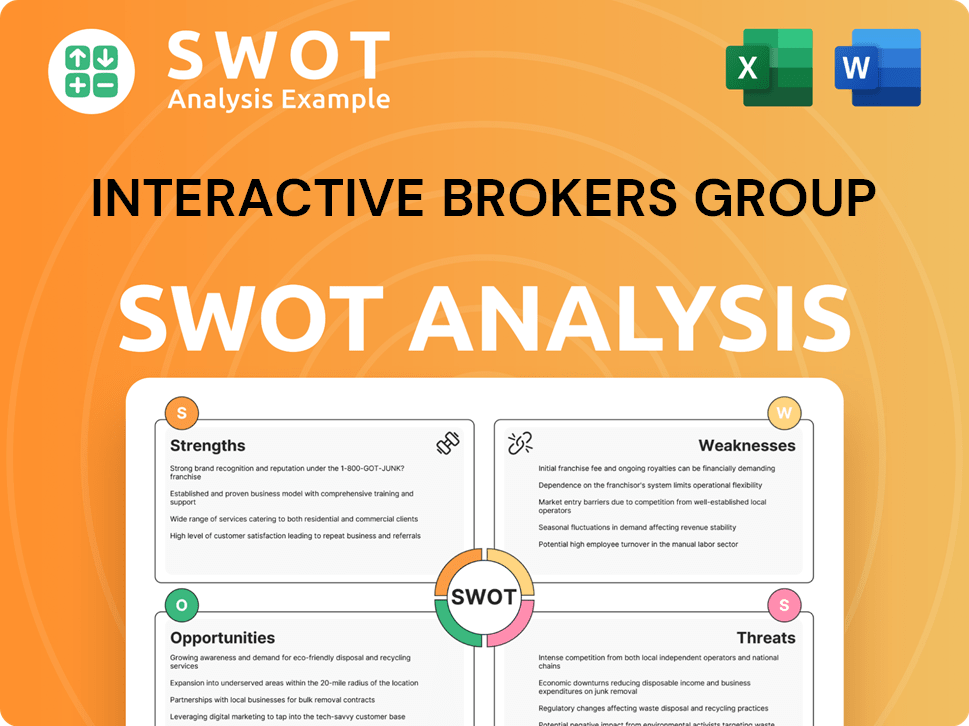

Interactive Brokers Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Interactive Brokers Group?

The Marketing Strategy of Interactive Brokers Group operates within a fiercely contested financial services industry. The Interactive Brokers competitive landscape is shaped by both direct and indirect rivals, each vying for market share and customer loyalty. Understanding these competitors is crucial for assessing IBKR's position and future prospects.

Direct competitors primarily include online brokerage firms that offer similar services, such as access to global markets and a wide range of tradable securities. These firms challenge Interactive Brokers through various strategies, including competitive pricing, marketing efforts, and the breadth of their product offerings. The competitive dynamics are constantly evolving, influenced by mergers, acquisitions, and the emergence of new market players.

Indirect competition comes from fintech companies and emerging platforms, which have disrupted the traditional brokerage model. These platforms often attract a new generation of investors by offering commission-free trading and simplified investing processes. The competitive landscape is further complicated by the ongoing evolution of technology and the increasing sophistication of financial products.

Several established online brokerage firms directly compete with Interactive Brokers. These firms offer similar services but may target different segments of the market.

A major player in the US market, Charles Schwab caters to a broad retail investor base. Schwab offers a wide range of services, including wealth management, which differentiates it from Interactive Brokers' focus on active traders.

Fidelity is another significant competitor, known for its comprehensive services and large customer base. Like Schwab, Fidelity offers a range of wealth management services alongside its brokerage platform.

E-Trade provides online brokerage services and competes through pricing and product offerings. E-Trade was acquired by Morgan Stanley in 2020, which has changed the competitive landscape.

Vanguard is known for its low-cost index funds and brokerage services. Vanguard's focus on passive investing and low fees makes it a strong competitor in the retail space.

Indirect competitors include fintech companies that have disrupted the traditional brokerage model. These platforms attract a new generation of investors.

Fintech companies have significantly impacted the financial services industry, particularly in the retail trading segment. These platforms often offer commission-free trading and simplified investing processes.

- Robinhood: Robinhood popularized commission-free trading, attracting a large user base, particularly among younger investors. As of Q1 2024, Robinhood reported having over 28 million active users.

- eToro: eToro offers social trading features, allowing users to copy the trades of more experienced investors. eToro's platform has gained popularity, especially in Europe and among newer investors.

- Commission-Free Trading: The trend towards commission-free trading, pioneered by Robinhood, has forced traditional brokers to adapt. Interactive Brokers introduced IBKR Lite to compete, but its core platform still charges commissions.

- Market Share Dynamics: The IBKR market analysis reveals that while Interactive Brokers caters to sophisticated traders, platforms like Robinhood have captured significant market share in the retail segment.

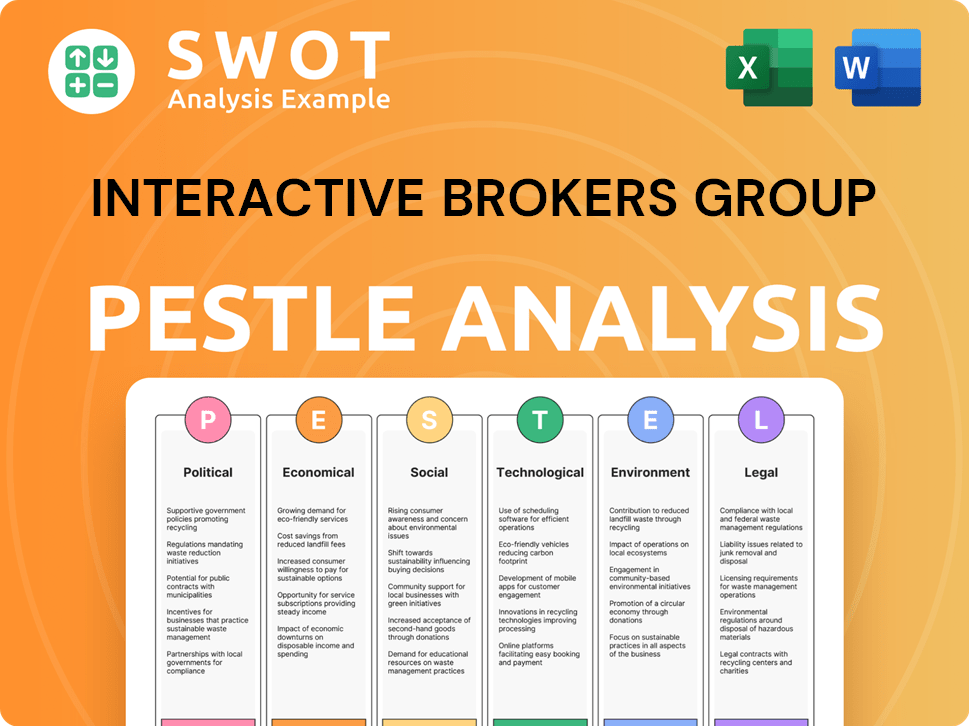

Interactive Brokers Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Interactive Brokers Group a Competitive Edge Over Its Rivals?

Interactive Brokers (IBKR) has carved out a strong position in the financial services industry by focusing on technology, automation, and global market access. Their approach allows them to offer competitive pricing and a wide range of trading options. This strategy has enabled them to attract both individual and institutional investors. For those interested in learning more, a Brief History of Interactive Brokers Group provides valuable context.

The company's competitive edge is further sharpened by its commitment to operational efficiency and cost control. This has led to high profitability and the ability to maintain a lean workforce while managing a substantial volume of client assets. Continuous innovation, such as the introduction of new platforms and features, ensures that IBKR stays ahead of the curve in a dynamic market. This focus on innovation is key to maintaining its competitive advantages.

IBKR's competitive advantages are rooted in its advanced trading technology, extensive global market access, and operational efficiency. These strengths enable the company to offer competitive pricing, a wide range of trading options, and robust risk management tools. The company's ability to maintain a lean workforce while managing a large volume of client assets translates into high profitability. These factors collectively contribute to IBKR's strong position in the online brokerage comparison.

Interactive Brokers' Trader Workstation (TWS) platform offers sophisticated tools and API access, catering to both individual and institutional investors. This technological advantage enables efficient operations and competitive pricing. For example, as of March 2024, the most expensive tier for margin loans was 6.83%.

Interactive Brokers provides clients with access to over 160 markets in 36 countries and 28 currencies from a single platform. This extensive international reach is a significant differentiator, especially for investors seeking diversification beyond their domestic markets. This global presence sets IBKR apart in the discount brokers landscape.

The company's highly automated business model and stringent cost control contribute to superior operational efficiency and profitability. This automation allows IBKR to manage a large volume of client equity with a relatively lean workforce. In 2024, the firm supported nearly $570 billion in client equity with just 3,000 employees.

IBKR offers highly competitive pricing, including low per-share pricing and exceptionally low margin rates. This pricing strategy is a key differentiator in the financial services industry. This is a significant advantage when considering Interactive Brokers vs. Charles Schwab comparison.

Interactive Brokers' competitive advantages are multifaceted, encompassing advanced technology, global reach, and operational efficiency. These advantages are crucial for its success in the Interactive Brokers competitive landscape. The company's commitment to innovation ensures it remains competitive.

- Technology: Sophisticated trading platform with advanced tools.

- Global Access: Trading in over 160 markets worldwide.

- Efficiency: Highly automated business model.

- Pricing: Competitive pricing, including low margin rates.

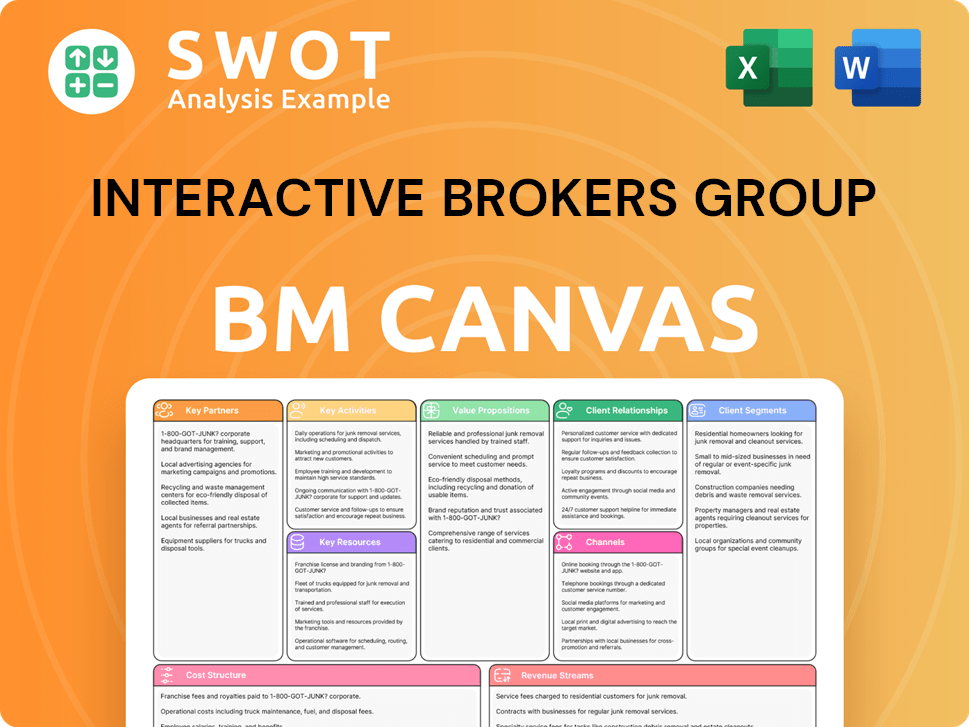

Interactive Brokers Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Interactive Brokers Group’s Competitive Landscape?

The Interactive Brokers competitive landscape is significantly influenced by industry trends, including technological advancements, regulatory changes, and evolving consumer preferences. The company faces risks from aggressive new competitors and the need to adapt to shifting market dynamics. However, opportunities exist in emerging markets, product innovation, and strategic partnerships. The future outlook for Interactive Brokers is tied to its ability to maintain technological leadership, expand globally, and adapt to regulatory and investor demands.

The financial services industry is dynamic, with the rise of online brokerage comparison tools and discount brokers. The company's ability to innovate and adapt is crucial for maintaining its market position. For instance, in Q1 2025, client accounts grew by 32% year-over-year to 3.62 million, demonstrating its continued growth among active traders and institutions.

Technological innovation, including AI-driven analytics and automated solutions, is a key trend. Regulatory changes, such as those concerning payment for order flow (PFOF), also shape the competitive environment. Consumer preferences are shifting toward more accessible and cost-effective trading options, with a demand for global market access.

Aggressive new competitors and simpler, user-friendly platforms pose a challenge. Increased scrutiny on data privacy and cybersecurity requires ongoing investment. Adapting to regulatory changes concerning PFOF and other financial regulations is also essential.

Emerging markets and strategic partnerships offer significant growth potential. Further product innovations and the expansion of digital offerings in regions like the UAE present opportunities. The company's commitment to financial literacy through platforms like IBKR Campus supports client acquisition and retention.

A sophisticated platform caters to active traders and institutions. The company's global reach across over 200 countries and territories is a significant advantage. Its business model, which generates revenue from commissions and net interest income, provides resilience. The upcoming four-for-one stock split, effective June 18, 2025, aims to broaden investor access.

The company must continue to invest in technology to stay ahead of competitors. Regulatory compliance and adaptation are crucial for long-term success. Expanding its global footprint and tailoring offerings to regional markets will drive growth.

- Focus on continuous platform enhancements, such as the recent launch of IBKR Desktop in February 2024.

- Adapt to regulatory changes, particularly those impacting PFOF and data privacy.

- Capitalize on growth opportunities in emerging markets and through product innovation, including cryptocurrency trading.

- Leverage strategic partnerships and educational initiatives to attract and retain clients.

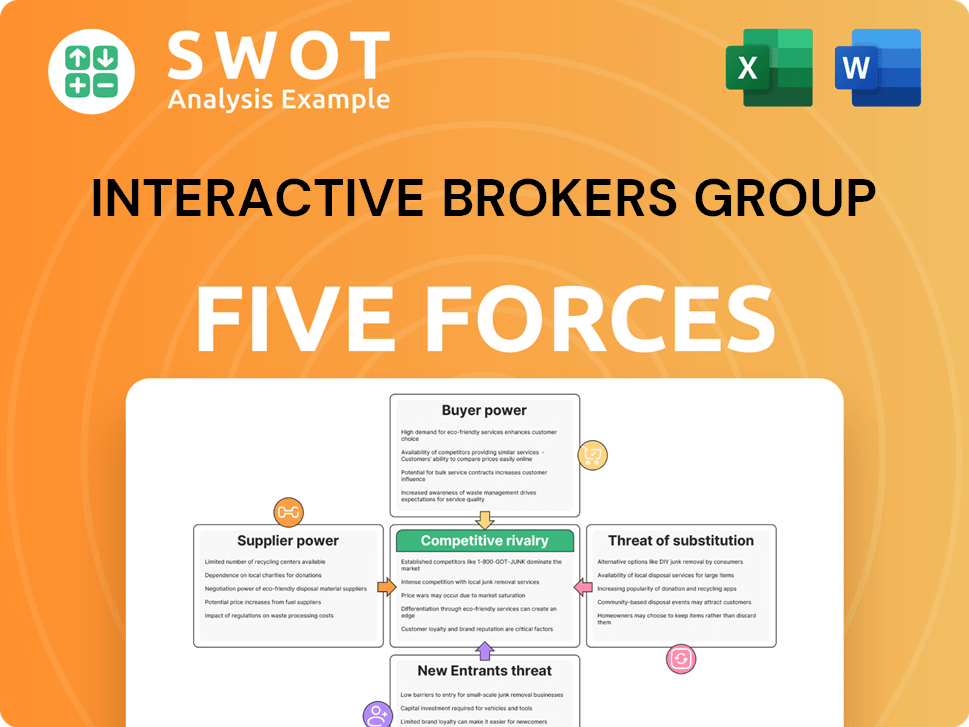

Interactive Brokers Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Interactive Brokers Group Company?

- What is Growth Strategy and Future Prospects of Interactive Brokers Group Company?

- How Does Interactive Brokers Group Company Work?

- What is Sales and Marketing Strategy of Interactive Brokers Group Company?

- What is Brief History of Interactive Brokers Group Company?

- Who Owns Interactive Brokers Group Company?

- What is Customer Demographics and Target Market of Interactive Brokers Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.