Interactive Brokers Group Bundle

How Does Interactive Brokers Group Navigate the Financial Markets?

Interactive Brokers Group (IBKR) has revolutionized online trading, offering unparalleled access to global markets. Founded in 1977, IBKR has consistently pushed the boundaries of financial technology. With impressive growth figures in early 2025, including a 58% surge in Daily Average Revenue Trades (DARTs), understanding IBKR's operational model is more crucial than ever.

This deep dive into Interactive Brokers will explore its core operations and value proposition, providing insights essential for anyone using a brokerage account. From its extensive market access to its competitive pricing, we'll unpack the strategies that have made Interactive Brokers Group SWOT Analysis a leader in the online trading space. Whether you're a seasoned investor or just starting, this analysis will equip you with the knowledge to navigate the complexities of the market.

What Are the Key Operations Driving Interactive Brokers Group’s Success?

Interactive Brokers Group (IBKR) delivers value through its highly automated and technologically advanced platform for global electronic brokerage. The company's core offerings include direct access trade execution and clearing for a wide array of financial instruments. Serving a diverse clientele, IBKR has a significant international presence, with approximately 80% of its accounts being non-US based.

The company's operational efficiency is rooted in its four decades of focus on technology and automation. This includes the development of its Trader Workstation (TWS) platform, which offers sophisticated tools for trading, risk management, and analytics. This technology enables efficient operations and competitive pricing, including low commission and margin rates. IBKR's global reach and integrated platform attract sophisticated traders.

IBKR's supply chain and distribution networks provide direct access to over 160 electronic exchanges and market centers in over 30 countries and 28 currencies, accessible from a single unified platform. This extensive global reach and integrated platform allow the company to offer unparalleled market breadth and execution quality, attracting sophisticated traders who prioritize low costs, best execution, and advanced trading capabilities. The IBKR Lite plan offers commission-free stock and ETF trading for non-institutional traders, while the Pro plan provides tiered commissions based on trading volume.

IBKR provides direct access trade execution and clearing services. It covers a wide range of financial instruments, including stocks, options, futures, currencies, and fixed income. The company's offerings are designed to meet the needs of various traders.

IBKR serves a diverse customer base, including individual investors, hedge funds, and financial advisors. A significant portion of its business comes from outside the Americas. This highlights its global reach and appeal to a wide range of clients.

IBKR's Trader Workstation (TWS) platform is a key component of its technological advantage. TWS offers advanced tools for trading, risk management, and portfolio management. This technology allows for efficient operations and competitive pricing.

IBKR provides access to over 160 electronic exchanges and market centers worldwide. This extensive network enables the company to offer unparalleled market breadth and execution quality. This global presence is a key differentiator.

IBKR's value proposition centers on providing a technologically advanced platform with a global reach. The company offers competitive pricing and a wide range of financial instruments. IBKR's focus on technology and automation allows it to provide efficient services.

- Direct market access and global reach.

- Competitive pricing, including low commissions and margin rates.

- Advanced trading tools and risk management features.

- A wide range of financial instruments.

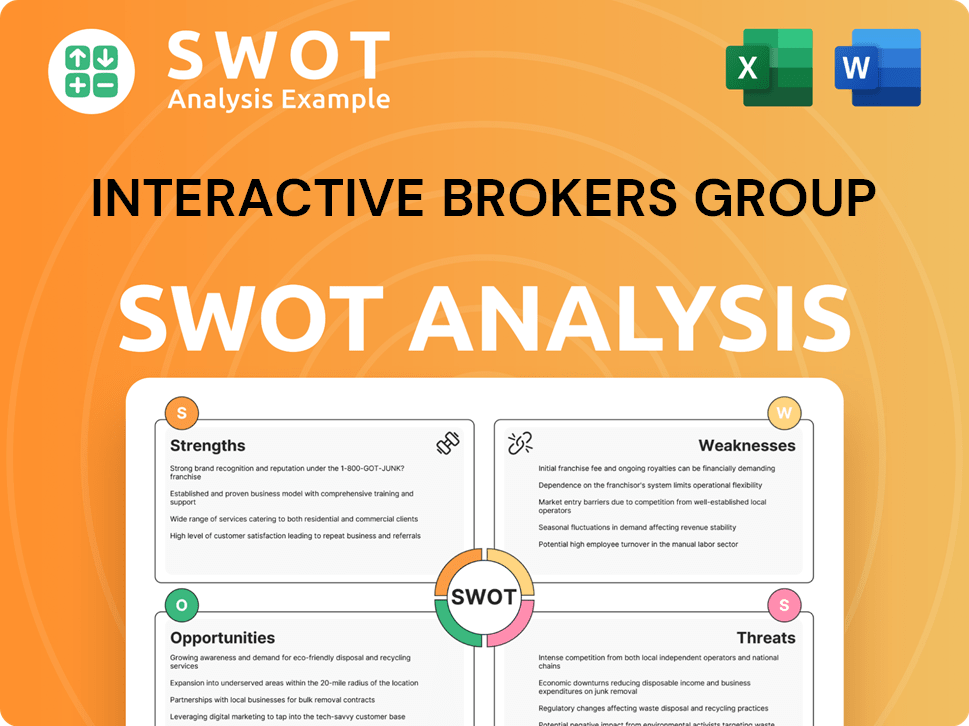

Interactive Brokers Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Interactive Brokers Group Make Money?

Interactive Brokers Group (IBKR) primarily generates revenue through trading commissions and net interest income. These two sources form the backbone of its financial performance, driving significant growth and contributing to its overall profitability. This dual-revenue model allows IBKR to cater to a diverse client base while maintaining a strong financial foundation.

In the first quarter of 2025, commission revenue for Interactive Brokers increased by 36% to $514 million. This surge was fueled by higher customer trading volumes across various financial instruments. Net interest income also saw a rise, increasing by 3% to $770 million, reflecting the impact of higher average customer margin loans and credit balances.

Beyond its core revenue streams, Interactive Brokers also generates income from other fees and services. These additional sources contribute to the company's diverse income profile and overall financial stability. The company's strategic approach to revenue generation involves multiple avenues, ensuring a robust financial model.

Interactive Brokers employs several innovative monetization strategies to maximize revenue. Its tiered pricing structure for the 'Pro' plan appeals to active and institutional traders. The 'Lite' plan offers commission-free trading on U.S. stocks and ETFs, attracting a broader retail investor base while generating revenue through payment for order flow. The company also profits from margin trading and currency conversions.

- Trading Commissions: IBKR charges commissions on trades. In Q1 2025, commission revenue increased by 36% to $514 million.

- Net Interest Income: This is generated from margin loans and customer credit balances. Net interest income increased by 3% to $770 million in Q1 2025.

- Other Fees and Services: This includes risk exposure fees and payments for order flow. This segment grew by 32% to $78 million in Q1 2025.

- Payment for Order Flow: Revenue from routing orders to market makers.

- Currency Diversification: IBKR bases its net worth in GLOBALs (a basket of currencies), contributing to earnings. In Q1 2025, this resulted in a gain of $127 million due to a 0.75% increase in the U.S. dollar value of the GLOBAL.

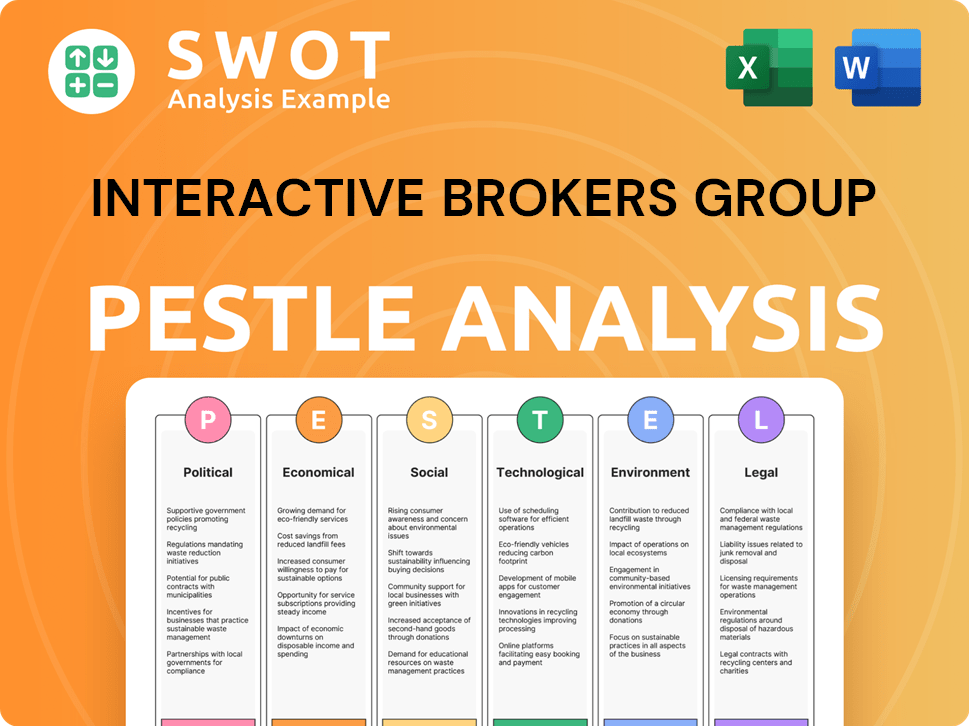

Interactive Brokers Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Interactive Brokers Group’s Business Model?

Interactive Brokers Group (IBKR) has consistently evolved, achieving key milestones that have solidified its position in the online trading landscape. The company's strategic moves, particularly its early adoption of technology, have been pivotal in shaping its operational capabilities and financial performance. Furthermore, IBKR's commitment to innovation and its ability to adapt to market changes have been crucial in maintaining its competitive edge.

A significant strategic move was the establishment of Interactive Brokers Group, Inc. in 1993, which expanded its brokerage services to retail and institutional investors. More recently, IBKR announced a four-for-one forward stock split and an increase in its quarterly cash dividend from $0.25 to $0.32 per share in Q1 2025. This move aimed to make stock ownership more accessible and attractive to a broader investor base. In August 2024, Interactive Brokers streamlined its European operations by consolidating its two EU investment firms into a single Irish-licensed entity, enhancing regulatory compliance across the European Economic Area.

Operational challenges include navigating regulatory changes and market volatility. IBKR addresses these challenges by adapting its compliance procedures and technology infrastructure. Its robust technological infrastructure and diversified revenue streams help maintain stability during market downturns. To learn more about the company's origins, you can read a Brief History of Interactive Brokers Group.

Interactive Brokers' competitive advantage is rooted in its technology. The Trader Workstation (TWS) platform and API access offer sophisticated tools. These features distinguish it from competitors in the online trading space.

IBKR's highly automated business model enables stringent cost control. This allows the company to offer competitive pricing on commissions and margin loans. This efficiency translates into a higher operating income margin compared to peers.

The company provides expansive global market access. It offers access to over 160 exchanges in 36 countries and 28 currencies. This global reach is a key differentiator, particularly for international clients.

IBKR continues to invest in technological innovation. Enhancements to its web-based Advisor Portal include advanced trading and portfolio management tools. An AI Commentary Generator for US-based financial advisors was launched in December 2024.

Interactive Brokers' competitive edge is based on technology, cost efficiency, and global market access. This allows the company to offer sophisticated trading tools and competitive pricing. IBKR's operating margins are significantly higher than those of its peers.

- Technology: Sophisticated trading platform and API access.

- Cost Efficiency: Highly automated model with lower operational costs.

- Global Reach: Access to over 160 exchanges worldwide.

- Financial Performance: Routinely earns operating margins in the high 60s, exceeding Charles Schwab's 45%-50%.

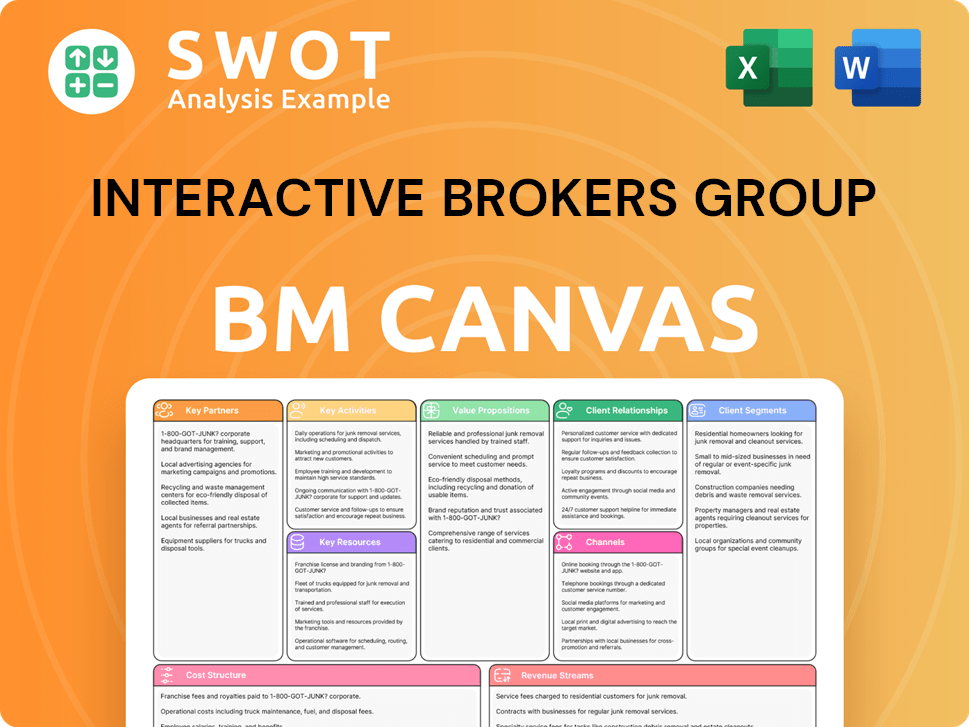

Interactive Brokers Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Interactive Brokers Group Positioning Itself for Continued Success?

Interactive Brokers Group (IBKR) holds a prominent position in the online trading industry, functioning as a leading automated global electronic broker. This is characterized by its extensive global reach and advanced trading technology. As of December 31, 2024, the firm had 3.337 million institutional and individual brokerage customers, with total customer equity reaching $568.2 billion. By April 2025, customer accounts increased to 3.62 million and client equity rose to $573.5 billion, reflecting robust growth.

Despite its strong market position, IBKR faces risks such as regulatory changes and market volatility. Competition from traditional brokerages and fintech firms is a constant factor. However, IBKR's technology and lower fees provide a competitive edge. Looking ahead, the company is poised for continued growth, driven by its expanding international presence and technological innovation.

IBKR is a leading automated global electronic broker, recognized for its global reach and advanced trading technology. It serves a diverse client base, including individual investors and financial advisors. This broad customer segment and global presence contribute to its solid market share in the online brokerage industry.

Key risks include regulatory changes, particularly concerning payment for order flow and increased compliance requirements. Market volatility and economic downturns can also impact trading volumes. Furthermore, competition from traditional and fintech firms remains a factor, though IBKR's technology and lower fees provide a competitive edge.

IBKR is positioned for continued growth, driven by its expanding international presence and technological innovation. Strategic initiatives include enhancing trading platforms and tools, such as the web-based Advisor Portal enhancements in December 2024. The company's efficient business model and focus on sophisticated clients are key to sustaining revenue growth.

IBKR differentiates itself through its advanced trading technology, lower fees, and global market access. The company's commitment to providing liquidity on better terms and its efficient, automated business model contribute to its success. To learn more about the company's growth strategy, read this article about Growth Strategy of Interactive Brokers Group.

Interactive Brokers focuses on enhancing its trading platforms and tools. This includes the web-based Advisor Portal enhancements, which integrate advanced features and AI-powered capabilities. Leadership emphasizes competing on price, speed, global product diversity, and advanced trading tools.

- Enhancements to trading platforms and tools.

- Focus on AI-powered capabilities.

- Commitment to providing liquidity on better terms.

- Continuous improvement of trading technology.

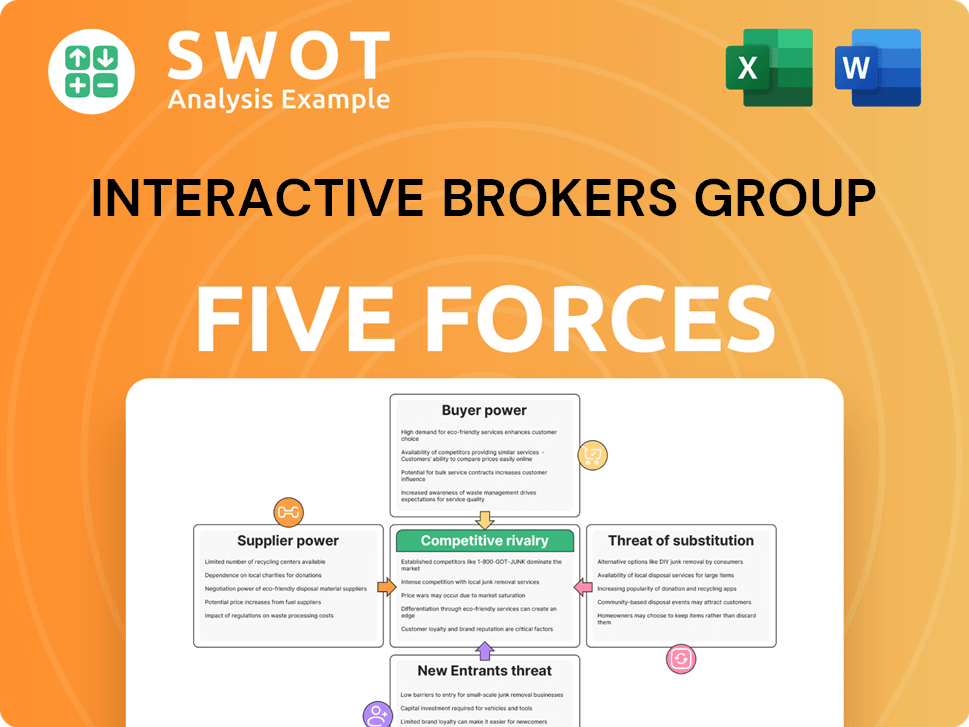

Interactive Brokers Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Interactive Brokers Group Company?

- What is Competitive Landscape of Interactive Brokers Group Company?

- What is Growth Strategy and Future Prospects of Interactive Brokers Group Company?

- What is Sales and Marketing Strategy of Interactive Brokers Group Company?

- What is Brief History of Interactive Brokers Group Company?

- Who Owns Interactive Brokers Group Company?

- What is Customer Demographics and Target Market of Interactive Brokers Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.