Interactive Brokers Group Bundle

Who Really Owns Interactive Brokers?

Understanding the Interactive Brokers Group SWOT Analysis is crucial, but have you ever wondered who pulls the strings at one of the largest electronic brokers in the US? The ownership structure of Interactive Brokers, a company that processes millions of trades daily, is key to grasping its strategic direction and future potential. Knowing the Interactive Brokers parent company and its owners is vital for any investor.

Interactive Brokers' journey from a market maker to a global brokerage powerhouse, with its complex IBKR holdings, is a fascinating case study in corporate evolution. This exploration will unravel the Interactive Brokers company structure, from its founder's initial vision to its current public ownership, offering insights into who controls Interactive Brokers and how this has shaped its success. Delving into the Interactive Brokers ownership history provides a comprehensive understanding of its governance and strategic focus.

Who Founded Interactive Brokers Group?

The story of Interactive Brokers Group begins with its founder, Thomas Peterffy. A Hungarian-born American, Peterffy started his journey in the financial world in 1977. He purchased a seat on the American Stock Exchange (AMEX), marking his initial foray into the industry.

Peterffy's entrepreneurial spirit quickly took hold. In 1978, he established T.P. & Co., expanding his trading activities. His innovative approach led to significant advancements, including the introduction of daily printed fair value pricing sheets in 1979 and the use of handheld computers for trading in 1983. These were early steps toward automating trading processes.

A key milestone in the company's evolution was the development of the first fully automated algorithmic trading system in 1987. This innovation underscored Peterffy's commitment to leveraging technology to enhance trading efficiency. This forward-thinking approach has shaped the company's operations.

Before the IPO, Interactive Brokers Group LLC (IBG LLC) served as the holding company. IBG Holdings LLC, controlled by Thomas Peterffy and his affiliates, held a significant portion of the equity.

The initial public offering in 2007 marked a pivotal moment. Interactive Brokers Group, Inc. (the public holding company) was established. The proceeds from the IPO were used to purchase membership interests in IBG LLC.

Thomas Peterffy's influence was central to the company's ownership. He and his affiliates beneficially owned approximately 95% of the equity interests in IBG LLC immediately after the IPO.

The initial ownership structure of Interactive Brokers, and its parent company, was heavily influenced by Thomas Peterffy's vision. The early agreements set the stage for the eventual public offering. The Growth Strategy of Interactive Brokers Group reflects the company's evolution.

Understanding the company's ownership structure is key to grasping its operational dynamics. The concentration of ownership in the hands of the founder and his affiliates highlights the importance of their strategic direction.

- Interactive Brokers ownership is largely influenced by the founder, Thomas Peterffy.

- The company's initial structure involved IBG LLC as the holding company, with Peterffy's control.

- The IPO in 2007 brought in public investors, but Peterffy retained substantial influence.

- The company's legal structure has evolved over time, but Peterffy's vision remains central.

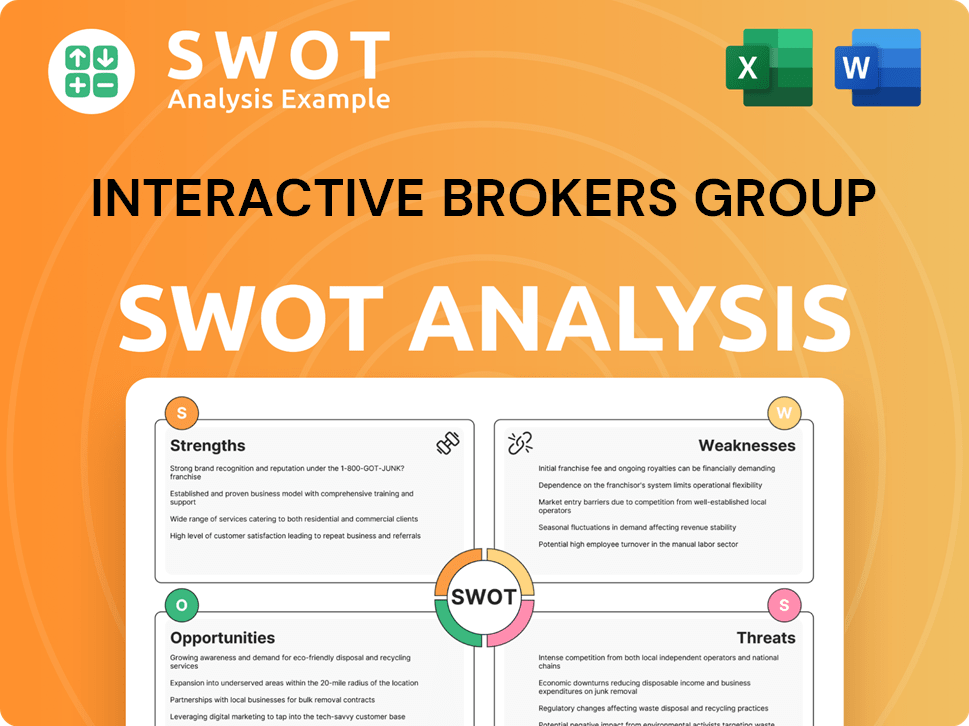

Interactive Brokers Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Interactive Brokers Group’s Ownership Changed Over Time?

The evolution of Interactive Brokers' ownership structure is marked by its initial public offering (IPO) on May 3, 2007. The IPO saw the company offer 40 million shares, approximately 10% of the company, at $30.01 per share, raising $1.2 billion. Following the IPO, Interactive Brokers Group, Inc. acquired about 10.0% of the membership interests in IBG LLC, which led to the consolidation of IBG LLC's financial results.

As of December 31, 2024, the ownership structure shows that about 25.8% of Interactive Brokers is publicly held, while the remaining 74.2% is owned by IBG Holdings LLC. This entity is largely controlled by Thomas Peterffy and his affiliates, who hold 91.4% of it. Peterffy is the founder, chairman, and the largest shareholder of Interactive Brokers, with an estimated net worth of $55.5 billion as of May 2025. As of January 27, 2023, Thomas Peterffy directly held 1,630,605 shares of Interactive Brokers Group Inc (IBKR) stock, valued at over $334 million.

| Key Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | May 3, 2007 | Public offering of approximately 10% of the company's shares. |

| Acquisition of IBG LLC Membership Interests | Post-IPO | Led to the consolidation of IBG LLC's financial results. |

| Current Ownership Structure | December 31, 2024 | Approximately 25.8% publicly held; 74.2% owned by IBG Holdings LLC, primarily controlled by Thomas Peterffy. |

Institutional investors significantly influence the Interactive Brokers ownership landscape. As of June 12, 2025, there were 1260 institutional owners and shareholders, holding a total of 108,419,282 shares. Major institutional shareholders include BlackRock, Inc., Vanguard Group Inc, and State Street Corp. Institutions held 84.71% of IBKR shares, while insiders held 15.29% as of March 2025. Understanding the Marketing Strategy of Interactive Brokers Group can offer additional insights into the company's operations.

Interactive Brokers' ownership is primarily split between public shareholders and IBG Holdings LLC, with Thomas Peterffy as the key figure.

- The IPO in 2007 marked a significant shift, making the company partially public.

- Institutional investors hold a substantial portion of the publicly traded shares.

- Thomas Peterffy, the founder, maintains significant control through IBG Holdings LLC.

- The company's structure involves both public and private ownership components.

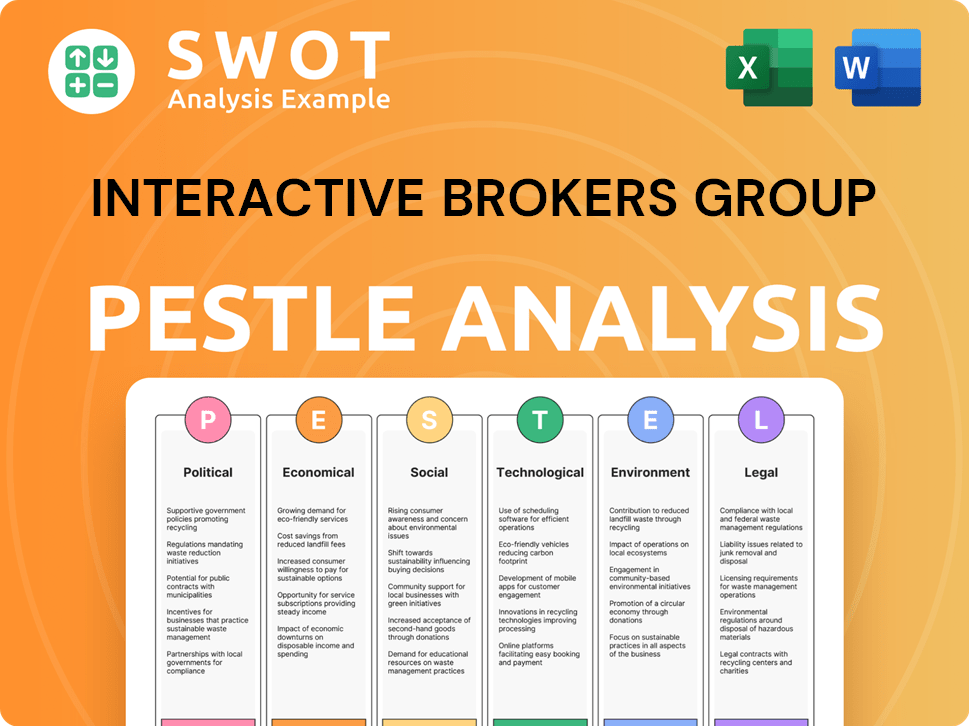

Interactive Brokers Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Interactive Brokers Group’s Board?

The Board of Directors of Interactive Brokers Group, Inc. plays a key role in the company's governance. Thomas Peterffy, the founder and Chairman, holds significant voting power. This structure impacts the company's decision-making processes.

The ownership structure grants substantial control to IBG Holdings LLC, which is indirectly controlled by Thomas Peterffy. This arrangement influences the election of directors and major corporate decisions. Understanding the board's composition and the voting dynamics is crucial for anyone interested in the company's operations.

| Committee | Members | |

|---|---|---|

| Audit Committee | Dr. Lawrence E. Harris (Chairman), Ms. Nicole Yuen, Mr. Richard Repetto | |

| Compensation Committee | Thomas Peterffy (Chairman), Earl H. Nemser, Milan Galik | |

| Nominating and Corporate Governance Committee | Earl H. Nemser (Chairman), Thomas Peterffy, Nicole Yuen |

As of March 3, 2025, there were 108,931,651 shares of Class A common stock outstanding. IBG Holdings LLC held all 100 shares of Class B common stock. This dual-class structure gives IBG Holdings LLC, and thus Thomas Peterffy, significant control over the company. This structure is a critical aspect of the Target Market of Interactive Brokers Group.

Thomas Peterffy, through IBG Holdings LLC, effectively controls Interactive Brokers. The dual-class share structure ensures his influence over key decisions.

- Founder Thomas Peterffy maintains substantial voting power.

- IBG Holdings LLC holds disproportionate voting rights.

- The structure impacts director elections and major corporate actions.

- Affiliates and management also hold ownership through Holdings membership.

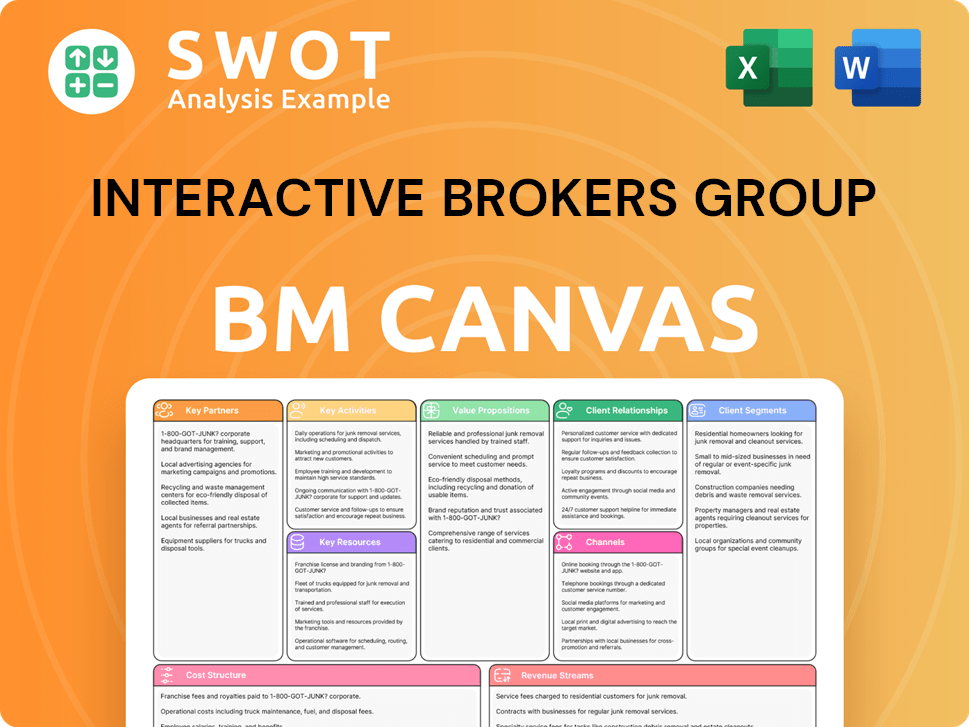

Interactive Brokers Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Interactive Brokers Group’s Ownership Landscape?

Recent developments at Interactive Brokers Group (IBKR) show a dynamic evolution in its ownership and operational structure. In April 2025, the Board of Directors approved an increase in the quarterly cash dividend from $0.25 to $0.32 per share, payable on June 13, 2025. Furthermore, to enhance accessibility for investors, the company announced a four-for-one forward stock split of its common stock, effective June 17, 2025.

Over the past few years, the ownership profile of Interactive Brokers has remained relatively stable, with significant institutional involvement. As of March 31, 2025, Asset Management One Co., Ltd. increased its IBKR holdings by 41,755 shares. During Q4 2024, WELLINGTON MANAGEMENT GROUP LLP notably increased its holdings by 1,476,135 shares. Conversely, some institutions, such as EGERTON CAPITAL (UK) LLP, reduced their positions. Overall, 354 institutional investors added shares, while 280 decreased their positions in the most recent quarter.

| Metric | Details | Date |

|---|---|---|

| Dividend Increase | From $0.25 to $0.32 per share | April 2025 |

| Stock Split | Four-for-one forward stock split | June 17, 2025 |

| Institutional Investors Adding Shares | 354 | Most Recent Quarter |

| Institutional Investors Decreasing Shares | 280 | Most Recent Quarter |

Founder Thomas Peterffy remains the largest shareholder, controlling approximately 70% of the company as of April 2025. The public holds about 24.5% of the company. The Competitors Landscape of Interactive Brokers Group reveals that the company's focus on institutional clients contributes to its high revenue per client. Despite moderate average revenue growth, its strong free cash flow generation and low debt position are viewed positively for future growth. Analysts have issued 'Buy' or 'Overweight' ratings on the stock in recent months, with positive outlooks from Barclays, UBS, Goldman Sachs, JMP Securities, Citigroup, and Piper Sandler in late 2024 and early 2025.

Thomas Peterffy holds approximately 70% of the company's shares.

Public ownership accounts for roughly 24.5% of the shares.

Asset Management One Co., Ltd. increased its holdings by 41,755 shares.

WELLINGTON MANAGEMENT GROUP LLP increased its holdings by 1,476,135 shares in Q4 2024.

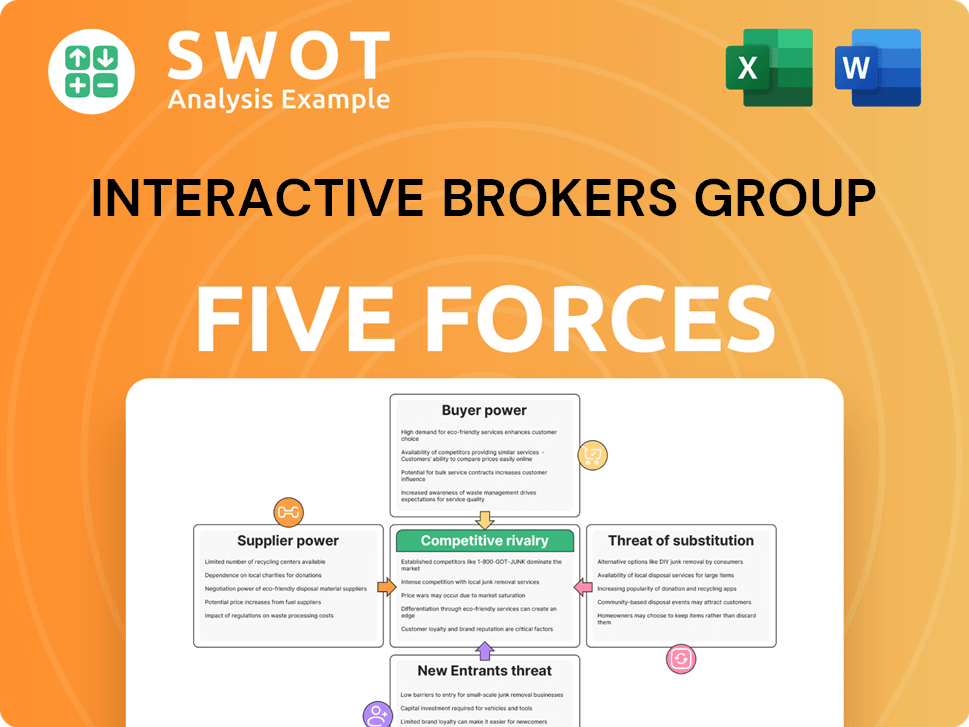

Interactive Brokers Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Interactive Brokers Group Company?

- What is Competitive Landscape of Interactive Brokers Group Company?

- What is Growth Strategy and Future Prospects of Interactive Brokers Group Company?

- How Does Interactive Brokers Group Company Work?

- What is Sales and Marketing Strategy of Interactive Brokers Group Company?

- What is Brief History of Interactive Brokers Group Company?

- What is Customer Demographics and Target Market of Interactive Brokers Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.