Interactive Brokers Group Bundle

Who Trades with Interactive Brokers?

Navigating the complexities of the financial world requires understanding the players involved, and for Interactive Brokers (IBKR), that starts with its customers. This exploration goes beyond just identifying who uses the Interactive Brokers Group SWOT Analysis to uncover the core of its client base. Understanding the customer demographics and target market is crucial for strategic success.

From its origins as a market maker to its current status as a global electronic broker, Interactive Brokers has seen its client profile evolve. This evolution necessitates a deep dive into its customer demographics, including factors like age range, income requirements, and geographic location. Analyzing the Interactive Brokers target audience allows for a better understanding of the company's customer acquisition strategy and the overall profitability of its client base.

Who Are Interactive Brokers Group’s Main Customers?

Understanding the customer base is crucial for any financial services company. For the [Company Name], the primary customer segments are well-defined, reflecting its positioning in the financial markets. This analysis delves into the key demographics and target market characteristics that shape its business strategy.

The company caters to a sophisticated clientele, including both institutional and individual investors. Its platform's advanced features and low-cost structure appeal to those seeking direct market access and comprehensive trading tools. This dual approach allows the company to serve a broad spectrum of financial professionals and active traders.

The company's customer base is characterized by its financial acumen and trading experience. The target market includes a mix of institutional clients, such as hedge funds and financial advisors, and self-directed individual investors. This diverse group benefits from the company's extensive product offerings and competitive pricing.

Institutional clients form a key segment, encompassing hedge funds, mutual funds, and financial advisors. These entities require advanced trading tools and robust clearing services. They typically manage substantial capital and have a deep understanding of complex financial products.

The company also targets self-directed individual investors who are actively engaged in the markets. These individuals often possess substantial portfolios and seek low-cost access to global markets. They are typically well-educated and have above-average income levels.

While specific age and gender demographics are not publicly segmented in detail, the platform's sophistication suggests a user base that skews towards experienced traders. The company's focus is on providing comprehensive market access and competitive pricing. The company has seen significant growth in its individual investor accounts.

As of Q1 2024, the company reported a 14% increase in client accounts year-over-year, reaching 2.89 million. This growth is driven by low commissions and extensive product offerings. The company has strategically broadened its appeal to include high-net-worth retail investors and financial advisors.

The company's target market is diverse, encompassing both institutional and individual investors. Its focus on advanced trading tools and low-cost access appeals to experienced traders and financial professionals. The company's strategic expansion includes a greater emphasis on international markets and high-net-worth clients.

- The company serves institutional clients, including hedge funds and financial advisors, and self-directed individual investors.

- The platform's sophistication suggests a user base that is experienced in trading.

- The company has seen significant growth in its individual investor accounts, with a 14% increase in client accounts year-over-year.

- The company has broadened its appeal to include high-net-worth retail investors and financial advisors.

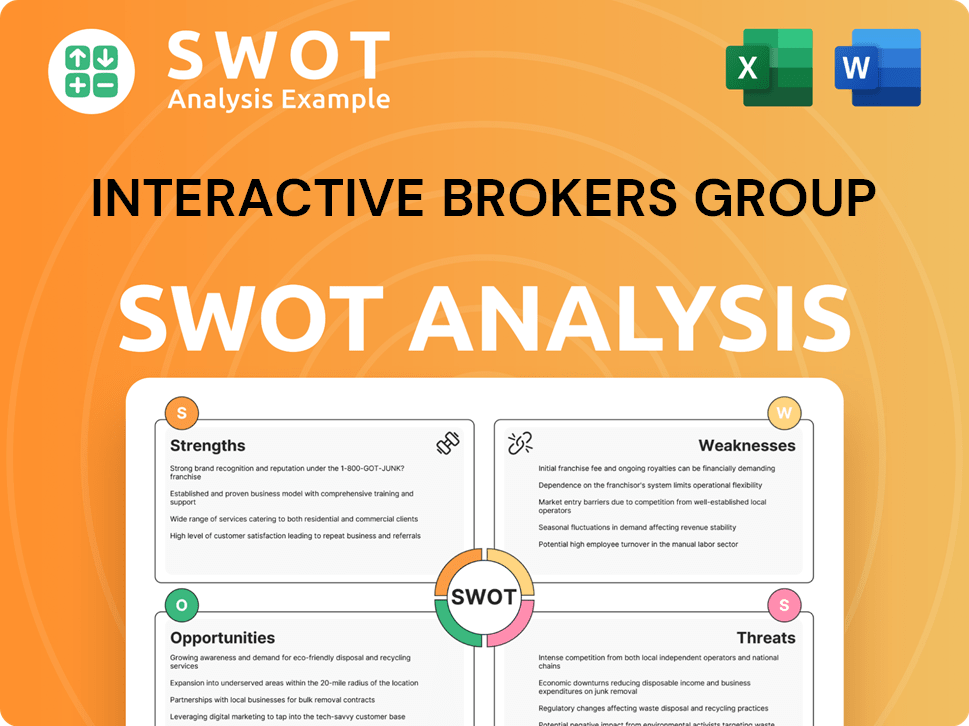

Interactive Brokers Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Interactive Brokers Group’s Customers Want?

The customer needs and preferences of Interactive Brokers (IBKR) are centered around advanced trading capabilities, cost-effectiveness, and global market access. These factors are crucial for attracting and retaining a diverse client base, from professional traders to active individual investors. Understanding these needs allows IBKR to tailor its services and marketing efforts effectively.

Professional and institutional clients, a significant segment of IBKR's target market, prioritize ultra-low latency execution, deep liquidity, and robust API connectivity. Active individual investors, on the other hand, are drawn to the platform for its extensive global market access, competitive pricing, and sophisticated analytical tools. Both segments share a common desire for control over their investments and the ability to implement diverse trading strategies.

IBKR's success lies in addressing common pain points in the brokerage industry, such as high costs and limited market access. By offering transparent pricing models and advanced trading features, IBKR caters to a financially literate audience that values efficiency and comprehensive market coverage. This approach is reflected in its product development and marketing strategies, which emphasize the benefits of low costs and extensive market access.

Professional traders require ultra-low latency execution and deep liquidity. They need comprehensive API connectivity for algorithmic trading. Execution quality and competitive commission structures are key drivers.

Active individual investors seek access to a vast array of global markets and products. They value competitive pricing and sophisticated analytical tools. The ability to trade stocks, options, futures, forex, and bonds from a single account is a key advantage.

Both groups benefit from transparent pricing models and advanced research tools. They seek control and the ability to implement diverse trading strategies. Both groups benefit from transparent pricing models and advanced research tools.

IBKR addresses high costs associated with traditional brokers. It provides access to international markets and advanced trading features. IBKR's competitive pricing and extensive product offerings are a major draw.

IBKR has expanded offerings to include fractional shares. It has enhanced portfolio analysis tools. These developments are in response to customer feedback and market trends.

Marketing emphasizes competitive pricing and extensive product offerings. It appeals to financially literate individuals who understand the value of low costs and broad market access. The platform, Trader Workstation (TWS), is designed for experienced traders.

IBKR's customer base values advanced functionality, cost efficiency, and global market access. The platform's ability to handle high-volume transactions and complex order types is crucial for professional clients. Active traders appreciate the ability to trade various asset classes from a single account.

- Cost Efficiency: Competitive commission structures and transparent pricing models are highly valued.

- Global Market Access: The ability to trade in diverse markets across the globe is a significant advantage.

- Advanced Functionality: Sophisticated analytical tools and customizable interfaces cater to experienced traders.

- Execution Quality: Ultra-low latency execution and deep liquidity are critical for professional clients.

- Product Breadth: Access to a wide range of financial instruments, including stocks, options, futures, forex, and bonds.

To understand how IBKR generates revenue and the business model that supports its customer offerings, you can read more about it in the Revenue Streams & Business Model of Interactive Brokers Group.

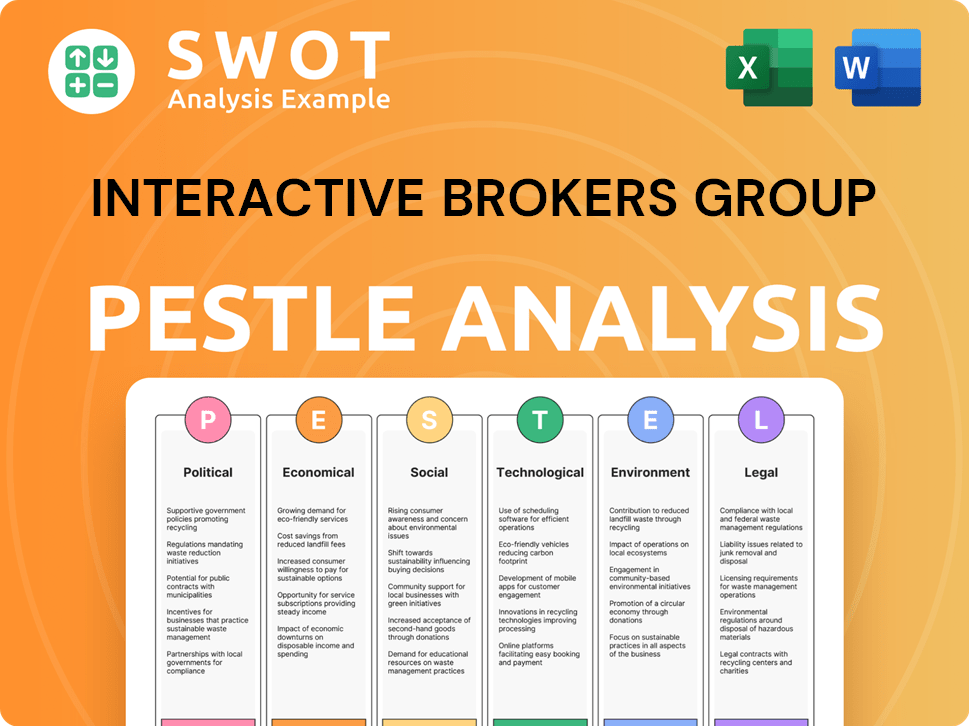

Interactive Brokers Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Interactive Brokers Group operate?

Interactive Brokers (IBKR) maintains a substantial and expanding global presence, strategically focusing on regions with well-established financial markets and a growing base of sophisticated investors. Its core markets include North America, particularly the United States, with significant international expansion in Europe, Asia (Hong Kong, Singapore, and Japan), and Australia. This geographical diversification is a key element of its business strategy, reflecting a commitment to serving a worldwide clientele.

The company's approach involves catering to diverse client needs across different regions. IBKR offers its services in multiple languages and provides localized trading platforms. It adheres to regional regulatory requirements by operating regulated entities in various jurisdictions, such as Interactive Brokers UK, Interactive Brokers Ireland, and Interactive Brokers Hong Kong. This localization strategy is crucial for attracting and retaining clients in different markets.

The company's geographic distribution of sales and growth indicates a strong trend toward international client acquisition, with a notable portion of new accounts originating from outside the United States. This global focus is a key factor in its long-term growth strategy, enabling it to reach a broader customer base and capitalize on opportunities in various financial markets. Understanding the Marketing Strategy of Interactive Brokers Group provides further insights into its global expansion efforts.

North America (primarily the United States), Europe, Asia (Hong Kong, Singapore, Japan), and Australia are key markets for IBKR. These regions have established financial markets and a strong presence of active traders and investors.

IBKR provides customer support in multiple languages, offers localized trading platforms, and complies with regional regulatory requirements. This includes operating regulated entities in jurisdictions like the UK, Ireland, and Hong Kong.

A significant portion of new accounts originates from outside the United States, highlighting IBKR's strategic emphasis on global diversification. This international expansion is a key driver of its overall growth.

IBKR's client base includes professional traders and active individual investors. These clients are attracted by the company's comprehensive product offerings and competitive pricing across various global markets.

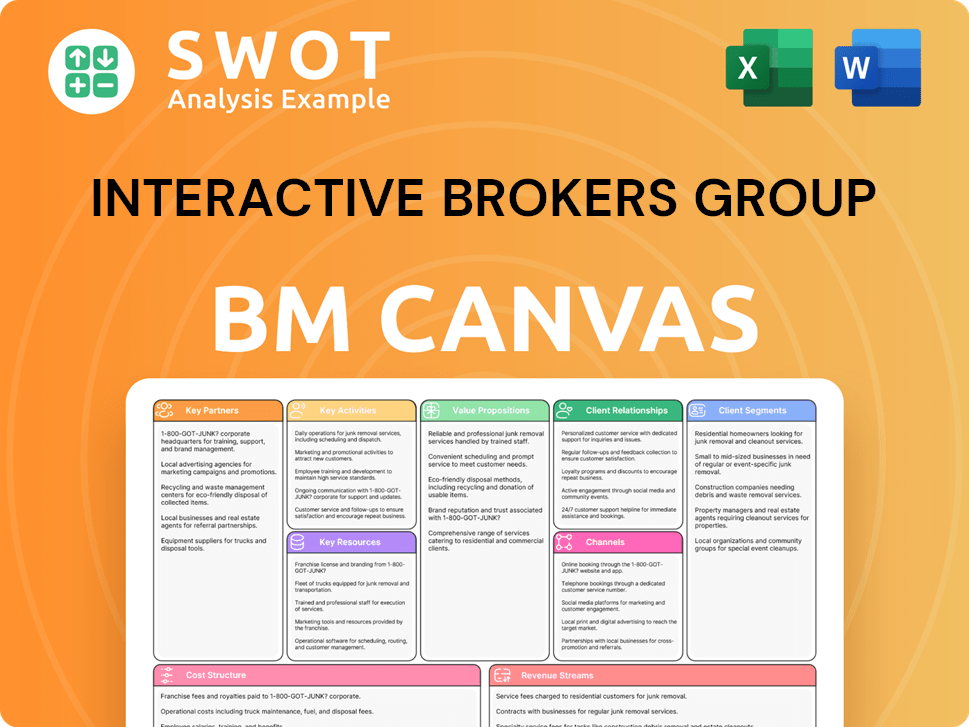

Interactive Brokers Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Interactive Brokers Group Win & Keep Customers?

Interactive Brokers (IBKR) employs a multi-pronged approach to acquire and retain customers, leveraging its reputation for competitive pricing, advanced technology, and a wide array of financial products. Their primary focus is on attracting financially literate individuals and institutions through digital marketing channels. IBKR emphasizes low commissions, narrow spreads, and access to a vast global market as key differentiators to attract clients.

The company's customer acquisition strategy relies heavily on its self-service platform and word-of-mouth referrals within the active trading community, particularly for individual investors. Direct sales tactics are used to engage institutional clients. Retention strategies focus on delivering a superior trading experience, continuous platform enhancements, and responsive customer service. They also offer educational resources to empower clients, contributing to their trading success and, consequently, their loyalty.

Customer data and segmentation are crucial for targeting campaigns. IBKR uses client data to understand trading patterns, product usage, and geographical preferences. This enables them to tailor communications and highlight relevant features or new offerings. The company's strategic adjustments have contributed to a steady increase in client accounts and assets under management, positively impacting customer lifetime value and reducing churn rates. To learn more about their expansion, consider reading about the Growth Strategy of Interactive Brokers Group.

IBKR's primary acquisition channels are digital, including online advertising, search engine optimization (SEO), and content marketing. They target financially literate individuals and institutions. The platform's self-service capabilities and word-of-mouth referrals are essential for attracting individual investors.

IBKR distinguishes itself through low commissions, narrow spreads, and access to over 150 markets in 33 countries. These competitive advantages are highlighted in their marketing materials. The company focuses on offering a technologically advanced trading platform.

IBKR focuses on providing a superior trading experience. This includes continuous enhancements to its Trader Workstation (TWS) platform and the introduction of new features. Responsive customer service and educational resources are also key to retaining clients.

IBKR uses client data to understand trading patterns, product usage, and geographical preferences. This allows them to tailor communications and highlight relevant features. The company's data-driven insights ensure precise and impactful outreach.

IBKR has broadened its appeal beyond professional traders. They have refined their marketing messages to highlight accessibility and ease of use. This strategic shift aims to attract a wider range of sophisticated retail investors.

- Focus on digital marketing and platform enhancements.

- Emphasis on low costs and global market access.

- Data-driven insights for targeted communications.

- Continuous platform improvements and educational resources.

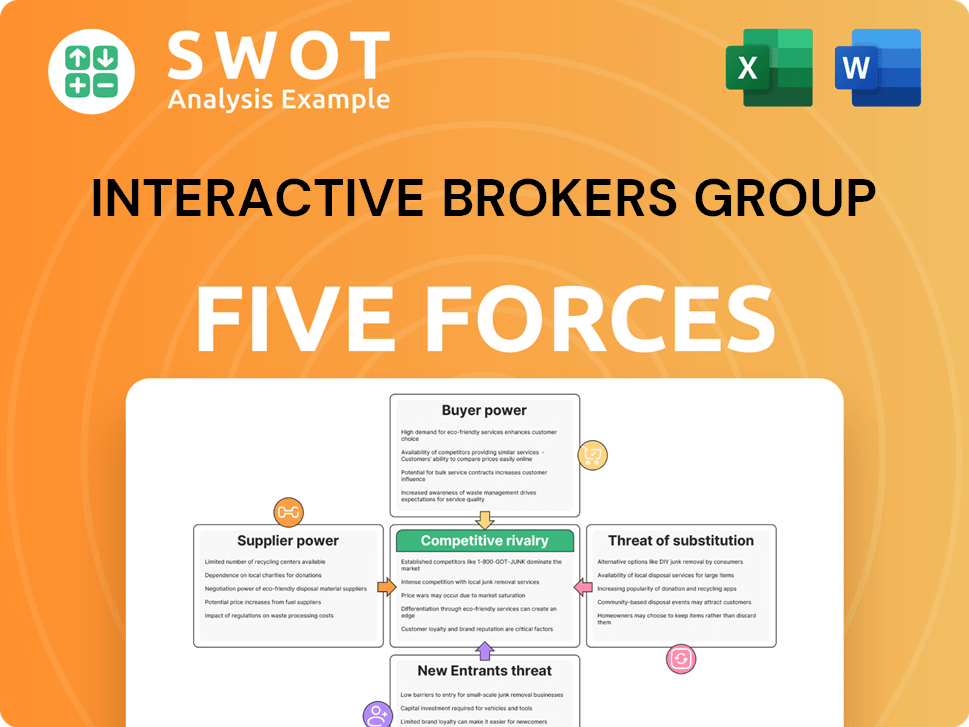

Interactive Brokers Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Interactive Brokers Group Company?

- What is Competitive Landscape of Interactive Brokers Group Company?

- What is Growth Strategy and Future Prospects of Interactive Brokers Group Company?

- How Does Interactive Brokers Group Company Work?

- What is Sales and Marketing Strategy of Interactive Brokers Group Company?

- What is Brief History of Interactive Brokers Group Company?

- Who Owns Interactive Brokers Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.