Interactive Brokers Group Bundle

How Does Interactive Brokers Dominate the Online Brokerage Landscape?

Interactive Brokers Group's success story is a masterclass in strategic sales and marketing, transforming the financial world. From its roots in automated options market making, the company has become a global powerhouse. This evolution showcases how technology and a laser focus on customer needs can reshape an industry. The company's journey provides a fascinating case study for understanding the dynamics of online brokerage marketing.

This analysis dives deep into the Interactive Brokers Group SWOT Analysis, exploring its innovative Interactive Brokers sales strategy and robust IBKR sales and marketing tactics. We'll dissect how Interactive Brokers marketing strategy has fueled its growth, examining its competitive analysis and brand positioning strategy within the financial services sales arena. Furthermore, we'll explore its customer acquisition cost and the effectiveness of its trading platform promotion, including an overview of its advertising campaigns, social media presence, and content marketing examples to understand how it attracts and retains its target audience.

How Does Interactive Brokers Group Reach Its Customers?

The sales strategy of Interactive Brokers (IBKR) centers on a digital-first approach. This strategy is designed to efficiently reach a global customer base. The company primarily uses its online platform and dedicated trading applications as its main sales channels, aligning with its identity as an automated electronic broker.

Interactive Brokers' marketing strategy focuses on attracting institutional and professional traders. These traders value efficiency and speed. The digital-first approach allows IBKR to scale globally without traditional brick-and-mortar costs. This contributes to its competitive pricing model, a key element of its customer acquisition strategy.

The evolution of IBKR's sales channels has been driven by technological advancements. The company continuously invests in its proprietary trading technology. This enhances its online platforms, making them user-friendly and comprehensive. Partnerships with financial advisors and hedge funds also expand its reach within professional trading communities, supporting its overall Growth Strategy of Interactive Brokers Group.

Interactive Brokers' primary sales channel is its online platform. This platform provides direct access to trade execution and clearing services. It caters to a target demographic that prioritizes efficiency and speed in trading.

IBKR utilizes direct sales teams to manage institutional client relationships. These teams also focus on onboarding larger professional accounts. This approach complements the online platform, providing personalized support.

IBKR forms partnerships with financial advisors, hedge funds, and prop trading firms. These collaborations expand IBKR's reach within professional trading communities. This strategy leverages existing networks to increase market penetration.

Continuous investment in proprietary trading technology is a key focus. This enhances the user experience on its online platforms. Technological upgrades support the company's competitive pricing model.

Interactive Brokers' sales strategy is heavily reliant on its online platform and direct sales efforts. It focuses on attracting institutional and professional traders. The company's marketing strategy leverages technology and strategic partnerships.

- Online Platform: The primary channel for direct access to trading services.

- Direct Sales: Dedicated teams manage institutional clients and onboard professional accounts.

- Partnerships: Collaborations with financial advisors and hedge funds expand market reach.

- Technology: Continuous investment in its trading technology enhances user experience and supports competitive pricing.

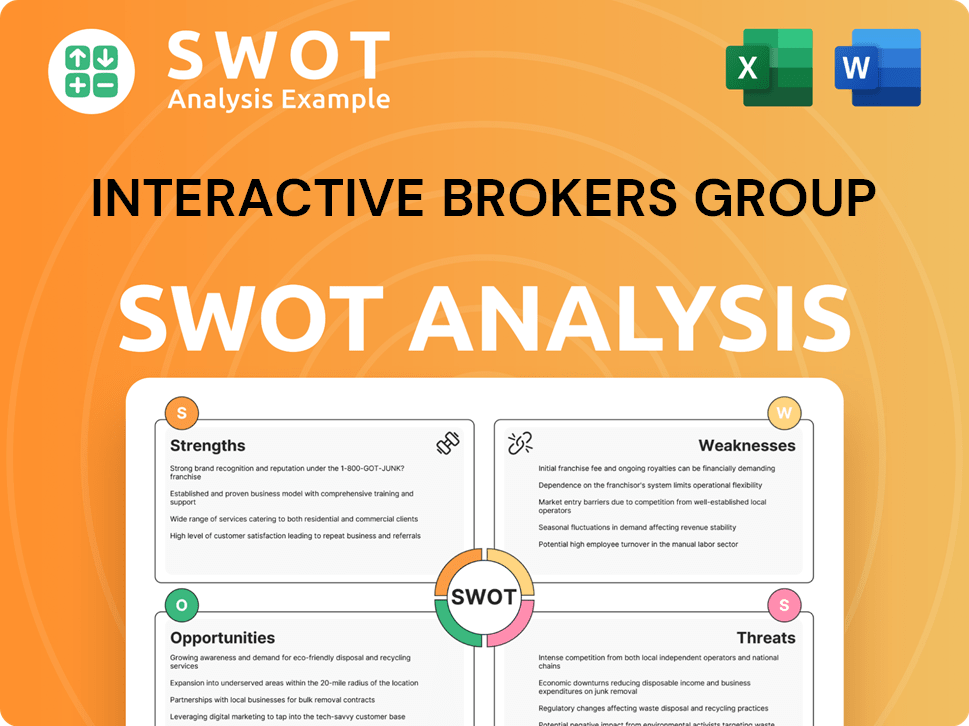

Interactive Brokers Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Interactive Brokers Group Use?

The marketing tactics of Interactive Brokers (IBKR) are meticulously crafted to attract and retain a sophisticated clientele. Their approach is heavily reliant on digital channels, utilizing data-driven strategies to engage with traders and investors who seek advanced trading capabilities and global market access. The focus is on providing valuable content and leveraging targeted advertising to reach the desired audience effectively.

IBKR's sales and marketing strategy is designed to establish thought leadership and provide value. This strategy includes a strong emphasis on content marketing, search engine optimization (SEO), and targeted advertising. The company aims to continuously optimize its campaigns based on user engagement and conversion rates, reflecting its commitment to a data-driven approach.

Interactive Brokers' marketing strategy is a blend of digital and traditional methods, tailored to reach a specific, informed audience. The company's approach is continuously refined based on performance metrics, ensuring that resources are allocated efficiently to maximize impact.

IBKR utilizes content marketing extensively, publishing in-depth market analyses, educational materials, and webinars through its Traders' Academy. This strategy aims to establish the company as a thought leader in the financial services sector. This approach helps to attract and educate potential clients, showcasing their expertise and providing value to their audience.

SEO is integral to IBKR's marketing, ensuring high visibility for its platforms and educational resources. This helps capture organic traffic from traders searching for specific tools or market information. By optimizing its online presence, IBKR aims to attract potential clients actively seeking information and services.

Paid advertising is strategically deployed on financial news websites, professional trading forums, and business-focused social media platforms like LinkedIn. This targets specific demographics interested in advanced trading capabilities and global market access. The use of paid advertising is carefully targeted to reach the most relevant audience segments.

Email marketing is utilized for lead nurturing, product updates, and personalized communications. IBKR segments its audience based on trading activity, product interest, and geographic location. This targeted approach ensures that communications are relevant and effective.

While digital channels are primary, IBKR may engage in targeted print advertisements in specialized financial publications. This approach complements its digital efforts, reaching a broader audience within the financial community. This helps to maintain brand visibility and reach potential clients through various channels.

IBKR continuously optimizes its marketing campaigns based on user engagement, conversion rates, and client acquisition costs. The company leverages advanced analytics tools to understand client behavior and tailor its messaging. This data-driven approach ensures that marketing efforts are efficient and effective.

IBKR's marketing approach is designed to attract and retain a sophisticated clientele. The company uses a variety of tactics to reach its target audience effectively. These strategies are continuously refined based on performance data to maximize their impact.

- Digital Focus: The primary focus is on digital channels, reflecting the online nature of its services.

- Targeted Advertising: Advertising campaigns are highly targeted to reach specific demographics interested in advanced trading.

- Content-Rich Approach: The company provides in-depth market analyses and educational materials to establish thought leadership.

- Data-Driven Decisions: Marketing campaigns are continuously optimized based on user engagement and conversion rates.

- Lead Nurturing: Email marketing is used for lead nurturing and personalized communications.

Understanding the Owners & Shareholders of Interactive Brokers Group can provide further insight into the company's strategic direction and financial performance, which directly influences its marketing strategies.

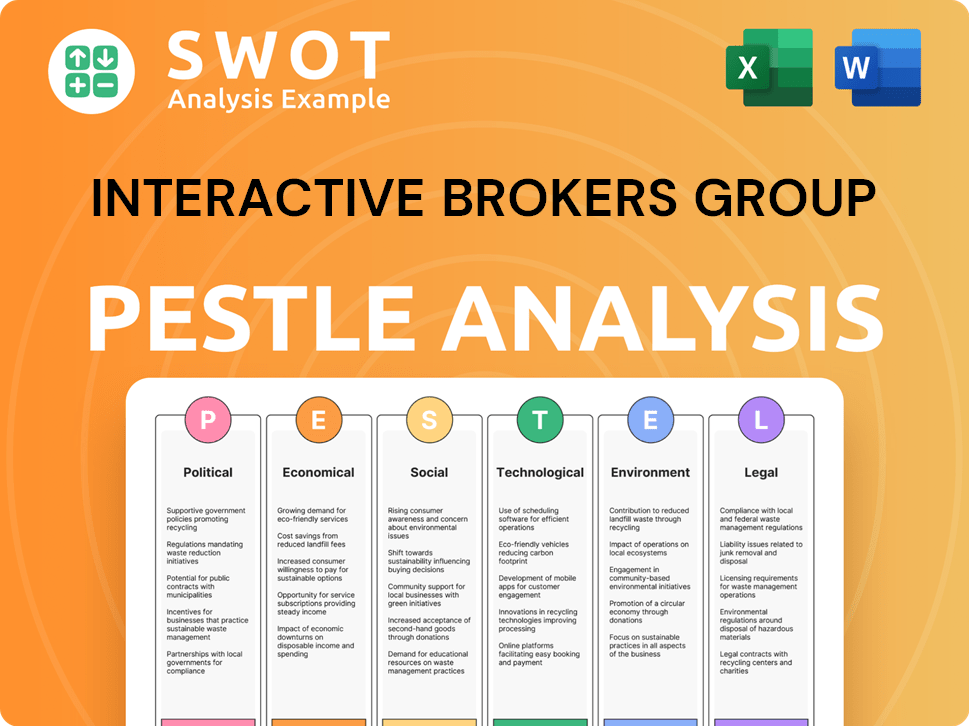

Interactive Brokers Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Interactive Brokers Group Positioned in the Market?

The brand positioning of Interactive Brokers (IBKR) centers on its commitment to technology, efficiency, and cost-effectiveness. This positions the company as a top choice for serious traders and institutional clients. The core message revolves around 'more for less,' offering access to global markets and a wide range of products at competitive commission rates.

The visual identity is professional and streamlined, emphasizing clarity and functionality. The tone of voice is authoritative and direct, focusing on factual information and technical expertise. The customer experience promises robust trading capabilities, reliable execution, and comprehensive market access, all delivered through a powerful platform.

Interactive Brokers' Interactive Brokers sales strategy and Interactive Brokers marketing strategy are designed to attract a specific audience. The company differentiates itself by offering direct market access to a wider range of products and exchanges than many competitors, combined with some of the lowest commissions in the industry. This approach is key to its brand positioning strategy.

Interactive Brokers offers a unique value proposition by providing access to global markets with low commissions. This appeals to active traders and institutional clients seeking cost-effective trading solutions. This is a key element in its online brokerage marketing approach.

The primary target audience includes active traders, institutional investors, and sophisticated individual investors. These clients value advanced trading tools, extensive market access, and low costs. Understanding the Interactive Brokers target audience analysis is crucial.

The competitive advantage lies in its technology-driven platform, low commissions, and broad market access. This combination attracts clients looking for efficient and cost-effective trading. This is a critical aspect of its financial services sales strategy.

Brand consistency is maintained across online platforms, educational materials, and client communications. This reinforces the image of a reliable and technologically advanced broker. The company's approach supports its trading platform promotion.

The company's approach includes continuous platform enhancements and expanding product offerings. This ensures it remains at the forefront of trading technology and client service. The company's Interactive Brokers marketing plan 2024 likely includes these elements.

- Focus on technological innovation to enhance trading platform capabilities.

- Expand product offerings to include a wider range of financial instruments.

- Maintain competitive commission rates to attract and retain clients.

- Provide comprehensive educational resources to support client trading activities.

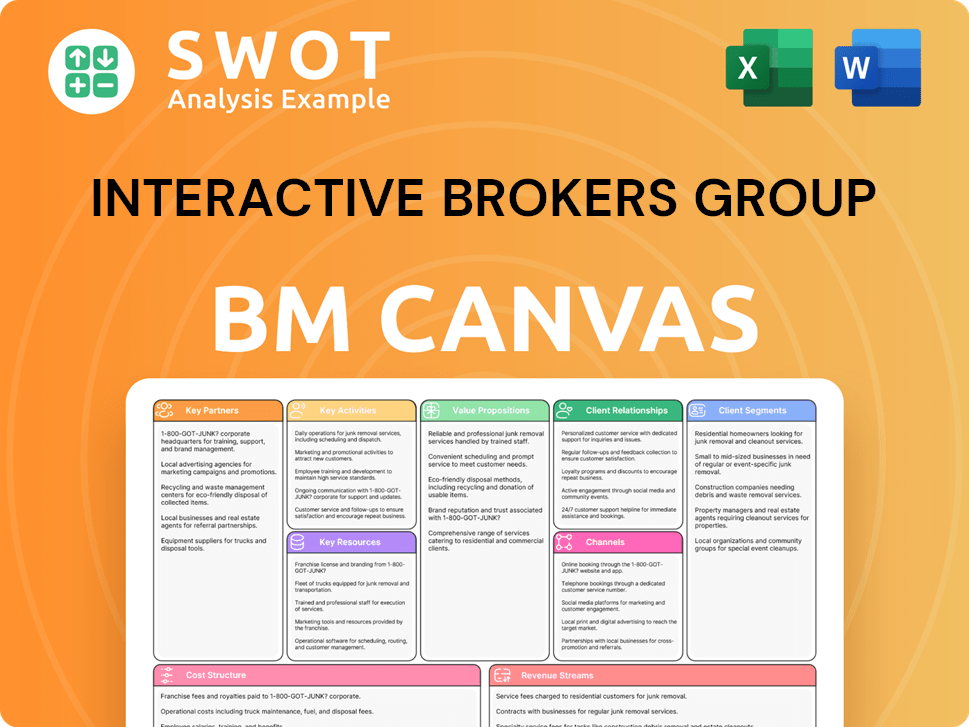

Interactive Brokers Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Interactive Brokers Group’s Most Notable Campaigns?

The Interactive Brokers Group's sales and marketing strategy pivots on highlighting its platform's strengths. This approach is less about broad emotional appeals and more about showcasing the platform's capabilities and cost benefits. The central focus remains on attracting sophisticated traders who prioritize efficient execution and cost-effectiveness, which is a key element of their online brokerage marketing.

A significant element of their strategy involves consistently emphasizing their low-commission structure and the extensive global product offerings. This continuous messaging serves as a core element of their growth strategy. It's a long-term commitment rather than a short-term campaign, and it's been successful in attracting and retaining clients. This strategy is evident in their increasing client accounts and trading volumes, demonstrating effective financial services sales.

More recent campaigns likely focus on promoting specific new features, such as expanded cryptocurrency trading options or enhanced analytical tools, or highlighting its global reach. These campaigns typically involve targeted digital ads, email blasts to existing and prospective clients, and content marketing pieces that detail the benefits of such features. The success of these campaigns is measured by increased adoption of new features, growth in international client accounts, and overall trading activity.

Ongoing promotion of the 'IBKR Pro' platform is a key campaign. This campaign emphasizes direct market access and competitive pricing. This is a core strategy in their Interactive Brokers marketing plan 2024.

Campaigns highlighting the ability to trade across many markets and currencies. This underscores a unique selling proposition for international traders. This is an important aspect of their Interactive Brokers international marketing strategy.

Targeted digital ads are a primary channel for promoting features and benefits. These ads are crucial for lead generation techniques. This approach is a key component of their Interactive Brokers advertising campaigns.

Content marketing pieces are used to detail the benefits of new features. This strategy helps to enhance their Interactive Brokers SEO strategy. This is a good example of Interactive Brokers content marketing examples.

The success of their campaigns is measured through various metrics. These include increased adoption of new features, growth in international client accounts, and overall trading activity. Evaluating these metrics provides insights into their Interactive Brokers customer acquisition cost.

- Client Accounts: In Q1 2024, Interactive Brokers reported 2.75 million client accounts, a 10% increase year-over-year.

- Daily Average Revenue Trades (DARTs): DARTs reached 2.15 million in Q1 2024, up 17% from Q1 2023.

- Market Presence: Ability to trade across 150 markets in 33 countries and 27 currencies.

- Target Audience: Sophisticated traders seeking optimal execution and cost efficiency.

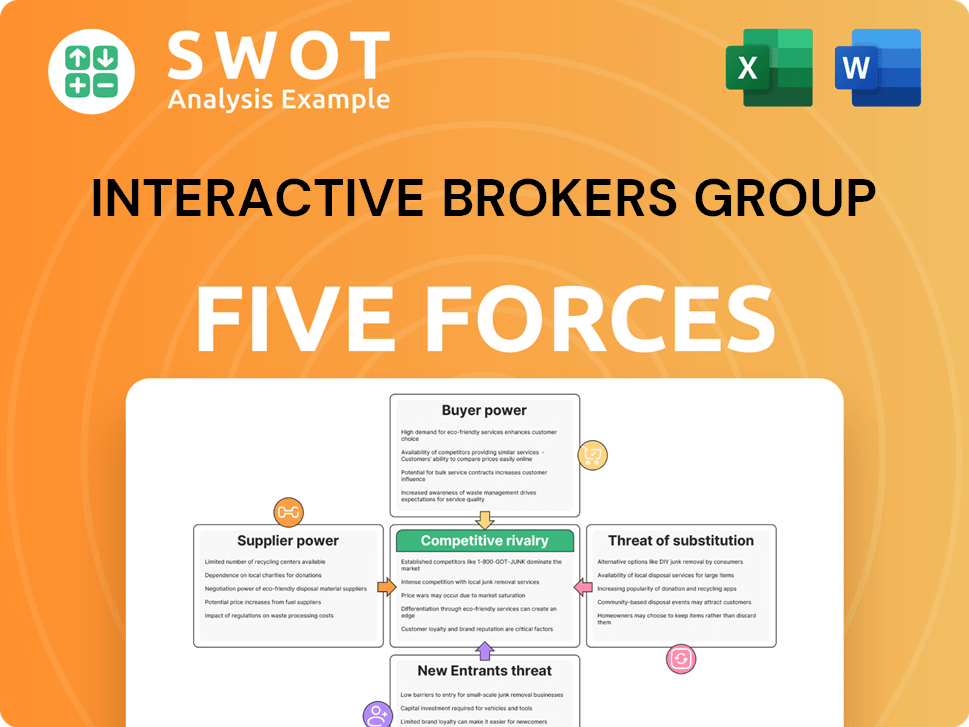

Interactive Brokers Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Interactive Brokers Group Company?

- What is Competitive Landscape of Interactive Brokers Group Company?

- What is Growth Strategy and Future Prospects of Interactive Brokers Group Company?

- How Does Interactive Brokers Group Company Work?

- What is Brief History of Interactive Brokers Group Company?

- Who Owns Interactive Brokers Group Company?

- What is Customer Demographics and Target Market of Interactive Brokers Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.