Jeronimo Martins Bundle

Can Jeronimo Martins Sustain Its Dominance in the Global Food Retail Arena?

The food retail industry is a battleground of shifting consumer demands, technological leaps, and fierce competition. Jeronimo Martins, a global player with roots stretching back to 1792, has navigated these waters for centuries. But how does this retail giant, with its significant international presence, stack up against its rivals?

This analysis dives deep into the Jeronimo Martins SWOT Analysis, dissecting its competitive landscape and revealing its strengths, weaknesses, opportunities, and threats. We'll explore Jeronimo Martins's competitors, analyze its business strategy, and examine its financial performance, including the 2023 results, to understand its position within the dynamic retail sector. This market analysis will provide valuable insights into Jeronimo Martins's future growth prospects and its ability to overcome challenges.

Where Does Jeronimo Martins’ Stand in the Current Market?

Jerónimo Martins holds a strong market position within the food retail industry, focusing on its core operations in Portugal, Poland, and Colombia. Its business strategy is centered around providing a wide range of food and non-food items through various retail formats, including supermarkets and cash & carry stores. This approach allows the company to cater to diverse consumer needs effectively.

The company has strategically positioned itself in different markets, such as Colombia, where it emphasizes a value-for-money proposition to attract a broad customer base. Jerónimo Martins' financial performance showcases its resilience, with a net profit of €756 million in 2023, marking a 10.6% increase compared to the previous year. This financial strength, combined with its geographic focus and market dominance in key regions, highlights its robust market position.

For a deeper dive into the origins and evolution of the company, you can explore the Brief History of Jeronimo Martins.

In Poland, Jerónimo Martins' Biedronka chain is the undisputed leader in the food retail sector. Biedronka reported sales of €21.5 billion in 2023, reflecting a 20.6% increase in local currency. This growth underscores Biedronka's dominant market share and its continued expansion.

In Portugal, Jerónimo Martins operates Pingo Doce supermarkets and Recheio cash & carry stores. Pingo Doce maintained a strong position in the Portuguese food retail market, contributing to overall sales with a 7.9% increase in 2023, reaching €5.1 billion. This highlights the company's sustained success in its home market.

The Ara chain in Colombia is rapidly expanding and gaining market share. Sales increased by 27.2% in local currency to €3.2 billion in 2023. This aggressive growth strategy is evident in the opening of 235 new stores in 2023, expanding its network to 1,351 stores.

Jerónimo Martins' financial health is robust, with a net profit of €756 million in 2023, an increase of 10.6% compared to the previous year. The company's strategic focus includes geographic expansion and maintaining dominant market shares in key regions. This approach ensures the company's resilient market position.

Jerónimo Martins' competitive landscape is defined by its strong market positions and strategic expansions. The company's ability to adapt its business strategy to different markets, such as Poland, Portugal, and Colombia, is a key factor in its success. The financial results for 2023 demonstrate the company's resilience and growth potential.

- Biedronka's Dominance: Biedronka's sales of €21.5 billion in Poland in 2023.

- Pingo Doce's Performance: Pingo Doce's sales of €5.1 billion in Portugal in 2023.

- Ara's Growth: Ara's sales of €3.2 billion in Colombia in 2023.

- Net Profit: The company's net profit of €756 million in 2023.

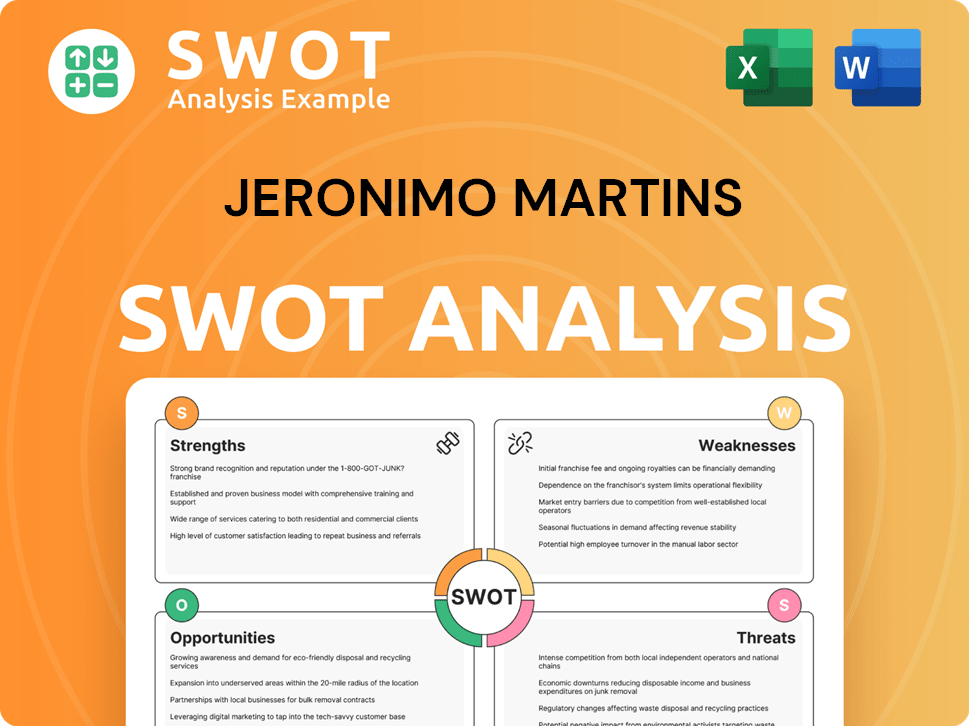

Jeronimo Martins SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Jeronimo Martins?

The Target Market of Jeronimo Martins faces a complex and dynamic competitive landscape. This landscape is shaped by a mix of direct and indirect competitors across its primary markets, which include Portugal, Poland, and Colombia. Understanding these competitors is crucial for analyzing the company's market position and future growth prospects.

The retail sector is constantly evolving, with discounters, supermarkets, and hypermarkets vying for market share. Jerónimo Martins' business strategy must adapt to the changing consumer preferences and the competitive pressures from both local and international players. The company's financial performance is directly influenced by its ability to compete effectively in these markets and maintain its competitive advantages.

The analysis of Jerónimo Martins' competitive landscape involves examining its key rivals in each geographical region. This includes assessing their market share, pricing strategies, store formats, and expansion plans. Such an analysis is essential for a comprehensive Jeronimo Martins market analysis.

In Poland, the company's Biedronka faces strong competition. Key competitors include Lidl Polska and Auchan. The Polish retail market is highly competitive, with discounters like Lidl gaining market share.

In Portugal, Pingo Doce and Recheio compete with Sonae MC (Continente) and international players such as Lidl and Aldi. The Portuguese retail landscape features a mix of traditional supermarkets and discounters.

In Colombia, the Ara chain competes with Grupo Éxito and Olímpica. The Colombian market is experiencing rapid modernization and increasing competition.

Online retailers and food delivery services represent indirect competition across all markets. These services challenge traditional brick-and-mortar models.

The competitive landscape is also influenced by potential mergers and alliances. Companies seek to consolidate market share and achieve economies of scale.

Understanding the competitive dynamics is crucial for Jerónimo Martins' strategic planning. This includes adapting to consumer behavior and leveraging competitive advantages.

The competitive landscape for Jerónimo Martins is characterized by intense rivalry and evolving market dynamics. In Poland, Lidl Polska's aggressive pricing and expansion pose a significant challenge to Biedronka. In Portugal, Sonae MC's strong domestic presence and the growth of Lidl and Aldi intensify competition for Pingo Doce. In Colombia, the expansion of Ara and the presence of Grupo Éxito and Olímpica create a complex environment. The rise of online retail and food delivery services further complicates the competitive environment. The company's ability to navigate these challenges and capitalize on opportunities will be critical for its future growth. Analyzing the Jeronimo Martins' financial results 2023 and ongoing strategic initiatives will provide further insights into its ability to maintain a strong market position.

The competitive landscape varies significantly across the regions where Jerónimo Martins operates. Key players and their market positions are constantly shifting, requiring continuous monitoring and strategic adaptation. A detailed Jeronimo Martins vs Lidl comparison reveals the pricing and expansion strategies of these two major discounters.

- Poland: Lidl Polska and Auchan are major competitors to Biedronka. The Polish retail sector is highly competitive, with discounters gaining market share.

- Portugal: Sonae MC (Continente), Lidl, and Aldi compete with Pingo Doce. The Portuguese market features a mix of formats, including traditional supermarkets and discounters.

- Colombia: Grupo Éxito and Olímpica are key competitors to Ara. The Colombian market is experiencing rapid modernization.

- Market Share Data: While specific market share data fluctuates, it is essential for Jerónimo Martins to monitor its position relative to competitors.

- Expansion Strategies: Jerónimo Martins' expansion strategy Poland and in other regions must consider the aggressive expansion plans of rivals like Lidl and Aldi.

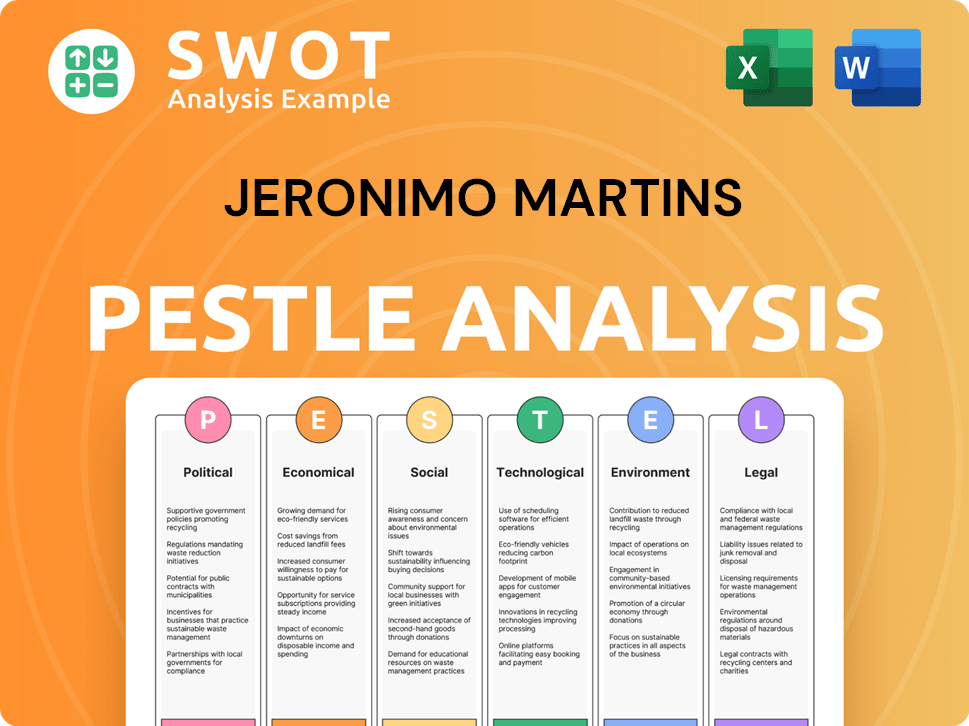

Jeronimo Martins PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Jeronimo Martins a Competitive Edge Over Its Rivals?

The Marketing Strategy of Jeronimo Martins showcases a robust competitive edge, particularly within the retail sector. Jerónimo Martins' strategic prowess is evident in its ability to maintain a strong position in a dynamic market. This includes a focus on operational efficiency and customer loyalty, which are crucial for sustained growth and market share.

The company's competitive landscape is shaped by its strategic moves and ability to adapt to market changes. Jerónimo Martins' financial performance is closely tied to its operational excellence and strategic investments. This approach allows the company to effectively navigate challenges and capitalize on opportunities within the industry.

Jerónimo Martins' competitive advantages are significant, contributing to its success in the retail sector. These advantages include a strong private label strategy, efficient supply chain management, and robust brand equity. These elements collectively enhance the company's ability to compete effectively and maintain its market position.

Jerónimo Martins excels with its private label brands, especially Biedronka in Poland. This strategy offers consumers value, combining competitive pricing with quality. The private label share significantly boosts profitability, contributing to its strong financial results. In recent years, private label products have accounted for a substantial portion of total sales, enhancing customer loyalty and margins.

The company's efficient supply chain and operational excellence are key. This includes optimized logistics, effective inventory management, and timely product delivery. These efficiencies translate into cost savings, which are passed on to consumers. Large-scale operations, particularly in Poland, allow for significant economies of scale in procurement.

Strong brand equity and customer loyalty, especially with Biedronka and Pingo Doce, are significant. These brands are trusted by millions, fostered through consistent quality, competitive pricing, and effective marketing. Jerónimo Martins leverages its understanding of local consumer preferences to tailor product assortments and marketing strategies.

Jerónimo Martins continuously invests in technology and digital transformation to maintain its edge. This includes enhancing e-commerce capabilities and leveraging data analytics for personalized customer experiences. These investments are crucial for adapting to market demands and maintaining a competitive advantage in the long term.

Jerónimo Martins' competitive advantages are multifaceted, contributing to its strong market position. These advantages are sustainable due to significant investments in infrastructure and continuous adaptation to market demands. The company's ability to maintain these advantages is crucial for its future growth prospects.

- Private Label Strength: High private label share enhances margins and customer loyalty.

- Operational Efficiency: Optimized supply chain and logistics reduce costs.

- Brand Loyalty: Strong brands like Biedronka and Pingo Doce foster trust.

- Technological Advancement: Continuous investment in digital capabilities.

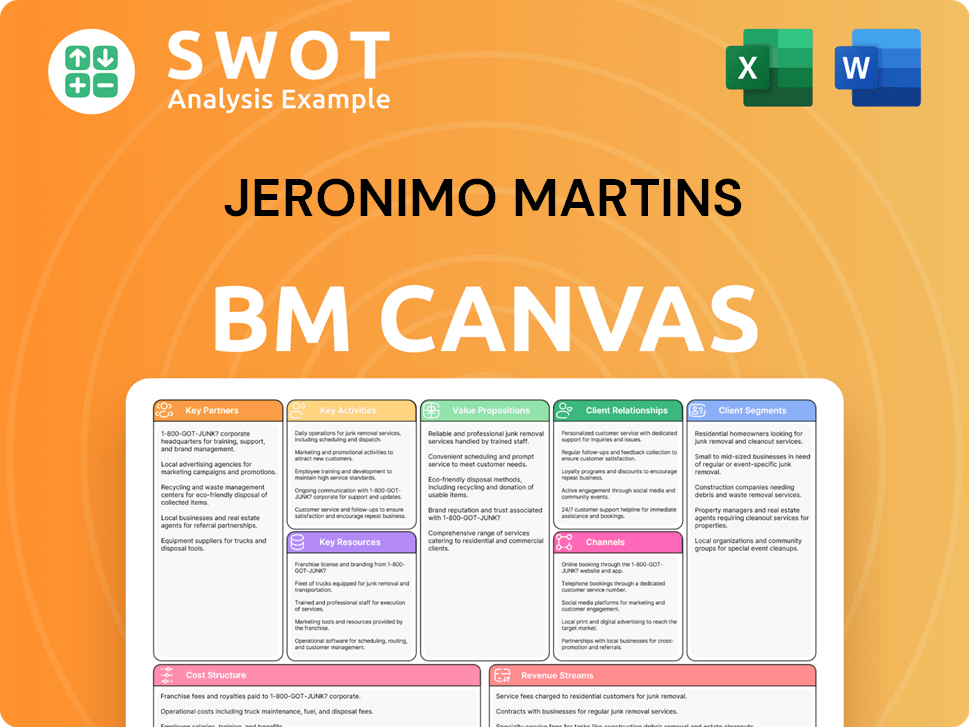

Jeronimo Martins Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Jeronimo Martins’s Competitive Landscape?

The food retail industry is undergoing significant transformations, shaping the Jeronimo Martins competitive landscape. This includes the rise of e-commerce, evolving consumer preferences, and economic fluctuations. Understanding these trends is crucial for assessing the company's position, potential risks, and future outlook. The company's ability to adapt to these changes will determine its success in a dynamic market.

Key risks include increased competition, supply chain disruptions, and changing consumer demands. However, Jeronimo Martins also has opportunities, such as expanding in emerging markets and innovating with products and services. Strategic decisions regarding online presence, sustainability, and customer experience will be vital for maintaining and improving its market position. For a deeper dive into the firm's mission and strategic direction, you can read about the Growth Strategy of Jeronimo Martins.

The food retail sector is seeing a surge in e-commerce, driven by consumer demand for convenience. Jeronimo Martins, like other players, must invest in digital platforms and delivery services to stay competitive. Another trend is the growing focus on sustainability and ethical sourcing, influencing product offerings and supply chain practices.

Economic volatility, including inflation and changes in disposable income, poses challenges. Supply chain disruptions and geopolitical instability also create uncertainty. Increased competition from discounters and online retailers requires continuous adaptation and innovation in the Jeronimo Martins business strategy.

Expansion in emerging markets, such as Colombia, provides significant growth potential. Product innovation, strategic partnerships, and leveraging data analytics offer avenues for competitive advantage. Enhancing customer experience and operational efficiency are also key to future success.

Jeronimo Martins must prioritize investments in digital infrastructure and online services to meet evolving consumer needs. A focus on sustainability and ethical sourcing can differentiate its offerings. Strategic alliances and data-driven decision-making will be crucial for navigating the Jeronimo Martins industry.

Jeronimo Martins can leverage several key areas to drive future growth and solidify its Jeronimo Martins market analysis. This involves strategic investments, product innovation, and operational improvements. Adapting to changing consumer behaviors will be crucial for sustained success.

- Expanding online delivery services, like Biedronka Home and Pingo Doce Express.

- Expanding its offerings of organic, locally sourced, and plant-based products.

- Enhancing its sustainability initiatives across its supply chain.

- Continued investment in its store network, particularly in Poland and Colombia.

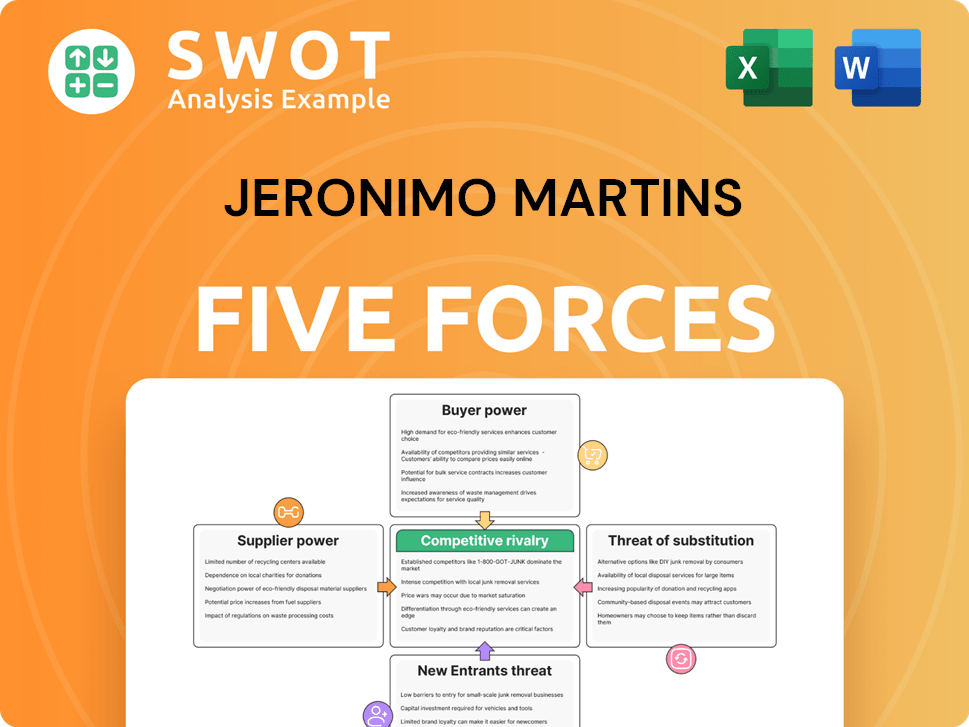

Jeronimo Martins Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Jeronimo Martins Company?

- What is Growth Strategy and Future Prospects of Jeronimo Martins Company?

- How Does Jeronimo Martins Company Work?

- What is Sales and Marketing Strategy of Jeronimo Martins Company?

- What is Brief History of Jeronimo Martins Company?

- Who Owns Jeronimo Martins Company?

- What is Customer Demographics and Target Market of Jeronimo Martins Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.