Jeronimo Martins Bundle

Unveiling the Secrets: How Does Jeronimo Martins Company Work?

Ever wondered how a retail giant like Jeronimo Martins, with its €30.6 billion in sales in 2024, dominates the food industry? This isn't just about selling groceries; it's a complex operation with strategic moves across Portugal, Poland, and Colombia. Understanding Jeronimo Martins SWOT Analysis is crucial for grasping the company's strengths and weaknesses.

Delving into the core of Jeronimo Martins, we'll explore its multifaceted business model, from efficient supply chains to its strategic store expansion. This deep dive into Jeronimo Martins operations will reveal how it has secured significant market share. Furthermore, we'll examine its financial performance analysis and how it adapts to local consumer preferences, making it a compelling case study for investors and business strategists alike.

What Are the Key Operations Driving Jeronimo Martins’s Success?

The Jeronimo Martins company generates value through its extensive retail network, offering a wide array of food and non-food products. It caters to diverse customer segments, from individual consumers to small businesses. The Jeronimo Martins business model revolves around rigorous sourcing, efficient logistics, and a strong emphasis on private label development.

A key element of Jeronimo Martins operations is its supply chain. The company leverages its scale to secure favorable terms with suppliers and optimize distribution networks. This ensures consistent product availability and freshness across its vast store network. Partnerships with local producers are also vital, particularly in countries like Colombia, where its stores aim to source a high percentage of their produce locally.

What makes the Jeronimo Martins company unique is its deep understanding of local markets and its ability to tailor its offerings accordingly. This localized approach, combined with a focus on cost efficiency and value, translates into competitive pricing and a consistent supply of quality products. Its core capabilities in supply chain management and retail execution enable it to maintain a strong competitive position.

Jeronimo Martins focuses on retail operations, primarily through its supermarket chains like Biedronka and Pingo Doce. Biedronka, for instance, has over 3,500 stores in Poland, emphasizing fresh products and private label brands. Pingo Doce in Portugal also prioritizes fresh produce and a convenient shopping experience. These operations are supported by robust supply chain management and logistics.

The value proposition of the Jeronimo Martins company is centered around offering quality products at competitive prices. This is achieved through efficient operations, strong private label offerings, and a focus on customer needs. The company's ability to adapt to local market preferences, as seen in its various store formats, enhances its value proposition, ensuring it remains relevant and appealing to a broad customer base.

How Jeronimo Martins works involves a sophisticated supply chain. The company invests significantly in its logistics infrastructure to ensure the rapid replenishment of stock across its extensive store network. This includes optimizing distribution networks and securing favorable terms with suppliers. Partnerships with local producers are also crucial, particularly in regions like Colombia, supporting both regional economies and product freshness.

The Jeronimo Martins company distinguishes itself through a localized approach. It tailors its offerings to meet specific local market needs, which results in a competitive edge. This strategy, combined with a focus on cost efficiency and value for money, translates into tangible customer benefits. The ability to adapt to local preferences is a key factor in maintaining a strong competitive position in diverse retail landscapes.

Jeronimo Martins excels in several key operational areas, contributing to its success. These strengths include efficient supply chain management, a focus on private label brands, and a deep understanding of local market dynamics. These factors enable the company to offer competitive pricing and maintain a strong market presence.

- Efficient Supply Chain: Optimizes distribution and ensures product availability.

- Private Label Focus: Enhances profitability and customer loyalty.

- Localized Strategy: Adapts offerings to local market preferences.

- Cost Efficiency: Provides value for money to customers.

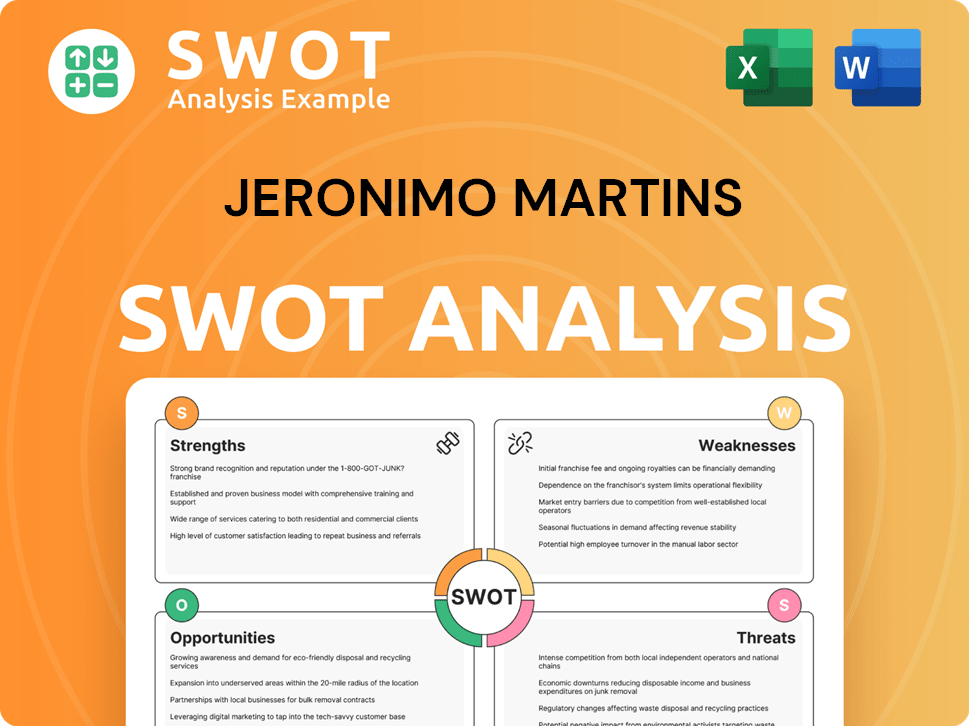

Jeronimo Martins SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Jeronimo Martins Make Money?

The Jeronimo Martins company generates most of its revenue through the sale of products across its various retail formats. In 2024, the company's total sales reached €30.6 billion, showcasing the scale of its operations. The primary revenue streams are from its supermarket and hypermarket operations in Portugal, Poland, and Colombia.

The Jeronimo Martins business model is centered around high sales volumes, efficient inventory management, and strategic pricing. The company also uses private label strategies to boost margins and customer loyalty. It focuses on optimizing store formats and locations to maximize foot traffic and sales per square meter.

The Polish supermarket chain, Biedronka, is the largest revenue contributor, with sales of €21.5 billion in 2024, a 17.1% year-on-year increase. Pingo Doce and Recheio in Portugal contributed €5.2 billion in sales in 2024, up 7.9%. Ara stores in Colombia saw a remarkable 50.7% increase, achieving €3.2 billion in sales in 2024, reflecting its fast expansion and market penetration.

Jeronimo Martins operations are primarily driven by its retail sales. The company's monetization strategies involve a mix of product sales, private label brands, and efficient store management. The focus on high sales volumes, strategic pricing, and efficient inventory management are key to its financial performance.

- Biedronka (Poland): The largest contributor, with €21.5 billion in sales in 2024.

- Pingo Doce and Recheio (Portugal): Contributed €5.2 billion in sales in 2024.

- Ara (Colombia): Achieved €3.2 billion in sales in 2024, showing rapid growth.

- Private Label Brands: Enhance margins and customer loyalty.

- Store Optimization: Maximizing foot traffic and sales per square meter.

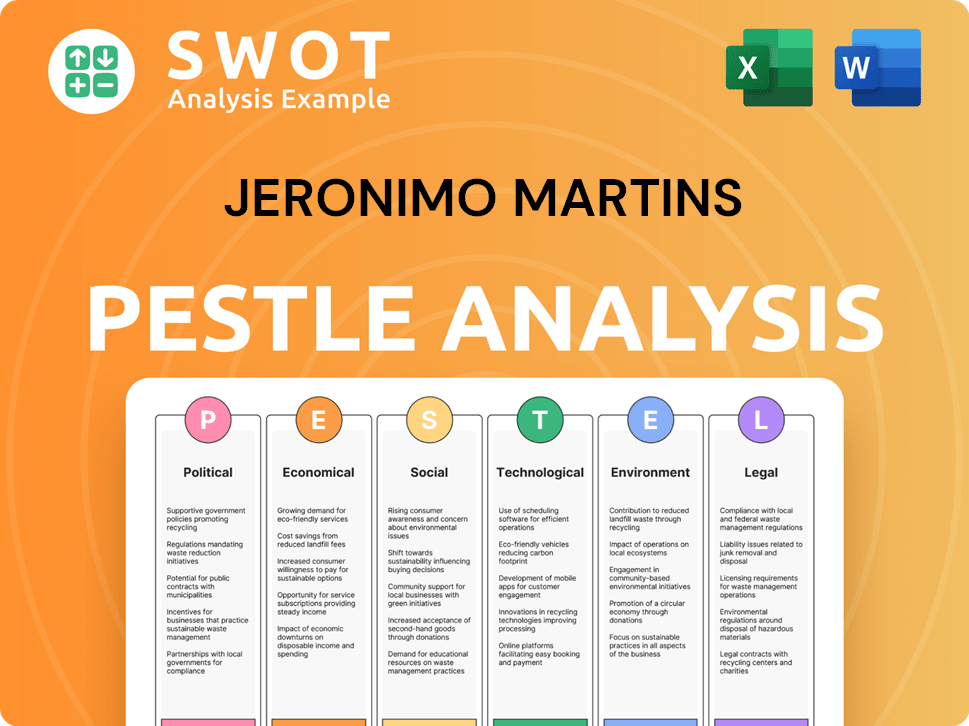

Jeronimo Martins PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Jeronimo Martins’s Business Model?

The story of the Jeronimo Martins company is one of strategic growth and adaptation. A key element has been its successful expansion beyond its home market, with the growth of Biedronka in Poland being a standout achievement since its acquisition in 1997. More recently, the company's rapid expansion of Ara in Colombia illustrates its ability to replicate its successful discount retail model in new markets. This demonstrates the company's adaptability and strategic foresight in navigating the complexities of international retail.

The company has shown resilience in the face of operational challenges, such as supply chain disruptions, by leveraging its robust logistics infrastructure and diversified sourcing. The company's ability to adapt to changing market conditions and consumer preferences is a testament to its strategic agility. Jeronimo Martins's approach involves a blend of organic growth and strategic acquisitions, allowing it to maintain a strong presence in its core markets while exploring opportunities for expansion.

The company's competitive advantages are rooted in several factors. Its strong brand recognition, particularly with Biedronka and Pingo Doce, fosters customer loyalty. Economies of scale, derived from its extensive network and purchasing power, enable it to offer competitive prices, a crucial factor in the food retail sector. Furthermore, its deep understanding of local consumer preferences, allowing for tailored product assortments and marketing strategies, provides a significant edge over less adaptable competitors. To learn more about the company's origins, consider reading the Brief History of Jeronimo Martins.

The acquisition of Biedronka in Poland in 1997 marked a pivotal moment, transforming Jeronimo Martins into a major player in the European retail market. The expansion of Ara in Colombia represents a strategic move into Latin America, demonstrating the company's ability to replicate its successful discount retail model in new geographies. These moves highlight Jeronimo Martins's commitment to growth and its ability to adapt its business model to different markets.

Jeronimo Martins focuses on expanding its presence in existing markets while exploring opportunities in new regions. The company continually adapts to new trends, such as the increasing demand for fresh and healthy products, by expanding its offerings in these categories and investing in its fresh produce supply chain. Digital transformation is also a key focus, with investments aimed at enhancing customer experience and operational efficiency.

Its strong brand recognition, particularly with Biedronka and Pingo Doce, fosters customer loyalty. Economies of scale, derived from its extensive network and purchasing power, enable it to offer competitive prices, a crucial factor in the food retail sector. Furthermore, its deep understanding of local consumer preferences, allowing for tailored product assortments and marketing strategies, provides a significant edge over less adaptable competitors.

In 2024, Biedronka's sales in Poland reached approximately €18.6 billion, demonstrating its continued dominance in the market. Ara's expansion in Colombia saw it opening new stores, contributing to the company's overall growth. Jeronimo Martins's focus on sustainability is reflected in its investments in eco-friendly practices, with the company aiming to reduce its carbon footprint across its operations.

Jeronimo Martins's success is built on a foundation of strong brand recognition, operational efficiency, and a deep understanding of its target markets. Its ability to adapt to changing consumer preferences and market dynamics has been crucial to its sustained growth. The company's focus on digital transformation and sustainability further strengthens its competitive position.

- Strong brand presence in key markets like Poland and Portugal.

- Efficient supply chain management and logistics.

- Adaptability to local consumer preferences.

- Commitment to sustainability and digital innovation.

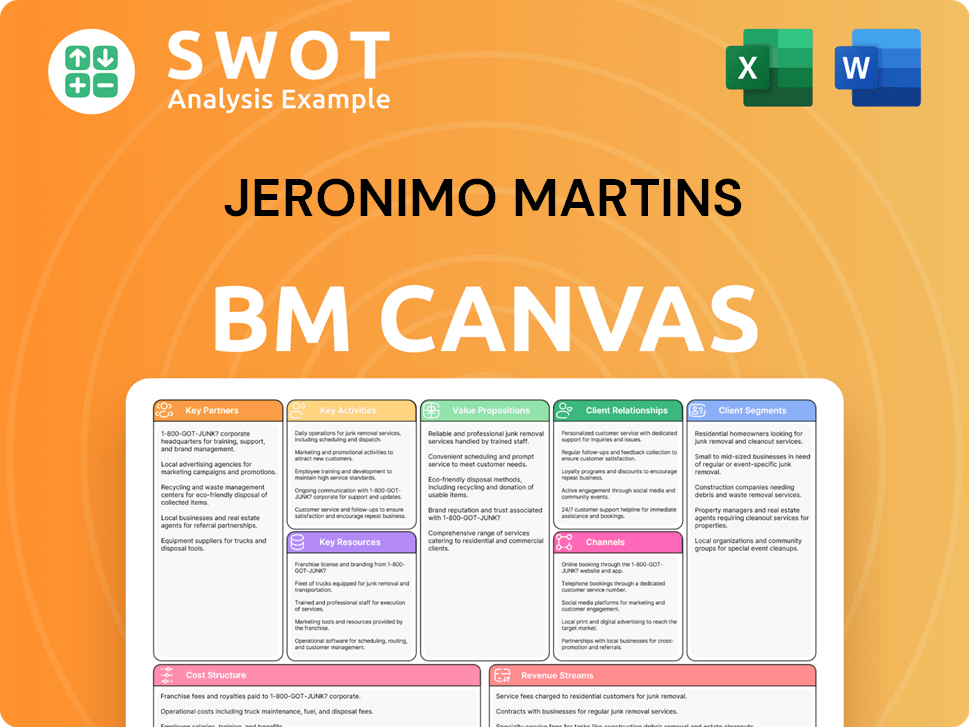

Jeronimo Martins Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Jeronimo Martins Positioning Itself for Continued Success?

The Jeronimo Martins company holds a strong position in the markets it serves. Biedronka, its primary food retail chain in Poland, is the largest in the country, with a significant market share. In Portugal, Pingo Doce is a major player in the supermarket segment. The company's expansion into Colombia with Ara positions it as a rapidly growing force in that market. This success is supported by its value proposition and consistent quality, fostering strong customer loyalty.

However, Jeronimo Martins faces several risks. These include intense competition from local and international retailers, potential regulatory changes impacting operations, and the effects of economic downturns or inflation on consumer spending. The evolving retail landscape, with the rise of e-commerce and changing consumer preferences, presents both challenges and opportunities for the company. Understanding Owners & Shareholders of Jeronimo Martins is also crucial to understanding the company's strategic direction.

Jeronimo Martins has a leading market position in its core geographies, particularly in Poland and Portugal. Biedronka dominates the Polish market, while Pingo Doce holds a significant share in Portugal's supermarket sector. The expansion of Ara in Colombia further solidifies its presence in the Latin American market.

The company faces risks such as intense competition, regulatory changes, and economic downturns. Competition from both local and international retailers can pressure margins. Changes in food safety, labor laws, and environmental regulations can increase operational costs. Economic fluctuations can also affect consumer spending.

Jeronimo Martins plans to sustain growth through store expansion, especially in Colombia, and optimizing its existing network. Investments in digitalization will improve operational efficiency and enhance customer experience. The company is committed to sustainable practices and responsible sourcing to maintain consumer trust.

Key initiatives include expanding into new markets, enhancing digital capabilities, and focusing on sustainability. The company is committed to offering value to consumers, adapting to the evolving retail environment through innovation, and making strategic investments to ensure long-term growth and profitability.

Jeronimo Martins is focused on expanding its store network, particularly in Colombia, and optimizing its existing stores. The company is investing in digitalization to improve operational efficiency and customer experience. Sustainability and responsible sourcing are also key priorities.

- Continued store expansion, especially in the Colombian market.

- Investments in digitalization to improve operational efficiency.

- Focus on sustainable practices and responsible sourcing.

- Enhancing customer experience through digital channels.

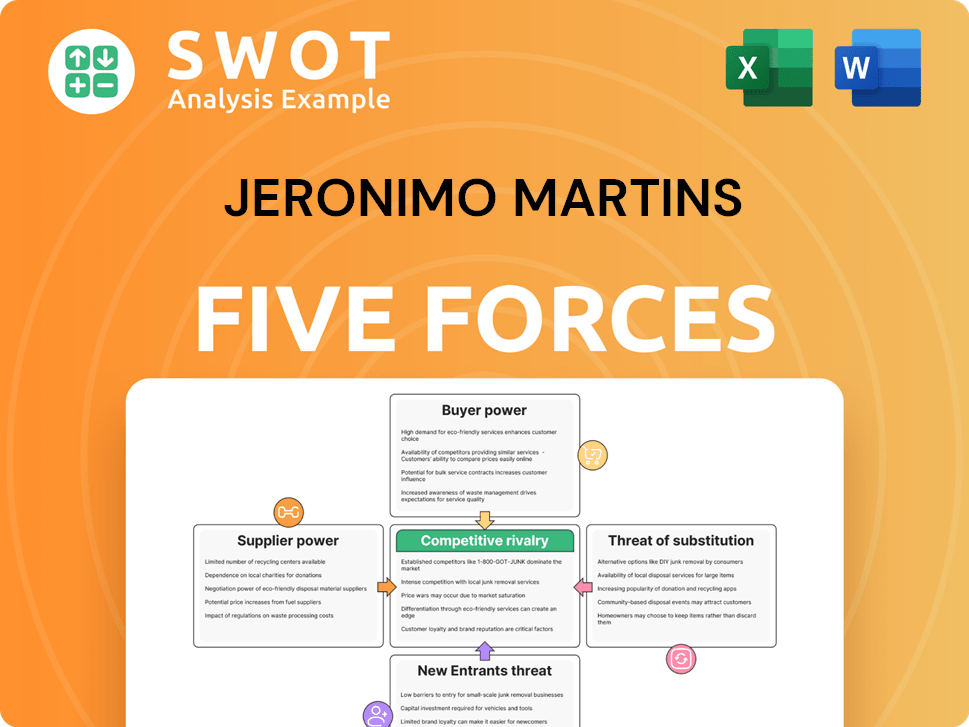

Jeronimo Martins Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Jeronimo Martins Company?

- What is Competitive Landscape of Jeronimo Martins Company?

- What is Growth Strategy and Future Prospects of Jeronimo Martins Company?

- What is Sales and Marketing Strategy of Jeronimo Martins Company?

- What is Brief History of Jeronimo Martins Company?

- Who Owns Jeronimo Martins Company?

- What is Customer Demographics and Target Market of Jeronimo Martins Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.