Jeronimo Martins Bundle

Who Really Controls Jeronimo Martins?

Uncover the forces steering the global food giant, Jeronimo Martins. Understanding the Jeronimo Martins SWOT Analysis is essential to grasping its strategic moves. This exploration unveils the intricate ownership structure of a company that has grown from a small Lisbon grocery store to a multi-billion dollar international enterprise. Discover how the evolution of Jeronimo Martins' ownership has shaped its remarkable journey.

From its humble beginnings in 1792, Jeronimo Martins has become a significant player in the food industry. This article dives deep into the Jeronimo Martins ownership, examining the influence of major shareholders and the company's strategic direction. We'll explore the Jeronimo Martins Group's history, its financial performance, and the impact of its ownership structure on its operations in Portugal, Poland, and Colombia. Learn about the key executives and the factors influencing the Jeronimo Martins stock price.

Who Founded Jeronimo Martins?

The story of Jeronimo Martins begins in 1792, with its founder, Jerónimo Martins, opening a small grocery store in Lisbon, Portugal. This early venture set the stage for what would become a significant player in the retail and distribution sectors. The original store gained recognition and even supplied the Portuguese Royal House.

The ownership of Jeronimo Martins underwent a crucial change in 1921. Francisco Manuel dos Santos, along with partners from Grandes Armazéns Reunidos, acquired the fine grocery store. This marked a pivotal moment, setting the foundation for future developments.

Despite facing initial financial challenges, Francisco Manuel dos Santos and Elísio Pereira de Val revitalized the business through significant restructuring. In 1941, Francisco Manuel dos Santos formalized his holdings by establishing Sociedade Francisco Manuel dos Santos (SFMS) with his seven children, ensuring the group's continuity and future vision.

Jeronimo Martins was founded in 1792 by Jerónimo Martins. The initial focus was a grocery store in Lisbon, Portugal. This store was known for its quality and became a supplier to the Portuguese Royal House.

In 1921, Francisco Manuel dos Santos and partners acquired the company. This marked a significant change in ownership. The acquisition was a key step in the company's history.

Francisco Manuel dos Santos and Elísio Pereira de Val restructured the business. In 1941, SFMS was established to ensure the group's future. This was a move to secure the company's long-term success.

A joint venture with Unilever in 1949 was crucial. Jeronimo Martins held 45% of Unilever Jerónimo Martins initially. This partnership helped the company grow and survive.

The joint venture with Unilever focused on producing margarines and detergents. This strategic move diversified the company's product range. It played a key role in the company's expansion.

The early ownership structure was primarily family-based. The establishment of SFMS in 1941 was a key step. This ensured the continuity of the business within the family.

The early ownership of Jeronimo Martins involved significant shifts and strategic partnerships. The establishment of SFMS in 1941 by Francisco Manuel dos Santos with his seven children was a critical step in securing the company's future. The partnership with Unilever in 1949, where Jeronimo Martins initially held a 45% stake, was instrumental in the company’s expansion, focusing on the production of margarines and detergents. This collaboration was vital for the company's survival and growth.

- 1792: Jerónimo Martins founded the company.

- 1921: Francisco Manuel dos Santos acquired the business.

- 1941: Sociedade Francisco Manuel dos Santos (SFMS) was established.

- 1949: Partnership with Unilever formed.

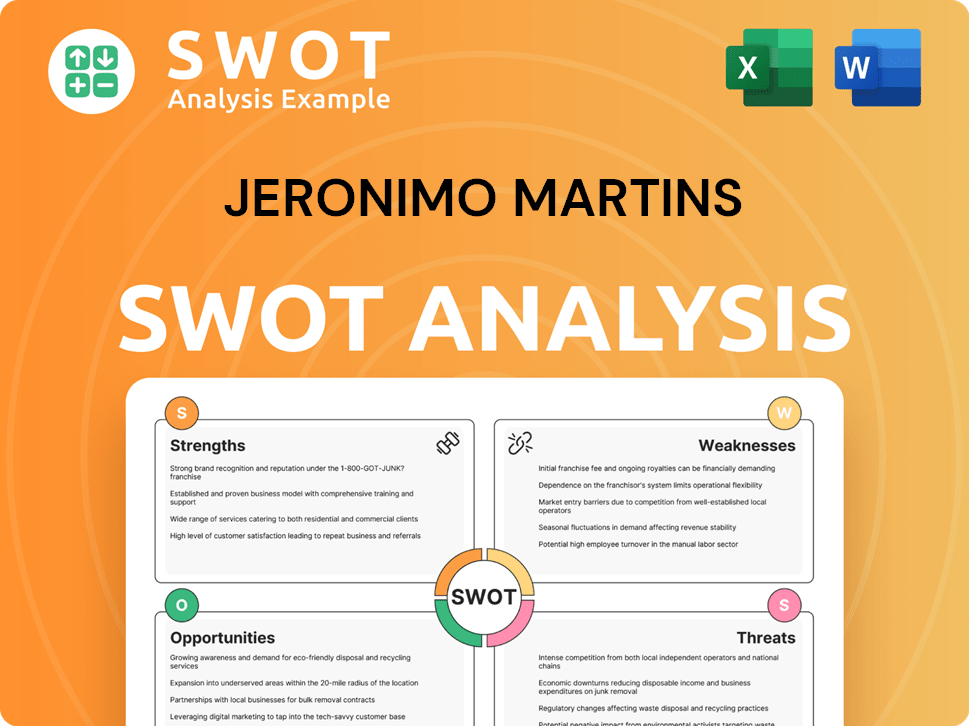

Jeronimo Martins SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Jeronimo Martins’s Ownership Changed Over Time?

The evolution of Jeronimo Martins' ownership structure has been a key factor in shaping its strategic direction. Since its listing on Euronext Lisbon in 1989, the company has seen shifts in its shareholder base, influencing its expansion and operational strategies. Understanding who owns Jeronimo Martins is crucial for investors and stakeholders alike. The primary shareholder, Sociedade Francisco Manuel dos Santos Holding N.V., formerly known as Sociedade Francisco Manuel dos Santos, holds a significant majority stake, which provides a stable foundation for the company's long-term vision.

The ownership structure of Jeronimo Martins has implications for its future. The company's focus on retail operations in Portugal, Poland, and Colombia, along with its investments in agribusiness, are influenced by its major shareholders. This stability, provided by the controlling stake of Sociedade Francisco Manuel dos Santos Holding N.V., allows for strategic decisions focused on sustained growth and market leadership. The presence of significant institutional investors further adds to the company's governance and financial stability.

| Ownership Aspect | Details | As of December 31, 2024 |

|---|---|---|

| Main Shareholder | Sociedade Francisco Manuel dos Santos Holding N.V. | 56.1% |

| Floating Shares and Own Shares | Remaining share capital | 43.9% |

| Treasury Shares | Own shares held by the company | 859,000 shares (0.14%) |

As of early 2025, several institutional investors hold notable stakes in Jeronimo Martins. These include T. Rowe Price Group, Inc. (2.10%), BlackRock, Inc. (1.98%), and The Vanguard Group, Inc. (1.81%). Other significant holders are Massachusetts Financial Services Company (1.52%), Comgest S.A., Impax Asset Management Group Plc, and Wellington Management Group LLP. This diverse shareholder base supports the company's strategic initiatives, including its expansion plans and commitment to sustainable growth. For more insights, explore the business model of Jeronimo Martins.

The ownership structure of Jeronimo Martins is primarily dominated by Sociedade Francisco Manuel dos Santos Holding N.V., ensuring stability and long-term strategic focus.

- The company is publicly traded on Euronext Lisbon.

- Significant institutional investors hold substantial stakes.

- The company holds treasury shares, representing a small percentage of its share capital.

- The ownership structure supports the company's expansion in Portugal, Poland, and Colombia.

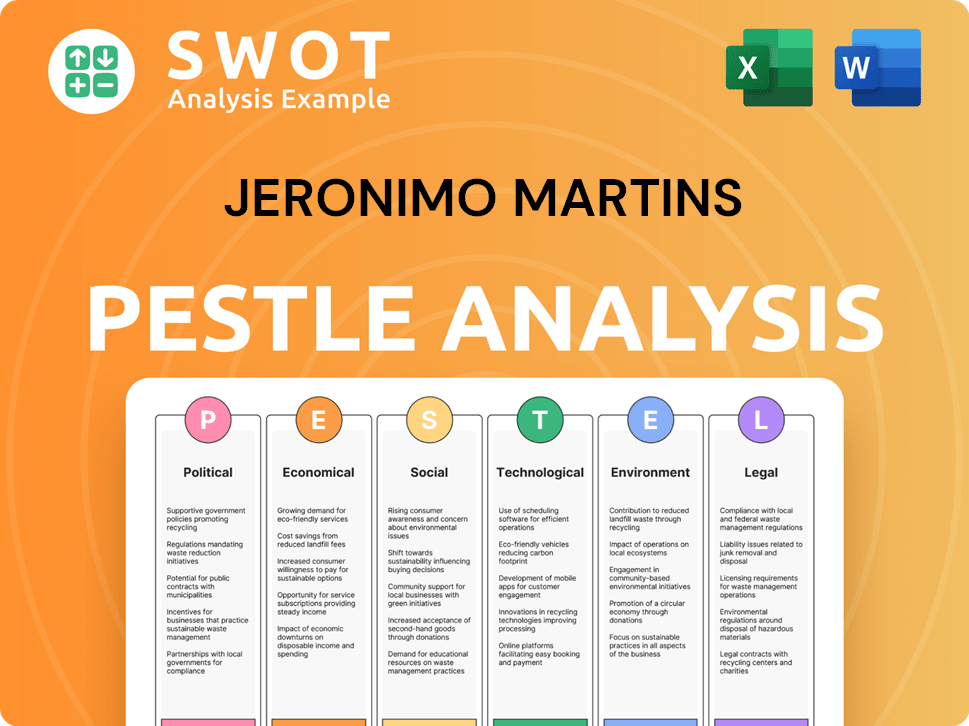

Jeronimo Martins PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Jeronimo Martins’s Board?

The Board of Directors of Jeronimo Martins is pivotal in the company's governance. The current board includes key figures such as Pedro Soares dos Santos, who serves as Chairman and Chief Executive Officer. Other notable members include Jose Soares dos Santos and Antonio Pedro de Carvalho Viana Baptista, who hold non-executive director positions. This structure ensures a balance of leadership and oversight within the Jeronimo Martins Group.

The composition of the board reflects the company's commitment to strong corporate governance, with a mix of executive and non-executive directors. This structure helps in making informed decisions and maintaining transparency. The Annual General Shareholders' Meeting, held on April 24, 2025, for the 2024 Corporate Governance Report, provides a platform for shareholders to engage with the board and exercise their rights.

| Role | Name | Details |

|---|---|---|

| Chairman and CEO | Pedro Soares dos Santos | Leads the company's strategic direction and overall management. |

| Non-Executive Director | Jose Soares dos Santos | Provides independent oversight and guidance. |

| Non-Executive Director | Antonio Pedro de Carvalho Viana Baptista | Offers additional expertise and perspective to the board. |

The voting structure within Jeronimo Martins is based on a one-share-one-vote principle. This means all issued shares have equal voting rights. Shareholders can participate in decision-making at the Annual General Shareholders' Meeting and can vote by post or electronically. This approach ensures that all Jeronimo Martins shareholders have a fair say in the company's direction. Institutional investors, such as Impax Asset Management, have demonstrated their influence by voting on key matters, highlighting the importance of shareholder engagement in governance.

Jeronimo Martins ownership structure is transparent, with a one-share-one-vote system. The Board of Directors, led by Pedro Soares dos Santos, plays a crucial role in governance. Shareholders can vote at the Annual General Meeting, influencing company decisions.

- The voting rights are equal for all shares.

- Institutional investors actively engage in governance.

- The Board includes both executive and non-executive directors.

- Voting can be done by post or electronically.

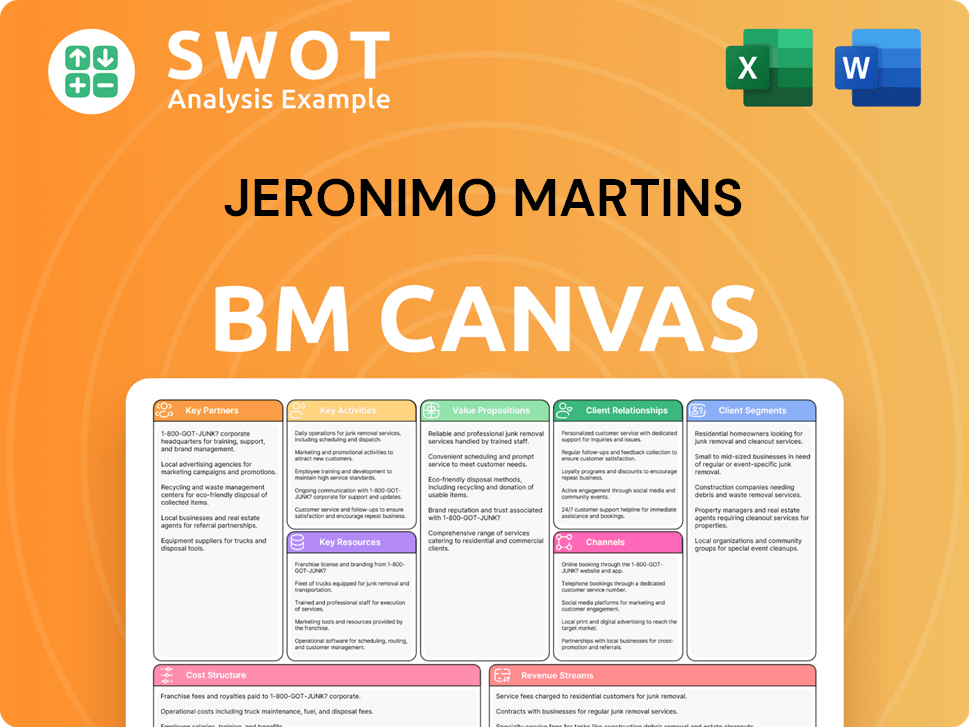

Jeronimo Martins Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Jeronimo Martins’s Ownership Landscape?

Over the past few years, Jeronimo Martins has shown a commitment to strategic expansion and has experienced shifts in its ownership structure. The company plans to invest around €1.1 billion in 2025 to expand and improve operations. This includes the expansion of Biedronka in Poland and entry into Slovakia in early 2025. In April 2025, the company secured approval to acquire 75 Colsubsidio supermarkets in Colombia. These moves are part of a broader strategy to increase its market presence and improve its operations.

A significant development in 2024 was the acquisition by Jerónimo Martins Agroalimentar, SA (JMA), a subsidiary of Jerónimo Martins, of 2,000,000 shares in Andfjord Salmon Group AS. This increased JMA's stake to 28.03%, showing confidence in the project and its sustainable production methods. The company's financial results for Q1 2025 included a 3.8% increase in sales, reaching €8.38 billion, with a net income of €127 million, up 31.4% from Q1 2024. The General Shareholders' Meeting on April 24, 2025, approved a dividend distribution of €0.59 per share, totaling €370.8 million.

The consistent majority ownership by Sociedade Francisco Manuel dos Santos provides a stable core for Jeronimo Martins. The increase in institutional ownership highlights continued investor confidence in the company's long-term strategy and performance. These factors are crucial in understanding the dynamics of Jeronimo Martins ownership and its future trajectory. The company's ownership structure remains a key element in its strategic decision-making and overall financial health. Understanding who owns Jeronimo Martins is key to understanding its strategic direction.

The Jeronimo Martins Group is a significant player in the retail sector. The company's performance is closely watched by investors. Its strategic moves are a key factor in understanding its market position.

The shareholders of Jeronimo Martins influence its strategic decisions. Major shareholders include Sociedade Francisco Manuel dos Santos. Institutional investors also hold significant stakes, reflecting confidence in the company.

Jeronimo Martins has a strong presence in Portugal. The company's headquarters are located in Portugal. Its operations in Portugal are a key part of its overall business strategy.

Sociedade Francisco Manuel dos Santos is the primary owner. The company's ownership structure includes institutional investors. Understanding the ownership is vital for assessing the company's direction.

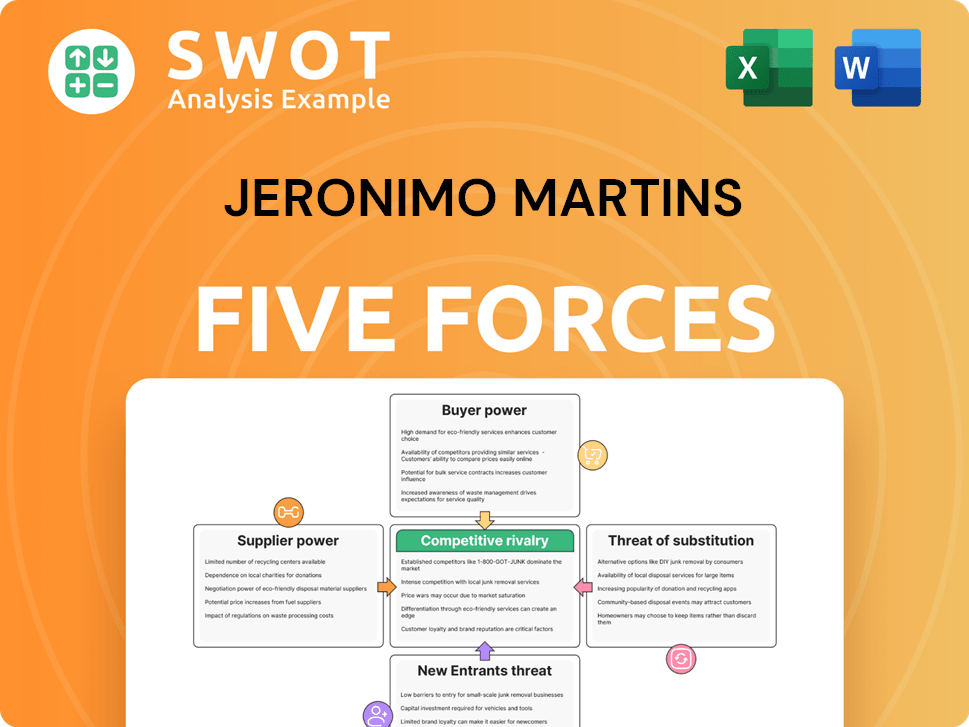

Jeronimo Martins Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Jeronimo Martins Company?

- What is Competitive Landscape of Jeronimo Martins Company?

- What is Growth Strategy and Future Prospects of Jeronimo Martins Company?

- How Does Jeronimo Martins Company Work?

- What is Sales and Marketing Strategy of Jeronimo Martins Company?

- What is Brief History of Jeronimo Martins Company?

- What is Customer Demographics and Target Market of Jeronimo Martins Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.