Legal & General Group Bundle

How Does Legal & General Group Stack Up in Today's Financial Arena?

The financial services industry is a battlefield, and Legal & General Group has been a key player since 1836. Understanding the Legal & General Group SWOT Analysis is crucial for grasping its position. This analysis dives deep into its market share, key competitors, and the strategic moves shaping its future. Prepare to uncover the dynamics of the UK insurance market and beyond.

This exploration of the Legal & General Group's competitive landscape will dissect its financial performance, offering a detailed competitor analysis. We'll examine its investment strategies, evaluate its competitive advantages and disadvantages, and assess the impact of market trends. The goal is to provide a comprehensive overview of Legal & General Group's strategic initiatives within the context of a rapidly evolving financial sector, including its global presence and the implications of the regulatory environment.

Where Does Legal & General Group’ Stand in the Current Market?

Legal & General Group maintains a strong market position within the global financial services industry, particularly in the UK. The company offers a diverse range of products, including life insurance, pensions, investment products, and asset management services. Its strategic focus on digital transformation and sustainable investing further strengthens its position in the evolving financial landscape.

The company's core operations revolve around providing financial security and investment solutions to individuals and institutions. Legal & General's value proposition lies in its ability to offer comprehensive financial products, supported by a strong brand reputation and a commitment to sustainable and responsible investing. This approach caters to a wide range of customer needs, from retirement planning to long-term investments.

As of December 31, 2023, Legal & General Group reported assets under management (AUM) of £1.2 trillion, demonstrating its significant scale and market presence. Legal & General Investment Management (LGIM) ranks among the largest institutional asset managers globally, further solidifying its position in the investment market. The company's consistent performance and strategic initiatives contribute to its robust competitive standing.

Legal & General holds a leading position in the UK's bulk purchase annuity (BPA) market. In 2023, the company secured a record £13.7 billion in BPA volumes. The company's operating profit for the full year 2023 was £1,667 million, showcasing strong financial health. The solvency II coverage ratio stood at 236% as of December 31, 2023, indicating a robust capital position.

The UK remains Legal & General's core market, accounting for a significant portion of its revenue and profits. Key product lines include life insurance, pensions, investment products, and asset management services. The company is actively seeking to strengthen its presence in international markets and expand its retail investment offerings to diversify its revenue streams.

Legal & General emphasizes digital transformation and sustainable investing to cater to evolving customer segments. The company focuses on ESG-compliant investment solutions. These initiatives help Legal & General maintain a competitive edge in the financial services industry. The company's strategic initiatives are detailed in Revenue Streams & Business Model of Legal & General Group.

Legal & General's strong financial performance is reflected in its operating profit of £1,667 million for 2023. The solvency II coverage ratio of 236% indicates a robust capital position. These financial metrics demonstrate the company's ability to withstand market fluctuations and maintain investor confidence. The company's financial health is a key factor in its competitive landscape.

Legal & General's competitive advantages include its strong brand reputation, extensive product offerings, and leading position in key markets like the UK BPA market. The company faces challenges such as increasing competition in the financial services sector and the need to adapt to changing market dynamics. Continuous innovation and strategic expansion are crucial for maintaining its competitive edge.

- Strong brand recognition and customer trust.

- Leading position in the UK pension market.

- Focus on sustainable and responsible investing.

- Need to navigate regulatory changes and market volatility.

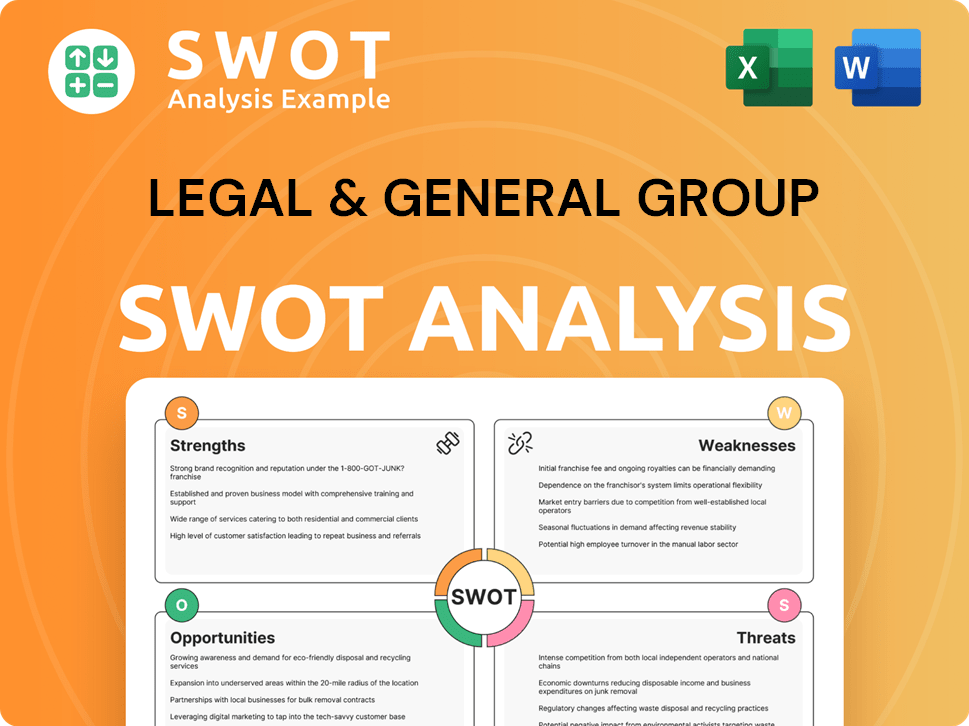

Legal & General Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Legal & General Group?

The Legal & General Group operates in a highly competitive financial services sector, facing a diverse range of rivals. This competition spans various business segments, including life insurance, pensions, and asset management. Understanding the competitive landscape is crucial for assessing its market position and future prospects.

The UK insurance market and global asset management arena are key battlegrounds. The company's financial performance is directly influenced by its ability to compete effectively against established players and emerging challengers. A thorough competitor analysis reveals the dynamics shaping its strategic initiatives.

In the UK, Legal & General Group competes with major players. These include Aviva, Prudential, Phoenix Group, and Standard Life (part of Phoenix Group). These companies offer similar services, creating a competitive environment.

Aviva is a direct competitor, offering life insurance, general insurance, and wealth management services. This diversification allows Aviva to challenge Legal & General Group across multiple product lines. Aviva's broad offerings create a competitive dynamic in the market.

Prudential, while having a significant Asian focus, maintains a presence in the UK retirement solutions market. This presence adds to the competitive pressure faced by Legal & General Group. Prudential's global reach influences its competitive strategy.

Phoenix Group is a consolidator of heritage life insurance funds. It competes in the bulk annuity space and with its open book products. This positions Phoenix Group as a key player in the UK insurance market.

In asset management, Legal & General Investment Management (LGIM) faces competition from global giants. These include BlackRock, Vanguard, Amundi, and State Street Global Advisors. These firms compete for institutional and retail mandates.

BlackRock's iShares ETF platform directly competes with LGIM's passive investment solutions. This competition highlights the importance of passive investment strategies. The competition affects market share and product offerings.

Emerging players in fintech and specialist asset managers also pose a challenge. These firms compete in areas like sustainable investing and alternative assets. These new entrants are reshaping the competitive dynamics.

- The competitive landscape is further shaped by mergers and acquisitions.

- Consolidation in the UK wealth management sector can alter market share.

- These changes impact the strategic initiatives of Legal & General Group.

- Understanding these trends is vital for assessing its market position.

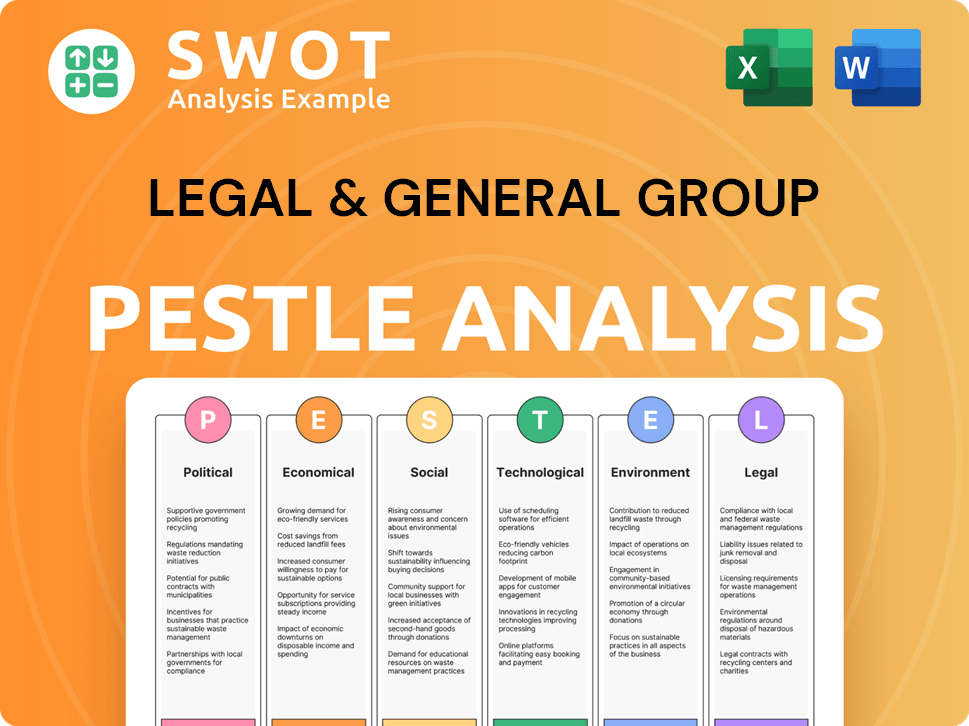

Legal & General Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Legal & General Group a Competitive Edge Over Its Rivals?

Understanding the competitive advantages of Legal & General Group is crucial for a thorough Insurance Market Analysis. The company has built a strong foundation over nearly two centuries. This longevity has fostered significant trust, which is a key factor in the financial services sector, especially in the UK insurance market.

Legal & General Group's success is also rooted in its diversified business model. This includes insurance, investment management, and retirement solutions. This approach helps to mitigate risks and capitalize on opportunities across different market segments. The company's strategic moves and market position have been shaped by these strengths.

The company's ability to adapt and innovate is a key aspect of its competitive edge. This includes investments in digital transformation to enhance customer experience and operational efficiencies. Its focus on sustainability in investment offerings further strengthens its position in the market.

Legal & General Group benefits from a strong brand reputation, built over a long history, which fosters customer loyalty. This is particularly important in the life insurance and pensions markets. The company's reputation helps attract new clients and maintain its market share.

Economies of scale, particularly within its asset management arm, LGIM, contribute to lower operating costs. This allows for competitive pricing of investment products. LGIM's substantial assets under management (AUM) provide a significant advantage in the market.

The diversified business model, spanning insurance, investment management, and retirement solutions, provides resilience. This diversification helps Legal & General Group withstand downturns in any single market segment. It also creates cross-selling opportunities, such as leveraging its position in workplace pensions for asset management mandates.

Significant investment in digital transformation enhances customer experience and operational efficiencies. While not always proprietary technology, the effective integration of digital platforms is a growing advantage. This is crucial for modern customer engagement and service delivery.

Legal & General Group's competitive advantages include a strong brand, economies of scale, a diversified business model, and digital transformation. These factors contribute to its strong market position. The company's long-standing presence in the UK insurance market and its strategic moves have shaped its success. For a deeper understanding of Legal & General's history, consider reading Brief History of Legal & General Group.

- Brand Reputation: A strong brand built over nearly two centuries, fostering customer loyalty.

- Economies of Scale: Lower operating costs through LGIM's massive AUM, enabling competitive pricing.

- Diversified Business Model: Resilience against market downturns and cross-selling opportunities.

- Digital Transformation: Enhanced customer experience and operational efficiencies through digital platforms.

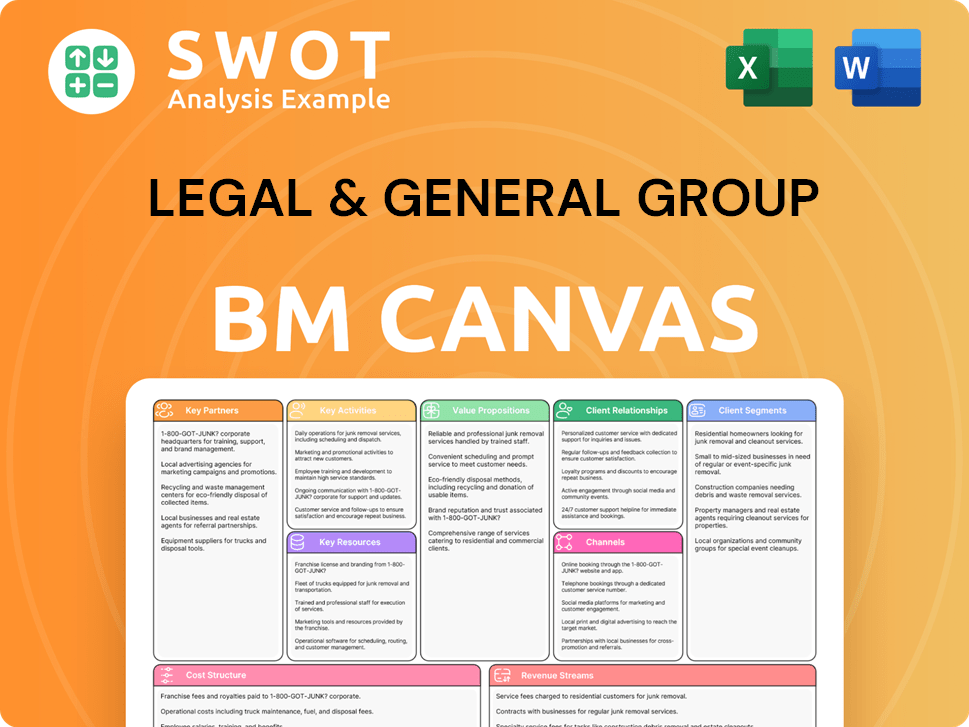

Legal & General Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Legal & General Group’s Competitive Landscape?

The financial services sector, including the insurance market, is experiencing significant shifts. These changes present both challenges and opportunities for Legal & General Group. Understanding these trends is crucial for assessing its competitive landscape and future prospects. The company's strategic responses to these industry dynamics will significantly influence its performance.

Legal & General Group's position in the UK insurance market and broader financial services is subject to various risks. These include regulatory changes, technological disruptions, and evolving consumer preferences. Its future outlook depends on its ability to navigate these challenges while capitalizing on emerging opportunities. A comprehensive analysis of its competitive environment is vital for informed decision-making.

Technological advancements, particularly in AI and data analytics, are reshaping financial product development and distribution. Regulatory changes, such as those related to consumer duty and sustainable finance, are also impacting the industry. Shifting consumer preferences, including a demand for digital services and ESG investments, are key drivers.

Increased competition from fintech firms and challenger banks poses a threat, especially in retail savings and investment. Pressure on fees in the asset management industry and the need for continuous technological investment are significant hurdles. Adapting to evolving consumer demands and regulatory changes requires strategic agility.

Expanding into new geographic markets, particularly in Asia, offers growth potential. Developing illiquid asset management capabilities and capitalizing on the demand for retirement solutions are also promising. Legal & General's strong focus on ESG investing through LGIM aligns with growing market interest.

Continued investment in technology and a focus on profitable growth areas, such as bulk annuities and illiquid assets, are key. A commitment to responsible capitalism and adapting to evolving consumer demands is essential. Further insights into the company's growth strategy can be found in this article: Growth Strategy of Legal & General Group.

The insurance market analysis reveals several trends affecting Legal & General Group. Digital transformation is crucial for maintaining a competitive edge. ESG investing is gaining momentum, presenting significant opportunities for sustainable growth.

- Digital Transformation: Investment in technology and digital platforms to enhance customer experience and operational efficiency.

- ESG Investing: Capitalizing on the growing demand for sustainable and responsible investment products.

- Regulatory Changes: Adapting to evolving regulations to ensure compliance and maintain customer trust.

- Competitive Landscape: Facing increased competition from both traditional and fintech firms.

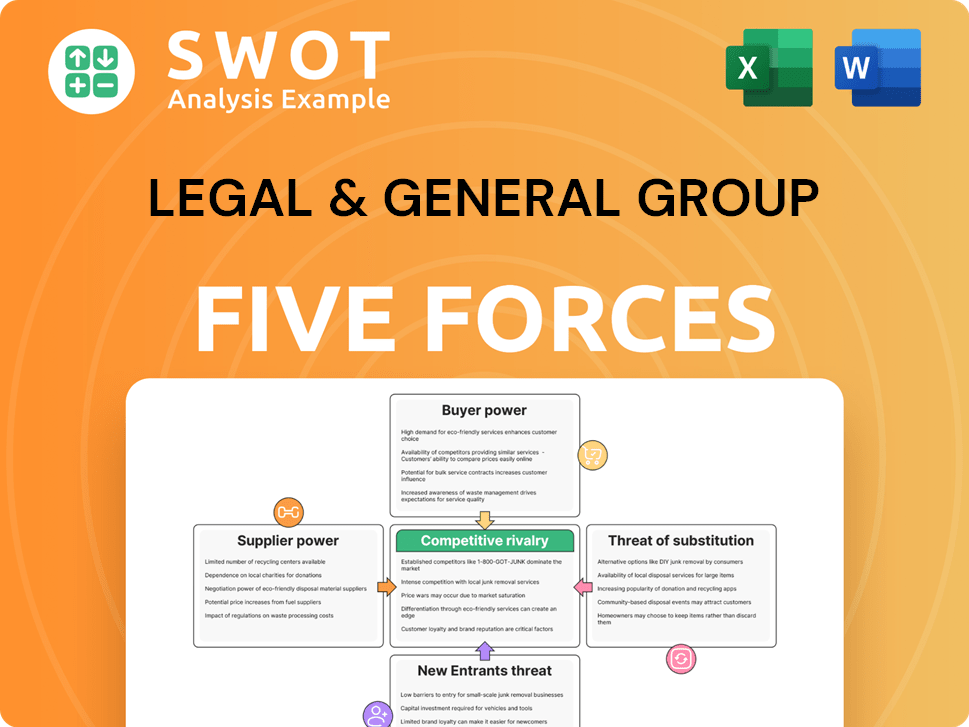

Legal & General Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Legal & General Group Company?

- What is Growth Strategy and Future Prospects of Legal & General Group Company?

- How Does Legal & General Group Company Work?

- What is Sales and Marketing Strategy of Legal & General Group Company?

- What is Brief History of Legal & General Group Company?

- Who Owns Legal & General Group Company?

- What is Customer Demographics and Target Market of Legal & General Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.