Lincoln Electric Bundle

Can Lincoln Electric Maintain Its Welding Dominance?

For over a century, Lincoln Electric SWOT Analysis has been a powerhouse in the welding industry, but how does it stack up against its rivals today? With a history rooted in innovation and a global presence, Lincoln Electric's competitive landscape is constantly shifting. Understanding its market position, primary competitors, and strategic advantages is crucial for anyone looking to navigate this dynamic sector.

This in-depth market analysis will dissect Lincoln Electric's competitive landscape, examining its key competitors and market share within the welding equipment manufacturers sector. We'll explore Lincoln Electric's strategies for market dominance, its financial performance compared to rivals, and the impact of automation on the welding industry. Furthermore, we'll investigate recent acquisitions and future trends, offering insights into how Lincoln Electric plans to maintain its leadership in the face of evolving challenges and opportunities within the welding industry.

Where Does Lincoln Electric’ Stand in the Current Market?

The company, a leading player in the welding and cutting equipment sector, holds a strong global market position. It is recognized as one of the top three global providers, offering comprehensive welding solutions that include both equipment and consumables. With a diverse product range, including arc welding power sources and robotic welding packages, the company serves customers in over 160 countries.

The company's operations are spread across 19 to 20 countries, with 71 manufacturing and automation system integration locations. Its primary product lines are segmented into Americas Welding, International Welding, and Harris Products Group. The company serves various end markets, including general fabrication, construction and infrastructure, and energy, which includes oil & gas and power generation.

As of March 31, 2025, the company had a trailing 12-month revenue of $4.03 billion, and approximately $4 billion in sales for the full fiscal year 2024. Despite market challenges, the company has shown financial resilience. The company's automation segment is a significant growth driver, projected to grow at twice the rate of the core welding business.

The company is a leading global provider in the welding industry. Its strong market position is supported by a comprehensive product portfolio and extensive global presence. The company competes with other major players in the welding machine market.

The company demonstrated financial resilience, with a 'Good' overall financial health score as of February 2025. It maintained dividend payments for 52 consecutive years, raising its dividend for 28 straight years. The company's market capitalization was approximately $11.73 billion as of February 2025 and $10.6 billion as of June 2, 2025.

The company's diverse product portfolio includes arc welding power sources, wire feeding systems, and robotic welding packages. Its primary product lines are segmented into Americas Welding (64% of FY 2024 sales), International Welding (23%), and Harris Products Group (13%). This segmentation helps the company serve various end markets effectively.

The automation segment is a significant growth driver, projected to grow at twice the rate of the core welding business. The company aims to reach $1 billion in sales in its automation segment by its 2025 target date. This strategic focus underlines the company's commitment to innovation and market leadership.

The company's competitive landscape is defined by its strong global presence and comprehensive product offerings. The company's financial performance, including a robust return on equity of 35% and return on assets of 13.52% in the last twelve months, demonstrates its market strength. The company's consistent dividend payments and growth further enhance its appeal.

- Global Market Leader: Top three global providers.

- Diverse Product Portfolio: Complete welding solutions.

- Financial Stability: Consistent dividend payments and growth.

- Strategic Growth: Focus on automation segment.

- Wide Market Reach: Serving customers in over 160 countries.

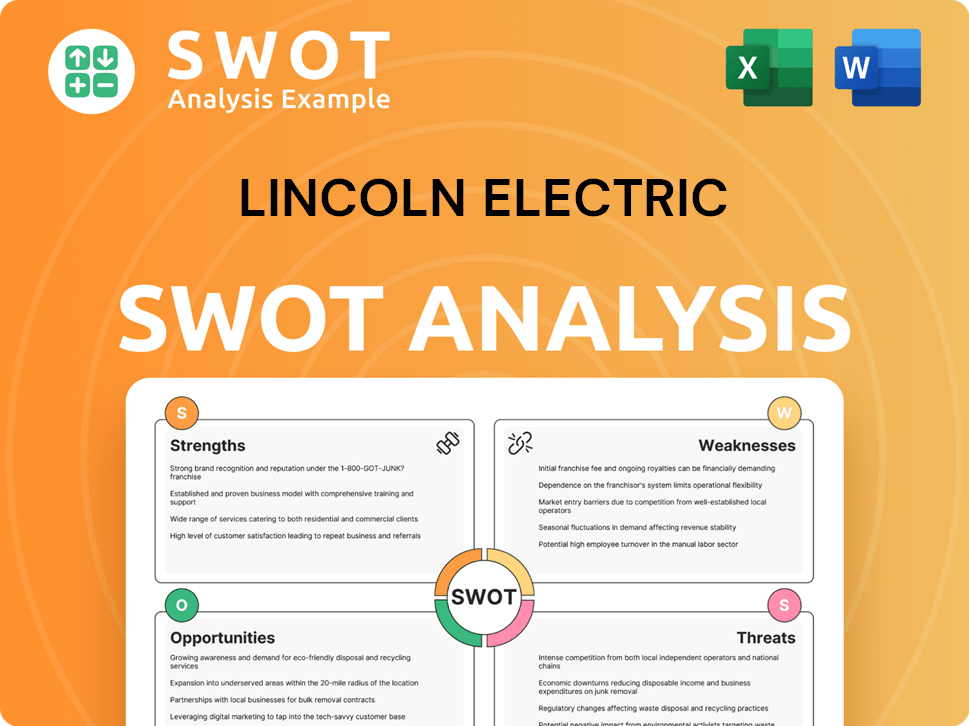

Lincoln Electric SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Lincoln Electric?

The competitive landscape for Lincoln Electric is primarily defined by its position within the global welding and cutting equipment industry. The company faces competition from both large, diversified industrial firms and specialized manufacturers. A thorough Lincoln Electric competitive landscape analysis reveals that the company must continually innovate and adapt to maintain its market position.

Understanding the Lincoln Electric competitors is crucial for investors and industry analysts. The company’s success depends on its ability to differentiate its products, manage costs, and effectively navigate the evolving demands of the welding industry. The market dynamics are shaped by technological advancements, shifts in customer preferences, and the strategic moves of its rivals.

A deep dive into the Lincoln Electric market analysis highlights the importance of understanding the competitive pressures. The company's strategies, including acquisitions and product development, are directly influenced by the actions of its competitors. The global welding equipment market is substantial, and Lincoln Electric’s ability to maintain or grow its market share is a key indicator of its performance.

Lincoln Electric's main rivals include Illinois Tool Works (ITW) and ESAB, recognized as top global providers in welding solutions. Other notable competitors include Ingersoll Rand, Xylem, and Miller Electric. These competitors challenge Lincoln Electric through product offerings and market share shifts.

Competitors like ESAB and Miller Welding may offer alternative high-tech products, such as robotic welding systems. This necessitates sustained R&D investment from Lincoln Electric. The focus on innovation is critical in maintaining a competitive edge within the welding industry.

Intense competition can lead to shifts in specific segments or geographies, impacting Lincoln Electric's market share. While Lincoln Electric maintains a leading global market share, it must remain vigilant against competitors seeking to gain ground in key areas. The welding equipment manufacturers are constantly vying for market position.

Smaller competitors might focus on niche markets or offer budget-friendly options, while larger rivals leverage extensive distribution networks. Lincoln Electric must balance its pricing strategies and distribution capabilities to compete effectively. Distribution networks are crucial for reaching a diverse customer base.

The increasing adoption of automation and robotics means that companies like Genesis Systems Group pose a direct challenge. Lincoln Electric must invest in advanced technologies to stay competitive. Automation is transforming the welding industry.

Lincoln Electric has engaged in strategic acquisitions to bolster its competitive standing, such as the acquisition of Vanair Manufacturing in July 2024 and Redviking in April 2024. These moves aim to enhance capabilities and differentiate it from rivals.

The competition in the welding industry is dynamic, with Lincoln Electric's market position influenced by various factors. To understand the company's competitive advantages, it's essential to consider its strategies in product development, market penetration, and operational efficiency. For a deeper dive, explore the Growth Strategy of Lincoln Electric.

Lincoln Electric faces challenges from competitors in product innovation, market share, pricing, and the adoption of new technologies. The company's strategies include strategic acquisitions and investments in research and development to maintain its competitive edge. The global market size for welding equipment is substantial, and Lincoln Electric must adapt to maintain its position.

- Product Innovation: Competitors constantly introduce new products and technologies.

- Market Share: Maintaining and growing market share is a continuous challenge.

- Pricing Pressure: Competitors may offer lower prices.

- Technological Advancements: Adoption of automation and robotics is critical.

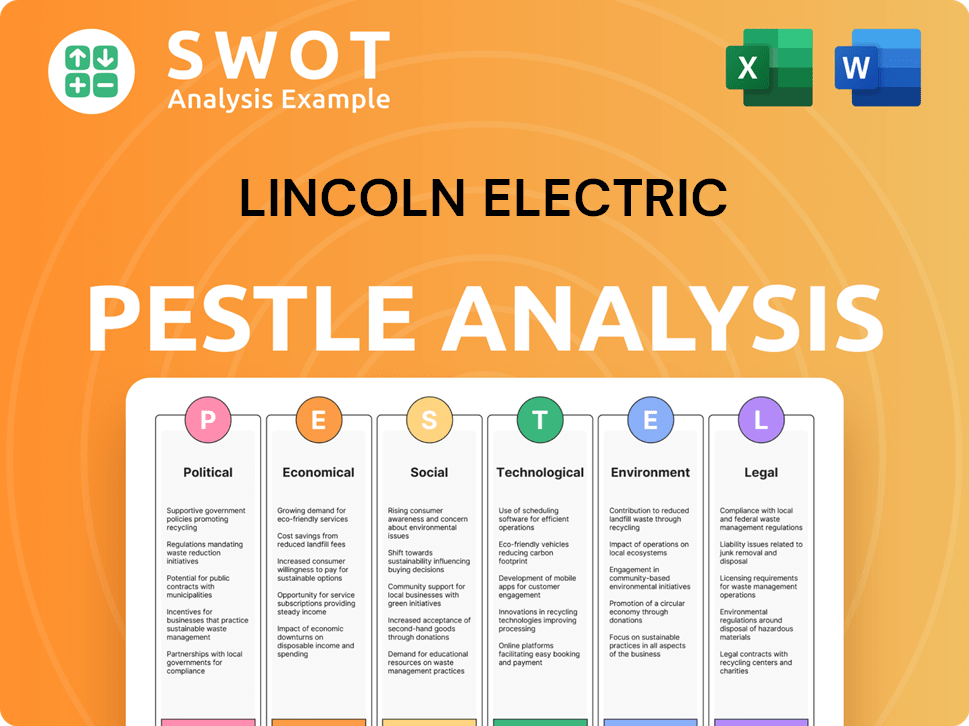

Lincoln Electric PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Lincoln Electric a Competitive Edge Over Its Rivals?

Understanding the Marketing Strategy of Lincoln Electric involves a deep dive into its competitive advantages. The company has solidified its position in the welding industry through a combination of brand strength, comprehensive offerings, and technological innovation. Its strategic moves, including acquisitions and investments in automation, have consistently enhanced its market position. A detailed Lincoln Electric market analysis reveals a sustained focus on customer needs and operational efficiency, contributing to its long-term success.

The competitive landscape for Lincoln Electric is shaped by its ability to offer complete welding solutions, encompassing both equipment and consumables. This 'one-stop-shop' approach differentiates it from many competitors, particularly those that specialize in only a segment of the market. The company's commitment to research and development, particularly in arc welding and automation, has created significant barriers to entry for new players. This focus on innovation has allowed Lincoln Electric to maintain a leading position in the welding equipment manufacturers sector.

Key to Lincoln Electric's competitive edge is its global presence and robust distribution network. With manufacturing and automation system integration locations across 20 countries and serving customers in over 160 countries, the company has established a strong foothold worldwide. This extensive reach allows it to capitalize on economies of scale and effectively serve a diverse customer base. Furthermore, its customer-centric approach, including its digital capabilities, enhances customer loyalty and generates substantial switching costs.

Lincoln Electric has built a strong brand name and reputation for reliability and quality since 1895. This long-standing trust is a significant competitive advantage, as customers often prioritize reliability and performance in welding equipment. This enduring reputation contributes to customer loyalty and helps maintain a strong market share.

Offering complete welding solutions, including both equipment and consumables, is a key differentiator. This 'one-stop-shop' approach streamlines the purchasing process for customers and enhances customer convenience. This comprehensive offering sets it apart from competitors that may only offer a limited range of products or services.

Lincoln Electric's substantial patent portfolio and engineering capabilities create high barriers to entry. Its technological advancements, particularly in arc welding and automation, provide a significant competitive edge. These innovations allow the company to offer cutting-edge solutions that meet the evolving needs of the welding industry.

Automation solutions and digital capabilities like CheckPoint software increase customer loyalty. These integrated systems are often mission-critical and deeply embedded in a customer's manufacturing process. This integration creates high switching costs, as customers are less likely to switch to a competitor once they are invested in Lincoln Electric's solutions.

Lincoln Electric's competitive advantages are multifaceted, including brand recognition, comprehensive solutions, and technological innovation. The company's global presence and robust distribution network, combined with a customer-centric approach, further strengthen its market position. These factors have allowed Lincoln Electric to maintain a strong position in the welding industry.

- Strong Brand and Reputation: Over a century of trust and reliability.

- Comprehensive Solutions: Offering both equipment and consumables.

- Proprietary Technologies: Advanced arc welding and automation.

- Customer Switching Costs: Integrated automation and digital solutions.

- Global Presence: Manufacturing in 20 countries, serving over 160.

- Unique Company Culture: Performance-based incentives and training.

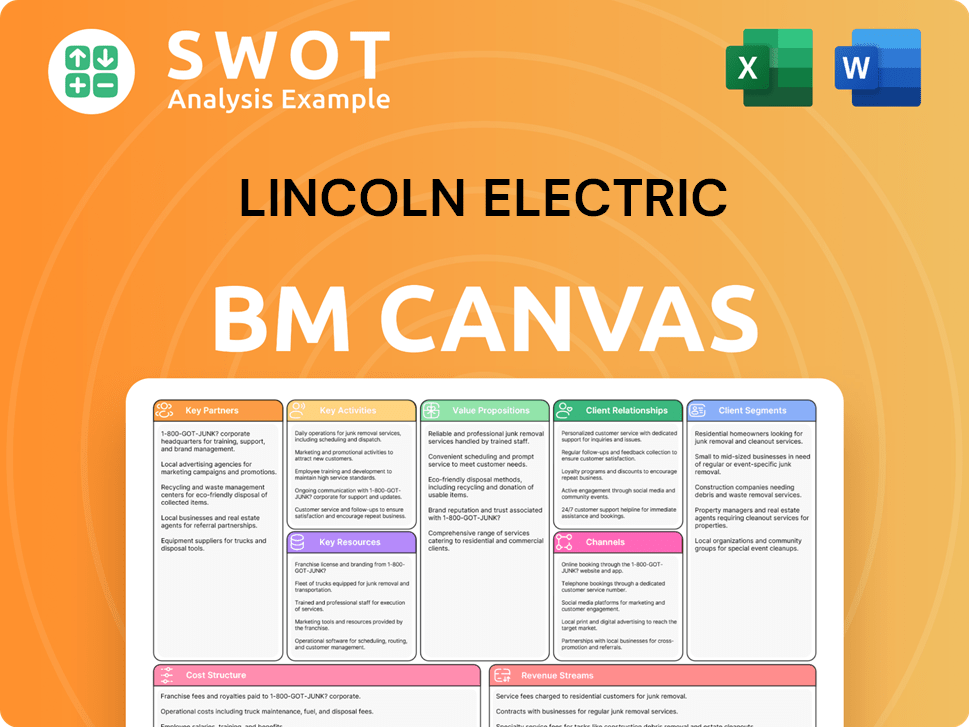

Lincoln Electric Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Lincoln Electric’s Competitive Landscape?

The Brief History of Lincoln Electric reveals the company's strong position in the welding industry, facing both established rivals and emerging competitors. Understanding the current market dynamics, including technological advancements, economic factors, and global trends, is essential for assessing its future prospects. This analysis delves into the industry trends, challenges, and opportunities shaping Lincoln Electric's competitive landscape.

The welding industry is undergoing significant transformation, driven by technological advancements, sustainability demands, and evolving manufacturing processes. These shifts create both challenges and opportunities for companies like Lincoln Electric, impacting their strategies and future performance. A thorough examination of these factors is crucial for understanding the industry's trajectory and Lincoln Electric's ability to maintain its market leadership.

The welding industry is experiencing significant changes. Automation and robotics, including AI-driven systems and cobots, are becoming more prevalent. Sustainability and the need for eco-friendly practices are also driving innovation, along with advanced materials and hybrid manufacturing.

Automation and robotics are significantly impacting the industry. Lincoln Electric's automation segment is a key growth driver. Sales grew from $400 million in 2020 to $911 million in 2024, with a $1 billion sales target by 2025. IoT and smart technologies are also crucial for optimizing operations.

Environmental concerns are driving demand for sustainable welding solutions. This presents an opportunity for Lincoln Electric to develop and market greener welding solutions, including recyclable materials and processes that reduce environmental impact.

The demand for advanced materials is influencing the development of specialized welding machinery. Hybrid manufacturing processes, which combine human expertise with robotic efficiency, require welders to have advanced tech skills.

Lincoln Electric faces several challenges, including market softness, a skilled labor shortage, and economic uncertainty. Despite these challenges, the company has significant opportunities, particularly in automation, infrastructure spending, and product innovation. Strategic initiatives and cost management are also key.

- Market Softness and Cyclicality: Broad-based weakness in end markets and a cyclical downturn are expected to cause mid-single-digit to high-single-digit declines in the near term. Deferred capital spending by industrial customers continues to impact demand.

- Skilled Labor Shortage: The industry faces a significant worker shortage, with over 400,000 welders needed in the U.S. in 2024. This necessitates continued investment in training and education.

- Tariffs and Economic Uncertainty: Pending tariffs and uncertain market conditions add to the challenges and could unfavorably impact net sales.

- Automation Segment Growth: The automation segment is projected to grow at twice the rate of the core welding business.

- Infrastructure Spending and Reshoring: Increased infrastructure projects and reshoring manufacturing will drive demand for welding equipment.

- Strategic Partnerships and Acquisitions: Collaborations and acquisitions can expand capabilities and market reach.

- Cost Management Initiatives: Aggressive cost-out programs are expected to generate $40-50 million in annualized savings throughout 2025.

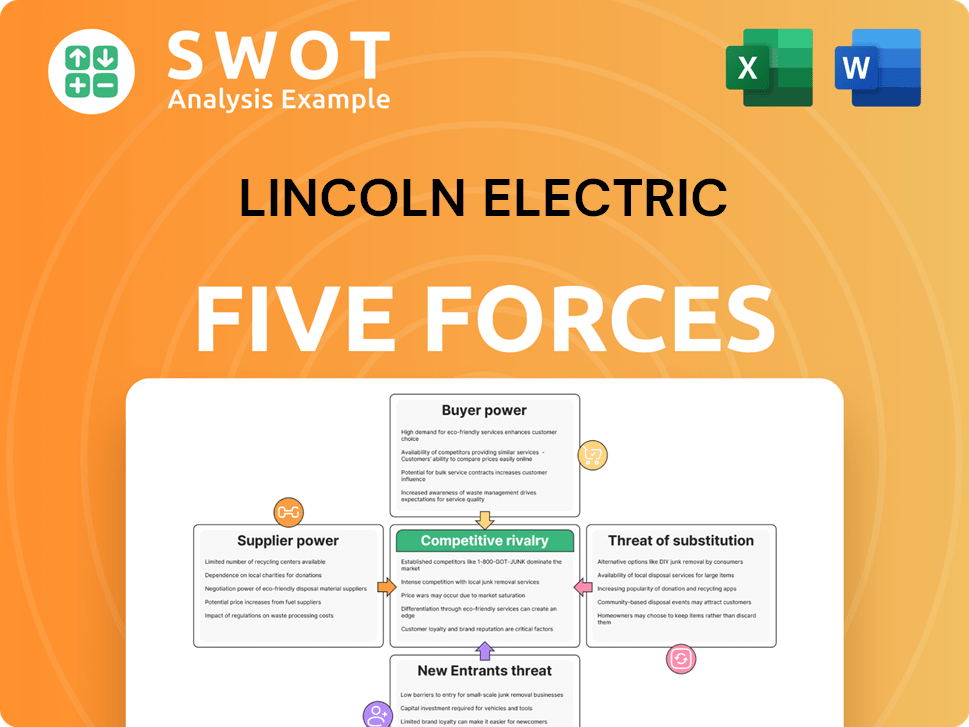

Lincoln Electric Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Lincoln Electric Company?

- What is Growth Strategy and Future Prospects of Lincoln Electric Company?

- How Does Lincoln Electric Company Work?

- What is Sales and Marketing Strategy of Lincoln Electric Company?

- What is Brief History of Lincoln Electric Company?

- Who Owns Lincoln Electric Company?

- What is Customer Demographics and Target Market of Lincoln Electric Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.