Lincoln Electric Bundle

Who Really Controls Lincoln Electric?

Unraveling the mystery of 'Who owns Lincoln Electric Company?' is key to understanding its future. With Steven B. Hedlund now leading the charge, the company's ownership structure becomes even more critical. Founded in 1895, Lincoln Electric's journey from a small startup to a global welding giant is a testament to the power of understanding its ownership.

This exploration of Lincoln Electric's ownership will reveal how its Lincoln Electric SWOT Analysis is shaped by its stakeholders. We'll examine the company's Lincoln Electric history, from its initial founding by John C. Lincoln to its current status as a publicly traded entity. Understanding the Lincoln Electric Company profile and the influence of Lincoln Electric owners is essential for anyone looking to invest in or understand this industrial leader. This deep dive into Lincoln Electric Company ownership will also touch on the Lincoln Electric leadership and Who owns Lincoln Electric.

Who Founded Lincoln Electric?

The story of the company begins in 1895 with its founder, John C. Lincoln. Initially focused on electric motors and chargers, the company's trajectory was shaped by Lincoln's innovative spirit. His vision set the stage for what would become a global leader in the welding industry.

In 1907, John C. Lincoln's brother, James F. Lincoln, joined the company. James played a crucial role in developing the company's unique incentive management system, which significantly impacted its culture and productivity. While the exact initial equity split isn't fully documented in public records, it's understood that John C. Lincoln, as the founder, held the controlling interest.

Early funding likely came from personal capital and possibly small, private investments from close associates or family members. The company's early ownership structure was closely held, with the Lincoln family maintaining significant control. This concentrated ownership allowed for a clear and consistent strategic direction in the company's formative years.

The company was founded in 1895 by John C. Lincoln.

The company initially focused on manufacturing electric motors and chargers.

John C. Lincoln was the primary owner, and James F. Lincoln joined in 1907.

The company started with a closely held ownership model, primarily controlled by the Lincoln family.

Early funding came from personal capital and potentially small private investments.

Concentrated ownership allowed for a clear strategic direction in the early years.

Understanding the early ownership structure of the company provides insight into its foundational values and strategic direction. Growth Strategy of Lincoln Electric highlights how the company's early focus on innovation and employee welfare, influenced by the Lincoln brothers' leadership, shaped its long-term success. The company's commitment to its employees and its innovative approach to manufacturing were key factors in its early growth. The company's history shows a consistent commitment to these principles.

- John C. Lincoln, the founder, held the primary ownership stake.

- James F. Lincoln joined in 1907 and played a key role in the company's development.

- The early ownership was closely held, with the Lincoln family maintaining control.

- The company's early success was influenced by the founders' vision and leadership.

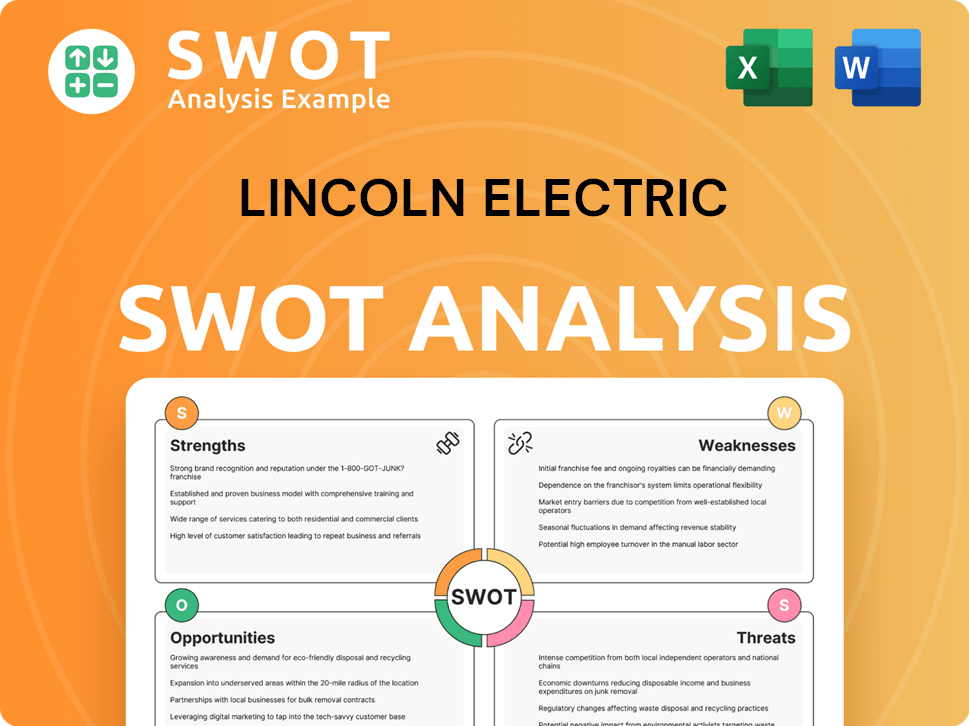

Lincoln Electric SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Lincoln Electric’s Ownership Changed Over Time?

The evolution of Lincoln Electric's ownership is marked by a significant shift from its origins. The company's journey began as a closely held family business. A pivotal moment in its history was the initial public offering (IPO) on the New York Stock Exchange (NYSE) on March 18, 1993, under the ticker symbol 'LECO'. This transition to a publicly traded company fundamentally altered its ownership structure, opening the door to a broader range of investors and institutional involvement.

Following the IPO, the ownership landscape of Lincoln Electric has transformed. The company's ownership has moved from a family-dominated structure to one largely influenced by institutional investors. This shift reflects a broader trend in the corporate world, where institutional investors play a significant role in shaping company strategies and financial performance. This change has brought in major asset management firms, mutual funds, and index funds as key shareholders, influencing the company's direction and emphasis on shareholder value.

| Ownership Aspect | Details | Impact |

|---|---|---|

| Initial Public Offering (IPO) | March 18, 1993, NYSE (LECO) | Transitioned from a private to a public company, broadening the shareholder base. |

| Institutional Investors | BlackRock Inc., The Vanguard Group, State Street Corporation | Hold a substantial portion of shares, influencing financial performance and strategic decisions. |

| Individual Insiders | Board members and executive officers | Align interests with shareholders, though holdings are smaller compared to institutions. |

As of early 2025, the major shareholders of Lincoln Electric include prominent institutional investors such as BlackRock Inc., The Vanguard Group, and State Street Corporation. The Vanguard Group, Inc. held approximately 11.2% of the shares as of March 31, 2025. BlackRock Inc. held around 9.8%, while State Street Corp held approximately 4.7%. This shift towards institutional ownership has led to a greater emphasis on financial performance and shareholder value.

The ownership of Lincoln Electric has evolved significantly since its IPO in 1993. Institutional investors now hold a major portion of the shares. This shift reflects a broader trend in the corporate world.

- The company's transition from a family-owned business to a publicly traded entity.

- The significant role of institutional investors like BlackRock and Vanguard.

- The alignment of interests between individual insiders and shareholders.

- The emphasis on financial performance and shareholder value.

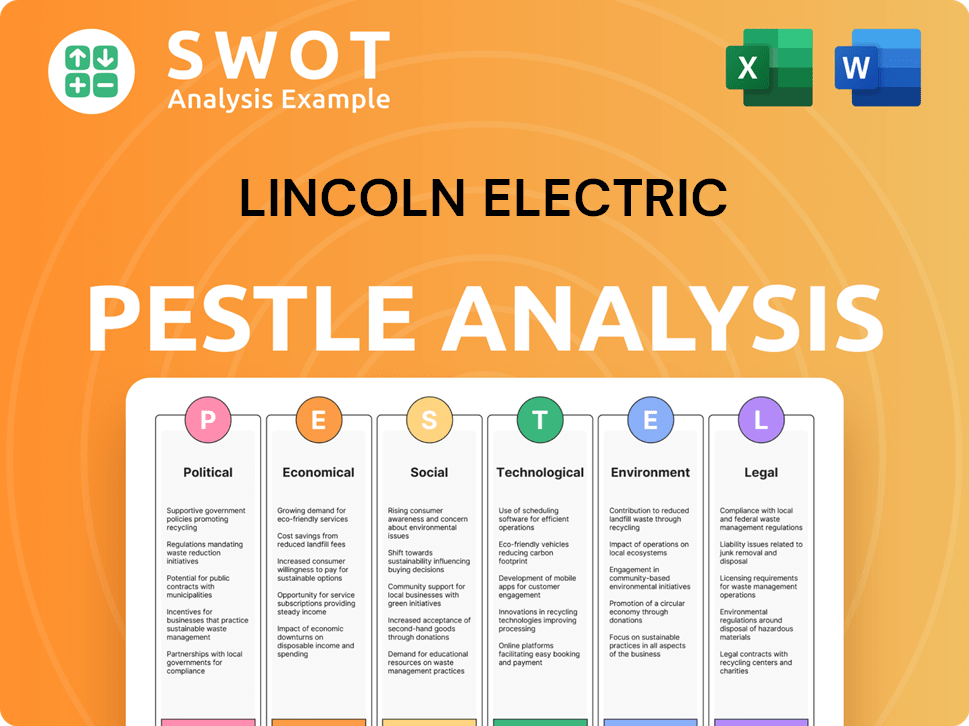

Lincoln Electric PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Lincoln Electric’s Board?

As of early 2025, the Board of Directors of Lincoln Electric includes a blend of independent directors and executive management, reflecting a commitment to corporate governance. The board benefits from the expertise of individuals with diverse backgrounds in manufacturing, finance, and global business. This ensures a broad range of knowledge in guiding the company. The presence of executives like Steven B. Hedlund, President and CEO, on the board ensures alignment between management and the operational aspects of the company. The majority of the board consists of independent directors, who are expected to represent the interests of all shareholders.

The composition of the board and its leadership are crucial in overseeing the strategic direction, financial performance, and executive compensation. These elements indirectly reflect the interests of its diverse ownership. Understanding the Marketing Strategy of Lincoln Electric can also provide insights into how the company is managed and the decisions made by the board.

| Board Member | Title | Relevant Experience |

|---|---|---|

| Steven B. Hedlund | President and CEO | Extensive experience in leadership and operational management. |

| Independent Directors | Various | Diverse backgrounds including manufacturing, finance, and global business. |

| Other Executives | Various | Experience in financial, operational, and strategic roles. |

Lincoln Electric operates under a one-share-one-vote structure, meaning each share of common stock generally entitles its holder to one vote. This democratic voting structure ensures that the collective voice of shareholders, particularly institutional investors who hold significant blocks of shares, carries substantial weight in corporate decisions. There is no public information indicating the existence of dual-class shares or special voting rights.

The Board of Directors at Lincoln Electric oversees the company's strategic direction and financial performance, ensuring alignment with shareholder interests. The company's one-share-one-vote structure gives each shareholder equal voting power.

- The board includes both independent directors and executive management.

- The voting structure is democratic, with no special voting rights.

- The board's role is crucial in overseeing strategic direction and financial performance.

- The company's governance structure is relatively stable.

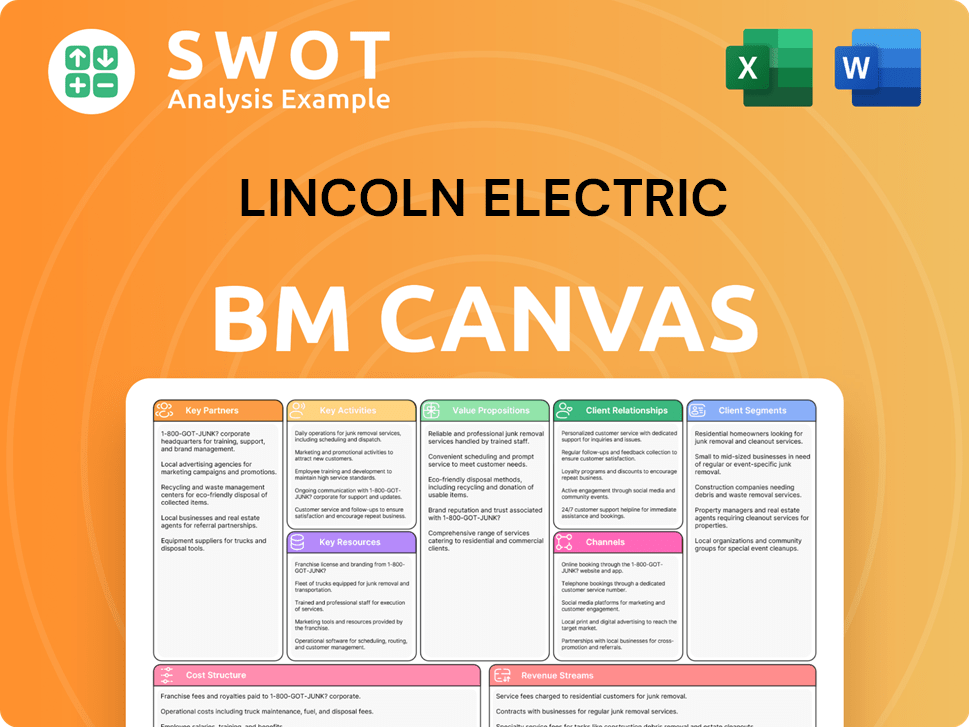

Lincoln Electric Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Lincoln Electric’s Ownership Landscape?

Over the past few years (2022-2025), the ownership of Lincoln Electric Company has remained relatively stable. The company has maintained a strong presence of institutional investors, which is typical for a publicly traded company with a long history. One key aspect of its financial strategy has been share buybacks, which aim to return value to shareholders and optimize the capital structure. For example, in 2023, Lincoln Electric authorized a new $500 million share repurchase program, reflecting its commitment to shareholder returns. This can increase the ownership percentage of the remaining shareholders.

While there haven't been any major shifts in ownership due to mergers or acquisitions, Lincoln Electric has pursued smaller, strategic acquisitions to broaden its product offerings and market reach. The acquisition of RedViking in 2023 is a good example of this, expanding its automation capabilities. These acquisitions are often funded through a mix of cash, debt, and sometimes, the issuance of new shares, which can have a slight dilutive effect on existing ownership. To gain a better understanding of the competitive environment, you can check out the Competitors Landscape of Lincoln Electric.

| Ownership Trend | Details | Impact |

|---|---|---|

| Share Buybacks | $500 million share repurchase program authorized in 2023. | Increases ownership percentage of remaining shareholders. |

| Strategic Acquisitions | Acquisition of RedViking in 2023. | Expands product portfolio and market reach; minor dilutive effect. |

| Institutional Ownership | Continued strong presence of institutional investors. | Reflects stability and attractiveness for long-term investors. |

Leadership changes, such as Steven B. Hedlund's appointment as CEO in January 2024, have occurred. Although these changes do not directly alter the ownership structure, they can influence investor confidence and, consequently, stock performance, which indirectly affects the value of ownership stakes.

Lincoln Electric has a history of returning value to shareholders through share repurchases. The $500 million program in 2023 highlights this commitment. This strategy increases the ownership stake of existing shareholders.

Acquisitions like RedViking in 2023 are aimed at expanding Lincoln Electric's capabilities. These moves, while not drastically changing the ownership structure, support long-term growth. They are typically funded through a mix of cash and debt.

Institutional investors continue to be a significant part of Lincoln Electric's shareholder base. This presence underscores the company's stability and its appeal as a long-term investment. This is common for mature manufacturing companies.

Leadership changes, such as the appointment of Steven B. Hedlund as CEO in January 2024, can impact investor confidence. While not directly changing ownership, these transitions can influence stock performance. They are crucial for company strategy.

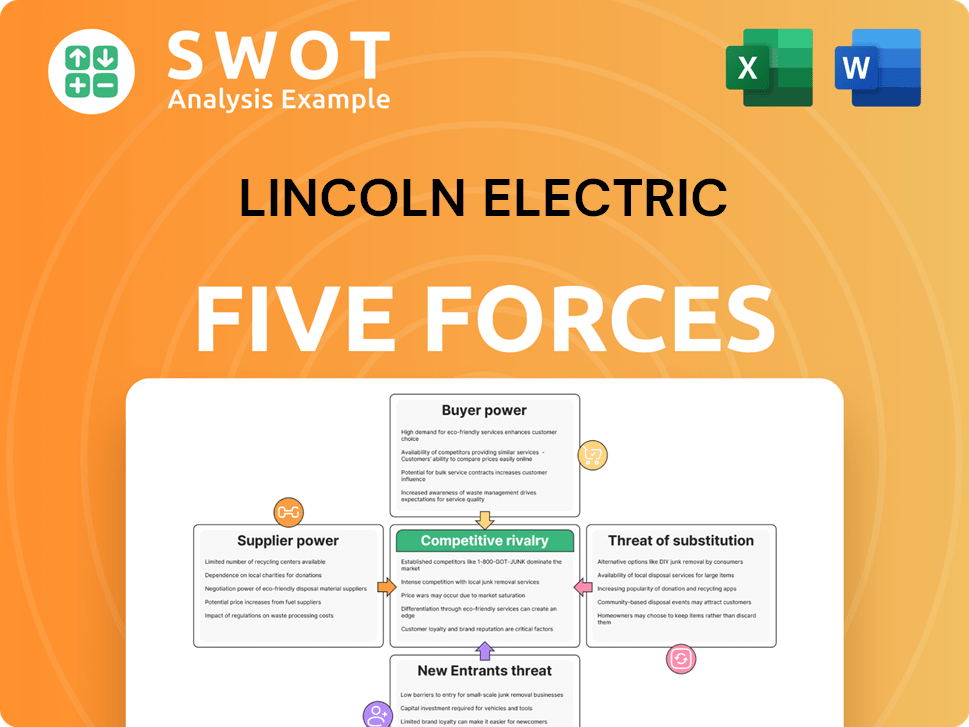

Lincoln Electric Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Lincoln Electric Company?

- What is Competitive Landscape of Lincoln Electric Company?

- What is Growth Strategy and Future Prospects of Lincoln Electric Company?

- How Does Lincoln Electric Company Work?

- What is Sales and Marketing Strategy of Lincoln Electric Company?

- What is Brief History of Lincoln Electric Company?

- What is Customer Demographics and Target Market of Lincoln Electric Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.