Lincoln Electric Bundle

Can Lincoln Electric Maintain Its Welding Dominance?

Lincoln Electric Holdings, Inc. (NASDAQ: LECO) stands as a global leader, and its growth strategy is constantly evolving within the industrial sector. The recent acquisition of Vanair Manufacturing, LLC in July 2024 highlights the company's commitment to expanding its mobile power solutions and technology platform. This strategic move is pivotal for accelerating growth and creating long-term value for the Lincoln Electric SWOT Analysis.

With nearly 130 years of experience, Lincoln Electric Company has transformed from a small electric motor manufacturer into a global powerhouse. The company's impressive $4 billion in sales in 2024 demonstrates its robust financial performance and market position. As the welding industry trends change, Lincoln Electric's future prospects depend on its ability to innovate, expand, and strategically plan within a dynamic global economy. The company's investment in research and development will be key for its competitive advantages.

How Is Lincoln Electric Expanding Its Reach?

The growth strategy of Lincoln Electric is significantly shaped by its expansion initiatives. These initiatives include entering new markets, diversifying product offerings, and engaging in strategic mergers and acquisitions. The company's 'Higher Standard 2025' strategy aims for high single to low double-digit growth, achieved through both organic and inorganic means. Acquisitions are projected to contribute approximately 300-400 basis points CAGR.

A prime example of inorganic growth is the July 2024 acquisition of Vanair Manufacturing, LLC. This acquisition positions the company as a leader in mobile power solutions for the U.S. service truck market. It complements existing maintenance and repair consumable offerings. Furthermore, it builds upon joint development equipment initiatives.

Beyond acquisitions, the company focuses on expanding its product and service offerings, particularly in the automation sector. Lincoln Electric aims to expand its automation platform to over $1 billion in sales by 2025, a substantial increase from $911 million in 2024. This growth is fueled by strategic investments in automation and additive solutions, such as the acquisition of Baker Industries. The company's international presence, accounting for roughly half of its sales, presents additional opportunities for revenue growth and diversification. Mission, Vision & Core Values of Lincoln Electric are key drivers in these expansion efforts.

The company actively seeks entry into new markets to broaden its customer base and revenue streams. This includes expanding its presence in regions with growing industrial sectors and increasing demand for welding and cutting solutions. They are also focusing on underpenetrated channels.

The company diversifies its product portfolio to cater to a wider range of applications and customer needs. This includes expanding its offerings in automation, additive manufacturing, and mobile power solutions. This strategy helps to mitigate risks associated with dependence on a single product line.

The company uses mergers and acquisitions to accelerate growth and gain access to new technologies, markets, and capabilities. The acquisition of Vanair Manufacturing, LLC is a prime example. This approach allows for rapid expansion and enhancement of its competitive position.

The company is heavily investing in the automation sector, aiming to increase sales to over $1 billion by 2025. This includes investments in automation and additive solutions to meet the growing demand for automated welding and cutting processes. This expansion is a key element of its growth strategy.

These initiatives are crucial for the company's growth and future prospects. They are designed to capitalize on emerging trends and strengthen its market position.

- Acquisitions: Strategic acquisitions like Vanair Manufacturing, LLC to expand into new markets.

- Product Development: Expanding product offerings in automation and additive manufacturing.

- Global Expansion: Leveraging its international presence to drive revenue growth.

- Partnerships: Forming partnerships to expand engineering and application expertise.

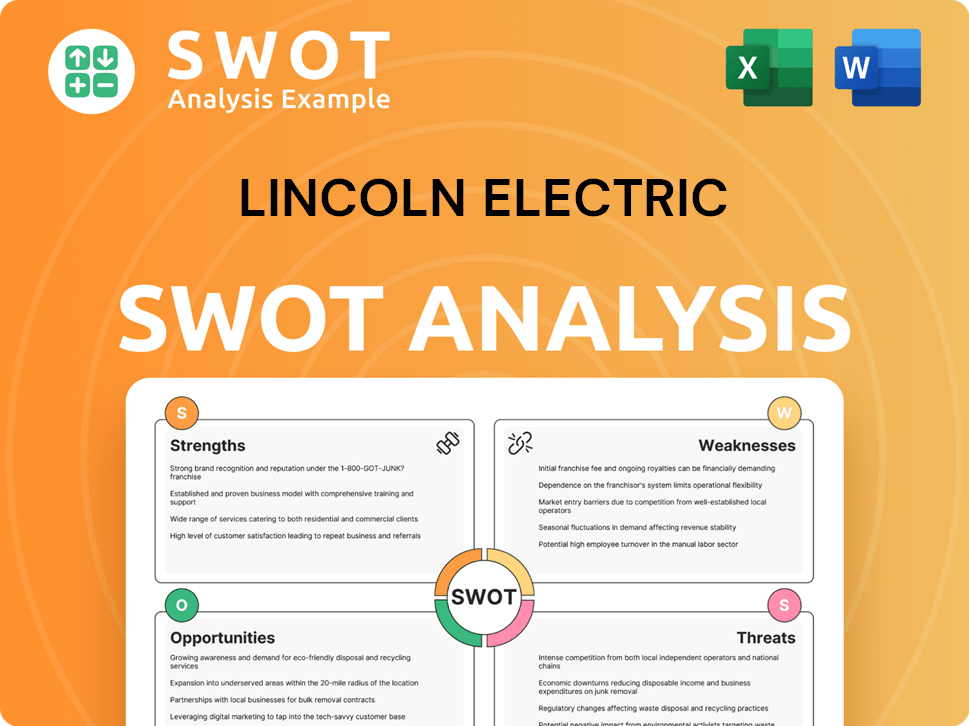

Lincoln Electric SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Lincoln Electric Invest in Innovation?

For Lincoln Electric Company, innovation and technology are central to its growth strategy. The company strategically invests in research and development (R&D) to maintain a competitive edge, particularly in the welding industry. This focus enables the company to develop advanced products and solutions that meet evolving market demands.

The company's approach emphasizes digital transformation and automation, aiming to capitalize on emerging opportunities. This strategic direction supports the company's 'Higher Standard 2025' strategy, which aims to accelerate growth through solutions technology and the expansion of its automation footprint.

The company's dedication to sustainability is also integrated into its innovation strategy, reflecting a commitment to reducing its environmental footprint. This focus on sustainability, combined with technological advancements, positions Lincoln Electric Company for long-term success in a changing market.

Lincoln Electric prioritizes R&D to create differentiated products. This commitment is crucial for staying ahead in the competitive welding market. Sustained investment in R&D is a key element of the company's growth strategy.

The company actively pursues digital transformation and automation to enhance its offerings. Lincoln Electric projects its automation portfolio to reach $1 billion in sales by 2025. Automation sales grew significantly from $400 million in 2020 to $911 million in 2024.

Lincoln Electric is recognized for its expertise in materials science, software development, and automation engineering. This technological leadership is a key competitive advantage. The company's innovation extends to advanced arc welding solutions.

The 'Higher Standard 2025' strategy aims to accelerate growth through solutions technology. This strategy includes the expansion of its automation footprint. This strategic plan is central to Lincoln Electric's future prospects.

Lincoln Electric integrates sustainability initiatives into its innovation strategy. The company has goals for reducing greenhouse gas emissions, energy intensity, and water use. In 2024, the company was recognized on TIME's America's Best Mid-Size Companies list, partly due to its enhanced sustainability programming.

Lincoln Electric offers a range of products, including advanced arc welding solutions. The company also provides automated joining, assembly, and cutting systems. Its product portfolio includes plasma and oxy-fuel cutting equipment and brazing and soldering alloys.

Lincoln Electric strategically focuses on niche, high-tech products, such as robotic welding systems, to differentiate itself in the market. This focus requires sustained R&D investment. The company's commitment to innovation supports its strong market position.

- Automation is a key area of growth, with sales increasing significantly.

- The company is investing in digital transformation to improve its offerings.

- Sustainability initiatives are integrated into its innovation strategy.

- Lincoln Electric continues to leverage its technological leadership in the welding industry.

- For more insights, explore the Competitors Landscape of Lincoln Electric.

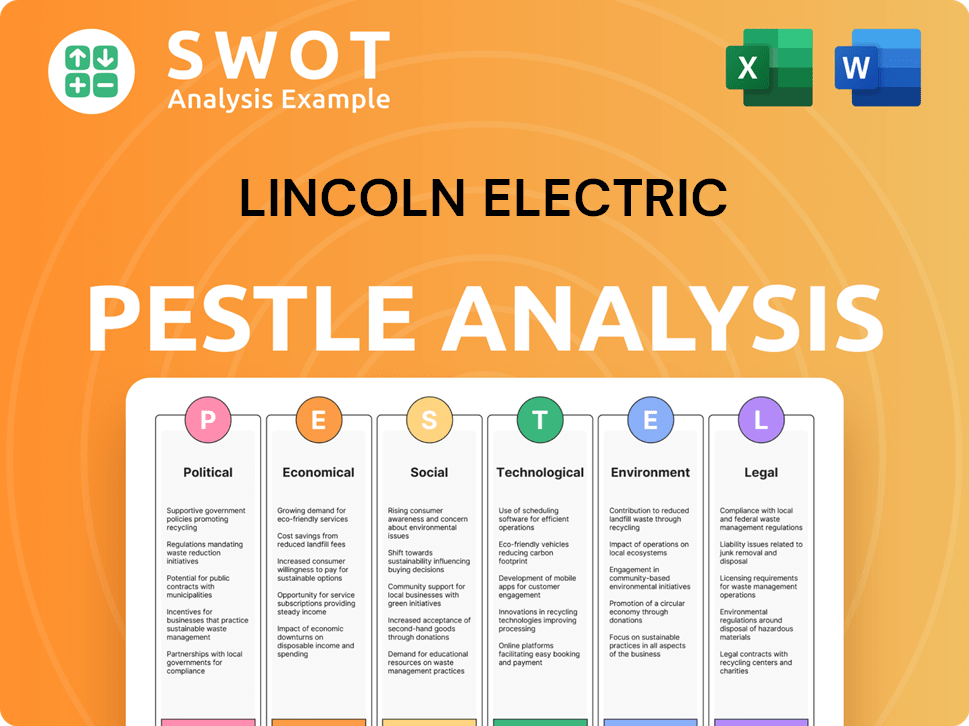

Lincoln Electric PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Lincoln Electric’s Growth Forecast?

The financial outlook for Lincoln Electric in 2025 anticipates continued growth, though it faces some market challenges. In the first quarter of 2025, the company's net sales reached $1,004.4 million, showing a 2.4% increase compared to the previous year. This growth was driven by acquisitions, which contributed 4.9%, but was slightly offset by a 1.2% decrease in organic sales and a 1.3% negative impact from foreign exchange rates.

Adjusted diluted earnings per share (EPS) for Q1 2025 were $2.16, a decrease from $2.23 in the same period last year. Despite this, the actual results surpassed analyst expectations, who had projected $2.22 for diluted EPS and $974.3 million in revenue for the quarter. This indicates the company's ability to navigate market fluctuations and maintain a strong financial position.

For the full year 2024, the company reported net sales of $4.0 billion and an adjusted EPS of $9.29. The adjusted operating income margin for 2024 was 17.6%. Looking forward to 2025, the company projects low single-digit sales growth, supported by positive pricing and acquisitions.

The company anticipates low single-digit sales growth in 2025. This growth is expected to be driven by positive pricing strategies and contributions from recent acquisitions. The company also expects a negative impact from foreign exchange rates.

By the end of 2025, the goal is to achieve an average adjusted operating margin of 16%. This represents a 200 basis point improvement compared to the previous cycle. The focus is on operational efficiency to enhance profitability.

The net profit margin is expected to increase from 12% in 2024 to 14% in 2025. This improvement will be achieved through enhanced operational efficiency and economies of scale. This will directly boost the company's profitability.

The company plans to increase share repurchases, allocating between $300 million and $400 million in 2025. This reflects confidence in the company's financial health and commitment to shareholder value.

Capital expenditures for 2025 are projected to be between $100 million and $120 million. These investments will focus on increasing capacity, improving operational effectiveness, and routine maintenance.

The company's strong cash flow generation, with Q1 2025 operating cash flow at a record $186 million and a 130% cash conversion ratio, supports its growth investments and shareholder returns. This financial strength allows for strategic investments.

The company's financial strategy for 2025 focuses on sustainable growth, operational improvements, and shareholder value. The company is focusing on key areas to ensure long-term success:

- Sales growth driven by pricing and acquisitions.

- Improved operating and net profit margins.

- Increased share repurchases to enhance shareholder value.

- Strategic capital expenditures for capacity and efficiency.

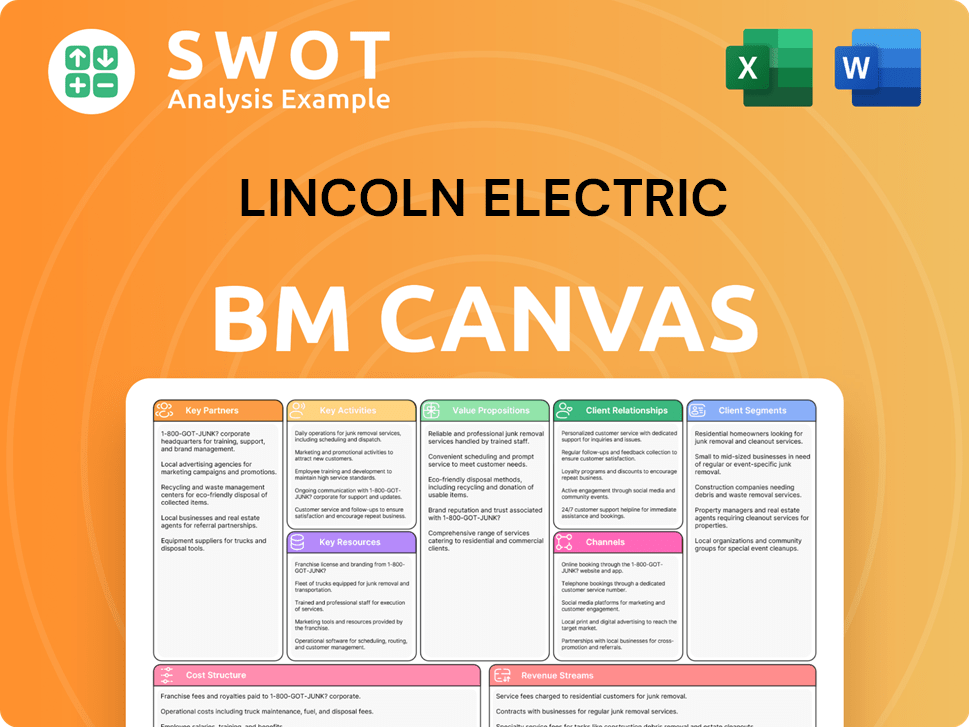

Lincoln Electric Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Lincoln Electric’s Growth?

The path forward for Lincoln Electric Company faces several potential hurdles. Macroeconomic factors, including economic downturns and supply chain disruptions, could affect the demand for its products. Additionally, geopolitical instability and changes in trade policies may pose challenges to the company's operations.

A highly competitive global market could squeeze profit margins, even though Lincoln Electric focuses on high-tech offerings like robotic welding systems. Operational risks, such as natural disasters and workforce issues, also add to the complexities. The company must navigate these challenges to maintain its growth trajectory.

The company's strong financial health, however, provides a degree of resilience. Lincoln Electric's ability to manage market risks, including currency fluctuations, is also a key factor. Despite the challenges, the company's focus on cost management and financial flexibility positions it to withstand market uncertainties.

Recessionary cycles and global supply chain disruptions can significantly impact demand for Lincoln Electric's products. Changes in raw material and logistics costs further complicate the situation. These factors can affect the company's ability to meet its financial goals.

The welding industry is intensely competitive, with rivals potentially undercutting pricing. While Lincoln Electric differentiates itself with high-tech products, sustained R&D investment is crucial. Maintaining a competitive edge requires constant innovation and efficiency.

Operational risks include disruptions from natural disasters, pandemics, and political unrest. Workforce challenges, such as maintaining a skilled labor force and integrating acquired businesses, also present obstacles. These risks can lead to production delays and increased costs.

Geopolitical conflicts, changes in trade policies, and tariffs can adversely affect business operations. Lincoln Electric's significant exposure to the U.S. market, accounting for approximately 60% of its sales, amplifies the risk associated with shifts in industrial demand due to government policies. These factors can affect international sales and profitability.

To maintain its competitive edge in high-tech welding products, Lincoln Electric must make sustained R&D investments. This can strain financial resources. Continuous innovation is critical to stay ahead of competitors and meet evolving customer demands.

Maintaining a skilled workforce and successfully integrating acquired businesses are key challenges. The company must ensure it has the talent and resources to support its growth plans. Effective integration of new businesses is essential for realizing synergies and achieving financial targets.

Lincoln Electric's aggressive cost management strategy aims to generate $40-50 million in annualized savings, with the full effect expected to materialize throughout 2025. These savings are designed to improve profitability and give the company financial flexibility. This strategy is crucial for navigating market fluctuations.

The company's strong financial position, shown by a moderate debt-to-capital ratio of 0.11 and a current ratio of 1.78, provides flexibility to handle market uncertainties. This financial strength enables the company to invest in growth and withstand economic downturns. The welding industry trends are also considered.

Lincoln Electric actively manages market risks, including foreign currency exchange rate fluctuations, through various financial instruments. This proactive approach helps protect the company's earnings and cash flow. Effective risk management is essential for sustained success.

The company's focus on high-tech products like robotic welding systems offers a degree of differentiation in the market. This strategy helps Lincoln Electric compete more effectively. For more in-depth analysis, explore the detailed analysis of Lincoln Electric Company.

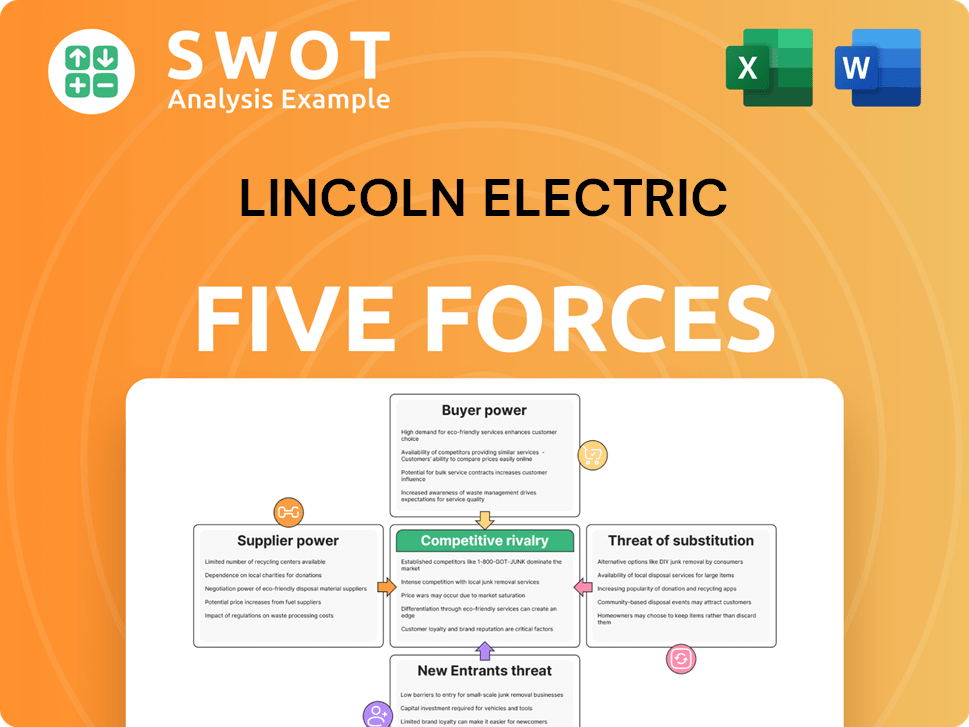

Lincoln Electric Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Lincoln Electric Company?

- What is Competitive Landscape of Lincoln Electric Company?

- How Does Lincoln Electric Company Work?

- What is Sales and Marketing Strategy of Lincoln Electric Company?

- What is Brief History of Lincoln Electric Company?

- Who Owns Lincoln Electric Company?

- What is Customer Demographics and Target Market of Lincoln Electric Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.