Lincoln Electric Bundle

How Does a Century-Old Welding Company Thrive?

Lincoln Electric, a global Lincoln Electric SWOT Analysis leader in the welding industry, has a legacy built on innovation and quality. This Welding Company is a critical supplier across diverse sectors, from automotive to energy. Understanding its operations is key for anyone interested in the dynamics of the global welding market and the Lincoln Electric Company's sustained success.

With its comprehensive portfolio of Welding Equipment, including arc welding power sources and consumables, Lincoln Electric has become a powerhouse. Its global footprint and continuous technological advancements highlight its role in shaping modern manufacturing. This analysis will explore the core operations, revenue streams, and strategic advantages that have cemented Lincoln Electric's competitive edge, providing insights into how it consistently delivers value in a dynamic market. Learn about Arc Welding and how this Manufacturing Company has evolved.

What Are the Key Operations Driving Lincoln Electric’s Success?

The core operations of the Welding Company focus on providing comprehensive welding, cutting, and joining solutions. This involves a diverse range of products, including arc welding power sources, wire feeding systems, and robotic welding packages. The company also offers welding consumables, such as electrodes and wires, catering to various industries like general fabrication and automotive.

Their value proposition centers around enhancing productivity, quality, and safety in welding applications. They achieve this through advanced manufacturing, rigorous quality control, and continuous research and development. The company's global supply chain and extensive distribution networks ensure efficient delivery of products worldwide.

The company's commitment to customer service, including technical support and training, helps customers optimize their welding processes. A key differentiator is the Lincoln Electric Incentive Management System, which aligns employee interests with company performance, fostering productivity and innovation.

The company offers a wide array of welding equipment, including arc welding machines, wire feeders, and robotic welding systems. They also provide consumables like electrodes, wires, and fluxes. These products serve various industries, from construction to automotive.

Their operational processes emphasize advanced manufacturing techniques and rigorous quality control. The company’s global supply chain ensures efficient sourcing and timely delivery. They also focus on continuous research and development to innovate new products.

Customer service is a priority, with technical support, training programs, and application engineering expertise available. They aim to help customers optimize their welding processes. This focus helps them maintain strong customer relationships.

The Lincoln Electric Company uses an Incentive Management System to align employee interests with company performance. This system fosters productivity and innovation. This approach contributes to their overall success.

The company’s focus on quality and efficiency translates into several key benefits for customers. These benefits include superior weld quality, increased operational efficiency, and enhanced worker safety. This helps the company maintain a competitive edge in the market.

- Superior Weld Quality: Products are designed to produce high-quality welds.

- Increased Operational Efficiency: Systems and processes are optimized for efficiency.

- Enhanced Worker Safety: Safety is a key consideration in product design and training.

- Comprehensive Solutions: Offering a wide range of products and services.

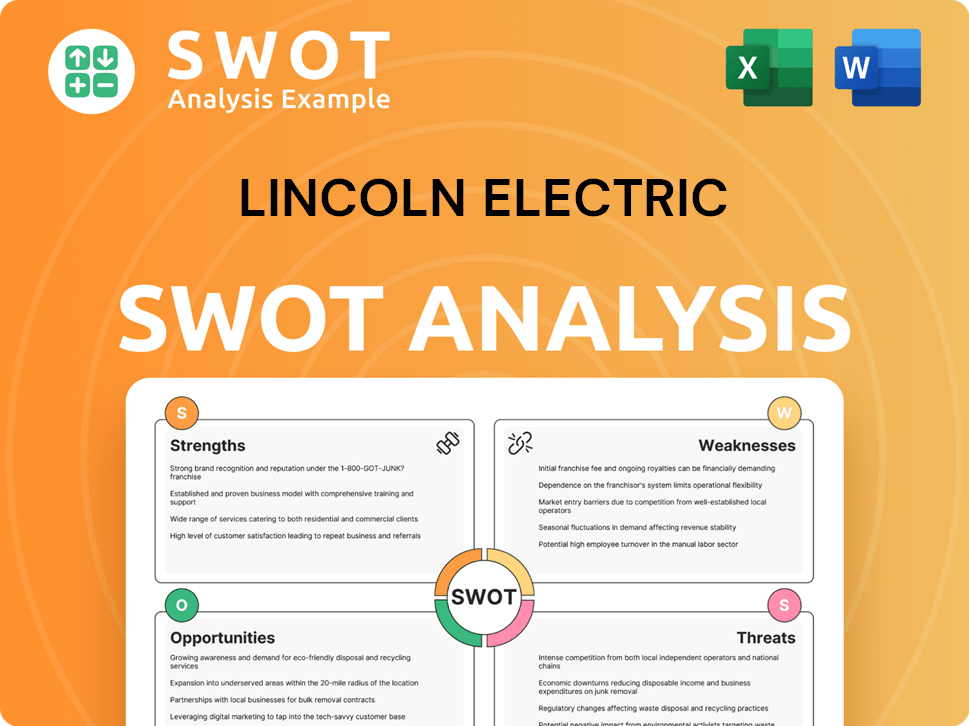

Lincoln Electric SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Lincoln Electric Make Money?

The primary revenue streams for the Lincoln Electric Company stem from its comprehensive offerings in welding, cutting, and joining solutions. These include the sale of welding consumables, welding equipment, and advanced automation solutions. In 2023, the company demonstrated its strong market position with total sales reaching $4.18 billion, reflecting a 3.3% increase compared to the previous year, underscoring its sustained growth and market resilience.

A significant portion of revenue is generated from consumables like electrodes and wires, which provide a recurring revenue stream. Equipment sales, including arc welding power sources, are also a major contributor. The company's strategic focus on automation solutions, such as robotic welding packages, reflects its adaptation to the evolving manufacturing landscape.

Services, including technical support and training, also contribute to the revenue mix. The company employs various monetization strategies, including tiered pricing and cross-selling opportunities, to cater to diverse customer needs.

The revenue streams are diversified, ensuring stability and growth. The company's global presence allows it to spread its revenue across different regions, reducing risks associated with economic fluctuations. The shift towards higher-margin automation solutions is a key strategic move.

- Welding Consumables: These include electrodes, wires, and fluxes, which are essential for ongoing welding operations, ensuring a steady stream of revenue.

- Welding Equipment: This segment encompasses arc welding power sources, wire feeding systems, and fume extraction units, catering to a wide range of welding needs.

- Automation Solutions: Robotic welding packages and other automation technologies are becoming increasingly important, reflecting the industry's shift towards automated manufacturing.

- Services: Technical support, training programs, and equipment maintenance services provide additional revenue streams and enhance customer relationships.

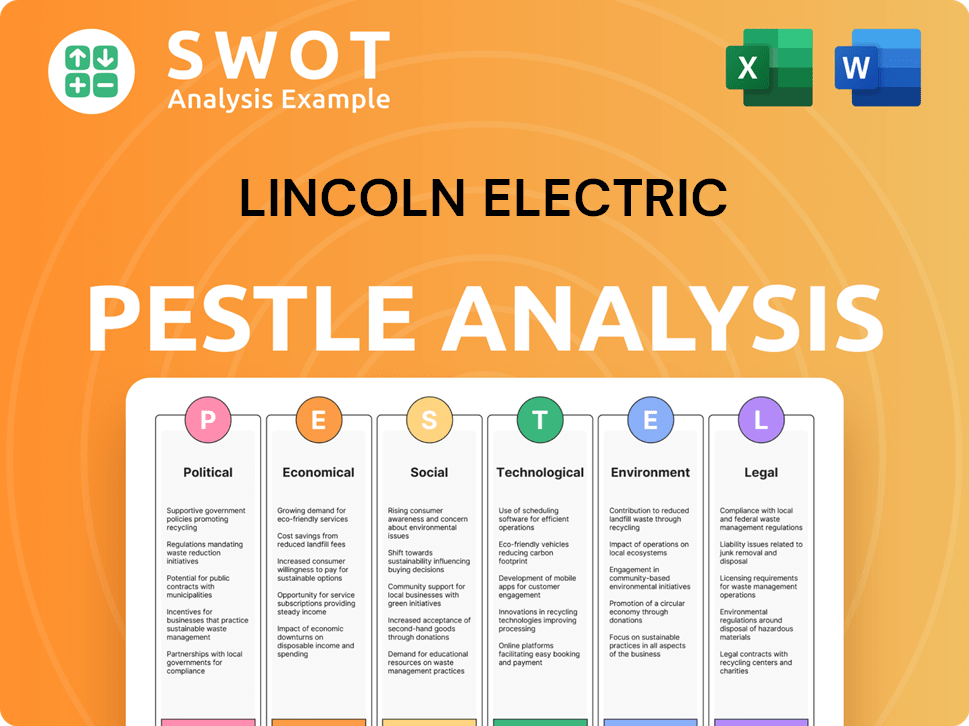

Lincoln Electric PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Lincoln Electric’s Business Model?

The operational and financial success of the Lincoln Electric Company has been shaped by key milestones and strategic decisions. A key element of its history is the consistent use of its Incentive Management System, which has promoted a culture of productivity and innovation. This has significantly contributed to its long-term success in the welding equipment market. The company's focus on research and development has led to groundbreaking welding technologies, setting industry standards.

The company has adapted to market changes, including supply chain disruptions and economic downturns, by leveraging its global manufacturing and distribution network. Its ability to adapt to new trends, such as the increasing demand for automation and sustainable manufacturing practices, has been a cornerstone of its strategy. This flexibility has been crucial for maintaining its competitive edge in the welding industry.

The company's competitive advantages are multifaceted, stemming from its strong brand recognition, technological leadership, and global reach. Its proprietary manufacturing processes and deep expertise in welding science provide a significant barrier to entry for competitors. Furthermore, economies of scale in production and distribution allow the company to maintain cost efficiencies. The company continues to adapt to new trends by focusing on digital transformation, expanding its automation portfolio, and investing in additive manufacturing technologies, ensuring its continued relevance and competitive edge in the evolving industrial landscape.

The company's history is marked by significant technological advancements in the welding equipment sector. The development of advanced robotic welding systems and digital welding solutions has been crucial in adapting to evolving manufacturing demands. These innovations have helped the company maintain its leadership position in the arc welding market.

The company has strategically expanded its global footprint to serve diverse markets. Investment in digital transformation and automation has been a key strategic focus. These moves have improved operational efficiency and broadened its product offerings, including various types of welding processes.

The company's competitive edge is rooted in its strong brand reputation and technological leadership. Its proprietary manufacturing processes and expertise in welding science create barriers to entry. Economies of scale in production and distribution allow it to maintain cost efficiencies, making it a formidable player in the manufacturing company sector.

The company is focusing on digital transformation, expanding its automation portfolio, and investing in additive manufacturing. These initiatives ensure its continued relevance and competitive edge in the evolving industrial landscape. The company's commitment to innovation is evident in its product catalog and ongoing research.

In recent years, the company has demonstrated strong financial performance. Its market position remains robust due to its diversified product offerings and global presence. As of 2024, the company's revenue was approximately $3.9 billion, reflecting its strong market position and operational efficiency. The company's focus on innovation and customer service continues to drive its success in the welding equipment market.

- Revenue: Approximately $3.9 billion (2024).

- Global Presence: Operations in multiple countries, ensuring diversified revenue streams.

- Market Leadership: Strong brand recognition and technological leadership in the welding industry.

- Strategic Investments: Continued investment in R&D and digital transformation.

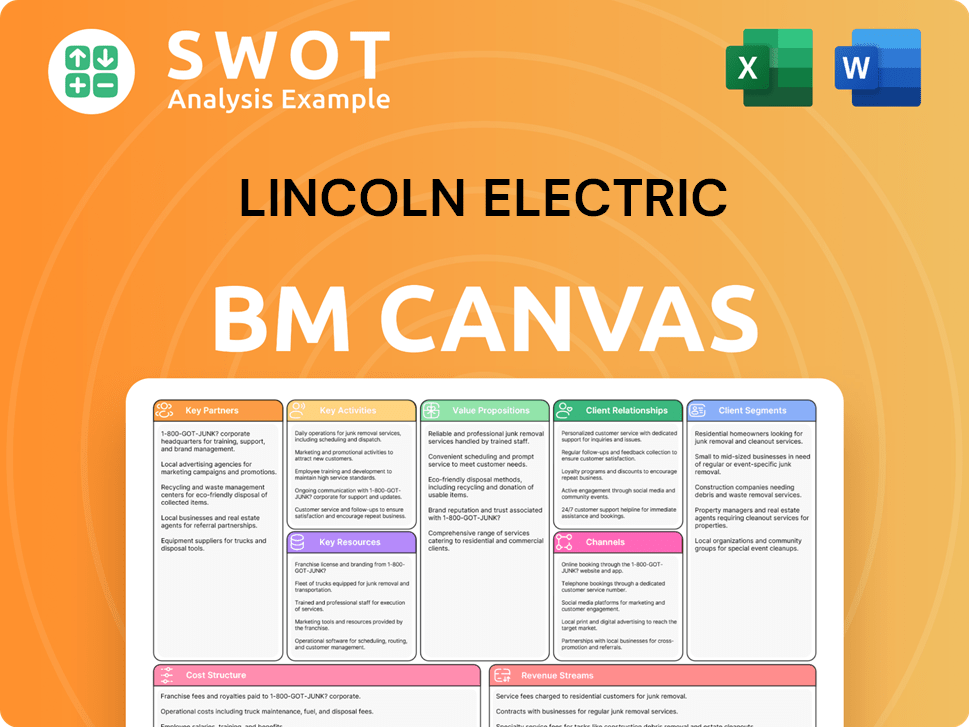

Lincoln Electric Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Lincoln Electric Positioning Itself for Continued Success?

The Lincoln Electric Company, a leading welding company, holds a strong position in the global welding, cutting, and joining industry. This position is characterized by its substantial market share, a loyal customer base, and a wide global reach. The company's comprehensive product portfolio, technological innovation, and established distribution channels give it a significant competitive edge. Its strong customer relationships, built on decades of reliable performance and service, further solidify its market standing.

However, the Lincoln Electric Company faces various risks, including economic downturns impacting industrial production, fluctuations in raw material costs, and intense competition from established players and new entrants. Regulatory changes and technological disruptions also pose challenges. To mitigate these risks, the company actively invests in automation, digital solutions, and sustainable manufacturing practices. Strategic acquisitions and a focus on customer-centric innovation are also key.

The Lincoln Electric Company is a global leader in the welding industry, known for its high-quality welding equipment and consumables. It competes with both domestic and international players. The company's brand reputation and extensive distribution network provide a solid foundation for its market presence.

Key risks include economic cycles affecting industrial output, raw material cost volatility, and intense competition. Technological advancements and regulatory changes also present challenges. The company must adapt to maintain its competitive edge, as discussed in Competitors Landscape of Lincoln Electric.

The company focuses on automation, digital solutions, and emerging markets for growth. Innovation in welding technology and expanding service offerings are also key. Strategic acquisitions and operational excellence are crucial for sustaining its leadership.

In 2024, Lincoln Electric reported net sales of approximately $4.1 billion. The company's commitment to innovation and operational efficiency continues to drive profitability. The company's focus on expanding its service offerings contributes to its revenue growth.

To address risks and drive growth, Lincoln Electric focuses on several strategic initiatives.

- Investing in automation and digital solutions to improve efficiency.

- Expanding into emerging markets to capture new opportunities.

- Focusing on sustainable manufacturing practices to meet environmental standards.

- Developing next-generation welding technologies and expanding service offerings.

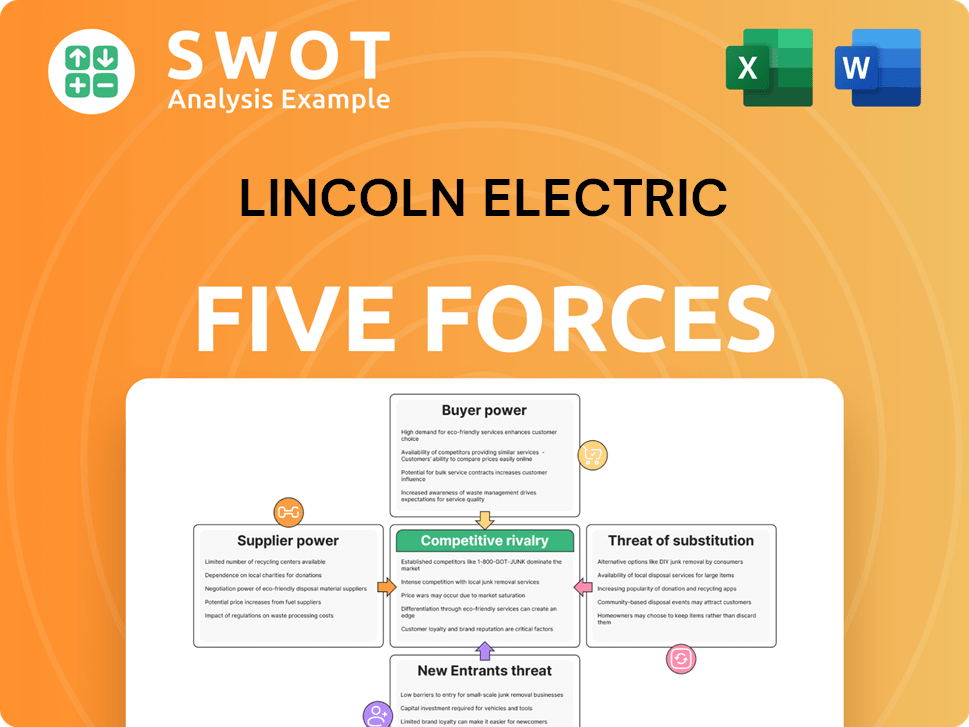

Lincoln Electric Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Lincoln Electric Company?

- What is Competitive Landscape of Lincoln Electric Company?

- What is Growth Strategy and Future Prospects of Lincoln Electric Company?

- What is Sales and Marketing Strategy of Lincoln Electric Company?

- What is Brief History of Lincoln Electric Company?

- Who Owns Lincoln Electric Company?

- What is Customer Demographics and Target Market of Lincoln Electric Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.