New World Development Bundle

Can New World Development Thrive in Today's Market?

New World Development (NWD), a Hong Kong heavyweight since 1970, faces a dynamic and demanding competitive landscape. This analysis dives deep into NWD's position, examining its rivals and the strategies it employs to stay ahead. With a focus on the evolving real estate market and the challenges in Greater China, understanding NWD's competitive edge is crucial.

From property development to infrastructure, NWD's diversified portfolio is under constant pressure. This report provides a comprehensive competitive analysis of New World Development, exploring its market share, financial performance, and future prospects. To gain a deeper understanding, consider exploring a detailed New World Development SWOT Analysis to uncover key insights into NWD's strengths, weaknesses, opportunities, and threats within the Hong Kong companies landscape.

Where Does New World Development’ Stand in the Current Market?

New World Development (NWD) holds a significant market position within the property and infrastructure sectors, primarily in Hong Kong and mainland China. Its core operations center on property development and investment, encompassing a diverse portfolio of residential, commercial, and retail properties. The company also has a substantial presence in the hospitality sector, operating hotels and residences across multiple regions.

As of December 31, 2024, NWD reported consolidated revenues of HK$16,789 million, demonstrating its substantial scale. The company's focus extends to the real estate market, with a strategic emphasis on expanding its footprint in mainland China, as evidenced by recent sales figures and future targets. The company's ability to generate sales and adapt to market dynamics is critical for sustaining its market position.

NWD's property development portfolio in Hong Kong comprised 33 projects as of June 30, 2024, with a total gross floor area (GFA) of approximately 24.9 million sq ft. The company also operates 20 hotels and residences across Hong Kong, mainland China, and Southeast Asia as of June 30, 2024, providing 7,661 guest rooms. These assets highlight NWD's extensive presence in key markets.

In the first quarter of 2025, NWD's residential sales in mainland China exceeded RMB2.1 billion, reflecting a year-on-year increase of over 52%. The company has set a revised annual contracted sales target for mainland China of RMB14 billion, with over 95% of this target met as of May 26, 2025. The company's financial performance has been impacted by non-cash impairment losses.

Despite successes, such as 'THE PAVILIA FOREST' in Kai Tak generating approximately HK$4 billion in contracted sales as of May 29, 2025, NWD reported a loss attributable to shareholders in the range of HK$6.6 billion to HK$6.8 billion for the six months ending December 2024. This loss contrasts with a profit of HK$502 million in the same period a year earlier. The company's net debt-to-equity ratio of 92% in mid-2024 indicates a leveraged position.

- The company's performance is influenced by economic trends.

- NWD's focus on mainland China sales reflects a strategic shift.

- Financial health is a key factor.

- The company's market position is impacted by its ability to adapt.

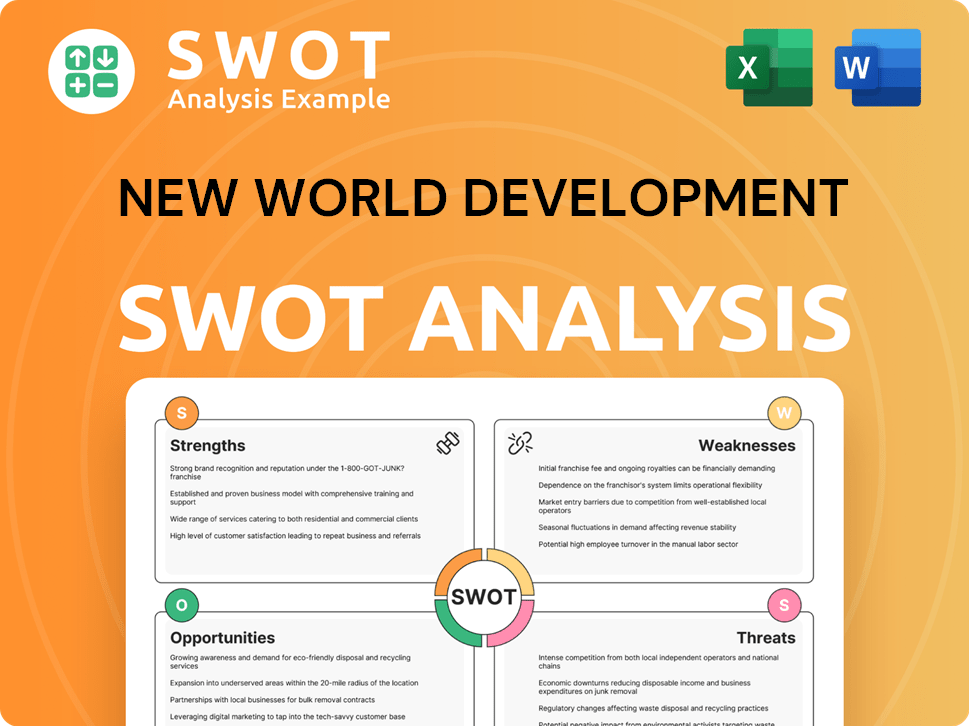

New World Development SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging New World Development?

The Competitive landscape for New World Development (NWD) is shaped by intense competition in the property development sectors of Hong Kong and mainland China. NWD faces both direct and indirect rivals, making strategic positioning and adaptability crucial for sustained success. Understanding the competitive dynamics is essential for investors and stakeholders assessing NWD's market position and future prospects.

The real estate market in these regions is highly fragmented, with numerous players vying for market share. Economic trends, government policies, and shifts in consumer preferences significantly influence the competitive environment. NWD's ability to navigate these complexities and differentiate itself through its property portfolio, investment strategy, and sustainability initiatives will be key to its performance.

NWD operates within a dynamic environment where market share and competitive advantages are constantly evolving. Analyzing the key competitors provides insights into the challenges and opportunities NWD faces, helping to understand its strategic responses and potential for growth.

Key direct competitors in Hong Kong's property market include major developers. These companies compete for market share in residential and commercial property development.

Sun Hung Kai Properties (SHKP), CK Asset Holdings, and Henderson Land Development Co Ltd are dominant players. These developers are projected to deliver 60% of new residential units in Hong Kong in 2025 and 2026.

Other significant competitors include China Resources, Jardine Matheson, Hang Lung Group, and Kerry Properties. These companies also compete for market share in the Hong Kong property market.

Competitors employ various strategies, such as focusing on smaller flats to meet demand. Mainland Chinese developers and smaller local players have reduced land acquisitions, concentrating supply among major Hong Kong developers.

In the commercial property sector, new completions and high vacancy rates intensify competition. The overall vacancy rate for Grade A office space in 2024 was 13.1%, highlighting the challenges faced by developers.

Mergers and alliances can shift competitive dynamics. NWD's collaborations with state-owned enterprises for residential projects in the Northern Metropolis exemplify this trend.

Several factors influence the competitive landscape for NWD. These include market share, financial performance, and strategic initiatives. Understanding these factors is crucial for evaluating NWD's position in the market and its ability to compete effectively.

- Market Share: The percentage of the market that a company controls.

- Financial Performance: Revenue, profitability, and return on investment.

- Strategic Initiatives: New projects, partnerships, and sustainability efforts.

- Economic Trends: Impact of economic cycles and government policies.

- Consumer Preferences: Demand for different types of properties.

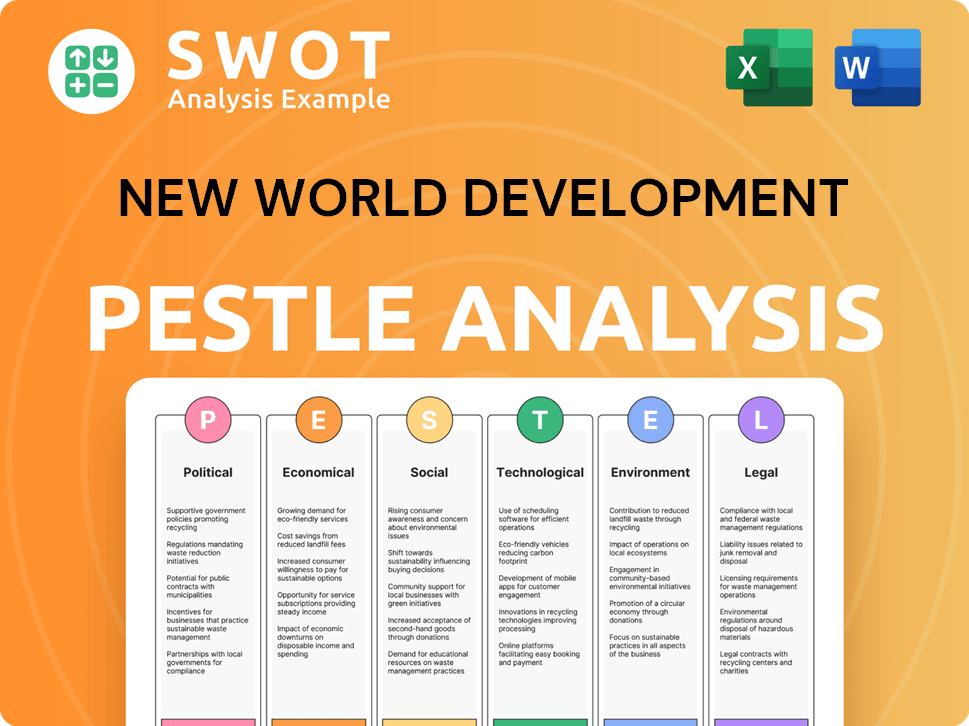

New World Development PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives New World Development a Competitive Edge Over Its Rivals?

Analyzing the competitive landscape of New World Development (NWD) reveals several key advantages. NWD's robust brand equity and extensive property portfolio, particularly in Hong Kong and mainland China, form a strong foundation. The company's commitment to its 'Artisanal Movement' philosophy further differentiates its offerings, aiming for unique and high-quality lifestyle experiences.

NWD's strategic focus on a 'dual-engine drive' model, combining property development and operation, supports its long-term growth strategy. The company's ability to achieve significant sales, such as the 'DEEP WATER PAVILIA' project, demonstrates strong brand recognition. Strategic partnerships, including collaborations with central and state-owned enterprises, also play a crucial role in expanding its market presence.

However, NWD faces challenges, including the impact of rising borrowing costs and the property market downturn. The sustainability of its debt-fueled expansion is under scrutiny. This competitive analysis highlights the strengths and weaknesses of NWD within the real estate market.

NWD benefits from its established brand reputation and a substantial portfolio of properties. This includes prime locations across Hong Kong and mainland China. The company's presence in the Greater Bay Area is particularly significant, contributing to its market position.

The 'Artisanal Movement' differentiates NWD by integrating culture, creativity, sustainability, and social innovation. This approach aims to create unique lifestyle experiences. Projects like K11 MUSEA exemplify this strategy, redefining retail and cultural spaces.

NWD's 'dual-engine drive' model, focusing on property development and operation, supports its growth strategy. This model is coupled with optimism about consumer markets in Hong Kong and mainland China. The company's strategic approach aims to achieve long-term success.

NWD actively engages in strategic partnerships, including collaborations with central and state-owned enterprises. These partnerships facilitate projects like those in the Northern Metropolis. They help unlock value from land reserves and provide new growth opportunities.

Despite its strengths, NWD faces challenges. Rising borrowing costs and the property market downturn pose risks to its financial performance. The sustainability of its debt-fueled expansion is a key concern.

- Market Volatility: Economic fluctuations impact NWD's financial results.

- Debt Levels: High debt levels increase financial risk.

- Competition: Intense competition from other Hong Kong companies.

- Regulatory Changes: Changes in regulations can affect project development.

For more insights into the financial aspects of NWD, including ownership and shareholder information, you can refer to this article: Owners & Shareholders of New World Development.

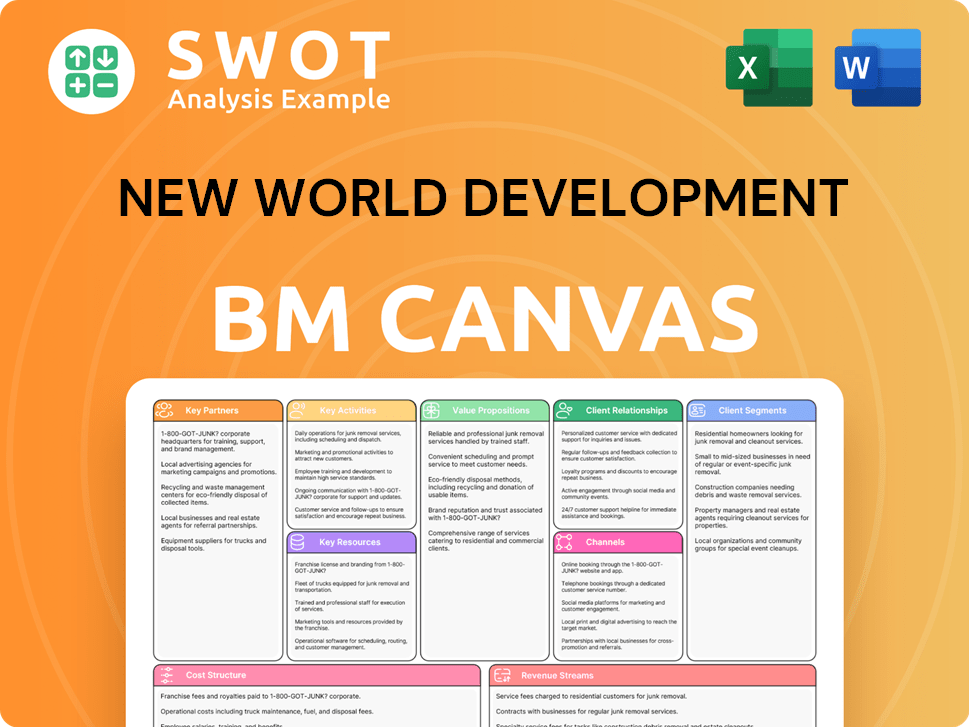

New World Development Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping New World Development’s Competitive Landscape?

The competitive landscape for New World Development (NWD) is heavily influenced by the dynamics of the real estate market. Hong Kong's property sector faces significant headwinds, with residential prices decreasing and office rents expected to decline. These trends, combined with economic uncertainties, shape NWD's strategic priorities and operational performance.

The future outlook for NWD involves navigating these challenges while capitalizing on opportunities in mainland China and through strategic initiatives. The company's financial health, particularly its debt levels, is a critical factor, influencing its ability to invest in new projects and sustain growth. Understanding these aspects is vital for assessing NWD's competitive position and potential for long-term success.

The Hong Kong real estate market is experiencing a downturn, with residential property prices falling. Grade A office rents are projected to decrease by 5-10% in 2025. Oversupply and economic uncertainties are significant factors impacting the market.

NWD faces challenges, including a high debt load, with a net debt-to-equity ratio of 92% in mid-2024. The company reported losses attributable to shareholders for the six months ending December 2024. Economic conditions and potential policy changes pose additional risks.

Opportunities exist in the recovering mainland China property market, where NWD's residential sales increased significantly. The company is expanding its rental income base through new projects. Strategic partnerships offer potential for long-term growth.

NWD aims to expand its rental income base through new rental properties like K11 ECOAST in Shenzhen. The company is focused on sustainable development and its 'Artisanal Movement' to attract consumers. Further insights can be found in the Growth Strategy of New World Development.

NWD's financial performance is influenced by market conditions and strategic initiatives. The company's debt levels and sales figures in mainland China are key indicators.

- Residential property prices in Hong Kong fell by 7.76% year-on-year in Q1 2025.

- Overall rents for Grade A offices are projected to decline by 5-10% in 2025.

- NWD's residential sales in mainland China exceeded RMB2.1 billion in Q1 2025, a 52% year-on-year increase.

- The company has raised its annual contracted sales target for mainland China to RMB14 billion.

New World Development Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of New World Development Company?

- What is Growth Strategy and Future Prospects of New World Development Company?

- How Does New World Development Company Work?

- What is Sales and Marketing Strategy of New World Development Company?

- What is Brief History of New World Development Company?

- Who Owns New World Development Company?

- What is Customer Demographics and Target Market of New World Development Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.