New World Development Bundle

Can New World Development Conquer Tomorrow's Markets?

New World Development, a Hong Kong powerhouse, has long been a bellwether for the real estate and infrastructure sectors. Founded in 1970, the company's journey reflects the critical importance of a well-defined New World Development SWOT Analysis and a forward-thinking Growth Strategy. From its early days in Real estate development, New World Development has strategically expanded its Investment portfolio and market reach.

This article dives deep into the Future Prospects of New World Development, examining its expansion plans and innovative approaches. We'll dissect how this major player in the Hong Kong market is navigating challenges and seizing opportunities. Get ready to explore the company's financial performance, sustainability initiatives, and strategic adaptations to stay ahead in a dynamic landscape, providing actionable insights for investors and strategists alike.

How Is New World Development Expanding Its Reach?

New World Development's Growth Strategy is centered on expanding its market presence and diversifying its revenue streams. The company focuses on strategic geographical expansion, particularly within mainland China. This includes developing large-scale integrated projects in major cities to capitalize on urbanization and a growing middle class.

The company is also broadening its product and service offerings. This involves introducing new residential concepts and pursuing mergers and acquisitions to strengthen its core businesses. Investments in healthcare and telecommunications are part of a strategy to expand its ecosystem and reach new customer segments. New World Development aims to increase its recurring income streams significantly by 2026.

The Future Prospects for New World Development involve continued investment in infrastructure and services, including roads, ports, and logistics. This is aimed at creating integrated urban solutions. The company's expansion plans also consider international markets, although specific details depend on market conditions and strategic partnerships.

New World Development is actively targeting mainland China for expansion, focusing on first and second-tier cities. This strategy aims to leverage urbanization trends and the rising middle class. The company is developing integrated commercial and residential projects to capitalize on these opportunities.

The company is expanding its offerings through new residential concepts like 'Artisanal Living'. Mergers and acquisitions are also used to strengthen core businesses and enter synergistic sectors. Investments in healthcare and telecommunications are part of the diversification strategy.

New World Development continues to invest in infrastructure, including roads, ports, and logistics. This investment aims to create integrated urban solutions. The company is focused on enhancing its recurring income streams.

The company has set a target to significantly increase its recurring income by 2026. This financial goal reflects the strategic shift towards more stable and predictable revenue sources. This is a key component of its long-term growth strategy.

New World Development's expansion plans are designed to navigate the dynamic Hong Kong market and beyond. The company is adapting to market changes through strategic investments and diversification. The company's approach to real estate development involves integrating art, culture, and sustainability into its projects, creating unique value propositions. This approach, combined with its strategic financial planning, positions the company for sustained growth and resilience.

New World Development's expansion strategy includes geographical diversification, particularly in mainland China. The company is focused on developing integrated projects and expanding its service offerings. These initiatives are designed to enhance its investment portfolio and secure its future prospects.

- Geographical Expansion: Focus on mainland China, targeting first and second-tier cities.

- Product Diversification: Launching new residential concepts and pursuing mergers and acquisitions.

- Infrastructure Investment: Continued investment in roads, ports, and logistics.

- Financial Targets: Aiming for a significant increase in recurring income by 2026.

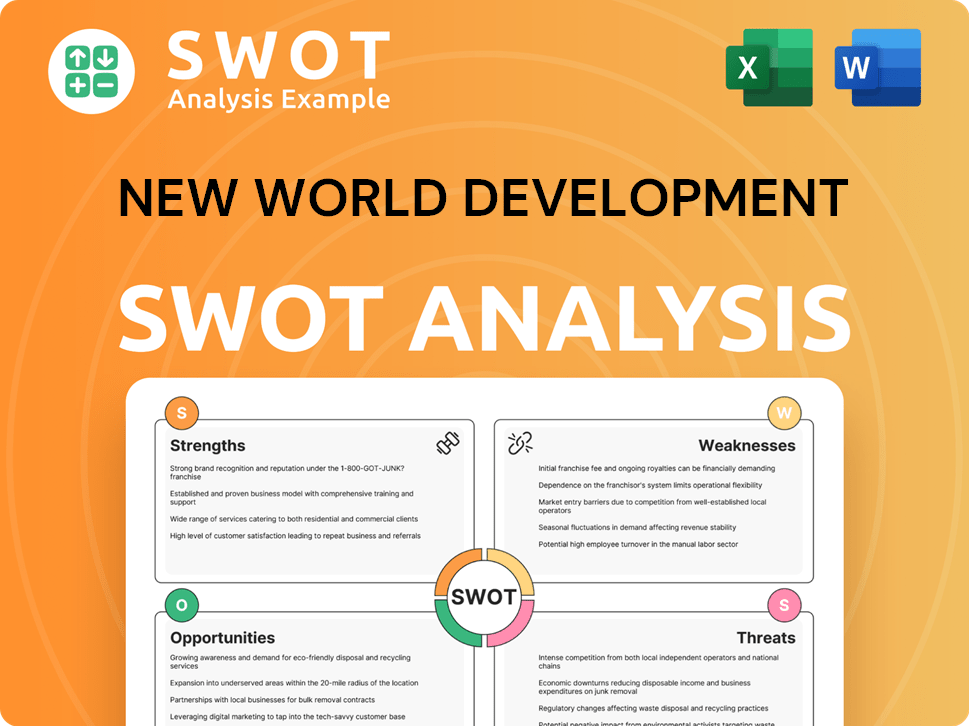

New World Development SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does New World Development Invest in Innovation?

The company's Growth Strategy centers on leveraging technology and innovation to enhance its operations and create value. This approach involves significant investments in research and development, particularly in areas like smart building technologies and digital transformation. The aim is to optimize efficiency, improve customer experience, and promote sustainability across its diverse portfolio of projects.

Digital transformation is a key focus, with the company utilizing mobile applications and online services to streamline property sales, leasing, and facility management. Furthermore, the company is exploring the application of artificial intelligence (AI) for predictive maintenance and personalized services. Sustainability is also a core component, with ambitious targets for reducing carbon emissions and promoting circular economy principles.

The company's commitment to innovation extends to its 'Artisanal Movement,' which blends craftsmanship with modern technology to create unique and culturally rich developments. This approach helps differentiate it in the competitive Hong Kong market.

The company integrates smart building technologies, including IoT solutions and data analytics, to optimize operational efficiency. These technologies enhance energy management, security, and overall building performance.

Digital transformation is evident in customer-facing platforms, streamlining property sales, leasing, and facility management. Mobile applications and online services are used to improve customer experience.

The company explores AI applications for predictive maintenance and personalized services. AI helps improve operational efficiency and enhance customer satisfaction.

Sustainability is deeply integrated, with a focus on green building certifications, energy-efficient designs, and renewable materials. The company has set ambitious sustainability targets.

The 'Artisanal Movement' blends craftsmanship with modern technology to create unique developments. This approach differentiates the company in the market.

The company invests in research and development, often through collaborations with external innovators. This investment supports the adoption of new technologies and innovative solutions.

The company's Future Prospects are closely tied to its ability to integrate these innovative strategies effectively. By focusing on smart technologies, digital platforms, and sustainable practices, the company aims to enhance its Real estate development projects and maintain a competitive edge in the Hong Kong market. For more insights into the company's structure, consider reading about Owners & Shareholders of New World Development.

The company's Growth Strategy involves several key initiatives designed to drive innovation and enhance its market position. These include:

- Implementing smart building technologies to improve efficiency and sustainability.

- Enhancing customer experience through digital platforms and AI-driven services.

- Focusing on sustainability initiatives, including green building certifications and emission reduction targets.

- Investing in research and development to explore new technologies and innovative solutions.

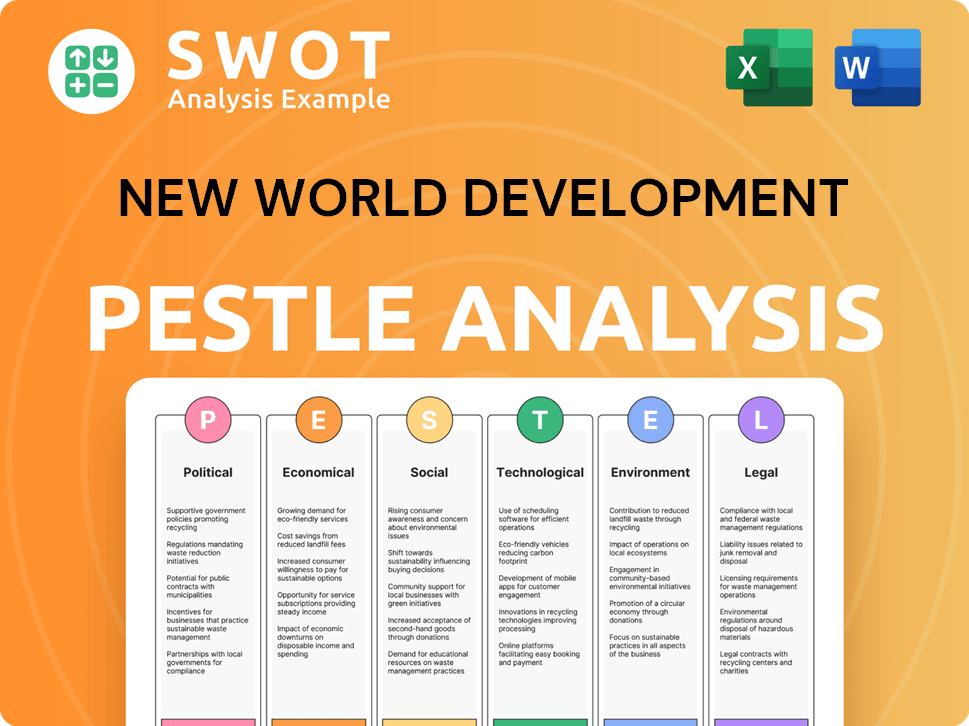

New World Development PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is New World Development’s Growth Forecast?

The financial outlook for New World Development (NWD) is shaped by its strategic growth ambitions, with projections indicating continued revenue growth. The company's focus on increasing recurring income streams is designed to enhance financial stability and reduce reliance on property sales. For the fiscal year ending December 31, 2023, NWD reported a core profit of HK$4.86 billion (approximately US$621 million), demonstrating resilience amidst market challenges.

NWD aims to significantly increase the contribution of recurring income to its overall profit, targeting around 50% by 2026. Investment levels remain robust, particularly in mainland China development projects and strategic diversification into new sectors like healthcare. Analysts generally forecast steady revenue growth for NWD in the coming years, driven by its diversified portfolio and expansion initiatives.

NWD maintains a healthy financial position, managing its debt levels and ensuring sufficient capital for future investments. Its financial strategy includes leveraging its asset base and exploring various funding avenues to support long-term growth objectives. The company's net gearing ratio was reported at 49.9% as of December 31, 2023, considered manageable within the industry. For more detailed insights into their target market, consider reading about the Target Market of New World Development.

NWD's revenue growth is anticipated to be steady, supported by its diverse investment portfolio and expansion plans. The company's strategic initiatives are designed to capitalize on market opportunities and drive sustainable financial performance. This growth is expected to be fueled by both property sales and increasing contributions from recurring income streams.

NWD aims to maintain stable profit margins through efficient operations and strategic investments. The focus on recurring income, such as rental income from investment properties and services, is critical for enhancing profitability. The company's ability to manage costs and adapt to market changes will be key to sustaining its profitability.

A key element of NWD's financial strategy is to increase recurring income. The target of approximately 50% of overall profit by 2026 indicates a strong commitment to this strategy. This shift towards more stable and predictable income streams is intended to reduce the volatility associated with property sales.

NWD continues to make significant investments in its development projects, particularly in mainland China. Prudent capital management, including managing debt levels and exploring funding avenues, is essential for supporting these investments. The company's financial position is considered healthy, with a manageable net gearing ratio.

Several key financial metrics highlight NWD's performance and future prospects. These include revenue growth, core profit, and the contribution of recurring income.

- Core profit for the year ending December 31, 2023, was approximately US$621 million (HK$4.86 billion).

- The company aims for recurring income to contribute around 50% of total profit by 2026.

- Net gearing ratio as of December 31, 2023, was 49.9%.

- Steady revenue growth is projected, supported by a diversified investment portfolio.

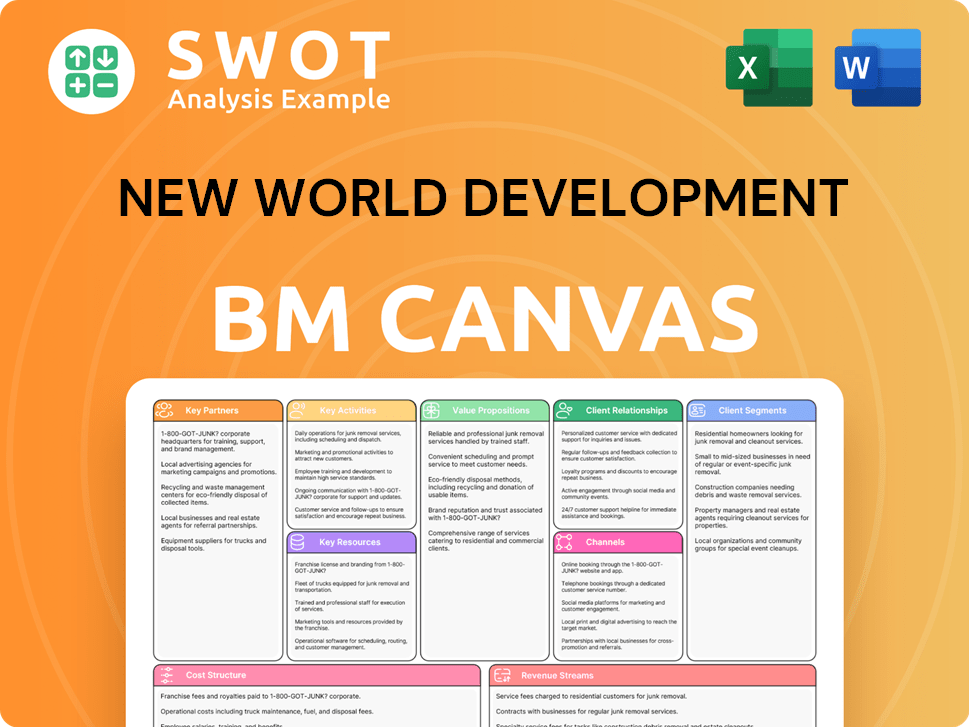

New World Development Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow New World Development’s Growth?

The Growth Strategy of New World Development faces several potential risks and obstacles. These challenges include market competition, regulatory changes, and supply chain vulnerabilities. Understanding these risks is crucial for assessing the company's Future Prospects and long-term success.

Market dynamics, particularly in the highly competitive Hong Kong and mainland China property markets, pose a continuous challenge. Regulatory changes, especially in the real estate sector, can also introduce uncertainty. The company has demonstrated resilience in overcoming past obstacles, such as navigating economic downturns and adapting to evolving consumer preferences.

Supply chain vulnerabilities and technological disruption, while presenting opportunities, also pose risks. Internal resource constraints, such as attracting and retaining top talent, could hinder project execution and innovation. Diversification, robust risk management, and scenario planning are key strategies for mitigating these risks.

Intense competition in the Hong Kong market can lead to pricing pressures. This can impact sales volumes and profit margins for New World Development's Real estate development projects. Competitors' strategies and market positioning must be closely monitored.

Governments in Hong Kong and mainland China frequently implement new policies related to property cooling measures and land supply. These changes can affect the company's development timelines and profitability. Understanding and adapting to these regulations is crucial.

Fluctuations in material prices or labor availability can impact construction costs and project timelines. Although less of a factor compared to other sectors, it is still a risk. Effective supply chain management is essential for mitigating these risks.

Failure to adapt to new construction methods or digital trends could pose a risk. Embracing technological advancements can improve efficiency and reduce costs. Staying updated with technological advancements is crucial.

Attracting and retaining top talent in a competitive environment can hinder project execution and innovation. Investing in employee development and creating a positive work environment is vital. This directly impacts the Investment portfolio.

Economic downturns can negatively impact the Hong Kong market and property values. New World Development needs to be prepared to adjust project pipelines and investment strategies. A diversified portfolio can help mitigate these risks.

New World Development mitigates risks through diversification across geographies and business segments. The company employs robust risk management frameworks and uses scenario planning to anticipate potential market shifts. Furthermore, the company has shown resilience in the face of previous challenges.

The company has successfully navigated economic downturns and adapted to evolving consumer preferences. In the past, they have strategically adjusted project pipelines and investment strategies. For example, during the 2008 financial crisis, New World Development adjusted its project timelines to align with market demand.

The ability to adapt and innovate will be key for New World Development's future success. Understanding the challenges and implementing effective strategies will be crucial for maintaining its market position. For further insights, explore the Revenue Streams & Business Model of New World Development.

Strategic adjustments to project pipelines and investment strategies are essential. The company must continuously assess market conditions and consumer preferences. This approach ensures that the company remains competitive and adaptable.

New World Development Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of New World Development Company?

- What is Competitive Landscape of New World Development Company?

- How Does New World Development Company Work?

- What is Sales and Marketing Strategy of New World Development Company?

- What is Brief History of New World Development Company?

- Who Owns New World Development Company?

- What is Customer Demographics and Target Market of New World Development Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.