New World Development Bundle

How Does New World Development Thrive in Asia's Dynamic Markets?

New World Development (NWD) is a powerhouse, dominating Hong Kong and Mainland China's real estate and infrastructure landscapes. Their recent success, like the rapid sales of 'DEEP WATER PAVILIA,' showcases their ability to capture the ultra-luxury market. Understanding New World Development SWOT Analysis is key to unlocking the secrets behind their enduring influence.

This deep dive into New World Development operations explores how this major player in real estate development generates revenue and adapts to market shifts. We'll unpack NWD Company's diverse portfolio, from property investment to infrastructure projects, and analyze their financial performance. Discover how they navigate challenges and what their future plans entail within the competitive Hong Kong developers market.

What Are the Key Operations Driving New World Development’s Success?

New World Development (NWD) creates value through a diversified operational model. Their core business areas include property development, property investment, infrastructure, and services, positioning them as a key player in the real estate and infrastructure sectors. This multi-faceted approach allows NWD to capture opportunities across various market segments, primarily in Hong Kong and Mainland China.

The company's operations span a wide range of activities. In property development, NWD focuses on residential, commercial, and retail projects. Property investment involves managing leased properties, including shopping malls and serviced apartments. Infrastructure investments cover roads, ports, and energy projects. Additionally, NWD offers services such as facilities management and operates department stores.

A distinctive element of NWD's strategy is its 'Artisanal Movement' philosophy. This approach integrates culture, creativity, and sustainability into its developments. This is seen in projects like K11 ECOAST in Shenzhen and the K11 Cultural Centre. Strategic partnerships, such as collaborations with state-owned enterprises, support their supply chain and distribution networks, contributing to their overall value proposition.

NWD's property development arm focuses on creating diverse properties. This includes residential, commercial, and retail spaces. Key projects like Mount Pavilia and grade-A office developments showcase their capabilities. The company's approach involves land acquisition, construction, and property management, ensuring quality and value.

NWD manages a portfolio of leased properties. This includes shopping malls like K11 MUSEA and K11 Art Mall. Serviced apartments also contribute to recurring income. Property investment provides a stable revenue stream. This segment is a key part of NWD's operational strategy.

The infrastructure segment involves investments in various projects. These include roads, ports, energy, water, and logistics. These investments are crucial for supporting economic growth. NWD's infrastructure projects enhance its market presence.

NWD's services include facilities management, contracting, and transport. They also operate hotels and department stores. These services diversify its revenue streams. The 75% interest in New World Department Store China is a significant part of this segment.

The 'Artisanal Movement' philosophy differentiates NWD. It integrates culture and sustainability into its projects. Strategic partnerships support supply chains and development. Collaborations with entities like China Resources Land help unlock value. These partnerships are crucial for projects in the Northern Metropolis.

- The K11 ECOAST project in Shenzhen exemplifies this approach.

- Partnerships with state-owned enterprises enhance project efficiency.

- Sustainability is a key focus in all developments.

- These elements contribute to NWD's unique value proposition.

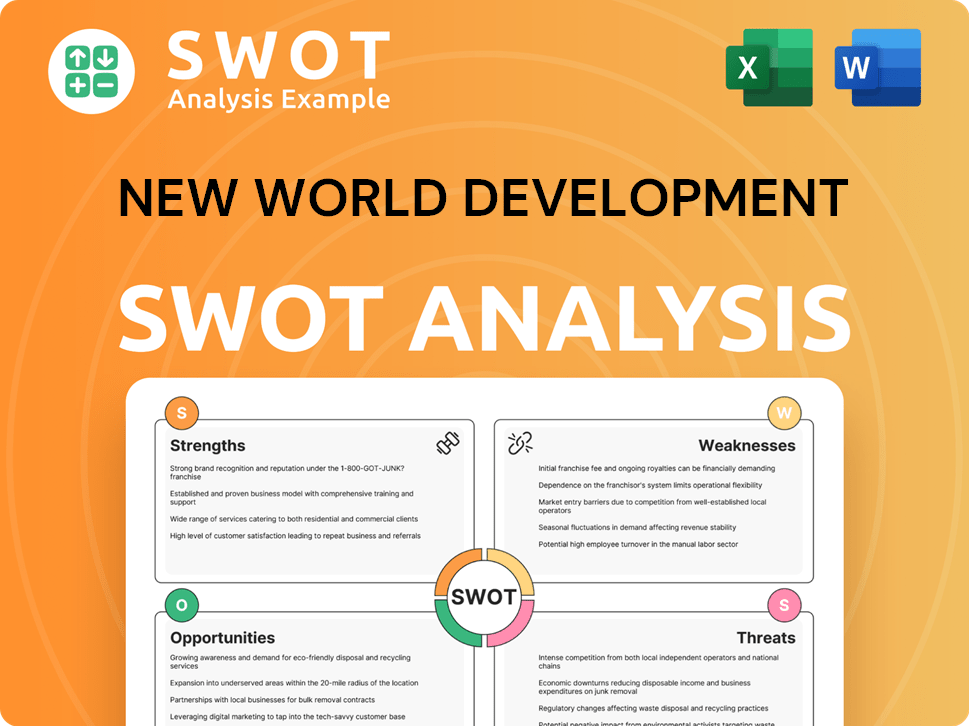

New World Development SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does New World Development Make Money?

Understanding the revenue streams and monetization strategies of the NWD Company is key to grasping its financial performance. The company's diverse operations, primarily centered on property development and investment, generate substantial revenue. This diversified approach allows NWD to navigate market fluctuations and capitalize on various opportunities within the real estate and related sectors.

As of December 31, 2024, the consolidated revenues for NWD reached HK$16,789 million for the six months ended. This demonstrates the scale of the company's operations and its ability to generate significant income across multiple business segments. The company's strategic initiatives and market positioning are crucial for its continued growth and profitability.

NWD's monetization strategies are multifaceted, encompassing traditional property sales, recurring rental income, and service fees. The company's focus on enhancing cash flow and deleveraging through non-core asset disposals further underscores its commitment to financial health. For fiscal year 2025, NWD aims to achieve HKD 26 billion from property sales and non-core asset disposal in Hong Kong and Mainland China combined.

NWD's revenue streams are primarily driven by property development and investment, with significant contributions from other sectors. The company's ability to generate income from multiple sources provides a diversified revenue base, mitigating risks associated with any single market segment. The following details the major revenue streams:

- Property Development: This segment focuses on residential properties in Hong Kong and Mainland China. For the six months ended December 31, 2024, revenues from property development in Hong Kong were HK$1,734 million, and in Mainland China, they reached HK$6,644 million. Projects like 'THE PAVILIA FOREST' in Kai Tak generated approximately HK$4 billion in contracted sales as of May 29, 2025.

- Property Investment: This includes income from leased lands and buildings, such as commercial properties and offices. Revenues from property investment in Hong Kong were HK$1,615 million, and in Mainland China, HK$944 million for the six months ended December 31, 2024. Recurring earnings from investment properties are expected to represent over 30% of NWD's operating profit in fiscal 2029.

- Hotel Operations: NWD operates hotels in Hong Kong, Mainland China, and Southeast Asia, including prominent brands like the Grand Hyatt Hong Kong and Rosewood Hong Kong. This segment contributed HK$1,210 million in revenue in FY2024.

- Department Stores: NWD holds a 75% interest in New World Department Store China, which operates department stores in Mainland China.

- Infrastructure and Services: This includes revenues from facilities management, contracting, transport, and strategic investments, as well as roads and ports, and energy, water, and logistics projects. The 'Others' segment, which includes media and technology, generated HK$9,450 million in revenue in FY2024.

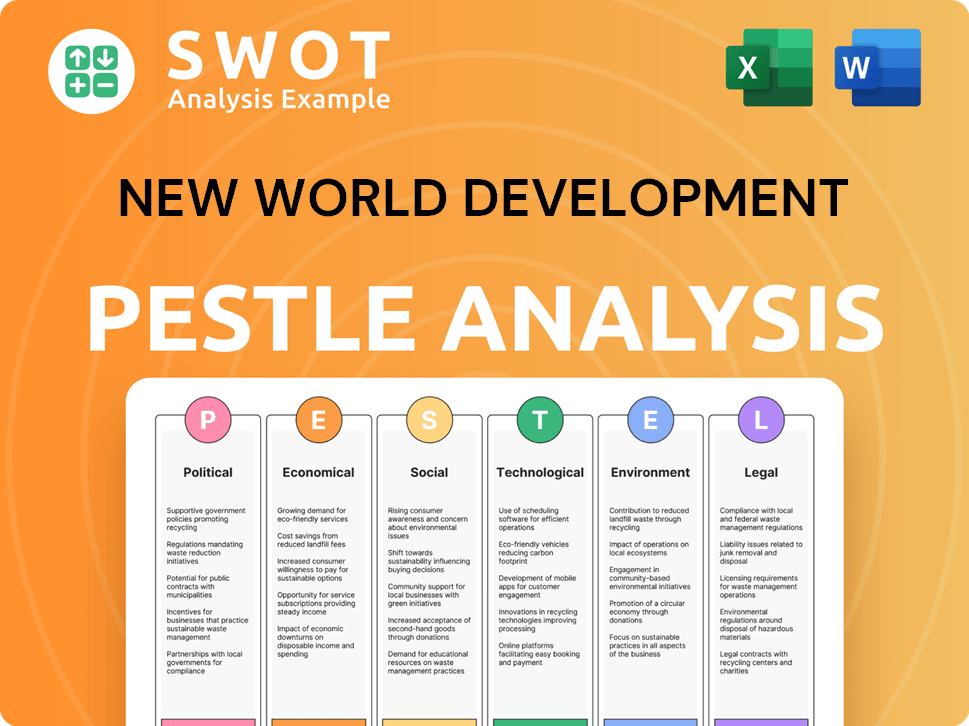

New World Development PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped New World Development’s Business Model?

Navigating a dynamic market, New World Development (NWD) has undergone significant strategic shifts. A key focus has been accelerating property sales and reducing debt. For the six months ending December 31, 2024, NWD reported a loss attributable to shareholders of HK$6,633 million, primarily due to impairment losses on investment and development properties. In response, the company has ramped up efforts to streamline capital expenditure and divest non-core assets.

The company's operational landscape includes challenges such as a subdued property market in both Hong Kong and Mainland China. Despite these headwinds, NWD has shown resilience through successful project launches. The company's strategic moves also involve collaborating with central and state-owned enterprises in Mainland China to expedite development, particularly in areas like the Northern Metropolis.

NWD aims to dispose of around CNY 3 billion of non-core assets in Mainland China in FY2025, following the completion of HKD 3.8 billion in non-core asset disposals between July and September 2024. These actions are part of a broader strategy to strengthen its financial position and adapt to changing market conditions. The company's focus on sustainability, with a net-zero science-based target by 2050 verified by the SBTi in December 2024, further underscores its commitment to long-term value creation.

NWD has achieved significant milestones, including successful project launches. 'THE PAVILIA FOREST' in Kai Tak sold approximately 540 units by March 24, 2025, generating about HK$4 billion in revenue. The 'DEEP WATER PAVILIA' project also saw strong initial sales, generating over HK$1.1 billion from 19 units sold by tender.

Strategic moves include accelerating property sales and deleveraging the balance sheet. The company is also focusing on streamlining capital expenditure and divesting non-core assets. NWD is collaborating with central and state-owned enterprises in Mainland China to expedite development.

The company's competitive advantages include strong brand recognition, especially with its K11 brand, which integrates culture and commerce. NWD also benefits from acquiring land through urban renewal projects in Mainland China at favorable terms. Furthermore, the company emphasizes sustainability, aiming for a net-zero science-based target by 2050.

For the six months ended December 31, 2024, NWD reported a loss attributable to shareholders of HK$6,633 million. The company is actively managing its financial performance by focusing on asset disposals and cost control. For more insights, consider exploring the Target Market of New World Development.

NWD's operations are significantly influenced by market dynamics in both Hong Kong and Mainland China. The company faces challenges from subdued property markets and economic factors. This includes the impact of outbound travel trends and a strong Hong Kong dollar.

- The K11 malls in Hong Kong experienced a 13% year-on-year decline in retail sales for the period ended December 31, 2024.

- NWD is strategically responding by focusing on project launches and asset disposals.

- The company's approach involves a mix of financial restructuring and strategic partnerships.

- NWD's future plans include expanding its presence in the Northern Metropolis.

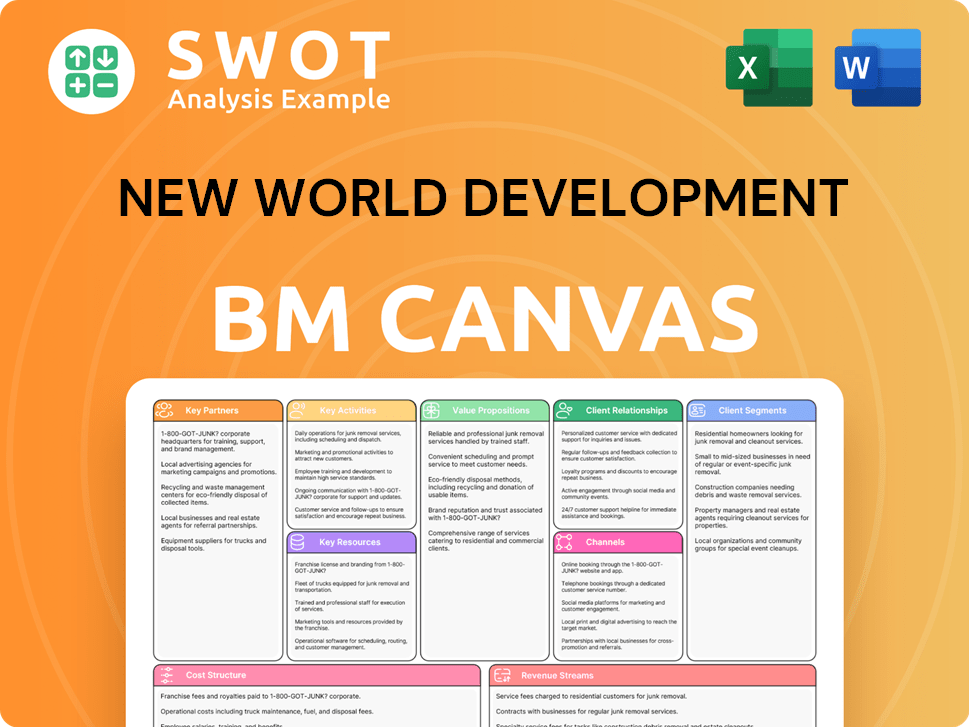

New World Development Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is New World Development Positioning Itself for Continued Success?

The Marketing Strategy of New World Development positions the company as a leading real estate developer in Hong Kong and Mainland China, although it faces significant challenges. Its 'Artisanal Movement' and K11 brand aim to differentiate offerings within a competitive market, focusing on unique cultural-retail experiences to enhance customer loyalty. However, the company's performance is heavily influenced by economic cycles and market dynamics in its primary operating regions.

NWD Company’s operations are subject to various risks, including property market downturns, high net gearing, and regulatory changes. The prolonged slump in the Hong Kong and Mainland China property markets, marked by weak consumer sentiment and high vacancy rates, has led to asset impairment losses and subdued profit margins. The company's financial health is further impacted by its high net gearing ratio, which was above 55% as of December 2024, the highest among its Hong Kong real estate peers.

NWD holds a significant position in the Hong Kong and Mainland China real estate development markets. Its focus on quality and unique offerings, such as the K11 brand, aims to differentiate it from competitors. However, market share and customer loyalty are subject to economic conditions and competition.

Key risks include the property market downturn in Hong Kong and Mainland China, high net gearing, and regulatory changes. The property market slump has led to asset impairment losses and subdued profit margins. High net gearing, exceeding 55% as of December 2024, poses a significant financial risk.

NWD aims to increase revenue from investment properties and is focused on strategic initiatives, including projects in Shenzhen and Hangzhou. The company is also converting farmland and engaging in urban renewal. It anticipates improvements in property sales margins and is committed to sustainability.

NWD is focused on increasing revenue from investment properties, with new commercial projects expected after fiscal 2025. It is also converting farmland in the Northern Metropolis and engaging in urban renewal. The company projects improvements in property sales margins, supported by projects in Kai Tak and North Point.

NWD is focused on increasing recurring income from investment properties and expanding its presence in key markets. The company is also committed to sustainability, targeting a net-zero science-based target by 2050. Anticipated rebound in consumer spending in Mainland China and Hong Kong should boost retail rental income.

- Expansion of investment properties portfolio.

- Conversion of farmland in the Northern Metropolis.

- Engagement in urban renewal projects.

- Commitment to a net-zero target by 2050.

New World Development Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of New World Development Company?

- What is Competitive Landscape of New World Development Company?

- What is Growth Strategy and Future Prospects of New World Development Company?

- What is Sales and Marketing Strategy of New World Development Company?

- What is Brief History of New World Development Company?

- Who Owns New World Development Company?

- What is Customer Demographics and Target Market of New World Development Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.