New World Development Bundle

Who Really Controls New World Development?

Unraveling the New World Development SWOT Analysis is just the beginning; understanding its ownership structure is key to grasping its future. The ownership of New World Development Company (NWD) profoundly impacts its strategic direction and market influence. Knowing who owns NWD is crucial for investors, stakeholders, and anyone seeking to understand this Hong Kong real estate and infrastructure giant.

From its roots as a family-led enterprise to its current status as a publicly traded entity, the evolution of New World Development's ownership tells a compelling story. This exploration will uncover the key shareholders, trace the shifts in ownership over time, and analyze the implications of these changes on the company's governance. Understanding the NWD owner and its shareholders is critical for anyone looking to invest in, partner with, or simply understand this influential player in the Asian market.

Who Founded New World Development?

The New World Development Company Limited (NWD) was established in 1970. The founders included Dr. Cheng Yu-tung and other prominent business figures. Dr. Cheng Yu-tung played a key role as Chairman and Managing Director, shaping the company's early direction.

The initial ownership structure of NWD primarily comprised the founding families and their close associates. This was a common pattern among large conglomerates in Hong Kong during that period. While specific equity splits from the beginning are not readily available in public records, the Cheng family, through Chow Tai Fook Enterprises Limited, has consistently been a major shareholder.

Early investors likely included local business elites and private investors who saw potential in Hong Kong's growing property market. The company's vision, centered on property and infrastructure, remained consistent from its inception.

Dr. Cheng Yu-tung and other business figures co-founded New World Development.

The founding families and their associates held the initial ownership stakes.

The Cheng family, through Chow Tai Fook Enterprises Limited, has been a cornerstone of the company's ownership.

Early backers included local business elites and private investors.

The founding team's vision focused on establishing a property and infrastructure empire.

There is no widely reported information about significant early ownership disputes or buyouts.

Understanding the early ownership of New World Development is crucial for anyone looking into the company's history. The initial structure, heavily influenced by Dr. Cheng Yu-tung and the Cheng family, set the stage for its future. For more insights into the company's strategic direction, consider exploring the Growth Strategy of New World Development.

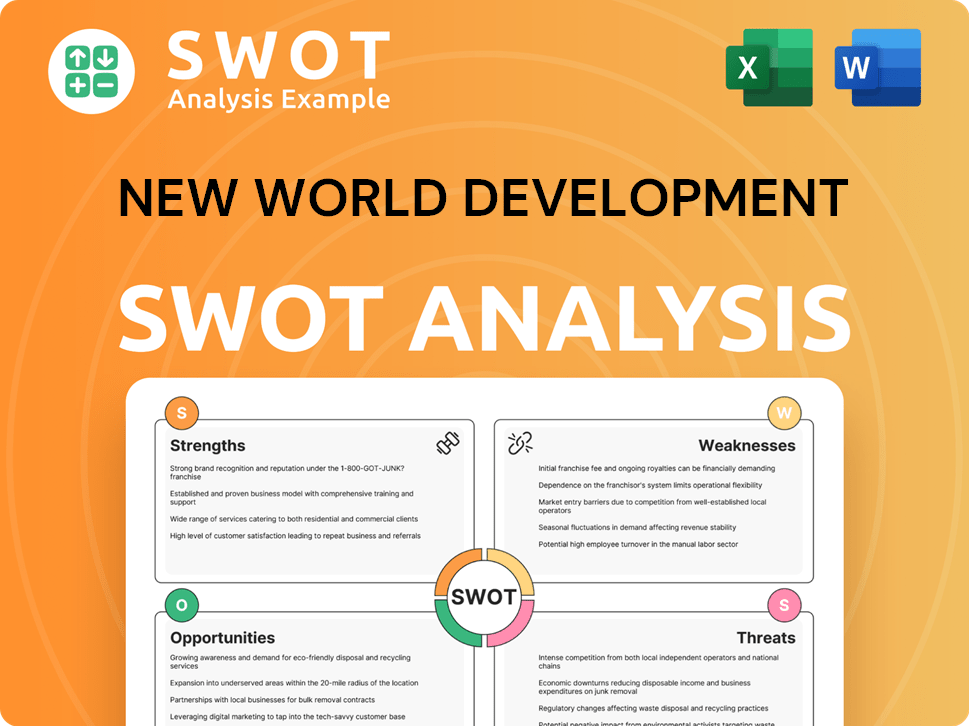

New World Development SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has New World Development’s Ownership Changed Over Time?

The ownership structure of New World Development Company (NWD) has seen significant changes since its initial public offering (IPO) in 1972. The IPO allowed for wider shareholding, but the founding family has maintained substantial control. The evolution of ownership reflects the company's growth and adaptation within the Hong Kong real estate market and beyond. Understanding the shifts in ownership provides insight into the strategic direction and stability of NWD.

Since its IPO, New World Development's ownership has been influenced by market dynamics and strategic decisions. The company's journey, as detailed in a Brief History of New World Development, shows how ownership changes have shaped its trajectory. Institutional investors and market fluctuations have played roles in the distribution of shares, yet the founding family's influence has remained a constant factor.

| Key Event | Impact on Ownership | Date |

|---|---|---|

| Initial Public Offering (IPO) | Brought NWD to public markets, allowing for broader shareholding. | 1972 |

| Market Fluctuations | Influenced the distribution of shares among institutional and individual investors. | Ongoing |

| Strategic Investments and Divestitures | May have led to shifts in major shareholders and ownership percentages. | Ongoing |

As of early 2025, the primary owner of NWD is Chow Tai Fook Enterprises Limited (CTFE), the Cheng family's private flagship company. CTFE's substantial stake, often exceeding 40% as of December 31, 2024, grants the Cheng family significant influence. Other major shareholders consist of institutional investors, whose holdings fluctuate based on market conditions. This ownership structure ensures continuity in NWD's long-term strategy, particularly in large-scale property and infrastructure projects. Finding information about NWD shareholders can be done through the company's annual reports and SEC filings.

The Cheng family, through CTFE, maintains significant control over New World Development. This ownership structure impacts strategic decisions and long-term planning.

- CTFE's stake often exceeds 40% as of recent reports.

- Institutional investors hold a substantial portion of the remaining shares.

- The founding family's influence ensures strategic continuity.

- Shareholder details can be found in annual reports and filings.

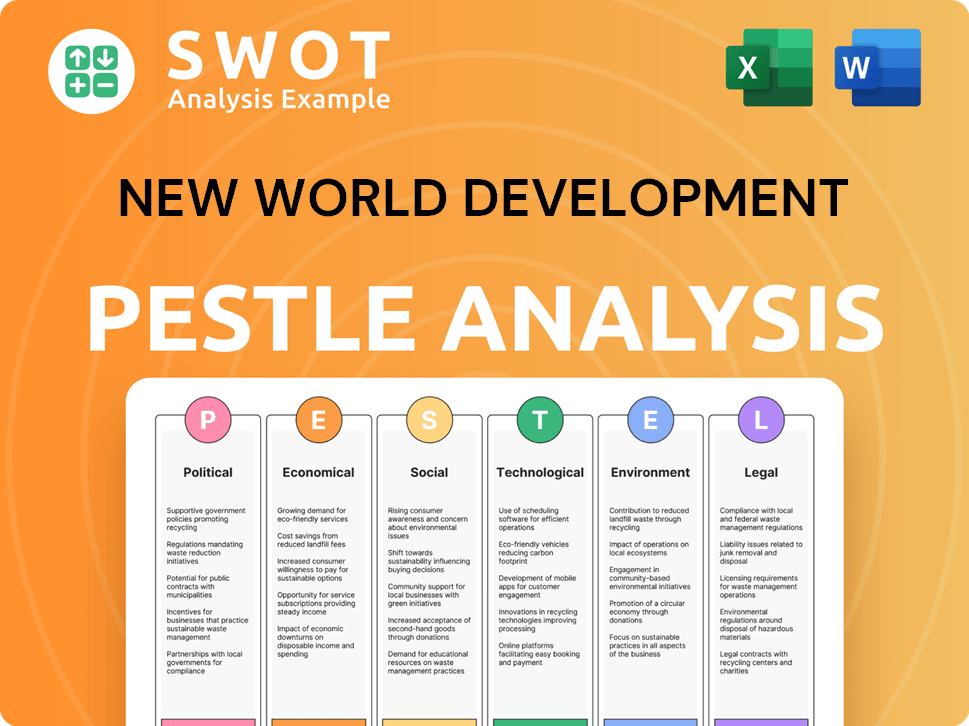

New World Development PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on New World Development’s Board?

As of early 2025, the Board of Directors of New World Development Company (NWD) includes a mix of executive, non-executive, and independent non-executive directors. Dr. Henry Cheng Kar-shun, son of the founder, Dr. Cheng Yu-tung, chairs the board as an Executive Director. He represents the major shareholder, Chow Tai Fook Enterprises Limited, which is controlled by the Cheng family. Other executive directors typically consist of key management personnel responsible for the company's operations. Non-executive and independent non-executive directors contribute external perspectives and expertise, often representing institutional investors or providing independent oversight.

The board structure reflects a blend of family influence and independent oversight, common in large Hong Kong-based companies. The presence of independent directors helps ensure good corporate governance. For more insights, consider exploring the Competitors Landscape of New World Development.

| Director Type | Role | Representative |

|---|---|---|

| Executive Directors | Key Management | Dr. Henry Cheng Kar-shun (Chairman) |

| Non-Executive Directors | External Perspective | Typically includes representatives from institutional investors |

| Independent Non-Executive Directors | Independent Oversight | Provide unbiased perspectives |

The voting structure at New World Development generally follows a one-share-one-vote principle. However, the substantial ownership held by Chow Tai Fook Enterprises Limited gives the Cheng family significant control. While there are no specific disclosures of special voting rights, the Cheng family's large shareholding ensures their dominance in shareholder votes and strategic decisions. The market capitalization of New World Development was approximately HKD $45.7 billion as of late 2024.

The Cheng family, through Chow Tai Fook Enterprises Limited, holds a controlling stake in New World Development (NWD).

- Dr. Henry Cheng Kar-shun, the Chairman, represents the family's interests.

- The board includes a mix of executive, non-executive, and independent directors.

- The voting structure is primarily one-share-one-vote, but the Cheng family's ownership ensures significant influence.

- The company's market capitalization is a key indicator of its financial standing.

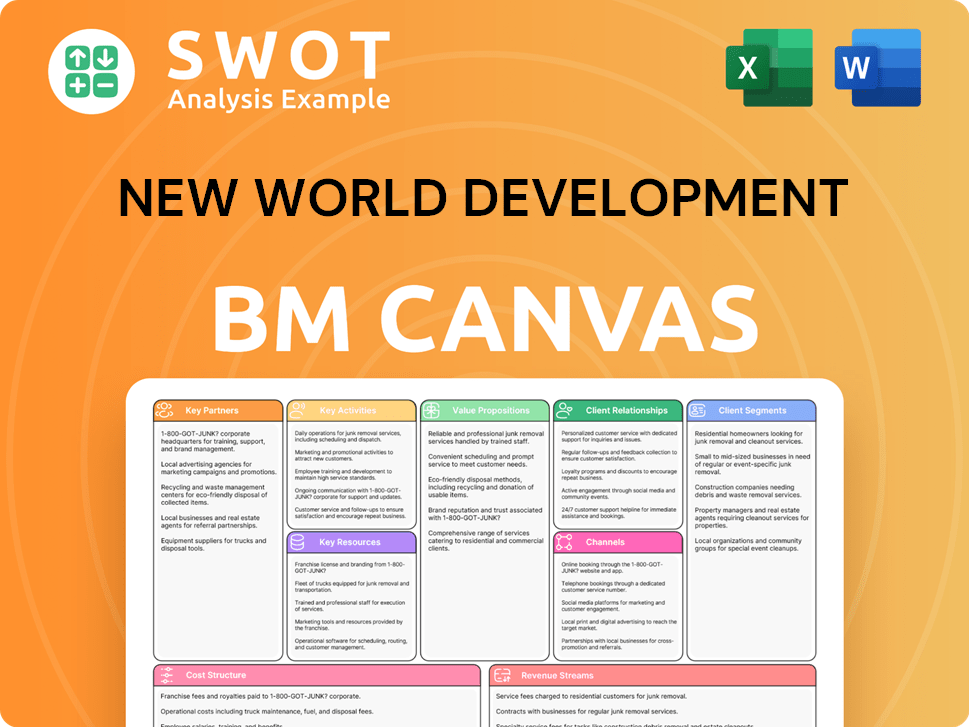

New World Development Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped New World Development’s Ownership Landscape?

In the past few years (2022-2025), the ownership of New World Development Company (NWD) has seen some adjustments. While the Cheng family, through Chow Tai Fook Enterprises, maintains a strong controlling stake, institutional investors have been actively managing their holdings. This is typical for Hong Kong real estate companies, where market sentiment and economic forecasts influence investment decisions. There haven't been any major shifts in the overall ownership structure, such as large-scale share buybacks or significant secondary offerings, that have been widely publicized.

Industry trends show that companies like New World Development are under increased scrutiny regarding Environmental, Social, and Governance (ESG) factors from institutional investors. The Cheng family continues to hold a significant position, distinguishing it from companies where founder influence has diminished. There have been no public announcements about potential privatization or changes to its public listing status. Leadership transitions within the Cheng family are managed to ensure continuity and stability in both ownership and management. The company's focus remains on its core property and infrastructure businesses, reflecting a balance between family control and broader public and institutional investment. As of early 2024, the market capitalization of NWD was approximately HKD $60 billion.

| Ownership Aspect | Details | Recent Trends |

|---|---|---|

| Major Shareholders | Cheng family via Chow Tai Fook Enterprises | Consistent control, with no major shifts in the past few years. |

| Institutional Investors | Various investment firms | Adjustments based on market conditions and ESG considerations. |

| Public Listing Status | Publicly listed | No announcements regarding privatization or delisting. |

The primary owner of New World Development Company (NWD) is the Cheng family, who control the company through Chow Tai Fook Enterprises. Institutional investors also hold significant shares, adjusting their portfolios based on market dynamics.

Recent developments include capital management activities, such as potential share buybacks, though no major changes to the ownership structure have been reported. The company is also focused on ESG factors, which are increasingly important to investors.

The Hong Kong real estate market influences investment decisions, with institutional investors adjusting their holdings based on economic outlooks. The company's leadership transitions are designed to ensure stability and continuity.

The future of New World Development ownership is expected to maintain a balance between family control and public investment. The company's focus on property and infrastructure businesses will likely continue.

New World Development Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of New World Development Company?

- What is Competitive Landscape of New World Development Company?

- What is Growth Strategy and Future Prospects of New World Development Company?

- How Does New World Development Company Work?

- What is Sales and Marketing Strategy of New World Development Company?

- What is Brief History of New World Development Company?

- What is Customer Demographics and Target Market of New World Development Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.