NWS Holdings Bundle

How Does NWS Holdings Stack Up in Today's Market?

NWS Holdings, a major player in infrastructure and services, has significantly impacted markets across Hong Kong, Mainland China, and Macau. With a diversified portfolio spanning roads, environmental management, and port logistics, understanding its competitive positioning is crucial. This analysis dives deep into the NWS Holdings SWOT Analysis, revealing its strengths, weaknesses, opportunities, and threats within a dynamic sector.

Recent financial performance, including a substantial profit increase for the fiscal year ending June 2024, highlights NWS Holdings' resilience and strategic acumen. Examining its competitive landscape, including its market position and key players, offers valuable insights for investors and strategists. This exploration of NWS Holdings' competitive environment will reveal its strategic alliances and how it navigates market challenges, providing a comprehensive NWS Holdings analysis.

Where Does NWS Holdings’ Stand in the Current Market?

NWS Holdings, now part of CTF Services Ltd, has a strong market position, operating in toll roads, insurance, logistics, construction, and facilities management. The company primarily focuses on Hong Kong, Mainland China, and Macau. This diversification helps stabilize its market position within the competitive landscape.

For the fiscal year ending June 30, 2024, NWS Holdings reported total revenue of HK$26,421.6 million. The company's strategic focus on diverse sectors and geographical areas contributes to its resilience and sustained performance in the market. An in-depth Growth Strategy of NWS Holdings provides further insights into its operational approach.

The company's attributable operating profit for fiscal year 2023 (July 2022 to June 2023) increased by 9.5% year-on-year to HK$4.1 billion, mainly due to growth in the insurance and logistics segments. This financial performance highlights the effectiveness of NWS Holdings' business strategy and its ability to capitalize on market opportunities. The company's infrastructure investment continues to support its market position.

As of June 30, 2024, NWS Holdings had approximately HK$26.8 billion in total available liquidity. This includes about HK$14.8 billion in cash and bank balances and approximately HK$12.0 billion in unutilized committed banking facilities. The company's strong financial position supports its ability to navigate market challenges.

The net debt balance increased to approximately HK$15.1 billion as of June 30, 2024, with the net gearing ratio increasing to 35%. NWS Holdings has proactively managed its debt, increasing the RMB debt proportion to 60% of its total debt and controlling the average borrowing cost at 4.7% per annum. This strategic approach helps manage financial risks.

Hip Hing Group, the construction arm of NWS Holdings, secured new contracts surging by 321% year-on-year to HK$21.9 billion in FY2024. The gross value of contracts on hand amounted to approximately HK$63.9 billion as of June 30, 2024. This significant growth indicates strong demand and operational success.

While specific market share figures are not readily available, the consistent growth in key areas and strategic portfolio optimization underscore NWS Holdings' strong standing. The company's diversified portfolio and financial strategies support its competitive advantages. These factors are crucial for understanding the competitive landscape.

NWS Holdings demonstrates a robust market position through its diverse business segments and strategic financial management. The company's focus on infrastructure investment and operational efficiency supports its long-term growth prospects. These factors contribute to its resilience within the competitive environment.

- Strong revenue and profit growth in key segments.

- Significant liquidity and proactive debt management.

- Substantial increase in new contracts for the construction arm.

- Strategic portfolio optimization and diversified business model.

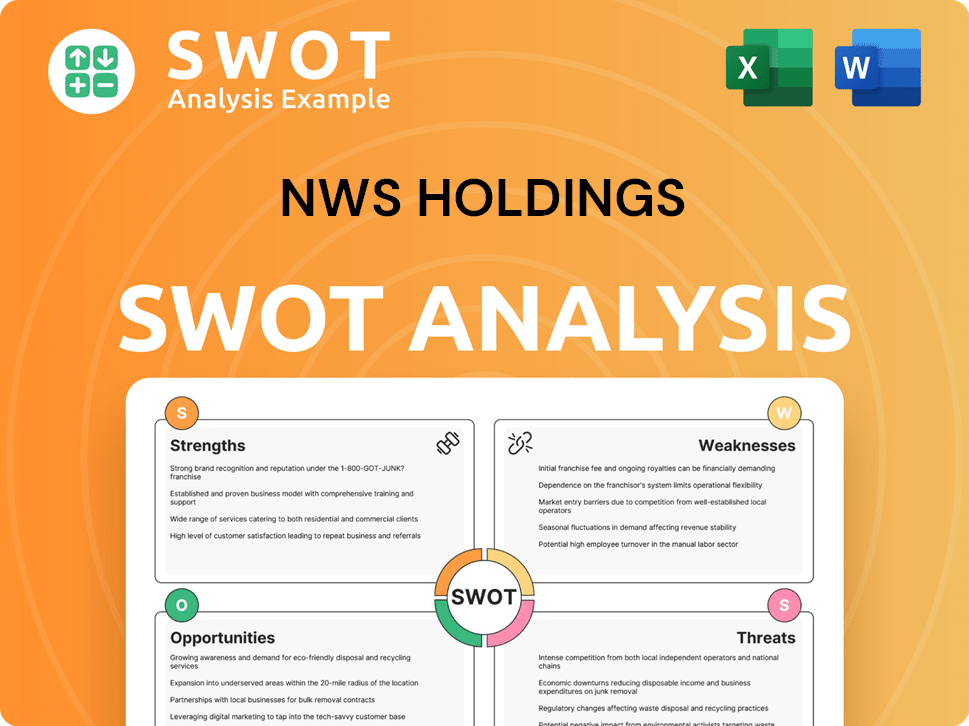

NWS Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging NWS Holdings?

The competitive landscape for NWS Holdings is complex, spanning various sectors. This analysis focuses on identifying key competitors and understanding the dynamics that shape NWS Holdings' market position. Understanding the NWS Holdings competitive environment is crucial for investors and stakeholders.

NWS Holdings analysis reveals that the company faces diverse competition across its business segments. This includes infrastructure investment, construction, real estate, and financial services. The competitive dynamics are influenced by both established players and emerging trends within the industry. For a deeper dive into the company's marketing strategies, you can read Marketing Strategy of NWS Holdings.

In the construction and engineering sector, NWS Holdings, with approximately 12,800 employees, competes with major players. These competitors include Shanghai Construction Group Co Ltd (48,821 employees), CLP Holdings Ltd (8,415 employees), Henderson Land Development Co Ltd (9,970 employees), and China CAMC Engineering Co Ltd (4,298 employees). The size and scope of these companies indicate the scale of competition within the industry.

Shanghai Construction Group Co Ltd, CLP Holdings Ltd, Henderson Land Development Co Ltd, and China CAMC Engineering Co Ltd are major competitors in the construction and engineering sector.

Within real estate, NWS Holdings competes with companies like Vingroup, Lendlease, and Eiffage. These companies have a long history and significant market presence.

CTF Life Insurance, a subsidiary of NWS Holdings, operates in a competitive financial services environment, particularly in the Greater Bay Area.

The broader operations of the parent company, News Corporation, also influence the competitive landscape, particularly in real estate advertising.

Emerging players and strategic alliances further shape the competitive environment, requiring NWS Holdings to continuously adapt its strategies.

Understanding the competitive advantages of NWS Holdings is essential for evaluating its market position and future prospects.

NWS Holdings faces competition across multiple sectors, requiring strategic adaptation.

- The construction and engineering sector is highly competitive, with several large players.

- Real estate and property development also present significant competition.

- The financial services sector, through CTF Life Insurance, operates in a dynamic environment.

- The parent company's activities also influence the competitive landscape.

- Strategic alliances and emerging players are key factors in the market.

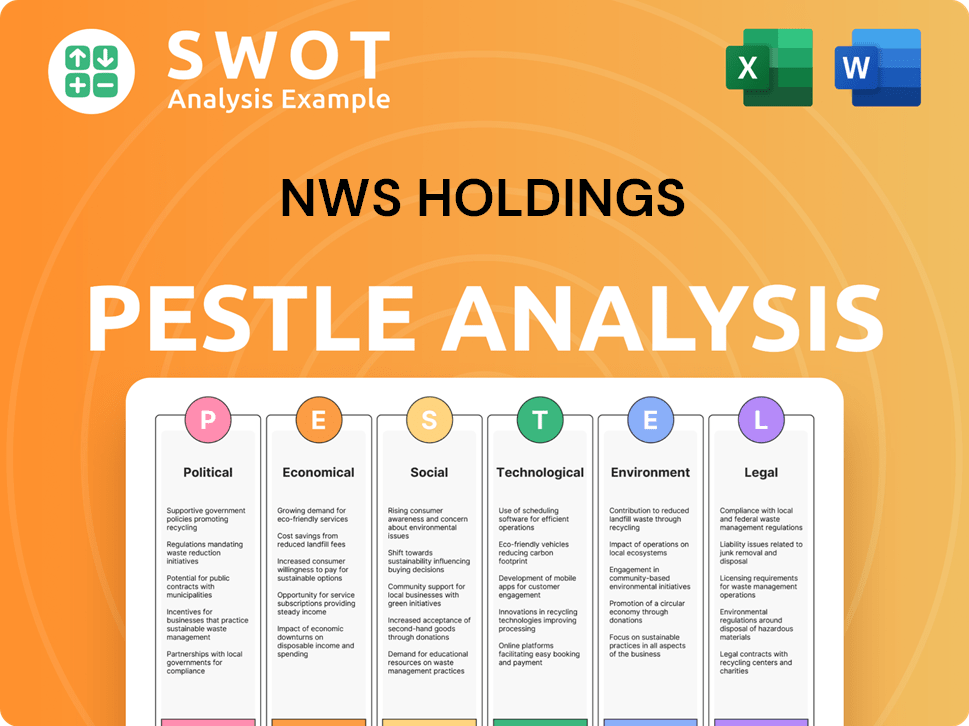

NWS Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives NWS Holdings a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of NWS Holdings involves a deep dive into its strategic strengths. The company's diverse business portfolio, strong financial health, and commitment to sustainability are key elements. This NWS Holdings analysis reveals how these factors contribute to its market position and resilience.

NWS Holdings, a prominent player among Hong Kong companies, has established a solid foundation for growth. The company's strategic moves, including proactive financial management and a focus on ESG principles, underscore its commitment to long-term value creation. Exploring the competitive advantages of NWS Holdings helps to understand its ability to navigate market challenges.

The company's diversified operations across various sectors, including toll roads, insurance, and construction, provide a buffer against economic fluctuations. This diversification, combined with a strong financial performance, positions NWS Holdings favorably in the competitive environment. For those interested in a deeper dive, consider reading about the Growth Strategy of NWS Holdings.

NWS Holdings benefits from a diversified portfolio of market-leading businesses. This strategy reduces reliance on any single sector and spreads risk. Key sectors include toll roads, insurance, logistics, construction, and facilities management, primarily operating in Hong Kong and Mainland China.

The company showcases strong financial health and cash flow generation. For the fiscal year ended June 30, 2024, the company reported an Adjusted EBITDA of HK$7,240.5 million, reflecting a 24% year-on-year growth. Total available liquidity was approximately HK$26.8 billion, providing financial flexibility.

NWS Holdings has demonstrated proactive financial management. An example is strategically increasing its RMB debt proportion to 60% of its total debt. This move acts as a natural hedge for its RMB assets and helps control finance costs, showcasing a forward-thinking approach.

NWS Construction Group, comprising Hip Hing Group, Vibro Group, and Quon Hing Group, secured new contracts worth HK$21.9 billion in FY2024. This highlights the company's strong market presence and operational capabilities within the construction segment.

NWS Holdings is committed to ESG principles through its 'Breakthrough 2050' framework, aiming for net-zero emissions by 2050. This commitment enhances the company's brand reputation and attracts sustainability-conscious stakeholders. Subsidiaries like Hip Hing Construction and CTF Life Insurance are aligning with SBTi standards.

- Focus on reducing carbon emissions.

- Enhancing corporate governance.

- Attracting ESG-focused investors.

- Improving long-term sustainability.

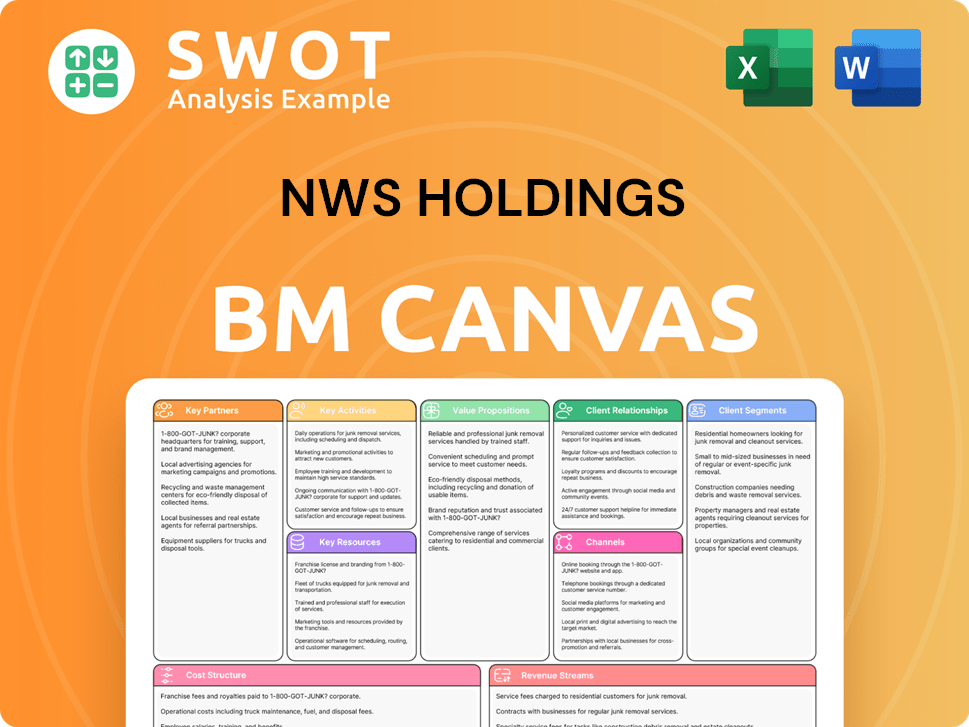

NWS Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping NWS Holdings’s Competitive Landscape?

The competitive landscape for NWS Holdings is shaped by evolving industry trends, presenting both challenges and opportunities. The company's diverse portfolio, spanning infrastructure, construction, and services, positions it within a dynamic market. Understanding these dynamics is crucial for assessing its future prospects and strategic positioning.

Several factors influence the competitive environment. Technological advancements and shifting consumer preferences are key drivers. Economic fluctuations and regulatory changes also play a significant role. This analysis examines the industry trends, future challenges, and opportunities affecting NWS Holdings.

Technological advancements are driving digital transformation across various sectors. Changes in consumer preferences, such as budget-conscious travelers, impact the hotel and facilities management segments. Global economic shifts and regulatory changes, like those in the Greater Bay Area, also affect the company.

Potential declines in demand in certain sectors and increased regulation pose challenges. Aggressive new competitors, leveraging innovative business models, could challenge established positions. Economic slowdowns in certain regions can impact performance, especially in the hotel sector.

Emerging markets, particularly in Mainland China and Southeast Asia, offer expansion opportunities. Product innovations and strategic partnerships can open new customer segments. The property development segment in Mainland China has approximately RMB8.3 billion in unrecognised gross revenue from contracted sales as of December 31, 2024.

NWS Holdings aims to achieve net zero by 2050 through its 'Breakthrough 2050' ESG framework. The company targets 50% of its debt financing from sustainability-linked or green finance by 2030. It continues to optimize its asset portfolio, focusing on sustainable cash flow and enhancing earnings quality.

NWS Holdings is focusing on diversification, financial prudence, and sustainability initiatives. This strategy aims to evolve its competitive standing and seize future opportunities. The company’s commitment to ESG principles and sustainable financing is a key element of its long-term growth strategy.

- Diversification: Spreading investments across various sectors to mitigate risks.

- Financial Prudence: Managing finances carefully to ensure stability.

- Sustainability Initiatives: Implementing ESG frameworks and green financing.

- Asset Portfolio Optimization: Focusing on businesses with sustainable cash flow.

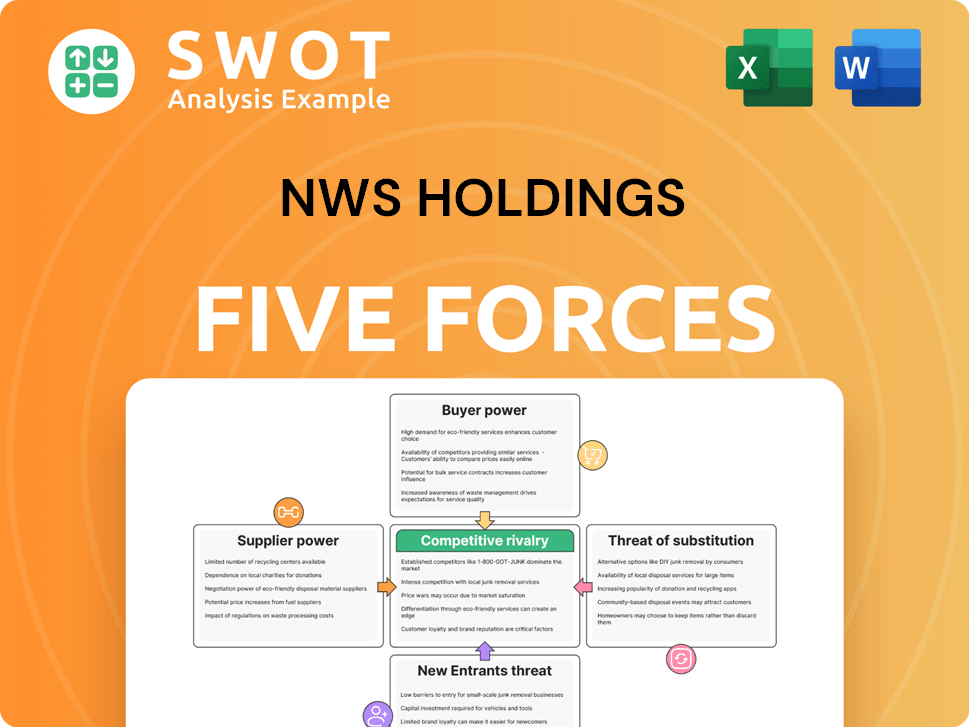

NWS Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of NWS Holdings Company?

- What is Growth Strategy and Future Prospects of NWS Holdings Company?

- How Does NWS Holdings Company Work?

- What is Sales and Marketing Strategy of NWS Holdings Company?

- What is Brief History of NWS Holdings Company?

- Who Owns NWS Holdings Company?

- What is Customer Demographics and Target Market of NWS Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.