NWS Holdings Bundle

How Does NWS Holdings Navigate the Complex World of Infrastructure and Services?

Explore the intricate sales and marketing strategies fueling the success of NWS Holdings, a Hong Kong-based powerhouse in infrastructure and services. From roads to environmental management, this company's approach is critical for its long-term projects and significant capital investments. Discover how NWS Holdings strategically positions itself in a competitive market, focusing on public and private sector clients across Hong Kong, Mainland China, and Macau.

This deep dive into the NWS Holdings SWOT Analysis will uncover the company's innovative sales and marketing strategy, examining its financial performance and market analysis. We'll dissect the company's approach to customer acquisition, brand building, and digital marketing, providing insights into its strategic planning process and how it tackles sales and marketing challenges. Learn about NWS Holdings's revenue generation strategies and its competitive advantage strategy to understand how it maintains its market leadership in a dynamic environment.

How Does NWS Holdings Reach Its Customers?

The sales and marketing strategy of NWS Holdings centers on direct sales and business-to-business (B2B) channels, reflecting its infrastructure and services-oriented business model. This approach is particularly evident in its core segments, including roads, environmental management, port and logistics, construction, and facilities management. The company directly engages with government entities, public bodies, and large private corporations to secure contracts and projects.

The construction segment, specifically NWS Construction Group, demonstrates this strategy effectively. In FY2024, the construction segment secured new contracts worth HK$21.9 billion, marking a significant increase of 321% year-on-year. As of June 30, 2024, the gross value of contracts on hand was approximately HK$63.9 billion. This underscores the reliance on direct negotiations and tender processes for revenue generation.

In the insurance segment, the company utilizes direct sales agents, brokers, and potentially online platforms to reach individual and corporate clients. Strategic investments involve direct capital deployment and partnerships across various industries. Digital engagement is likely increasing for information dissemination and client relationship management, especially in facilities management and environmental services. For more details on the company's financial structure, consider reading about Owners & Shareholders of NWS Holdings.

NWS Holdings primarily uses direct sales and B2B channels. This is due to the nature of its infrastructure and services businesses. This approach is particularly effective for large-scale projects and government contracts.

The construction segment, represented by NWS Construction Group, secured new contracts worth HK$21.9 billion in FY2024. This represents a 321% year-on-year increase. The gross value of contracts on hand was approximately HK$63.9 billion as of June 30, 2024.

The insurance segment uses direct sales agents and brokers. Strategic investments involve direct capital deployment and partnerships. Digital channels are likely growing for information and relationship management.

Digital platforms are likely used for information dissemination and client relationship management. The company is involved in sustainable financing, such as issuing green bonds. This showcases strategic financial partnerships.

NWS Holdings employs a focused sales strategy, primarily utilizing direct sales and B2B channels to align with its business model. The company leverages these channels to engage with key stakeholders and secure significant contracts. The approach is supported by strategic partnerships and digital engagement.

- Direct Sales: Direct engagement with government entities and large corporations.

- B2B Focus: Emphasis on business-to-business transactions for infrastructure and services.

- Digital Integration: Increasing use of digital platforms for information and client management.

- Strategic Partnerships: Collaboration in sustainable financing and other key areas.

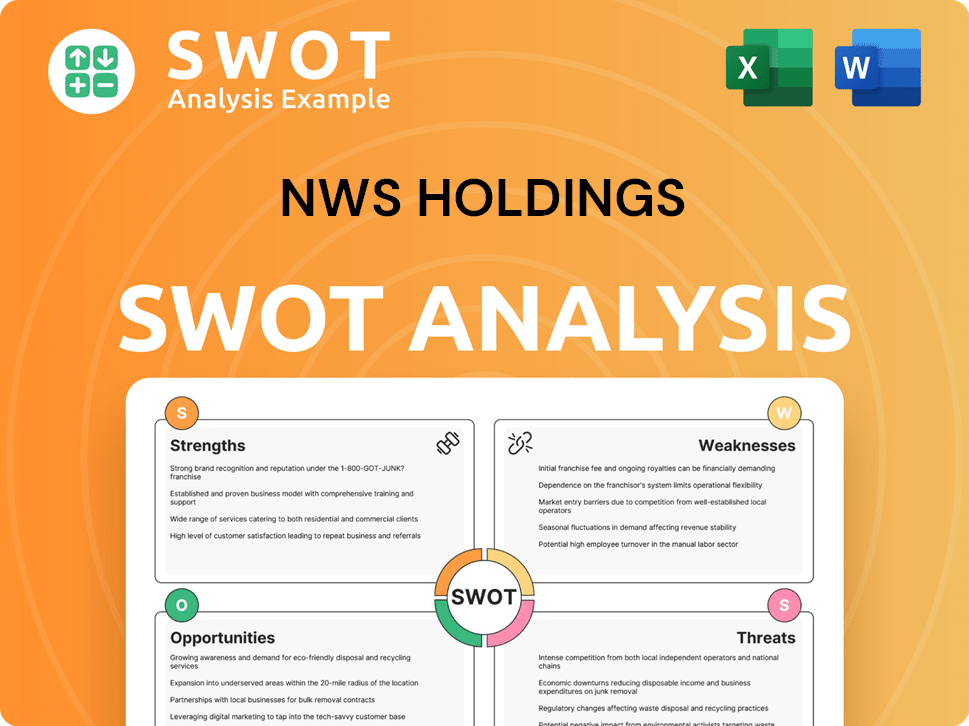

NWS Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does NWS Holdings Use?

The sales and marketing strategy of NWS Holdings is multifaceted, designed to enhance brand awareness, generate leads, and drive sales, particularly within its business-to-business (B2B) context. This approach includes a blend of digital and traditional marketing tactics, alongside a strong emphasis on Environmental, Social, and Governance (ESG) factors. The company leverages its commitment to sustainability as a key marketing tool, appealing to stakeholders who prioritize responsible business practices. For a deeper understanding of their target market, you can check out an article about the Target Market of NWS Holdings.

Digital marketing plays a crucial role, with the company maintaining an informative corporate website and engaging in investor relations communications. Traditional media is also utilized for corporate reputation management and public awareness. Data-driven marketing is a key aspect, involving the analysis of project success rates, client satisfaction, and market trends to refine service offerings and identify new opportunities. The company's commitment to ESG is a significant marketing tool, as highlighted by its 'Breakthrough 2050' ESG framework and its efforts to align business units with Science Based Targets initiative (SBTi) standards.

NWS Holdings employs a range of strategies to build awareness and drive sales. These strategies are tailored to the B2B environment, leveraging digital platforms, traditional media, and data analysis. The company's approach reflects a commitment to sustainability and responsible business practices, which is communicated through dedicated ESG reports and press releases. The company's focus on ESG is evident in its commitment to the 'Breakthrough 2050' framework and its alignment with SBTi standards.

NWS Holdings utilizes digital marketing through its corporate website and investor relations communications. Online presentations and reports are common, ensuring stakeholders receive timely and relevant information. This approach supports the company's overall sales and marketing strategy.

ESG is a significant marketing tool, highlighted by the 'Breakthrough 2050' ESG framework. The company aligns its business units with SBTi standards, communicating its commitment through dedicated ESG reports and press releases. This resonates with stakeholders prioritizing responsible business practices.

Traditional media supports corporate reputation management and public awareness. Press releases about financial results and project milestones are key. For example, the FY2024 results showed a 44% increase in profit attributable to shareholders.

NWS Holdings leverages industry awards and rankings for marketing purposes. Recognition in the Institutional Investor 2024 Asia Pacific (Ex-Japan) Executive Team Rankings for ESG performance is a key example. This enhances the company's credibility and brand visibility.

Data-driven marketing involves analyzing project success rates, client satisfaction, and market trends. The company collaborates with the Business Environment Council, releasing its first Corporate Climate Action Research Report in May 2024. This helps in understanding industry challenges and opportunities.

Subsidiaries like Hip Hing Construction and CTF Life Insurance submit commitment letters for carbon reduction to SBTi. CTF Life is the first in its sector in the Greater Bay Area to do so. This highlights the company's commitment to sustainability.

NWS Holdings employs a comprehensive marketing strategy that includes digital marketing, ESG initiatives, traditional media, industry recognition, and data-driven analysis. These tactics work together to enhance brand awareness, generate leads, and drive sales. The company's focus on sustainability and data-driven insights provides a competitive advantage.

- Digital platforms and investor relations communications.

- Emphasis on ESG through the 'Breakthrough 2050' framework and SBTi alignment.

- Use of traditional media for corporate reputation management.

- Leveraging industry awards and rankings.

- Data-driven analysis of project success and market trends.

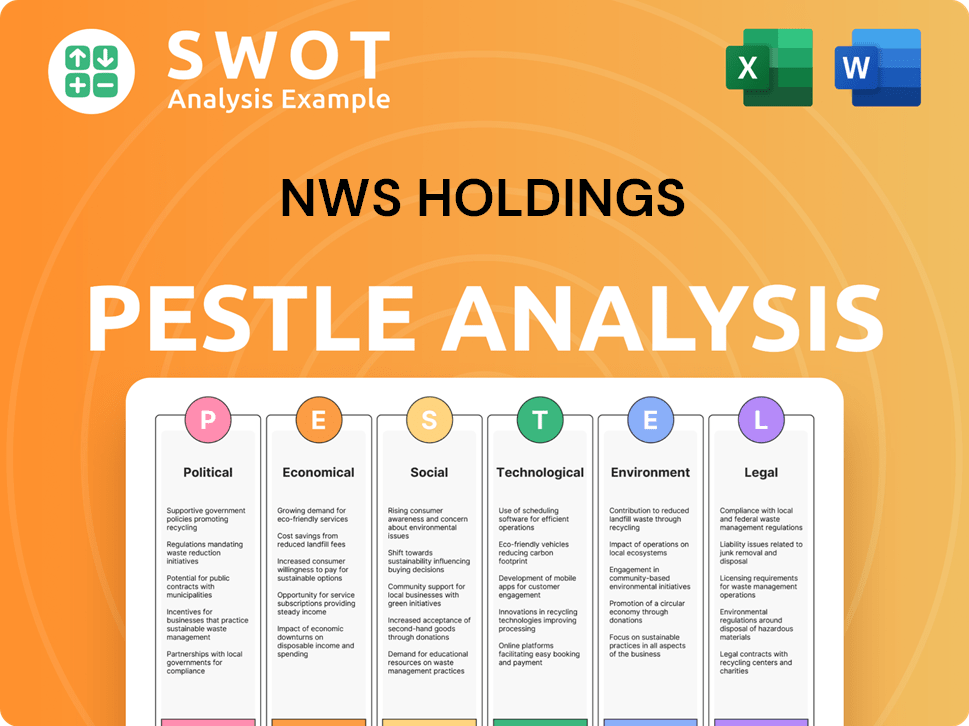

NWS Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is NWS Holdings Positioned in the Market?

The brand positioning of NWS Holdings, now CTF Services Limited, is centered on its identity as a leading diversified conglomerate. It emphasizes operational excellence and shared value for stakeholders and the community. This is achieved through a focus on infrastructure and services, underpinned by reliability, expertise, and a commitment to sustainable development.

The core message of NWS Holdings revolves around 'fostering connectivity that enables communities to thrive.' This message aligns with its diverse business portfolio, which is integral to urban development and public services. The company's 'Breakthrough 2050' ESG framework further reinforces this commitment, aiming for net-zero emissions by 2050 and integrating sustainability into its core operations.

The Growth Strategy of NWS Holdings includes a focus on brand consistency through corporate communications, investor relations, and sustainability reporting to ensure a unified message across all touchpoints. The company's rebranding to CTF Services Limited, effective November 2024, with its stock code remaining unchanged, signifies a strategic shift while ensuring continuity for investors. This strategic approach is further supported by its financial performance and recognition in ESG excellence.

NWS Holdings differentiates itself through its diversified portfolio, which provides resilience and a broad impact across essential sectors. This diversification allows it to serve various market segments and mitigate risks associated with economic fluctuations. The company's diverse range of services and infrastructure projects enhances its market position.

The primary target audiences for NWS Holdings include governments, large corporations, and institutional investors. The company appeals to these groups by demonstrating long-term value creation, financial stability, and a responsible approach to business. This approach is crucial for securing contracts and maintaining investor confidence.

NWS Holdings' financial performance reflects its strong market position and effective sales strategy. The overall Attributable Operating Profit increased by 21% year-on-year to HK$4,167.4 million in FY2024. This growth underscores the company's financial health and its ability to generate revenue.

The company's brand perception is further solidified by its recognition with an 'Honourable Mention' in the 'Awards of Excellence in ESG' at The Hong Kong Corporate Governance & ESG Excellence Awards 2024. This recognition highlights NWS Holdings' commitment to sustainability and responsible business practices, which are integral to its marketing strategy.

The brand positioning of NWS Holdings, now CTF Services Limited, relies on several key elements that contribute to its market success. These elements collectively define the company's identity and value proposition, supporting its sales strategy and overall business strategy.

- Operational Excellence: Emphasis on efficient and effective operations across all business segments.

- Shared Value: Commitment to creating value for stakeholders and the community through sustainable practices.

- Sustainability: Integration of environmental, social, and governance (ESG) factors into core business operations.

- Financial Stability: Demonstrated by consistent financial performance and growth, attracting investors.

- Reliability and Expertise: Building trust through dependable services and specialized knowledge in infrastructure and services.

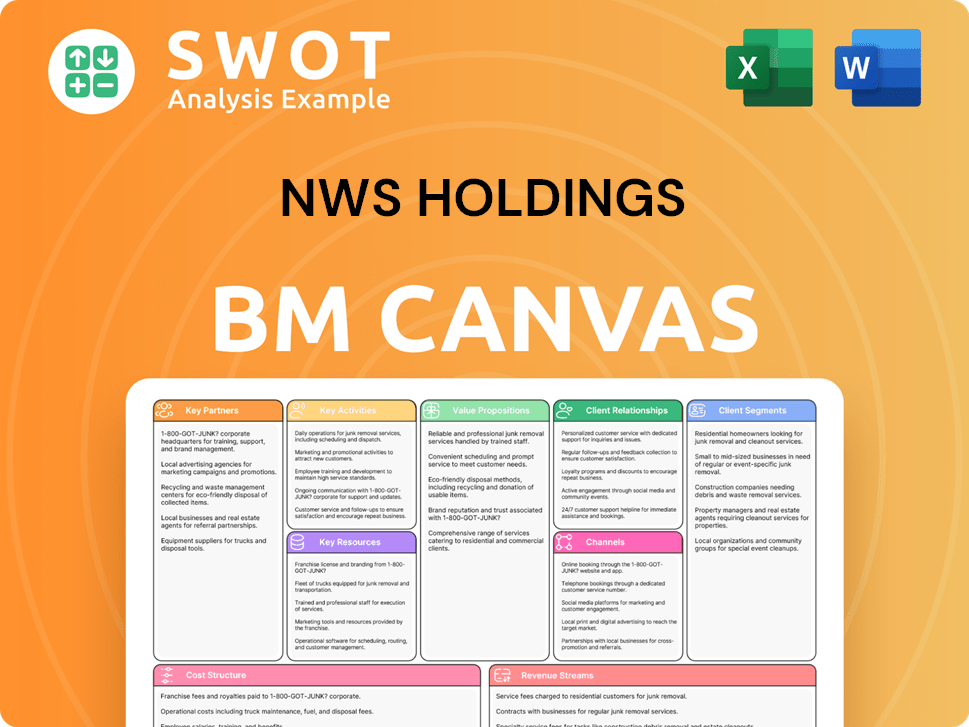

NWS Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are NWS Holdings’s Most Notable Campaigns?

For a conglomerate like NWS Holdings, the concept of 'campaigns' is less about direct consumer marketing and more about strategic initiatives that enhance its corporate image and drive business growth. These initiatives are crucial for its NWS Holdings business strategy, focusing on long-term sustainability and stakeholder value. The company's approach involves aligning its diverse business units, from roads to insurance, with broader environmental, social, and governance (ESG) goals.

A key focus is the 'Breakthrough 2050' ESG framework, which sets ambitious targets for sustainable development, including achieving net-zero emissions by 2050. This framework requires all business segments to adhere to Science Based Targets initiative (SBTi) standards. This commitment is demonstrated by the successful submission of commitment letters for carbon reduction by Hip Hing Construction and CTF Life Insurance. These actions highlight the company's dedication to environmental responsibility and its efforts to build a resilient and future-ready business.

Furthermore, NWS Holdings actively engages in market analysis and public relations to communicate its achievements and industry leadership. The release of its first Corporate Climate Action Research Report in May 2024, in collaboration with the Business Environment Council, provided valuable insights into climate action across various sectors in Hong Kong. These efforts are essential components of the NWS Holdings marketing strategy, helping the company to maintain a positive reputation and attract investors.

The 'Breakthrough 2050' framework is a significant NWS Holdings sales strategy, setting ambitious goals for sustainable development. It focuses on achieving net-zero emissions by 2050 and aligning all business units with SBTi standards. This initiative boosts business resilience and enhances future readiness, showcasing the company's commitment to environmental responsibility.

The Corporate Climate Action Research Report, released in May 2024, provides insights into climate action across key sectors in Hong Kong. This report, a collaborative effort, enhances NWS Holdings' reputation as a leader in sustainable development. It showcases the company's commitment to industry collaboration and responsible market practices.

NWS Holdings received top-tier recognition in the Institutional Investor 2024 Asia Pacific (Ex-Japan) Executive Team Rankings for 'Best Overall ESG'. This recognition validates the company's strategic focus and investor relations efforts. It highlights the effectiveness of its sustainability initiatives and commitment to stakeholder value.

NWS Construction Group secured a 321% year-on-year increase in new contracts, reaching HK$21.9 billion in FY2024. This growth reflects successful business development efforts within the construction segment. It demonstrates the effectiveness of the company's NWS Holdings sales strategy in securing new projects.

The primary focus of NWS Holdings' strategic campaigns is on sustainability, corporate responsibility, and business development.

- 'Breakthrough 2050' ESG Framework: Sets ambitious sustainability targets.

- Corporate Climate Action Research Report: Enhances industry leadership.

- Institutional Investor Recognition: Validates strategic focus and investor relations.

- Construction Segment Growth: Shows the effectiveness of business development initiatives.

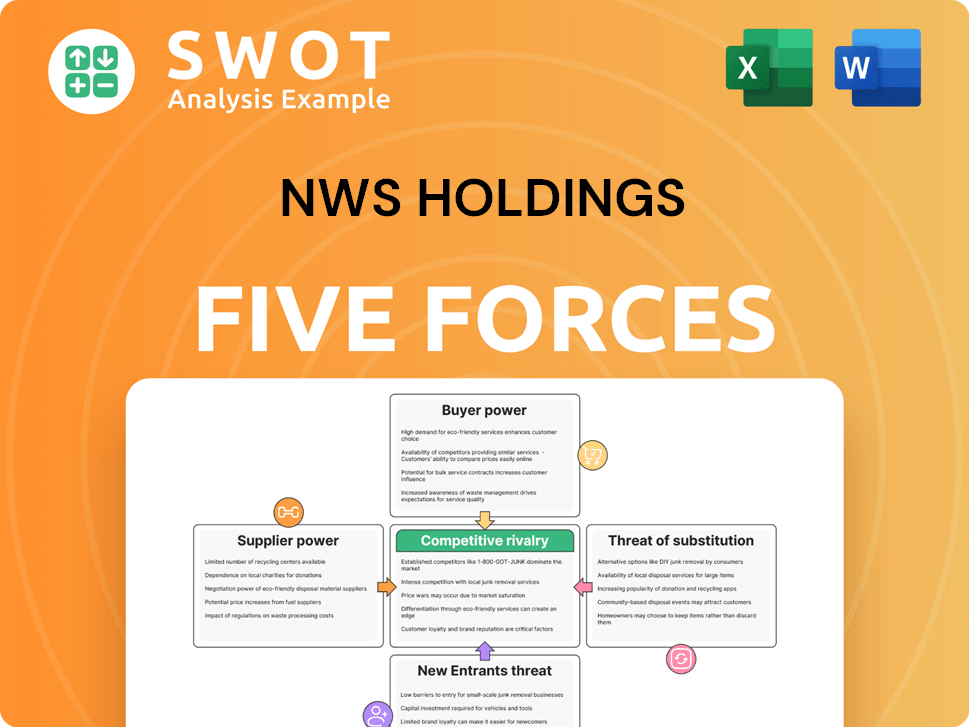

NWS Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of NWS Holdings Company?

- What is Competitive Landscape of NWS Holdings Company?

- What is Growth Strategy and Future Prospects of NWS Holdings Company?

- How Does NWS Holdings Company Work?

- What is Brief History of NWS Holdings Company?

- Who Owns NWS Holdings Company?

- What is Customer Demographics and Target Market of NWS Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.