NWS Holdings Bundle

Can NWS Holdings Navigate the Future Successfully?

NWS Holdings, a key player in infrastructure and services, is at a pivotal juncture, especially after its 2023 privatization. This strategic shift by Chow Tai Fook Enterprises aims to boost operational agility and competitive edge. Founded in Hong Kong in 2002, NWS Holdings has evolved from its roots in New World Development to become a diversified conglomerate.

The NWS Holdings SWOT Analysis reveals how the company's growth strategy and future prospects are shaped by its market position and strategic planning. Its diverse portfolio across roads, environment management, and more, positions it for significant expansion. Understanding NWS Holdings' business strategy and financial performance is crucial for investors and stakeholders looking at long-term goals and investment opportunities in the infrastructure investment sector.

How Is NWS Holdings Expanding Its Reach?

NWS Holdings is actively pursuing several expansion initiatives to strengthen its business and secure future growth. These initiatives are designed to leverage the company's existing strengths in infrastructure and services while exploring new opportunities for growth and diversification. The company's strategic focus includes entering new markets and expanding its product and service offerings to meet evolving industry demands.

A key element of NWS Holdings' growth strategy involves geographic expansion, particularly within Mainland China. The company is focusing on the Greater Bay Area, a region of significant economic development. This strategic move allows NWS Holdings to capitalize on the growing demand for infrastructure and services driven by urbanization and economic growth.

In addition to geographic expansion, NWS Holdings is also diversifying its product and service offerings. This includes exploring new areas within its existing segments, such as waste-to-energy projects and hazardous waste treatment in environmental management. Furthermore, the company is actively evaluating potential mergers and acquisitions to enhance its market share and diversify revenue streams.

NWS Holdings is targeting the Greater Bay Area for expansion, leveraging its expertise in infrastructure and services. This strategic move aims to capitalize on the region's economic growth and increasing demand for related services. The company's focus on Mainland China reflects its commitment to tapping into high-growth markets.

The company is exploring new areas within its existing segments, such as waste-to-energy projects and hazardous waste treatment. This diversification strategy aims to enhance revenue streams and adapt to evolving environmental regulations. Evaluating potential mergers and acquisitions is another key initiative for growth.

NWS Holdings is actively evaluating potential mergers and acquisitions to align with its core competencies. These strategic moves aim to acquire new technologies, expand market share, and diversify revenue streams. The company's approach is to seek synergistic opportunities that enhance its overall business performance.

The company continues to explore opportunities in port and logistics, leveraging its established network and operational capabilities. This includes enhancing connectivity and efficiency across the regions it serves. These initiatives are vital for maintaining a competitive edge in the industry.

NWS Holdings' expansion initiatives are designed to drive business development and enhance financial performance. The company's focus on the Greater Bay Area and diversification into waste-to-energy projects aligns with its long-term goals. These strategies are expected to improve revenue growth and market position.

- Expansion into the Greater Bay Area is a key strategic move.

- Diversification into waste-to-energy projects enhances revenue streams.

- Evaluating mergers and acquisitions is a core part of the growth strategy.

- Focus on port and logistics enhances connectivity and efficiency.

NWS Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does NWS Holdings Invest in Innovation?

NWS Holdings is strategically focused on leveraging technology and innovation to drive sustained growth across its diverse business segments. This commitment is reflected in its investments in research and development, in-house technological advancements, and strategic collaborations with external innovators and technology providers. The core of this strategy involves a significant emphasis on digital transformation, aiming to improve operational efficiency, enhance service delivery, and create new value propositions.

The company's approach to innovation is multifaceted, encompassing the adoption of automation across its infrastructure assets, such as smart road management systems and automated port operations. This focus extends to exploring cutting-edge technologies like Artificial Intelligence (AI) and the Internet of Things (IoT) to enhance predictive maintenance in its road networks and improve real-time monitoring in its environmental facilities. Sustainability initiatives are also integral, with investments in green technologies for waste management and promoting energy-efficient solutions in construction projects.

These technological advancements and platforms directly support NWS Holdings' growth objectives by improving cost-effectiveness, enhancing safety, and enabling the development of more sophisticated and environmentally friendly services. While specific patent details or recent awards are not widely publicized, the company's continuous investment in these areas demonstrates its commitment to innovation-driven leadership within its industries. This approach is crucial for achieving long-term goals and maintaining a competitive edge in the market.

NWS Holdings is actively pursuing digital transformation across its operations. This includes the implementation of smart road management systems and automated port operations. The goal is to increase efficiency and improve service delivery.

The company is exploring the use of Artificial Intelligence (AI) and the Internet of Things (IoT). These technologies are aimed at improving predictive maintenance in road networks and enhancing real-time monitoring in environmental facilities.

NWS Holdings is investing in green technologies for waste management and promoting energy-efficient solutions in its construction projects. This reflects a commitment to sustainable development and environmental responsibility.

A key aspect of NWS Holdings' innovation strategy is improving operational efficiency. This is achieved through automation, digital transformation, and the application of advanced technologies. The aim is to optimize processes and reduce costs.

The company's innovation efforts are designed to enhance service delivery across its various business segments. This includes improving the quality and reliability of services offered to customers. This is a key component of the overall growth strategy.

NWS Holdings engages in strategic collaborations with external innovators and technology providers. These partnerships help the company access new technologies and expertise. This collaborative approach supports its innovation goals.

These technological advancements and strategic initiatives are designed to contribute directly to NWS Holdings' growth objectives. The focus on innovation is expected to improve cost-effectiveness, enhance safety, and enable the development of more sophisticated and environmentally friendly services. This approach supports the company's long-term goals and enhances its market position.

- Cost Reduction: Automation and digital transformation are expected to reduce operational costs across various business segments.

- Enhanced Safety: The implementation of advanced technologies aims to improve safety measures in infrastructure projects and operations.

- Environmental Sustainability: Investments in green technologies and energy-efficient solutions support sustainable development goals.

- Service Enhancement: The integration of AI and IoT technologies is expected to improve service delivery and customer satisfaction.

- Competitive Advantage: These initiatives are designed to provide a competitive edge in the market.

NWS Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is NWS Holdings’s Growth Forecast?

The financial outlook for NWS Holdings is shaped by its diverse portfolio and strategic initiatives. For the fiscal year that ended on December 31, 2023, the company reported a profit attributable to shareholders of HK$1,073.4 million. This marks a significant improvement compared to the previous period. The focus on infrastructure and services, which typically generate stable cash flows, provides a solid financial foundation.

Following its privatization, detailed public disclosures regarding specific revenue targets and profit margins for the immediate future are limited. However, strategic moves like the divestment of non-core assets, such as the sale of its interest in the Beijing Capital International Airport, signal a focus on optimizing the portfolio to enhance profitability and streamline operations. This approach is key to the company's Brief History of NWS Holdings and its evolution.

The privatization by Chow Tai Fook Enterprises Limited suggests a long-term investment perspective, potentially offering greater flexibility in funding strategic projects without the immediate pressures of the public market. The company's financial objectives are likely aligned with its historical performance of generating consistent returns from its infrastructure assets. Simultaneously, it seeks new avenues for growth within its services segments, particularly in environmental and facilities management, areas experiencing increasing demand.

NWS Holdings' financial performance in 2023 showed a strong rebound, with a profit attributable to shareholders of HK$1,073.4 million. This reflects the company's effective strategies and operational improvements. The company's focus on core infrastructure and services businesses contributed to this positive financial outcome.

The sale of assets, such as the interest in Beijing Capital International Airport, demonstrates a strategic shift towards streamlining operations. This move is aimed at enhancing profitability and focusing on core competencies. These actions are part of the company's broader business development strategy.

The company continues to invest in infrastructure projects, which are crucial for long-term growth. These investments are designed to generate stable cash flows and provide a solid financial foundation. This approach supports sustainable development and long-term goals.

NWS Holdings is expanding its services segments, particularly in environmental and facilities management. These areas are experiencing growing demand, offering new avenues for revenue growth. This expansion is a key part of the company's strategic planning.

The future prospects for NWS Holdings are positive, driven by its strategic initiatives and market position. The company's focus on infrastructure investment and business development is expected to drive revenue growth. The privatization by Chow Tai Fook Enterprises Limited provides a stable platform for long-term success.

- Continued infrastructure investment to ensure stable cash flows.

- Expansion of services segments to capture growing market demand.

- Strategic portfolio optimization to enhance profitability.

- Disciplined capital allocation and sustainable growth strategies.

NWS Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow NWS Holdings’s Growth?

The NWS Holdings faces several risks that could affect its Growth Strategy and future plans. These challenges stem from market competition, regulatory changes, and supply chain issues. Understanding these potential obstacles is crucial for evaluating the company's long-term Future Prospects.

Market dynamics, including competition in infrastructure and services, pose significant hurdles. Regulatory shifts and technological advancements also present substantial risks. Effective risk management and strategic planning are essential for mitigating these challenges and ensuring sustainable Business Development.

NWS Holdings, like other companies involved in Infrastructure Investment, must navigate a complex landscape. The company’s ability to adapt to these challenges will significantly influence its Financial Performance and overall success.

Competition in the infrastructure and services sectors is intense. Competitors, both domestic and international, constantly seek market share. This competitive pressure can impact project profitability and market position.

Changes in government policies can significantly affect operations. Shifts in infrastructure development, environmental regulations, or foreign investment rules can impact profitability. Compliance costs, such as those related to environmental standards, can be substantial.

Supply chain disruptions can impact project timelines and costs. Delays in receiving specialized equipment or materials can lead to increased expenses and project delays. Effective supply chain management is critical.

Failure to adapt to new technologies can make existing services less competitive. The rapid pace of technological innovation requires continuous investment and adaptation. Embracing new technologies is essential for maintaining a competitive edge.

Shortages of skilled labor or challenges in attracting talent can hinder growth. Efficient resource management, including workforce planning and development, is crucial. Addressing these constraints is vital for executing growth strategies.

Geopolitical instability can affect cross-border investments. Political risks and international relations can impact projects and investments. Monitoring and adapting to geopolitical shifts are important.

NWS Holdings employs a diversified portfolio to reduce reliance on any single segment. Robust risk management frameworks and scenario planning are used to anticipate challenges. The company's long-standing presence in complex markets suggests effective adaptation strategies. For more insights, explore the Mission, Vision & Core Values of NWS Holdings.

Geopolitical tensions pose risks to cross-border investments. The increasing emphasis on sustainable and green infrastructure requires significant investment. Adapting to these emerging risks is crucial for long-term success. The company must continuously adapt to evolving market conditions.

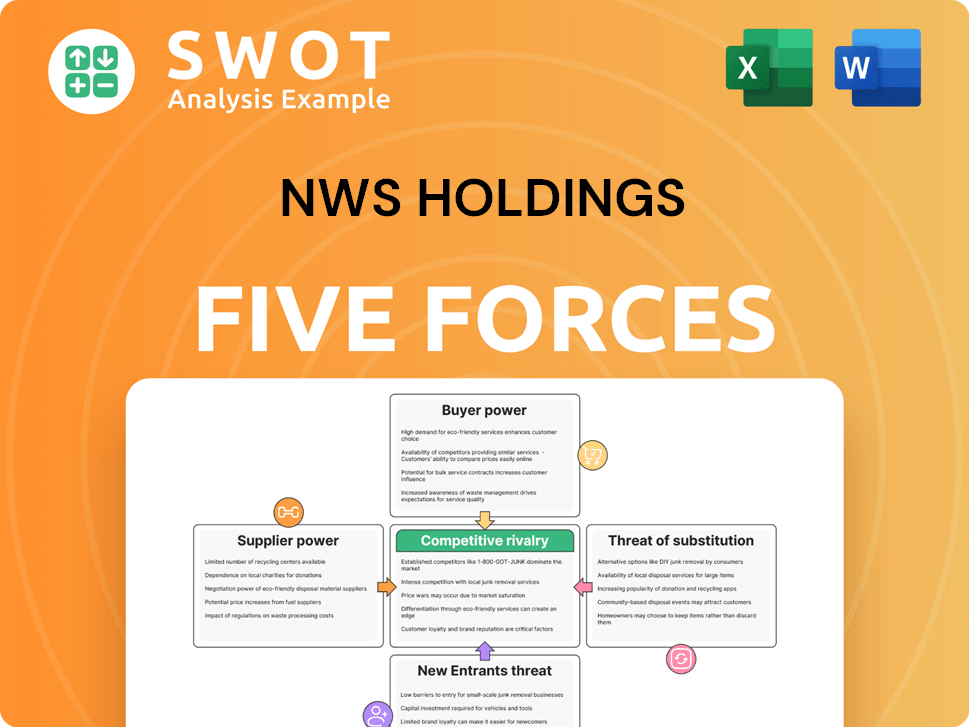

NWS Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of NWS Holdings Company?

- What is Competitive Landscape of NWS Holdings Company?

- How Does NWS Holdings Company Work?

- What is Sales and Marketing Strategy of NWS Holdings Company?

- What is Brief History of NWS Holdings Company?

- Who Owns NWS Holdings Company?

- What is Customer Demographics and Target Market of NWS Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.