NWS Holdings Bundle

Unveiling NWS Holdings: How Does This Infrastructure Giant Operate?

NWS Holdings, a key player in Hong Kong and beyond, manages a diverse portfolio spanning vital sectors like roads and environmental services. Its influence shapes urban development and trade, making it a critical entity to understand. This exploration dives into the core of NWS Holdings operations, offering insights for investors and industry watchers alike.

From NWS Holdings SWOT Analysis to its impact on public services, this analysis provides a comprehensive view. We'll dissect the NWS Holdings business model, exploring its revenue streams and strategic maneuvers within the infrastructure investment landscape. Understanding the company's structure and financial performance is key to grasping its role in the region's economic future.

What Are the Key Operations Driving NWS Holdings’s Success?

NWS Holdings creates value through its diverse portfolio of infrastructure and services. This includes toll roads, environmental management, port and logistics, and construction services. The company serves a wide range of customers, from government entities to individual consumers, ensuring essential services and infrastructure development.

The core of NWS Holdings operations involves capital-intensive, integrated processes. These processes span project financing, engineering, construction, and ongoing management. This approach allows the company to manage complex, long-term projects effectively.

The company's value proposition is built on its ability to deliver essential services and infrastructure. This is achieved through strategic investments and operational excellence, particularly in Hong Kong and Mainland China. Moreover, a recent article, Growth Strategy of NWS Holdings, provides further insights into the company's operational approach.

NWS Holdings operates through several key segments, including toll roads, environmental management, and port services. These segments are supported by construction and facilities management. The company's diversified approach helps to mitigate risks and capitalize on various market opportunities.

NWS Holdings invests heavily in infrastructure projects, focusing on long-term value creation. The company's operations are characterized by high capital expenditure and long-term contracts. This focus on infrastructure investment supports sustainable growth and provides essential services.

Revenue is generated through toll fees from roads, fees from environmental services, and port and logistics charges. Construction and facilities management also contribute to revenue through project-based income and ongoing management fees. The company's diverse revenue streams contribute to its financial stability.

As one of the leading Hong Kong companies, NWS Holdings plays a crucial role in providing public services. These services include transportation, waste management, and port facilities. The company's operations are essential for the functioning of the city.

NWS Holdings operations are characterized by long-term projects and significant capital investments. The company's supply chain relies on strong relationships with contractors and technology providers. Its distribution networks are integrated with its infrastructure assets.

- Toll Roads: Planning, construction, and maintenance of expressways and bridges.

- Environmental Management: Waste processing and water purification using advanced technologies.

- Port and Logistics: Management of port terminals, warehousing, and transportation networks.

- Construction and Facilities Management: Large-scale building projects and asset management.

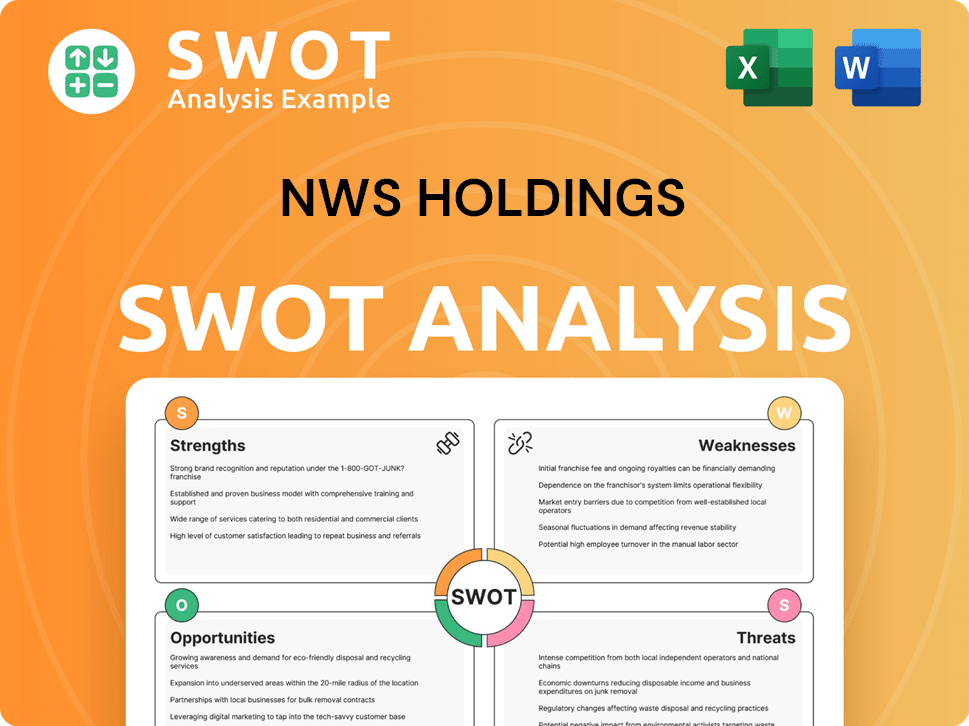

NWS Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does NWS Holdings Make Money?

The revenue streams and monetization strategies of NWS Holdings are diverse, primarily stemming from its infrastructure and services segments. These strategies are designed to ensure stable and predictable cash flows, leveraging long-term contracts and strategic investments. The company's approach focuses on maximizing returns through various business operations.

A significant portion of NWS Holdings' revenue comes from its infrastructure segment. This includes income from roads, environmental management, and port and logistics operations. The company also engages in strategic investments that contribute to its overall financial performance.

The financial year ended June 30, 2024, showed that the Infrastructure segment, encompassing roads and environment, remained a key income generator for the company. This highlights the importance of these sectors in NWS Holdings operations.

The primary revenue streams for NWS Holdings are varied. These streams are designed to provide a diversified income base, reducing reliance on any single source. The company's business model is built on a foundation of infrastructure and service provision.

- Roads: Toll fees from expressways and bridges, driven by traffic volume and toll rates.

- Environmental Management: Income from waste treatment, waste-to-energy plants, and water treatment services.

- Port and Logistics: Handling fees, warehousing charges, and logistics services.

- Construction and Facilities Management: Project fees, property management, and maintenance contracts.

- Strategic Investments: Dividends, interest income, and capital gains from investee companies.

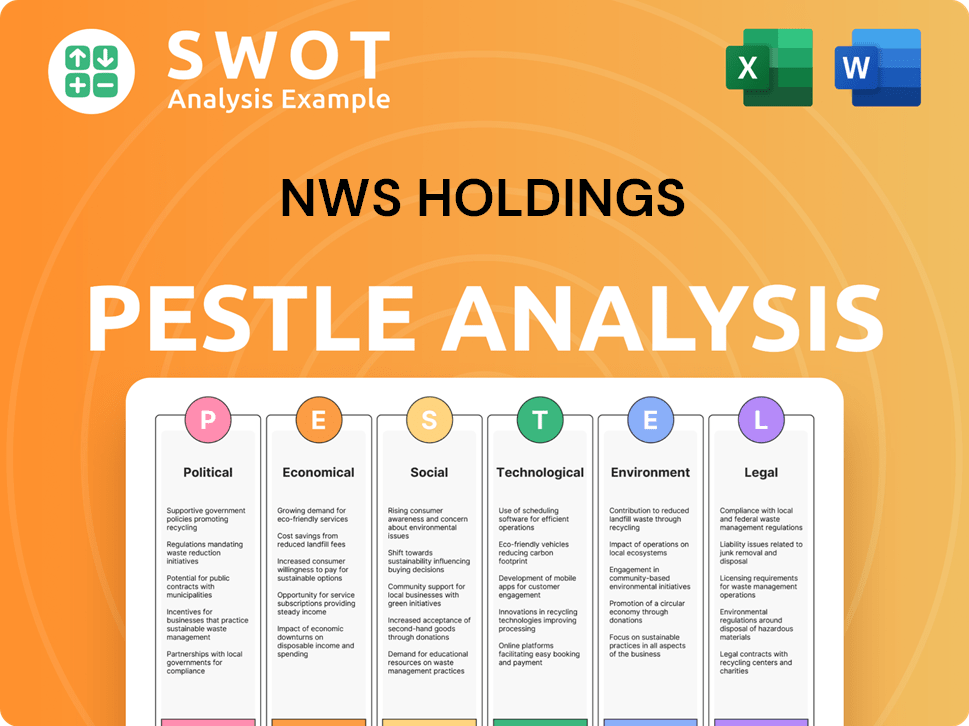

NWS Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped NWS Holdings’s Business Model?

NWS Holdings has achieved several significant milestones that have shaped its trajectory and financial results. Key strategic moves have been instrumental in its growth, particularly its expansion within Mainland China's infrastructure sector, focusing on toll roads and environmental management. The company has also strategically diversified its portfolio, broadening its revenue streams and mitigating risks.

The company's approach to navigating market challenges, including economic downturns and regulatory changes, has involved optimizing operations and strategically divesting non-core assets. Its competitive advantages are rooted in a strong brand reputation, extensive experience in large-scale infrastructure projects, and a deep understanding of the regulatory environments in Hong Kong, Mainland China, and Macau. These factors have enabled it to maintain a strong position in the market.

NWS Holdings' competitive edge is further enhanced by its established relationships with government bodies and local partners. Economies of scale derived from its extensive asset base contribute to cost efficiencies. The company continues to adapt to new trends, such as digitalization in infrastructure management and increasing demand for sustainable environmental solutions, by investing in technology and adopting greener practices to maintain its competitive edge and ensure long-term viability. For a detailed look at its growth strategies, consider reading the Growth Strategy of NWS Holdings.

NWS Holdings has achieved several key milestones. These include significant expansions in Mainland China's infrastructure sector, particularly in toll roads and environmental management. The company's strategic diversification beyond traditional infrastructure has also been a key development.

Strategic moves include continuous expansion within Mainland China's infrastructure sector, capitalizing on the country's rapid urbanization. Diversification into facilities management and strategic investments has broadened its revenue base. The proposed disposal of its construction business interest, as announced in late 2023, is a strategic pivot.

NWS Holdings' competitive advantages stem from its strong brand reputation and extensive operational experience. Its deep understanding of the regulatory landscapes in Hong Kong, Mainland China, and Macau provides a significant edge. Established relationships with government bodies and local partners are also crucial.

The company's financial performance is influenced by its infrastructure investments and public services. NWS Holdings' ability to adapt to market changes and optimize operations has been critical. The diversification of its portfolio has helped in maintaining financial stability.

NWS Holdings operations involve infrastructure investment and public services, with a focus on toll roads, environmental management, and facilities management. The company's business model centers on long-term infrastructure projects and service provision, generating revenue through user fees, service charges, and strategic investments.

- Infrastructure Investment: Focused on toll roads and environmental projects.

- Public Services: Includes facilities management and other services.

- Revenue Generation: Through user fees, service charges, and strategic investments.

- Market Focus: Primarily in Hong Kong, Mainland China, and Macau.

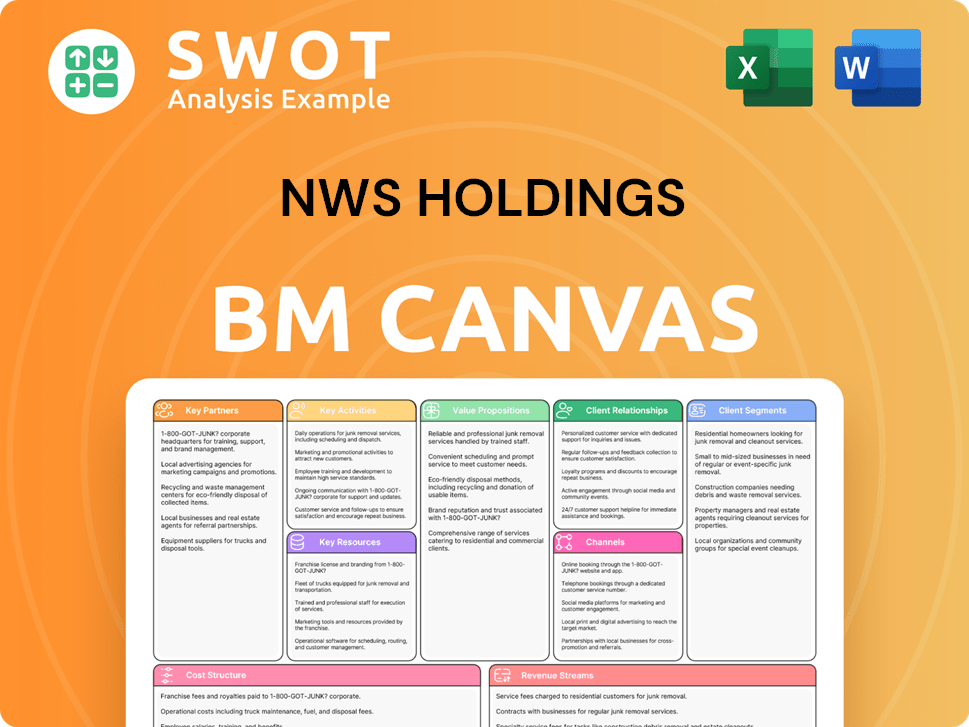

NWS Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is NWS Holdings Positioning Itself for Continued Success?

NWS Holdings holds a strong industry position, particularly in infrastructure and services within Hong Kong and Mainland China. Its extensive asset base and long-standing presence contribute to significant market share in segments like toll roads and environmental management. The company faces risks including regulatory changes, competition, and macroeconomic factors impacting traffic volumes and demand for services.

Looking ahead, NWS Holdings focuses on strategic initiatives to sustain and expand its revenue generation. This includes investing in high-growth infrastructure projects, particularly in environmental protection and smart city solutions, aligning with government policies. The proposed privatization could significantly alter the company's operational strategies and future trajectory.

NWS Holdings maintains a prominent position in infrastructure and services, especially in Hong Kong and Mainland China. Its diverse portfolio includes toll roads, environmental management, and other public services. The company's established presence provides a competitive advantage, supported by its extensive asset base and customer loyalty.

The company faces several risks that could impact its performance. These include potential regulatory changes affecting toll rates and environmental standards. Increased competition from both domestic and international players also poses a challenge. Macroeconomic slowdowns and fluctuations in raw material costs further contribute to the risks.

NWS Holdings is focused on strategic initiatives aimed at sustaining and expanding its revenue generation. This involves continued investment in high-growth infrastructure projects, especially in environmental protection and smart city solutions. The company is also exploring digital transformation to enhance operational efficiency.

Key strategic initiatives include investments in high-growth infrastructure projects. The company is also focused on exploring digital transformation to enhance efficiency. The proposed privatization by Chow Tai Fook Enterprises Limited could significantly alter the company's future trajectory, potentially leading to a more focused approach.

NWS Holdings's success hinges on several factors, including effective management of its diverse portfolio and navigating regulatory environments. The company's ability to adapt to changing market conditions and capitalize on infrastructure investment opportunities is crucial for future growth. The ongoing urbanization and infrastructure development trends in its key markets provide significant prospects.

- The company's financial performance is closely tied to traffic volumes on its toll roads and demand for its environmental services.

- NWS Holdings must effectively manage its debt obligations, particularly in the face of potential interest rate fluctuations.

- The proposed privatization could reshape the company's strategic focus and operational strategies.

- Brief History of NWS Holdings provides more insights into its past.

NWS Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of NWS Holdings Company?

- What is Competitive Landscape of NWS Holdings Company?

- What is Growth Strategy and Future Prospects of NWS Holdings Company?

- What is Sales and Marketing Strategy of NWS Holdings Company?

- What is Brief History of NWS Holdings Company?

- Who Owns NWS Holdings Company?

- What is Customer Demographics and Target Market of NWS Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.