Reckitt Benckiser Group Bundle

How Does Reckitt Benckiser Navigate the Consumer Goods Battlefield?

Reckitt Benckiser Group Plc (RB Group), a titan in the consumer goods sector, boasts a vast array of health, hygiene, and nutrition products. This global powerhouse has captivated consumers worldwide for over two centuries. But how does Reckitt, with its impressive Reckitt Benckiser Group SWOT Analysis, maintain its edge in an increasingly competitive market?

Understanding the Competitive Landscape of Reckitt Benckiser is crucial for investors, analysts, and strategists alike. This market analysis will dissect the RB Group's industry position, examining its key rivals and competitive advantages. We'll explore how Reckitt Benckiser navigates market challenges and opportunities, providing a comprehensive strategic overview of its future outlook within the consumer goods industry.

Where Does Reckitt Benckiser Group’ Stand in the Current Market?

Reckitt Benckiser (RB Group) holds a prominent position within the consumer goods sector, particularly in the health, hygiene, and nutrition segments. The company's core operations revolve around developing, manufacturing, and marketing a wide range of consumer health, hygiene, and home products. Its value proposition centers on providing trusted brands that address everyday consumer needs, focusing on innovation and consumer health.

In fiscal year 2023, Reckitt reported an annual revenue of £14.61 billion, demonstrating a 1.07% growth, and for the full year 2024, underlying net revenue was £14.2 billion. The company's adjusted operating profit increased by 8.6% in 2024, showcasing its financial strength and operational efficiency. Reckitt's strategic focus on 'Powerbrands' and geographical diversification underlines its competitive strategy within the consumer goods market.

Reckitt Benckiser's core operations involve the development, manufacturing, and marketing of consumer health, hygiene, and home products. The company's focus is on high-growth and high-margin 'Powerbrands' like Mucinex, Strepsils, and Dettol. These brands are key drivers of the company's revenue and profitability.

The value proposition of Reckitt Benckiser centers on providing trusted brands that address everyday consumer needs. The company emphasizes innovation and consumer health, offering products that improve the quality of life. Reckitt aims to deliver consistent growth and shareholder value through its strong brand portfolio.

In 2024, Reckitt's underlying net revenue was £14.2 billion, with like-for-like sales growth of 1.4%. The company's adjusted operating profit increased by 8.6% in 2024, and the adjusted operating margin expanded by 140 basis points to 24.5%. The company returned £2.7 billion to shareholders in 2024 through dividends and share buybacks.

Reckitt is reorganizing its business into three segments effective January 1, 2025: core Reckitt, Essential Home, and Mead Johnson Nutrition. The company is also actively working to exit its 'Essential Home' portfolio by the end of 2025 and exploring strategic options for its Mead Johnson Nutrition business. This strategic shift aims to streamline operations and focus on core growth areas.

Reckitt Benckiser's strong market position is supported by a diverse portfolio of well-known brands and a global presence. The company's focus on high-growth, high-margin products, such as those in the 'core Reckitt' segment, drives its financial performance. The company's strategic initiatives, including the reorganization into three segments and the exit from the 'Essential Home' portfolio, aim to enhance its focus on core growth areas and improve operational efficiency. For a deeper dive into Reckitt's growth strategy, you can read more in this article: Growth Strategy of Reckitt Benckiser Group.

- Core Reckitt: The 'core Reckitt' portfolio, representing 71% of revenue in Q1 2025, grew by 3.1% like-for-like (LFL).

- Geographical Balance: Europe contributes 35%, North America 27%, and Emerging Markets 38% of FY2023 net revenue.

- Financial Health: The company returned £2.7 billion to shareholders in 2024 through dividends and share buybacks.

- Future Outlook: Reckitt aims for group LFL net revenue growth of 2% to 4% for full-year 2025.

Reckitt Benckiser Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Reckitt Benckiser Group?

The RB Group operates within a highly competitive consumer goods market, facing intense rivalry across its health, hygiene, and nutrition segments. The Competitive Landscape is shaped by a mix of established giants and emerging players, all vying for market share and consumer loyalty. Understanding the competitive dynamics is crucial for assessing the company's strategic positioning and future prospects.

Reckitt Benckiser competes globally, with its performance significantly influenced by its ability to innovate, manage its brand portfolio, and adapt to evolving consumer preferences. The company's strategic moves, such as divesting non-core assets, reflect its efforts to sharpen its focus and enhance its competitive edge. This focus is crucial for maintaining and improving its position in the face of stiff competition.

Reckitt Benckiser faces strong competition from major global players. These competitors challenge RB Group across various fronts, including pricing, innovation, and marketing. Understanding these rivals is key to evaluating Reckitt Benckiser's strategic position.

P&G is a significant competitor, especially in cleaning, personal care, and health products. P&G's diverse portfolio directly challenges Reckitt Benckiser's brands. The competition between these two giants is fierce, with each striving for market dominance.

Unilever is a major competitor in hygiene and personal care. Unilever's extensive range of products competes directly with Reckitt Benckiser's offerings. The competition is particularly strong in the household and personal care sectors.

Johnson & Johnson competes in health and personal care, particularly in over-the-counter medicines and antiseptic products. This competition impacts Reckitt Benckiser's health-related product lines. The rivalry is intense in the health sector.

Other competitors include Henkel, Nestlé, Amway, Clorox, Colgate-Palmolive, and Church & Dwight. These companies also challenge Reckitt Benckiser across various product categories. The market is highly fragmented.

In the drain cleaner market, specific competitors include Comstar International, PurposeBuilt Brands, S. C. Johnson & Son, and Zep Inc. These companies compete with Reckitt Benckiser's drain cleaner products. The competition is focused within this niche market.

The Competitive Landscape is dynamic, with companies constantly innovating and adapting. Intense marketing campaigns, product innovation, and efforts to gain market share are common. Reckitt Benckiser and its rivals are always striving to stay ahead.

- Eco-Friendly Products: The push for eco-friendly and sustainable products is strong, with companies like Reckitt Benckiser launching new formulations. This reflects changing consumer preferences.

- Infant Nutrition: The infant nutrition segment, where Reckitt Benckiser's Mead Johnson Nutrition operates, faces intense competition. This segment has been impacted by supply disruptions and litigation.

- E-commerce: The expansion of e-commerce is transforming the FMCG market, favoring companies that can adapt to online sales and digital marketing. This shift impacts Reckitt Benckiser's distribution strategies.

- Strategic Moves: Reckitt Benckiser is divesting non-core assets to focus on its high-margin Powerbrands. This strategic move aims to streamline operations and enhance its competitive edge.

- Market Analysis: For more detailed insights, consider reading about Marketing Strategy of Reckitt Benckiser Group.

Reckitt Benckiser Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Reckitt Benckiser Group a Competitive Edge Over Its Rivals?

The competitive landscape for the RB Group is defined by its robust brand portfolio and strategic market positioning. The company, a major player in the consumer goods sector, leverages its global presence and diverse product offerings to maintain a strong competitive edge. Understanding the competitive advantages of Reckitt Benckiser is crucial for investors and analysts alike, as it provides insights into the company's resilience and growth potential.

Key milestones and strategic moves have shaped Reckitt Benckiser's trajectory, allowing it to navigate the dynamic consumer goods market effectively. The company's ability to innovate and adapt to changing consumer preferences has been central to its success. A look at the Brief History of Reckitt Benckiser Group reveals the evolution of its strategic approach.

Reckitt Benckiser's competitive advantages are multifaceted, stemming from its strong brand equity, global reach, and commitment to innovation. These elements work together to fortify its position in the industry and contribute to its financial performance.

Reckitt Benckiser benefits from strong brand recognition and consumer loyalty, particularly with brands like Lysol and Dettol. These brands are synonymous with cleanliness and protection, attracting a broad audience. This strong brand recognition acts as a buffer against market fluctuations and supports consistent demand.

The company invests significantly in research and development to launch new and improved products. In Q1 2025, innovations in products like Lysol Air and Mucinex contributed to core segment growth. Reckitt aims to bring forward 40% more innovation in 2025 compared to 2024, utilizing AI tools to accelerate R&D.

Reckitt Benckiser operates in nearly 200 countries, expanding its market reach and diversifying revenue streams. Its robust supply chain network ensures product availability, building consumer confidence. This widespread presence enables cost efficiencies and competitive pricing.

Reckitt holds leadership positions in specific niche categories, such as auto dishwashing (35% global share with Finish), surface and disinfection (33% global share with Lysol and Dettol), intimate well-being (around 40% market share), and sore throat remedies (over 20% global share). This focus provides entrenched advantages.

Reckitt Benckiser's competitive strategy is built on several key strengths that contribute to its industry position and financial performance. These advantages have been consistently leveraged in marketing, product development, and strategic partnerships.

- Strong Brand Portfolio: A diverse range of well-known brands with high consumer recognition.

- Innovation: Continuous investment in R&D to meet evolving consumer demands.

- Global Footprint: Operations in nearly 200 countries, providing market reach and revenue diversification.

- Operational Efficiency: A robust supply chain and efficient distribution network.

- Niche Market Leadership: Dominant positions in specific categories.

Reckitt Benckiser Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Reckitt Benckiser Group’s Competitive Landscape?

The RB Group operates within the dynamic consumer goods sector, facing intense Industry Competition. Its Competitive Landscape is shaped by technological advancements, evolving consumer preferences, and global economic shifts. Navigating these factors is critical for sustaining and enhancing its market position.

Reckitt Benckiser's strategic focus includes addressing market saturation, regulatory changes, and economic downturns. Supply chain disruptions and ongoing litigations also pose risks. Conversely, the company is well-positioned to capitalize on growth opportunities in emerging markets and through product innovation, as discussed in Revenue Streams & Business Model of Reckitt Benckiser Group.

Reckitt Benckiser leverages AI and big data analytics to personalize consumer experiences. It optimizes product recommendations and enhances product formulations. Digital transformation strategies are in place to increase operational efficiency and engage with digitally native consumers. This includes improving brand visibility both in-store and online, and scaling e-commerce efforts in 2025.

Consumer preferences are shifting towards healthier, more sustainable, and eco-friendly products. Reckitt Benckiser's dedication to sustainability, including efforts to reduce its carbon footprint, enhances brand attractiveness. The launch of eco-friendly Dettol formulations is a direct response to the rising demand for sustainable hygiene solutions.

Reckitt Benckiser faces intense competition from major players like Procter & Gamble and Unilever. Regulatory changes and global economic downturns can impact sales. Supply chain disruptions and ongoing litigation challenges also pose significant hurdles. These factors pressure the company's RB Group market share and financial performance.

Emerging markets, particularly in India, Africa, and Southeast Asia, present significant growth opportunities. Product innovations, such as the introduction of new Durex Intensity condoms and Lysol Laundry Sanitizer, continue to drive growth. Strategic partnerships and acquisitions can also unlock new avenues for expansion. Reckitt Benckiser's strong performance in emerging markets, with a 10.7% LFL net revenue growth in Q1 2025, underscores this potential.

Reckitt Benckiser is executing a strategy to sharpen its portfolio and simplify its organization. The company is focusing on its high-growth, high-margin Powerbrands. It is on track to exit its 'Essential Home' portfolio by the end of 2025, while exploring options for Mead Johnson Nutrition. The 'Fuel for Growth' program aims to optimize fixed costs, targeting a reduction to 19% of net revenue by 2027 from 20.9% in 2024, supporting margin expansion.

- Reckitt Benckiser is investing in innovation and marketing.

- The company aims to remain resilient and deliver long-term value.

- Strategic realignment aims to create a more efficient and agile company.

- These initiatives are designed to strengthen Reckitt Benckiser's Competitive Advantages.

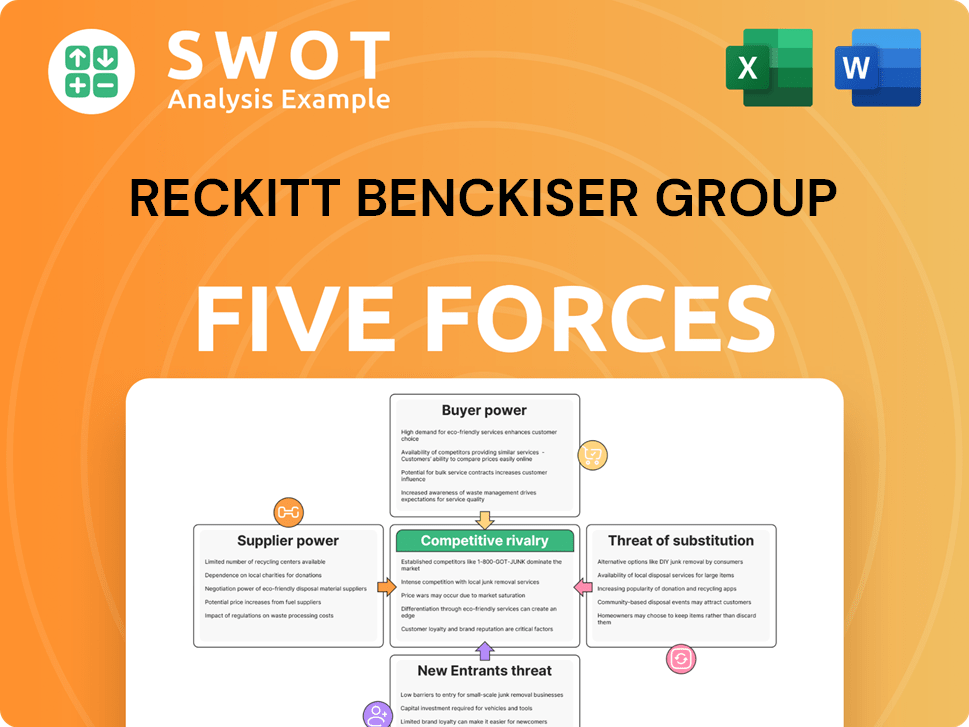

Reckitt Benckiser Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Reckitt Benckiser Group Company?

- What is Growth Strategy and Future Prospects of Reckitt Benckiser Group Company?

- How Does Reckitt Benckiser Group Company Work?

- What is Sales and Marketing Strategy of Reckitt Benckiser Group Company?

- What is Brief History of Reckitt Benckiser Group Company?

- Who Owns Reckitt Benckiser Group Company?

- What is Customer Demographics and Target Market of Reckitt Benckiser Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.