Reckitt Benckiser Group Bundle

How Does Reckitt Benckiser Thrive in the Consumer Goods Market?

Ever wondered how everyday essentials like Lysol and Dettol are brought to your home? Reckitt Benckiser Group, a global powerhouse, is behind many of the world's most trusted health, hygiene, and nutrition brands. Understanding the inner workings of this multinational corporation reveals insights into the consumer goods sector and the strategies driving its success. This exploration uncovers the secrets of Reckitt Benckiser Group SWOT Analysis, and its enduring market presence.

Reckitt Benckiser's impressive financial performance, with £14.6 billion in net revenue in 2023, showcases its resilience and strategic focus. Delving into the company's business operations, from its robust supply chain to its innovative marketing strategy, provides a comprehensive view of how RB Group maintains its competitive edge. This analysis is crucial for investors, consumers, and industry observers seeking to understand the dynamics of the consumer goods market and the enduring influence of Reckitt Benckiser Company.

What Are the Key Operations Driving Reckitt Benckiser Group’s Success?

The core operations of the Reckitt Benckiser (RB Group) revolve around the development, manufacturing, marketing, and distribution of health, hygiene, and nutrition products. The Reckitt Benckiser Company focuses on providing solutions for healthier lives and cleaner homes, meeting global consumer needs. Its product range serves various customer segments, from families seeking cleaning solutions to parents needing infant nutrition and individuals looking for over-the-counter health remedies. Key brands such as Lysol, Dettol, Strepsils, Nurofen, Enfamil, and Nutramigen are central to its business.

Reckitt Benckiser's value proposition is centered on delivering products that improve consumer well-being. They aim to offer trusted solutions that cater to essential needs in health, hygiene, and nutrition. Their brands are designed to provide effective and reliable products, ensuring consumer satisfaction and loyalty. This approach helps Reckitt Benckiser maintain a strong market position.

Operationally, Reckitt Benckiser uses a global manufacturing footprint to serve regional markets and optimize its supply chain. The company invests in research and development (R&D) to drive product innovation. Raw materials are sourced through a global network, with a focus on sustainability and ethical practices. Distribution channels include retail outlets, pharmacies, e-commerce platforms, and direct-to-consumer models. This integrated approach, from R&D to shelf, ensures a consistent supply of trusted products that enhance consumer well-being, differentiating Reckitt Benckiser in a competitive market. To learn more about their growth strategy, see Growth Strategy of Reckitt Benckiser Group.

Reckitt Benckiser operates a global manufacturing network, strategically located to serve various regional markets. This setup helps optimize supply chain efficiency, ensuring products reach consumers effectively. The company focuses on managing complex supply chains to meet diverse market demands.

R&D is a core function, driving product innovation and ensuring offerings remain relevant. Reckitt Benckiser invests significantly in R&D to develop new products and improve existing ones. This commitment helps them stay ahead in the competitive market.

Reckitt Benckiser uses multiple distribution channels, including retail, pharmacies, and e-commerce. This multi-channel approach allows them to reach consumers across various purchasing points. They also utilize direct-to-consumer models to enhance market reach.

Strong brand recognition and extensive marketing capabilities support Reckitt Benckiser's operations. Effective marketing strategies help maintain and strengthen brand loyalty. Their marketing efforts are crucial for maintaining a competitive edge.

Reckitt Benckiser's operational strength lies in its ability to scale production and manage complex supply chains. They adapt to local market demands, supported by strong brand recognition and extensive marketing capabilities. This integrated approach ensures a consistent supply of trusted products.

- Global Manufacturing: Strategic production facilities worldwide.

- R&D Focus: Continuous product innovation and improvement.

- Multi-Channel Distribution: Reaching consumers through various outlets.

- Brand Strength: Leveraging strong brand recognition and marketing.

Reckitt Benckiser Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Reckitt Benckiser Group Make Money?

The RB Group generates revenue primarily through the sale of its branded health, hygiene, and nutrition products. The company's financial success is closely tied to its ability to market and distribute these products globally. Understanding the revenue streams and monetization strategies of Reckitt Benckiser is crucial for investors and stakeholders.

For the full year 2023, the net revenue reached £14.6 billion. This revenue is categorized into three main segments: Health, Hygiene, and Nutrition. Each segment contributes significantly to the overall financial performance of the Reckitt Benckiser Company.

The Health segment, featuring brands like Strepsils and Nurofen, benefits from consistent demand for over-the-counter medicines. The Hygiene segment, including Lysol and Dettol, sees strong sales driven by consumer focus on cleanliness. The Nutrition segment, with brands such as Enfamil, caters to the specific needs of infants and children.

The company employs various strategies to maximize revenue and profitability. These strategies include volume growth, price optimization, and premiumization across its product portfolio. The use of tiered pricing and e-commerce expansion are also key components of its monetization approach.

- Volume Growth: Increasing the quantity of products sold through effective marketing and distribution.

- Price Optimization: Adjusting prices to maximize revenue while considering consumer demand and market conditions.

- Premiumization: Offering higher-priced products with enhanced features or benefits to increase profit margins.

- Tiered Pricing: Providing different product sizes and formats to cater to a range of consumer budgets.

- E-commerce and Digital Marketing: Expanding online sales channels and digital marketing efforts to reach more consumers. Further insights into the company's marketing approach can be found in this article: Marketing Strategy of Reckitt Benckiser Group.

Reckitt Benckiser Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Reckitt Benckiser Group’s Business Model?

The journey of the Reckitt Benckiser Company (RB Group) is marked by significant milestones and strategic maneuvers that have shaped its current market position. A pivotal moment for the company was the acquisition of Mead Johnson Nutrition in 2017, a strategic move that significantly bolstered its presence in the global infant nutrition market and diversified its portfolio beyond health and hygiene. This acquisition, while presenting integration challenges, ultimately expanded RB Group's reach into a high-growth category.

More recently, the company has focused on portfolio optimization, including divestitures of non-core brands to streamline business operations and concentrate on its most profitable segments. For instance, the sale of its Scholl footwear business in 2021 and some of its less strategic brands allowed Reckitt Benckiser to sharpen its focus on its core health, hygiene, and nutrition pillars. This strategic realignment reflects a broader trend in the consumer goods sector, where companies are increasingly focusing on core competencies and high-growth areas.

The company has navigated operational and market challenges such as supply chain disruptions, particularly during recent global events, and fluctuating raw material costs. RB Group has responded by enhancing supply chain resilience, investing in digitalization, and implementing pricing strategies to mitigate inflationary pressures. These strategies are crucial for maintaining profitability and market share in a dynamic global environment. For more information on the Reckitt Benckiser's target market, you can read this article: Target Market of Reckitt Benckiser Group.

Acquisition of Mead Johnson Nutrition in 2017 expanded RB Group's portfolio. Divestiture of Scholl footwear in 2021 streamlined operations. Strategic focus on core health, hygiene, and nutrition segments.

Focus on portfolio optimization through divestitures and acquisitions. Investment in supply chain resilience and digitalization. Implementation of pricing strategies to manage inflation.

Strong brand equity and consumer trust built over decades. Global brand portfolio that fosters customer loyalty. Economies of scale in manufacturing and distribution.

RB Group's financial performance is influenced by its ability to adapt to market trends. In recent years, the company has focused on increasing its e-commerce presence and developing sustainable products. The company's financial reports for 2024 and 2025 will provide the most current data on its performance.

Reckitt Benckiser's competitive edge is multifaceted, rooted in its strong brand equity and consumer trust. Its portfolio of globally recognized brands provides a significant advantage, fostering customer loyalty and enabling premium pricing. Furthermore, the company benefits from economies of scale in manufacturing and distribution, allowing for cost efficiencies.

- Strong brand recognition and consumer loyalty.

- Economies of scale in manufacturing and distribution.

- Continuous investment in R&D for innovative products.

- Adaptability to market trends, including e-commerce and sustainability.

Reckitt Benckiser Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Reckitt Benckiser Group Positioning Itself for Continued Success?

Reckitt Benckiser (RB Group) holds a significant position in the global consumer goods market. This is particularly evident in the health, hygiene, and nutrition sectors. The company competes with major players like Procter & Gamble and Unilever. RB Group maintains a strong market share due to its portfolio of leading brands and its extensive global distribution network.

Despite its robust market standing, Reckitt Benckiser faces several risks. These include regulatory changes, intense competition, fluctuations in raw material costs, and evolving consumer preferences. The company must continuously innovate and adapt to maintain its competitive edge and meet consumer demands.

Reckitt Benckiser is a key player within the consumer goods industry, particularly in health, hygiene, and nutrition. Its strong market share is driven by well-known brands and a global distribution network. The company benefits from a degree of stability due to demand for essential products.

Reckitt Benckiser faces risks such as regulatory changes and intense competition. Fluctuations in raw material costs and currency exchange rates also pose challenges. Adapting to changing consumer preferences, including the demand for sustainable products, is crucial for the company's success.

Reckitt Benckiser is focused on sustainable growth through innovation within its core categories. Digital transformation, including enhanced e-commerce and data analytics, is a priority. The company is committed to operational efficiency and brand building to sustain revenue generation.

The company's strategic initiatives include innovation, digital transformation, and operational efficiency. They are investing in brand building and leveraging data analytics. These efforts are designed to enhance e-commerce capabilities and understand consumer behavior better.

Reckitt Benckiser's performance is influenced by its ability to navigate industry-specific challenges and capitalize on growth opportunities. The company's ability to adapt to market dynamics is essential. Understanding the competitive landscape is crucial for strategic planning. You can find more information by reading Competitors Landscape of Reckitt Benckiser Group.

- Regulatory changes can impact product formulations and marketing.

- Intense competition necessitates continuous innovation and marketing investments.

- Consumer preferences for sustainable products drive product development.

- Digital transformation enhances e-commerce and data analytics capabilities.

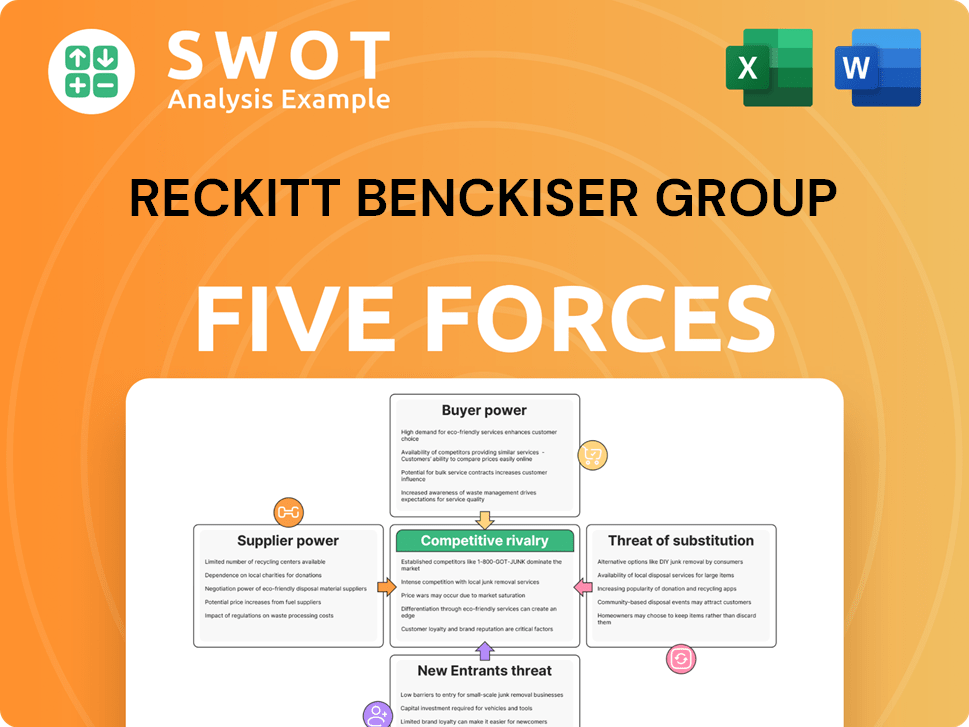

Reckitt Benckiser Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Reckitt Benckiser Group Company?

- What is Competitive Landscape of Reckitt Benckiser Group Company?

- What is Growth Strategy and Future Prospects of Reckitt Benckiser Group Company?

- What is Sales and Marketing Strategy of Reckitt Benckiser Group Company?

- What is Brief History of Reckitt Benckiser Group Company?

- Who Owns Reckitt Benckiser Group Company?

- What is Customer Demographics and Target Market of Reckitt Benckiser Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.