Reckitt Benckiser Group Bundle

Who Buys from Reckitt Benckiser?

In the ever-evolving landscape of consumer goods, understanding the Reckitt Benckiser Group SWOT Analysis is crucial for investors, analysts, and strategists alike. The company's success hinges on a deep understanding of its Customer Demographics and Target Market. From the impact of global events on demand to strategic portfolio shifts, Reckitt's ability to adapt defines its future.

This deep dive into Reckitt Benckiser explores the Consumer Profile, providing insights into Market Segmentation strategies and consumer behavior. We'll dissect the Target Market for key brands like Lysol, Dettol, and Nurofen, examining factors such as age, income, and geographic location. By understanding these demographics, stakeholders can make informed decisions about investment, marketing, and business planning within the RB Group.

Who Are Reckitt Benckiser Group’s Main Customers?

Understanding the Customer Demographics and Target Market of Reckitt Benckiser (RB Group) is crucial for grasping its market strategy. RB Group primarily targets consumers (B2C) globally, offering a diverse portfolio of health, hygiene, and nutrition products. This broad approach means the company serves a wide range of customers.

The Target Market for RB Group is extensive, encompassing various age groups, income levels, and family statuses. This is due to the essential nature of many of its products, such as over-the-counter medicines, cleaning supplies, and infant formula. These products cater to everyday needs, ensuring a consistent customer base.

A significant strategic shift for RB Group involves a sharpened focus on its 'Powerbrands'. These brands, which include Mucinex, Strepsils, Gaviscon, Nurofen, Lysol, Dettol, Harpic, Finish, Vanish, Durex, and Veet, represent a major portion of the company's revenue. In 2024, these Powerbrands accounted for 71% of total revenue within the 'core Reckitt' business. This indicates a move towards higher-margin, high-growth categories.

Emerging Markets are now RB Group's largest and fastest-growing geographical segment. In 2024, this segment delivered a 5.5% growth, with China leading the way with double-digit performance. This focus highlights the company's strategic shift towards these regions.

Product innovation plays a key role in emerging markets. For example, the success of Durex Fetherlite HA condoms in China, popular among women who make up over a third of buyers, shows how RB Group tailors its products to meet specific demographic needs.

RB Group's Consumer Profile is diverse, reflecting its wide range of products. The company's Market Segmentation strategy focuses on both geographic and product-specific consumer groups. This approach allows RB Group to tailor its marketing and product offerings effectively.

- Health & Hygiene: This segment includes products like Dettol, Lysol, and Strepsils, targeting consumers concerned with health and cleanliness.

- Sexual Wellbeing: Brands like Durex cater to a broad demographic, with product innovations addressing specific needs in various markets.

- Household Products: Finish and Vanish target consumers looking for effective cleaning solutions.

- Nutrition: Mead Johnson Nutrition, although planned to be exited by the end of 2025, caters to the infant formula market.

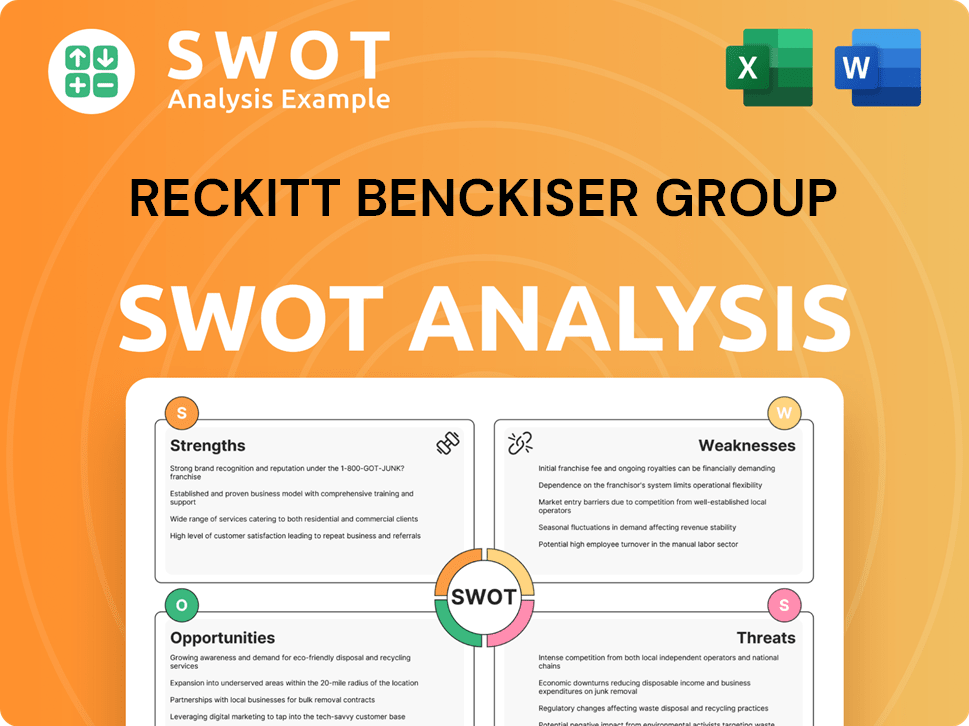

Reckitt Benckiser Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Reckitt Benckiser Group’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any business. For the company, this involves a deep dive into the motivations and behaviors of its diverse customer base. The company tailors its products and marketing strategies to meet these needs, ensuring customer satisfaction and loyalty.

The company's customer needs are centered around health, hygiene, and nourishment. Purchasing decisions are driven by practical needs, such as effective cleaning and germ protection, and psychological factors, including trust in established brands. The company's commitment to innovation and sustainability further shapes its approach to meeting evolving consumer demands.

The company's approach is data-driven, leveraging consumer insights and scientific innovation to develop superior products. This commitment is reflected in its product development, marketing campaigns, and overall business strategy.

Customers seek products that deliver on their core promises, such as effective cleaning and germ protection. Trust in established brands plays a significant role in influencing purchasing decisions. Aspirational desires for a healthier lifestyle also drive consumer behavior.

Product efficacy is a primary consideration, with consumers prioritizing products that deliver the promised results. Brand reputation and consumer trust are also key factors. Sustainability is becoming increasingly important, with eco-conscious consumers seeking environmentally friendly options.

The company continually innovates to meet evolving consumer needs. It adapts to gender-specific needs, as seen with the growth of Veet Men. The company also addresses unmet needs and pain points, such as the launch of new products.

The company is committed to achieving 100% recyclable packaging by 2025. This commitment reflects the growing importance of sustainability among consumers. This initiative aligns with the preferences of eco-conscious consumers.

The company invests heavily in research and development to create new products. In 2023, the company allocated £500 million to new product development. This investment demonstrates the company's commitment to innovation.

The company's product development is influenced by market trends and consumer feedback. The introduction of Mucinex Mighty Chews in 2024 demonstrates the company's focus on addressing unmet needs. New product launches are a key part of the company's strategy.

The success of Durex Fetherlite HA condoms in China, launched in 2022, highlights the company's ability to meet specific consumer needs. The growth of Veet Men, capturing over 80% of the global market, illustrates the company's adaptation to evolving gender-specific needs. The introduction of Mucinex Mighty Chews in 2024 showcases the company's focus on innovation and addressing unmet needs in the healthcare sector. For an in-depth look at how the company approaches growth, consider reading about the Growth Strategy of Reckitt Benckiser Group.

- The company's focus on health and hygiene products, such as Dettol and Lysol, aligns with consumer demand for germ protection, especially during events like the COVID-19 pandemic.

- The company's investment of £500 million in R&D in 2023 underscores its commitment to innovation and product development, ensuring it meets evolving consumer preferences.

- The launch of products like Mucinex Mighty Chews in 2024 demonstrates the company's ability to identify and address unmet needs in the market.

- The company's sustainability initiatives, such as the goal of 100% recyclable packaging by 2025, cater to the growing eco-conscious consumer segment.

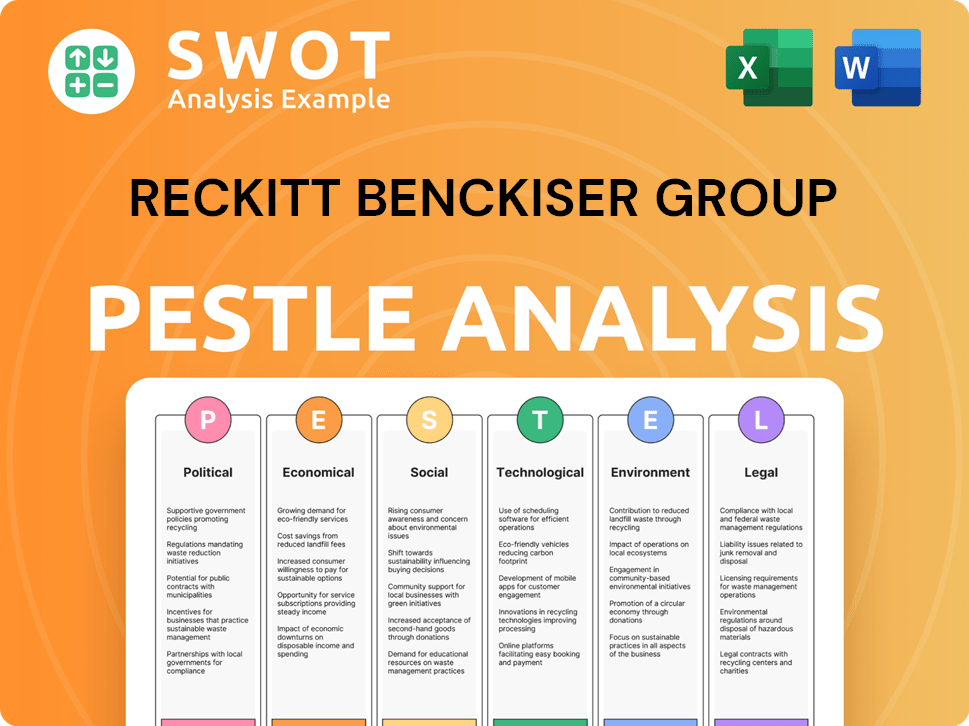

Reckitt Benckiser Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Reckitt Benckiser Group operate?

The geographical market presence of the company, also known as RB Group, is extensive, with operations spanning over 60 countries and product sales in more than 200 markets globally. This widespread reach allows the company to cater to a diverse range of consumer needs and preferences. In 2024, the company restructured its core business into three main areas: North America, Europe, and Emerging Markets.

Emerging Markets are now the largest and fastest-growing segment for the company, achieving a 5.5% growth rate in 2024, with China showing strong double-digit performance. In 2023, Emerging Markets accounted for 38% of net revenue, followed by Europe at 35%, and North America at 27%. This highlights the importance of these markets for the company's overall financial health and future growth prospects. The company's strategy focuses on adapting to regional differences in customer demographics and preferences.

The company's approach to market segmentation and consumer targeting is crucial for its success. The company's focus on 'Powerbrands' like Dettol, Lysol, and Durex is designed to drive growth in these diverse markets. Furthermore, the company is actively managing its portfolio through divestitures, such as exiting its 'Essential Home' portfolio and exploring options for Mead Johnson Nutrition by the end of 2025. This strategic approach enables the company to concentrate on high-growth, high-margin brands and regions.

Emerging Markets are the primary growth driver, achieving a 5.5% increase in 2024. China's double-digit performance within this segment is particularly noteworthy. This underscores the importance of these regions for the company's future expansion and revenue generation.

In 2023, Emerging Markets contributed 38% of net revenue, Europe accounted for 35%, and North America represented 27%. This breakdown illustrates the geographical distribution of the company's revenue streams and its reliance on different markets.

The success of products like Durex Fetherlite HA condoms in China showcases the company's ability to tailor products to regional preferences. This targeted approach is crucial for capturing market share in diverse consumer markets. For more insights, see Marketing Strategy of Reckitt Benckiser Group.

The company is actively managing its portfolio through divestitures, such as exiting its 'Essential Home' portfolio. This strategic move allows the company to focus on high-growth, high-margin brands and regions, optimizing resource allocation.

North America is projected to see low-single-digit growth in Q1 2025, influenced by retailer destocking and the ramp-up of new capacity for Lysol. This indicates a cautious outlook for the region in the short term.

Europe is expected to remain relatively flat in 2025. This suggests that the company is focusing its growth efforts on other regions, particularly the rapidly expanding Emerging Markets. The company is adapting to the changing needs of its customers.

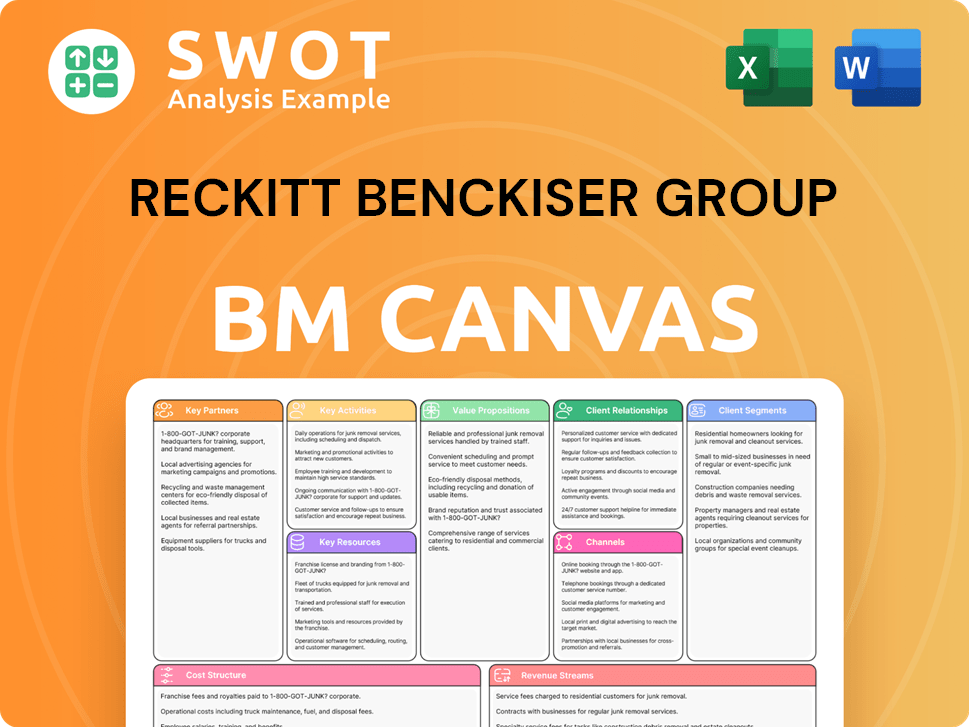

Reckitt Benckiser Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Reckitt Benckiser Group Win & Keep Customers?

The customer acquisition and retention strategies of Reckitt Benckiser (RB Group) are centered around its leading 'Powerbrands,' which drive both consumer acquisition and loyalty. These brands, including Dettol, Lysol, Durex, and Nurofen, are key to the company's market leadership and consumer trust. RB Group uses a multifaceted approach involving marketing, product innovation, and loyalty programs to engage and retain its customer base.

Marketing efforts leverage digital, traditional, and social media channels to boost brand recognition and consumer loyalty. While digital engagement is a focus, RB Group continually refines its agile digital marketing campaigns to meet the expectations of tech-savvy consumers. These efforts aim to strengthen connections with consumers and drive repeat purchases.

Customer retention is significantly enhanced through loyalty programs. The success of the Schiff Rewards program, which rewards customers for entering product codes, demonstrates the company's commitment to building brand engagement and emotional connections. This approach aligns with the broader trend in the FMCG sector of employing brand-level loyalty programs to attract new segments and foster stronger customer engagement.

RB Group uses a mix of digital, traditional, and social media to reach its target market. Advertising and smart messaging are employed to enhance brand recognition and consumer loyalty.

Continuous innovation is a key strategy, with new product lines like Dettol Instant Hand Sanitizer contributing to sales growth. Tailoring product features, such as Durex Fetherlite HA condoms in China, also plays a role.

Loyalty programs, such as Schiff Rewards, incentivize repeat purchases. These programs offer rewards and strengthen emotional connections with customers, driving brand engagement.

RB Group's commitment to sustainability, including its goal of 100% recyclable packaging by 2025, appeals to environmentally conscious consumers, thereby contributing to brand preference and customer retention.

RB Group's approach to customer acquisition and retention is comprehensive, combining strategic marketing, product innovation, and loyalty initiatives. The company's focus on its 'Powerbrands' and its commitment to sustainability are key elements of its strategy. Further details on the company’s history can be found in Brief History of Reckitt Benckiser Group.

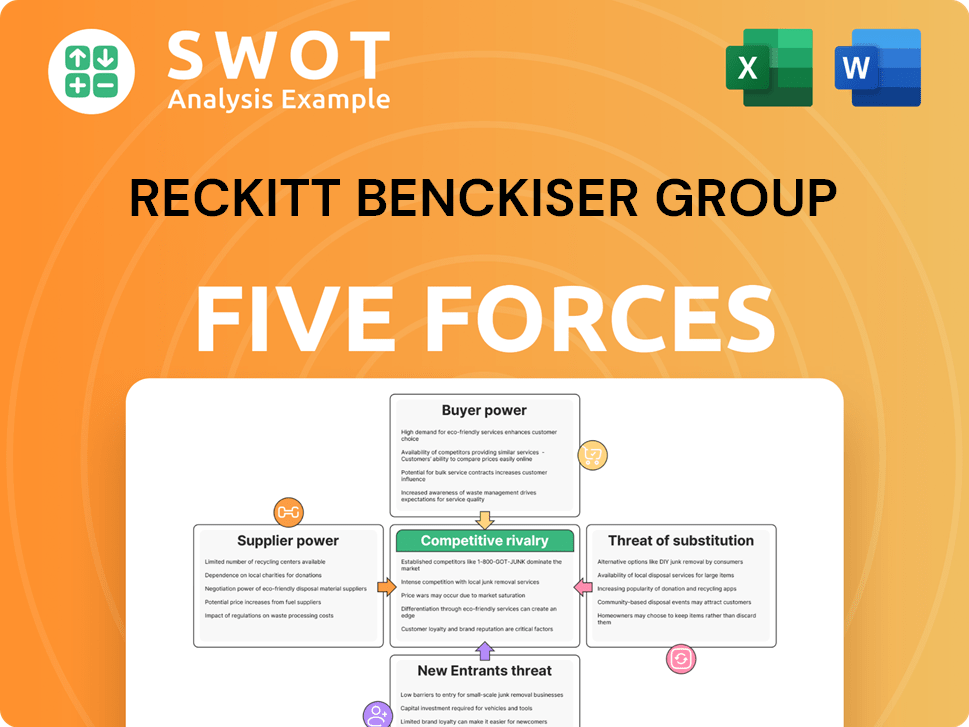

Reckitt Benckiser Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Reckitt Benckiser Group Company?

- What is Competitive Landscape of Reckitt Benckiser Group Company?

- What is Growth Strategy and Future Prospects of Reckitt Benckiser Group Company?

- How Does Reckitt Benckiser Group Company Work?

- What is Sales and Marketing Strategy of Reckitt Benckiser Group Company?

- What is Brief History of Reckitt Benckiser Group Company?

- Who Owns Reckitt Benckiser Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.