SCB X Public Company Bundle

How is SCB X Navigating the Cutthroat Financial Tech Arena?

SCB X Public Company, a financial powerhouse in Thailand, is boldly reshaping its strategy to dominate the ASEAN fintech scene. This transformation, born from the reorganization of Siam Commercial Bank, positions SCBX at the forefront of digital innovation in the financial sector. With ambitious goals for regional expansion and a focus on cutting-edge technologies, understanding the SCB X Public Company SWOT Analysis is crucial.

This analysis will dissect the SCB X competitive landscape, providing a comprehensive competitive analysis SCB X to understand its strategic moves. We'll explore SCB X market position, identify key SCB X competitors, and evaluate its SCB X financial performance, offering insights into its growth strategy and future outlook. Furthermore, we'll examine SCB X competitive advantages and disadvantages to help you understand how SCB X Public Company plans to compete in this dynamic market.

Where Does SCB X Public Company’ Stand in the Current Market?

SCB X Public Company operates as an investment holding company, primarily for its subsidiary, Siam Commercial Bank (SCB). Its business model is structured across three generations: Banking Services (Gen 1), Consumer and Digital Financial Services (Gen 2), and Platform and Technology Business (Gen 3). This diversified approach allows SCB X to engage in various financial sectors, providing a broad range of services.

The company's value proposition centers around leveraging its diverse financial services to meet the evolving needs of its customers. This includes traditional banking services, innovative digital financial solutions, and investments in platform and technology businesses. SCB X aims to create value by providing comprehensive financial services that cater to different customer segments and market trends.

SCB X reported a consolidated net profit of Baht 12,502 million for the first quarter of 2025, marking a 10.8% increase year-over-year. The 2024 consolidated net profit was Baht 43,943 million, a 1.0% increase from the previous year. These figures demonstrate the company's sustained financial health and growth.

SCB X maintains a strong capital adequacy ratio, standing at 18.8% at the end of Q1 2025 and 18.9% at the end of 2024. The non-performing loan (NPL) ratio was 3.45% at the end of Q1 2025, improving from 3.52% the previous year and 3.37% at the end of 2024. The NPL coverage ratio remained high at 156% in Q1 2025 and 158% in 2024.

As of June 6, 2025, SCB X's market capitalization was approximately 395,635.11 million Baht. This reflects the company's significant presence and valuation in the market.

The Gen 2 businesses, including CardX, AutoX, Monix, and Abacus Digital, expanded their consumer lending operations. In 2024, the customer base grew to 11.5 million, a 15% year-on-year increase, with outstanding loans reaching 185 billion baht, a 2.1% growth.

SCB X has shifted its focus towards higher-quality customers with stronger repayment capabilities. This strategic adjustment, along with robust risk management, is expected to improve profitability. The company's cost-to-income ratio improved to 39.9% in Q1 2025, down from 42.3% in 2024, indicating successful cost containment.

- SCB X's market position is strengthened by its diverse business segments.

- The company's financial health is supported by a strong capital adequacy ratio and prudent asset quality management.

- The strategic shift towards higher-quality customers is expected to improve profitability.

- The company's cost-to-income ratio has improved, reflecting efficient cost management.

SCB X Public Company SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging SCB X Public Company?

The Owners & Shareholders of SCB X Public Company face a dynamic and multifaceted competitive landscape. This analysis explores the key players challenging its market position and the strategic initiatives designed to maintain and enhance its financial performance.

Understanding the SCB X competitive landscape is crucial for assessing its future outlook. The company's diverse operations, spanning traditional banking, digital finance, and technology ventures, position it against a broad spectrum of competitors, each vying for market share in a rapidly evolving financial sector.

The primary direct competitors of SCB X in traditional banking include major Thai banks. These banks offer similar services, competing on market share, innovation, customer experience, and pricing strategies.

Key competitors include Kasikornbank PCL, Krung Thai Bank PCL, Bangkok Bank, and TMBThanachart Bank PCL. These banks have a significant presence in the Thai financial market.

SCB X faces competition from virtual banks and fintech companies. The 'Ignite Finance' initiative and the emergence of virtual banks are intensifying competition in the digital space.

The Bank of Thailand plans to issue three virtual bank licenses by mid-2025. Consortiums led by Gulf Energy Development and Ascend Money Group are potential disruptors.

Gen 2 businesses such as CardX, AutoX, Monix, and Abacus Digital compete with fintech companies and non-bank financial institutions. The digital payments market is also highly competitive.

SCB Julius Baer Securities Company Limited faces increased competition in the wealth management industry. Banks and digital wealth platforms are competing for the mass affluent segment.

The competitive analysis of SCB X reveals a complex interplay of established banks, fintech disruptors, and technology-driven ventures. SCB X's strategic initiatives, including investments in AI and deep tech, indicate a focus on innovation to maintain its market position.

- Market Share: SCB X's market share is constantly challenged by its competitors.

- Digital Services: Innovation in digital services is a key battleground.

- Customer Experience: Enhancing customer experience is a priority.

- Pricing Strategies: Competitive pricing plays a crucial role.

SCB X Public Company PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives SCB X Public Company a Competitive Edge Over Its Rivals?

The Revenue Streams & Business Model of SCB X Public Company showcases a robust competitive landscape. SCB X Public Company has strategically positioned itself within the Thai financial sector through key milestones and strategic moves. The company's transformation into a financial holding company has been crucial, allowing for diversification and a broader market reach.

A deep dive into the SCB X competitive landscape reveals a focus on digital transformation and AI integration. This strategic shift aims to enhance customer service and operational efficiency. The company's financial performance, including a consolidated net profit of Baht 43,943 million in 2024, underscores its financial strength and ability to invest in future growth.

The competitive analysis of SCB X highlights its commitment to innovation and strategic partnerships. These moves are designed to create seamless and personalized digital banking experiences. The company's strong capital adequacy ratio of 18.9% as of 2024 and high NPL coverage ratio of 158% in 2024 provide a solid foundation for sustainable growth and resilience.

SCBX's structure allows it to diversify its offerings across traditional banking, consumer and digital finance, and platform and technology businesses. This diversification includes wealth management, insurance, and digital lending. This broad portfolio enables cross-selling opportunities and a holistic approach to customer needs.

The company aims to become an 'AI-first organization', targeting 75% of revenue through AI technologies by 2027. SCB is modernizing its core banking system, integrating advanced digital technologies, and leveraging data and AI to analyze customer needs swiftly. This includes AI-powered credit scoring for instant loan approvals and optimizing retail loan portfolios.

SCBX’s strong financial position provides a robust foundation for continued investment in technology and strategic initiatives. A consolidated net profit of Baht 43,943 million in 2024 and a healthy capital adequacy ratio of 18.9% support its transformation goals. The company's prudent asset quality management, with a high NPL coverage ratio of 158% in 2024, enhances its stability.

Strategic partnerships, such as the collaboration with Databricks for its Data Intelligence Platform, bolster its technological capabilities. These partnerships aim to create seamless and personalized digital banking experiences. Initiatives like PointX aim to enhance customer engagement and build group-level loyalty through AI-driven personalized recommendations.

SCB X's competitive advantages are built on a comprehensive ecosystem, digital transformation, and a strong financial foundation. The company's focus on AI and data-driven insights enhances customer experiences and operational efficiency. Strategic partnerships and prudent financial management further solidify its market position.

- Diversified offerings across banking, consumer finance, and technology.

- Aggressive embrace of digital transformation and AI integration.

- Strong financial position with a high capital adequacy ratio.

- Strategic partnerships to enhance technological capabilities.

SCB X Public Company Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping SCB X Public Company’s Competitive Landscape?

The Thai financial services industry is experiencing rapid change, creating both opportunities and challenges for SCB X Public Company. A key aspect of the SCB X competitive landscape is the digital transformation, with the company investing heavily in digital offerings and AI. The company is also navigating increasing competition from virtual banks and evolving customer expectations, requiring strategic adaptability to maintain its SCB X market position.

Risks include potential asset quality issues, especially in the SME segment, and the impact of global economic shifts. However, SCB X Public Company's strategic initiatives, such as focusing on sustainable growth and exploring new opportunities in Climate Tech, aim to mitigate these risks and ensure long-term resilience. The company is focused on continuous growth from existing businesses, efficient cost management, and improved debt collection processes, which is a key strategy for 2025.

The financial sector in Thailand is undergoing a digital revolution. Digital payments and e-commerce are growing, driven by government initiatives and increased smartphone use. This shift is reshaping consumer behavior towards cashless transactions, creating opportunities for SCB X Public Company to enhance its digital services and expand its reach.

The rise of virtual banks poses a significant challenge. The Bank of Thailand plans to issue three virtual banking licenses by mid-2025, intensifying competition. Potential asset quality concerns, particularly in the SME segment, and the impact of global economic shifts also present challenges for SCB X competitors.

AI adoption across the financial sector provides opportunities for enhanced efficiency and personalized services. The wealth management industry's transformation, driven by regulatory changes and digital disruption, presents growth opportunities. SCB X Public Company can leverage technology to offer tailored advice and expand its wealth management services.

SCB X Public Company is focused on continuous growth from existing businesses. The company is committed to sustainable growth, including its Net Zero target by 2050, and is exploring growth opportunities in Climate Tech. These initiatives aim to enhance resilience and align with global sustainability trends.

SCB X Public Company is focusing on several key strategies to navigate the evolving financial landscape. These include leveraging AI to enhance operations, expanding wealth management services, and pursuing sustainable growth initiatives. For more details on the company's long-term vision, consider reading about the Growth Strategy of SCB X Public Company.

- Targeting 75% AI-derived revenue by 2027.

- Aiming for complete workforce AI literacy by 2025.

- Focusing on efficient cost management and improved debt collection processes for 2025.

- Pursuing growth opportunities in Climate Tech.

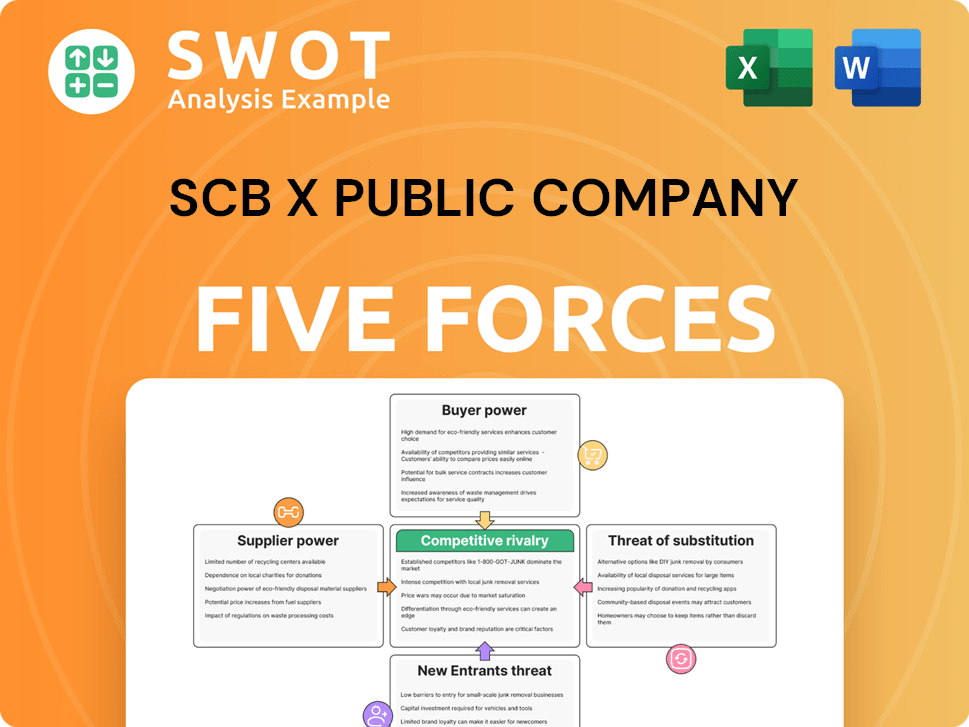

SCB X Public Company Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SCB X Public Company Company?

- What is Growth Strategy and Future Prospects of SCB X Public Company Company?

- How Does SCB X Public Company Company Work?

- What is Sales and Marketing Strategy of SCB X Public Company Company?

- What is Brief History of SCB X Public Company Company?

- Who Owns SCB X Public Company Company?

- What is Customer Demographics and Target Market of SCB X Public Company Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.