SCB X Public Company Bundle

How is SCB X Redefining Sales and Marketing in the Fintech Era?

SCB X Public Company, formerly Siam Commercial Bank, is undergoing a massive transformation, evolving from a traditional bank into a leading regional financial technology group. This shift is fueled by a bold vision to serve 200 million customers across ASEAN, demanding a cutting-edge sales and marketing approach. Understanding SCB X's strategies is crucial for anyone interested in the future of finance.

This exploration delves into the core of SCB X's SCB X Public Company SWOT Analysis, dissecting its sales and marketing strategies to understand how it plans to achieve its ambitious goals. We'll examine its innovative digital marketing strategy, including its approach to customer relationship management and social media marketing. Furthermore, this analysis will provide insights into SCB X's SCB X sales strategy and SCB X marketing strategy, offering a comprehensive SCB X market analysis to understand its competitive positioning and future trends, including its SCB X business model and its impact on SCB X financial performance.

How Does SCB X Public Company Reach Its Customers?

The sales channels of SCB X Public Company, reflect a strategic blend of traditional and digital approaches. This multi-faceted strategy aims to reach a diverse customer base effectively. The company's approach is designed to capitalize on both established physical networks and the growing importance of digital platforms.

The core banking services, under Siam Commercial Bank (SCB Bank), leverage a network of physical branches across Thailand. These branches are complemented by international locations in key areas like Singapore, Hong Kong, and others. This extensive network supports a comprehensive range of financial products and services, ensuring accessibility for a wide audience. The company is also focused on its SCB X sales strategy to meet the market needs.

SCBX is actively enhancing its digital banking capabilities. The company aims to increase the proportion of revenue from digital channels to 25% of total earnings by 2025, a significant jump from 7% in 2023 and a targeted 13% for 2024. This growth is driven by expanding digital wealth management offerings and other digital services.

SCB Bank maintains a network of physical branches in Thailand and international branches in key locations. These branches offer a wide range of financial products and services. The physical branches are a key component of SCBX's sales strategy.

SCBX is focused on expanding its digital banking capabilities, including digital wealth management. The company aims to increase digital revenue to 25% by 2025. The SCB EASY app is a primary digital channel for various services.

Strategic acquisitions, like Home Credit Vietnam, expand SCBX's market presence. The acquisition of Home Credit Vietnam is expected to be completed by the first half of 2025. Partnerships, such as the consortium with KakaoBank and WeBank, drive innovation.

SCBX is focusing on omnichannel integration to provide seamless customer experiences. Home Credit Vietnam's robust omnichannel distribution networks, including 14,000 point-of-sale locations, are part of this strategy. This integration is critical for customer acquisition.

SCBX’s sales strategy involves a blend of physical and digital channels. This approach allows the company to reach a broad customer base and adapt to evolving market trends. The focus on digital channels is a key part of the SCB X marketing strategy.

- Physical Branches: Traditional banking services and face-to-face customer interactions.

- Digital Platforms: SCB EASY app and other digital services for online banking.

- Strategic Partnerships: Collaborations to expand market reach and innovation.

- Acquisitions: Expanding market presence, such as Home Credit Vietnam.

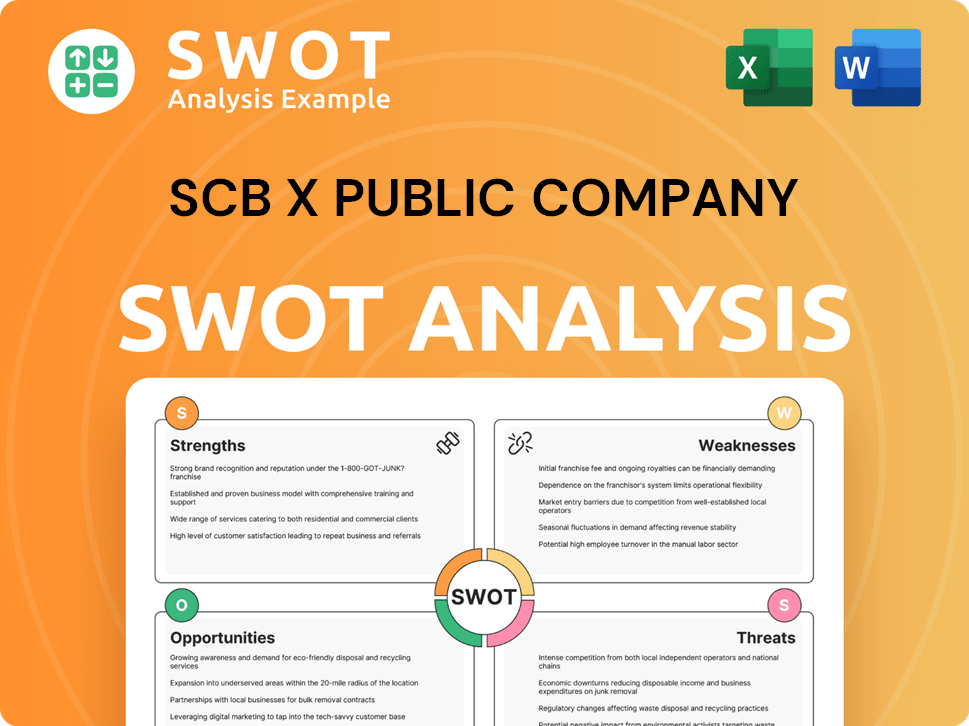

SCB X Public Company SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does SCB X Public Company Use?

The marketing tactics of SCB X Public Company are multifaceted, designed to boost brand awareness, generate leads, and ultimately drive sales. Their approach strategically integrates both digital and traditional media channels. This comprehensive strategy is crucial for maintaining a strong presence in the competitive financial market.

A key element of SCB X's marketing strategy is its strong emphasis on data-driven marketing, customer segmentation, and personalization. By leveraging AI and machine learning, the company aims to understand customer needs and deliver tailored solutions efficiently. This focus is evident in initiatives like the 'Digital Bank with Human Touch' strategy, enhancing customer experiences across all channels.

SCB X's dedication to digital transformation is further supported by its investment in AI. The company has over 230 AI initiatives impacting all functions, from front to back office, with the goal of optimizing costs and unlocking revenue streams. SCB X aims to generate 75% of its revenue through AI technologies by 2027, showcasing its forward-thinking approach.

SCB X employs a variety of digital marketing tactics. These include content marketing, SEO, and paid advertising, although specific details are not provided. The company's focus on digital transformation strongly implies significant use in reaching and engaging target audiences.

Content marketing is a key component of SCB X's digital strategy. The release of the 'AI Outlook 2025' whitepaper in May 2025 demonstrates the company's commitment to sharing insights and establishing itself as an AI-first organization.

Traditional media channels continue to play a role in brand awareness. This includes TV, radio, and print, particularly for the established Siam Commercial Bank brand. Events are also common for financial institutions to engage with customers.

SCB DataX, a Center of Excellence for Data and AI, enhances competitiveness through advanced data solutions and AI. The core banking system revamp, set to pilot in early 2025, includes AI-powered banking services.

SCB X focuses on customer engagement through various channels. The 'Digital Bank with Human Touch' strategy aims to provide seamless service experiences. This approach is crucial for understanding the target market of SCB X Public Company.

Future marketing trends for SCB X involve greater AI integration and data-driven strategies. The company is investing heavily in AI technologies to transform its operations and enhance customer experiences.

SCB X's marketing strategy combines digital and traditional methods, with a strong emphasis on data and AI. This approach aims to drive sales and build brand awareness.

- Data-driven marketing and customer segmentation.

- AI and machine learning to understand customer needs.

- Content marketing, including whitepapers and reports.

- Integration of AI in core banking services.

- Use of traditional media for broad brand awareness.

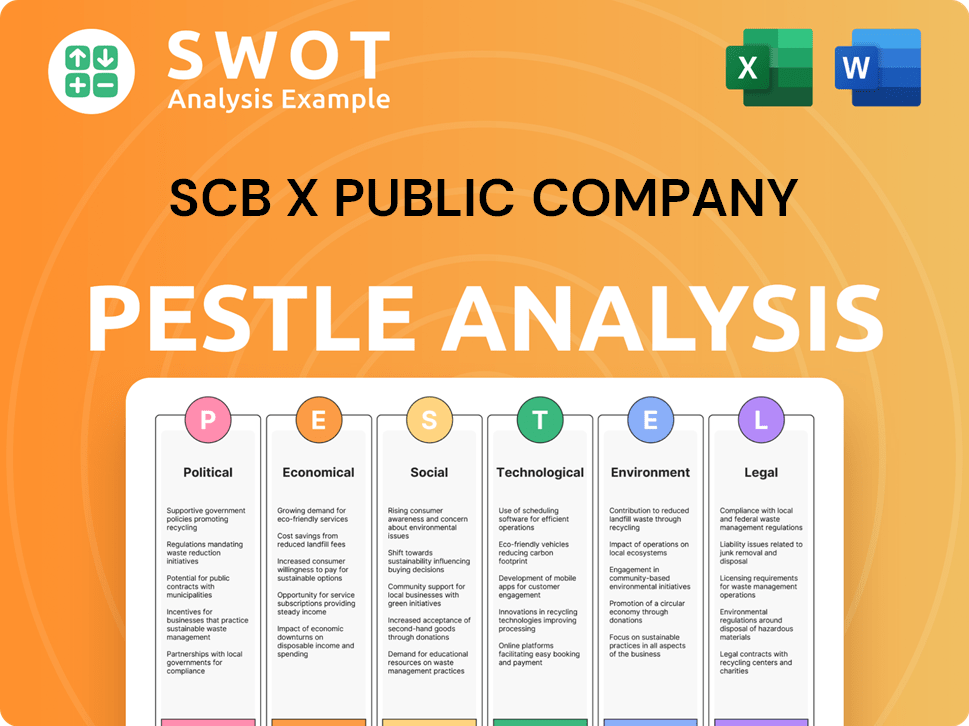

SCB X Public Company PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is SCB X Public Company Positioned in the Market?

SCBX's brand positioning centers on being a forward-thinking financial technology group. This is a key aspect of its Revenue Streams & Business Model of SCB X Public Company. The company emphasizes innovation and leveraging advanced technology to differentiate itself in the market. Its core message is transforming into the 'Most Admired Regional Financial Technology Group in ASEAN', aiming to serve 200 million customers across the region.

The company's strategy highlights a shift beyond traditional banking toward a diversified, tech-driven conglomerate. This approach is evident in its 'Digital Bank with Human Touch' strategy, combining digital technologies with personalized customer service. Furthermore, SCBX is heavily invested in becoming an 'AI-first organization'. This commitment is underscored by its goal to generate 75% of its revenue through AI technologies by 2027 and achieve complete workforce AI literacy by 2025.

Brand consistency is maintained across its subsidiaries, including CardX, AutoX, MONIX, and InnovestX. This approach ensures a unified brand experience for customers. SCBX also prioritizes prudent risk management and financial stability, reflected in its 'AA+(tha)' credit rating from Fitch Ratings (Thailand) Co., Ltd. as of April 25, 2025, with a 'Stable' outlook. This focus supports its SCB X financial performance and market position.

SCBX's 'Digital Bank with Human Touch' strategy combines advanced digital technologies with personalized customer service. This approach aims to enhance customer experience and build loyalty. The strategy supports the company's goals for SCB X sales strategy for digital banking.

SCBX is focused on becoming an 'AI-first organization', aiming to generate 75% of revenue through AI by 2027. This includes achieving complete workforce AI literacy by 2025. This strategy is crucial for SCB X digital marketing strategy and overall competitiveness.

SCBX ensures brand consistency across its various subsidiaries, like CardX, AutoX, MONIX, and InnovestX. This approach maintains a unified brand experience for all customers. This is a key element of SCB X brand positioning strategy.

The company emphasizes prudent risk management and financial stability. This is reflected in its 'AA+(tha)' credit rating from Fitch Ratings (Thailand) Co., Ltd. as of April 25, 2025, with a 'Stable' outlook. This supports SCB X public company investor relations.

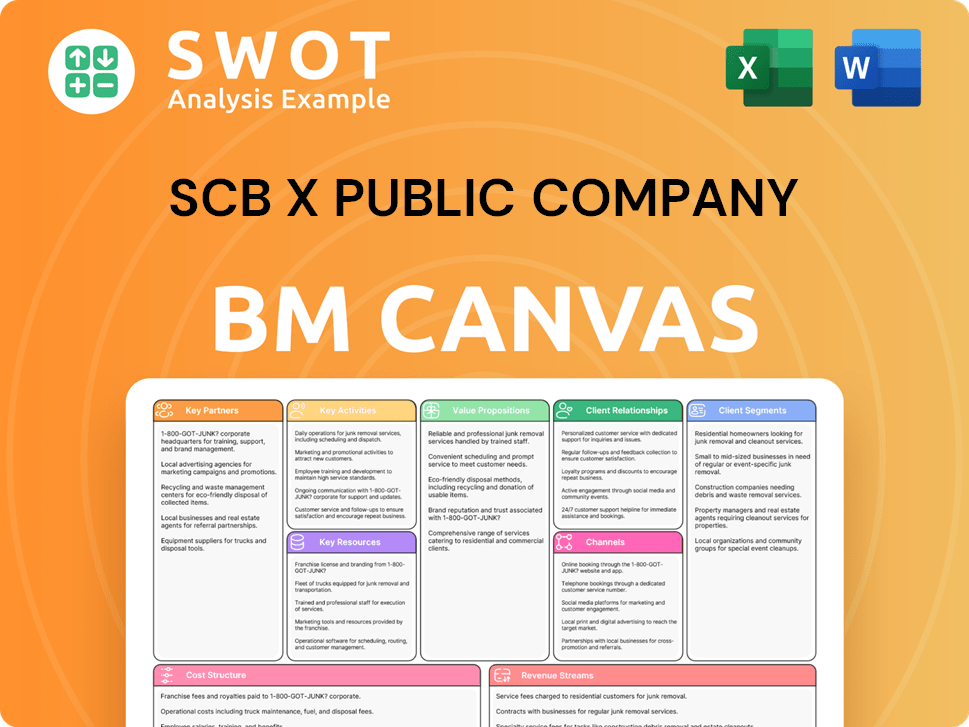

SCB X Public Company Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are SCB X Public Company’s Most Notable Campaigns?

The sales and marketing strategy of SCB X Public Company is characterized by a series of key campaigns designed to drive growth, enhance its market position, and adapt to the evolving financial landscape. These initiatives reflect the company's commitment to innovation, customer-centricity, and leveraging digital technologies. The overarching goal is to establish itself as a leading financial technology group in the region, focusing on both organic growth and strategic acquisitions.

These campaigns are integral to SCB X's broader business model, which emphasizes digital transformation and the expansion of its service offerings. By focusing on digital banking, wealth management, and strategic partnerships, SCB X aims to capture new market opportunities and provide enhanced value to its customers. The company's financial performance is closely tied to the success of these campaigns, with specific targets set for digital revenue growth and market share expansion.

A comprehensive Growth Strategy of SCB X Public Company includes a detailed look at these campaigns, providing insights into their objectives, strategies, and expected outcomes. This approach is crucial for understanding how SCB X plans to navigate the competitive environment and achieve its long-term goals.

In 2021, the reorganization of Siam Commercial Bank into SCBX was a pivotal strategic move. This transformation aimed to enhance competitiveness and drive long-term business value. The objective was to position SCBX as a leading regional financial technology group.

This ongoing initiative focuses on enhancing digital banking capabilities, particularly in wealth management. The campaign aims to achieve significant digital revenue growth. The target is to reach 13% by the end of 2024 and 25% by 2025.

Launched in May 2025, this campaign offered stable investment alternatives amidst global financial market uncertainty. The debentures, with a 4-year maturity and a fixed interest rate of 2.60% per annum, were exclusively available via the SCB EASY app. The minimum subscription amount was 1,000 baht.

Announced in February 2024, this acquisition is set to be completed by the first half of 2025. It aims to strengthen SCBX's presence in the high-growth ASEAN market. Home Credit Vietnam has an existing customer base of 15 million and 14,000 point-of-sale locations.

The launch of 'SCBX AI Outlook 2025' in May 2025 is a significant campaign for thought leadership. This whitepaper, Thailand's first AI whitepaper for business, shares SCBX's vision in implementing AI technology.

The group aims to generate 75% AI-derived revenue by 2027. This positions SCBX as an AI-driven organization. This strategy is part of the company's digital transformation efforts.

The 'Digital Bank with Human Touch' strategy supports wealth management growth. This campaign achieved a 15% growth in core wealth revenue in 2024 for SCB Bank. This is a key performance indicator.

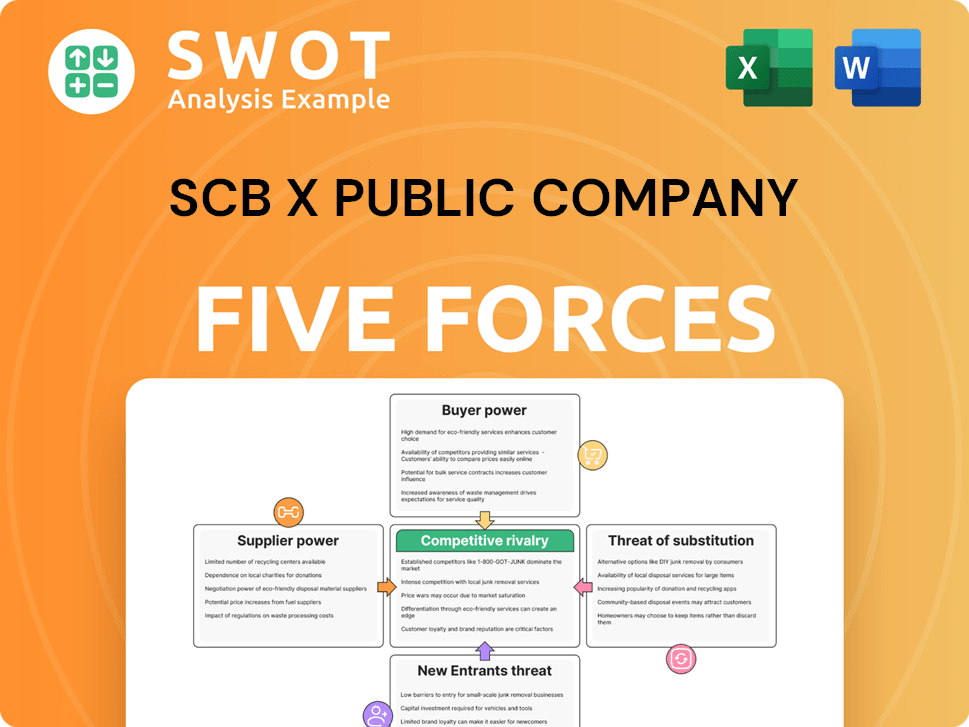

SCB X Public Company Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SCB X Public Company Company?

- What is Competitive Landscape of SCB X Public Company Company?

- What is Growth Strategy and Future Prospects of SCB X Public Company Company?

- How Does SCB X Public Company Company Work?

- What is Brief History of SCB X Public Company Company?

- Who Owns SCB X Public Company Company?

- What is Customer Demographics and Target Market of SCB X Public Company Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.