SCB X Public Company Bundle

Decoding SCB X's Customer Base: Who Are They?

In the rapidly evolving SCB X Public Company SWOT Analysis landscape, understanding the customer is paramount. SCB X, a leader in the Financial Services Industry, has strategically transformed, making it crucial to analyze its Customer Demographics and Target Market Analysis. This exploration is vital for investors, strategists, and anyone seeking to understand the future of finance in Southeast Asia.

This deep dive into SCB X's customer landscape will uncover the nuances of its SCB X Customers, from their age range and income levels to their digital behaviors and financial aspirations. We'll investigate their Market Segmentation strategies, marketing approaches, and how SCB X adapts to meet their needs. Ultimately, we aim to provide a comprehensive understanding of how SCB X is positioned within its target market and how it leverages customer insights to drive growth and innovation.

Who Are SCB X Public Company’s Main Customers?

Understanding the Customer Demographics and Target Market Analysis of SCB X Public Company is crucial for assessing its market position and strategic direction within the Financial Services Industry. SCB X, a leading financial institution, serves a diverse customer base, segmented into distinct groups based on their needs and financial behaviors. This segmentation allows for targeted product development and marketing strategies, enhancing customer engagement and profitability.

SCB X's approach to its Target Market involves a dual focus on both Business-to-Consumer (B2C) and Business-to-Business (B2B) segments. The B2C segment includes retail banking customers, wealth management clients, and digital-native users, each with specific demographic profiles and financial requirements. The B2B segment caters to small and medium-sized enterprises (SMEs) and large corporations, providing tailored financial solutions.

The company's ability to adapt to changing market dynamics, such as the increasing demand for digital financial services, has been a key driver of its success. SCB X's strategic initiatives are heavily influenced by its understanding of its SCB X Customers and their evolving needs, ensuring that its offerings remain relevant and competitive in the market.

Retail banking customers represent a broad demographic, encompassing various age groups, income levels, and educational backgrounds. These customers typically seek fundamental banking services such as savings accounts, loans, and payment solutions. SCB X provides these services to a wide range of individuals, ensuring accessibility and meeting diverse financial needs.

The wealth management segment primarily targets affluent and high-net-worth individuals, typically aged 45 and older. These clients have higher income levels and sophisticated financial needs, including investment advisory services, private banking, and estate planning. This segment is a key focus for SCB X, with assets under management (AUM) reaching approximately 1.7 trillion baht in 2023.

The digital-native segment comprises younger individuals, typically aged 18-40, who prioritize convenience and mobile-first solutions. This group is characterized by higher digital literacy and a preference for seamless online experiences. SCB X has seen significant growth in this segment, driven by the adoption of its SCB EASY application, with 16 million digital users as of 2023.

For B2B customers, SCB X serves SMEs and large corporations. SMEs often require working capital loans and trade finance, while large corporations demand more complex financial instruments and treasury services. This segment highlights the company's ability to provide diverse financial solutions tailored to the specific needs of businesses.

SCB X's strategic focus is influenced by market research indicating the increasing demand for digital financial services and the growing wealth in Thailand. The company invests heavily in technology and develops specialized products to meet these evolving customer needs. This approach allows SCB X to effectively target its diverse customer segments and maintain a competitive edge.

- Digital Transformation: Investing heavily in digital platforms and mobile applications to cater to the digital-native segment.

- Wealth Management Expansion: Developing sophisticated financial products and services to attract high-net-worth individuals.

- SME Support: Providing tailored financial solutions and digital payment options to support small and medium-sized enterprises.

- Customer-Centric Approach: Continuously analyzing customer data and feedback to refine products and services, ensuring they meet the evolving needs of the target market.

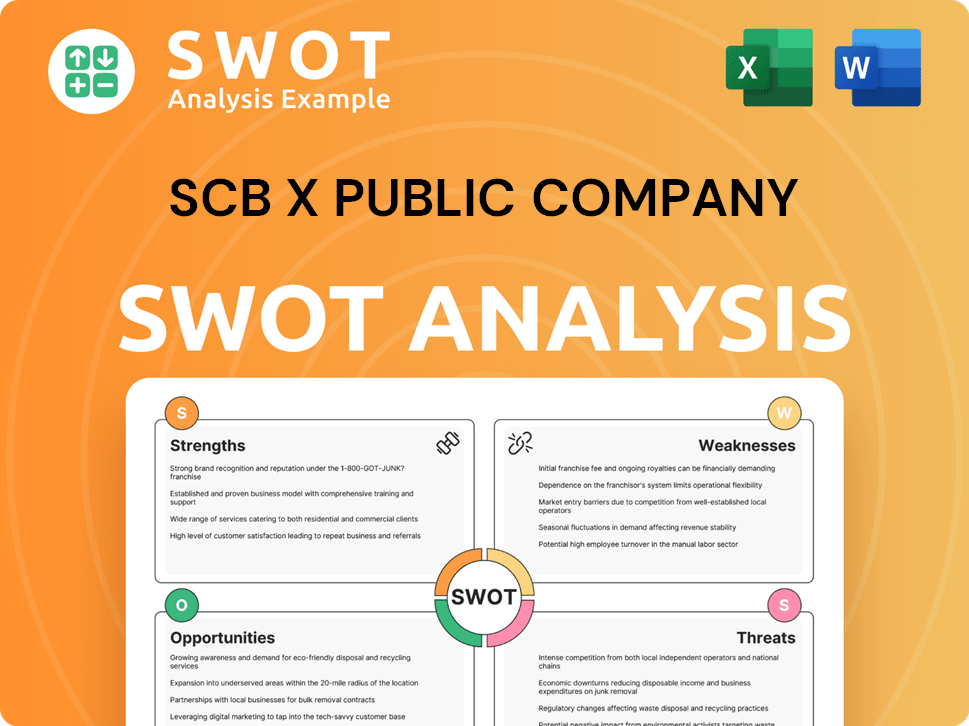

SCB X Public Company SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do SCB X Public Company’s Customers Want?

Understanding the needs and preferences of customers is crucial for the success of any financial institution. For SCB X Public Company, this involves a deep dive into the diverse customer base to tailor services effectively. This analysis helps in refining marketing strategies and product development, ensuring alignment with customer expectations and market trends.

The evolving landscape of the financial services industry demands continuous adaptation to meet the changing demands of consumers. SCB X Public Company focuses on providing convenient, secure, and personalized financial solutions. This approach is essential to maintain customer loyalty and attract new clients in a competitive market.

The company's success hinges on its ability to understand and cater to different customer segments. This includes retail customers, wealth management clients, and digital-native users. By addressing their specific needs and preferences, SCB X Public Company aims to strengthen its market position and drive sustainable growth. For further insights, explore the Growth Strategy of SCB X Public Company.

Retail customers prioritize ease of use and accessibility in their financial transactions. This drives the demand for digital banking services, including mobile applications for transactions, bill payments, and transfers. The SCB EASY app is a prime example of meeting these needs, offering seamless on-the-go financial management.

Security and reliability are fundamental concerns across all customer segments. These factors significantly influence trust and loyalty. Robust security measures and dependable services are essential for maintaining customer confidence and ensuring long-term relationships.

Wealth management clients seek personalized advice, strong investment performance, and exclusive services. They require tailored solutions that align with their financial goals, risk tolerance, and legacy planning. Dedicated relationship managers provide comprehensive wealth advisory services.

Digital-native customers value user-friendly interfaces, instant services, and integrated platforms. They often seek more than just banking, such as lifestyle features or rewards programs. Their purchasing behaviors are heavily influenced by digital marketing and peer reviews.

Common pain points include the need for faster loan approvals, simplified account opening processes, and more intuitive digital tools. Addressing these issues improves customer satisfaction and streamlines the overall banking experience. SCB X focuses on continuous improvement in these areas.

Marketing efforts are tailored to specific demographics. Targeted digital campaigns for younger segments emphasize convenience and innovation. For wealth clients, exclusive events and personalized consultations highlight expertise and bespoke solutions. These strategies enhance customer engagement.

Customer feedback and market trends, particularly the rise of fintech and embedded finance, have significantly influenced SCB X's product development. For example, the expansion into digital lending platforms and partnerships with e-commerce players reflects the need to provide integrated financial solutions at the point of need.

- Digital Banking Growth: The adoption of digital banking services continues to rise, with mobile transactions increasing by approximately 25% year-over-year.

- Wealth Management Focus: The wealth management segment is expanding, with assets under management (AUM) growing by about 18% annually.

- Customer Satisfaction: Customer satisfaction scores for digital services have improved, with a 15% increase in positive feedback.

- Fintech Integration: Strategic partnerships with fintech companies have increased by 20%, enhancing service offerings.

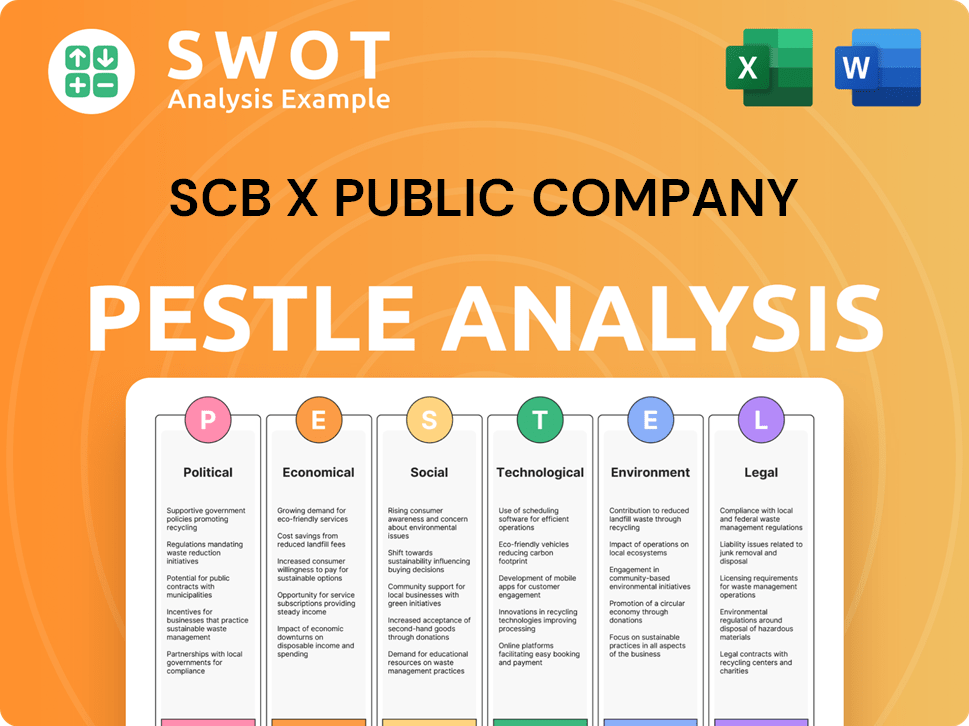

SCB X Public Company PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does SCB X Public Company operate?

The primary focus of SCB X Public Company's geographical market presence is Thailand, where it has established a robust network and strong brand recognition. The company's operations and customer engagement are primarily concentrated within the country. Its extensive network of branches and digital platforms spans across all major regions and cities in Thailand.

SCB X has a significant market share in Thailand, particularly in urban areas like Bangkok. The company is strategically expanding its reach within the Southeast Asian region. This expansion involves strategic investments and partnerships in other Southeast Asian countries.

The company's approach involves adapting its branch network and developing digital solutions to cater to diverse communities and varying levels of digital literacy. Marketing efforts are also tailored to regional nuances and cultural preferences. Digital adoption is driving significant growth across all regions within Thailand.

SCB X's main market is Thailand, where it has a strong presence. The company's operations are centered in Thailand, with a nationwide network of branches and digital touchpoints.

The company is exploring expansion in Southeast Asia. This includes investments and partnerships in other countries in the region.

SCB X tailors its services to different customer segments within Thailand. Urban customers often use digital banking and wealth management services, while rural customers may prefer traditional banking.

Digital adoption is a key driver of growth across all regions. SCB X is focused on developing digital solutions to meet diverse customer needs.

The geographic distribution of Owners & Shareholders of SCB X Public Company customers is heavily concentrated within Thailand. The company's customer base is spread across various regions, with a significant presence in urban centers like Bangkok.

- Bangkok and major cities: Higher concentration of customers.

- Rural areas: Customers may rely on traditional banking services.

- Digital adoption: Driving growth across all regions.

- Regional expansion: Strategic investments in Southeast Asia.

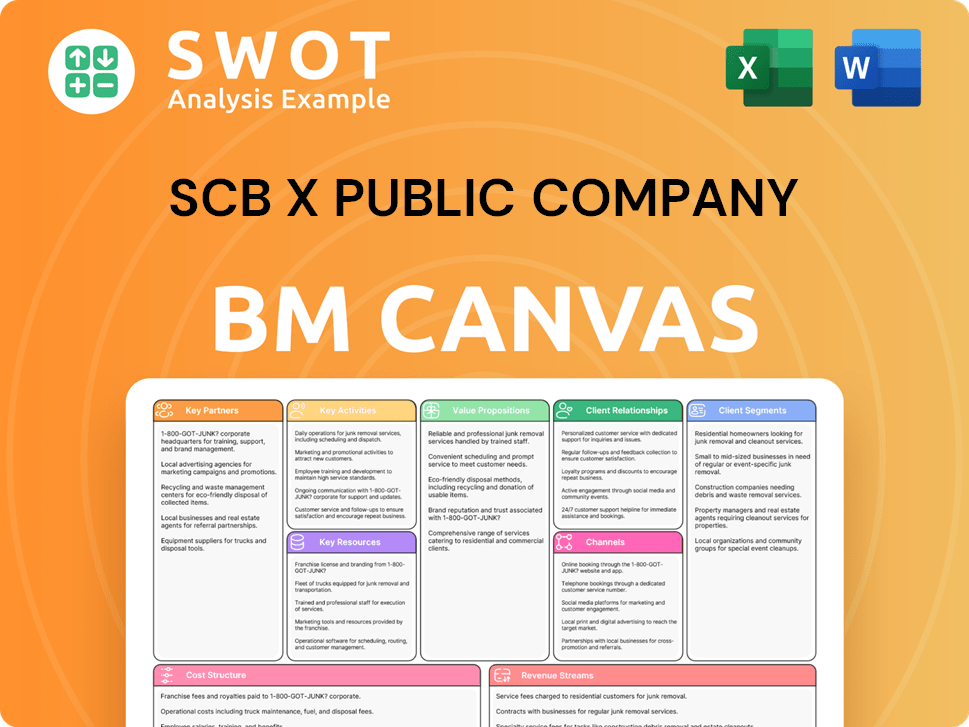

SCB X Public Company Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does SCB X Public Company Win & Keep Customers?

SCB X Public Company (SCB X) employs a comprehensive strategy for acquiring and retaining customers, utilizing both traditional and digital channels to reach its target market. The company focuses on understanding its Customer Demographics to tailor its offerings and marketing efforts effectively. This approach allows it to build strong relationships and enhance customer lifetime value within the Financial Services Industry.

The company's customer acquisition strategy involves extensive digital marketing, leveraging social media, search engines, and mobile applications to target specific demographics with personalized product offerings. Traditional advertising methods, such as television and radio, are also employed to increase brand awareness and reach a broader audience. Strategic partnerships and referral programs further incentivize customer onboarding.

Customer retention strategies center on fostering loyalty and enhancing customer lifetime value. SCB X uses loyalty programs, personalized customer experiences through CRM systems, and responsive after-sales support. Continuous investment in the SCB EASY application, adding new features and improving user experience, is a key retention tool. This data-driven approach aims to improve acquisition efficiency and enhance retention rates.

SCB X utilizes digital marketing across various platforms, including social media, search engines, and mobile apps. These campaigns target specific demographics with personalized product offerings. The goal is to reach a wider audience and drive customer acquisition efficiently.

Traditional advertising methods, such as television, radio, and print media, are also used. These methods help in building broader brand awareness. They are particularly useful for reaching segments that are less active digitally.

Strategic partnerships with e-commerce platforms and fintech companies are crucial. These partnerships help in acquiring new digital users. Financial services are integrated directly into consumer journeys through these collaborations.

Referral programs and attractive sign-up bonuses incentivize new customer onboarding. These incentives encourage new customers to join. They are a key part of the customer acquisition strategy.

SCB X's customer retention strategies are centered on building loyalty and enhancing customer lifetime value. This includes loyalty programs, personalized customer experiences, and responsive after-sales support. The company continually invests in its SCB EASY application, adding new features and improving user experience. This data-driven approach aims to improve acquisition efficiency and enhance retention rates.

Loyalty programs offer rewards, discounts, and exclusive privileges for consistent engagement. These programs encourage repeat business and customer loyalty. They are designed to enhance customer lifetime value.

Robust CRM systems deliver personalized customer experiences. They allow the company to tailor communications and product recommendations. This is based on individual customer data and preferences.

Responsive customer support channels, including call centers and chatbots, are critical. They are essential for resolving issues and maintaining satisfaction. This includes in-app support for convenience.

Continuous investment in the SCB EASY application is a key retention tool. The company regularly adds new features and improves user experience. This is specifically for its digital customer base.

SCB X has shifted towards a more data-driven approach. This involves targeted campaigns based on customer segmentation and behavioral analytics. The aim is to enhance customer loyalty and lifetime value.

Customer segmentation allows for more relevant and timely financial solutions. This improves the efficiency of customer acquisition. It also enhances retention rates.

SCB X focuses on a multi-channel approach to reach its Target Market Analysis. This includes digital marketing, traditional advertising, and strategic partnerships. The goal is to acquire and retain customers effectively.

- Digital Marketing: Utilizes social media, search engines, and mobile apps for targeted campaigns.

- Traditional Advertising: Employs television, radio, and print for broader brand awareness.

- Strategic Partnerships: Collaborates with e-commerce platforms and fintech companies.

- Loyalty Programs: Offers rewards and exclusive privileges to retain customers.

- CRM Systems: Personalizes customer experiences through data-driven interactions.

For a deeper understanding of the competitive landscape and the strategies of SCB X, you might find insights in the Competitors Landscape of SCB X Public Company.

SCB X Public Company Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SCB X Public Company Company?

- What is Competitive Landscape of SCB X Public Company Company?

- What is Growth Strategy and Future Prospects of SCB X Public Company Company?

- How Does SCB X Public Company Company Work?

- What is Sales and Marketing Strategy of SCB X Public Company Company?

- What is Brief History of SCB X Public Company Company?

- Who Owns SCB X Public Company Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.