SM Investments Bundle

Can SM Investments Company Maintain Its Dominance?

As a leading Philippine conglomerate, SM Investments SWOT Analysis is a critical component of understanding its position. SM Investments Company (SMIC) has a significant presence across the retail, banking, and property sectors. A deep dive into the competitive landscape of SMIC is essential to understand its market position and future prospects.

This article provides a detailed market analysis of SMIC, exploring its competitive advantages and key rivals within the Philippine conglomerate landscape. We will analyze SMIC's business strategy, including its strategic initiatives and investment portfolio overview, to assess its ability to maintain its market share. Furthermore, we'll examine the impact of SMIC on the Philippine economy and explore relevant market trends, offering insights for investors and business strategists alike.

Where Does SM Investments’ Stand in the Current Market?

SM Investments Corporation (SMIC) holds a significant market position across its core business segments in the Philippines. As a leading Philippine conglomerate, SMIC's competitive landscape is shaped by its diverse portfolio, including retail, banking, and property development. This strategic diversification allows SMIC to capture growth opportunities and mitigate risks across different sectors of the Philippine economy.

The company's value proposition lies in its ability to offer integrated services and products that cater to a wide range of consumer needs. SMIC's extensive network of retail stores, financial institutions, and property developments creates a synergistic effect, enhancing customer convenience and loyalty. This integrated approach strengthens SMIC's market position and provides a competitive advantage in the Philippine market.

SM Retail, Inc. is a dominant player in the Philippine retail sector, operating a vast network of department stores, supermarkets, and specialty stores. While specific market share figures for 2024-2025 are still emerging, SM Retail consistently holds a leading position. Its geographic presence is extensive, with a strong foothold in urban centers and expanding reach into emerging provincial areas.

SMIC's affiliates, BDO Unibank and China Banking Corporation, are among the largest and most influential banks in the Philippines. BDO Unibank consistently ranks as the largest bank in the Philippines in terms of assets, loans, deposits, and trust funds as of early 2024. This strong financial position provides SMIC with significant leverage and stability.

SM Prime Holdings is the largest integrated property developer in the Philippines, with a commanding presence in mall development and management, residential condominiums, and conventions. As of the first quarter of 2024, SM Prime reported a 7% increase in consolidated net income, reaching PHP 10.0 billion, with mall revenues growing by 8% to PHP 15.7 billion. This highlights its continued dominance in the property sector.

Over time, SMIC has demonstrated a strategic shift towards integrated developments, combining retail, residential, and leisure components, further solidifying its market position. While its position is strong nationwide, its presence in certain niche segments or remote regions might be less pronounced compared to local specialists.

SMIC's diverse portfolio and strategic initiatives contribute significantly to its strong market position. As of early 2024, BDO Unibank remains the largest bank in the Philippines, and SM Prime's first-quarter 2024 results show robust growth.

- SM Retail consistently holds a leading position in the Philippine retail sector.

- BDO Unibank is the largest bank in the Philippines.

- SM Prime is the largest integrated property developer.

- SMIC's integrated developments enhance its market position.

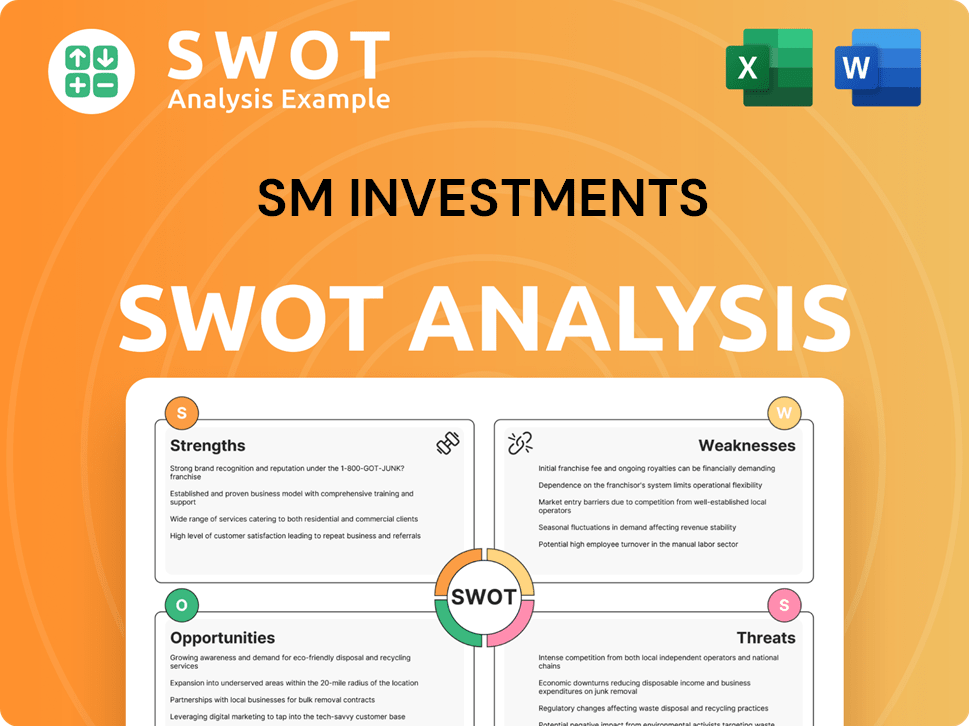

SM Investments SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging SM Investments?

The competitive landscape for SM Investments Company (SMIC) is multifaceted, encompassing various sectors where it operates. As a major Philippine conglomerate, SMIC faces diverse competitors in retail, banking, and property development. Understanding its key rivals is crucial for a thorough market analysis and to assess its business strategy.

SMIC's competitive advantage and financial performance are continuously shaped by the actions of its rivals. The evolving market trends and strategic initiatives of these competitors directly impact SMIC's market share and growth strategy. A detailed overview of the key players provides insights into the dynamics of the Philippine stock market and the broader impact on the Philippine economy.

For a deeper understanding of the company's origins, consider reading the Brief History of SM Investments.

SM Retail's primary competitors include Robinsons Retail Holdings, Inc., Puregold Price Club, Inc., and emerging e-commerce platforms. These rivals challenge SMIC's market share through aggressive expansion and innovative strategies.

BDO Unibank and China Banking Corporation compete with major players such as Metropolitan Bank and Trust Company (Metrobank), Bank of the Philippine Islands (BPI), and Ayala-led banks. These banks compete in consumer lending, corporate banking, and wealth management.

SM Prime Holdings competes with Ayala Land, Inc. and Robinsons Land Corporation. These property developers engage in high-profile battles for prime land acquisitions and strategic partnerships.

E-commerce platforms like Shopee and Lazada pose an indirect threat to SMIC's retail sector. These platforms disrupt traditional retail through online sales and logistics innovation.

Metrobank reported a 34.3% increase in net income for Q1 2024, reaching PHP 12.6 billion, indicating strong competitive activity in the banking sector.

Ayala Land is a formidable rival, particularly in high-end residential developments, office spaces, and integrated mixed-use estates.

The competitive landscape for SMIC is dynamic, with rivals employing various strategies to gain market share. This includes aggressive expansion, digital innovation, and strategic partnerships. The entry of new players in emerging sectors like logistics and healthcare also introduces new competitive dynamics, albeit on a smaller scale currently. The competitive landscape directly influences SMIC's strategic initiatives and growth strategy.

- Retail: Robinsons Retail Holdings, Inc., Puregold Price Club, Inc., and e-commerce platforms.

- Banking: BDO Unibank, China Banking Corporation, Metrobank, BPI, and Ayala-led banks.

- Property: Ayala Land, Inc. and Robinsons Land Corporation.

- E-commerce: Shopee and Lazada.

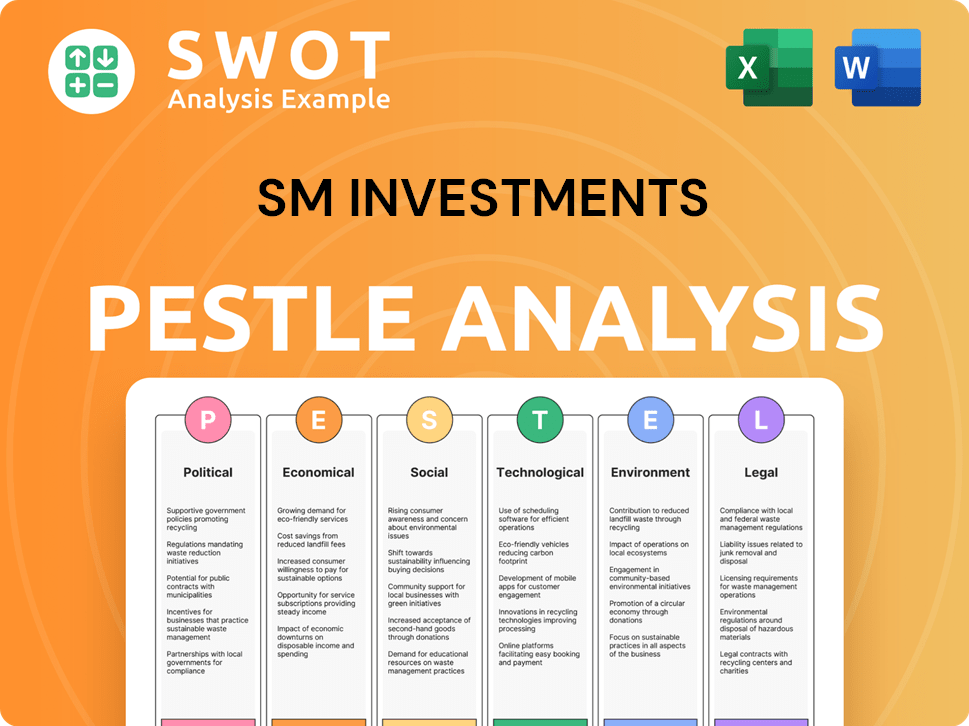

SM Investments PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives SM Investments a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of SM Investments Company (SMIC) requires a deep dive into its core strengths. SMIC, a prominent Philippine conglomerate, has built a formidable position through strategic diversification and a robust ecosystem. This analysis examines the key competitive advantages that enable SMIC to maintain its market leadership and navigate the dynamic business environment.

SMIC's success is rooted in its ability to integrate various business segments, creating synergies that competitors find difficult to replicate. This integrated model, combined with strong brand recognition and financial prowess, forms the foundation of its competitive edge. This approach has allowed SMIC to achieve consistent growth and adapt to evolving market trends, making it a key player in the Philippine economy.

The competitive advantages of SMIC are multifaceted, encompassing its integrated business model, strong brand equity, and financial strength. These elements work together to create a resilient and adaptable business, making it a leader in the Philippine market. For a deeper understanding of their target audience, consider reading about the Target Market of SM Investments.

SMIC's integrated business model is a significant competitive advantage. The synergy between its retail, banking, and property arms creates a powerful ecosystem. For example, SM malls provide a ready customer base for its retail tenants and banking services, enhancing operational efficiency.

The 'SM' brand is synonymous with shopping and leisure in the Philippines. This strong brand recognition translates into high foot traffic in its malls and customer preference for its retail and banking services. Decades of consistent service and widespread presence have built this strong brand.

SMIC's vast mall footprint provides a significant barrier to entry for new competitors. This extensive physical distribution network is particularly crucial in a market where e-commerce penetration is still evolving. This network allows SMIC to maintain a strong presence across the country.

SMIC's financial strength allows it to undertake large-scale investments and expansions. This financial muscle enables it to withstand economic downturns more effectively. The consistent profitability of its core businesses supports this financial stability.

SMIC's competitive advantages are a result of its strategic diversification and integrated business model. These advantages include a strong brand, extensive distribution network, and financial strength. These factors contribute to SMIC's resilience and market leadership.

- Integrated Ecosystem: The synergy between retail, banking, and property businesses.

- Strong Brand Recognition: The 'SM' brand is widely recognized and trusted.

- Extensive Network: Vast mall footprint providing a barrier to entry.

- Financial Prowess: Ability to undertake large-scale investments and withstand downturns.

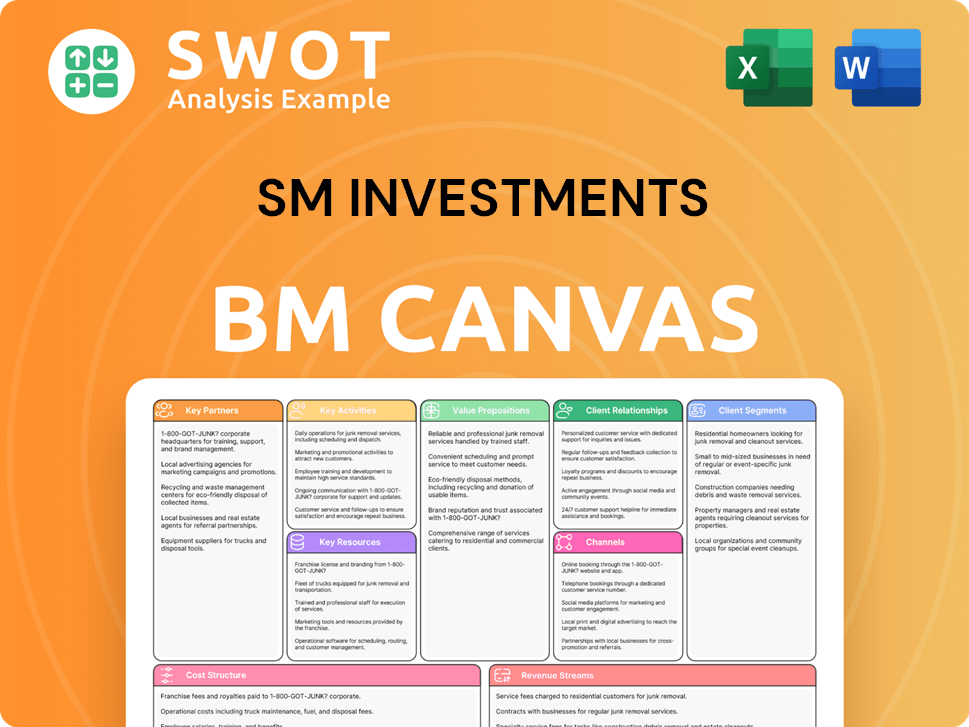

SM Investments Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping SM Investments’s Competitive Landscape?

The competitive landscape of SM Investments Company (SMIC) is significantly influenced by evolving industry trends, presenting both challenges and opportunities. Digital transformation, regulatory changes, and global economic shifts are key factors shaping the company's strategic direction. Understanding these dynamics is crucial for investors and stakeholders analyzing SMIC's market position and future prospects.

Risks include the rise of niche competitors and the impact of inflation on consumer spending. However, opportunities abound in expanding into emerging markets and leveraging innovative retail and financial products. Strategic initiatives, such as diversification and digital transformation, are vital for SMIC's sustained growth and resilience in the dynamic Philippine market. For a detailed understanding of how SMIC generates revenue, explore Revenue Streams & Business Model of SM Investments.

The retail sector is witnessing a surge in e-commerce, with online sales continually increasing. This shift necessitates significant investments in omnichannel strategies for companies like SMIC. Sustainability and personalized customer experiences are also becoming increasingly important, driving product innovation and marketing strategies.

Digital banking and fintech solutions are reshaping the financial services landscape. SMIC's banking arm faces the need to adopt digital platforms to enhance customer engagement and operational efficiency. Regulatory changes and evolving consumer preferences are driving the adoption of digital payment systems.

Inflation and consumer spending power significantly impact retail sales and property demand. The Philippine economy's growth, as seen with the 5.7% GDP growth in Q1 2024, provides a favorable backdrop, but inflationary pressures remain a concern. Economic shifts can influence SMIC's strategic decisions.

The rise of niche market players and new entrants in e-commerce and digital banking intensifies competition. SMIC must continuously innovate and adapt to maintain its market share. Strategic partnerships and product diversification are crucial for staying competitive.

SMIC faces challenges from digital disruption and economic volatility but also has significant growth opportunities. Expansion into emerging markets and innovation in retail offerings are key strategies. Strategic initiatives are focused on long-term sustainability and market leadership.

- Challenges: Adapting to digital transformation, managing inflationary pressures, and competing with niche players.

- Opportunities: Expanding in provincial markets, product innovation, strategic partnerships, and integrated developments.

- Strategic Initiatives: Diversification, digital transformation, focus on integrated developments, and sustainability.

- Market Analysis: Continuously monitor market trends, consumer behavior, and competitor strategies for informed decision-making.

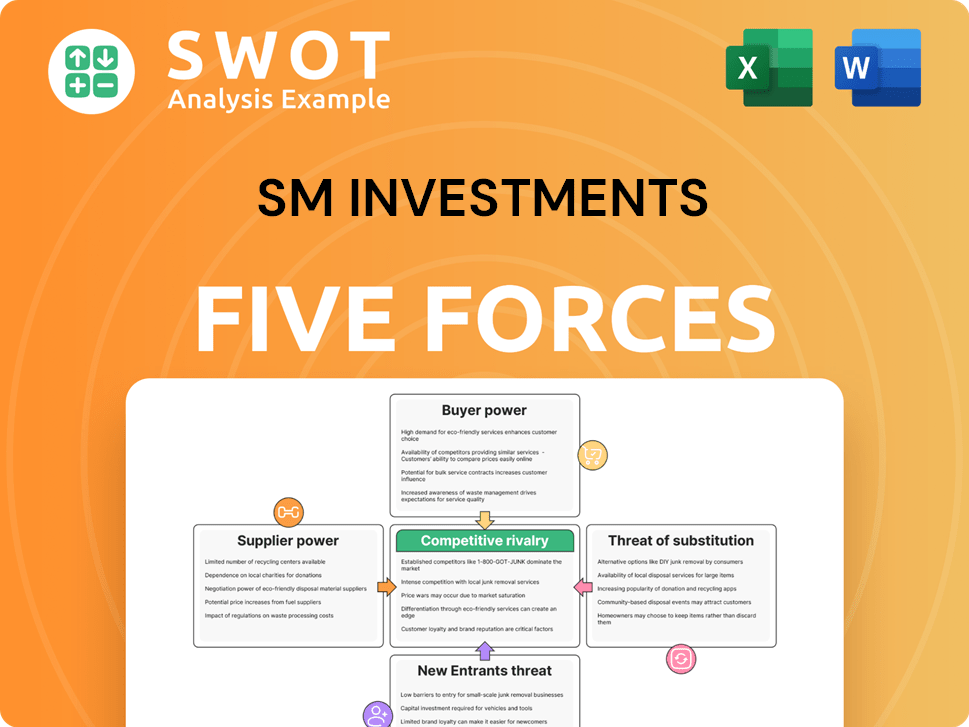

SM Investments Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SM Investments Company?

- What is Growth Strategy and Future Prospects of SM Investments Company?

- How Does SM Investments Company Work?

- What is Sales and Marketing Strategy of SM Investments Company?

- What is Brief History of SM Investments Company?

- Who Owns SM Investments Company?

- What is Customer Demographics and Target Market of SM Investments Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.