SM Investments Bundle

Who Really Controls SM Investments Corporation?

Unraveling the ownership of SM Investments Company, a cornerstone of the Philippine economy, is crucial for anyone seeking to understand its strategic direction. The legacy of Henry Sy, who founded the SM Investments SWOT Analysis, a company that started as a shoe store in 1958, continues to shape its destiny. This deep dive into SMIC ownership will illuminate the forces steering this powerful Philippine conglomerate.

Understanding who owns SMIC is paramount, especially considering its vast influence across retail, banking, and property. From the initial vision of Henry Sy to its current market capitalization, the SM Group's ownership structure has evolved significantly. This analysis will explore the key shareholders and the impact of this structure on SM Investments Company's future, providing insights for investors and stakeholders alike. Discover the details of SM Investments Company's ownership structure and its implications.

Who Founded SM Investments?

The origins of SM Investments Corporation (SMIC) are deeply rooted in the vision of its founder, Henry Sy Sr. He launched his first shoe store, ShoeMart, in October 1958 in Manila, Philippines, marking the beginning of what would become a major Philippine conglomerate.

Initially, the ownership of the company was entirely within the Sy family. Henry Sy Sr. held the controlling stake, driving the company's early growth. The company's expansion was largely fueled by its internal operations and the reinvestment of profits.

The early years of SMIC involved informal family arrangements rather than formal agreements. The focus was on providing a wide array of goods to Filipino consumers, which allowed for swift decision-making and rapid expansion during its formative years.

Henry Sy Sr. founded the company, establishing the foundation for its future growth.

The ownership was concentrated within the Sy family, with Henry Sy Sr. holding the controlling stake.

The company's growth was primarily funded through internal operations and the reinvestment of profits.

Early agreements were likely informal family arrangements rather than formal contracts.

The founding team's vision was centered on providing a wide array of goods to the Filipino consumer.

This concentrated ownership allowed for swift decision-making and agile expansion.

Understanding the early ownership of SMIC provides insight into its initial strategies and growth. The company's history, as detailed in a Brief History of SM Investments, began with Henry Sy Sr.'s vision and the Sy family's concentrated ownership, which facilitated the company's early expansion. Today, SMIC is a publicly listed company, and its ownership structure has evolved from its early days. The company's market capitalization is a significant indicator of its success, with recent figures reflecting its strong position in the Philippine market. SMIC's subsidiaries and affiliates span various sectors, including retail, property, and banking, contributing to its overall net worth.

- The initial ownership was solely within the Sy family.

- Henry Sy Sr. held the controlling stake.

- Growth was primarily funded through internal operations.

- Early agreements were informal family arrangements.

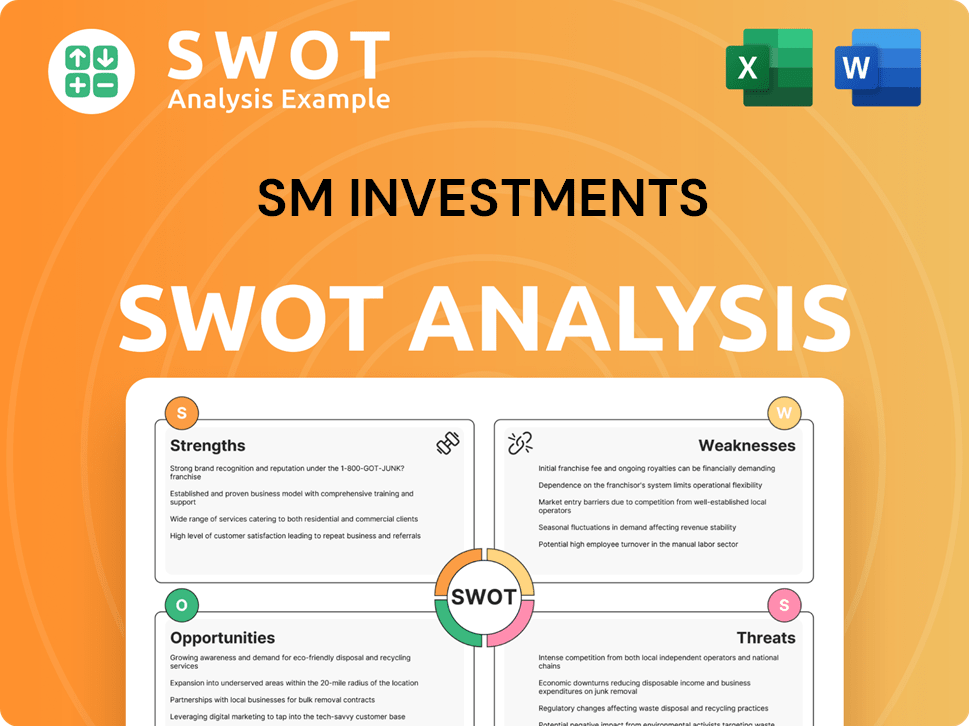

SM Investments SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has SM Investments’s Ownership Changed Over Time?

The ownership structure of SM Investments Company (SMIC) has transformed significantly since its inception. The company's journey from a privately held family business to a publicly listed conglomerate marks a key evolution in its ownership. A pivotal moment occurred on February 15, 2005, when SM Investments Corporation debuted on the Philippine Stock Exchange (PSE). This initial public offering (IPO) opened the door for public participation and diversified its ownership base. This transition was a strategic move, allowing for increased capital and enhanced market visibility for the SM Group.

The Sy family, through various holding companies and direct ownership, remains the primary owner of SMIC. Their strategic influence is paramount, guiding the company's long-term vision and major investment decisions. The family's stake in SM Prime Holdings, a major subsidiary, is significant, underscoring their continued control over the conglomerate's property arm. Institutional investors, both local and international, also hold significant portions of SMIC's shares. This includes a mix of mutual funds, index funds, and other asset management firms.

| Shareholder Type | Approximate Percentage of Ownership (as of Q1 2024) | Notes |

|---|---|---|

| Sy Family | 60% - 70% | Through various holding companies and direct ownership. |

| Institutional Investors | 20% - 30% | Includes mutual funds, index funds, and asset management firms. |

| Individual Insiders | 5% - 10% | Primarily members of the Sy family who are also executives or directors. |

The shift to a publicly traded company introduced transparency and external scrutiny, yet the Sy family's strategic influence remains constant. This continued family control, even with public listing, has allowed for consistent strategic direction and a focus on long-term growth across its diversified portfolio. To understand more about the company's structure, you can read more about SM Investments in this article: 0.

The Sy family maintains significant control over SM Investments Corporation, ensuring strategic continuity.

- Public listing in 2005 diversified ownership and increased market visibility.

- Institutional investors hold a substantial portion of the shares.

- The ownership structure balances family influence with public market dynamics.

- Understanding the ownership is crucial for investors interested in the Philippine conglomerate.

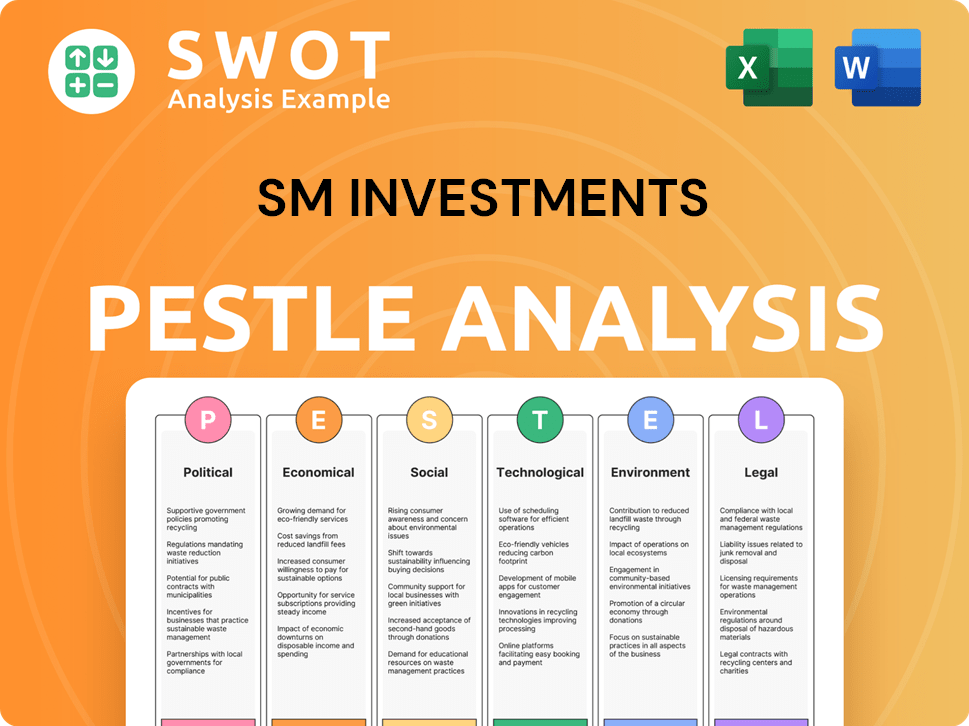

SM Investments PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on SM Investments’s Board?

The Board of Directors of SM Investments Corporation, a prominent Philippine conglomerate, is pivotal in its governance structure. As of early 2024, the board typically includes members of the Sy family, reflecting their significant ownership stake. Key figures include Jose Sio as Chairman and Frederic DyBuncio as President and CEO. The board also includes independent directors, who are tasked with providing objective oversight and representing the interests of all shareholders. This structure aims to balance family control with broader shareholder considerations.

The composition of the board and its leadership play a crucial role in shaping the strategic direction of SM Investments Company. The presence of family members, such as those from the Sy family, ensures that the company's legacy and long-term vision are considered in decision-making processes. Independent directors contribute to the board's diversity and bring in external perspectives, which are essential for effective corporate governance. This blend of family representation and independent oversight helps to ensure that SM Investments Company operates in a manner that is both strategically sound and compliant with regulatory requirements.

| Board Member | Role | Affiliation |

|---|---|---|

| Jose Sio | Chairman of the Board | Sy Family |

| Frederic DyBuncio | President and CEO | Sy Family |

| Independent Directors | Various | Independent |

The voting structure at SM Investments Corporation generally follows a one-share-one-vote principle for its common shares. However, the concentration of ownership within the Sy family, who founded SM Investments Company, grants them considerable control. Their substantial holdings allow them to significantly influence key corporate decisions, including director elections and strategic initiatives. While there are no publicly disclosed special voting rights, the family's majority ownership ensures their collective voting power is substantial. For more insights into the company's operations, you can explore the Revenue Streams & Business Model of SM Investments.

The Sy family maintains significant control over SM Investments Company. Key decisions are heavily influenced by their voting power, stemming from their substantial shareholdings. Independent directors provide oversight, balancing family interests with broader shareholder concerns.

- The Sy family's ownership structure is a key factor in SMIC's governance.

- Independent directors ensure a degree of balance in decision-making.

- The one-share-one-vote system is in place, but ownership concentration matters.

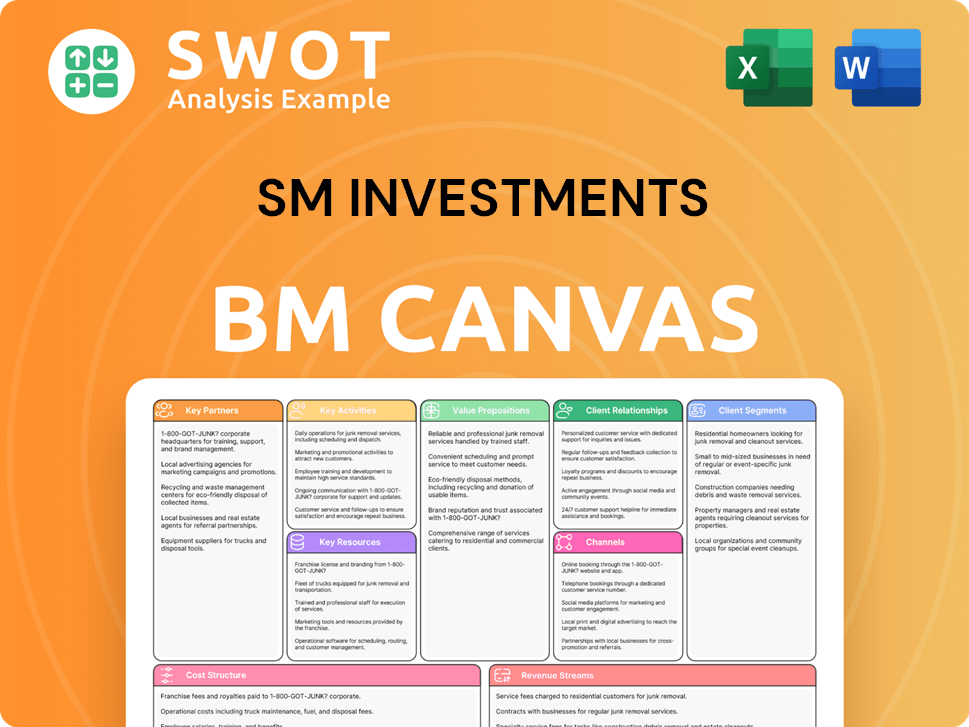

SM Investments Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped SM Investments’s Ownership Landscape?

Over the past few years, the ownership of SM Investments Company (SMIC) has seen a consistent trend: the Sy family has maintained significant control. This is coupled with the ongoing presence of institutional investors. While there haven't been any major share buybacks or new offerings that dramatically altered the ownership structure, the company has continued its strategic investments and expansions across its various subsidiaries. These moves, such as recent expansions in retail and property, indirectly affect the overall value of SMIC shares to investors. Leadership changes have also largely involved the transition of responsibilities to the second and third generations of the Sy family.

The strategic direction of the company remains firmly in the hands of the Sy family. This is a deliberate strategy to retain control over their business empire. Industry trends in the Philippines and globally show increasing interest from institutional investors in stable, diversified conglomerates like SMIC. There have been no public announcements about an impending privatization or a significant shift away from the current ownership structure. The company's focus is on sustainable growth across its core businesses.

| Key Aspect | Details | Recent Data (2024-2025) |

|---|---|---|

| Ownership Stability | Sy Family's Influence | Maintained controlling stake, no significant dilution. |

| Institutional Investors | Presence of Institutional Investors | Steady participation, reflecting confidence in SMIC's performance. |

| Strategic Moves | Subsidiary Expansions | Ongoing M&A activities in retail and property, enhancing shareholder value. |

The Target Market of SM Investments is a comprehensive guide to understanding the company's diverse portfolio and its impact on its stakeholders.

The Sy family continues to be the primary owner, ensuring strategic continuity. Their focus on sustainable growth is evident in their long-term vision. The company's leadership transition involves the second and third generations.

The ownership structure of SMIC is characterized by a strong controlling stake held by the Sy family. Institutional investors also hold significant shares. This balance provides stability and investor confidence.

The Sy family, the founders of the SM Group, maintains significant ownership. This ensures strategic alignment and long-term vision. Institutional investors also hold substantial shares, reflecting confidence in SMIC.

SMIC has focused on strategic investments and expansions in recent years. These moves in retail and property portfolios enhance shareholder value. Leadership transitions to the second and third generations of the Sy family.

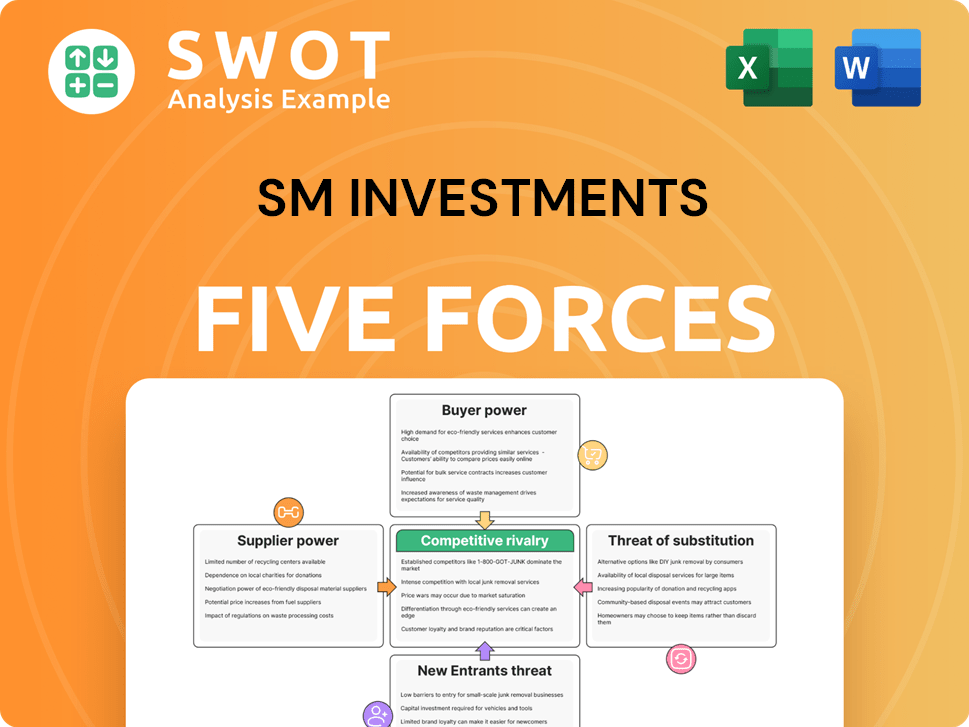

SM Investments Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SM Investments Company?

- What is Competitive Landscape of SM Investments Company?

- What is Growth Strategy and Future Prospects of SM Investments Company?

- How Does SM Investments Company Work?

- What is Sales and Marketing Strategy of SM Investments Company?

- What is Brief History of SM Investments Company?

- What is Customer Demographics and Target Market of SM Investments Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.