SM Investments Bundle

Decoding SM Investments Company: How Does It Thrive?

Ever wondered how a single entity can touch nearly every facet of daily life in the Philippines? SM Investments Company (SMIC), a powerhouse in Southeast Asia, is the answer. From bustling shopping malls to essential banking services, the SM Investments SWOT Analysis reveals the strategies behind its success.

This deep dive into SMIC's business operations will explore its diverse portfolio, including its retail empire, banking ventures, and property developments. Understanding the SM Group's financial performance and strategic decisions is vital for anyone seeking to navigate the complexities of the Philippine market. Learn about SMIC's expansion plans and how this Philippine conglomerate continues to shape the economic landscape.

What Are the Key Operations Driving SM Investments’s Success?

SM Investments Company (SMIC), a prominent Philippine conglomerate, creates and delivers value through its core business operations. These primary operations span retail, banking, and property development. The company's integrated approach allows for significant synergies, contributing to its robust financial performance and market position.

The value proposition of SMIC is centered on providing diverse products and services, accessible financial solutions, and vibrant lifestyle destinations. This is achieved through extensive networks of stores, branches, and properties, catering to a wide range of customer needs. SMIC's strategic focus and operational efficiency are key to its success.

Understanding the inner workings of SMIC provides insights into how the company invests money and its overall impact on the Philippine economy. For those interested in learning more about the company's marketing strategies, consider reading about the Marketing Strategy of SM Investments.

SMIC's retail arm offers a wide array of goods and services through department stores, supermarkets, and specialty stores. This includes The SM Store, SM Supermarket, and Ace Hardware. The company leverages robust supply chain management to ensure product availability and competitive pricing across its outlets.

The banking sector, primarily through BDO Unibank and China Banking Corporation, provides a comprehensive suite of financial services. These services include retail and corporate banking, lending, and investment options. Accessibility and reliability are key components of its value proposition.

SM Prime Holdings develops and manages shopping malls, residential condominiums, and integrated resorts. This includes SM Group's shopping malls. The value proposition focuses on creating vibrant lifestyle destinations and quality living spaces. The company's integrated developments combine retail, residential, office, and leisure components.

SMIC's structure allows for significant synergies between its business operations. For example, the banking arm provides financial services to customers within the retail and property networks, creating a captive customer base. This integrated approach enhances efficiency and market penetration.

In 2024, SM Investments Company reported strong financial results, driven by growth across its core businesses. SMIC's financial performance reflects its strategic focus and operational efficiency.

- Retail: Continued expansion and strong consumer spending.

- Banking: Increased loan growth and improved asset quality.

- Property: New mall openings and residential project launches.

- Financial Performance: SMIC's latest news and updates, and financial statements show consistent revenue growth and profitability.

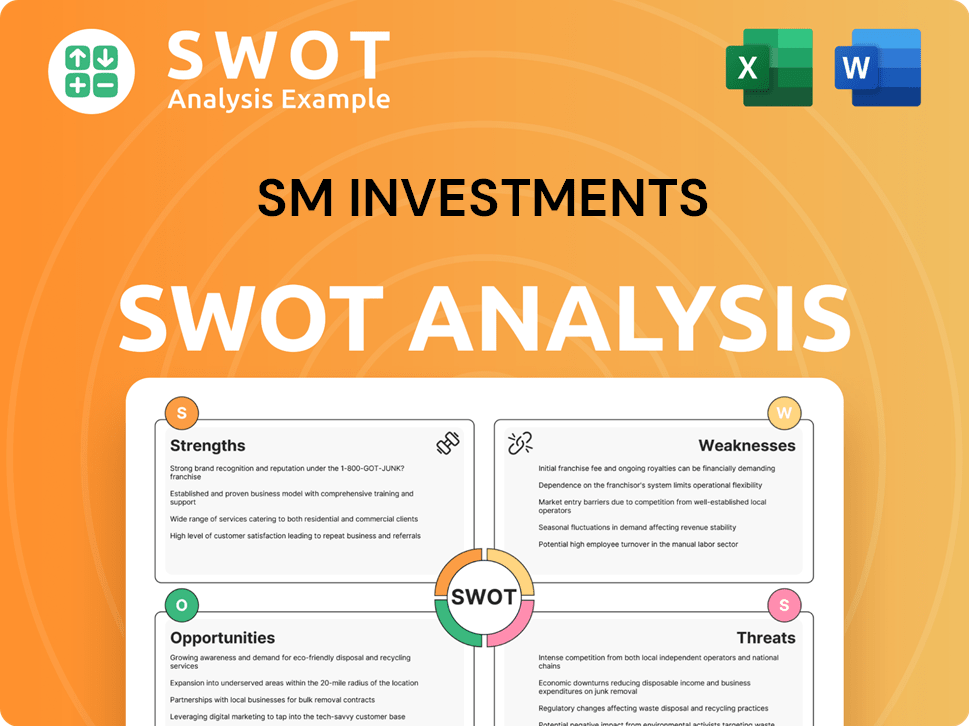

SM Investments SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does SM Investments Make Money?

SM Investments Corporation (SMIC), a leading Philippine conglomerate, employs diverse revenue streams across its core businesses. These strategies enable SMIC to maintain a strong financial foundation and adapt to market changes. The company's approach to monetization is multifaceted, focusing on both immediate sales and long-term customer value.

The company's business operations are structured to maximize revenue generation across various sectors. This diversification helps SMIC mitigate risks and capitalize on growth opportunities. Through strategic initiatives and a customer-centric approach, SMIC aims to enhance its financial performance and maintain its market leadership.

Understanding the revenue streams and monetization strategies of SM Investments Company is crucial for investors and stakeholders. The company's financial success is a result of its diversified business model and strategic initiatives. For more details on the ownership structure, you can refer to Owners & Shareholders of SM Investments.

The retail segment of SM Investments Company generates revenue primarily through direct sales of goods. This includes department stores, supermarkets, and specialty stores. In 2024, the retail segment continued to be a significant contributor to SMIC's revenue, driven by increased consumer spending and the expansion of its store network.

- Direct Sales: Revenue from the sale of goods in department stores, supermarkets, and specialty stores.

- Private Label Brands: Sales of products under the company's own brands, offering higher profit margins.

- Promotional Campaigns: Revenue generated through various promotional activities and discounts.

- Loyalty Programs: Repeat purchases and enhanced customer lifetime value through loyalty programs.

The banking and financial services segment, managed through BDO Unibank and China Banking Corporation, generates revenue from multiple sources. This segment's performance is a key indicator of SMIC's overall financial health. In 2024, BDO Unibank reported a net income of PHP 73.4 billion, demonstrating the strong performance of this segment.

- Interest Income: Income from loans and investments.

- Service Charges and Commissions: Fees from various banking transactions.

- Trading Gains: Profits from trading activities.

- Tiered Interest Rates: Attract deposits and loans.

- Transaction Fees: Fees for services like remittances and fund transfers.

- Wealth Management Fees: Fees from investment products.

The property segment, primarily through SM Prime Holdings, generates revenue from mall rentals, sales of residential units, and revenues from leisure and entertainment properties. SM Prime Holdings reported a consolidated net income of PHP 40 billion in 2024. The property segment's strategic initiatives have significantly contributed to SMIC's financial performance.

- Mall Rentals: Revenue from leasing space to retail tenants.

- Residential Sales: Revenue from the sale of residential units.

- Leisure and Entertainment: Revenues from leisure and entertainment properties.

- Long-Term Lease Agreements: Stable revenue through long-term agreements with retail tenants.

- Pre-selling of Residential Units: Generating revenue before completion.

- Property Management Fees: Fees associated with property management and leisure facilities.

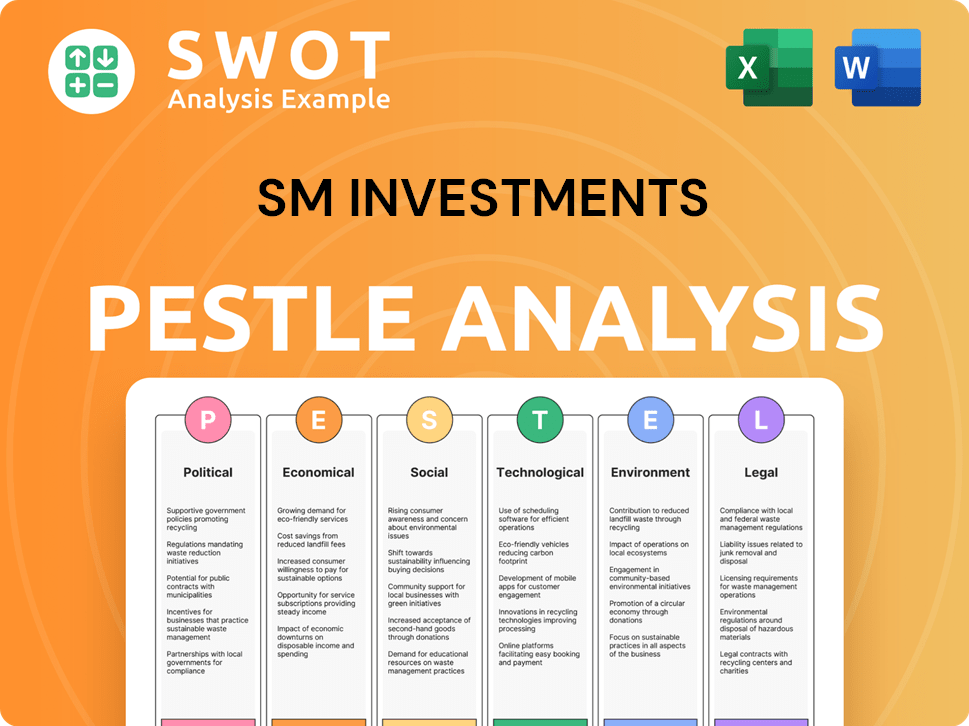

SM Investments PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped SM Investments’s Business Model?

The evolution of SM Investments Company (SMIC) is marked by significant milestones and strategic decisions that have solidified its position as a leading Philippine conglomerate. Key to its growth has been the continuous expansion of its mall network, alongside the strategic integration of its retail arm. The consolidation within its financial sector, particularly through BDO Unibank and China Banking Corporation, has created a robust financial powerhouse.

SMIC has strategically navigated various challenges, including economic downturns and the recent global health crisis. Its ability to adapt, such as by transitioning retail operations to online platforms and implementing safety protocols in its malls, has been crucial. Furthermore, its proactive response to supply chain disruptions, through strengthening local sourcing and diversifying international suppliers, has mitigated potential impacts.

The company's competitive advantages are multifaceted. The 'SM' brand is a symbol of quality and reliability in the Philippines. Its integrated ecosystem, where malls, banks, and retail outlets support each other, creates a powerful network effect. SMIC's deep understanding of the Philippine consumer and its ability to adapt to evolving market trends, including the increasing adoption of digital technologies, sustains its business model.

SMIC's journey includes the expansion of its mall network, entry into the China market, and the growth of its retail arm through strategic acquisitions. The consolidation of its banking interests under BDO Unibank and China Banking Corporation has been a pivotal move. These actions have diversified its revenue streams and strengthened its market position.

SMIC has adapted its retail operations to online platforms and implemented health and safety protocols in its malls. It has also strengthened local sourcing and diversified international suppliers. These actions reflect its proactive approach to navigating economic challenges and maintaining business continuity. SMIC continues to invest in digital transformation across its segments.

The 'SM' brand's strength, economies of scale, and integrated ecosystem provide a significant competitive advantage. Its deep understanding of the Philippine consumer and ability to adapt to market trends, including digital technologies, are also key. SMIC's focus on operational efficiency and customer experience further enhances its market position.

In 2023, SMIC reported a consolidated revenue of approximately PHP 448.1 billion, a 15% increase from the previous year. Net income rose by 26% to PHP 42.1 billion, demonstrating strong financial performance across its core business operations. The retail segment saw a revenue increase of 16%, while the property segment grew by 12%. The financial services segment also contributed significantly to the overall positive results.

SMIC's competitive edge is built on brand strength, economies of scale, and an integrated ecosystem. Its ability to understand and adapt to the Philippine market, including the adoption of digital technologies, is crucial. The company's focus on operational efficiency and customer experience further solidifies its market position.

- Brand Recognition: The 'SM' brand is synonymous with quality and reliability.

- Integrated Ecosystem: Malls, banks, and retail outlets support each other, enhancing customer loyalty.

- Market Adaptation: Deep understanding of the Philippine consumer and digital technology adoption.

- Financial Strength: Strong financial performance and diverse revenue streams.

For more insights into the competitive landscape, consider exploring the Competitors Landscape of SM Investments.

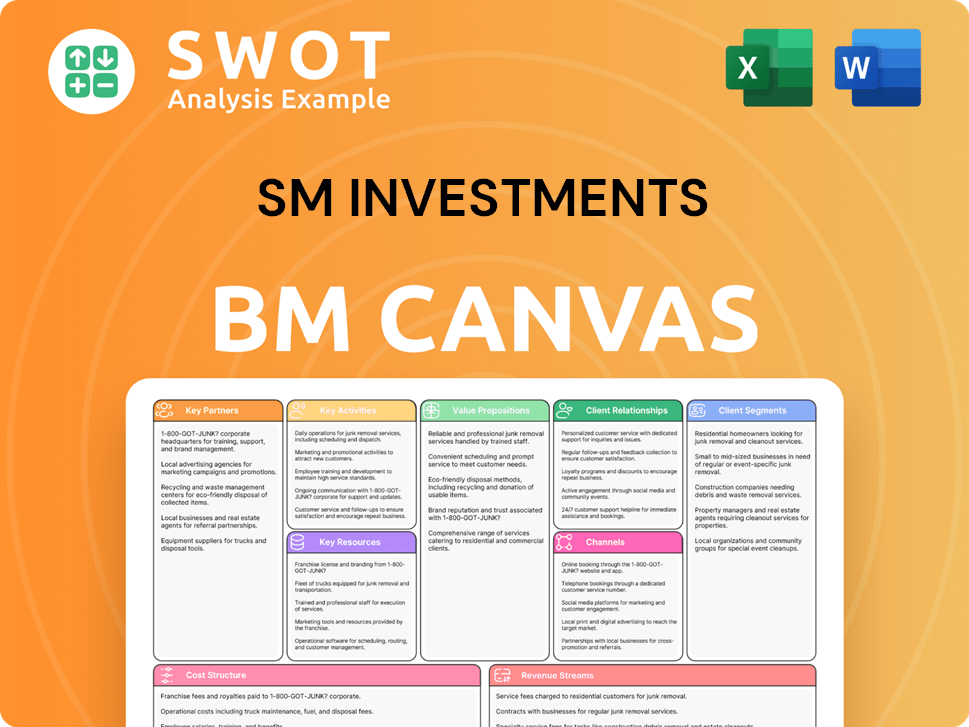

SM Investments Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is SM Investments Positioning Itself for Continued Success?

The SM Investments Company (SMIC), a prominent Philippine conglomerate, holds a commanding position in its core sectors. Its retail arm, encompassing department stores and supermarkets, leads consumer spending in the Philippines. SM Supermalls, known for their size and high foot traffic, serve as vital community hubs. BDO Unibank, a subsidiary, consistently ranks as the largest bank in the Philippines by assets, loans, and deposits. SM Prime Holdings, another key unit, is a leading developer and operator of shopping malls and residential properties. This robust structure underpins the company's financial performance and market dominance.

Despite its strong market position, SMIC faces several risks that could affect its business operations. These include regulatory changes in the banking and retail sectors, increased competition from e-commerce and digital banking, and technological disruption. The company must also adapt to changing consumer preferences, such as the shift towards online shopping and sustainable products. Geopolitical factors and economic downturns could also impact consumer spending and business growth. Understanding these challenges is crucial for investors and stakeholders looking at the long-term prospects of the SM Group.

SMIC's retail sector has a substantial market share, leading consumer spending in the Philippines. BDO Unibank, a subsidiary, is consistently the largest bank by assets. SM Prime Holdings, a key unit, is a leading property developer and operator of shopping malls and residential properties.

SMIC faces regulatory changes, competition from e-commerce, and technological disruption. Changing consumer preferences and economic downturns also pose challenges. The company needs to adapt to remain competitive and maintain financial performance.

SMIC plans to expand retail and property footprints, especially in underserved areas and China. The company is investing in digital transformation for efficiency and improved customer experience. Sustainable growth, diversification, and leveraging its integrated business model are key strategies.

The company is focused on synergistic growth across its core businesses. SMIC is exploring new opportunities in high-growth sectors like logistics and healthcare. Adapting to market dynamics is crucial to maintain its leadership position. For more insights, read about the Target Market of SM Investments.

SMIC continues to focus on sustainable growth and diversification across its core businesses. The company is actively investing in digital transformation and expanding its presence in key markets. These strategic moves are aimed at enhancing efficiency, improving customer experience, and capturing new growth opportunities.

- Retail expansion in underserved areas and China.

- Digital transformation investments across all segments.

- Focus on synergistic growth and new investment opportunities.

- Adapting to market dynamics to maintain leadership.

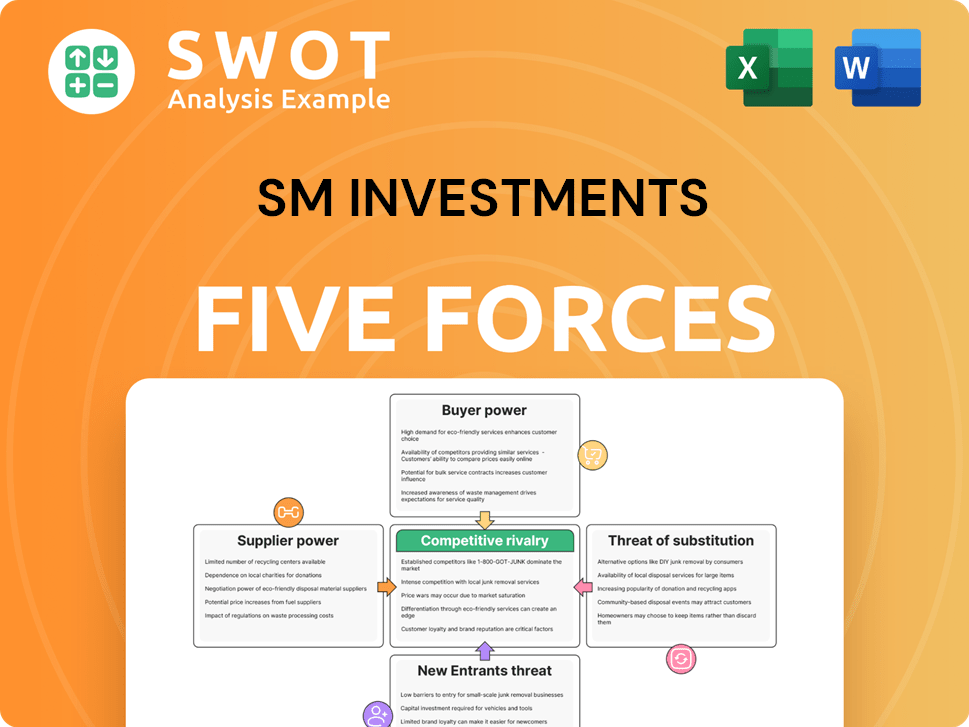

SM Investments Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SM Investments Company?

- What is Competitive Landscape of SM Investments Company?

- What is Growth Strategy and Future Prospects of SM Investments Company?

- What is Sales and Marketing Strategy of SM Investments Company?

- What is Brief History of SM Investments Company?

- Who Owns SM Investments Company?

- What is Customer Demographics and Target Market of SM Investments Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.