SM Investments Bundle

Can SM Investments Company Maintain Its Dominance?

Explore the dynamic world of SM Investments Corporation (SMIC), a leading Philippine conglomerate, and uncover its strategic roadmap for sustained success. From its humble beginnings as a shoe store, SMIC has transformed into a powerhouse, impacting various sectors. This analysis dives deep into SMIC's growth strategy, examining its core businesses and future prospects.

Understanding the SM Investments SWOT Analysis is crucial to grasp SMIC's strengths, weaknesses, opportunities, and threats. This comprehensive overview will delve into SMIC's expansion strategies across retail, banking, and property, providing insights into its financial performance and market position. Furthermore, we'll examine the company's forward-looking approach, including its ventures into renewable energy and other innovative areas, to assess its long-term growth outlook as a Philippine Conglomerate.

How Is SM Investments Expanding Its Reach?

SM Investments Company (SMIC), a leading Philippine conglomerate, is actively pursuing an aggressive expansion strategy. This strategy focuses primarily on underserved areas across the Philippines. The goal is to broaden its reach in retail, banking, and property development. This approach aims to capitalize on growth opportunities within the country.

The company's expansion efforts are driven by a desire to access new customers. It also seeks to diversify revenue streams and align with national development priorities. These initiatives are designed to support inclusive economic growth. The company's strategy is to strengthen its market position across multiple sectors.

In 2024, SMIC added a significant number of retail stores, malls, and bank branches. This expansion underscores its commitment to growth. The company continues to invest heavily in its core businesses. It is also strategically venturing into emerging sectors.

In 2024, SMIC expanded its retail footprint significantly. The company added a total of 619 retail stores across the Philippines. This expansion was part of a broader strategy to increase market penetration. Over 85% of this expansion occurred in the provinces.

SM Prime Holdings, SMIC's property arm, plans to invest ₱100 billion in 2025. This investment will prioritize malls, residences, and integrated property developments. New mall developments will add 205,400 square meters of gross floor area.

In 2024, SMIC expanded its banking presence with the addition of 73 bank branches. This expansion aims to increase financial inclusion. The company's strategy includes strengthening its banking services.

SM Development Corporation (SMDC) plans to roll out 8,000 to 10,000 residential units in 2024. These units are targeted for Northern Luzon, Visayas, and Mindanao. A ₱67 billion investment is planned for SM Residences and integrated property developments.

SMIC's expansion strategy also includes investments in emerging sectors like renewable energy and logistics. The company's subsidiary, Philippine Geothermal Production Company (PGPC), is expanding its geothermal steam supply. In logistics, 2GO Group launched new vessels to enhance connectivity. These initiatives demonstrate SMIC's commitment to long-term growth and sustainability. For more insights, you can check out an article about SM Investments Company's growth strategy.

SMIC's expansion initiatives span multiple sectors. The company is focusing on both organic growth and strategic investments. These efforts are designed to create a diversified and resilient business model.

- Retail: Continued store openings, particularly in underserved areas.

- Property: New mall developments and residential projects across the country.

- Banking: Increased branch network to improve financial services access.

- Renewable Energy: Expansion of geothermal energy production.

- Logistics: Enhancing shipping and logistics capabilities.

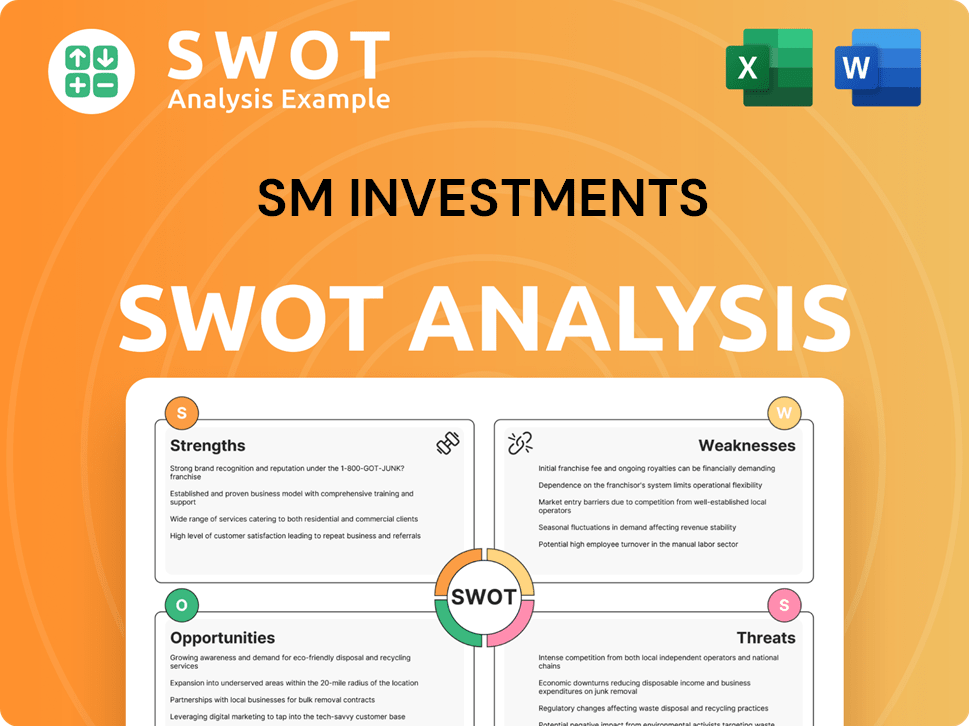

SM Investments SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does SM Investments Invest in Innovation?

The innovation and technology strategy of SM Investments Company (SMIC) is geared towards sustained growth across its diverse portfolio. This approach emphasizes digital transformation and sustainability, integrating technology to enhance customer experience and improve operational efficiency. While specific details on R&D investments are not widely publicized, SMIC's subsidiaries actively implement technological advancements.

SMIC's commitment to innovation is evident in its sustainability initiatives. These efforts are designed to reduce environmental impact and promote long-term growth. The company's subsidiaries are at the forefront of implementing these strategies.

SMIC's commitment to integrating innovation and technology with its growth and sustainability objectives is clear. This is achieved through a variety of initiatives across its different business segments.

SM Investments Company focuses on digital transformation to enhance customer experience and streamline operations. This strategy involves the adoption of new technologies across various business units.

Sustainability is a core focus, with significant investments in green infrastructure and renewable energy projects. These efforts aim to reduce the company's environmental footprint.

SMIC's banking arm, BDO Unibank, is a major funder of renewable energy projects. This supports the company's broader environmental goals and contributes to the growth of the renewable energy sector.

SMIC supports micro, small, and medium enterprises (MSMEs) by integrating them into its supply chain. This provides access to financing, market opportunities, and mentorship, fostering entrepreneurship.

The company is expanding its 'Green Finds' program and accelerating sustainability efforts in its retail brands. This includes offering eco-friendly products and implementing green store concepts.

SMIC actively implements water recycling initiatives to optimize consumption and reduce environmental impact. This is part of its broader sustainability strategy.

The company's approach to innovation is multifaceted, encompassing digital transformation, sustainability, and support for MSMEs. These strategies are key drivers of SMIC's growth and contribute to its long-term outlook. As of December 2023, BDO Unibank funded PHP898 billion in sustainable finance, including loans to 59 renewable energy initiatives. The company aims to reduce its carbon footprint by 40% by 2040. The integration of over 100,000 MSMEs into its supply chain highlights its commitment to inclusive growth. For a deeper understanding of SM Investments Company's business model and revenue streams, consider reading Revenue Streams & Business Model of SM Investments.

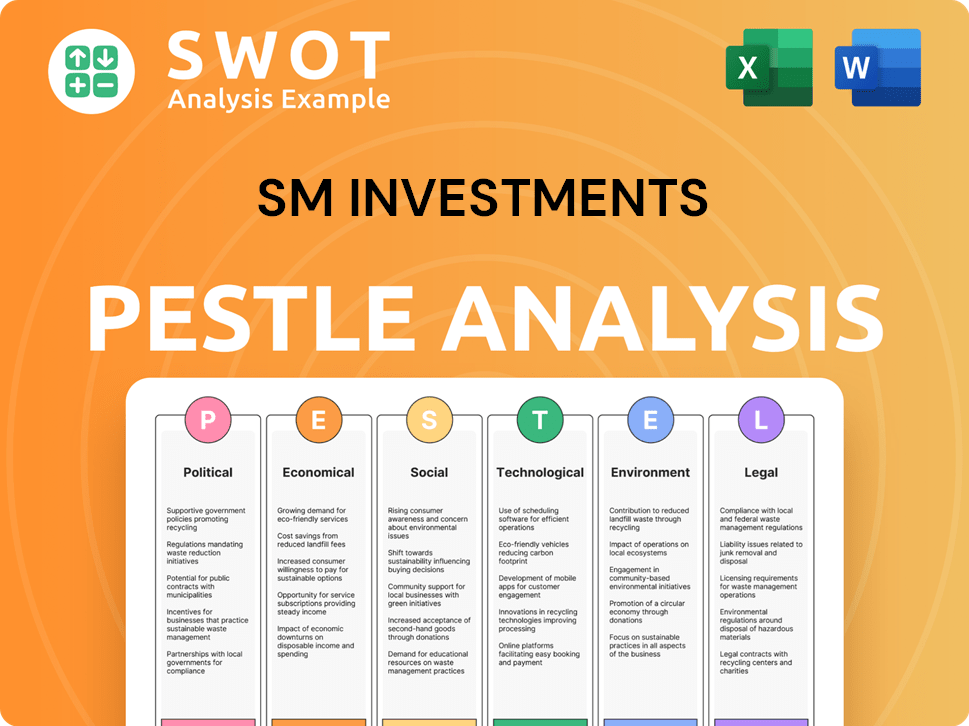

SM Investments PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is SM Investments’s Growth Forecast?

In 2024, SM Investments Company (SMIC) showcased robust financial health, with a consolidated net income of ₱82.6 billion, a 7% increase from the previous year. This strong performance underscores the effectiveness of its growth strategy and its ability to navigate market dynamics. The company's focus on diverse sectors, including retail, property, and banking, has provided a solid foundation for sustained expansion.

The company's revenue reached ₱654.8 billion, up 6% from 2023, with the fourth quarter of 2024 showing the highest growth at 9.4%. This momentum is expected to continue into 2025. The first quarter of 2025 saw a consolidated net income of ₱20.1 billion, a 9% increase year-over-year, with revenues at ₱152.0 billion, up 6%.

SMIC's financial outlook for 2025 is positive, supported by strategic investments and strong performance across its core businesses. The company's strategic allocation of resources and its commitment to shareholder value indicate a positive trajectory for future growth.

Banking was the primary driver of net income in 2024, contributing 49% to the total. BDO Unibank's net income increased by 12% to ₱82.0 billion, supported by robust performance across its core businesses. China Banking Corporation also saw a 13% increase in net income to ₱24.8 billion.

The property sector, led by SM Prime Holdings, contributed significantly, with a 14% surge in net income to ₱45.6 billion. Revenues in this sector expanded by 10% to ₱140.4 billion. This growth highlights the company's successful real estate ventures and strategic developments.

SM Retail's net income reached ₱20.9 billion, an improvement from ₱19.9 billion the previous year, with revenues increasing by 5% to ₱434.5 billion. Food retail was the strongest performer, driven by expanded store networks. This reflects SMIC's effective strategies in the retail market.

Portfolio investments contributed 7% to net income. SMIC's total assets increased by 7% to ₱1.7 trillion. The company maintains a conservative financial position with a net debt to equity ratio of 31% to 69% in 2024, ensuring financial stability.

SMIC has allocated a capital expenditure (CapEx) budget of ₱115 billion for 2025, a 15% increase, to fund projects in retail, banking, and energy. This investment underscores the company's commitment to future growth and expansion. Additionally, the company announced a 44% increase in shareholder dividends for 2025, reaching ₱13 per share (₱11 regular, ₱2 special), and a ₱60 billion share buyback program.

- The increased CapEx signals confidence in the company's long-term prospects.

- The dividend increase and share buyback program enhance shareholder value.

- These actions reflect SMIC's belief in the resilience of the Philippine economy.

- Analysts are optimistic about continued revenue and profitability growth.

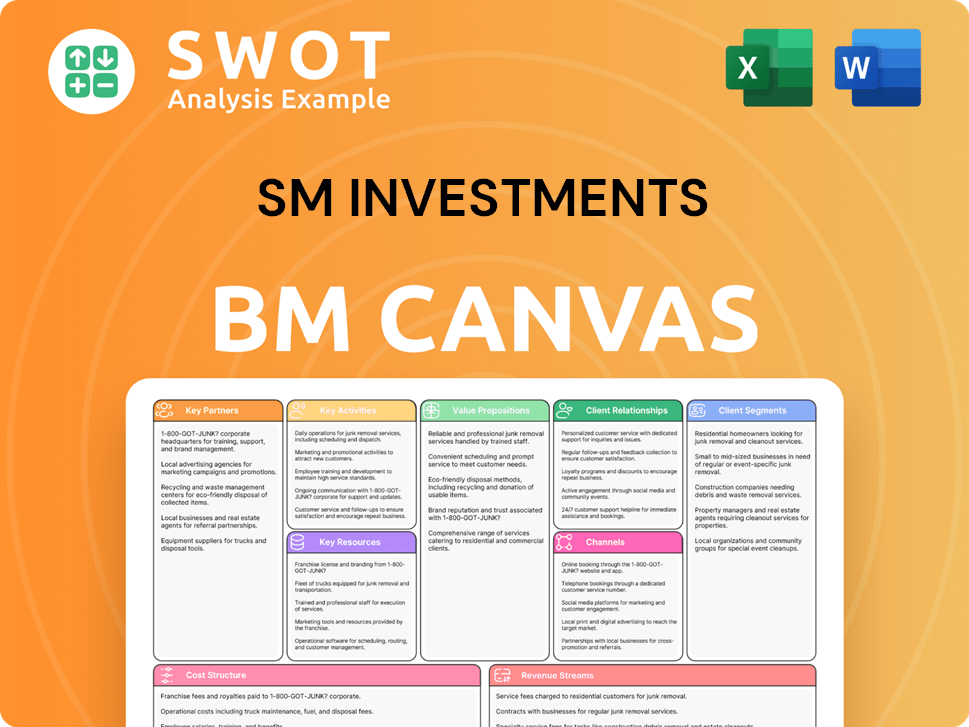

SM Investments Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow SM Investments’s Growth?

While the future for SM Investments Company (SMIC) looks promising, several potential risks and obstacles could impact its Growth Strategy SMIC. These challenges span market competition, regulatory changes, and the need to adapt to technological advancements. Understanding these factors is crucial for assessing the overall SMIC Future Prospects.

The company operates in highly competitive sectors like retail, banking, and property, making it essential to stay ahead of market trends. Furthermore, expansion into underserved areas, while a growth driver, requires navigating diverse local market dynamics and potential competitive responses. The ability to mitigate these risks will be critical to SMIC's sustained success.

Regulatory changes and policy shifts in the Philippines could affect SMIC's operations and expansion plans. The company must also continuously adapt to evolving digital landscapes to maintain its competitive edge, which is a challenge across all industries. Internal resource constraints, such as talent acquisition, could also affect the pace of expansion and operational efficiency.

The Philippine Conglomerate faces intense competition across its core businesses. The retail, banking, and property sectors are all highly competitive, requiring constant innovation and strategic adaptation to maintain market share. This competitive landscape necessitates that SMIC stay agile and responsive to consumer demands and market trends.

Changes in Philippine regulations can significantly impact SMIC's operations and expansion. Changes in tax laws, licensing regulations, or other government policies can affect profitability and the feasibility of new projects. The ability to navigate these regulatory environments is crucial for long-term growth.

Supply chain disruptions pose a risk, particularly for a company with extensive retail and logistics operations. Global economic uncertainties can exacerbate these vulnerabilities. Adapting to these challenges is critical for maintaining operational efficiency and ensuring product availability.

Technological advancements require continuous adaptation. SMIC must invest in digital transformation and leverage technologies like AI and IoT to maintain its competitive edge. Staying current with digital trends is essential for long-term success and relevance in the market.

Internal resource constraints, like talent acquisition and retention, can affect expansion. The competitive labor market requires strategic human resource management to ensure the company has the skilled workforce needed for growth. Efficient resource allocation is key to operational success.

Global macroeconomic factors, including interest rates and trade environments, are continuously monitored. Despite positive consumer confidence, inflationary pressures and currency volatility remain challenges. SMIC's ability to adapt to these conditions is crucial for SMIC Financial Performance.

SMIC addresses these risks through a diversified business model and a strong balance sheet. The company's diversified portfolio across retail, property, and banking helps mitigate risks associated with any single sector. A robust financial position provides flexibility to navigate economic downturns and invest in strategic opportunities.

Leadership expresses confidence in navigating challenges and seizing opportunities. The company's long-term perspective, guided by its founder's philosophy, emphasizes resilience during difficult times. Strategic initiatives, such as the recent share buyback program, demonstrate confidence in the company's value.

SMIC aligns its objectives with government priorities. This alignment helps in navigating regulatory landscapes and fostering a supportive business environment. It also promotes sustainable growth and contributes to the overall economic development of the Philippines.

To better understand the competitive landscape and strategic positioning, it's beneficial to look at the Competitors Landscape of SM Investments. This analysis provides insights into how SMIC stacks up against its rivals and the strategies it can employ to maintain its competitive edge.

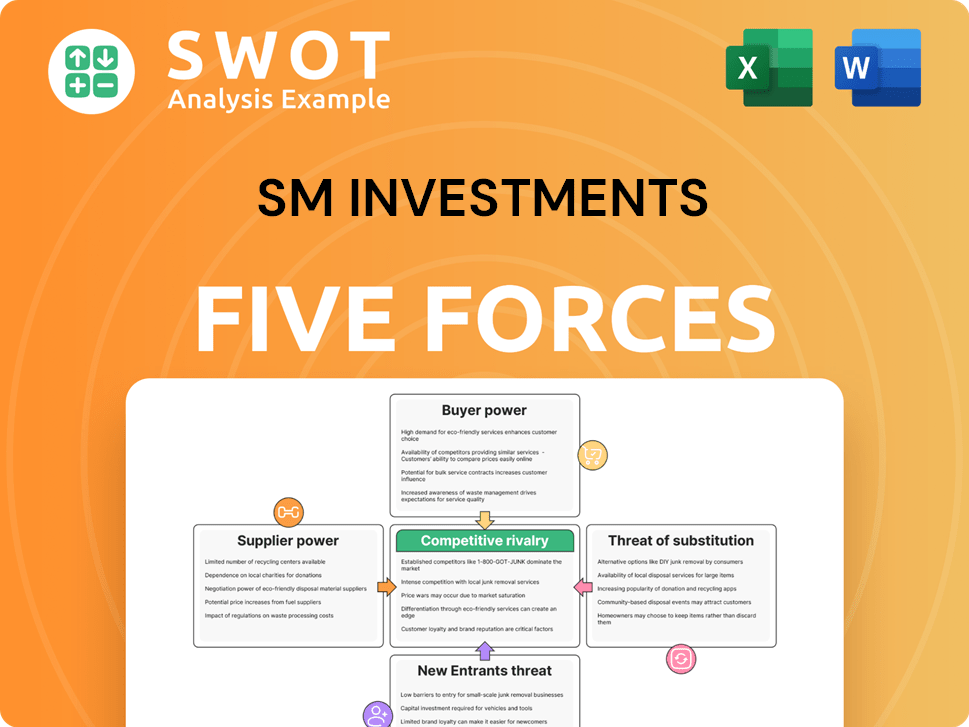

SM Investments Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SM Investments Company?

- What is Competitive Landscape of SM Investments Company?

- How Does SM Investments Company Work?

- What is Sales and Marketing Strategy of SM Investments Company?

- What is Brief History of SM Investments Company?

- Who Owns SM Investments Company?

- What is Customer Demographics and Target Market of SM Investments Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.