SM Investments Bundle

Decoding SM Investments Company: Who Are Their Customers?

Understanding the intricate web of customer demographics and target markets is paramount for any business, especially a behemoth like SM Investments Company (SMIC). Their strategic moves, like expanding beyond Metro Manila, highlight the importance of knowing their customer base. This deep dive explores how SMIC has adapted its strategies to cater to a diverse and evolving consumer landscape across the Philippines.

From humble beginnings as a shoe store, SMIC has become a diversified conglomerate, making a thorough SM Investments SWOT Analysis critical for understanding its trajectory. This evolution necessitates a detailed examination of SM Investments Company's customer segmentation, market analysis, and consumer profile. Analyzing the company's business strategy and its ability to adapt to changing consumer preferences across various income levels and geographic locations is key to understanding its success. This exploration provides crucial insights for investors and strategists, offering a glimpse into SMIC's resilience and future growth.

Who Are SM Investments’s Main Customers?

Understanding the customer demographics and target market of SM Investments Company (SMIC) is crucial for grasping its business strategy. SMIC's diverse operations across retail, banking, and property development mean it caters to a broad spectrum of consumers and businesses. This multifaceted approach allows SMIC to capture a significant share of the Philippine market.

The company's primary customer segments are segmented by its business divisions. In retail, SMIC focuses on consumers (B2C), serving various demographics through its supermarkets, department stores, and specialty retail outlets. The banking arm, BDO Unibank and China Banking Corporation, serves both consumers and businesses, offering services from basic savings to complex financial instruments. SM Prime Holdings, the property arm, targets both B2C customers for residential properties and B2B clients for office spaces and commercial leases.

The success of SMIC hinges on its ability to understand and adapt to evolving consumer preferences and economic trends. The company's strategic focus on integrated lifestyle hubs and services catering to overseas Filipino workers demonstrates its commitment to meeting the changing needs of its target market. This adaptability is key to maintaining its market position and driving future growth.

SMIC's retail operations target a wide range of consumers. These include mass-market consumers who frequent SM Supermarkets and Hypermarkets for daily needs, value-conscious shoppers at SM Department Stores, and more affluent individuals seeking premium brands. The target age group spans various demographics, from young professionals and families to retirees. SM City malls are designed as lifestyle destinations, appealing to a broad demographic.

BDO Unibank and China Banking Corporation serve both consumers and businesses. Individual banking customers range from those seeking basic savings accounts to high-net-worth individuals. Business customers include SMEs needing commercial loans and treasury services, as well as large corporations requiring complex financial instruments. The banking sector also focuses on services for overseas Filipino workers.

SM Prime Holdings targets both B2C and B2B clients. Residential condominiums (SMDC) cater to consumers, while office spaces and commercial leases within malls are aimed at businesses. This dual approach allows SMIC to diversify its revenue streams and cater to different market segments.

SMIC operates extensively across the Philippines, with a growing presence in key urban and regional areas. Its market share varies across its business segments, with retail and banking holding significant positions. The company's expansion strategy includes both organic growth and strategic acquisitions to increase its market share. The company is also exploring international expansion.

SMIC's market analysis involves understanding consumer preferences, shopping habits, and income levels. The company conducts market research to tailor its offerings and marketing strategies. This includes customer loyalty programs and promotions to retain and attract customers.

- Consumer Preferences: SMIC monitors consumer preferences to adapt its product offerings and services.

- Shopping Habits: Analyzing shopping habits helps SMIC optimize store layouts and marketing campaigns.

- Income Levels: Understanding the income levels of its customers allows SMIC to target the right products and services.

- Competitive Landscape: SMIC continuously assesses its competitive landscape to maintain its market position.

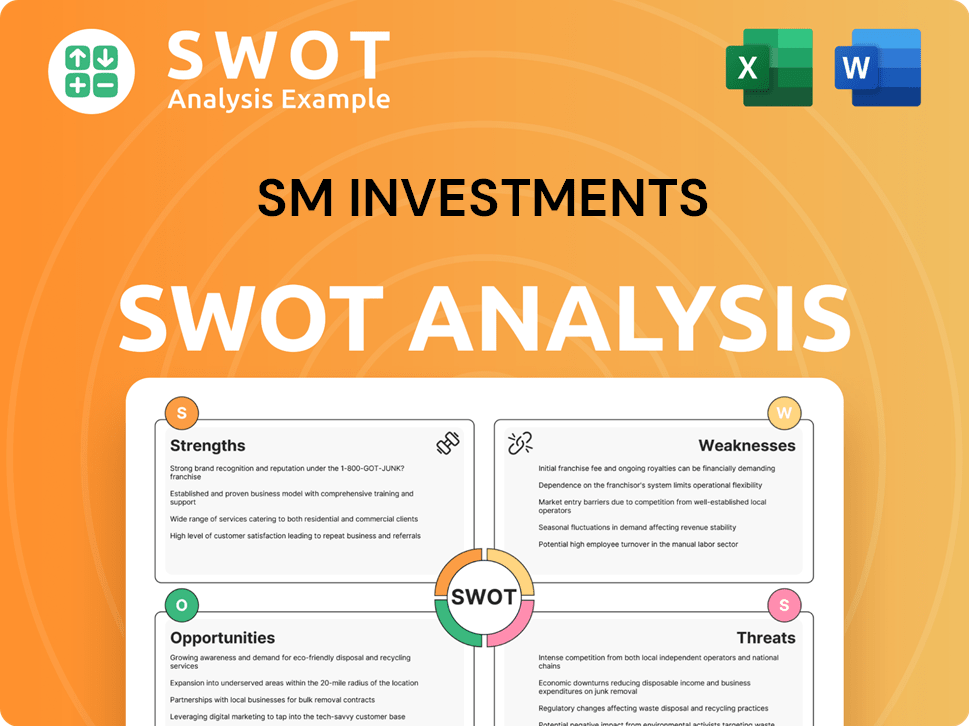

SM Investments SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do SM Investments’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of SM Investments Company. The company's diverse business segments, including retail, banking, and property, cater to a wide range of customer needs. This approach allows SMIC to capture a broad market and maintain a strong presence in the Philippine economy.

The company's ability to adapt to changing consumer behaviors is a key factor in its sustained growth. Through market analysis and continuous feedback, SMIC refines its offerings to meet the evolving demands of its customer base. This customer-centric approach ensures that SMIC remains competitive and relevant in the market.

The target market for SM Investments Company is broad, encompassing various demographics and income levels. The company's strategy focuses on providing value, convenience, and a diverse range of products and services. This approach allows SMIC to cater to different segments of the population and maintain a strong market position.

Customers in retail prioritize affordability, convenience, and variety. SM Supermarkets and Department Stores offer accessible daily essentials and general merchandise. Value for money and promotional offers drive purchasing decisions.

Banking customers prioritize security, accessibility, and efficient service. BDO Unibank and China Banking Corporation cater to savings, remittances, and credit needs. Interest rates and transaction fees influence decision-making.

Customers in property seek lifestyle, location, and investment potential. Residential buyers want modern living spaces and amenities. Businesses prioritize foot traffic and brand visibility.

Loyalty programs like the SM Advantage Card foster repeat purchases in retail. Digital banking platforms and ATM networks enhance customer convenience in banking. Integrated complexes offer comprehensive lifestyle solutions in property.

Increasing demand for sustainable living and digital integration influences product development. Eco-friendly mall designs and online banking features are examples of adaptation. SM Supermalls are integrating digital wayfinding and online ordering.

SM Investments Company operates extensively throughout the Philippines. The company's customer base is primarily located within the country. SMIC's presence is concentrated in major urban centers and key provinces.

SM Investments Company's customer base is diverse, with segments defined by income, age, and lifestyle. Brief History of SM Investments provides context on the company's evolution and market positioning.

- Retail: Focuses on value-conscious consumers, families, and those seeking convenience.

- Banking: Targets individuals and businesses needing financial services, including savings, loans, and investments.

- Property: Caters to residents, businesses, and investors looking for modern living spaces and commercial properties.

- Consumer Preferences: Customers value convenience, affordability, and a wide selection of products and services.

- Marketing Strategies: Tailored to each segment, including promotional offers, loyalty programs, and digital platforms.

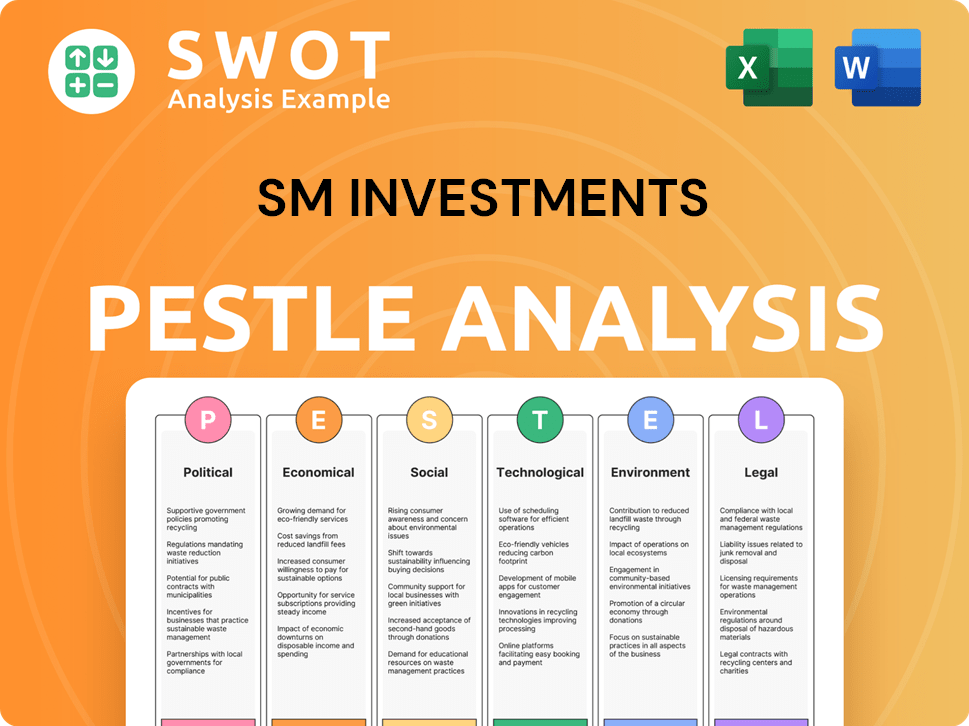

SM Investments PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does SM Investments operate?

SM Investments Corporation (SMIC) primarily focuses its geographical market presence within the Philippines. The company has established a strong presence across key cities and provinces. This strategic focus allows SMIC to leverage its brand recognition and market share effectively.

Its major markets are concentrated in Metro Manila and other highly urbanized areas. SM Prime Holdings, a key subsidiary, operated 85 malls in the Philippines as of early 2024. These malls have a gross leasable area of 9.9 million square meters. This extensive network underscores SMIC's dominant position in the domestic market.

SMIC also has a limited international presence. This is primarily through SM Prime, which operates 7 malls in China. This international venture allows the company to diversify its revenue streams. It also allows SMIC to tap into the vast Chinese consumer market.

SMIC's primary focus is the Philippines. The company has a strong presence in Metro Manila and other urban areas. This focus allows SMIC to cater to diverse customer demographics and preferences.

SMIC strategically expands into provincial growth centers. These include Cebu, Davao, and Pampanga. This expansion recognizes the increasing purchasing power in these regions. It also allows SMIC to broaden its target market.

SMIC has a limited international presence in China. This is through SM Prime's mall operations. This diversification helps to tap into the Chinese consumer market. It also provides additional revenue streams.

SMIC tailors its offerings to regional preferences. This includes adapting retail assortments and mall layouts. They also implement marketing campaigns that resonate with local values. This approach ensures success in diverse markets.

The company's approach to market expansion involves maximizing penetration in underserved provincial areas. SMIC's balanced approach to market expansion is evident in the geographic distribution of sales and growth. This shows strong performance in both established urban centers and rapidly developing provincial hubs. To understand the consumer profile and market analysis of SM Investments Company, it's essential to examine its geographic presence and how it adapts its business strategy to local conditions. For a deeper dive into SM Investments' strategies, you can refer to this article about SM Investments.

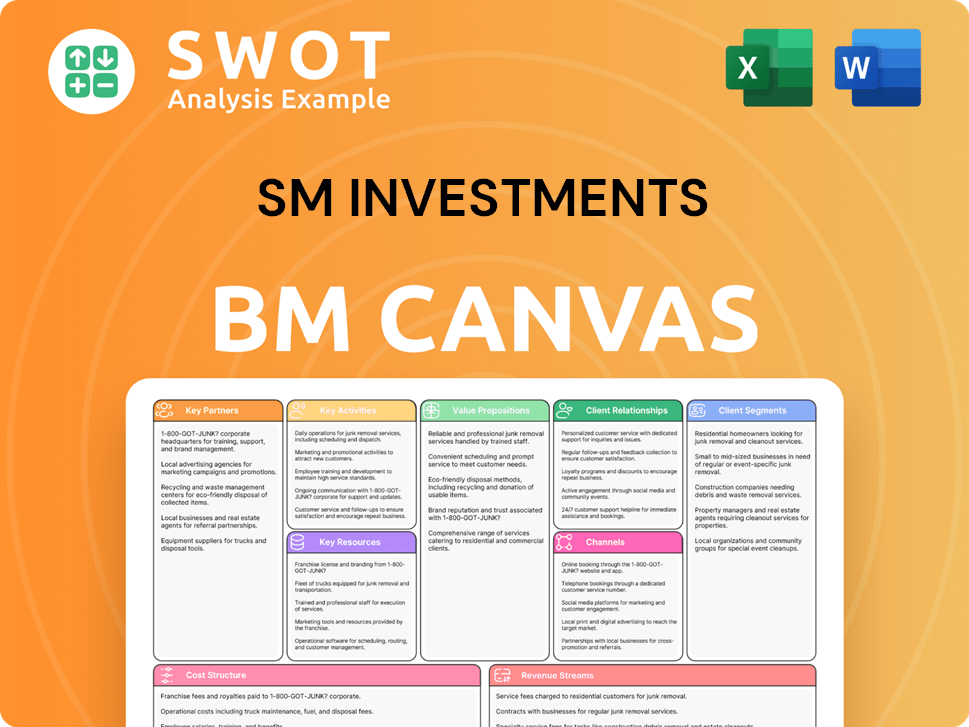

SM Investments Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does SM Investments Win & Keep Customers?

SM Investments Corporation (SMIC) strategically cultivates customer relationships through comprehensive acquisition and retention strategies. These strategies are designed to leverage its diverse business portfolio, encompassing retail, banking, and property, to create a cohesive and engaging customer journey. The company's approach focuses on attracting new customers while simultaneously fostering loyalty among existing ones, driving long-term growth and market dominance. This dual focus is crucial for sustaining a competitive edge in the dynamic Philippine market.

The company employs a multi-faceted approach to customer acquisition, utilizing both traditional and digital marketing channels. Traditional advertising, including television, radio, and print, remains relevant, especially for mass-market services. However, SMIC is increasingly investing in digital marketing, such as social media campaigns, search engine optimization (SEO), and online advertisements, to reach a broader and younger demographic. Sales promotions and bundled offerings are also common, particularly in retail and property, to attract new customers. This integrated approach ensures a wide reach across various consumer segments.

Customer retention at SMIC is heavily reliant on loyalty programs and personalized experiences. The SM Advantage Card, a cornerstone of its retail loyalty program, rewards frequent shoppers with points, discounts, and exclusive offers, encouraging repeat visits. Banking services also offer loyalty initiatives and personalized financial advisory services. After-sales support, particularly in property development, plays a crucial role in maintaining customer satisfaction and retention. These efforts are designed to build lasting relationships and increase customer lifetime value.

SMIC utilizes a blend of traditional and digital marketing. Traditional methods like TV, radio, and print advertising are still used, but digital channels are gaining prominence. Social media, SEO, and online ads are key components of their strategy to reach a wider audience. Influencer marketing is also increasingly utilized to promote new products, mall events, and banking services.

The SM Advantage Card is a central element of SMIC's retail loyalty program, offering rewards to frequent shoppers. BDO Unibank and China Banking Corporation provide loyalty initiatives and personalized financial advisory services. After-sales service in property development is also critical for customer satisfaction. These efforts enhance customer retention and foster long-term relationships.

SMIC leverages customer data from loyalty programs, online transactions, and banking activities. This data enables customer segmentation and targeted marketing. For example, data analytics helps determine the most effective retail promotions for specific mall locations or the most relevant banking products for different income brackets. This approach enhances marketing effectiveness.

Successful acquisition campaigns often involve cross-promotions between SM's various businesses. Examples include collaborations between mall tenants and BDO banking services. Innovative retention strategies include exclusive previews for loyalty cardholders and community-building events within SMDC properties. These integrated efforts enhance customer engagement and drive sales.

SMIC's approach is increasingly data-driven and digitally integrated, enhancing customer loyalty through convenience and personalization. This strategy aims to increase customer lifetime value and reduce churn rates. For example, the company's investment in data analytics allows it to tailor marketing messages, as demonstrated by the use of the SM Advantage Card, which has over 10 million members as of 2023, driving repeat purchases and customer loyalty. The company is also actively expanding its digital banking services, with BDO Unibank reporting over 6 million digital banking users in 2024, highlighting the shift towards digital engagement. Furthermore, SM Prime Holdings, the property arm, focuses on creating community-building events within its residential developments, which contribute to higher resident satisfaction and retention rates. For more insights into the company's ownership structure, you can refer to the article Owners & Shareholders of SM Investments.

Traditional advertising across TV, radio, and print media remains relevant for mass-market reach. Digital marketing, including social media campaigns and SEO, targets a wider, younger demographic. Sales promotions, seasonal sales, and bundled offerings are common to attract customers in retail and property segments.

The SM Advantage Card rewards frequent shoppers, encouraging repeat purchases. Banking services offer loyalty programs and personalized financial advisory services. Responsive customer support and property management services are essential in property development.

SMIC uses customer data from loyalty programs and transactions to segment its customer base. This allows tailored marketing messages and product recommendations. Data analytics helps determine effective retail promotions and relevant banking products.

Cross-promotions between mall tenants and BDO banking services are common. Exclusive previews for loyalty cardholders and community-building events enhance customer engagement. These integrated efforts improve customer experience and drive sales.

SMIC is moving towards a more data-driven and digitally integrated strategy. This enhances customer loyalty by improving convenience and personalization. This results in higher customer lifetime value and lower churn rates.

The company focuses on understanding its customer demographics and preferences. This customer-centric approach allows SMIC to tailor its products, services, and marketing efforts. The goal is to meet customer needs and expectations effectively.

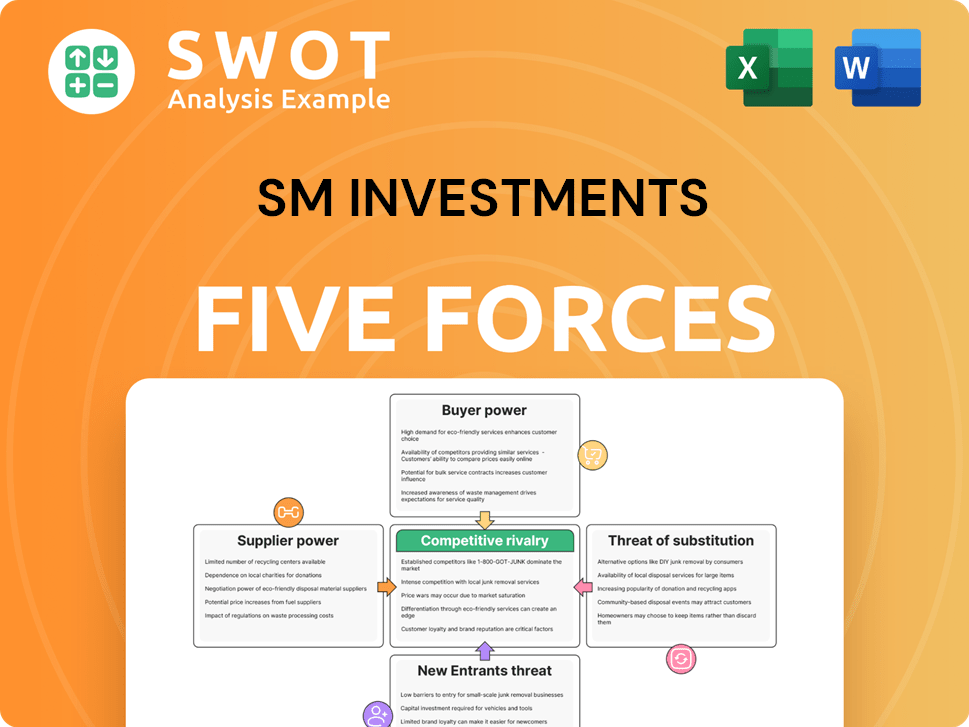

SM Investments Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SM Investments Company?

- What is Competitive Landscape of SM Investments Company?

- What is Growth Strategy and Future Prospects of SM Investments Company?

- How Does SM Investments Company Work?

- What is Sales and Marketing Strategy of SM Investments Company?

- What is Brief History of SM Investments Company?

- Who Owns SM Investments Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.