Synopsys Bundle

How Does Synopsys Dominate the EDA Arena?

Synopsys, a titan in electronic design automation (EDA), is at the forefront of technological innovation, powering the chips and software that define our modern world. With a remarkable 15% year-over-year revenue increase, reaching $6.127 billion in 2024, and a strategic acquisition of Ansys on the horizon, Synopsys is poised for even greater expansion. This strategic move will broaden its product portfolio and open new markets in system-level design.

Understanding the Synopsys SWOT Analysis is crucial to grasp its position in the EDA market. This deep dive into the Synopsys competitive landscape will uncover its primary rivals and assess its market share. We'll explore Synopsys competitors, providing a comprehensive Synopsys competitor analysis report, and examine the company's financial performance compared to competitors. This analysis will reveal Synopsys' key rivals and competitive advantages within the dynamic electronic design automation industry.

Where Does Synopsys’ Stand in the Current Market?

The company holds a dominant market position within the electronic design automation (EDA) industry. The company's core operations revolve around providing software, intellectual property (IP), and services for designing and verifying integrated circuits (ICs) and electronic systems. Its value proposition lies in enabling innovation in the semiconductor and electronics industries by offering tools that enhance design efficiency, reduce time-to-market, and improve product performance.

The company’s products and services are crucial for creating advanced technologies across various sectors. These include automotive, healthcare, aerospace and defense, telecom and data center, and consumer electronics. The company's solutions help customers manage the increasing complexity of modern electronic designs, supporting the development of cutting-edge products.

The company is a clear leader in the EDA market. In 2024, along with Cadence, the company controlled over two-thirds of the EDA market. The company's market share is estimated at 38% according to some reports, while others show it at 31%.

The company operates through two main segments: Design Automation and Design IP. Design Automation generated $4.221 billion in revenue in fiscal year 2024, representing 68.9% of total revenue. Design IP contributed $1.906 billion, or 31.1% of the total.

The United States was the largest revenue contributor, accounting for 44.71% ($2.74 billion) of total revenue in fiscal year 2024. China contributed approximately $989.5 million, or 16% of total revenue. South Korea and Europe are also significant markets.

The company reported record full-year 2024 revenue of $6.127 billion, a 15% year-over-year increase. For the second quarter of fiscal year 2025, revenue reached $1.604 billion. The company's non-GAAP diluted EPS for fiscal year 2024 was $13.20, up 25% year-over-year.

The company's strong market position is supported by its financial health and the growth of the EDA market. The global EDA market was valued at approximately $15.12 billion in 2024 and is projected to reach $16.65 billion in 2025, with a compound annual growth rate (CAGR) of 10.1%. This growth is driven by the increasing demand for complex ICs and the miniaturization of electronic devices. For more insights into the company's financial structure, you can read about Owners & Shareholders of Synopsys.

- The company's Design Automation segment includes advanced silicon design tools and verification products.

- The Design IP segment encompasses embedded processors, interface IP, and security solutions.

- The company's customer base includes automotive, healthcare, and consumer electronics industries.

- The company anticipates a year-over-year decline in China revenue for fiscal year 2025 due to U.S. export controls.

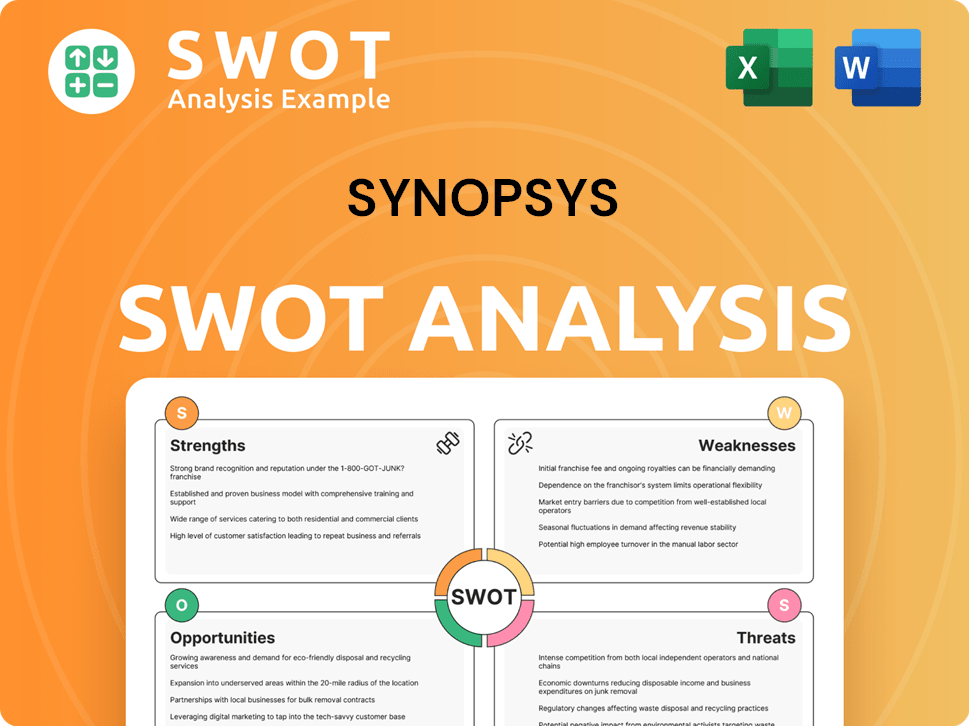

Synopsys SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Synopsys?

The electronic design automation (EDA) market is highly concentrated, and the Synopsys competitive landscape is dominated by a few key players. This intense competition drives continuous innovation, particularly in areas like AI integration and solutions for advanced process nodes. Understanding the Synopsys competitors and their strategies is crucial for assessing the company's market position and future prospects.

Synopsys market share is a key indicator of its success in the EDA sector. The company faces both direct and indirect competition, with the landscape constantly evolving due to mergers, acquisitions, and the emergence of new technologies. The competitive dynamics are further influenced by global economic factors and geopolitical events, such as U.S. export controls impacting sales in China.

Synopsys industry analysis reveals a competitive environment where market share is highly concentrated. The primary competitors are Cadence Design Systems and Siemens EDA (formerly Mentor Graphics). These three companies collectively control over 90% of the EDA market. The article Growth Strategy of Synopsys provides additional insights into the company's overall business approach.

Cadence is a major rival, offering electronic system design and computational software solutions. The competition is intense, especially in AI integration and advanced process node solutions. Both companies are impacted by U.S. export controls on China.

Siemens EDA holds a significant share of the EDA market, particularly in the Chinese market. It provides a comprehensive suite of design automation tools and services. The company's focus on specific market segments makes it a strong competitor.

Ansys is a leader in engineering simulation. Synopsys is in the process of acquiring Ansys, expected to close in the first half of 2025. This acquisition aims to expand Synopsys' capabilities in multiphysics simulation and strengthen its AI-driven design ecosystem.

Indirect competition comes from new and emerging players disrupting the traditional competitive landscape, as well as from customers' own internal design tools and capabilities. Smaller companies like Rambus, PDF Solutions, and Ceva are also present in the broader technology and software sectors.

Mergers and alliances, like Synopsys' acquisition of Ansys, significantly impact competitive dynamics. These actions consolidate market share and expand product offerings. The EDA market is subject to rapid technological advancements and changing customer needs.

The U.S. export controls on China have a notable impact. Synopsys reported nearly $1 billion in China sales in fiscal year 2024 (16% of total revenue), and Cadence reported $550 million (12% of total revenue) from China in the same period. These figures highlight the importance of the Chinese market.

The Synopsys competitive landscape is shaped by several key factors. These include product offerings, technological innovation, market share, and regional presence. Understanding these factors is essential for a comprehensive Synopsys competitor analysis report.

- Product Portfolio: The breadth and depth of EDA tools and solutions offered.

- Technological Innovation: The ability to integrate AI and develop solutions for advanced process nodes.

- Market Share: The percentage of the EDA market controlled by each company.

- Regional Presence: The strength of sales and operations in key markets like China.

- Mergers and Acquisitions: Strategic moves to expand product offerings and market reach.

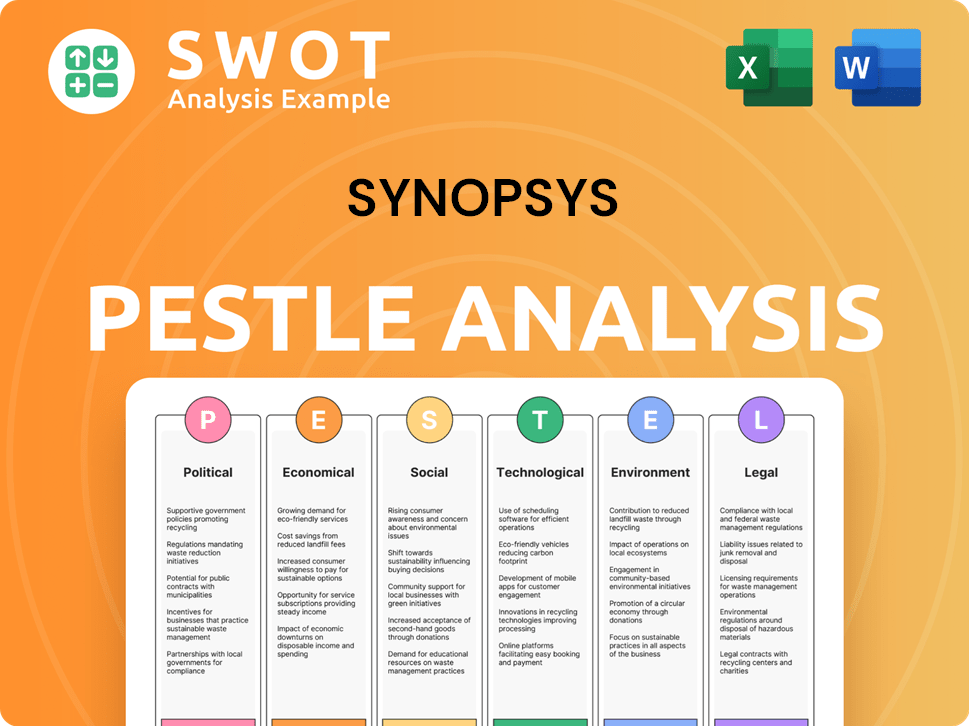

Synopsys PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Synopsys a Competitive Edge Over Its Rivals?

Understanding the Growth Strategy of Synopsys involves recognizing its robust competitive advantages. These advantages are rooted in its proprietary technologies, extensive intellectual property (IP) portfolio, and strong customer loyalty. These factors have allowed the company to maintain a significant market position within the Electronic Design Automation (EDA) market.

The company's success is also driven by its commitment to research and development, which is crucial in an industry that demands continuous innovation. This commitment is backed by a strong financial foundation, allowing for strategic acquisitions and investments. As of October 2024, the company held approximately $3.9 billion in cash, enabling it to further strengthen its competitive edge.

The competitive landscape for Synopsys is shaped by its ability to integrate its products deeply into client workflows. This integration creates high switching costs, resulting in near 100% customer retention rates. Its EDA tools are critical for chip development, where reliability, speed, and precision are paramount.

Synopsys' core strength lies in its proprietary technologies and a vast IP portfolio. This includes a comprehensive suite of tools covering the entire design flow, from front-end design to verification. The IP segment, representing around 30% of its revenue in fiscal year 2023, is a significant and growing part of its business. This extensive IP portfolio provides chip designers with essential building blocks, solidifying its competitive advantage in the EDA market.

A key advantage is Synopsys' leadership in AI-driven design tools and hardware-assisted verification solutions. The Synopsys.ai suite enhances engineering productivity and improves silicon quality. Generative formal verification capabilities have shown over 30% average productivity improvements for designers. This focus on AI is crucial for the semiconductor industry, enabling more efficient design and verification of complex chips.

Synopsys benefits from strong customer loyalty, largely due to the high switching costs associated with its deeply integrated products. The company's products are essential for chip development, making it difficult for customers to switch to competitors. This stickiness ensures near 100% retention rates, a testament to the critical role its EDA tools play in the industry.

Synopsys' strong financial foundation, characterized by robust gross profit margins and a healthy cash position, provides the resources for significant investment in innovation and strategic acquisitions. This substantial R&D budget is vital in an industry where continuous innovation is crucial. This financial strength allows Synopsys to maintain its competitive edge and adapt to industry changes effectively.

The company's competitive advantages are built upon a foundation of proprietary technology, a vast IP portfolio, and strong customer relationships. These advantages are sustained by high switching costs, the specialized nature of EDA software, and continuous investment in advanced technologies like AI.

- Proprietary Technologies and IP: Extensive portfolio of EDA tools and IP solutions.

- AI-Driven Design Tools: Leadership in AI-driven design and hardware-assisted verification.

- Customer Loyalty: High retention rates due to deep integration and high switching costs.

- Financial Strength: Robust financial position enabling investment in innovation and acquisitions.

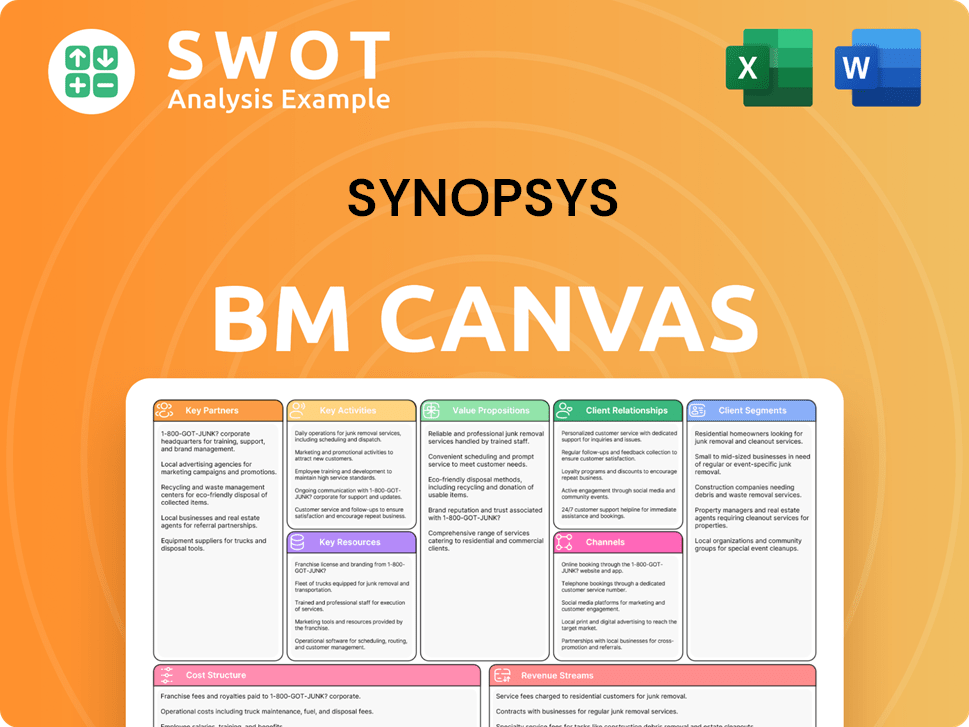

Synopsys Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Synopsys’s Competitive Landscape?

The competitive landscape for Synopsys is significantly shaped by industry trends, future challenges, and emerging opportunities within the electronic design automation (EDA) market. The company's position is influenced by its ability to navigate dynamic shifts in technology, geopolitical factors, and evolving customer needs. Understanding these elements is crucial for assessing Synopsys's long-term viability and strategic direction.

Synopsys faces both risks and opportunities as the EDA market evolves. The company's financial performance is closely tied to the semiconductor and electronics manufacturing sectors. This means Synopsys is susceptible to demand volatility and supply-demand gaps. However, strategic acquisitions and a focus on innovation offer avenues for growth and market expansion.

The EDA industry is experiencing growth driven by the increasing demand for complex integrated circuits. Key drivers include AI, high-performance computing, IoT devices, and 5G technology, all of which require sophisticated EDA tools. The global EDA market is projected to reach $16.65 billion in 2025 and grow to $22.73 billion by 2029, with a CAGR of 8.1%.

Geopolitical tensions, particularly U.S. export controls on EDA software sales to China, pose a significant challenge. China accounted for approximately 16% of Synopsys' total revenue in fiscal year 2024 ($989.5 million). Sluggish recovery in key markets also impacts Synopsys' customer base.

The pervasive intelligence era, driven by AI, is accelerating technology innovation, expanding Synopsys' customer base. The company's AI-driven EDA solutions are crucial for the semiconductor industry. The growth of IoT and connected devices also drives demand for EDA tools.

Synopsys is focusing on strategic partnerships and workforce development initiatives to support long-term growth. Continued investment in AI and system design innovation, operational excellence, and proactive risk management are key strategies. A deeper understanding of the Target Market of Synopsys can provide more insights.

Several factors are critical in shaping Synopsys' competitive position and future prospects. These include the rapid advancements in AI and its integration into EDA tools, the impact of geopolitical regulations on market access, and the company's ability to adapt to evolving customer demands. These elements will significantly impact Synopsys' market share and overall performance.

- AI Integration: Synopsys' success depends on its ability to leverage AI to enhance its EDA solutions, driving innovation.

- Geopolitical Risks: Export controls and trade regulations pose challenges, particularly in key markets like China.

- Market Dynamics: Demand volatility in the semiconductor and electronics sectors influences Synopsys' financial performance.

- Strategic Acquisitions: The acquisition of Ansys expands capabilities and opens new market opportunities.

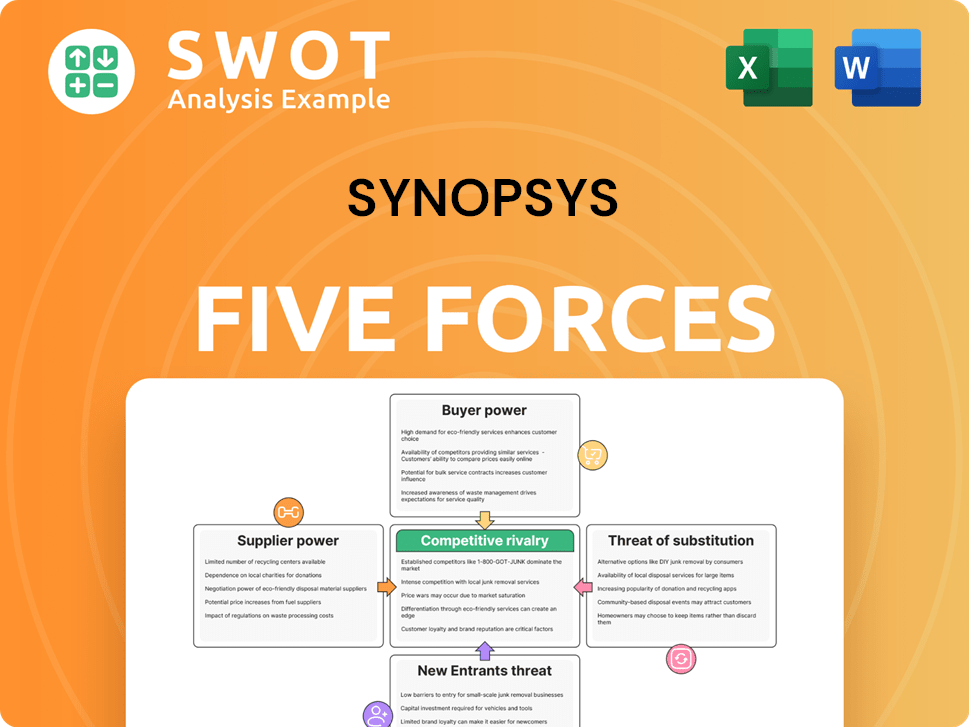

Synopsys Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Synopsys Company?

- What is Growth Strategy and Future Prospects of Synopsys Company?

- How Does Synopsys Company Work?

- What is Sales and Marketing Strategy of Synopsys Company?

- What is Brief History of Synopsys Company?

- Who Owns Synopsys Company?

- What is Customer Demographics and Target Market of Synopsys Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.