Synopsys Bundle

How Does the Synopsys Company Power Our Tech Future?

Synopsys, a global leader in electronic design automation (EDA) and semiconductor IP, is the hidden engine driving the technology we rely on every day. With record-breaking financial results, including $6.127 billion in revenue for fiscal year 2024, the Synopsys SWOT Analysis reveals the company's strategic prowess. Its solutions are fundamental to designing and testing the integrated circuits (ICs) and software that shape modern life.

From high-performance computing to automotive innovations, understanding how Synopsys works is key to grasping the future of tech. This deep dive explores its critical role in the semiconductor design landscape. We'll uncover how this EDA software giant generates revenue, its strategic moves, and its enduring value in a rapidly evolving technological world.

What Are the Key Operations Driving Synopsys’s Success?

The core operations of the Synopsys company revolve around providing essential software, intellectual property (IP), and services that facilitate the design and verification of complex integrated circuits and electronic systems. This Synopsys company primarily serves the semiconductor and electronics industries, offering solutions to fabless semiconductor companies, integrated device manufacturers (IDMs), and system companies. Their offerings are categorized into two main business segments: Design Automation and Design IP.

The company's value proposition lies in enabling its customers to innovate and compete in the rapidly evolving semiconductor and electronics markets. By providing advanced tools and IP, Synopsys helps customers reduce design time, mitigate risks, and achieve faster time-to-market for their products. Their comprehensive suite of solutions is deeply integrated into customer workflows, making them indispensable for modern chip design processes. This focus on innovation and customer success is reflected in their financial performance and market position.

The company's effectiveness stems from its comprehensive, end-to-end suite of solutions that are deeply integrated into customer workflows, making them indispensable. This translates into customer benefits such as increased productivity, faster time-to-market, and reduced design errors. To understand more about the specific market the company serves, you can read about the Target Market of Synopsys.

The Design Automation segment is a key part of How Synopsys works, generating a significant portion of the company's revenue. This segment includes advanced silicon design tools, verification products, and related services. These tools are essential for the complex process of chip design, from initial conceptualization to final manufacturing preparation.

The Design IP segment provides pre-designed and pre-verified intellectual property, which customers integrate into their chip designs. This segment significantly reduces design time and risk for customers. This segment contributed $1.906 billion to annual revenue in fiscal year 2024, accounting for 31.1% of the total.

In fiscal year 2024, the Design Automation segment generated $4.221 billion in revenue, representing 68.9% of the company's total revenue. The company's financial success is driven by its ability to provide indispensable tools and IP in the semiconductor industry.

Synopsys invests heavily in research and development (R&D) to stay at the forefront of innovation. These investments are critical for maintaining their competitive edge in a rapidly evolving industry. This commitment to innovation ensures that the company continues to provide cutting-edge solutions.

Customers benefit from increased productivity, faster time-to-market, and reduced design errors. The company's tools streamline the complex process of chip design, from initial conceptualization to final manufacturing preparation. The company's solutions are deeply integrated into customer workflows, making them indispensable.

- Increased productivity through automated design processes.

- Faster time-to-market for new products.

- Reduced design errors and improved product quality.

- Comprehensive, end-to-end solutions for chip design and verification.

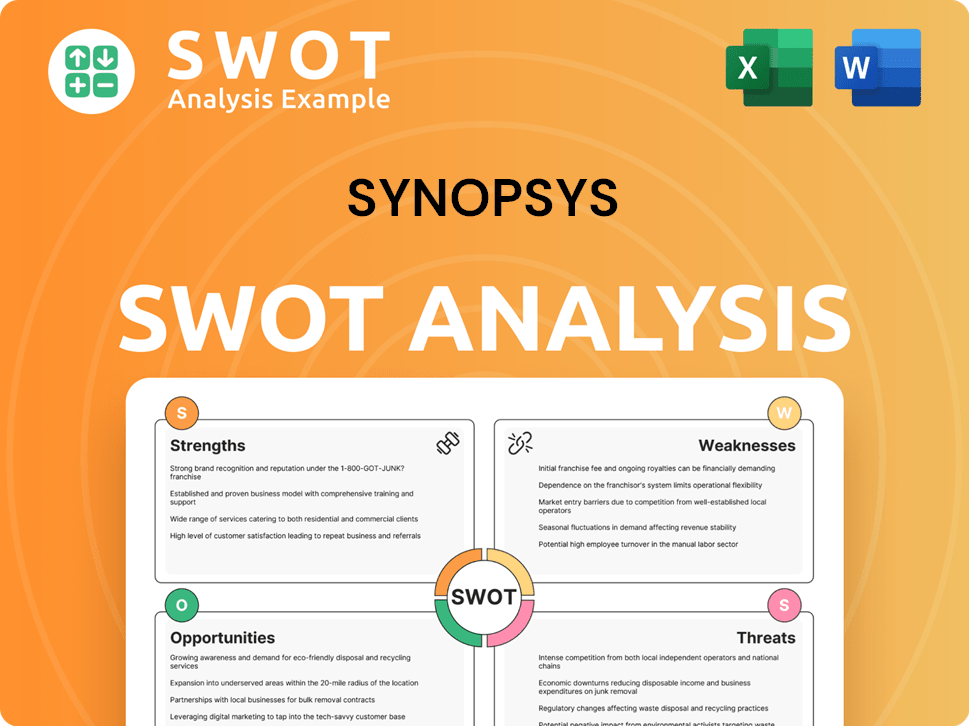

Synopsys SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Synopsys Make Money?

The core of how the Synopsys company operates revolves around its revenue streams and monetization strategies. The company primarily generates income through product licenses and maintenance services, catering to a global customer base. This approach allows Synopsys to maintain a steady and diverse financial foundation.

In fiscal year 2024, the total revenue of Synopsys reached $6.127 billion, marking a 15% year-over-year increase. This growth underscores the company's strong market position and effective strategies. Understanding these revenue streams is crucial to grasping the financial health and operational dynamics of Synopsys.

The major revenue streams for Synopsys are divided into two main segments: Design Automation (EDA) and Design IP. These segments are crucial for Synopsys's financial performance and market presence. The company's ability to maintain and expand these revenue streams is essential for its future growth.

The two primary revenue streams for Synopsys are Design Automation (EDA) and Design IP. EDA is the largest segment, accounting for the majority of the company's revenue. This segment includes a range of products and services that support the design and verification of integrated circuits.

- Design Automation (EDA): This segment is the largest contributor, generating $4.221 billion in fiscal year 2024, representing 68.9% of total revenue. This includes revenue from digital and custom integrated circuit (IC) design software, verification hardware and software products, manufacturing-related design products, FPGA design software, AI-driven EDA solutions, and professional services.

- Design IP: This segment contributed $1.906 billion to annual revenue in fiscal year 2024, accounting for 31.1% of the total. Revenue here comes from interface, foundation, security, and embedded processor IP, as well as IP subsystems and IP implementation services.

In fiscal year 2024, the revenue breakdown by product and service categories included: License ($1.80 billion), License and Maintenance ($3.22 billion), and Technology Service ($1.10 billion). License and Maintenance was the largest segment, representing 52.62% of total revenue. Synopsys's monetization strategies incorporate subscription-based models for its software and licensing agreements for its IP, creating a recurring revenue base. The company also uses bundled services and tiered pricing to meet various customer needs and project complexities. Geographically, the United States was the largest revenue contributor at $2.74 billion (44.71%) in fiscal year 2024. The company anticipates continued double-digit revenue growth in fiscal year 2025, projecting revenue to range between $6.745 billion and $6.805 billion. For more details on Synopsys's operations, you can read about how Synopsys works.

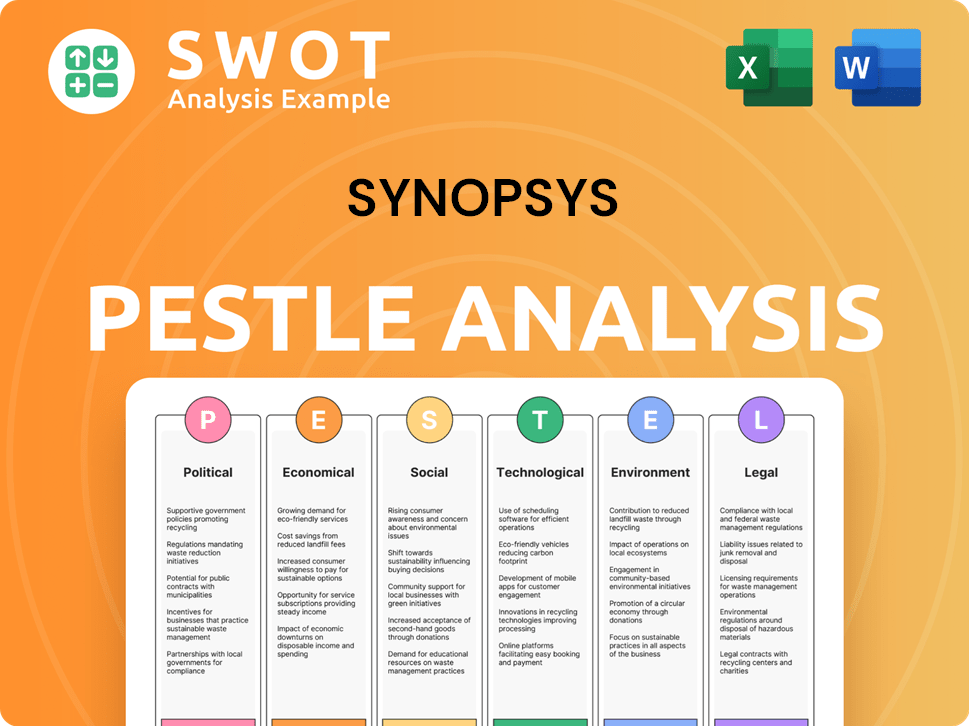

Synopsys PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Synopsys’s Business Model?

Synopsys company has achieved significant milestones and made strategic moves to solidify its market leadership in the electronic design automation (EDA) sector. A key strategic move is the pending acquisition of Ansys, a leader in simulation and analysis, with the transaction expected to close in the first half of 2025. This $35 billion merger aims to expand Synopsys' total addressable market (TAM) to approximately $70 billion by 2030. This integration will provide customers with a comprehensive 'silicon to systems' design solution by integrating electronics and physics, augmented by AI.

Another pivotal strategic decision was the sale of its Software Integrity business, completed in September 2024. This move allowed Synopsys to sharpen its focus on its core design automation and IP businesses. These strategic shifts highlight the company's commitment to adapting to the evolving needs of the semiconductor industry and its focus on providing comprehensive solutions.

The company faces operational and market challenges, including macroeconomic uncertainties and geopolitical risks, particularly in China, where US restrictions and a weak economic environment have impacted sales growth. Despite these headwinds, Synopsys continues to innovate, with a strong focus on AI-driven design tools and hardware-assisted verification solutions. For instance, its Synopsys.ai generative formal verification capability has shown over 30% average productivity improvements for designers.

Completion of the sale of the Software Integrity business in September 2024, allowing a sharper focus on core EDA and IP businesses. The pending acquisition of Ansys, expected to close in the first half of 2025, is a major strategic move. Continuous investment in AI-driven innovation and strategic acquisitions to address the increasing complexity in semiconductor and system design.

The pending acquisition of Ansys, a $35 billion deal, aims to expand the total addressable market (TAM) to approximately $70 billion by 2030. Focus on AI-driven design tools and hardware-assisted verification solutions. Strategic decisions such as the sale of the Software Integrity business to concentrate on core design automation.

Strong brand strength and technological leadership in EDA software. A comprehensive suite of tools from front-end design to verification deeply integrated into client workflows. Substantial R&D investments and end-to-end solutions reinforce its competitive edge against rivals like Cadence and Siemens.

Macroeconomic uncertainties and geopolitical risks, particularly in China, impact sales growth. The need to continuously innovate and adapt to the rapid changes in the semiconductor industry. Maintaining market leadership in a highly competitive environment with companies like Cadence.

Synopsys' competitive advantages include its strong brand strength and technological leadership in EDA software. The company provides a comprehensive suite of tools from front-end design to verification that are deeply integrated into client workflows, creating high switching costs and significant barriers to entry. The company's substantial R&D investments and its ability to provide an end-to-end set of solutions further reinforce its competitive edge against rivals.

- Strong brand and technological leadership.

- Comprehensive suite of tools.

- High switching costs for customers.

- Substantial R&D investments.

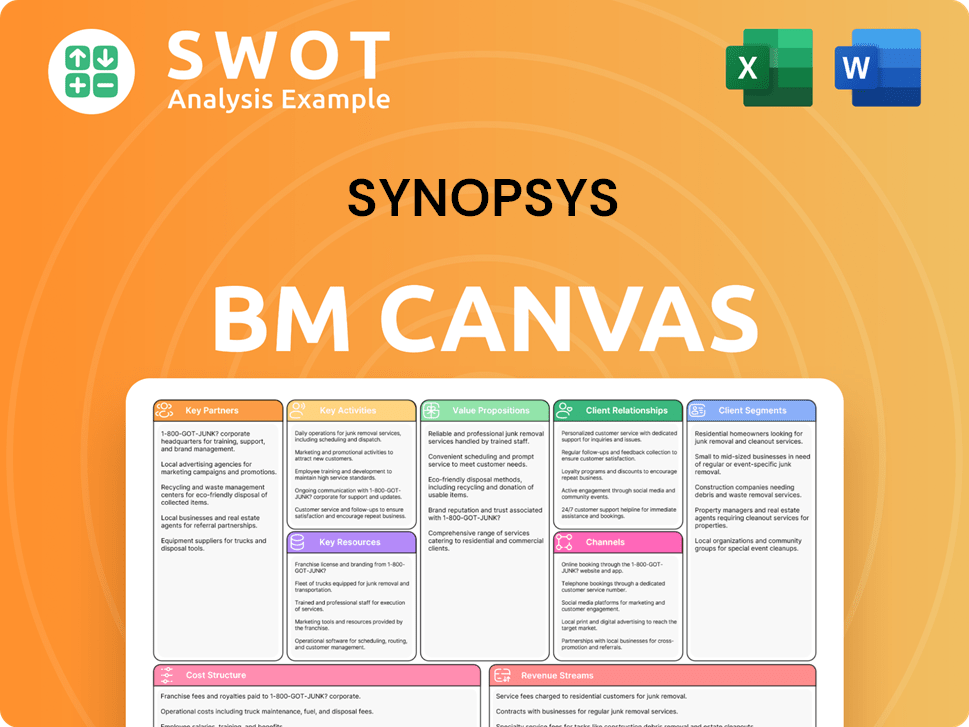

Synopsys Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Synopsys Positioning Itself for Continued Success?

Let's explore the industry position, risks, and future outlook for the Synopsys company. Synopsys holds a leading position in the electronic design automation (EDA) software market. Its comprehensive suite of tools is essential for its customers. This article aims to give you insights into the Synopsys company, its operations, and its strategic direction.

Synopsys has a substantial global presence, with significant revenue contributions from various regions. However, the company faces macroeconomic and geopolitical risks. The pending acquisition of Ansys presents both strategic benefits and integration challenges. The following sections will delve deeper into these aspects.

Synopsys is a leader in the EDA software market, competing with Cadence Design Systems and Siemens EDA. It holds the largest market share in digital design. The company's tools are considered indispensable to its customers in the semiconductor design industry. Synopsys provides essential software for chip design.

Synopsys generates revenue globally, with a strong presence in the United States, China, Korea, and Europe. In fiscal year 2024, the United States contributed 44.71% of the revenue. The company's financial health is robust, with strong gross profit margins and more cash than debt. Check out Owners & Shareholders of Synopsys for more financial insights.

Synopsys faces several risks, including macroeconomic uncertainties like rising interest rates and inflation. Geopolitical risks, especially US restrictions on China, pose challenges. The acquisition of Ansys introduces integration complexities and regulatory scrutiny. Furthermore, the company's reliance on a concentrated customer base presents a potential risk.

The increasing prevalence of high-risk open-source vulnerabilities in commercial codebases is a significant cybersecurity risk. This is particularly relevant in the semiconductor industry. Addressing these vulnerabilities is crucial for maintaining customer trust and ensuring the security of Synopsys products and solutions.

Synopsys is focused on capitalizing on mega-trends such as AI and silicon proliferation. The company is targeting AI and hardware-assisted verification for growth. The company is expecting double-digit revenue growth in fiscal year 2025, with revenue guidance of $6.745 billion to $6.805 billion.

- The Ansys merger is projected to expand Synopsys' non-GAAP operating margin and unlevered free cash flow margins.

- The merger is expected to be accretive to non-GAAP EPS within the second full year.

- Synopsys aims to deliver high-quality engineering software and solutions.

- The company is focused on sustainable growth and synergies from the Ansys integration.

Synopsys Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Synopsys Company?

- What is Competitive Landscape of Synopsys Company?

- What is Growth Strategy and Future Prospects of Synopsys Company?

- What is Sales and Marketing Strategy of Synopsys Company?

- What is Brief History of Synopsys Company?

- Who Owns Synopsys Company?

- What is Customer Demographics and Target Market of Synopsys Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.