Synopsys Bundle

Who Does Synopsys Serve?

In the fast-paced world of technology, understanding Synopsys SWOT Analysis is crucial for navigating the complexities of the semiconductor and software industries. But who exactly benefits from Synopsys's cutting-edge innovations in areas like AI-driven chip design? This exploration delves into the core of Synopsys's business strategy: its customer demographics and the specific target market it aims to capture.

This deep dive into Synopsys's customer profile and Synopsys target market will examine the company's evolution from its early days in EDA tools to its current position, offering IP products and software integrity solutions. We'll uncover Synopsys customer demographics by industry, geographic distribution, and company size, providing a comprehensive Synopsys market analysis. Understanding who are Synopsys's ideal customers and their needs is key to appreciating Synopsys's sustained success and future growth.

Who Are Synopsys’s Main Customers?

Understanding the customer demographics and target market of Synopsys is crucial for grasping its business model. Synopsys primarily serves the business-to-business (B2B) sector, focusing on the semiconductor and electronics industries. Its solutions are tailored for companies involved in integrated circuit (IC) design, semiconductor manufacturing, and the development of electronic systems and software. This focus shapes its Synopsys customer profile.

The primary Synopsys target market includes large technology corporations, fabless semiconductor companies, foundries, and original equipment manufacturers (OEMs). These entities rely on Synopsys's products and services to design, verify, and manufacture complex electronic systems and software. The company's customer base is composed of professionals such as electrical engineers, chip architects, software developers, and R&D teams.

Synopsys's business segments align with its customer groups. The Design Automation segment, which includes silicon design tools and verification products, generated $4.221 billion in revenue for fiscal year 2024, representing 68.9% of the company's total revenue. The Design IP segment, which includes embedded processors and security solutions, contributed $1.906 billion to annual revenue, accounting for 31.1% of the total in fiscal year 2024. The 'License and Maintenance' revenue stream was the largest in fiscal year 2024, generating $3.22 billion and representing 52.62% of Synopsys's total revenue. For more details, you can explore the Revenue Streams & Business Model of Synopsys.

Synopsys's customers are primarily within the semiconductor and electronics industries. These include IC design companies, semiconductor manufacturers, and companies developing electronic systems. This customer segmentation by industry is a core aspect of Synopsys's business strategy.

The target demographic includes electrical engineers, chip architects, and software developers. R&D teams involved in the design, verification, and manufacturing of complex electronic systems also make up a significant portion of Synopsys's user base. These professionals are key Synopsys users.

The Design Automation and Design IP segments reflect the customer base. The Design Automation segment accounted for the majority of the revenue in fiscal year 2024. The Design IP segment also contributed a significant portion of the revenue.

The increasing importance of AI and software-defined systems is driving growth for Synopsys. The pending acquisition of Ansys is a strategic move to enhance capabilities in simulation and analysis. This broadening of capabilities is aimed at attracting a wider range of Synopsys clients.

Synopsys's customer base is concentrated in the semiconductor and electronics industries. The company's solutions are tailored for professionals involved in the design and manufacturing of complex electronic systems. Understanding the Synopsys customer demographics is vital.

- Focus on B2B clients in the semiconductor and electronics sectors.

- Target audience includes electrical engineers, chip architects, and software developers.

- Revenue is primarily generated from Design Automation and Design IP segments.

- Strategic shifts towards AI and simulation solutions are expanding the customer base.

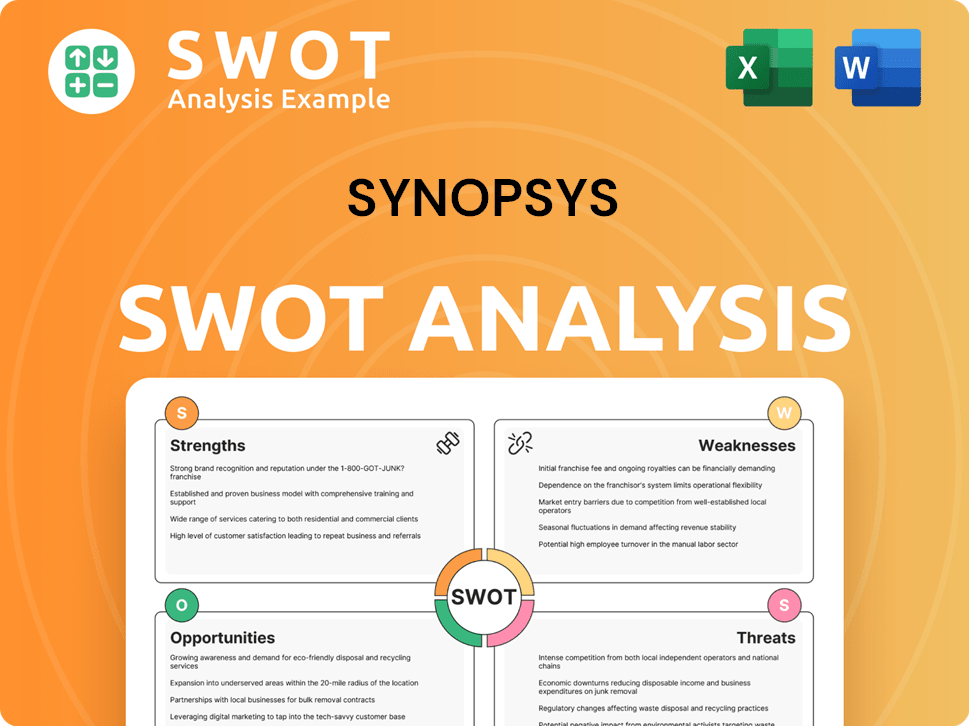

Synopsys SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Synopsys’s Customers Want?

Understanding the customer needs and preferences is crucial for any company, and for Synopsys, this involves a deep dive into the demands of the chip and software development sectors. Their customers, which include a wide array of tech companies, are primarily driven by the need for efficiency, accuracy, and innovation. These are the core elements influencing their purchasing behaviors and decision-making processes.

The ability of Synopsys's tools and IP to address the growing complexity of modern designs, speed up time-to-market, and ensure the reliability and security of their products is a major factor. This focus is especially critical as the demand for high-performance computing, AI integration in chip design, and the development of software-defined systems continues to rise. Synopsys's success is closely tied to how well it meets these evolving requirements.

Synopsys customers are looking for solutions that offer strong verification capabilities, advanced silicon design tools, and comprehensive IP blocks that can be easily integrated into their designs, significantly cutting down development cycles. For instance, the value of Synopsys's hardware-assisted verification solutions and advancements in EDA software, particularly for 2nm projects, is highly recognized for boosting productivity.

Synopsys addresses the escalating complexity of chip designs, a common pain point for its customers. This includes managing intricate designs and ensuring they meet performance and power consumption targets.

Another key area is mitigating design errors. Synopsys provides tools and solutions that help customers identify and correct errors early in the design process, reducing costly rework and delays.

Optimizing performance and power consumption is also a priority. Synopsys's tools enable customers to fine-tune their designs for optimal efficiency, which is critical in competitive markets.

Synopsys is heavily investing in AI-driven design automation tools to meet evolving industry demands. Products like DSO.ai and Synopsys.ai Copilot are examples of this focus.

Synopsys offers a wide array of tools and IP, allowing customers to choose solutions that best fit their specific design challenges and development workflows. This comprehensive approach is a key differentiator.

The acquisition of Ansys is expected to enhance Synopsys's capabilities in multiphysics simulation, further addressing customer needs in areas like mechanical and thermal analysis.

The Marketing Strategy of Synopsys is heavily influenced by its customer base. Synopsys's customer profile includes semiconductor companies, electronic system providers, and software developers. These customers are spread across various industries, including automotive, aerospace, consumer electronics, and data centers. The company's focus on innovation and meeting the specific needs of its customers is evident in its product development and market approach. Synopsys's revenue for fiscal year 2024 was approximately $6.04 billion, demonstrating its strong market position and customer base.

Synopsys's customers prioritize solutions that address the increasing complexity of chip designs, accelerate time-to-market, and ensure product reliability and security. They value tools that offer robust verification capabilities, advanced silicon design tools, and comprehensive IP blocks.

- Efficiency and Productivity: Customers seek tools that enhance design efficiency and reduce development cycles.

- Advanced Technologies: The integration of AI and the development of software-defined systems are key drivers.

- Reliability and Security: Solutions that ensure the reliability and security of products are highly valued.

- Comprehensive Solutions: Customers prefer a suite of tools and IP that can be tailored to their specific needs.

- Innovation: Continuous R&D, especially in AI-driven design automation, is crucial to meet evolving industry demands.

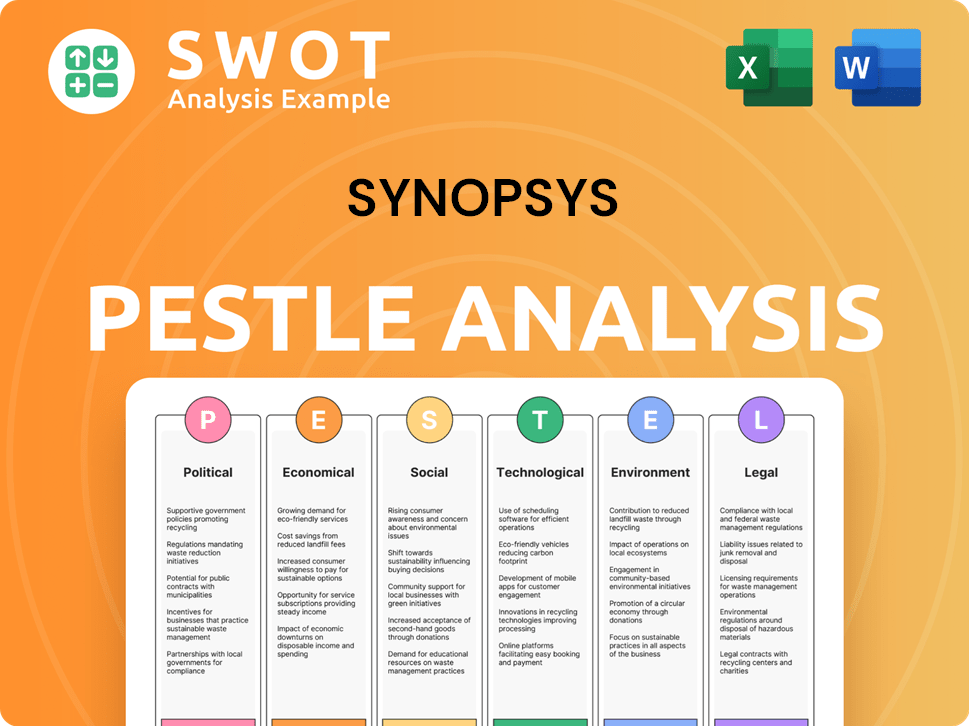

Synopsys PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Synopsys operate?

The geographical market presence of Synopsys is substantial, reflecting its crucial role in the semiconductor and electronics sectors globally. Understanding the distribution of its customers and their needs is essential for effective market analysis. The company's revenue breakdown by region offers insights into its primary markets and how it caters to diverse customer demographics.

In fiscal year 2024, Synopsys generated a significant portion of its revenue from the United States, which accounted for $2.74 billion, or 44.71% of the total. Other key markets, such as China and Korea, Republic of, also contributed substantially to the company's revenue, demonstrating its global reach. This geographical diversity is crucial for understanding the company's overall market performance.

Synopsys's revenue in China reached $989.52 million, representing 16.15% of total revenue, and in Korea, Republic of, it was $773.02 million, or 12.62%. Europe contributed $614.58 million, or 10.03%. The 'Other Countries' category accounted for $1.01 billion, or 16.49% of the revenue. This distribution highlights the importance of the company's global customer base and the varying needs of its clients.

The United States remains the largest market for Synopsys, generating nearly half of its total revenue in fiscal year 2024. This highlights the strong demand for its solutions within the US semiconductor industry. The company's focus on innovation and customer satisfaction in this region is critical.

China and Korea, Republic of, are significant markets, with China experiencing an 11.65% revenue increase from 2023 to 2024, and Korea, Republic of, seeing a 21.77% rise. This growth indicates increasing demand and the effectiveness of Synopsys's strategies in these regions. Understanding the customer demographics in these areas is key.

Despite strong growth, Synopsys faces challenges in China due to macroeconomic factors and trade restrictions. This may lead to a revenue decline in fiscal year 2025 compared to 2024. The company's ability to adapt to these challenges is crucial for its continued global success. The Growth Strategy of Synopsys provides additional insights.

Synopsys localizes its offerings and marketing to succeed in diverse markets, recognizing the variations in customer demographics and preferences. This approach helps the company to cater to the specific needs of its clients across different regions. The company's effective regional engagement is evident in its performance.

The company's ongoing investments in AI and system design innovation are global, aiming to serve its diverse customer base effectively. This commitment to innovation ensures that Synopsys remains competitive and meets the evolving needs of its customers. This includes understanding the needs of Synopsys customers in various geographic locations.

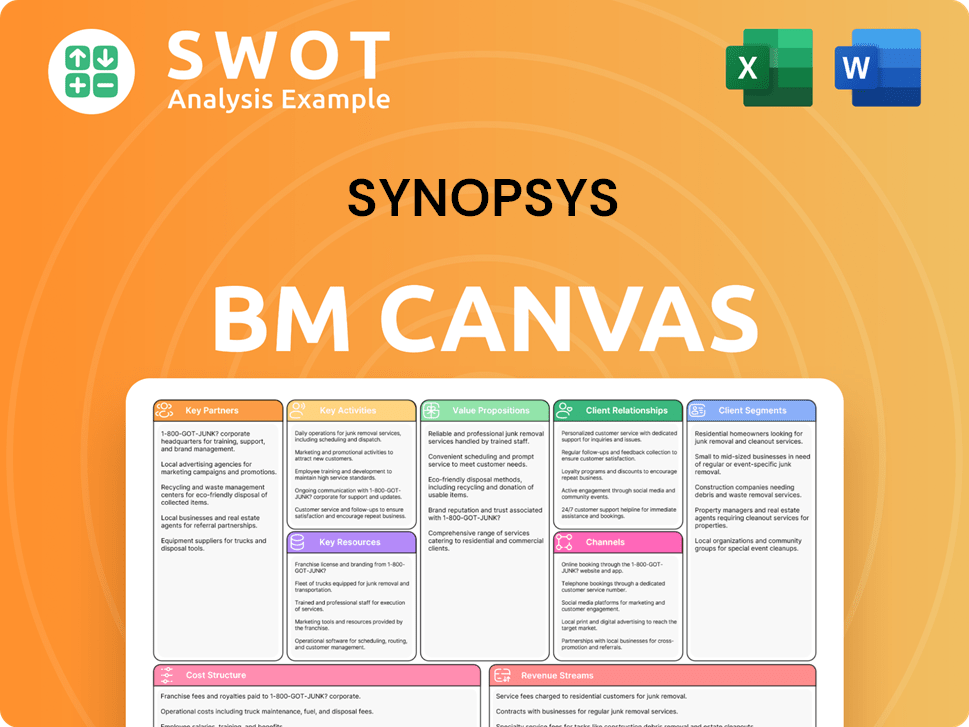

Synopsys Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Synopsys Win & Keep Customers?

Synopsys strategically focuses on both acquiring and retaining customers within the electronic design automation (EDA) and intellectual property (IP) sectors. Their customer acquisition efforts are centered on showcasing technological advancements, particularly in AI-driven chip design and hardware-assisted verification. Strategic collaborations and acquisitions, such as the pending acquisition of Ansys, are key components of their growth strategy, aimed at expanding their market reach and offering more comprehensive solutions. This approach allows them to attract new clients by addressing their evolving design needs and shortening time-to-market cycles.

Customer retention is a critical aspect of Synopsys's business model, driven by the essential nature of their products and strong customer relationships. The company's commitment to providing ongoing support, professional services, and subscription-based licensing models fosters customer loyalty. Continuous investment in research and development, along with a focus on customer feedback, ensures that their offerings remain at the forefront of the industry. This dedication to innovation and customer service helps maintain a loyal customer base.

The company's customer acquisition and retention strategies are crucial for maintaining its market leadership. Synopsys's ability to adapt to industry changes, such as the divestiture of its Software Integrity business in September 2024, reflects its focus on core competencies and customer needs. This strategic focus, combined with a dedication to innovation and customer satisfaction, positions the company for continued success in the competitive EDA and IP markets. Understanding the Brief History of Synopsys provides context for its evolution and customer-centric approach.

Synopsys leverages cutting-edge technology, including AI-driven chip design, to attract new clients. Strategic collaborations, like the one with SiMa.ai, expand into emerging markets. The pending acquisition of Ansys is a significant move to broaden its customer base and capabilities.

Partnerships with companies like SiMa.ai and Vector Informatik are direct channels for acquiring new customers. These collaborations help expand into new markets, particularly in automotive and edge AI solutions. Such collaborations are a core part of their acquisition strategy.

Synopsys offers ongoing support, professional services, and subscription-based licensing to ensure customer loyalty. They prioritize customer feedback to improve products and meet evolving industry needs. Continuous R&D and AI-driven innovations are vital for keeping solutions at the forefront.

The divestiture of the Software Integrity business in September 2024 allowed Synopsys to focus on its core EDA and IP segments. This strategic shift is expected to strengthen its market position and customer relationships. This focus helps maintain a strong customer base.

Synopsys's customer demographics are primarily composed of companies within the semiconductor, electronics, and software industries. Their target market includes companies of various sizes, from startups to large multinational corporations. The company's customer profile typically includes engineers, designers, and managers involved in chip design, verification, and software development.

- Semiconductor Manufacturers: Companies that design and manufacture integrated circuits (ICs).

- Electronics OEMs: Original Equipment Manufacturers that integrate ICs into their products.

- Software Developers: Companies using Synopsys tools for software security and development.

- Automotive Companies: Increasingly important as they integrate more electronics into vehicles.

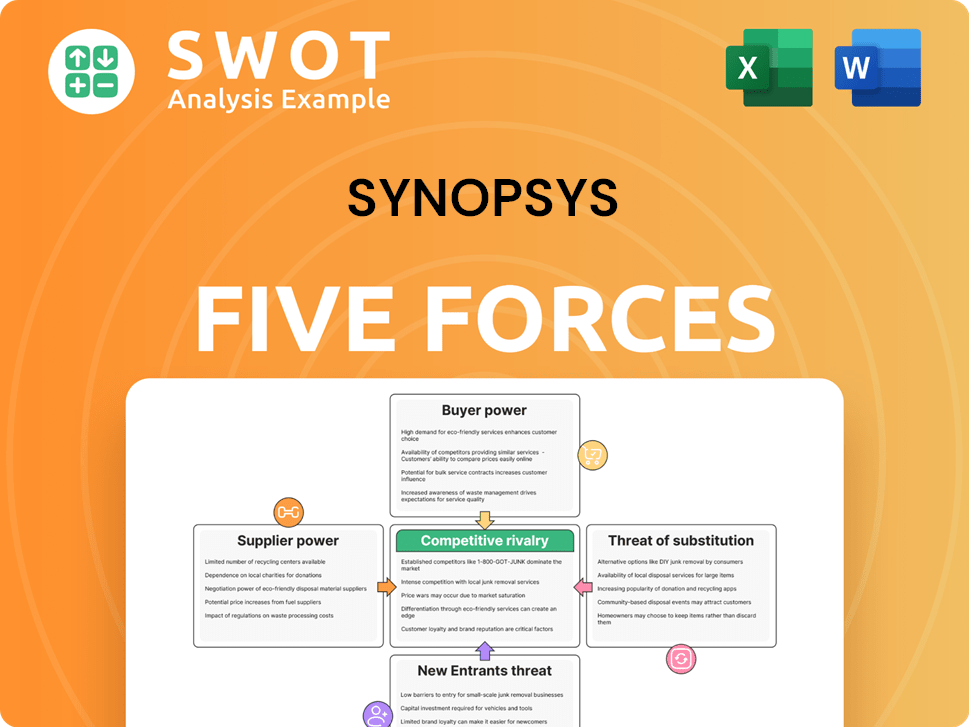

Synopsys Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Synopsys Company?

- What is Competitive Landscape of Synopsys Company?

- What is Growth Strategy and Future Prospects of Synopsys Company?

- How Does Synopsys Company Work?

- What is Sales and Marketing Strategy of Synopsys Company?

- What is Brief History of Synopsys Company?

- Who Owns Synopsys Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.