T-Mobile US Bundle

Who's Challenging T-Mobile US in the Wireless Wars?

T-Mobile US has revolutionized the telecom sector, but the fight for market dominance is far from over. This analysis dives deep into the T-Mobile US SWOT Analysis, uncovering the key players and strategies shaping the future of mobile communications. Discover how T-Mobile's 'Un-carrier' approach stacks up against its rivals in this dynamic industry.

Understanding the T-Mobile US competitive landscape is critical for investors and strategists alike. This report provides a comprehensive T-Mobile US market analysis, examining T-Mobile US competitors, their market share, and the competitive advantages that define success in the telecommunications industry. From T-Mobile US vs Verizon comparison to T-Mobile US vs AT&T comparison, we explore the factors driving T-Mobile US subscriber growth and its evolving business strategy.

Where Does T-Mobile US’ Stand in the Current Market?

T-Mobile US is a major player in the U.S. wireless industry, offering mobile voice, messaging, and data services. The company operates under the core brands of T-Mobile and Metro by T-Mobile, catering to both postpaid and prepaid customers. Its primary focus is on providing comprehensive postpaid offerings, while Metro by T-Mobile provides budget-friendly prepaid plans.

The company also provides wholesale wireless network access to mobile virtual network operators and offers fixed wireless internet access using its 5G network. T-Mobile generates all its revenue within the U.S., including Puerto Rico and the U.S. Virgin Islands. The company's strategic moves, including the merger with Sprint and the planned acquisition of US Cellular, have significantly shaped its market position and competitive advantages.

As of Q2 2024, T-Mobile held a significant market share in the U.S. wireless market, making it a key player in the telecommunications industry. This competitive landscape includes major rivals like Verizon and AT&T. The company's financial performance and strategic initiatives are crucial for understanding its position within the sector.

In Q2 2024, T-Mobile held approximately 32.3% of the wireless subscriptions in the U.S. mobile market. This positions it as the second-largest player, closely competing with Verizon and AT&T. The subscriber base includes both postpaid and prepaid customers, with postpaid accounting for the majority of revenue.

T-Mobile's revenue streams are primarily from postpaid and prepaid mobile services. In 2024, postpaid customers contributed 79% of the revenue, while prepaid accounted for 16%. The company's total revenue for 2024 increased to $81.4 billion. In Q1 2025, total revenues reached $20.9 billion, a 7% year-over-year increase.

The merger with Sprint in 2020 significantly boosted T-Mobile's 5G capabilities and market share. The planned acquisition of US Cellular is set to increase market penetration, particularly in smaller markets and rural areas. This acquisition is expected to increase market penetration from 17.5% to 20% in 2025 and over 33% in the long run.

T-Mobile's competitive advantages include its growing 5G network, strategic acquisitions, and a strong focus on customer acquisition strategies. The company's financial health remains robust, with net income increasing significantly. For more details on the company's growth strategy, see Growth Strategy of T-Mobile US.

T-Mobile's market position is defined by its significant market share, diverse revenue streams, and strategic initiatives. The company's ability to compete with major rivals like Verizon and AT&T is a key factor in its success. The company's focus on customer acquisition and network expansion drives its competitive advantage.

- Second-largest player in the U.S. mobile market as of Q2 2024.

- Postpaid services contribute the majority of revenue.

- Strategic acquisitions, such as US Cellular, enhance market reach.

- Strong financial performance with increasing revenues and net income.

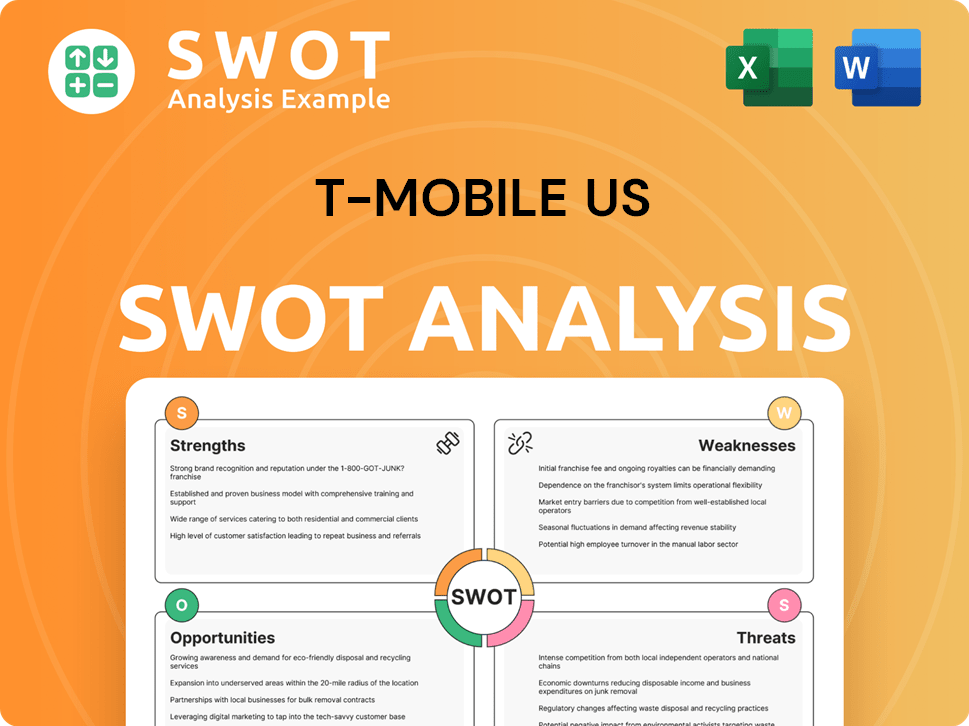

T-Mobile US SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging T-Mobile US?

The Owners & Shareholders of T-Mobile US operates within a fiercely contested

T-Mobile US competitive landscape

, grappling with both direct and indirect rivals. The telecommunications industry is characterized by intense competition, particularly amongmobile network operators

andwireless carriers

. Understanding the competitive dynamics is crucial for evaluating the company's performance and future prospects.The primary competitors challenging T-Mobile US include major players in the wireless market. These companies compete on network coverage, speed, pricing, and bundled services. Analyzing the competitive landscape helps to understand the strategic moves and market positioning of T-Mobile US.

AT&T and Verizon are the most significant direct competitors of T-Mobile US. As of December 31, 2024, T-Mobile held a market share of 35%, while Verizon had 34%, and AT&T held 27% of the U.S. mobile market.

Competition among these wireless carriers involves network coverage, speed, pricing, and bundled services. T-Mobile's 5G network leadership is a key differentiator, while AT&T and Verizon are described as lagging in 5G Advanced deployment.

Cable companies like Comcast and Charter offer competitive mobile services, often through bundling strategies. Dish Network is another competitor, though its wholesale partnerships with T-Mobile are expected to taper in 2025 as Dish expands its infrastructure.

Emerging tech companies such as Google and Amazon are identified as potential threats in the telecommunications industry. These companies could disrupt the market with innovative services.

In Q1 2025, T-Mobile added 495,000 new phone customers, while AT&T reported 324,000 postpaid phone net additions, and Verizon recorded a net loss of 289,000 postpaid phone customers. These figures highlight the ongoing 'battles' for

T-Mobile US market share

.The acquisition of US Cellular by T-Mobile in 2024, valued at $4.4 billion, is a strategic move to strengthen its position, particularly in rural markets. This acquisition is part of T-Mobile's broader

T-Mobile US business strategy

.Several factors are critical in the

T-Mobile US competitive landscape

.- Network quality and coverage, including 5G deployment.

- Pricing plans and promotional offers.

- Bundled services and customer loyalty programs.

- Strategic acquisitions and partnerships.

- Innovation in technology and services.

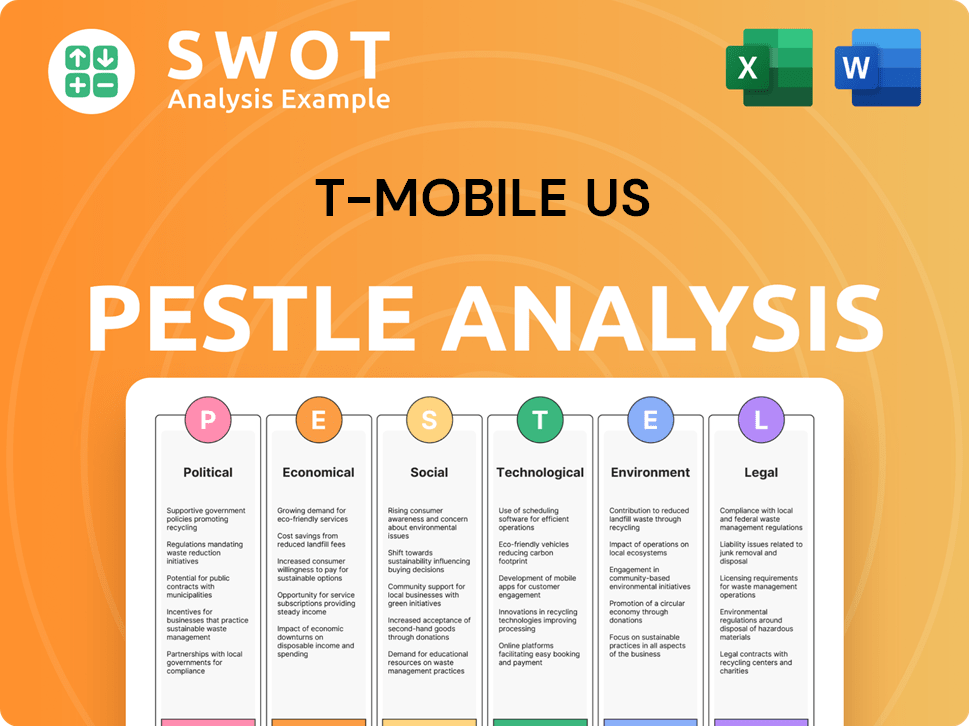

T-Mobile US PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives T-Mobile US a Competitive Edge Over Its Rivals?

The competitive landscape for T-Mobile US is shaped by its distinctive strategies and robust infrastructure, setting it apart from rivals. A key differentiator is the 'Un-carrier' approach, which has reshaped customer expectations. This strategy includes eliminating contracts and simplifying pricing, building a strong brand identity. T-Mobile's focus on customer-centric perks further enhances its market position.

T-Mobile US distinguishes itself through its innovative strategies and solid network infrastructure. Its 'Un-carrier' strategy has redefined customer expectations by eliminating contracts, simplifying pricing, and offering customer-centric perks. This approach builds a strong brand identity that resonates with customers seeking transparency and value in the telecommunications industry.

A significant advantage for T-Mobile is its expansive and fast 5G network. As of 2024, its 5G network covers over 300 million people across the United States. T-Mobile's leadership in 5G is further solidified by its mid-band spectrum holdings, largely acquired from the Sprint merger in 2020, providing a significant advantage in 5G coverage, speed, and capacity over competitors like AT&T and Verizon.

T-Mobile's 5G network covers over 300 million people across the United States as of 2024. The standalone 5G network now covers approximately 98% of Americans. This extensive coverage provides a competitive edge, especially in underserved rural areas.

The 'Un-carrier' strategy eliminates contracts, simplifies pricing, and offers customer-centric perks. This approach builds a strong brand identity. This strategy helps T-Mobile stand out in the crowded wireless carriers market.

Acquisitions like Sprint (2020), US Cellular (2024), and Vistar Media (2025) have strengthened T-Mobile's competitive edge. These moves expand spectrum, customer base, and diversify revenue streams. This helps T-Mobile in the long run.

T-Mobile has strong customer satisfaction rates and loyalty programs. This contributes to a stable and growing customer base. These factors are crucial for maintaining a competitive position.

T-Mobile US leverages several key advantages in the competitive landscape. These include its advanced 5G network, the innovative 'Un-carrier' strategy, and strategic acquisitions. These elements collectively enhance its market position and drive subscriber growth.

- 5G Network Leadership: T-Mobile's 5G network covers over 300 million people, providing a significant competitive edge.

- 'Un-carrier' Strategy: This strategy eliminates contracts and simplifies pricing, attracting customers.

- Strategic Acquisitions: Acquisitions like Sprint have expanded its spectrum and customer base.

- Customer Satisfaction: Strong customer satisfaction rates and loyalty programs contribute to a stable customer base.

T-Mobile's commitment to network excellence is demonstrated by its investments in AI-driven technologies and satellite mobile services. For example, T-Mobile is partnering with OpenAI and NVIDIA to develop AI-RAN, aiming for a self-optimizing network. In November 2024, T-Mobile received FCC approval for its partnership with Starlink to provide satellite connectivity for mobile phones, aiming to eliminate dead zones. These initiatives highlight T-Mobile's focus on innovation and improving its service offerings. To learn more about T-Mobile's overall strategy, consider reading about the Growth Strategy of T-Mobile US.

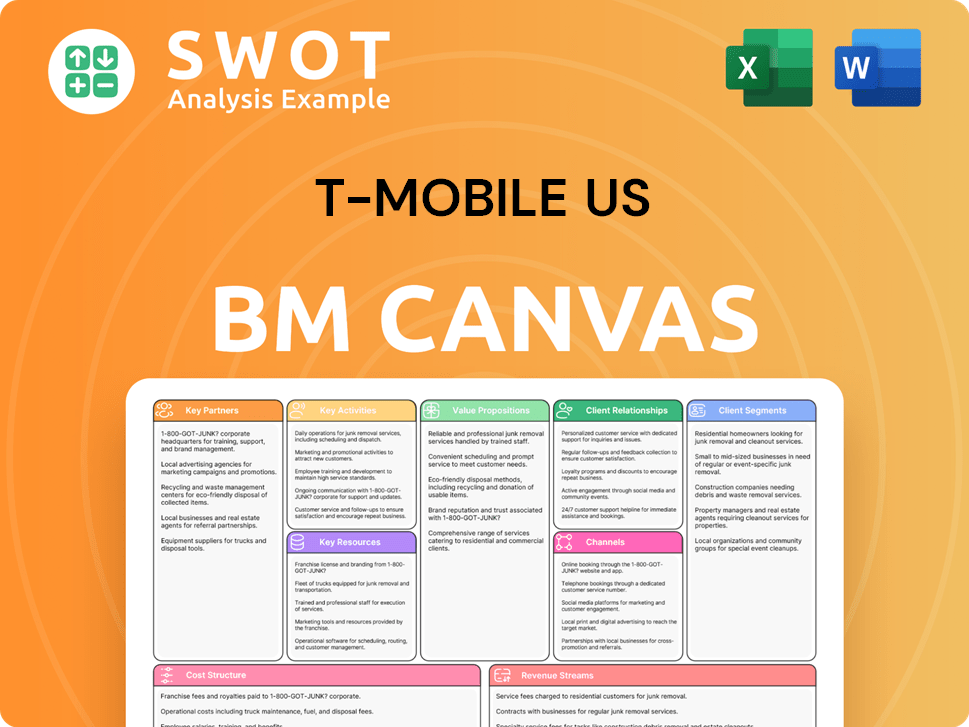

T-Mobile US Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping T-Mobile US’s Competitive Landscape?

The telecommunications industry is experiencing a significant transformation, driven by technological advancements and evolving consumer preferences. This dynamic environment presents both challenges and opportunities for companies like T-Mobile US. The company's strategic positioning, particularly its early investment in 5G, is crucial for maintaining its competitive edge and capitalizing on future revenue streams.

However, the industry is also characterized by intense competition, market saturation, and regulatory scrutiny. These factors, combined with the substantial capital expenditures required for network expansion, create risks. Despite these challenges, T-Mobile US is focused on expanding into underserved areas, diversifying its revenue streams, and forming strategic partnerships to ensure long-term growth and resilience in the evolving telecommunications landscape.

A key trend is the widespread adoption and evolution of 5G technology. T-Mobile US has a first-mover advantage and continues to invest heavily in its 5G network. The wireless market is nearing saturation, making competitive gains crucial, and cable companies are increasingly entering the wireless market with bundled offerings. The company is also leveraging AI for network optimization and improved customer experience.

Intense competition from AT&T and Verizon, who are also investing in 5G and AI capabilities, remains a significant challenge for T-Mobile US. The company also faces potential regulatory scrutiny over pricing strategies and the ongoing reliance on capital expenditures for network expansion. Economic uncertainties and a heavy debt burden from recent acquisitions also pose risks.

T-Mobile US has several growth opportunities, including expansion into underserved rural areas, particularly with the acquisition of US Cellular. The company is also diversifying its revenue beyond traditional mobile services through initiatives like 5G home internet, where it leads the fixed wireless access market. Strategic partnerships, such as the collaboration with Starlink, are also key.

T-Mobile US is actively exploring new business models and leveraging AI for network optimization and improved customer experience, as seen in its T Challenge 2025 for AI innovation in telecoms. Furthermore, T-Mobile's T-Fiber program aims to extend fiber-optic internet to 12 to 15 million households by 2030. The company is focused on increasing profitability, with a projected Core Adjusted EBITDA between $33.2 billion and $33.7 billion for 2025.

T-Mobile US anticipates continued growth, projecting 5.5 million to 6.0 million postpaid net customer additions in 2025. The company's focus on 5G home internet is evident, with a goal to reach 12 million 5G broadband customers by 2028. T-Mobile US is strategically positioned to compete in the evolving telecommunications market.

- T-Mobile US leads the fixed wireless access market, accounting for nearly 60% of all fixed wireless subscribers in the U.S. in Q4 2024.

- The company's T-Fiber program aims to extend fiber-optic internet to 12 to 15 million households by 2030.

- Projected Core Adjusted EBITDA for 2025 is between $33.2 billion and $33.7 billion.

- T-Mobile US aims to reach 12 million 5G broadband customers by 2028.

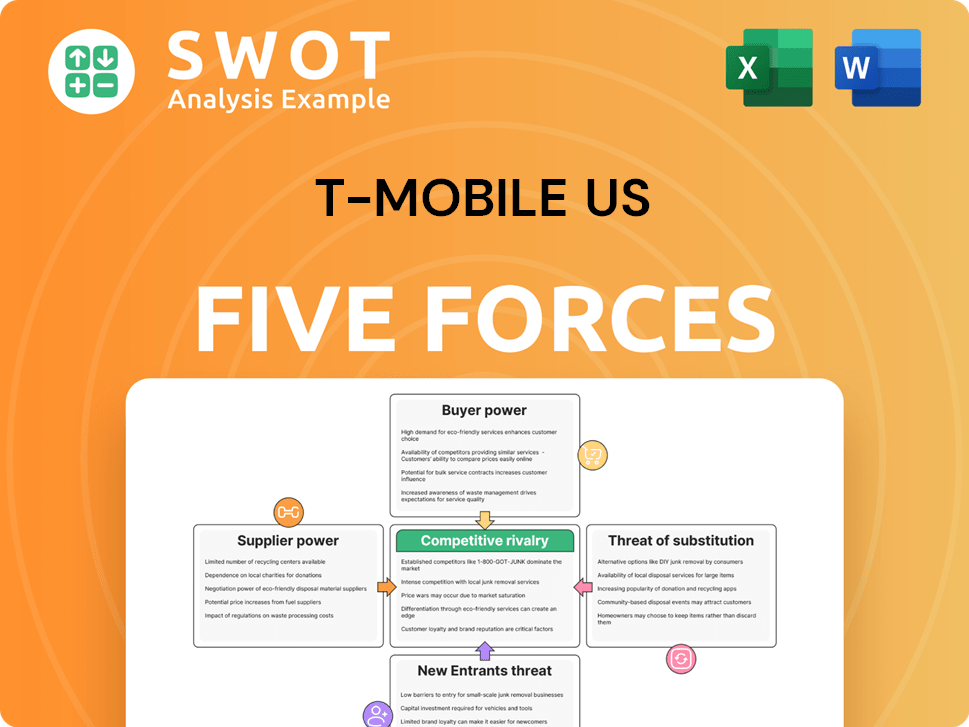

T-Mobile US Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of T-Mobile US Company?

- What is Growth Strategy and Future Prospects of T-Mobile US Company?

- How Does T-Mobile US Company Work?

- What is Sales and Marketing Strategy of T-Mobile US Company?

- What is Brief History of T-Mobile US Company?

- Who Owns T-Mobile US Company?

- What is Customer Demographics and Target Market of T-Mobile US Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.