T-Mobile US Bundle

Who Really Owns T-Mobile US?

Understanding the ownership of T-Mobile US is crucial for investors and anyone interested in the telecommunications landscape. The company's strategic direction, financial performance, and market position are all deeply influenced by its ownership structure. From its humble beginnings to its current status as a major player, the evolution of T-Mobile US SWOT Analysis is a fascinating story.

This article will explore the intricacies of T-Mobile US ownership, revealing the key players behind the second-largest wireless carrier in the U.S. We'll examine the T-Mobile parent company, major T-Mobile shareholders, and the impact of the 2020 merger with Sprint. Learn about the T-Mobile US stock and how the company's ownership has shaped its trajectory, including details on who controls T-Mobile US and its corporate governance.

Who Founded T-Mobile US?

The story of T-Mobile US, and its ownership, begins with VoiceStream Wireless PCS, established in 1994. John W. Stanton, the founder of Western Wireless Corporation, was the driving force behind its inception. This early phase set the stage for the company's evolution into a major player in the telecommunications industry.

VoiceStream Wireless was spun off from Western Wireless in 1999, marking a significant step in its development. The company expanded further by acquiring two regional GSM carriers in 2000. These acquisitions were crucial in building its network and customer base.

The most significant shift in ownership occurred in 2001. Deutsche Telekom AG acquired VoiceStream Wireless, Inc., for $35 billion, and Powertel, Inc. for $24 billion. This acquisition gave Deutsche Telekom a controlling stake, leading to the renaming of VoiceStream Wireless Inc. to T-Mobile USA, Inc., in July 2002.

VoiceStream Wireless PCS, founded in 1994, was the initial form of what would become T-Mobile US. John W. Stanton founded the company.

In 1999, VoiceStream Wireless was spun off as a separate entity from Western Wireless.

VoiceStream Wireless acquired two regional GSM carriers in 2000, expanding its footprint.

Deutsche Telekom acquired VoiceStream Wireless in 2001, becoming the majority owner. This was a pivotal moment in the history of T-Mobile US, significantly impacting the company's ownership structure.

In July 2002, VoiceStream Wireless Inc. was renamed T-Mobile USA, Inc., reflecting the new ownership and branding.

By the end of 2001, VoiceStream Wireless had 19,000 employees and served 7 million subscribers. This established a strong foundation for future growth.

The early ownership of T-Mobile US, or rather, its predecessor, VoiceStream Wireless, was initially rooted in Western Wireless Corporation. The acquisition by Deutsche Telekom marked a significant shift, establishing Deutsche Telekom as the T-Mobile US parent company. Today, understanding who owns T-Mobile involves examining the current ownership structure, which has evolved considerably since the early days. Key details about the company, including its financial reports and stock information, are available for those interested in T-Mobile US stock.

- John W. Stanton founded VoiceStream Wireless PCS in 1994.

- Deutsche Telekom acquired VoiceStream Wireless in 2001.

- The company was renamed T-Mobile USA, Inc., in 2002.

- Deutsche Telekom's acquisition was a key moment in the history of T-Mobile US.

T-Mobile US SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has T-Mobile US’s Ownership Changed Over Time?

The ownership of T-Mobile US has seen significant shifts over the years. After Deutsche Telekom acquired VoiceStream Wireless in 2001, the merger with MetroPCS in 2013 marked a key change, with the combined entity going public on the New York Stock Exchange as TMUS. MetroPCS shareholders gained a 26% stake in the new company. The merger with Sprint in April 2020 was another pivotal moment, leading to Deutsche Telekom holding 43%, SoftBank (Sprint's owner) with 24%, and public shareholders with 33%.

Deutsche Telekom has since increased its stake, surpassing 50% in April 2023 and reaching 51.4% by April 2024. In June 2024, Deutsche Telekom acquired an additional 6.7 million shares from SoftBank, solidifying its majority control. This included SoftBank's remaining 7.4% stake via a proxy agreement. These changes have influenced T-Mobile's strategic direction, especially its 5G network expansion, which now covers around 98% of the American population. For more insights, you can explore the Marketing Strategy of T-Mobile US.

| Ownership Evolution | Key Dates | Ownership Stakes |

|---|---|---|

| VoiceStream Wireless Acquisition | 2001 | Deutsche Telekom |

| Merger with MetroPCS | 2013 | MetroPCS shareholders (26%) |

| Merger with Sprint | April 1, 2020 | Deutsche Telekom (43%), SoftBank (24%), Public Shareholders (33%) |

| Deutsche Telekom Increases Stake | April 2023 | Deutsche Telekom (50%+) |

| Deutsche Telekom Further Increases Stake | June 2024 | Deutsche Telekom (Majority Control) |

As of April 2025, the ownership breakdown of T-Mobile US shows Deutsche Telekom AG holding 51.54%, institutional investors holding 35.51%, and individuals holding 0.42%. Institutional investors increased their holdings from 32.03% to 32.14% in April 2025. This ownership structure significantly impacts T-Mobile's strategic decisions and operational direction.

T-Mobile US PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on T-Mobile US’s Board?

The current board of directors of T-Mobile US reflects the company's ownership structure, with Deutsche Telekom holding considerable influence. Deutsche Telekom holds a significant number of board seats, which highlights its majority voting control. Although T-Mobile US operates independently with its leadership team, Deutsche Telekom's board representation gives it substantial say in strategic decisions. Understanding the T-Mobile US ownership structure is key to assessing its corporate governance.

The composition of the board and the voting structure support long-term stability, but also centralize control within Deutsche Telekom. The structure has not seen major changes recently. The company operates with a one-share-one-vote structure, but Deutsche Telekom's majority stake grants it outsized control. There have been no major public proxy battles or activist investor campaigns reported in 2024-2025 that have significantly reshaped decision-making. Knowing who owns T-Mobile is essential for understanding its strategic direction.

| Board Member | Role | Affiliation |

|---|---|---|

| Timotheus Höttges | Chairman of the Board | Deutsche Telekom |

| Mike Sievert | CEO | T-Mobile US |

| Melani Griffith | Director | T-Mobile US |

Deutsche Telekom's influence is a crucial aspect of T-Mobile US parent company dynamics. This ownership structure impacts strategic decisions and the overall direction of the company. The board's composition and voting structure are designed to ensure stability while centralizing control. For more insights, you can explore this detailed analysis of T-Mobile US.

Deutsche Telekom has a significant presence on the board, reflecting its majority ownership.

- The board's structure supports stability, but centralizes control.

- The one-share-one-vote structure is in place, but Deutsche Telekom's stake gives it significant influence.

- There have been no major proxy battles or activist campaigns recently.

- Understanding T-Mobile shareholders and the T-Mobile US stock dynamics is essential for investors.

T-Mobile US Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped T-Mobile US’s Ownership Landscape?

Over the past few years, the ownership structure of T-Mobile US has remained relatively stable, with Deutsche Telekom (OTCQX: DTEGY) as the majority owner. However, there have been significant developments in capital returns to shareholders. T-Mobile has authorized a new share buyback program for up to $14 billion until the end of 2025, as part of a broader plan to support up to $80 billion in investments and capital returns through 2027, with $50 billion allocated for buybacks and dividends. In Q1 2025, the company repurchased $2.47 billion in shares and paid $1.003 billion in dividends, reflecting a commitment to shareholder value. For the full year 2024, T-Mobile repurchased 59.4 million shares for $11.1 billion and paid $3.3 billion in cash dividends.

The company's strategic direction also includes aggressive mergers and acquisitions. Recent acquisitions, such as UScellular (announced May 2024 for $4.4 billion), aim to expand its subscriber base and diversify revenue streams. T-Mobile's expansion strategy is further supported by joint ventures with KKR and EQT to acquire Lumos Networks and Metronet, focusing on fiber broadband coverage. These moves are designed to strengthen its market position and provide a broader range of services. To understand more about the company's strategic moves, you can read about the Growth Strategy of T-Mobile US.

| Metric | Details | Year |

|---|---|---|

| Share Repurchases | $11.1 billion | 2024 |

| Dividends Paid | $3.3 billion | 2024 |

| Share Repurchases | $2.47 billion | Q1 2025 |

| Dividends Paid | $1.003 billion | Q1 2025 |

| Postpaid Net Customer Additions (Projected) | Between 5.5 million and 6.0 million | 2025 |

Leadership succession has also been a topic of discussion. Srini Gopalan, the newly appointed Chief Operating Officer, is seen as a potential successor to CEO Mike Sievert, who is under contract until 2028. Gopalan is leading T-Mobile's digital transformation efforts, including AI-driven customer experience initiatives and large-scale ERP and Telco Cloud projects. The company anticipates continued customer growth, with postpaid net customer additions expected to be between 5.5 million and 6.0 million in 2025, demonstrating its focus on expanding its customer base and enhancing operational efficiency.

Deutsche Telekom remains the majority owner. The company focuses on shareholder value through buybacks and dividends.

A new share buyback program of $14 billion until the end of 2025. T-Mobile repurchased $2.47 billion in shares and paid $1.003 billion in dividends in Q1 2025.

UScellular acquisition for $4.4 billion. Joint ventures to expand fiber broadband coverage.

Srini Gopalan as potential CEO successor. Postpaid net customer additions are expected to be between 5.5 million and 6.0 million in 2025.

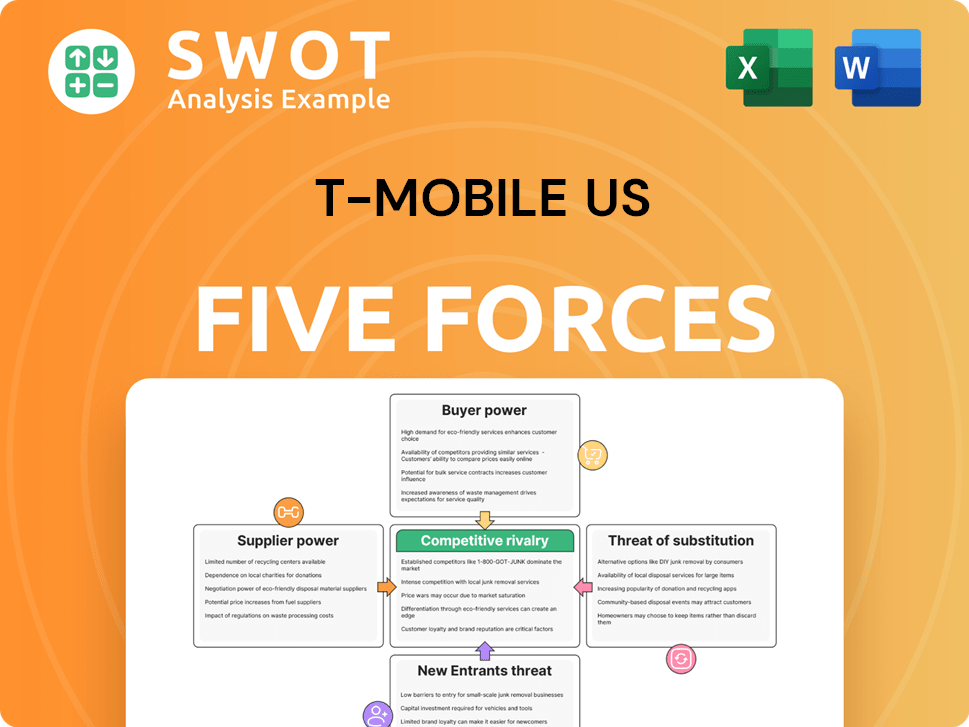

T-Mobile US Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of T-Mobile US Company?

- What is Competitive Landscape of T-Mobile US Company?

- What is Growth Strategy and Future Prospects of T-Mobile US Company?

- How Does T-Mobile US Company Work?

- What is Sales and Marketing Strategy of T-Mobile US Company?

- What is Brief History of T-Mobile US Company?

- What is Customer Demographics and Target Market of T-Mobile US Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.