Ventia Services Bundle

How Does Ventia Services Stack Up in a Competitive Market?

Ventia Services Group Limited is a major player in Australia and New Zealand's infrastructure services sector, but who are its rivals? Understanding the Ventia Services SWOT Analysis is crucial for any investor or strategist. This introduction delves into Ventia's origins and growth, setting the stage to explore its competitive environment.

Ventia's success hinges on navigating a complex competitive landscape and maintaining a strong market share. This analysis will examine Ventia's competitors, assess its industry position, and uncover the strategies that drive its performance. We'll explore Ventia Services service offerings and how they contribute to its overall business strategy. A comprehensive Ventia Services market analysis report is essential for anyone seeking to understand this dynamic sector.

Where Does Ventia Services’ Stand in the Current Market?

Ventia Services Group holds a prominent position in the essential infrastructure services sector, primarily within Australia and New Zealand. The company's extensive service offerings encompass crucial areas such as transport networks, telecommunications infrastructure, property and social infrastructure management, and water and energy solutions. This diversified portfolio allows Ventia to serve a wide range of clients, from government entities to commercial businesses, solidifying its market penetration.

The company's strategic focus has shifted towards integrated solutions and long-term service contracts, moving beyond transactional engagements to become a trusted partner. This evolution is supported by digital transformation initiatives, enhancing operational efficiency and service delivery. Ventia's commitment to innovation and its ability to adapt to evolving market demands are key factors in its sustained success.

Ventia's operational footprint is largely concentrated in Australia and New Zealand, where it has built a strong reputation. Its ability to provide comprehensive services across multiple sectors contributes to its resilience and competitive advantage. For a deeper dive into how Ventia operates, consider exploring the Revenue Streams & Business Model of Ventia Services.

Ventia's core operations revolve around providing essential infrastructure services, including transport, telecommunications, and utilities. The value proposition lies in delivering integrated solutions that enhance efficiency and reliability for clients. This approach ensures long-term partnerships and sustainable growth.

Ventia's primary market presence is in Australia and New Zealand, where it has established a strong operational base. The company strategically focuses on these regions to leverage its expertise and build lasting client relationships. This geographic focus allows for efficient service delivery and localized expertise.

For the 12 months ended December 31, 2023, Ventia reported revenue of $5.0 billion and an EBITDA of $444 million, demonstrating its significant scale. This financial performance allows for continued investment in capabilities and strategic growth. The company's strong financial position supports its ability to secure and execute large-scale projects.

Ventia's strategic positioning emphasizes integrated solutions and long-term service contracts, moving beyond transactional engagements. Key competitive advantages include its extensive experience in the defense sector and its management of large-scale transport and telecommunications networks. This approach fosters strong client relationships and drives sustainable growth.

Ventia's strengths lie in its diversified service offerings, geographic focus, and strong financial performance. The company's market position is enhanced by its ability to provide integrated solutions and its long-term service contracts. This allows Ventia to maintain a competitive edge in the infrastructure services sector.

- Diversified service offerings across transport, telecommunications, and utilities.

- Strong presence in Australia and New Zealand.

- Robust financial performance with $5.0 billion in revenue for 2023.

- Emphasis on integrated solutions and long-term contracts.

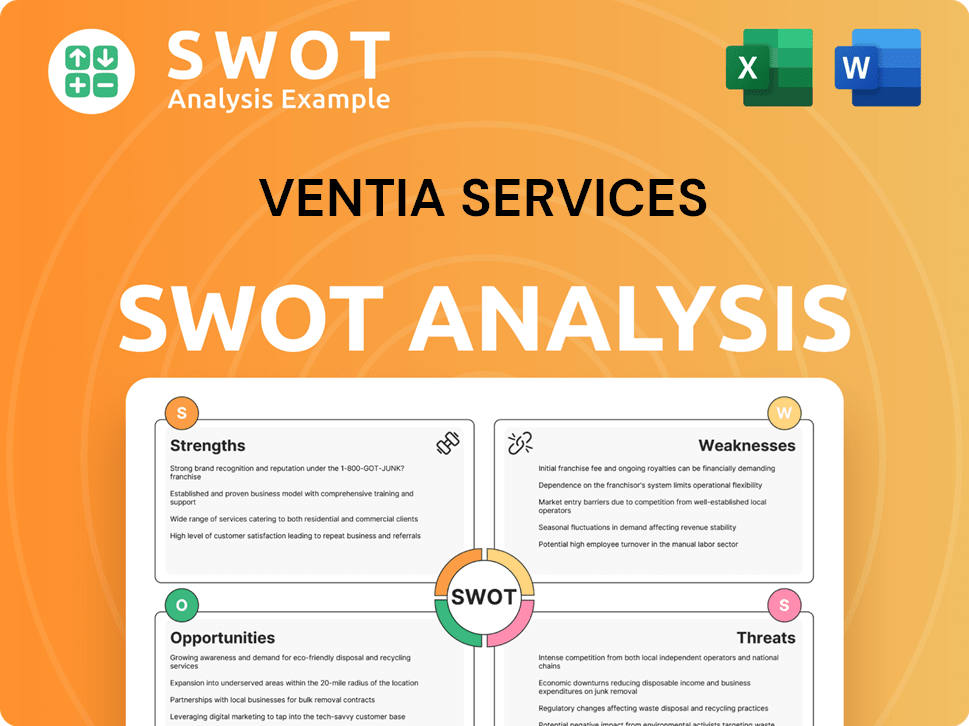

Ventia Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Ventia Services?

The competitive landscape for Ventia Services is defined by a mix of large, diversified service providers and more specialized firms. The company faces competition across various sectors, including infrastructure, telecommunications, and essential services. Understanding the key players and their strategies is crucial for analyzing Ventia's market position and future prospects.

Ventia's main competitors often compete for similar contracts, particularly in areas like transport, utilities, and defense. The industry is dynamic, with mergers, acquisitions, and technological advancements constantly reshaping the competitive environment. Analyzing these competitive dynamics is essential for investors and stakeholders interested in the Ventia Services company profile.

Ventia operates within a competitive landscape where it competes with both large, diversified services companies and specialized niche players. Its most significant direct competitors in Australia and New Zealand include Broadspectrum (now part of Ventia), Downer EDI, and UGL (a subsidiary of CIMIC Group). Before its acquisition by Ventia, Broadspectrum was a major competitor across sectors like defense, social infrastructure, and transport. Downer EDI is a prominent integrated services company with a strong presence in transport, utilities, and facilities management, often competing directly with Ventia for large government and commercial contracts. UGL offers engineering, construction, and maintenance services across infrastructure, power, and resources.

Downer EDI is a major competitor, particularly in transport, utilities, and facilities management. It often competes directly with Ventia for large government and commercial contracts. Downer's extensive rail and road maintenance capabilities pose direct competition in the transport sector.

UGL provides engineering, construction, and maintenance services across infrastructure, power, and resources. Its expertise in complex engineering projects gives it a strong competitive edge in specific infrastructure development and maintenance areas. UGL is a key rival in the infrastructure and resources sectors.

Broadspectrum, before its acquisition by Ventia, was a major competitor across various sectors. This acquisition has reshaped the competitive landscape, consolidating market share. The acquisition has increased Ventia's market share and capabilities.

The competitive landscape also includes smaller, specialized firms that offer niche services or target specific geographic areas. These firms can provide specialized services, creating additional competition. They often focus on specific segments or regions.

Competition often revolves around pricing, innovative service delivery models, technological integration, and demonstrating a strong track record. High-profile battles for major infrastructure maintenance contracts are common. Companies leverage established relationships and operational efficiencies.

Emerging players leveraging new technologies in smart infrastructure management or predictive maintenance could disrupt traditional service delivery models. Mergers and acquisitions significantly reshape competitive dynamics. Technological advancements are a key factor.

Competition is driven by factors like pricing, innovation, and client satisfaction. Recent acquisitions, such as Ventia's purchase of Broadspectrum, have reshaped the market. For a deeper dive into the company's history, consider reading the Brief History of Ventia Services.

Several factors influence the competitive dynamics in the services sector, including pricing strategies, service delivery models, and technological integration. Companies must demonstrate a strong track record to secure contracts.

- Pricing: Competitive pricing is crucial for winning contracts.

- Innovation: Innovative service delivery models and technological integration are key differentiators.

- Track Record: A strong track record of project delivery and client satisfaction is essential.

- Technological Integration: Leveraging technology, such as smart infrastructure management, is becoming increasingly important.

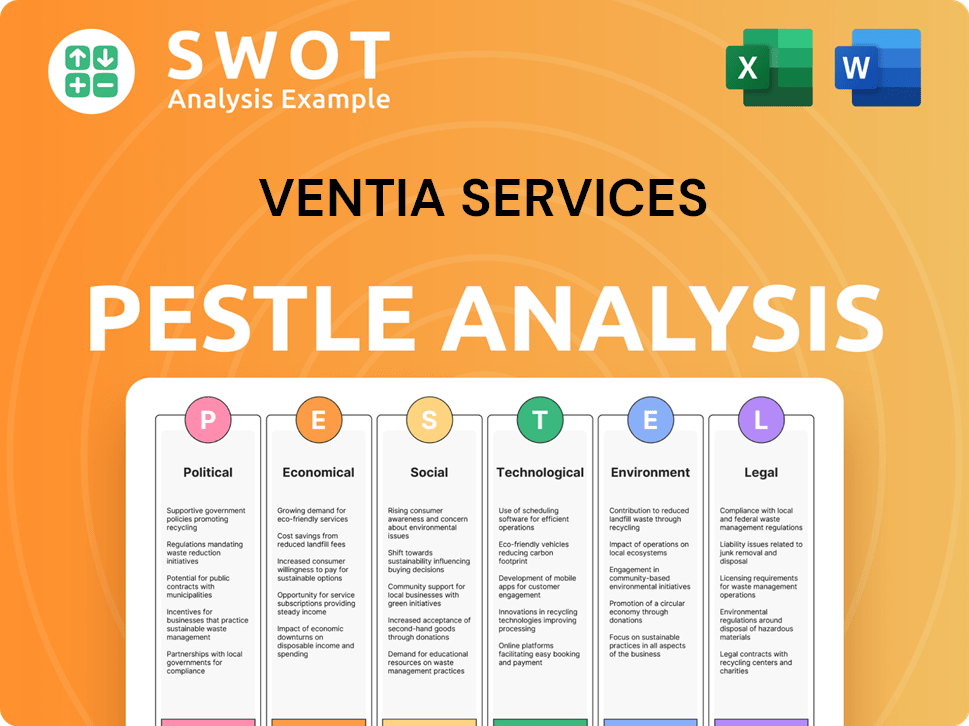

Ventia Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Ventia Services a Competitive Edge Over Its Rivals?

The competitive landscape for Ventia Services is shaped by its strategic moves, including significant acquisitions and partnerships, which have expanded its service offerings and market reach. These moves are aimed at strengthening its position in the infrastructure services market, enhancing its ability to compete with both established and emerging players. Understanding Ventia's competitive advantages is crucial for assessing its long-term sustainability and growth potential within the industry.

Key milestones for Ventia include securing major contracts and expanding its service portfolio to cater to diverse sectors such as transport, telecommunications, and defense. These strategic initiatives have been instrumental in building a robust client base and solidifying its market presence. Ventia's focus on innovation, particularly in digital solutions, further distinguishes it from competitors, enabling it to offer more efficient and cost-effective services.

Ventia's competitive edge is maintained through its extensive scale and integrated service offerings, allowing it to provide bundled solutions that improve efficiency and cost savings for clients. The company's deep expertise and long-standing relationships, especially with government and defense clients, build substantial trust and customer loyalty. This approach, combined with a significant work-in-hand value, reflects strong client confidence and long-term contract stability.

Ventia provides a comprehensive suite of services across various sectors, including transport, telecommunications, property, and defense. This integrated approach allows the company to offer bundled solutions, leading to greater efficiency and cost savings for clients. Its extensive operational footprint across Australia and New Zealand enables efficient resource deployment and localized support.

Ventia has deep expertise and long-standing relationships within critical sectors, particularly with government and defense clients. The company's history and track record of delivering complex services build substantial trust and customer loyalty. This is evident in its significant pipeline of work, reflecting strong client confidence and long-term contracts.

Ventia leverages technology and innovation to enhance its service delivery. The company invests in digital solutions for operational efficiency, predictive maintenance, and data-driven insights, leading to improved service quality and reduced downtime for clients. This focus on technology helps to optimize service offerings and maintain a competitive edge.

Ventia's strong talent pool and focus on safety and sustainability contribute to its reputation and operational excellence. These factors are crucial for maintaining high service standards and ensuring client satisfaction. The company's commitment to these areas supports its long-term competitive advantages.

Ventia's competitive advantages are multifaceted, stemming from its integrated service offerings, deep expertise in key sectors, and focus on technology and innovation. These elements combine to create a robust and sustainable business model. The company’s success is also reflected in its financial performance and its ability to secure long-term contracts.

- Scale and Integrated Services: Ventia's ability to offer a wide range of services across multiple sectors allows for bundled solutions, increasing efficiency and reducing costs.

- Strong Client Relationships: Long-standing relationships with government and defense clients build trust and loyalty, providing a stable base for future projects.

- Technological Innovation: Investments in digital solutions enhance service delivery, improve efficiency, and provide data-driven insights.

- Operational Excellence: A focus on safety, sustainability, and a strong talent pool contributes to a positive reputation and high service standards.

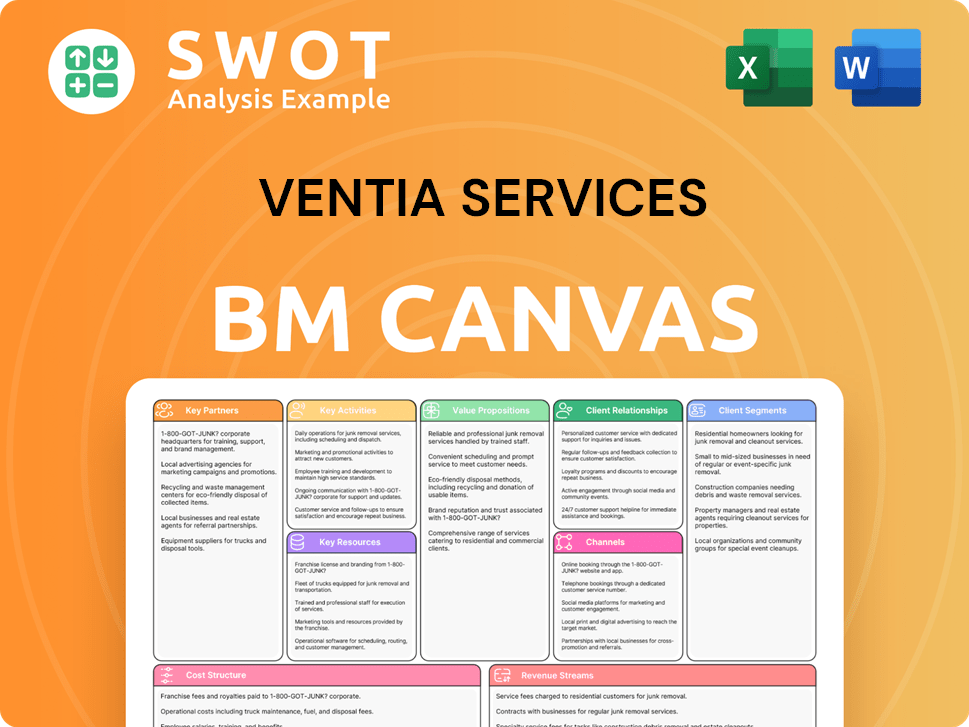

Ventia Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Ventia Services’s Competitive Landscape?

The infrastructure services sector is currently experiencing significant shifts, driven by technological advancements, regulatory changes, and global economic conditions. These factors shape the competitive landscape for companies like Ventia Services, influencing their strategies and market positioning. Understanding these trends is crucial for assessing Ventia's future prospects and the challenges it faces.

Ventia's position in the market is influenced by its ability to adapt to these changes while maintaining operational efficiency and delivering value to its clients. The company's success hinges on its capacity to innovate, manage risks, and capitalize on emerging opportunities within the dynamic infrastructure services industry. This analysis provides insights into the industry trends, potential challenges, and future opportunities for Ventia.

The infrastructure services industry is witnessing rapid technological advancements, with smart infrastructure, IoT, and data analytics transforming asset management. Regulatory changes and a growing focus on ESG factors are also significant trends, pushing companies towards sustainable practices. Global economic shifts, including inflation and potential slowdowns, impact infrastructure spending and project pipelines.

Key challenges include the need for continuous investment in new technologies to remain competitive. Navigating economic uncertainties and potential project delays due to economic downturns also poses a significant hurdle. Aggressive new market entrants and intense price competition from established rivals could also impact Ventia's market share and profitability.

Ventia can leverage technological advancements to enhance efficiency and offer predictive maintenance services. The demand for sustainable practices and ESG credentials presents opportunities for differentiation. Population growth and climate change create sustained opportunities in renewable energy, digital connectivity, and climate adaptation projects.

Ventia is focusing on operational excellence, innovation in service delivery, and strategic partnerships to address market challenges. Targeted acquisitions are likely to expand its capabilities and market reach. The company's focus on essential services provides a degree of resilience against economic fluctuations.

To maintain its competitive edge, Ventia needs to prioritize innovation, particularly in digital solutions and sustainable practices. Strengthening ESG credentials and adapting to regulatory changes are crucial. Strategic partnerships and targeted acquisitions can enhance market reach and service offerings. For detailed insights, you can also explore the Marketing Strategy of Ventia Services.

- Investment in digital technologies to improve efficiency and service offerings.

- Focus on sustainable practices and ESG compliance to meet client demands.

- Strategic partnerships and acquisitions to expand market presence and capabilities.

- Continuous monitoring of economic trends and adaptation to potential slowdowns.

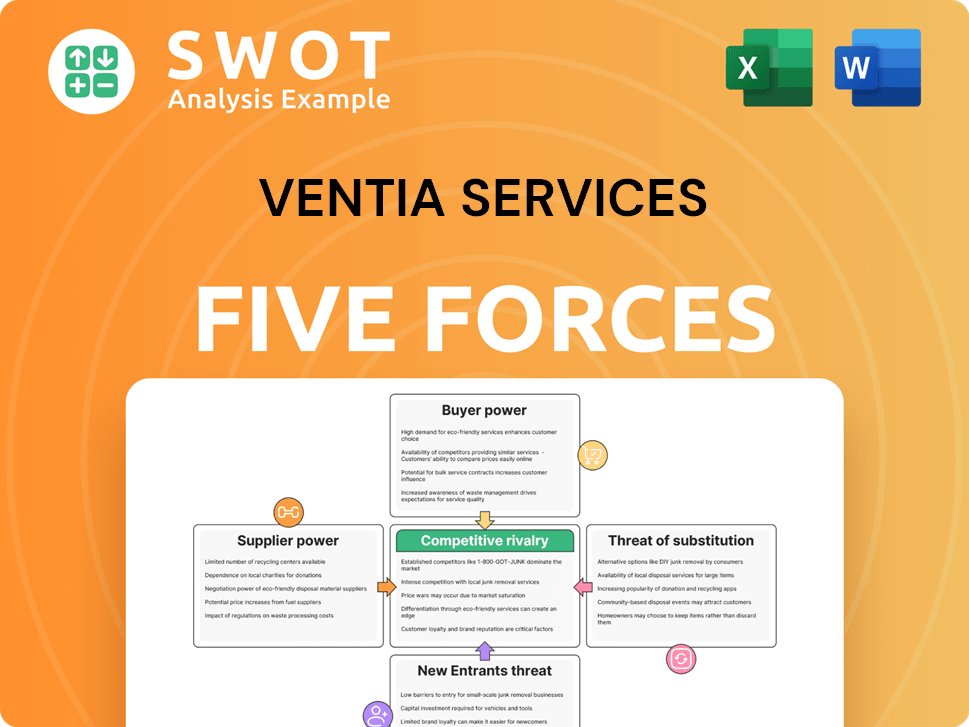

Ventia Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ventia Services Company?

- What is Growth Strategy and Future Prospects of Ventia Services Company?

- How Does Ventia Services Company Work?

- What is Sales and Marketing Strategy of Ventia Services Company?

- What is Brief History of Ventia Services Company?

- Who Owns Ventia Services Company?

- What is Customer Demographics and Target Market of Ventia Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.